Professional Documents

Culture Documents

Monthly Budget Worksheet

Uploaded by

api-534083600Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monthly Budget Worksheet

Uploaded by

api-534083600Copyright:

Available Formats

CONNECTIONS LA102

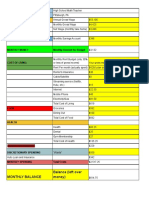

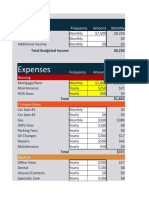

MONTHLY BUDGET WORKSHEET

NAME: Meghan Milanak OCCUPATION:Physician Assistant

The first step to building a budget is to write down all of your income and expenses. Use this worksheet to see how much you plan

to spend each month after you graduate. Use O*NET (https://www.onetonline.org) to determine an average salary for an occupation

you are considering. If given a salary range, use the midpoint of the range. Divide an annual salary by 12 in order to obtain the

monthly salary. Use Google in order to determine the average costs for monthly expenses in the city/town that you plan to live. Go

through the list of options available for you to spend your hard earned money on. Highlight the monthly “needs” in red and the

monthly “wants” in blue.

INCOME MONTHLY TOTAL

Paycheck (your salary after deducting 30% for taxes) $94,420-$28,326=$66,094/12=$5,507.83

(Pennsylvania)

Other income $0

TOTAL MONTHLY INCOME $5,507.83

EXPENSES MONTHLY TOTAL

SAVINGS TOTAL: $500

Savings/Emergency Fund $500

HOUSING/LIVING EXPENSES TOTAL: $1572.80

Mortgage or Rent $1,250 (apartment rent)

Home or Renter Insurance $30

Utilities (electric, gas, water, sewage) $169.80

Phone $73

Trash Removal $0

Maintenance $50

FOOD EXPENSES TOTAL:$350

Groceries $250

Dining Out $100

TRANSPORTATION EXPENSES TOTAL: $600

Car payment or payment for public transportation $300

Gas $120

Parking and Tolls $20

Car Insurance $118

Car Maintenance $42

PERSONAL/FAMILY/SCHOOL EXPENSES TOTAL: $995

Clothing and Shoes $175

Toiletries $75

Hair Cuts and Manicures/Pedicures $25

Pets $0

Gifts $100

Laundry/Dry Cleaning $20

School Loans $600

HEALTH EXPENSES TOTAL: $384

Medication (OTC and Prescription) $50

Health Insurance $321

Life Insurance $13

ENTERTAINMENT EXPENSES TOTAL: $450

Cable and Internet $70

Movies/Concerts/Sporting Events $150

Vacation $200

Alcohol/Tobacco/Lottery $30

TOTAL OF ALL EXPENSES: $4851.80

Monthly Income - Monthly Expenses = Disposable Income or a Deficit

_____$5,507.83____ - _____$4851.80________ = _____$655.20_____

After completing the monthly budget worksheet, what actions will you need to take upon

graduation, and what actions can you do while attending Seton Hill University that will help

prepare you for the necessary spending habits once you graduate?

While at Seton Hill, I should consider the money I am spending to ensure financial stability in

the future. I should establish a monthly budget for right now, so I can limit and control how

much I spend. This would help prevent me from beginning mindless spending habits and to

help in establishing savings. Also, I should consider either a work-study or getting a part-time

job. I can then try to work more when classes are not in session to start “cushioning” my

savings account. After I graduate, I should initially consider living at home or getting a

roommate to save money. Also, I should plan out an even more detailed, adapted budget to

start healthy spending habits.

