Professional Documents

Culture Documents

Gururaj Gurunath Govind Rao Vs The State of Karnataka On 1 August 1994

Uploaded by

Manjunath DasappaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gururaj Gurunath Govind Rao Vs The State of Karnataka On 1 August 1994

Uploaded by

Manjunath DasappaCopyright:

Available Formats

Gururaj Gurunath Govind Rao ...

vs The State Of Karnataka on 1 August, 1994

Karnataka High Court

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

Equivalent citations: AIR 1995 Kant 267, ILR 1994 KAR 2341, 1994 (4) KarLJ 441

Author: R Babu

Bench: M . S.B., S Rajendra, N Bhat

ORDER Rajendra Babu, J.

1. This reference arises out of an order made by two of us (Rajendra Babu and Bhat JJ.) under

Section 7 of the Karnataka High Court Act on the question --- "Whether orders made under Section

118(2b) by the Assistant Commissioner in appeals against the orders of Tahsildar are subject to

revision by Divisional Commissioner under Section 118 A of the Act or not?"

2. The petition out of which this reference arises is directed against an order made by the Divisional

Commissioner in exercise of the powers under Section 118A of the Karnataka Land Reforms Act

('the Act', for brevity). The said revision petition was filed before the Divisional Commissioner

against an order made by the Assistant Commissioner in an appeal confirming an order made by the

Tahsildar granting resumption to the petitioner under Section 15 of the Act. It is urged on behalf of

the petitioner that an order under Section 118(2b) of the Act is 'final' as provided in the Section

itself. Relying upon a decision of this Court in Srimanmaharaja Niranjan Jagadguru Mallikarjuna

Murugarajendra Mahaswamy v. Deputy Commissioner it is urged that Section 118(2b) of the Act

having used the expression 'final' in respect of an order made by the Assistant Commissioner in an

appeal and in the absence of express words in that Section or in Section 118A of the Act which affects

that finality, it is submitted that the Divisional Commissioner has no power or jurisdiction to

interfere with such an order.

3. On behalf of the respondents, it is submitted that in view of the decision in Chhagan Lal v. The

Municipal Corporation, Indore -- merely because" a" provision is made rendering a decision final,

will not take away the remedy by way of revision and that will only be effective in taking away a

remedy by way of appeal and unless the finality clause is associated with the expression shall not be

questioned in a court of law except as otherwise provided in the Act', the remedy of revision under S.

118A cannot be taken as excluded. It is therefore submitted that the order made by the Assistant

Commissioner in an appeal against an order of the Tahsildar is subject to revision under Section

118A of the Act and as such as the Divisional Commissioner did have the jurisdiction to make a

decision.

4. Section 118 of the Act provides for appeals against certain orders. Under Section 118(2) of the Act,

appeals lies to Revenue Appellate Tribunal against every order passed by the Deputy Commissioner

or an Officer authorised under sub-section (1) of Section 77, the Assistant Commissioner or the "

prescribed authority under Section 83 of the Act and such a decision shall be final. Under Section

118(2b) of the Act, appeals ties to the Assistant Commissioner from every order made by the

Tahsildar and the order of the Assistant Commissioner on such appeal shall be final. Under Section

118A of the Act, the Division Commissioner has powers of revision suo motu or on the application of

any person against any order passed by the Assistant Commissioner against which no appeal lies, or

the record of any order passed or proceeding recorded by the Tahsildar for the purpose of satisfying

Indian Kanoon - http://indiankanoon.org/doc/418357/ 1

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

himself as to the legality or propriety of such order or as to the regularity of such proceeding and

may pass such order with respect thereto as he thinks fit, after giving an opportunity to the affected

person.

5. It is urged that an appeal would lie to the Appellate Tribunal under Section 118(2) of the Act in

two classes of cases viz., (i) the orders made under Section 77(1) of the Act either by the Deputy

Commissioner or any authorised officer and (ii) orders made under Section 83 of the Act either by

the Assistant Commissioner or any prescribed authority. It is also urged that under the said

provision, every order passed by the Deputy Commissioner or the Assistant Commissioner or

Authorised Officer under Section 77( 1) or 83 of the Act would be subject to appeal under Section

83(2) of the Act. If the latter view is accepted, there wilt be no order against which a revision would

lie to the Divisional Commissioner under Section I ISA of the Act and it is only in cases falling under

Section 118(2b) such revision would lie. If the former view there would be several orders of the

Assistant Commissioner against which such a revi-sional would lie. However, under both

subsections (2) and (2b) of Section 118 of the Act, orders made by the Appellate Authorities are

rendered final. It is also submitted that in the scheme of the Act there are provisions only providing

one appeal or one revision in order to avoid multiplicity of litigation and to effectuate speedy

implementation of the Land Reforms. Hence, the scope of powers under Section 118(2); 118(2b) and

118A of the Act should be interpreted in such away as to be harmonious with this intention.

