Professional Documents

Culture Documents

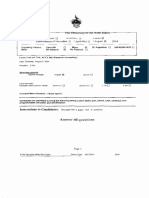

Simple Tax Estimator: A Adjustments Amounts

Uploaded by

Sithick Mohamed0 ratings0% found this document useful (0 votes)

14 views2 pages.

Original Title

Simple Tax Estimator

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesSimple Tax Estimator: A Adjustments Amounts

Uploaded by

Sithick Mohamed.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

www.ExcelDataPro.

com A Adjustments Amounts

Simple Tax Estimator 1 Educator expenses $ -

Filing Status Married- Filing Jointly 2 IRA deduction $ 3,000

Number of Dependents 2 3 Student loan interest deduction $ 500

Number of Personal Exemptions (Self, Spouse) 2 4 Tuition and fees deduction $ 2,300

Total Personal Exemptions 4 5 Health savings account deduction $ -

Number of Filer above 65 1

Tax Bracket 10% 6 Moving expenses $ -

Assumptions Amounts 7 50% of self-employment tax $ -

Gross Annual Income $ 75,000 8 Self-employed Health Insurance Deduction $ -

Adjustments $ 5,800 9 Other Self-Employed Plans (SEP, SIMPLE, etc) $ -

Adjusted Gross Income (AGI) $ 69,200 10 Penalty paid on early withdrawal of savings $ -

Standard Deduction $ 1,550 11 Alimony paid $ -

Itemized Deductions $ 8,450 Total Adjustments $ 5,800

Personal Exemptions $ 16,200

Total Taxable Income $ 43,000 B Tax Credits Amounts

Tax Credits $ 400 1 Foreign tax credit $ 200

Tax Estimates $ 3,900 2 Credit for child and dependent care expenses $ 100

3 Credit for the elderly or the disabled $ -

4 Education credits $ 100

5 Retirement savings contributions credit $ -

6 Child tax credit $ -

7 Adoption credit $ -

8 Other Credits $ -

Total Tax Credits $ 400

You might also like

- Financial statements activityDocument2 pagesFinancial statements activityAditya Nigam100% (1)

- Household Budget Worksheet - Track Income & ExpensesDocument1 pageHousehold Budget Worksheet - Track Income & ExpensesJohn GoodenNo ratings yet

- For BIR Use Only Annual Income Tax ReturnDocument12 pagesFor BIR Use Only Annual Income Tax Returnmiles1280No ratings yet

- Accounting ProjectDocument107 pagesAccounting Projectapi-353552300100% (2)

- Iso 15686 5 2017Document15 pagesIso 15686 5 2017Kassahun AberaNo ratings yet

- CPA Exam Online Regulation Question GuideDocument62 pagesCPA Exam Online Regulation Question Guidemgorm003No ratings yet

- Argument EssayDocument2 pagesArgument Essayapi-491420987100% (1)

- personal-balance-sheet-14Document2 pagespersonal-balance-sheet-14k60.2113340007No ratings yet

- Managing Personal Finances WiselyDocument39 pagesManaging Personal Finances WiselyYong Chun WahNo ratings yet

- Personalbudget AbrilpereztorresDocument2 pagesPersonalbudget Abrilpereztorresapi-337682376No ratings yet

- Goals and financial plans for retirement, education, and home purchaseDocument5 pagesGoals and financial plans for retirement, education, and home purchaseChintu WatwaniNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Plan for Retirement and Children's EducationDocument5 pagesPlan for Retirement and Children's EducationSrushti RajNo ratings yet

- Personal Finance For Canadians 9th Edition Currie Solutions ManualDocument9 pagesPersonal Finance For Canadians 9th Edition Currie Solutions ManualLesterBriggssNo ratings yet

- Family ExpensesDocument2 pagesFamily Expensesapi-531444255No ratings yet

- Our Rich Journey - Ultimate Financial Independence BudgetDocument13 pagesOur Rich Journey - Ultimate Financial Independence BudgetDinesh Kumar0% (1)

- 6 Budget WorksheetDocument3 pages6 Budget Worksheetmerxedes xoNo ratings yet

- Household Monthly Budget1Document4 pagesHousehold Monthly Budget1jaysonNo ratings yet

