Professional Documents

Culture Documents

Questbridge Parent Income & Expense Declaration Form

Uploaded by

AmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questbridge Parent Income & Expense Declaration Form

Uploaded by

AmanCopyright:

Available Formats

MIE.

P 9/02/2016

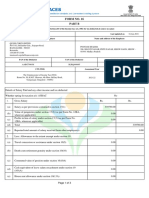

QUESTBRIDGE PARENT INCOME & EXPENSE DECLARATION FORM

Page 1 of 2

Student’s Name Student’s USC ID Number

Last First

Student’s Date of Birth

MM/DD/YY

Section 1: Parent Income

Parent: Please list ALL sources of income that are used to meet living expenses, including foreign income. Please report all figures in US dollars and as whole numbers rounded to the nearest

dollar. If an item does not apply, enter “n/a” in the space provided.

Note: If your total 2016 yearly income will be significantly less than your 2015 income, please attach a letter of explanation (if one has not been previously submitted). Also provide the

following required documentation:

• Letter from employer indicating: date of termination, reduction in hours worked, or reduction in salry/wages

• Copy of most recent pay stub (including year-to date earnings)

• Statements from (if applicable): Social Security Administration, Public Assistance Agencies, State Unemployment Compensation Office, State or Private Disability Insurance Agencies

This Parent Income & Expense Declaration includes information for: Both parents Father only Mother only Noncustodial Parent Stepfather Stepmother Legal Guardian

SOURCE OF INCOME MONTHLY AVERAGE IN 2015 MONTHLY AVERAGE IN 2016

Gross wages/salary/tips of Parent 1 (Exclude severance pay and tax-deferred income) $ $

Total to date for 2016: $ Estimate for remainder of 2016: $

Gross wages/salary/tips of Parent 2 (Exclude severance pay and tax-deferred income) $ $

Total to date for 2016: $ Estimate for remainder of 2016: $

Net income from business or farm (gross income minus business/farm expenses) $ $

Net income from rentals, partnerships, royalties, trusts, or corporations $ $

(gross income minus expenses)

Interest/dividends $ $

Capital gains $ $

Social Security (Include benefits for dependent children as well as yourself.) $ $

Pensions/annuities $ $

Alimony/spousal support $ $

Unemployment benefits $ $

Date Benefits Start

Date Benefits End

Severance pay $ $

Workers’ compensation/disability benefits $ $

Temporary Assistance for Needy Families (TANF) $ $

Child support received for all children $ $

Veterans’ noneducational benefits $ $

(Please specify source)

Money received or paid on your behalf, including financial support from abroad: $ $

(Please specify source of support: name/relationship.)

Housing, food and other living allowances from your employer $ $

(Include cash payments and value of benefits.) Indicate: military clergy other

Payments made to tax deferred accounts pension and saving plans, $ $

such as IRA, KEOGH, 401(k), 403(b)

Personal loans $ $

(Please specify source) (Please specify source)

Do you have documentation for these personal loans, such as a promissory note

or repayment schedule? Yes No N/A

Other: $ $

(Please specify source) (Please specify source)

TOTAL MONTHLY INCOME $ $

(If monthly income is less than expenses, attach an explanation and documentation to show how remaining

expenses are met, or documentation of amounts past due.

continued on page 2 >

Please submit to USC Financial Aid Office • Visit financialaid.usc.edu/questbridge to obtain document submission instructions.

MIE.P 9/02/2016

QUESTBRIDGE PARENT INCOME & EXPENSE DECLARATION FORM

Page 2 of 2

Student’s Name Student’s USC ID Number

Last First

Student’s Date of Birth

MM/DD/YY

Section 2: Parent Expenses

Parent: Next to each item, fill in the dollar amount of your family’s average monthly living expenses. If your family shares living expenses with others, indicate only that portion of expenses

which your family pays. If an expense occurs other than monthly, please convert it to a monthly average. Please report all figures as whole numbers rounded to the nearest dollar. Report only your

family’s living expenses. DO NOT REPORT ANY BUSINESS OR RENTAL PROPERTY EXPENSES. Fill in all items. If an item does not apply, enter “n/a” in the space provided.

