Professional Documents

Culture Documents

How To Read A Performance Advertisement That Describes A Mutual Fund's Total Return

Uploaded by

Bruno Pinto Ribeiro0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

How to Read a Performance Advertisement that Describes a Mutual Fund's Total Return

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageHow To Read A Performance Advertisement That Describes A Mutual Fund's Total Return

Uploaded by

Bruno Pinto RibeiroCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

How to Read a Performance Advertisement that

Describes a Mutual Fund’s Total Return

1 Performance is just one consideration. market funds.) Although past performance

This hypothetical ad emphasizes past can’t predict future results, it can show you how

performance. Recognize that past performance volatile the fund has been.

has limitations (see note 7). In addition, Classic Investments 5 Understand standardized performance.

remember that performance is just one factor

among several that will determine your long- Have your investments stood the test of time? If not, take a Standardized performance measures let you

compare similar funds. These numbers represent

term success as an investor. According to the look at ours. We build ours to weather all kinds of market

U.S. Securities and Exchange Commission (SEC), the average annual change in the value of a

other factors include: climates. And we offer styles to suit every investment hypothetical investment made at the beginning

of the specified time period. They assume any

• the fund’s objectives and strategies; temperament. Isn’t it time to invest in a Classic?

dividends and capital gains distributions are

• the fund’s sales charges, fees, and expenses; reinvested, and they take into account fund

fees, expenses, and sales charges. When funds

• the taxes you may pay when you receive a advertise these returns, they can’t emphasize

distribution from the fund; “good” numbers over “poor” ones. By law,

• how large the fund is and how long it has all standardized numbers must be equally

existed; prominent. But bear in mind that standardized

5 Average Annual Total Returns figures do not reflect what your personal return

• how much risk the fund takes and how volatile as of 3/31/03 3 would have been because they don’t take into

it is; and

account the timing of your individual transactions

Year to Date

• any recent changes in the fund’s operations. during each period.

Classic Fund as of 6/30/03 1 Year 5 Year 10 Year 4

See “Mutual Fund Investing: Look at More Than 6 Understand other performance measures.

a Fund’s Past Performance” for more information. Doric Fund 11.64% 6 -18.55% 0.17% 8.88%

Fund ads can include other performance numbers

2 Ionic Fund 13.87% -26.90% 2.20% 8.63% in addition to the mandated one-, five-, and

2 Remember your goals.

ten-year figures (see note 4). But they can’t be

When you see an interesting ad for a fund, ask

Corinthian Fund 10.72% -20.33% -1.49% 9.12% given greater prominence than the required data.

yourself first if the fund fits your investment 1

When you’re reviewing these figures, keep your

goals. If you’re not sure, ask for and read the

Performance data quoted above is historical. Past performance is no own investment goals in mind. For example, how

fund’s prospectus. For example, an ad for an

important is six months of exceptionally good or

aggressive growth fund simply isn’t relevant if guarantee of future results. Current performance may be higher or lower poor performance when you’re investing for your

you’re investing for income.

than the performance data quoted. The principal value and investment retirement in 25 years?

3 Check the date. 7 return of an investment will fluctuate so that your shares, when redeemed,

7 Performance varies.

Check the date used to calculate annual returns. may be worth more or less than their original cost. You can obtain This paragraph highlights the limitations of

The more time that has elapsed between then performance data current to the most recent month end (available relying too heavily on past performance data.

and now, the more likely the fund’s performance

within seven business days of the most recent month end) by calling Much of this information already appears

may have changed, perhaps significantly, since

1-800-CLASSIC or by visiting www.classicinvestments.com. in mutual fund ads. But on April 1, 2004,

that date. Beginning April 1, 2004, all mutual

performance ads will be required to include

fund ads must include information on how to

this paragraph or similar language. Here you

obtain the fund’s performance as of the end of

the most recent month (see note 7), unless the

You should consider the fund’s investment objectives, risks, and charges will also learn how to get more current figures,

and expenses carefully before investing. For this and other important unless the ad already includes them.

ad already includes the updated figures. 8

information, please obtain a fund prospectus from Classic Investments 8 Consider all factors.

