Professional Documents

Culture Documents

Debt Management: Ramstein Airman and Family Readiness Center

Uploaded by

gradstudent090 ratings0% found this document useful (0 votes)

5 views17 pagesOriginal Title

Debt Management

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views17 pagesDebt Management: Ramstein Airman and Family Readiness Center

Uploaded by

gradstudent09Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 17

DEBT MANAGEMENT

Ramstein Airman and Family Readiness Center

OBJECTIVES

Understand and evaluate your individual debt

situation

Learn practical tips and information for debt

management

INTRODUCTION

SECURED AND UNSECURED

DEBTS

WARNING SIGNS OF DEBT

TROUBLE

FIGURING HOW MUCH YOU

OWE

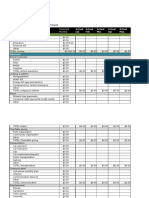

Net Wages or Salary You Other Household Total Monthly

Member Income

Job 1 $3117 + $937 = $4054

Job 2 $0 + $0 = $0

Other Monthly Income

Bonuses $0 + $0 = $0

Commissions $0 + $0 = $0

Tips $0 + $115 = $115

Dividends or interest $90 + $130 = $220

Rent or lease received $950 + $0 = $950

Alimony or child support $0 + $150 = $150

Trust payments received $0 + $0 = $0

Pension or retirement pay + =

$0 $0 $0

Social Security $0 + $0 = $0

Disability pay $0 + $0 = $0

Help from relatives or friends $0 + $0 = $0

Other $0 + $0 = $0

Total Income $4157 + $1332 = $5489

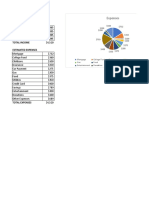

VARIABLE EXPENSES FIXED EXPENSES

Food $455 Rent $1300

Utilities $145 Renter’s Insurance $80

Gas, oil, maintenance $130 Car loan payment $625

Clothing and upkeep $140 Car insurance $140

Education $400 Retirement contributions $215

Personal allowances $200 Savings $75

Credit Cards $860 Investments $250

Child Care $120 Professional Memberships $28

Clothing $60 Subscriptions $16

Entertainment $120 Total Fixed Expenses $2729

Vacations $60

Cell Phone $70

Total Variable Expenses $2760

TOTAL EXPENSES $5489

FIGURING HOW MUCH YOU

OWE

PRIORITIZING YOUR

DEBTS

NEGOTIATING WITH YOUR

CREDITORS

PROTECTIONS AVAILABLE

TO SERVICEMEMBERS

FINDING MONEY TO PAY

YOUR DEBTS

WHAT TO AVOID WHEN YOU

NEED MONEY

SCAMS THAT TARGET

MILITARY PERSONNEL

REBUILDING YOUR

CREDIT

FINAL THOUGHTS

You might also like

- Budget OverviewDocument2 pagesBudget Overviewanalystman06No ratings yet

- OfficeSuite BudgetOverviewDocument3 pagesOfficeSuite BudgetOverviewJulianoorNo ratings yet

- OfficeSuite BudgetOverviewDocument4 pagesOfficeSuite BudgetOverviewManuel Eduardo Ipenza NegriNo ratings yet

- 6 Budget WorksheetDocument3 pages6 Budget Worksheetmerxedes xoNo ratings yet

- Budget OverviewDocument3 pagesBudget Overviewkbcqdcthr8No ratings yet

- BudgetDocument2 pagesBudgetbrodyschmidt14No ratings yet

- LearnVest Sample Portfolio Builder PlanDocument44 pagesLearnVest Sample Portfolio Builder PlanTechCrunch100% (1)

- Budget Worksheet-JODocument2 pagesBudget Worksheet-JOJames OyeniyiNo ratings yet

- English Financial ActivityDocument3 pagesEnglish Financial ActivityJose AvilezNo ratings yet

- Financial PlanDocument4 pagesFinancial Planapi-393558164No ratings yet

- OfficeSuite BudgetOverviewDocument6 pagesOfficeSuite BudgetOverviewShreyas RamachandranNo ratings yet

- Monthly Family BudgetDocument3 pagesMonthly Family BudgetMohamed ElhousniNo ratings yet

- Personal Financial Statement Template 1Document3 pagesPersonal Financial Statement Template 1Aaron JacksonNo ratings yet

- Monthly Budget Template-2Document8 pagesMonthly Budget Template-2Kirit0% (1)