• Does the family pay rent? Yes No

• Does the family pay mortgage? Yes No If YES, are payments current? Yes No

• If family pays neither rent nor mortgage, or if mortgage payments are not current, please explain:

MONTHLY EXPENSES: AVERAGE AMOUNT PER MONTH IN 2015 AVERAGE AMOUNT PER MONTH IN 2016

Child Support paid $ $

Home mortgage/rent (Do not include insurance, property tax or mortgage on rental properties) $ $

Property tax on primary residence $ $

Food and household supplies $ $

Utilities (gas, electric, water, etc.) $ $

Phone, cable, Internet $ $

Clothing $ $

Child care $ $

Private, elementary/secondary school tuition $ $

Insurance (home, car, health, life, etc.) $ $

Medical/health expenses paid out of pocket and NOT covered by insurance $ $

Gasoline and auto maintenance or public transportation $ $

Car payments (Make: Year: ) $ $

(Make: Year: ) $ $

Personal loan payments $ $

Other: $ $

TOTAL MONTHLY EXPENSES $ $

(If your 2015 monthly income is less than your expenses, please attach an explanation and documentation

to show how remaining expenses are met, or documentation of amounts past due.)

Certification:

I/we affirm that all the information on this form is true and correct to the best of my/our knowledge. I/we understand that USC may verify all estimates of income at year end. Adjustments

may be made to current or future financial aid if inaccurate estimates of income result in a financial aid over award. Signatures are required for all persons reporting the income/expenses above.

Parent 1 Printed Name and Signature Date Parent 2 Printed Name and Signature Date

Please submit to USC Financial Aid Office • Visit financialaid.usc.edu/questbridge to obtain document submission instructions.

You might also like

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- Special Circumstances Appeal FormDocument2 pagesSpecial Circumstances Appeal FormEsplanadeNo ratings yet

- Form 04Document7 pagesForm 04bradleytedhouseofkingston174No ratings yet

- Retirement Planning WorkbookDocument8 pagesRetirement Planning Workbooktwankfanny100% (3)

- HR0081 3Document1 pageHR0081 3ynsengaNo ratings yet

- Financial Statement WorksheetDocument2 pagesFinancial Statement WorksheetDillon BartNo ratings yet

- 2020 Emergency Undergraduate Grant Application: April 2020: Eligible ExpensesDocument5 pages2020 Emergency Undergraduate Grant Application: April 2020: Eligible Expensesbba. ssjhNo ratings yet

- AZRC-ERF Fillable Application Forms (May 2017)Document5 pagesAZRC-ERF Fillable Application Forms (May 2017)Karen CraigNo ratings yet

- Fca 2021 EnglishDocument4 pagesFca 2021 Englishcarlos19940331No ratings yet

- 712 Fee Waiver ApplicationDocument2 pages712 Fee Waiver ApplicationUstad Mahboob Niralay AlamNo ratings yet

- Personal Cash Flow WorksheetDocument1 pagePersonal Cash Flow WorksheetJerry liuNo ratings yet

- SSVF Financial Assessment FormDocument4 pagesSSVF Financial Assessment Formthe tigerNo ratings yet

- Ao239 1 PDFDocument5 pagesAo239 1 PDFAnonymous wqT95XZ5No ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument9 pagesInancial Lanning Orksheet: Statement of Net WorthKevin Baladad100% (1)

- Form 2Document2 pagesForm 2api-383904539No ratings yet

- Shortsale Financial Information SheetDocument1 pageShortsale Financial Information SheetCharles LeitnerNo ratings yet

- Inancial Lanning Orksheet: Statement of Net WorthDocument8 pagesInancial Lanning Orksheet: Statement of Net WorthDu Baladad Andrew MichaelNo ratings yet

- Profit and Loss WorksheetDocument1 pageProfit and Loss WorksheetNEWS CENTER MaineNo ratings yet

- New DR-6 Form (2017)Document10 pagesNew DR-6 Form (2017)Roger ShermanNo ratings yet

- WSCSS - Worksheets 3 Parent 2023 01Document6 pagesWSCSS - Worksheets 3 Parent 2023 01mom2asherloveNo ratings yet

- Last Name: - First Name: - Date of Birth (Month/Day/Year) : - (For Current Students) HUIDDocument4 pagesLast Name: - First Name: - Date of Birth (Month/Day/Year) : - (For Current Students) HUIDCheeseFrightNo ratings yet

- Budget Worksheet: Monthly Net IncomeDocument1 pageBudget Worksheet: Monthly Net IncomeErnestKalamboNo ratings yet

- Affidavit of Indigence: This Section To Be Filled Out by Court PersonnelDocument4 pagesAffidavit of Indigence: This Section To Be Filled Out by Court PersonnelJUGGALO NinjaNo ratings yet

