Professional Documents

Culture Documents

Get Insured Today in 3 Simple Steps!: Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers

Uploaded by

Dhaval ParmarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Get Insured Today in 3 Simple Steps!: Beware of Spurious Phone Calls and Fictitious / Fraudulent Offers

Uploaded by

Dhaval ParmarCopyright:

Available Formats

–

SBI Life – Sampoorn Suraksha (UIN: 111N040V04) is a Group non-linked non-participating pure risk premium life insurance product, which offers a yearly

renewable group life insurance. It is a comprehensive plan that can be availed to provide for cover against death at competitive rates.

Get insured today in 3 Simple Steps!

Enjoy Instant coverage 24x7, worldwide

Simple to manage with auto renewal option

No Medical Examination required

Supports Family Members and Dependants Financially in case of Untimely Death of the member

Premiums Paid are eligible for tax Rebates (under section 80C of the Income Tax Act, 1961)

Available on YONO platform of SBI

Life cover at an affordable Premium

This is a One Year Group Term Renewal Scheme, presently under

Classification SBI Life - Sampoorn Suraksha (UIN: 111N040V04), available to users of SBI YONO application

Scope of Cover Any SBI YONO user can voluntarily enroll for this cover (subject to eligibility conditions as stated below)

Age at Entry (As On Last Birthday) Minimum : 18 Years Maximum : 55 Years

Age at Maturity (As On Last Birthday) Minimum : 19 Years Maximum : 56 Years

Policy Term 1 Year, renewable upto 55 years of age

Depending on current age (as on enrolment or renewal)

Premium Premium rates are subject to review.

Minimum : ` 2 lakhs

Maximum :

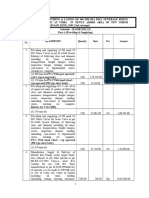

Age (In years) Maximum Sum Assured (In Lacs)

Sum Assured 18 - 35 40

(Rounded Down to Nearest Lakh) 36 - 45 30

46 - 50 20

51 - 55 10

The Sum assured would be capped to a multiple of your average account balance

Death Benefit Sum Assured

Maturity Benefit Not Applicable

The cover under the Scheme will cease on the following :

1. Attainment of 56 years of age (as on last birthday)

Termination of Insurance cover 2. Nonpayment of renewal premium

3. Payment of Claim to the beneficiary

Surrender Benefit Not Applicable

Suicide Exclusion: Suicide claims would be excluded in the first 12 months of coverage. In other words, in case of

death due to suicide in the first 12 months of cover the Sum Assured is not payable. In such a scenario, the 80% of

Exclusion the total premiums paid (net of taxes & cess) till the date of death in respect of the member will be refunded without

interest, provided the member policy is in-force.

In the event that you are not satisfied with the terms and conditions of the policy, and wish to cancel the policy, you can do so

by returning the policy to the company along with a letter requesting for cancellation within 15 days for policies sourced through

Free Look Cancellation any channel mode other than Direct Marketing channel and 30 days for policies sourced through Direct Marketing channel of

receipt of policy.

Premium paid by you will be refunded after deducting stamp duty, taxes and the proportionate risk premium.

67

BEWARE OF SPURIOUS PHONE CALLS AND FICTITIOUS / FRAUDULENT OFFERS

IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint.

All the product features under this plan have been chosen by the master policyholder in his capacity as the group administrator. Only features chosen by the Master Policyholder are available to you, based on

eligibility. State Bank of India is a Registered Corporate Agent (CoR No. 003) of SBI Life Insurance Company Limited. Insurance is underwritten by SBI Life Insurance Company Limited.For more details on risk factors,

terms and conditions please read sales brochure carefully before concluding a sale. The purchase by bank's Customer of any insurance products is purely voluntary and is not linked to availment of any other facility

from the bank. Trade logo displayed above belongs to State Bank of India and is used by SBI Life under license.Registered and Corporate Office: SBI Life Insurance Company Limited, Natraj, M.V. Road & Western