6. In answering the question referred to us it may be quite appropriate to examine the scope of

Section 118(2) of the Act for the question that is posed to us is whether from the order made by the

Assistant Commissioner in an appeal against the order of the Tahsildar, a revision would lie under

Section 118A of the Act to the Divisional Commissioner. The language of Section 118A w.ould admit

of examination of the record or any order passed by the Assistant Commissioner against which no

appeal lies. As against the order made under Section 118(2b) of the Act, no appeal lies for that is

rendered final. The expression 'final' has been the subject matter of several decisions and in Re

pilmore's Application (1957) I All ER 796 -- the expression final has been examined and it is stated

that the word 'final' means -- 'without appeal' and it does not mean 'without recourse to other

remedies". A remedy which will arise in cases of exercise of power in excess of jurisdiction or for

error of law on the face of the record, would certainly lie and unless there be express words, the

jurisdiction of an authority is not taken away. Lord Justice Parker in his opinion stated that there

are many instances where a statute provides that a decision shall be "final". Sometimes, as here, the

statute provides that subject to a specific right of appeal the decision shall be final. In such a case it

may be said that the expression 'shall be final' is merely a pointer to the fact that there is no further

appeal, and the remedy by way of certiorari is not by way of appeal. A revision is not by way of an

appeal. In South Asia Industries Private Ltd. v. S.B. Sarup Singh -- it was explained that the

expression 'final' prima facie connotes that an order passed on appeal under the Act is conclusive

and no further appeal lies against it. But, it does not mean a remedy other than an appeal would not

lie.

7. The distinction between a revision and appeal is wellknown. While the revisional power is

discretionary, the remedy of appeal is by way of a tight given to a party and scope of an appeal is as

much as that of the original authority unless limited by the provisions of the statute itself and in

Indian Kanoon - http://indiankanoon.org/doc/418357/ 2

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

revision only legality, propriety or regularity of such proceeding can be gone into and not other

aspects.

8. However, the learned counsel for the petitioner sought to rely upon a decision in Commissioner of

Sales Tax, U.P., Lucknow v. M/s. Suger Cotton Bowl Refilling Works. In that case, decision of the

Commissioner under the U.P. Sales Tax Act has been rendered final subject only to an appeal before

three member Bench of the Tribunal. Therefore, it was held that further revision to the High Court

was not maintainable. The Supreme Court examined the language of Section 11 of the U.P. Sales Tax

Act and stated that a revision is not entertainable -- from, the decision of the Commissioner which

has been subjected to an appeal before the Tribunal in view of the language used. In the absence of a

specific provision that such revision, will be maintainable, such revision will not lie for S. 35(5) of

the said Act stated that the decision of the Commissioner of Sales Tax under the section shall,

subject to an appeal to the Tribunal, be final. In view of the language of that Section, in their

opinion, further revision to the High Court against the decision of the Tribunal was not

contemplated. In the particular scheme of the enactment, it was stated that an appeal lies to Bench

of three members of the Tribunal and no further revision from such an order would lie and it was

also noticed that the Tribunal had come in the place of the High Court in hearing the appeal. In such

a situation, to contemplate that the language of section envisages that the order of the

Commissioner to be final subject to an appeal to the Tribunal and that a further revision lies to the

High Court, is unwarranted. The circumstance of substitution of the High Court by the Tribunal to

hear appeal against the order of the Commissioner weighed with the Supreme Court very heavily.

But, in the present case that is not the situation at all. The Divisional Commissioner, Deputy

Commissioner, Assistant Commissioner and the Tahsildar constitute an heirarchy of officers with

the Divisional Commissioner having supervisory control over them akin to Section 115, C.P.C. In

such an event, it cannot be said that the decision in to the aid of the petitioner.

9. In Madhaji Lakhiram v. Mashrubhai Mahadevbhai Raban, (FB) question of finality of orders

made under the Bombay Tenancy and Agricultural Lands Act was considered. The finality of the

decision rendered under Section 88C (5) of that Act subjected to a revision under Section 76 was

considered. In that decision it was held that the expression 'final' is not used by the Legislature in

any limited or technical sense of not subject to appeal, but it is used in the wider sense of not being

subject to revision. In that decision, it was noticed that the said Act did not contain any definition of

the expression 'final'. It is also noticed thereto the position in law that there is ample authority for

the view that mere use of words 'shall be final' in an enactment does not have the effect of shutting

out a revisional jurisdiction. The ordinary meaning of words 'shall be final' is merely that there shall

be no appeal against such order. But, comparing the powers of the Gujarat Revenue Tribunal under

Section 76 of the Act relating to revisional power and that of the High Court under Section 115,

C.P.C. it is held that in certain aspects there are differences and therefore, on the scheme of the

provisions of the Act it must be held that the expression 'final' means final including revision.