4 Compare performance.

and read it carefully before investing. You’ll see this or similar language in fund ads

Performance information in mutual fund

beginning April 1, 2004. This paragraph reminds

advertisements is strictly regulated. All

you that performance is only one way to size

performance ads must include figures calculated

up a fund. Other fund features, such as risk

using SEC standards so that you can make

and expenses, are also important. For more

accurate comparisons among similar funds. For

information, please see “Questions You Should

stock and bond funds, one-, five-, and ten-year

average annual total returns must be included Ask Before You Invest in a Mutual Fund.”

in the ad. (There are separate rules for money Copyright © 2003 by the Investment Company Institute

You might also like

- Stock Market Efficiency & Stock ValuationDocument23 pagesStock Market Efficiency & Stock ValuationKaila SalemNo ratings yet

- How To Swing Trade by Brian PezimDocument248 pagesHow To Swing Trade by Brian PezimSravan KumarNo ratings yet

- Estimating Maintenance CapExDocument65 pagesEstimating Maintenance CapExBruno Pinto RibeiroNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document30 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Karan SainiNo ratings yet

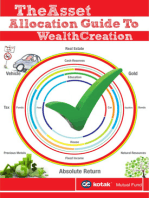

- The Asset Allocation Guide to Wealth CreationFrom EverandThe Asset Allocation Guide to Wealth CreationRating: 4 out of 5 stars4/5 (2)

- Fixed IncomeDocument90 pagesFixed Incometushar3010@gmail.com100% (1)

- Finance NotesDocument246 pagesFinance NotesRL3451No ratings yet

- 9. Portfolio Management 9.1. Different Types of Investors & Investment Products 9.1.1. 重要知识点 9.1.1.1. Portfolio overviewDocument52 pages9. Portfolio Management 9.1. Different Types of Investors & Investment Products 9.1.1. 重要知识点 9.1.1.1. Portfolio overviewEvelyn YangNo ratings yet

- Why Invest in Mutual Fund AMFIDocument30 pagesWhy Invest in Mutual Fund AMFISethuraman VNo ratings yet

- Company-Valuation Saas PDFDocument14 pagesCompany-Valuation Saas PDFCapitaine KrunchNo ratings yet

- Biases That Skew Our ThinkingDocument3 pagesBiases That Skew Our ThinkingBruno Pinto Ribeiro100% (1)

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document30 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)swapnil deokarNo ratings yet

- A Concise Guide To Investing in SharesDocument18 pagesA Concise Guide To Investing in SharesVivek HandaNo ratings yet

- 02a Creating - An - Investment - Policy - StatementDocument16 pages02a Creating - An - Investment - Policy - StatementBecky GonzagaNo ratings yet

- Corporate Finance 1 PDFDocument324 pagesCorporate Finance 1 PDFHE HUNo ratings yet

- Isgpore PDFDocument16 pagesIsgpore PDFGabriel La MottaNo ratings yet

- Investment FundsDocument21 pagesInvestment FundsGerry Lynne MabanoNo ratings yet

- FM MidtermDocument392 pagesFM MidtermSatya SinghNo ratings yet

- FM - 1Document15 pagesFM - 1akesingsNo ratings yet

- Mdi 0618Document24 pagesMdi 0618macc407150% (2)

- Capitalmind Adaptive Momentum Special Five Year Report PDFDocument17 pagesCapitalmind Adaptive Momentum Special Five Year Report PDFAnkit KejriwalNo ratings yet

- PDF Bro Questions PDocument4 pagesPDF Bro Questions PabhinavfunddNo ratings yet

- Chapter 2: Securities: Types, Features and ConceptsDocument22 pagesChapter 2: Securities: Types, Features and ConceptsTeja MullapudiNo ratings yet

- Style Drift: Do You Know Where Your Assets Are?: Synergy Financial GroupDocument4 pagesStyle Drift: Do You Know Where Your Assets Are?: Synergy Financial GroupgvandykeNo ratings yet

- 3rd Ed v1.0 - M9A - Keyconcepts (Chapter 5)Document2 pages3rd Ed v1.0 - M9A - Keyconcepts (Chapter 5)Samuel SaravananNo ratings yet

- Analyse Mutual Fund Portfolio - 7 Important ParametersDocument3 pagesAnalyse Mutual Fund Portfolio - 7 Important Parametersdvg6363238970No ratings yet

- Financial Management: TO, Faridha.RDocument23 pagesFinancial Management: TO, Faridha.RSrinivasan SrinivasanNo ratings yet

- Discuss The Techniques of Capital BudgetingDocument1 pageDiscuss The Techniques of Capital BudgetingMokhlesurNo ratings yet

- Why Invest in Preferred Shares?: TH THDocument6 pagesWhy Invest in Preferred Shares?: TH THSiti Shakiroh Ahmad TajudinNo ratings yet

- DMZ 1953 DMZ Partners Semi Annual FY 22 23 (Redacted)Document5 pagesDMZ 1953 DMZ Partners Semi Annual FY 22 23 (Redacted)Vikas GNo ratings yet