- Budget DefenseDocument19 pagesBudget Defenseapi-687516998No ratings yet

- Finance 1050 Financial FormsDocument162 pagesFinance 1050 Financial Formsapi-492847624No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1Naddie DeoreNo ratings yet

- Manage Your Money Chart: Budget WorksheetDocument4 pagesManage Your Money Chart: Budget WorksheetRyan GreenbergNo ratings yet

- Personal Budget Spreadsheet 10 2020-2 2Document4 pagesPersonal Budget Spreadsheet 10 2020-2 2api-685542779No ratings yet

- Ruben Lopes Insurace Case StudyDocument3 pagesRuben Lopes Insurace Case Studygabbarsinghh00123No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1ivan.breNo ratings yet

- Family Budget PlannerDocument10 pagesFamily Budget PlannerMohamed ElhousniNo ratings yet

- Bit Family BudgetDocument2 pagesBit Family Budgetapi-531482387No ratings yet

- Cash Flow Statement SampleDocument8 pagesCash Flow Statement SampleHeatman RobertNo ratings yet

- Budget ExampleDocument4 pagesBudget ExampleLizmarie ColónNo ratings yet

- Budget 3Document1 pageBudget 3JackNo ratings yet

- Tax Calculator - Residents - YA21Document1 pageTax Calculator - Residents - YA21Bharat MaddulaNo ratings yet

- Monthly BudgetDocument2 pagesMonthly Budgetddemo17demoNo ratings yet

- Budget Worksheet: Career Graphic DesignerDocument5 pagesBudget Worksheet: Career Graphic DesignerArkoNo ratings yet

- Monthly Budget WorksheetDocument2 pagesMonthly Budget Worksheetapi-534083600No ratings yet

- Budget Worksheet For ProjectDocument6 pagesBudget Worksheet For Projectapi-659586586No ratings yet

- James Sanchez: Housing EntertainmentDocument1 pageJames Sanchez: Housing Entertainmentapi-27370104No ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Cashflow 4Q2020Document11 pagesCashflow 4Q2020SitNo ratings yet

- Monthly BudgetDocument2 pagesMonthly Budgetprince_misaNo ratings yet

- Course Title: Estate Planning and Risk ManagementDocument10 pagesCourse Title: Estate Planning and Risk ManagementSahil MitraNo ratings yet

- Account Summary 01-27-2018Document4 pagesAccount Summary 01-27-2018Metodio Caetano MonizNo ratings yet

- Traditional College Student Budget WorksheetDocument20 pagesTraditional College Student Budget WorksheetManishTewaniNo ratings yet

- Budget SheetDocument6 pagesBudget Sheetapi-660331252No ratings yet

- 1.09 - Jackson Combass 09.22.2023Document5 pages1.09 - Jackson Combass 09.22.2023jackson combassNo ratings yet

- Personal Budget Templatev2 - 0Document12 pagesPersonal Budget Templatev2 - 0syedpandtNo ratings yet

- An Overview of Your Current Financial Picture: Family IncomeDocument6 pagesAn Overview of Your Current Financial Picture: Family IncomesampaccNo ratings yet

- 6.01 Financial Statements ActivityDocument2 pages6.01 Financial Statements ActivityAditya Nigam100% (1)

- Client Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Document5 pagesClient Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Srushti RajNo ratings yet

- Budget Worksheet: Number of Members in Your Household 6Document6 pagesBudget Worksheet: Number of Members in Your Household 6api-377100979No ratings yet

- Traditional-College-Student 3 - 2Document6 pagesTraditional-College-Student 3 - 2api-735179875No ratings yet

- Budget SpreadsheetDocument1 pageBudget Spreadsheetinco kenzieNo ratings yet

- Personal Monthly Budget3Document1 pagePersonal Monthly Budget3api-365167519No ratings yet

- Salary Certificate TemplateDocument1 pageSalary Certificate TemplateMd shah JahanNo ratings yet

- Business Financial PlanDocument10 pagesBusiness Financial PlanMónica EstefaníaNo ratings yet

- Personal Monthly Budget SpreadsheetDocument2 pagesPersonal Monthly Budget SpreadsheetWilliam LandimNo ratings yet

- Traditional-College-Student 3 - 2 1 6Document6 pagesTraditional-College-Student 3 - 2 1 6api-735540493No ratings yet

- Payroll Aggregated ReportDocument22 pagesPayroll Aggregated Reportplainnuts420No ratings yet