- Form D - Income Certification - 5-26-2021 - EnglishDocument4 pagesForm D - Income Certification - 5-26-2021 - EnglishtavoNo ratings yet

- Assets, Income Other Source of Funds, and Expenses of Proposed WardDocument3 pagesAssets, Income Other Source of Funds, and Expenses of Proposed WardPaolo W. PanganNo ratings yet

- Igrad Daily Income and Expense DiaryDocument17 pagesIgrad Daily Income and Expense DiaryPallavi DhingraNo ratings yet

- Final SCDocument84 pagesFinal SCNausheen ZainulabeddinNo ratings yet

- 2010-2011 Financial Aid Verification Worksheet/Independent: A. Student InformationDocument2 pages2010-2011 Financial Aid Verification Worksheet/Independent: A. Student Informationoliver4269No ratings yet

- Family Law Financial Affidavit Short FormDocument9 pagesFamily Law Financial Affidavit Short Formscadam817No ratings yet

- Arizona Court Rules: Home Table of ContentsDocument4 pagesArizona Court Rules: Home Table of ContentsMr CutsforthNo ratings yet

- Harvard College Project for Asian and International Relations Financial Statement ApplicationDocument5 pagesHarvard College Project for Asian and International Relations Financial Statement ApplicationDhairya ChandrojayNo ratings yet

- Investiing Questionaire in Capital MarketDocument5 pagesInvestiing Questionaire in Capital MarketJoel CyrusNo ratings yet

- Budgeting-Worksheet GP PDFDocument2 pagesBudgeting-Worksheet GP PDFSamantha ForeNo ratings yet

- Budgeting 101 Budget PlanningDocument1 pageBudgeting 101 Budget PlanningJomelson Tan CoNo ratings yet

- Finaid FormDocument3 pagesFinaid FormlemonescentNo ratings yet

- Generic Life Insurance Needs Analysis Worksheet 2014-10Document3 pagesGeneric Life Insurance Needs Analysis Worksheet 2014-10Christophe BernardNo ratings yet

- Rental Energy AppDocument2 pagesRental Energy AppsandyolkowskiNo ratings yet

- Payroll Deduction AuthorizationDocument1 pagePayroll Deduction AuthorizationDixie Anne AndradeNo ratings yet

- EFD - Annual Report For 2016 - Klobuchar, Amy JDocument7 pagesEFD - Annual Report For 2016 - Klobuchar, Amy JErin LaviolaNo ratings yet

- OpenDocument5 pagesOpensoni19mohitNo ratings yet

- Severe Financial Hardship 09 - 19Document6 pagesSevere Financial Hardship 09 - 19anthony rudduckNo ratings yet

- Sworn Financial StatementDocument6 pagesSworn Financial Statementbatousai1900No ratings yet

- Household Budget CalculatorDocument10 pagesHousehold Budget Calculatorsiddhu85No ratings yet

- CCSG-1 Rev. 8-05 Child Support WorksheetDocument2 pagesCCSG-1 Rev. 8-05 Child Support WorksheetKingsley Omon-EdoNo ratings yet

- Salary Settlement ModelDocument1 pageSalary Settlement ModelScribdTranslationsNo ratings yet

- Application For Benefit Payment Financial Hardship: D D M M Y Y Y YDocument4 pagesApplication For Benefit Payment Financial Hardship: D D M M Y Y Y Ykevin mccormacNo ratings yet

- CollegeOrganizer2019 ComparingTheCostsDocument1 pageCollegeOrganizer2019 ComparingTheCostsSiangNo ratings yet

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpNo ratings yet

- PDF 1020 Make Budget Worksheet PDFDocument2 pagesPDF 1020 Make Budget Worksheet PDFawefawefawe100% (2)

- Simple Tax Estimator: A Adjustments AmountsDocument2 pagesSimple Tax Estimator: A Adjustments AmountsSithick MohamedNo ratings yet

- Please Read This Before You Start: Q2 Note: Please Give Your HouseDocument8 pagesPlease Read This Before You Start: Q2 Note: Please Give Your HouseChristopher MitchellNo ratings yet

- Cambrian College In-Course Awards: Applicant InformationDocument4 pagesCambrian College In-Course Awards: Applicant InformationrenebellemareNo ratings yet

- Salary Slip Template 11Document1 pageSalary Slip Template 11Vijay R100% (1)

- Budget Planning Worksheet - ChurchDocument4 pagesBudget Planning Worksheet - ChurchApostle Akuffo AnsahNo ratings yet