- Retirement Planning WorkbookDocument8 pagesRetirement Planning Workbooktwankfanny100% (3)

- Copy of Copy of BLANK Financial SummaryDocument2 pagesCopy of Copy of BLANK Financial SummaryLauren StairNo ratings yet

- Generic Life Insurance Needs Analysis Worksheet 2014-10Document3 pagesGeneric Life Insurance Needs Analysis Worksheet 2014-10Christophe BernardNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- Jasper and Anneka Rehnquist Case Study SolutionDocument5 pagesJasper and Anneka Rehnquist Case Study SolutionChintu WatwaniNo ratings yet

- Financial Health CheckDocument7 pagesFinancial Health CheckJason TangNo ratings yet

- 1.09 - Jackson Combass 09.22.2023Document5 pages1.09 - Jackson Combass 09.22.2023jackson combassNo ratings yet

- Personal Balance SheetDocument2 pagesPersonal Balance SheetSeleneNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Questbridge Parent Income & Expense Declaration FormDocument2 pagesQuestbridge Parent Income & Expense Declaration FormAmanNo ratings yet

- Student Budget Plan 1Document2 pagesStudent Budget Plan 1api-515880411No ratings yet

- Presentation SlidesDocument99 pagesPresentation SlidesKelly-Ann LamerNo ratings yet

- Acct2015 07082014Document7 pagesAcct2015 07082014Tan TaylorNo ratings yet

- Tim Hart Financial Plan FPLN 365 Spring 2017Document13 pagesTim Hart Financial Plan FPLN 365 Spring 2017api-377996169No ratings yet

- Budget OverviewDocument2 pagesBudget Overviewanalystman06No ratings yet

- BRRRR v2Document5 pagesBRRRR v2SujitKGoudarNo ratings yet

- Salary Slip Template 11Document1 pageSalary Slip Template 11Vijay R100% (1)

- Debt Management: Ramstein Airman and Family Readiness CenterDocument17 pagesDebt Management: Ramstein Airman and Family Readiness Centergradstudent09No ratings yet

- Confirmation Statement: Nisar H Baig 18474 ORCHID DR LEESBURG, VA 20176 CTRL: 1Document5 pagesConfirmation Statement: Nisar H Baig 18474 ORCHID DR LEESBURG, VA 20176 CTRL: 1abaig76No ratings yet

- Monthly Budget Overview and Expenses ReportDocument6 pagesMonthly Budget Overview and Expenses ReportAnonymous JJdVR5ZoYNo ratings yet

- Course Title: Estate Planning and Risk ManagementDocument10 pagesCourse Title: Estate Planning and Risk ManagementSahil MitraNo ratings yet

- Personal Cash Flow WorksheetDocument1 pagePersonal Cash Flow WorksheetJerry liuNo ratings yet

- Budget Worksheet: Career Graphic DesignerDocument5 pagesBudget Worksheet: Career Graphic DesignerArkoNo ratings yet

- Financial Analysis Example Excel TemplateDocument3 pagesFinancial Analysis Example Excel TemplateRosa LindaNo ratings yet

- Long-Term Financial Planning and GrowthDocument37 pagesLong-Term Financial Planning and GrowthNauryzbek MukhanovNo ratings yet

- US Master Tax Guide (PDFDrive)Document1,258 pagesUS Master Tax Guide (PDFDrive)sutan mNo ratings yet

- Ruben Lopes Insurace Case StudyDocument3 pagesRuben Lopes Insurace Case Studygabbarsinghh00123No ratings yet

- Benefits SummaryDocument2 pagesBenefits SummaryGustavo StorNo ratings yet

- Richc Dad Financial Statement TemplateDocument10 pagesRichc Dad Financial Statement TemplatealwaysleadneverfollowNo ratings yet

- Budget Worksheet-JODocument2 pagesBudget Worksheet-JOJames OyeniyiNo ratings yet

- BudgetDocument2 pagesBudgetbrodyschmidt14No ratings yet

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument33 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualngocalmai0236h100% (32)

- Document 1510 4516Document54 pagesDocument 1510 4516rubyhien46tasNo ratings yet

- South Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions ManualDocument38 pagesSouth Western Federal Taxation 2016 Comprehensive 39th Edition Hoffman Solutions Manualihlemadonna100% (13)