Express Highway Junction, Andheri (East), Mumbai-400 069 IRDAI Registration No. 111. CIN: L99999MH2000PLC129113 | Email: info@sbilife.co.in | www.sbilife.co.in 72.YILS.ver.05-09-20 F ENG

You might also like

- SampoornaDocument1 pageSampoornaimam janiNo ratings yet

- Scheme DetailsDocument1 pageScheme DetailsSubhadip MaitiNo ratings yet

- Jeganathan AnnuallyDocument3 pagesJeganathan AnnuallySenthilkumarNo ratings yet

- 5years Pay 15years Policy TermDocument3 pages5years Pay 15years Policy TermSenthilkumarNo ratings yet

- BenefitIllustrationDocument4 pagesBenefitIllustrationshikha742642No ratings yet

- Key Feature Document: You Have Chosen Step Up Income Option Maturity Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Step Up Income Option Maturity Benefit: Income BenefitAnji Reddy BijjamNo ratings yet

- 825 E-Term 288V01 SLDocument5 pages825 E-Term 288V01 SLIncredible MediaNo ratings yet

- Key Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitKhushi GuptaNo ratings yet

- Key Feature Document: You Have Chosen Assured Income Option at Maturity: Income Benefit: Non Payment of PremiumDocument4 pagesKey Feature Document: You Have Chosen Assured Income Option at Maturity: Income Benefit: Non Payment of PremiumKevin NagvekarNo ratings yet

- Key Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income Benefitsibabrata chatterjeeNo ratings yet

- Key Feature Document: You Have Chosen Wealth Creation Option Maturity Benefit: Death Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Wealth Creation Option Maturity Benefit: Death Benefit: Income BenefitAnji Reddy BijjamNo ratings yet

- Max Life Saral Jeevan Bima ProspectusDocument9 pagesMax Life Saral Jeevan Bima Prospectusmohan krishnaNo ratings yet

- SampoornSuraksha SchemeDetails14102022190Document1 pageSampoornSuraksha SchemeDetails14102022190Murthy NandulaNo ratings yet

- Insurance Policy BIDocument5 pagesInsurance Policy BILakshav KapoorNo ratings yet

- Key Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitDocument3 pagesKey Feature Document: You Have Chosen Second Income Option Maturity Benefit: Death Benefit: Income BenefitSantosh Kumar RoyNo ratings yet

- Sales Brochure LIC-s E-Term Rev PDFDocument3 pagesSales Brochure LIC-s E-Term Rev PDFRamesh ThumburuNo ratings yet

- LIC S Bima Gold - 512N231V01 PDFDocument8 pagesLIC S Bima Gold - 512N231V01 PDFPooja ReddyNo ratings yet

- Ko Tak Term PlanDocument8 pagesKo Tak Term PlanRKNo ratings yet

- Bima Gold by Lic of India - 9811896425Document3 pagesBima Gold by Lic of India - 9811896425Harish ChandNo ratings yet

- Sales Brochure LIC S Single Premium Endowment PlanDocument9 pagesSales Brochure LIC S Single Premium Endowment Plansantosh kumarNo ratings yet

- Metlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Document4 pagesMetlife Group Accident Death Benefit Plus Rider - Sales Literature - tcm47-66271Amit PrasadNo ratings yet

- EProtect BrochureDocument13 pagesEProtect Brochurehyhy 21No ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Bajaj Allianz: Fortune GainDocument14 pagesBajaj Allianz: Fortune GainSudhirGajareNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- HDFC Life Brochure-15Document16 pagesHDFC Life Brochure-15nayaksaismritiNo ratings yet

- Endowment Policy: By: Prateek BindalDocument38 pagesEndowment Policy: By: Prateek BindalPrateek BindalNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiNo ratings yet

- LIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)Document14 pagesLIC's Jeevan Umang (UIN: 512N312V02) (A Non-Linked, Participating, Individual, Life Assurance Savings (Whole Life) Plan)manoj gokikarNo ratings yet

- Saral Jeevan Bima Brochure-BRDocument10 pagesSaral Jeevan Bima Brochure-BRprabuNo ratings yet