- Profit-And-Loss-Statement WELLS FARGODocument2 pagesProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiNo ratings yet

- Copy of Copy of BLANK Financial SummaryDocument2 pagesCopy of Copy of BLANK Financial SummaryLauren StairNo ratings yet

- The Actors Fund Financial Wellness Program: Budgeting Nuts & Bolts WorkbookDocument10 pagesThe Actors Fund Financial Wellness Program: Budgeting Nuts & Bolts WorkbookKyrie CourterNo ratings yet

- Income Tax Return 2019Document9 pagesIncome Tax Return 2019Sh'Nanigns X3No ratings yet

- International Applicant Financial Form: InstructionsDocument2 pagesInternational Applicant Financial Form: Instructionspenusila6941100% (1)

- 25 - Prayas Study-Proposal SummaryDocument5 pages25 - Prayas Study-Proposal SummaryAmanNo ratings yet

- Climate of BiharDocument295 pagesClimate of BiharSimarjit SinghNo ratings yet

- HectohexecontadihedronDocument5 pagesHectohexecontadihedronAmanNo ratings yet

- School of Architecture and Design, WellingtonDocument10 pagesSchool of Architecture and Design, WellingtonSwapnil ShrivastavNo ratings yet

- SOM-Unit-4 QuestionsDocument39 pagesSOM-Unit-4 QuestionsI ALPHABLADENo ratings yet

- North-East Vernacular Architecture and Bioclimatism: February 2019Document10 pagesNorth-East Vernacular Architecture and Bioclimatism: February 2019Riya BansalNo ratings yet

- DCR NGP PDFDocument147 pagesDCR NGP PDFSamruddhi chinchwadkarNo ratings yet

- Open House 2310Document3 pagesOpen House 2310AmanNo ratings yet

- Disclosure To Promote The Right To InformationDocument29 pagesDisclosure To Promote The Right To InformationGunapriya HariharanNo ratings yet

- School of Architecture and Design, WellingtonDocument10 pagesSchool of Architecture and Design, WellingtonSwapnil ShrivastavNo ratings yet

- Ekh Iwmp Xi DPRDocument224 pagesEkh Iwmp Xi DPRAmanNo ratings yet

- MAthesis 4cities FURLONG JAMESDocument93 pagesMAthesis 4cities FURLONG JAMESAmanNo ratings yet

- Design of Living Spaces in Dormitories: SciencedirectDocument7 pagesDesign of Living Spaces in Dormitories: SciencedirectCheryl GetongoNo ratings yet

- Chapitre 1Document26 pagesChapitre 1Truong HuynhNo ratings yet

- Bringing Multipurpose Spaces to Your Campus CafeDocument14 pagesBringing Multipurpose Spaces to Your Campus CafeAmanNo ratings yet

- ShelterProjects2010 LoresDocument134 pagesShelterProjects2010 LoresAmanNo ratings yet

- 5.vesara - Central Indian Style TempleDocument50 pages5.vesara - Central Indian Style TempleIsaa JatuNo ratings yet

- 181 Sample ChapterDocument56 pages181 Sample ChapterveerendraNo ratings yet

- Ptu B.tech 1 Math2 2015Document2 pagesPtu B.tech 1 Math2 2015AmanNo ratings yet

- Chapter: 1.1 Energy Scenario Part-I: Objective Type Questions and AnswersDocument6 pagesChapter: 1.1 Energy Scenario Part-I: Objective Type Questions and AnswersAnonymous VDn6xxNo ratings yet

- Virtual WorkDocument15 pagesVirtual WorkRamesh Bammankatti100% (1)

- Chapter: 1.1 Energy Scenario Part-I: Objective Type Questions and AnswersDocument6 pagesChapter: 1.1 Energy Scenario Part-I: Objective Type Questions and AnswersAnonymous VDn6xxNo ratings yet

- Scanned by CamscannerDocument15 pagesScanned by CamscannerAmanNo ratings yet

- Statics Meriam Kraige 7th Edition Solutions ManualDocument4 pagesStatics Meriam Kraige 7th Edition Solutions ManualAman0% (5)

- Online Mid-Semester ExamsDocument3 pagesOnline Mid-Semester ExamsAmanNo ratings yet

- Radius-Of-Curvature 1570108488016 PDFDocument12 pagesRadius-Of-Curvature 1570108488016 PDFSiddharth GuptaNo ratings yet

- Timoshenko and His Books: SimhaDocument9 pagesTimoshenko and His Books: Simha穆坤No ratings yet