10. The cleavage of oipinion as to an enactment uses the word 'final' in relation to a decision of an

authority is demonstrable by reference to a decision in A.IR 1988 SC 812 -- M/s Jetha Bai & Sons V.

M/s. Sunderdas Rathenan Etc; In that case, the Supreme Court was concerned with the

interpretation of the provisions of Kerala Buildings (Lease and Rent) Control Act as to whether

Indian Kanoon - http://indiankanoon.org/doc/418357/ 3

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

against the revisional order made by the revision court under Section 20 thereto, a second revision

would be lie to the High Court. On an examination of the scheme of the provisions thereto, it was

noticed that Section 18(5) of the said Act declares that an order of the Rent Control Court shall be

final subject to the decision of the appellate authority and the order of the appellate authority shall

be final and shall not be liable to be called in question in any court of law, except as provided

thereto. When the Legislature has declared that even an order of the Rent Control Court and the

decision of the appellate authority shall be final at their respective stages unless the order is

modified by the Appellate Authority or the Revisional authority as the case may be. There is no

necessity for the Legislature to declare once over again that an order passed in revision by the

District Judge or the High Court as the case may be will also have the seal of finality. It is also

noticed that, the Legislature has not merely conferred finality to the decision of an appellate

authority, but has further laid down that the decision shall not be liable to be called in question in

any court of law except as provided under Section 20. These additional words clearly spell out the

prohibition or exclusion of a second revision under Section 115, C.P.C. to the High Court. While

referring to a decision of the Supreme Court in Shyamaraju Hegde v. Venkatesha, in relation to a

question whether by reason of Section 48(6) of the Karnataka Rent Control Act, a further revision

against a revisional order passed by the District Judge under Section 50(2) of the KRC Act would lie

or not under Section 115, C.P.C. it was held by a Full Bench of this court in the light of the decisions

in Chhaganlalv. Municipal Corporation Indore and Krishnadas Bhatija v. A. S. Venkatachala Shetty

(SLP (Civil) No. 913 of 1978 decided on 13-2-1978) that the jurisdiction of the High Court under

Section 115, C.P.C. to revise an order of the District Judge passed under Section 50(2) stood

unaffected. However, in a subsequent decision rendered by a Full Bench in M.M. Yaragatti v. Vasant

that view was upset and the Supreme Court considered the correctness of that view and the view

expressed in Shyamaraju Hegde's case. It was noticed therein that having regard to the Legislative

history that the right of appeal has been completely taken away and the entire proceedings are

sought to be limited to a two tier system viz., the Rent Control court and the Revisional Court

whereas under the Kerala Act there is a three tier system viz., the Rent Control Court, the Appellate

Court and the Revisional Court. A further revision to the High Court would not lie under the Kerala

Act, while under the Karnataka Act it would lie and though the language of the Karnataka Act is to

the effect that the order made there shall be final and shall not be liable to be called in question

before any authority or in a proceeding in any suit or other proceedings. The Supreme Court

reckoned the same at a lesser decree than the terms under the Kerala Act because the word 'finality'

in the two enactments under the relevant provisions present distinctly different perspectives.

Therefore, one cannot say with any definiteness or lay down any general principle as to whether the

expression 'final' in regard to an order made by an authority would not leave open the door to

revision. Hence, we are of the view that the matter should be examined not merely on the language

of a particular provision, but also bearing in mind the entire scheme of the Act and, if necessary the

legislative history thereto.

11. In the present cast the question for consideration is whethere Section 118 A of the Act would

empower the Divisional Commissioner to revise an order made under Section 118(2b) and whether

such juridiction is excluded merely because it is stated that from every order passed by the

Tahsildar, an appeal shall lie to the Assistant Commissioner and the order of the Assistant

Commissioner on such appeal shall be final. As noticed earlier, in the scheme of the Act, from every

Indian Kanoon - http://indiankanoon.org/doc/418357/ 4

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

order made by the Deputy Commissioner or officers authorised under Section 77 or 83 of the Act

and by the Assistant Commissioner, an appeal would lie to the Appellate Tribunal, while it is only in

case of the orders made by the Tahsildar an appeal lies to the Assistant Commissioner and that

order made by the Assistant Commissioner in such a case is rendered final. Considering the scheme

of the Act that in no case other than the one envisaged under Section 118(2b), a revision would lie to

the Divisional Commissioner in respect of an order made by the Assistant Commissioner. We must

hold that the order made by the Assistant Commissioner is subject to revision by the Divisional

Commissioner.