- Chapter 2 - Asset Allocation DecisionDocument24 pagesChapter 2 - Asset Allocation DecisionImejah FaviNo ratings yet

- What To Evaluate in A Mutual Fund Factsheet - Investor EducationDocument3 pagesWhat To Evaluate in A Mutual Fund Factsheet - Investor EducationAnkit SharmaNo ratings yet

- Assignment II - Quiz 2Document5 pagesAssignment II - Quiz 2tawfikNo ratings yet

- CH 12Document33 pagesCH 12Albert CruzNo ratings yet

- Risk MGMT in PE-GSAM Jan11Document28 pagesRisk MGMT in PE-GSAM Jan11Jess LeungNo ratings yet

- Ipq 2.19.2010Document2 pagesIpq 2.19.2010lion_parthNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- Investment Analysis - Bba 314Document48 pagesInvestment Analysis - Bba 314arthurNo ratings yet

- Fact Sheet - Legal and General Global Emerging Markets Index Fund 31-08-2020 UKDocument4 pagesFact Sheet - Legal and General Global Emerging Markets Index Fund 31-08-2020 UKLesley Fernandes MoreiraNo ratings yet

- Cbmec 102 ProjectDocument3 pagesCbmec 102 ProjectcyrillejeahdpNo ratings yet

- Cornell Notes W2Document9 pagesCornell Notes W2Amalia Kusuma DewiNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- Detailed Report On Investment AnalysisDocument4 pagesDetailed Report On Investment AnalysisRadha MaheshwariNo ratings yet

- Steps To Build Your PortfolioDocument3 pagesSteps To Build Your PortfolioVivek SahNo ratings yet

- Corporate Finance B40.2302 Lecture Notes: Packet 1: Aswath DamodaranDocument332 pagesCorporate Finance B40.2302 Lecture Notes: Packet 1: Aswath Damodaranset_hitNo ratings yet

- Chapter 2 - 211031 - 121711Document34 pagesChapter 2 - 211031 - 121711CY YangNo ratings yet

- Finance Difference Between and Short Notes CAP IIDocument74 pagesFinance Difference Between and Short Notes CAP IIbinuNo ratings yet

- Factors First A Risk-Based Approach To Harnessing Alternative Sources of Income WhitepaperDocument20 pagesFactors First A Risk-Based Approach To Harnessing Alternative Sources of Income WhitepaperLalit PonnalaNo ratings yet

- Mba 3rd Sem Finance Notes (Bangalore University)Document91 pagesMba 3rd Sem Finance Notes (Bangalore University)Pramod Aiyappa50% (2)

- AQR (2014) Capital Market Assumptions For Major Asset ClassesDocument12 pagesAQR (2014) Capital Market Assumptions For Major Asset ClassesQONo ratings yet

- Exchange Funds An Important Alternative For Your Asset AllocationDocument8 pagesExchange Funds An Important Alternative For Your Asset Allocationportercaldwell636No ratings yet

- Types of Securities Equity DebtDocument21 pagesTypes of Securities Equity DebtTeja MullapudiNo ratings yet

- MF Selection TheRight ApproachDocument2 pagesMF Selection TheRight ApproachMahesh NarayananNo ratings yet

- Presentation HDFC Mutual Fund - Product Suite - Oct 18Document57 pagesPresentation HDFC Mutual Fund - Product Suite - Oct 18ritik bumbakNo ratings yet

- Private Equity Part 4Document7 pagesPrivate Equity Part 4Paolina NikolovaNo ratings yet

- Exam Alternative InvestmentsDocument8 pagesExam Alternative InvestmentsHulcourtNo ratings yet

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Document2 pagesPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187No ratings yet

- Module 5Document15 pagesModule 5Alliah Gwyneth RemilloNo ratings yet

- AMFI IAP PresentationDocument34 pagesAMFI IAP Presentationservices mpbNo ratings yet

- BF Las q4 Week 1 For Qa CheckedDocument12 pagesBF Las q4 Week 1 For Qa CheckedTrunks KunNo ratings yet

- Ifrs Standards and Long Term InvestmentsDocument26 pagesIfrs Standards and Long Term InvestmentsKirosTeklehaimanotNo ratings yet

- IFS - Mutual FundsDocument36 pagesIFS - Mutual FundsBun From BakeryNo ratings yet

- Empirical Finance Newsletter, September 2009 (Plus Stock Screen Results)Document4 pagesEmpirical Finance Newsletter, September 2009 (Plus Stock Screen Results)The Manual of IdeasNo ratings yet

- Retired Investor - Getting Through Difficult Markets, AAII, 2011Document2 pagesRetired Investor - Getting Through Difficult Markets, AAII, 2011Ryan ReitzNo ratings yet