You might also like

- Sample BudgetDocument3 pagesSample Budgetwbfuller16641No ratings yet

- The Cost of Living Project (50 Points) : Income Source of IncomeDocument4 pagesThe Cost of Living Project (50 Points) : Income Source of IncomeMukesh Kumar100% (1)

- IWT Conscious Spending PlanDocument50 pagesIWT Conscious Spending PlanAshly Han0% (1)

- Copy of Unit 2-Budget Project - Rose-Lee MDocument1 pageCopy of Unit 2-Budget Project - Rose-Lee Mapi-545588474No ratings yet

- Budget 3Document1 pageBudget 3JackNo ratings yet

- NelsonDocument1 pageNelsonapi-532076052No ratings yet

- 6 Budget WorksheetDocument3 pages6 Budget Worksheetmerxedes xoNo ratings yet

- College Student Budget: Semester 1 Semester 2 Semester 3 Semester 4Document6 pagesCollege Student Budget: Semester 1 Semester 2 Semester 3 Semester 4Roxana RacuNo ratings yet

- NachamkinDocument1 pageNachamkinapi-532187335No ratings yet

- Cost of Living Spreadsheet - Computer AppsDocument1 pageCost of Living Spreadsheet - Computer Appsapi-390350587No ratings yet

- Family BudgetDocument3 pagesFamily BudgetThuoNo ratings yet

- New York Budget - Sheet1Document2 pagesNew York Budget - Sheet1api-669976041No ratings yet

- Monthly Family BudgetDocument3 pagesMonthly Family BudgetMohamed ElhousniNo ratings yet

- BudgetDocument2 pagesBudgetbrodyschmidt14No ratings yet

- Projected Budget Spreadsheet 1Document10 pagesProjected Budget Spreadsheet 1Ismail UsmanNo ratings yet

- After College Budget 2017Document10 pagesAfter College Budget 2017api-358027640No ratings yet

- Budget Worksheet: Career Graphic DesignerDocument5 pagesBudget Worksheet: Career Graphic DesignerArkoNo ratings yet

- Personal Budget Spreadsheet 10 2020-2 2Document4 pagesPersonal Budget Spreadsheet 10 2020-2 2api-685542779No ratings yet

- Budget WorksheetDocument4 pagesBudget Worksheetsenuli WithanachchiNo ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- PaymentsDocument1 pagePaymentsapi-390350690No ratings yet

- Trevor Kernan - LifeHappensDocument3 pagesTrevor Kernan - LifeHappensTrevor KernanNo ratings yet

- Family Budget (Monthly) 1Document11 pagesFamily Budget (Monthly) 1Mbongeni MaxwellNo ratings yet

- Budget Template: Monthly Income Monthly ExpensesDocument1 pageBudget Template: Monthly Income Monthly ExpensesipasetiNo ratings yet

- FINAL - Estimated Budget WorksheetDocument1 pageFINAL - Estimated Budget WorksheetmtomicaNo ratings yet

- Cash Flow Template 42Document8 pagesCash Flow Template 42ianachieviciNo ratings yet

- Benefits Highlights 2018Document5 pagesBenefits Highlights 2018Marcus CosmeNo ratings yet

- Numbers Goals and Budgeting Chapters 1 3 Jorge MartinezDocument2 pagesNumbers Goals and Budgeting Chapters 1 3 Jorge Martinezapi-366687408No ratings yet

- Boyce A BudgetDocument4 pagesBoyce A Budgetapi-513816841No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1Naddie DeoreNo ratings yet

- Monthly Expenses: Income 1 Income 2 Extra Income Total MonthlyDocument1 pageMonthly Expenses: Income 1 Income 2 Extra Income Total Monthlydavidlam0109No ratings yet

- Family Budget (Monthly) 1Document6 pagesFamily Budget (Monthly) 1ivan.breNo ratings yet

- Economics Work 1Document2 pagesEconomics Work 1api-634974986No ratings yet

- Weekly Budget Planner - 0Document6 pagesWeekly Budget Planner - 0Nabila ArifannisaNo ratings yet

- MontoyaDocument1 pageMontoyaapi-531942769No ratings yet

- Budget Project WorksheetDocument9 pagesBudget Project Worksheetapi-637596993No ratings yet