12. The next argument is based upon the provisions of Section 57 of the Karnataka Land Revenue

Act. Sectiqn 2(B) of the Act states that the words and expressions used in this Act but not defined

shall have the meaning assigned to them in the Karnataka Land Revenue Act, 1964 and the Transfer

of Property Act, 1882 as the case may be Section 57 of the Revenue Act provides that whenever in

this Act it is declared that an order of a revenue officer shall be final, such expression shall be

deemed to mean that no appeal lies from such order. The argument is that inasmuch as the

expression 'final' has not been defined in the Act, the definition of the same expression under

Section 57 of the Karnataka Land Revenue Act would govern the construction of the words in

Section 118(2b) of the Act. Under Section 2(B) of the Act, what is applied is the definition under the

Karnataka Land Revenue Act and not a fiction created thereto. The language of Section 57 shows

that the provision is not conceived as definition of the expression 'final'. The definitions in the

Revenue Act are to be found in Section 2 thereof. That section does not contain any definition of the

word 'final'. Section 57 of the Land Revenue Act is not intended to deal with the word 'final' alone

but also it deals with the legal effect of a declaration in the Court about the finality of the decision or

order. What it says is that if Revenue Act declares that a decision or order shall be final thereto, such

an expression shall be deemed to have the meaning assigned to it in the Section. In other words, the

Section creates a fiction that the decision or order is final shall mean that the decision or order shall

not be subject to an appeal. Proceeding on this basis, it was contended that Section 57 of the Land

Revenue Act could not be applied to the present case. This argument receives support from

Madhaji's case decided by Gujarat High Court.

13. It could be seen as held in St. Aubyn v. Attorney General, (1951) 2. All ER 473, referred to in Hira

H. Advani v. State of Maharashtra, , the expression 'deemed' which is normally used to create a

statutory fiction may also be used to put beyond doubt a meaning which may otherwise be uncertain

or give an expression a comprehensive description that it includes what is obvious, what is uncertain

and what is, in the ordinary sense, impossible. In our view, Section 57 provides for the meaning of

expression 'final'. We have referred to certain decisions which take the view that final means as

without recourse to appeal but does not exclude revision and that is the meaning attributed to the

expression 'final' in Section 57 of the Land Revenue Act. However, in Madhaji's case, the Full Bench

held that there will be a repugnancy between the definition and the context if Section 212 of the

Bombay Land Revenue Code were to be made applieable to the Tenancy Act in the sense in which it

is contended that a revision would lie and hence the conclusion was reached on the language of the

relevant enactment.

Indian Kanoon - http://indiankanoon.org/doc/418357/ 5

Gururaj Gurunath Govind Rao ... vs The State Of Karnataka on 1 August, 1994

14. It was also submitted that Section 57 of the Land Revenue Act, if at all to be applied, must be

applied in its entirety. The said section provides that the Tribunal alone is competent to modify,

annul or reverse such order. But, the Section consists of two parts; one part refers to the meaning to

be attributed to the expression 'final' while the other part refers to the powers of the Tribunal. In

understanding the meaning of the expression 'final', the other part of the provision need not be

looked at. Hence, we are of the view that on the basis of S. 57 of the Karnataka Land Revenue Act, it

could he construed that expression 'final' in S. 118(2b) of the Act should be understood as only

pertaining to appeal.

15. We may also notice that in S. 118 of the Act only matters relating to appeals are dealt with and no

powers or provisions relating to revision arc referred to or considered. Therefore, finality in S.

118(2b) would only make it clear that no further appeal would lie for in the event it had not been

rendered final, an appeal could have been preferred against an order made by the Assistant

Commissioner also to the Tribunal as provided in S. 118(2) of the Act. If it were to be construed that

the Assistant Commissioner exercises powers even in relation to matters other than S. 83 of the Act,

an appeal would lie to the Tribunal. In the circumstances, on the scheme of the provisions of the Act,

we must hold that S. 118A of the Act would cover an order made by the Assistant Commissioner

under S. 118(2b) of the Act.