- Boy Will Be Boys - Gender, Overconfidence, and Common Stock InvestmentDocument32 pagesBoy Will Be Boys - Gender, Overconfidence, and Common Stock InvestmentBruno Pinto RibeiroNo ratings yet

- An Interview With Nobel Laureate Richard ThalerDocument7 pagesAn Interview With Nobel Laureate Richard ThalerBruno Pinto RibeiroNo ratings yet

- Narratives and ValuationsDocument37 pagesNarratives and ValuationsBruno Pinto RibeiroNo ratings yet

- The Investor's Dilemma - Mutual Funds or Stocks?: by Mohnish PabraiDocument4 pagesThe Investor's Dilemma - Mutual Funds or Stocks?: by Mohnish PabraiBruno Pinto RibeiroNo ratings yet

- Arlington Value Combined FilesDocument48 pagesArlington Value Combined FilesBruno Pinto RibeiroNo ratings yet

- Risk vs. Uncertainity in InvestingDocument6 pagesRisk vs. Uncertainity in InvestingBruno Pinto RibeiroNo ratings yet

- Capital Leases Enterprise ValueDocument4 pagesCapital Leases Enterprise ValueLukas SavickasNo ratings yet

- Dps 103 Basic Financial Accounting PDFDocument129 pagesDps 103 Basic Financial Accounting PDFlizzy mandenda100% (1)

- Working CapitalDocument15 pagesWorking CapitalJoshua CabinasNo ratings yet

- Assumptions:: Simple LBO Model - Key Drivers and Rules of ThumbDocument2 pagesAssumptions:: Simple LBO Model - Key Drivers and Rules of Thumbw_fibNo ratings yet

- Market Barometers: A Look at Stock Indexes and How They WorkDocument2 pagesMarket Barometers: A Look at Stock Indexes and How They Workprachi_williamNo ratings yet

- UFLEX - Docx FinalDocument60 pagesUFLEX - Docx FinalNeha Ahuja ChadhaNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Case Study #2 - Growing PainsDocument8 pagesCase Study #2 - Growing PainsLiamNo ratings yet

- Dividends ReviewerDocument8 pagesDividends ReviewerjasminetubaNo ratings yet

- SV Chapter-IV CLCDocument63 pagesSV Chapter-IV CLCĐinh Phương DungNo ratings yet

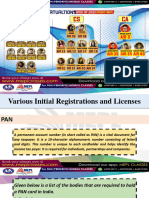

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- 2008 2007 AssetsDocument11 pages2008 2007 AssetssrksamiNo ratings yet

- Understanding Business and Entrepreneurship - 2024 v2 PDF-1Document37 pagesUnderstanding Business and Entrepreneurship - 2024 v2 PDF-1Nomvuma GubesaNo ratings yet

- Cost AccountingDocument13 pagesCost AccountingSaleh RaoufNo ratings yet

- Lesson 1 RIGHT OF APPRAISALDocument6 pagesLesson 1 RIGHT OF APPRAISALDi CanNo ratings yet

- B-4 HomeworkDocument5 pagesB-4 HomeworkDaniel GabrielNo ratings yet

- Account Titles T Account Rules of Debit and CreditDocument9 pagesAccount Titles T Account Rules of Debit and Creditignacio.dant3No ratings yet

- PPT#12 Different Kind of InvestmentDocument15 pagesPPT#12 Different Kind of Investmentshi lapsNo ratings yet

- Compliance Checklist For Audit of Corporate EntitiesDocument17 pagesCompliance Checklist For Audit of Corporate EntitiesaarthisingireddyNo ratings yet

- CostingDocument3 pagesCostingSukhrut MNo ratings yet

- Unit 4: Consolidations and EliminationsDocument3 pagesUnit 4: Consolidations and Eliminationss4hanasd 1809No ratings yet

- Jawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Document5 pagesJawaban Modul Pertemuan VI - Transaksi Antar Perusahaan - Persediaan (Upstream)Mega RefiyaniNo ratings yet

- Far 02 - Discontinued Operations and Non-Current Assets Held For SaleDocument2 pagesFar 02 - Discontinued Operations and Non-Current Assets Held For SaleMarie GonzalesNo ratings yet

- Statement of Cash FlowsDocument34 pagesStatement of Cash FlowsFahd RizwanNo ratings yet

- MC For Test 1Document13 pagesMC For Test 1Michelle LamNo ratings yet

- CASH FLOW ESTIMATION & RISK ANALYSIS DawDocument7 pagesCASH FLOW ESTIMATION & RISK ANALYSIS DawMaximusNo ratings yet