- Personal Finance For Canadians 9th Edition Currie Solutions ManualDocument9 pagesPersonal Finance For Canadians 9th Edition Currie Solutions ManualLesterBriggssNo ratings yet

- 03-M2 Personal Finance SpreadsheetDocument20 pages03-M2 Personal Finance SpreadsheetAtlass StoreNo ratings yet

- Couples BudgetDocument6 pagesCouples BudgetIzamar RiveraNo ratings yet

- 1 Math 9 Startup AssignmentDocument8 pages1 Math 9 Startup Assignmentstephanie.rcNo ratings yet

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- Ibbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Document2 pagesIbbotson Sbbi: Stocks, Bonds, Bills, and Inflation 1926-2019Bastián EnrichNo ratings yet

- Chapter 5Document3 pagesChapter 5Showki WaniNo ratings yet

- Richards Laura - The Golden WindowsDocument147 pagesRichards Laura - The Golden Windowsmars3942No ratings yet

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Document73 pagesA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNo ratings yet

- Aluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyDocument2 pagesAluminum 3003-H112: Metal Nonferrous Metal Aluminum Alloy 3000 Series Aluminum AlloyJoachim MausolfNo ratings yet

- 18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFDocument1 page18 - PPAG-100-HD-C-001 - s018 (VBA03C013) - 0 PDFSantiago GarciaNo ratings yet

- Online EarningsDocument3 pagesOnline EarningsafzalalibahttiNo ratings yet

- Kaitlyn LabrecqueDocument15 pagesKaitlyn LabrecqueAmanda SimpsonNo ratings yet

- BYJU's July PayslipDocument2 pagesBYJU's July PayslipGopi ReddyNo ratings yet

- HSBC in A Nut ShellDocument190 pagesHSBC in A Nut Shelllanpham19842003No ratings yet

- Hip NormDocument35 pagesHip NormAiman ArifinNo ratings yet

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Document7 pagesExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghNo ratings yet

- Brand Positioning of PepsiCoDocument9 pagesBrand Positioning of PepsiCoAbhishek DhawanNo ratings yet

- Rofi Operation and Maintenance ManualDocument3 pagesRofi Operation and Maintenance ManualSteve NewmanNo ratings yet

- Walmart, Amazon, EbayDocument2 pagesWalmart, Amazon, EbayRELAKU GMAILNo ratings yet

- General Field Definitions PlusDocument9 pagesGeneral Field Definitions PlusOscar Alberto ZambranoNo ratings yet

- Amare Yalew: Work Authorization: Green Card HolderDocument3 pagesAmare Yalew: Work Authorization: Green Card HolderrecruiterkkNo ratings yet

- Group 1 Disaster Management Notes by D. Malleswari ReddyDocument49 pagesGroup 1 Disaster Management Notes by D. Malleswari Reddyraghu ramNo ratings yet

- Sustainable Urban Mobility Final ReportDocument141 pagesSustainable Urban Mobility Final ReportMaria ClapaNo ratings yet

- Recall, Initiative and ReferendumDocument37 pagesRecall, Initiative and ReferendumPhaura Reinz100% (1)

- CANELA Learning Activity - NSPE Code of EthicsDocument4 pagesCANELA Learning Activity - NSPE Code of EthicsChristian CanelaNo ratings yet

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaNo ratings yet

- Presentation Report On Customer Relationship Management On SubwayDocument16 pagesPresentation Report On Customer Relationship Management On SubwayVikrant KumarNo ratings yet

- Enerparc - India - Company Profile - September 23Document15 pagesEnerparc - India - Company Profile - September 23AlokNo ratings yet

- Laporan Praktikum Fisika - Full Wave RectifierDocument11 pagesLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanNo ratings yet

- Unit 1Document3 pagesUnit 1beharenbNo ratings yet

- Separation PayDocument3 pagesSeparation PayMalen Roque Saludes100% (1)

- How To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFDocument35 pagesHow To Create A Powerful Brand Identity (A Step-by-Step Guide) PDFCaroline NobreNo ratings yet

- Executive Summary - Pseudomonas AeruginosaDocument6 pagesExecutive Summary - Pseudomonas Aeruginosaapi-537754056No ratings yet

- MSDS - Tuff-Krete HD - Part DDocument6 pagesMSDS - Tuff-Krete HD - Part DAl GuinitaranNo ratings yet