16. In Srimanmaharaja Niranjana Jagad-guru Mallikarjuna Murugarajendra Maha-swamy v. Deputy

Commissioner, ,. a Division Bench of this Court had occasion to consider the scope of provisions of

the Karnataka Land Revenue Act. It was held therein that in exercise of his powers under S. 136 of

the Land Revenue Act, the Deputy Commissioner has no power to revise the appellate order tinder

sub-sec. (2) thereof. Section 136(2) uses the expression 'final' as regards the order of the appellate

authority made under that provision and there are no express words in any other provision enabling

a revision and when the appellate authority makes an order under S. 136(2) of the Land Revenue

Act, the order made by the original authority under S. 129 of the Act merges with the latter and

therefore the Deputy Commissioner has no power to interfere with the order made under S. 129 of

the said Act when it has been a subject-matter in appeal. That decision stood on the scheme and

scope of the provisions of the Land Revenue Act. It was pointed out therein that the expression

rendering an appellate authority as final would be rendered otiose, if it were a subject-matter for

revision. But, we cannot subscribe to that rationale, with respect, because where an order of

authority is rendered final whether the same is subject to further revision should be understood in

the light of the decisions of the Supreme Court referred to earlier wherein it is explained that the

meaning to be attributed to expression 'final' will depend upon the scheme of the provisions of the

Act and cannot be read in isolation. Merely because an expression 'final' is used, it cannot be said

that a revision would not lie against such an order.

17. In that view of the matter, we hold that a revision lies under S. 118A of the Act against an order

made by the Assistant Commissioner in a proceeding arising under S. 118(2b) of the Act and we

answer the question referred to us accordingly.

18. Order accordingly.

Indian Kanoon - http://indiankanoon.org/doc/418357/ 6

You might also like

- Affidavit of Refund of Money: Engineering Consultancy Services (ELC Builders For Brevity), Which Is Owned and Operated byDocument1 pageAffidavit of Refund of Money: Engineering Consultancy Services (ELC Builders For Brevity), Which Is Owned and Operated byJames PeregrinoNo ratings yet

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- CPC MemorialDocument21 pagesCPC MemorialRashi Pandit100% (4)

- In The High Court of Karnataka at BengaluruDocument43 pagesIn The High Court of Karnataka at BengaluruManjunath DasappaNo ratings yet

- FV Aurban-Plad3155821-Phpapp01fvafdvaDocument590 pagesFV Aurban-Plad3155821-Phpapp01fvafdvaFrialyn100% (1)

- Assistant Commissioner Order Is Subjected To Revision Before Deputy Commissioner Under Karnataka Land Revenue Act 2012 Wp-67926-2011Document62 pagesAssistant Commissioner Order Is Subjected To Revision Before Deputy Commissioner Under Karnataka Land Revenue Act 2012 Wp-67926-2011Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್67% (3)

- Jeevesh PlaintDocument6 pagesJeevesh PlaintSHIVAM SHARMANo ratings yet

- Institution of Suit - CasesDocument25 pagesInstitution of Suit - CasesAnonymousNo ratings yet

- Quizzer in Corpo Set ADocument10 pagesQuizzer in Corpo Set ACJBNo ratings yet

- Aguirre V SOJDocument2 pagesAguirre V SOJJaz Sumalinog0% (1)

- Madan Kumar and Others Vs State of Karnataka and Others On 30 November 1998Document3 pagesMadan Kumar and Others Vs State of Karnataka and Others On 30 November 1998Manjunath DasappaNo ratings yet

- Interpretation of Statute Case Bangladesh vs. Abdul MannanDocument5 pagesInterpretation of Statute Case Bangladesh vs. Abdul MannanShadab AshrafNo ratings yet

- Indian Law Report - Allahabad Series - Sep2008Document76 pagesIndian Law Report - Allahabad Series - Sep2008PrasadNo ratings yet

- Report 203Document97 pagesReport 203Jivaansha SinhaNo ratings yet

- 6-Whether Sending Partition Decree To Collector For Partition of Property Is Ministerial Act Not A Judicial FunctionDocument7 pages6-Whether Sending Partition Decree To Collector For Partition of Property Is Ministerial Act Not A Judicial FunctionAnurag TamrakarNo ratings yet

- The Commissioner of Sales Tax U.P. V Madan LalDocument2 pagesThe Commissioner of Sales Tax U.P. V Madan LalRenuNo ratings yet

- Hindustan Petroleum Corporation Ltd. v. Dilbahar SinghDocument32 pagesHindustan Petroleum Corporation Ltd. v. Dilbahar SinghBar & BenchNo ratings yet

- This Judgement Ranked 1 in The Hitlist.: 1975 (2) ILR (Punjab) 310: 1973 PLJ 462: 1973 RLR 456Document7 pagesThis Judgement Ranked 1 in The Hitlist.: 1975 (2) ILR (Punjab) 310: 1973 PLJ 462: 1973 RLR 456GURMUKH SINGHNo ratings yet