- Life BrochureDocument8 pagesLife BrochureHar DonNo ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- Isecure LoanDocument8 pagesIsecure Loansameer hNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanRupran RaiNo ratings yet

- Bhagyalakshmi Sales Brochure W 4 5in X H 8in SPDocument8 pagesBhagyalakshmi Sales Brochure W 4 5in X H 8in SPMexico EnglishNo ratings yet

- Magnum Fortune Plus Plan-Bajaj AllianzeDocument18 pagesMagnum Fortune Plus Plan-Bajaj AllianzeDwarkesh PanchalNo ratings yet

- Saral Jeevan Bima: Bajaj Allianz LifeDocument8 pagesSaral Jeevan Bima: Bajaj Allianz LifeSuresh MouryaNo ratings yet

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- Jeevan Ankur LicDocument7 pagesJeevan Ankur LicVenkat RamanaaNo ratings yet

- HDFC Capital GuaranteeDocument34 pagesHDFC Capital GuaranteeRanjan SharmaNo ratings yet

- LIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)Document21 pagesLIC Jeevan Umang Brochure 9-Inch-X-8-Inch Eng (2021)sri_plnsNo ratings yet

- Aegon Life Akhil Bharat Term PlanDocument9 pagesAegon Life Akhil Bharat Term Planmohinlaskar123No ratings yet

- Lic Leaflet Endoment Plan4 5x8 Inches WXH NewDocument16 pagesLic Leaflet Endoment Plan4 5x8 Inches WXH NewVishal 777No ratings yet

- Sales Brochure LIC S Navjeevan To CC DeptDocument14 pagesSales Brochure LIC S Navjeevan To CC DeptRajasekar KaruppusamyNo ratings yet

- When It Comes To Securing Your Loved Ones, Trust Us.: Saral JeevanDocument10 pagesWhen It Comes To Securing Your Loved Ones, Trust Us.: Saral Jeevanjithin jayNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocument13 pagesLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNo ratings yet

- Savings Advantage Plan LeafletDocument2 pagesSavings Advantage Plan LeafletNishanthNo ratings yet

- 2.whole Life PlansDocument3 pages2.whole Life PlansKoshyNo ratings yet

- Benefits:: Date of Commencement of Risk Under The PlanDocument10 pagesBenefits:: Date of Commencement of Risk Under The PlanDwellerwarriorNo ratings yet

- Eprotect BrochureDocument13 pagesEprotect BrochureAbhishek RamNo ratings yet

- Life Partner Plus Pay Endowment To Age 75 NewDocument6 pagesLife Partner Plus Pay Endowment To Age 75 NewshamaritesNo ratings yet

- Endowment PolicyDocument38 pagesEndowment PolicyGourav DeNo ratings yet

- Lic Brochure 917 Single Endoment Plan 2021Document12 pagesLic Brochure 917 Single Endoment Plan 2021राजकुमार पटेल स्वदेशी प्रचारकNo ratings yet

- Max Life Future Genius Education Plan ProspectusDocument16 pagesMax Life Future Genius Education Plan ProspectusmanishaNo ratings yet

- HDFC Life Click 2 Wealth - Brochure - Retail - V3Document16 pagesHDFC Life Click 2 Wealth - Brochure - Retail - V3a26geniusNo ratings yet

- Fortune Gain BrochureDocument15 pagesFortune Gain Brochurevishwasgowdaraj3377No ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Yj" XTRBM: MTKM' MTKMF) R F Mv"Tobtk Nòhtu Jtuftu Òuztnu & ZTBTH IgtheDocument8 pagesYj" XTRBM: MTKM' MTKMF) R F Mv"Tobtk Nòhtu Jtuftu Òuztnu & ZTBTH IgtheDhaval ParmarNo ratings yet

- Yj" XTRBM: Mjåa TBTK Ybhuje HTSGBTK 16Btk, 'Unbtk 279Btk BuDocument8 pagesYj" XTRBM: Mjåa TBTK Ybhuje HTSGBTK 16Btk, 'Unbtk 279Btk BuDhaval ParmarNo ratings yet