- Future Planning StuffDocument1 pageFuture Planning Stuffapi-389861291No ratings yet

- Traditional AdultDocument6 pagesTraditional Adultapi-699037645No ratings yet

- 02.04 Why BudgetDocument17 pages02.04 Why BudgetmeaNo ratings yet

- Mind Your Money TrackerDocument13 pagesMind Your Money TrackerdhawalthefoodieNo ratings yet

- Her First 100K College Budget SpreadsheetDocument2 pagesHer First 100K College Budget SpreadsheetSarah EllenNo ratings yet

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- Eco Budget SheetDocument6 pagesEco Budget Sheetapi-732387992No ratings yet

- CCCSBudget WorksheetDocument1 pageCCCSBudget Worksheetsmarta@keraNo ratings yet

- BudgetDocument1 pageBudgetapi-357349956No ratings yet

- Courtenay Pyburn Spending PlanDocument8 pagesCourtenay Pyburn Spending Planapi-369840303No ratings yet

- BudgetDocument4 pagesBudgetjlsmith25100% (1)

- Monthly Budget Worksheet-2Document4 pagesMonthly Budget Worksheet-2Yuyao QuNo ratings yet

- Monthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileDocument1 pageMonthly Budget Worksheet: (804) 323-6800 (800) 285-6609 Visit A Branch MobileMikaila BurnettNo ratings yet

- Make A Budget: My Income This MonthDocument2 pagesMake A Budget: My Income This MonthjuanNo ratings yet

- Income Amounts Expenses Amounts Monthly Savings Yearly SavingsDocument12 pagesIncome Amounts Expenses Amounts Monthly Savings Yearly SavingsTyandTeresa NixonNo ratings yet

- Traditional-College-Student 3 - 2 1 6Document6 pagesTraditional-College-Student 3 - 2 1 6api-735540493No ratings yet

- PayneDocument1 pagePayneapi-532062590No ratings yet

- Budget DoneDocument6 pagesBudget Doneapi-695864872No ratings yet

- My Budget: Expense Type: 1 Pri Current Monthy Cost: Survive 1Document22 pagesMy Budget: Expense Type: 1 Pri Current Monthy Cost: Survive 1jasmineNo ratings yet

- ADULTHOODDocument1 pageADULTHOODLotteNo ratings yet

- Jarrens ExelDocument1 pageJarrens Exelapi-393540504No ratings yet

- McguireDocument6 pagesMcguireapi-735265682No ratings yet

- For Single Military Women Only: 10 Easy-Breezy Retirement TipsFrom EverandFor Single Military Women Only: 10 Easy-Breezy Retirement TipsNo ratings yet

- The Young Adult's Guide to The Galaxy - The Young Adult's TextbookFrom EverandThe Young Adult's Guide to The Galaxy - The Young Adult's TextbookNo ratings yet

- GridDocument12 pagesGridapi-534083600No ratings yet

- Milanak ConflictresolutionDocument2 pagesMilanak Conflictresolutionapi-534083600No ratings yet

- Milanak-Quest Bar AnalysisDocument2 pagesMilanak-Quest Bar Analysisapi-534083600No ratings yet

- Exercise and Eating HabitsDocument18 pagesExercise and Eating Habitsapi-534083600No ratings yet

- Organic Principles Lab-Esterification: Seton Hill University Spring 2019Document3 pagesOrganic Principles Lab-Esterification: Seton Hill University Spring 2019api-534083600No ratings yet

- Advance Corporate Accounting Syllabus IDocument2 pagesAdvance Corporate Accounting Syllabus IJøël JøëlNo ratings yet

- churches, governmental authorities and agencies) who is not a party to the agreement. (không cho vào pp) "Cái nào t in đậm thì m hẵng cho vào pp nha"Document2 pageschurches, governmental authorities and agencies) who is not a party to the agreement. (không cho vào pp) "Cái nào t in đậm thì m hẵng cho vào pp nha"BP RosiesunflowerandlilliesNo ratings yet