- Durairaj & Others v. Venugopal & AnotherDocument15 pagesDurairaj & Others v. Venugopal & AnotherSheroy BroachaNo ratings yet

- Rent CaseDocument14 pagesRent CaseSnehal RautNo ratings yet

- Second Memorial Moot Court Rajkumar Ghore PlaintiffDocument14 pagesSecond Memorial Moot Court Rajkumar Ghore Plaintiffpriyankakokane25No ratings yet

- 2018 Ico 466Document5 pages2018 Ico 466K R Rajeev KrishnanNo ratings yet

- Wellington Associates LTD Vs Kirit MehtaDocument9 pagesWellington Associates LTD Vs Kirit MehtaAnkit KumarNo ratings yet

- Section 54 CPC-08JuneDocument27 pagesSection 54 CPC-08JuneHaryana Olympic AssociationNo ratings yet

- Amiya Kumar Basu Vs Pankaj Kr. Chakraborty & Ors. On 6 November, 1998Document7 pagesAmiya Kumar Basu Vs Pankaj Kr. Chakraborty & Ors. On 6 November, 1998Arisha NusratNo ratings yet

- Greena Fernando V. Teckla Saparamadu: HeldDocument5 pagesGreena Fernando V. Teckla Saparamadu: Heldmohganewatta ganewattaNo ratings yet

- Government of IndiaDocument97 pagesGovernment of IndiaLatest Laws TeamNo ratings yet

- S 29A C E PSH: Issue: Appointment of Arbitrator Under Section 29A?Document8 pagesS 29A C E PSH: Issue: Appointment of Arbitrator Under Section 29A?Shachi SinghNo ratings yet

- Legal Provisions of Section 115 of Code of Civil Procedure 1908Document23 pagesLegal Provisions of Section 115 of Code of Civil Procedure 1908Aditya VermaNo ratings yet

- JUDGMENT - ORDER in - WRIT - A No. 49414 of 2008 at Allahabad Dated-30.9.2008 CASE TITLE - Raj Kumar Rajpoot vs. Smt. Usha Devi Lahauti & OthersDocument8 pagesJUDGMENT - ORDER in - WRIT - A No. 49414 of 2008 at Allahabad Dated-30.9.2008 CASE TITLE - Raj Kumar Rajpoot vs. Smt. Usha Devi Lahauti & OthersNeena BatlaNo ratings yet

- CrossExaminationINInterim Bhanwarlal Vs SMT (1) - Kamla Devi On 27 July, 1981Document3 pagesCrossExaminationINInterim Bhanwarlal Vs SMT (1) - Kamla Devi On 27 July, 1981PrasadNo ratings yet

- Indian Farmers Fertilizer CoOperative Limited Vs BSC20182901181739401COM374811Document16 pagesIndian Farmers Fertilizer CoOperative Limited Vs BSC20182901181739401COM374811mohitpaliwalNo ratings yet

- 1975 (2) ILR (Punjab) 310: 1973 PLJ 462: 1973 RLR 456: This Judgement Ranked 1 in The HitlistDocument13 pages1975 (2) ILR (Punjab) 310: 1973 PLJ 462: 1973 RLR 456: This Judgement Ranked 1 in The HitlistGURMUKH SINGHNo ratings yet

- National Thermal Power Corporation LTD Vs Siemens S070234COM868987Document11 pagesNational Thermal Power Corporation LTD Vs Siemens S070234COM868987vikramshantu86047No ratings yet

- Appeals and Revisions-Civil: Part A The Appellate System of The PunjabDocument13 pagesAppeals and Revisions-Civil: Part A The Appellate System of The PunjabTanisha TomarNo ratings yet

- Sllr-1978-79-80-V1-Bill1m0ria-V. Minister of Lands and Land Development & Mahaweli DevelDocument7 pagesSllr-1978-79-80-V1-Bill1m0ria-V. Minister of Lands and Land Development & Mahaweli DevelFelicianFernandopulleNo ratings yet

- ADRS Case AnalysisDocument10 pagesADRS Case AnalysisMedsNo ratings yet

- The Executive Officer Vadakku Valliyur Town Panchayat Vs M Mattar MohideenDocument5 pagesThe Executive Officer Vadakku Valliyur Town Panchayat Vs M Mattar MohideenMuthu SrinithiNo ratings yet

- M.Y. Eqbal and Kurian Joseph, JJDocument5 pagesM.Y. Eqbal and Kurian Joseph, JJBhola PrasadNo ratings yet

- Mohanlal Shamji Soni Vs Union of India UOI and Ors1110s910181COM206847Document10 pagesMohanlal Shamji Soni Vs Union of India UOI and Ors1110s910181COM206847Geetansh AgarwalNo ratings yet