- Steps For Solving A Truss SWDocument3 pagesSteps For Solving A Truss SWAmanNo ratings yet

- The Role of Social Media in Mobilizing Political Protest: Evidence From The Tunisian RevolutionDocument47 pagesThe Role of Social Media in Mobilizing Political Protest: Evidence From The Tunisian RevolutionAmanNo ratings yet

- Retirement Notification FormDocument2 pagesRetirement Notification FormAbongile PhinyanaNo ratings yet

- SET 23 24 Detail Guide EDocument20 pagesSET 23 24 Detail Guide ENishan MahanamaNo ratings yet

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IINo ratings yet

- Job Offer Lette2 (1) 2021Document4 pagesJob Offer Lette2 (1) 2021James GassettNo ratings yet

- Excel Salary Slip Format DownloadDocument2 pagesExcel Salary Slip Format DownloadFARAZ KHANNo ratings yet

- Poniman, SE., M.S.A., Ak., CADocument10 pagesPoniman, SE., M.S.A., Ak., CAshelvira viraNo ratings yet

- Annex PDocument4 pagesAnnex PRu Hani FahNo ratings yet

- Pay Structure of Public Employees in PakistanDocument28 pagesPay Structure of Public Employees in PakistanAamir50% (10)

- certification ETHICSDocument22 pagescertification ETHICSranjitdhillon770No ratings yet

- VLS - GMBH FS FY 19 20Document44 pagesVLS - GMBH FS FY 19 20Elizabeth Sánchez LeónNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Commission by Samuel Mabugu: PresentationDocument20 pagesCommission by Samuel Mabugu: PresentationBuddha 2.ONo ratings yet

- Events After Reporting Period: Chapter 3 - Notes To Financial StatementsDocument8 pagesEvents After Reporting Period: Chapter 3 - Notes To Financial StatementsKimberly Claire AtienzaNo ratings yet

- SAE Claim FormDocument5 pagesSAE Claim FormNovaPNo ratings yet

- ILA - US Exam: GAAP, Statutory Reporting and TaxationDocument9 pagesILA - US Exam: GAAP, Statutory Reporting and TaxationBabymetal LoNo ratings yet

- Retire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsDocument16 pagesRetire With A Smile Retire With A Smile: Investment Solutions Investment SolutionsParam SaxenaNo ratings yet

- Specimen - Case - Study - CP1 Paper 2 - 2019 - Final PDFDocument6 pagesSpecimen - Case - Study - CP1 Paper 2 - 2019 - Final PDFking hkhNo ratings yet

- Anna - Joachim - Report EditedDocument23 pagesAnna - Joachim - Report Editedjupiter stationery100% (1)

- BSP V COADocument12 pagesBSP V COAJuan AlatticaNo ratings yet

- Important Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735Document1 pageImportant Information About Form 1099-G: D D Flaumenbaum 2481 Haff Ave North Bellmore Ny 11710-2735ddouglasf2357No ratings yet

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- CH2-Notes EnglishDocument8 pagesCH2-Notes Englishhayleyparsons1984No ratings yet

- Norma Mabeza, Petitioner, vs. National Labor Relations Commission, PETER NG/HOTEL SUPREME, Respondents. G.R. No. 118506. April 18, 1997Document1 pageNorma Mabeza, Petitioner, vs. National Labor Relations Commission, PETER NG/HOTEL SUPREME, Respondents. G.R. No. 118506. April 18, 1997Mae Clare BendoNo ratings yet

- Employee Record Form: Employee'S Passport PhotographDocument3 pagesEmployee Record Form: Employee'S Passport PhotographRicksonNo ratings yet

- Form 1099-MISC and Form 1099-NEC Reporting 2021Document2 pagesForm 1099-MISC and Form 1099-NEC Reporting 2021Finn KevinNo ratings yet

- Welfare Provision Scheme Policy 23 24 v0.1Document13 pagesWelfare Provision Scheme Policy 23 24 v0.1Leo LouisNo ratings yet

- Form 16-Part B - 2020-2021Document3 pagesForm 16-Part B - 2020-2021Ravi S. SharmaNo ratings yet

- Tax 1 - Quiz #6 - Gross Income (With Inclusions and Exclusions)Document5 pagesTax 1 - Quiz #6 - Gross Income (With Inclusions and Exclusions)Mary CuisonNo ratings yet

- AccentureDocument1 pageAccenturesdrfNo ratings yet