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (41)

- FML DL 7 Nov Wippppppppppppppppp Course HeroDocument3 pagesFML DL 7 Nov Wippppppppppppppppp Course HeroD’ WackjackNo ratings yet

- Retirement Budget WorksheetDocument2 pagesRetirement Budget WorksheetBella MelendresNo ratings yet

- Cash Flow Calculator CFO SelectionsDocument12 pagesCash Flow Calculator CFO Selections202040336No ratings yet

- Pengurusan Kewangan KeluargaDocument6 pagesPengurusan Kewangan KeluargaNurul NadiahNo ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ch4-Recordedlecture-Fall2023 17 5166787619170306Document38 pagesCh4-Recordedlecture-Fall2023 17 5166787619170306ronny nyagakaNo ratings yet

- Budget Overview: Actual vs Projected ExpensesDocument6 pagesBudget Overview: Actual vs Projected Expensesivan.breNo ratings yet

- Stanford MyinTuition ResultsDocument1 pageStanford MyinTuition Resultsganeshshanbhag14No ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- "Conditions of Contract For CONSTRUCTION Works" - New Red BookDocument13 pages"Conditions of Contract For CONSTRUCTION Works" - New Red BookSithick MohamedNo ratings yet

- PM_1712070541Document14 pagesPM_1712070541Sithick MohamedNo ratings yet

- FIDIC Guarantees Bonds and RetentionsDocument7 pagesFIDIC Guarantees Bonds and RetentionspieremicheleNo ratings yet

- 7 BotDocument7 pages7 BotSithick MohamedNo ratings yet

- Title Seven (Termination of Employment Contract and End of Service Gratuity)Document12 pagesTitle Seven (Termination of Employment Contract and End of Service Gratuity)DrMohamed RifasNo ratings yet

- Induction: Policy StatementDocument9 pagesInduction: Policy StatementSithick MohamedNo ratings yet

- 3-Claims, Disputes & Arbitration PDFDocument23 pages3-Claims, Disputes & Arbitration PDFMMSNo ratings yet

- Subcontracting Under UAE LawDocument7 pagesSubcontracting Under UAE LawSithick MohamedNo ratings yet

- 8 - ArbitrationDocument22 pages8 - ArbitrationSithick MohamedNo ratings yet

- 4B - Adjustments For ChangesDocument10 pages4B - Adjustments For ChangesSithick MohamedNo ratings yet

- 1 - Contracts, Claims & ArbitrationDocument26 pages1 - Contracts, Claims & ArbitrationSithick MohamedNo ratings yet

- 4A - Non Forseeable Physical ObstructionsDocument13 pages4A - Non Forseeable Physical ObstructionsSithick MohamedNo ratings yet

- Impact of Back To Back' Payment Clause On The Cash Flow of Subcontractor in The UAEDocument90 pagesImpact of Back To Back' Payment Clause On The Cash Flow of Subcontractor in The UAESithick MohamedNo ratings yet

- Unpaid Leave in UAE During Coronavirus All You Need To KnowDocument5 pagesUnpaid Leave in UAE During Coronavirus All You Need To KnowSithick MohamedNo ratings yet

- Uae Civil Code English TranslationDocument261 pagesUae Civil Code English Translationzozo458No ratings yet

- Example of Price Adjustment As of FIDICDocument7 pagesExample of Price Adjustment As of FIDICVijay Kumar100% (1)

- Proposals For A Subcontractor's Escape From Conditional ClausesDocument32 pagesProposals For A Subcontractor's Escape From Conditional ClausesSithick MohamedNo ratings yet

- Aecom ME Handbook 2015Document55 pagesAecom ME Handbook 2015Le'Novo FernandezNo ratings yet

- Primavera 6 Course GuideDocument4 pagesPrimavera 6 Course GuideSithick MohamedNo ratings yet

- BSI Group Company ProfileDocument13 pagesBSI Group Company ProfileBSI PhilippinesNo ratings yet

- Introduction To Project Planning PDFDocument20 pagesIntroduction To Project Planning PDFSithick MohamedNo ratings yet

- Costguide 2015 Web PDFDocument8 pagesCostguide 2015 Web PDFSithick MohamedNo ratings yet