- Draft-Cpc-Rules-2023 KarnatakaDocument24 pagesDraft-Cpc-Rules-2023 KarnatakaTeju AletiNo ratings yet

- Law Web - What Are Powers and Duties of Tahsildar While Executing Partition DecreeDocument6 pagesLaw Web - What Are Powers and Duties of Tahsildar While Executing Partition DecreekalerenukaNo ratings yet

- NSDL v. SEBI PDFDocument22 pagesNSDL v. SEBI PDFjay1singheeNo ratings yet

- Partition Act PDFDocument0 pagesPartition Act PDFZiaul HoqueNo ratings yet

- Maharashtra ( (2004) 8 SCC 505) Had Considered The Question Whether All TheDocument76 pagesMaharashtra ( (2004) 8 SCC 505) Had Considered The Question Whether All Theshanthraju ybNo ratings yet

- ALL H.C MOHD USMAN VS SAYED MOHD NASIR - Contempt - Alternate RemedyDocument3 pagesALL H.C MOHD USMAN VS SAYED MOHD NASIR - Contempt - Alternate RemedyRamraj VishwakarmaNo ratings yet

- New Miraj Cafe Vs RamakaranDocument4 pagesNew Miraj Cafe Vs RamakaranSME 865100% (1)

- 2022LHC6710Document8 pages2022LHC6710WaqasSanaNo ratings yet

- Case On Imposition of CostDocument10 pagesCase On Imposition of CostJAYESHNo ratings yet

- 88 TNCSDocument4 pages88 TNCSVasanthanayagan VasanthanayagnNo ratings yet

- AIR 1975 Ker 15Document2 pagesAIR 1975 Ker 15Ramesh Babu TatapudiNo ratings yet

- Written SubmissionsDocument13 pagesWritten SubmissionsSanjit ShenoyNo ratings yet

- CRP 2338 2018Document13 pagesCRP 2338 2018Yedavelli BadrinathNo ratings yet

- Syarikat Maltaco SDN BHD V Eow Teh YuDocument6 pagesSyarikat Maltaco SDN BHD V Eow Teh YuMohamad MursalinNo ratings yet

- Registration Project 1454Document9 pagesRegistration Project 1454Amit Singh RathourNo ratings yet

- Judgement - 14 Feb 2020Document9 pagesJudgement - 14 Feb 2020Raj hnNo ratings yet

- Letter Patent Appeal: Limitation ActDocument4 pagesLetter Patent Appeal: Limitation ActShalini SonkarNo ratings yet

- CPC Final Draft NewwwDocument10 pagesCPC Final Draft NewwwMithlesh ChoudharyNo ratings yet

- S. 10 - Deduction of Collection Charge in Order To Recovery of Dues As Arrears of Land Revenue Would Be PermissibleDocument41 pagesS. 10 - Deduction of Collection Charge in Order To Recovery of Dues As Arrears of Land Revenue Would Be PermissibleAnshul SinghNo ratings yet

- Lahore High Court, Lahore: Judgment SheetDocument23 pagesLahore High Court, Lahore: Judgment SheetNaveedNo ratings yet

- CPC I Final Term Answer Paper: Submitted By: Tanvir MahtabDocument8 pagesCPC I Final Term Answer Paper: Submitted By: Tanvir MahtabALIFNo ratings yet

- Advocates Act Case LawDocument13 pagesAdvocates Act Case LawPayal KarnaneyNo ratings yet

- Surya Dev Rai Vs Ram Chander RaiDocument15 pagesSurya Dev Rai Vs Ram Chander RaiShivam PatelNo ratings yet

- Jayalakshmi Coelho Vs Oswald Joseph Coelho On 28 February, 2001Document20 pagesJayalakshmi Coelho Vs Oswald Joseph Coelho On 28 February, 2001Manjunath DasappaNo ratings yet

- 152 Supreme Court SatnamDocument8 pages152 Supreme Court SatnamManjunath DasappaNo ratings yet

- Notes On R.C JurisdictionDocument1 pageNotes On R.C JurisdictionManjunath DasappaNo ratings yet

- Rd70bhudasa2005dated20052006 PDFDocument5 pagesRd70bhudasa2005dated20052006 PDFManjunath DasappaNo ratings yet

- H.N. Chandrashekar Sec 56 of KLRDocument12 pagesH.N. Chandrashekar Sec 56 of KLRManjunath DasappaNo ratings yet

- H. Hiriyannaiah Vs Divisional Commissioner On 28 August, 1990Document7 pagesH. Hiriyannaiah Vs Divisional Commissioner On 28 August, 1990Manjunath DasappaNo ratings yet