- Yard Fencing KSEB 2Document6 pagesYard Fencing KSEB 2isan.structural TjsvgalavanNo ratings yet

- Consumer Complaint Form: InstructionsDocument3 pagesConsumer Complaint Form: InstructionsEFRAIN PIZARRONo ratings yet

- Policyhome 010008Document5 pagesPolicyhome 010008Nikunj SavaliyaNo ratings yet

- Cochingyan v. R & B Surety, 151 SCRA 339Document14 pagesCochingyan v. R & B Surety, 151 SCRA 339BernsNo ratings yet

- 117N096V01-PNB MetLife Guaranteed Savings Plan - tcm47-69773Document32 pages117N096V01-PNB MetLife Guaranteed Savings Plan - tcm47-69773chander prakashNo ratings yet

- GroupAssig IFSDocument20 pagesGroupAssig IFSTEBENRAJ SEGARNo ratings yet

- Swimming For Autistic Children by Cerebral Palsy Alliance: Presenting by Pawandeep Kaur STUDENT ID 1067235Document17 pagesSwimming For Autistic Children by Cerebral Palsy Alliance: Presenting by Pawandeep Kaur STUDENT ID 1067235Pawan JohalNo ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyLester AcupidoNo ratings yet

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- Calanoc v. Court of AppealsDocument1 pageCalanoc v. Court of AppealswuplawschoolNo ratings yet

- Forensic Accounting and Complex Claims Facc All ServicesDocument10 pagesForensic Accounting and Complex Claims Facc All ServicesEduardo CanedoNo ratings yet

- TN KNTHCMDocument19 pagesTN KNTHCMLee HuongNo ratings yet

- Exercise Chap 3Document28 pagesExercise Chap 3JF FNo ratings yet

- Travelcare Medical: Single TripDocument25 pagesTravelcare Medical: Single Tripsike1977No ratings yet

- Number Problems: Numerical Reasoning 85 86 Ultimate Psychometric TestsDocument7 pagesNumber Problems: Numerical Reasoning 85 86 Ultimate Psychometric TestsThuy LeNo ratings yet

- Indemnity Bond For NSCDocument2 pagesIndemnity Bond For NSCVidhyadar ThotaNo ratings yet

- Theory QuestionsDocument256 pagesTheory QuestionsSachin KumarNo ratings yet

- Thank You For Choosing AllstateDocument2 pagesThank You For Choosing AllstateHelen DowneyNo ratings yet

- Tongko Vs Manufacturer's LifeDocument2 pagesTongko Vs Manufacturer's LifeRal CaldiNo ratings yet

- 12 - Chapter 8Document22 pages12 - Chapter 8Vinay Kumar KumarNo ratings yet

- Moa Construction TemplateDocument5 pagesMoa Construction TemplateJovinyl Lojares100% (1)

- Ahm 250 PDFDocument5 pagesAhm 250 PDFArunaNo ratings yet

- Kailash Vasdev, New Delhi Bajaj Electricals LTD., Mumbai: - Kailesh VasudevDocument1 pageKailash Vasdev, New Delhi Bajaj Electricals LTD., Mumbai: - Kailesh VasudevGurvinder SinghNo ratings yet

- SSRN Id2571379Document150 pagesSSRN Id2571379NudzejmaNo ratings yet

- A Study of Performance Sbi Life InsuranceDocument12 pagesA Study of Performance Sbi Life InsuranceSubir DasNo ratings yet

- Stucture of Financial Sector of PakistanDocument5 pagesStucture of Financial Sector of PakistanSYEDWASIQABBAS RIZVINo ratings yet

- Personal History Statement FormDocument24 pagesPersonal History Statement FormHexiros CafeNo ratings yet

- Financial BanksDocument9 pagesFinancial BanksV Venkata Naga Sai DeepikaNo ratings yet