- Des 0003 A1 Project Design Coord ChecklistDocument21 pagesDes 0003 A1 Project Design Coord ChecklistSithick MohamedNo ratings yet

- Fidic Conditions of ContractDocument6 pagesFidic Conditions of Contractblogs4140% (1)

- STAFF Annual Leave ScheduleDocument1 pageSTAFF Annual Leave ScheduleSithick MohamedNo ratings yet

- Building Completion Stat (From Web)Document10 pagesBuilding Completion Stat (From Web)Sithick MohamedNo ratings yet

- Meed Fa Construction Crane-Survey-Dubai 022016 PDFDocument32 pagesMeed Fa Construction Crane-Survey-Dubai 022016 PDFSithick MohamedNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayAmit KumarNo ratings yet

- Report On Estates and TrustsDocument22 pagesReport On Estates and TrustsKelvin CulajaráNo ratings yet

- Tuzon v. Court of AppealsDocument7 pagesTuzon v. Court of Appealslovekimsohyun89No ratings yet

- Summer Internship ReportDocument23 pagesSummer Internship ReportSwadhi Swagatika PandaNo ratings yet

- 130 U PDFDocument2 pages130 U PDFgglionhartNo ratings yet

- LEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsDocument2 pagesLEAD BATCH 2 - ERG-TAX 1 Estate Tax - George James Comprehensive Problem-AnsJims Leñar CezarNo ratings yet

- Samsung Sustainability Reports 2014Document69 pagesSamsung Sustainability Reports 2014nicholasdeleoncircaNo ratings yet

- Proc ManualDocument106 pagesProc ManualtintinreyesjrNo ratings yet

- Deductions Principles ExplainedDocument2 pagesDeductions Principles ExplainedAvox EverdeenNo ratings yet

- Emaran Bill at TarangDocument6 pagesEmaran Bill at TarangKamakhya MallNo ratings yet

- Tax Solutions: Section 871 (M)Document2 pagesTax Solutions: Section 871 (M)Felix ChanNo ratings yet

- CIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.Document2 pagesCIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.preiquency100% (1)

- Authorization LetterDocument1 pageAuthorization Lettersridhar4No ratings yet

- Socioeconomic impact of COVID-19 in MozambiqueDocument18 pagesSocioeconomic impact of COVID-19 in MozambiqueildoNo ratings yet

- Border TaxationDocument6 pagesBorder TaxationShariful Islam JoyNo ratings yet

- Aces Philippines Cellular Satellite Corporation Vs CIRDocument3 pagesAces Philippines Cellular Satellite Corporation Vs CIRCSBJ100% (3)

- H01 - Principles of TaxationDocument9 pagesH01 - Principles of Taxationnona galidoNo ratings yet

- Artists and Sportsmen - Art 17 OECDDocument4 pagesArtists and Sportsmen - Art 17 OECDFrancisco Alves FreitasNo ratings yet

- TAXATION-PROBLEMS-2020Document59 pagesTAXATION-PROBLEMS-2020MimiNo ratings yet

- BQ Addendum - SG Petani 3Document22 pagesBQ Addendum - SG Petani 3Mohd ZamriNo ratings yet

- Jasmine Teahouse Business ProposalDocument39 pagesJasmine Teahouse Business ProposalethelNo ratings yet

- LawDocument10 pagesLawTannaoNo ratings yet

- 10 Professional Tax Software Must-Haves White PaperDocument2 pages10 Professional Tax Software Must-Haves White PaperRakesh KumarNo ratings yet

- Excel - Vali InvoiceDocument1 pageExcel - Vali Invoicemaazhu78No ratings yet

- Chapter 6 Deductions From The Gross Estate PDFDocument7 pagesChapter 6 Deductions From The Gross Estate PDFDudz MatienzoNo ratings yet

- US Internal Revenue Service: Irb03-52Document41 pagesUS Internal Revenue Service: Irb03-52IRSNo ratings yet

- The Relevance of States in A Globalized World Jose Aims R. Rocina, PHD Political Science Professor, de La Salle University-DasmarinasDocument13 pagesThe Relevance of States in A Globalized World Jose Aims R. Rocina, PHD Political Science Professor, de La Salle University-Dasmarinaserrol salasNo ratings yet