- SEC 56 D.C. POWERS H.K. Nagesh S - O KrishnegondaDocument3 pagesSEC 56 D.C. POWERS H.K. Nagesh S - O KrishnegondaManjunath DasappaNo ratings yet

- Farm House CircularDocument4 pagesFarm House CircularManjunath DasappaNo ratings yet

- Ride Sharing App Terms and ConditionsDocument57 pagesRide Sharing App Terms and Conditionsforhad karimNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sahil sachdevaNo ratings yet

- This Content Downloaded From 103.232.241.147 On Mon, 19 Sep 2022 16:51:43 UTCDocument15 pagesThis Content Downloaded From 103.232.241.147 On Mon, 19 Sep 2022 16:51:43 UTCsayondeepNo ratings yet

- Update To The Court - County Attorney's OfficeDocument5 pagesUpdate To The Court - County Attorney's OfficeNBC MontanaNo ratings yet

- Doctrine of FrustrationDocument15 pagesDoctrine of FrustrationAkshat TiwaryNo ratings yet

- Job No. 537 ADocument4 pagesJob No. 537 AMahmoud SamiNo ratings yet

- Consular Electronic Er - Print ApplicationDocument6 pagesConsular Electronic Er - Print ApplicationIrakli DavitashviliNo ratings yet

- BLGF DOF DC No 002 2020Document13 pagesBLGF DOF DC No 002 2020Elmar BlancoNo ratings yet

- Thoery of IR June Exam NotesDocument36 pagesThoery of IR June Exam NotesRalitsa HristovaNo ratings yet

- Adidas America Vs NCAADocument3 pagesAdidas America Vs NCAARamej AdapaNo ratings yet

- Session Twelve: Harambee and Development 12.1 ObjectivesDocument4 pagesSession Twelve: Harambee and Development 12.1 ObjectivesJpricarioNo ratings yet

- FMMA Vol 2 8th EditionDocument323 pagesFMMA Vol 2 8th EditionRana UsmanNo ratings yet

- G.R. No. 140756 - PEOPLE OF THE PHILIPPINES vs. JUAN GONZALES ESCOTE, ET ALDocument20 pagesG.R. No. 140756 - PEOPLE OF THE PHILIPPINES vs. JUAN GONZALES ESCOTE, ET ALLucy HeartfiliaNo ratings yet

- Orwell'S 1984 and The Concept of PowerlessnessDocument9 pagesOrwell'S 1984 and The Concept of PowerlessnessIJELS Research JournalNo ratings yet

- TEXT and CONTEXT CONNECTIONS RawDocument19 pagesTEXT and CONTEXT CONNECTIONS RawLester MolinaNo ratings yet

- Tamil Nadu Police - WikipediaDocument26 pagesTamil Nadu Police - WikipediaRamanujam ThangarajNo ratings yet

- 7 Todd, Zoe, Indigenizing The AnthropoceneDocument14 pages7 Todd, Zoe, Indigenizing The AnthropoceneNay LimaNo ratings yet

- Maldives: Private Sector Development ProjectDocument16 pagesMaldives: Private Sector Development ProjectADBGADNo ratings yet

- ERH-Payment Import Format Description BEC-November-2018 - UkDocument15 pagesERH-Payment Import Format Description BEC-November-2018 - UkCine WorldNo ratings yet

- B. Com (Banking and Insurance) - Sem-VI Subject: Auditing II Question BankDocument9 pagesB. Com (Banking and Insurance) - Sem-VI Subject: Auditing II Question Bankcharanjeet singh chawlaNo ratings yet

- WEEK 7A - Philippines Under American TutelageDocument28 pagesWEEK 7A - Philippines Under American TutelageJULIANA NICOLE TUIBUENNo ratings yet

- Downtown Dubai Opera District: Typical Services Reservation Cross Section For Corridor Width of 30.50MDocument1 pageDowntown Dubai Opera District: Typical Services Reservation Cross Section For Corridor Width of 30.50Mabdullah sahibNo ratings yet

- PMiles Redemption FormDocument1 pagePMiles Redemption FormArgentum SurferNo ratings yet

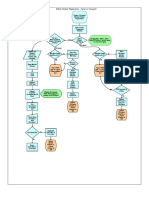

- Mobile Number Reg FlowchartDocument1 pageMobile Number Reg FlowchartKarthikayani PalaniNo ratings yet

- Case Analysis Samira Kohli vs. Prabha ManchandaDocument5 pagesCase Analysis Samira Kohli vs. Prabha ManchandaAshish JhaNo ratings yet