- Road and Building Division District Panchayat Amreli Tender PaperDocument58 pagesRoad and Building Division District Panchayat Amreli Tender PaperDhaval ParmarNo ratings yet

- Road and Building Division District Panchayat Amreli Tender PaperDocument58 pagesRoad and Building Division District Panchayat Amreli Tender PaperDhaval ParmarNo ratings yet

- Schedule B Umra RisingDocument10 pagesSchedule B Umra RisingDhaval ParmarNo ratings yet

- FAQs Licensing Registration 21 12 2022Document20 pagesFAQs Licensing Registration 21 12 2022Dhaval ParmarNo ratings yet

- GeM Bidding 3886535Document7 pagesGeM Bidding 3886535Dhaval ParmarNo ratings yet

- 04 Vol-III-B-Technical Specification For Civil WorksDocument153 pages04 Vol-III-B-Technical Specification For Civil WorksDhaval ParmarNo ratings yet

- Statement of Axis Account No:913010032902471 For The Period (From: 01-05-2022 To: 09-12-2022)Document5 pagesStatement of Axis Account No:913010032902471 For The Period (From: 01-05-2022 To: 09-12-2022)Dhaval ParmarNo ratings yet

- PMB Auction 8-12Document1 pagePMB Auction 8-12Dhaval ParmarNo ratings yet

- 03 Vol III B General Specs CivilDocument143 pages03 Vol III B General Specs CivilDhaval ParmarNo ratings yet

- 01 Vol III A Extent of WorksDocument26 pages01 Vol III A Extent of WorksDhaval ParmarNo ratings yet

- 05 Vol III B Tech Specs WTPDocument131 pages05 Vol III B Tech Specs WTPDhaval ParmarNo ratings yet

- 07 Vol III C Mechanical DatasheetDocument12 pages07 Vol III C Mechanical DatasheetDhaval ParmarNo ratings yet

- 02 Vol III B General ScheduleDocument32 pages02 Vol III B General ScheduleDhaval ParmarNo ratings yet

- Thrust Block 22.5 Bend A3Document1 pageThrust Block 22.5 Bend A3Dhaval ParmarNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaDhaval ParmarNo ratings yet

- 01 Extent of Work 21-01-2021Document48 pages01 Extent of Work 21-01-2021Dhaval ParmarNo ratings yet

- 06 Vol III C Mechanical Works SpecificationDocument54 pages06 Vol III C Mechanical Works SpecificationDhaval ParmarNo ratings yet

- VOL 1A Technical Bid RevisedDocument50 pagesVOL 1A Technical Bid RevisedDhaval ParmarNo ratings yet

- Swara Tours and Travels - Tender DocumentDocument23 pagesSwara Tours and Travels - Tender DocumentDhaval ParmarNo ratings yet

- Bid Documents For Design, Build & Operate Contract ForDocument9 pagesBid Documents For Design, Build & Operate Contract ForDhaval ParmarNo ratings yet

- 001 VOL 1A Technical Bid 13519 PDFDocument116 pages001 VOL 1A Technical Bid 13519 PDFDhaval ParmarNo ratings yet

- Is 14846Document24 pagesIs 14846rinabiswas100% (1)

- BRTS MS GrillDocument30 pagesBRTS MS GrillDhaval ParmarNo ratings yet

- 001 VOL 1B Pasvi 19 03 19Document89 pages001 VOL 1B Pasvi 19 03 19Dhaval ParmarNo ratings yet

- Advertisement For Senior Project EngineerDocument1 pageAdvertisement For Senior Project EngineerDhaval ParmarNo ratings yet

- Pavan Vapi To AhmedabadDocument2 pagesPavan Vapi To AhmedabadDhaval ParmarNo ratings yet

- 04 Schedule BDocument10 pages04 Schedule BDhaval ParmarNo ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- A Comparative Study of Ulip Plans Offered by Icici Prudential and Other Life Insurance CompaniesDocument11 pagesA Comparative Study of Ulip Plans Offered by Icici Prudential and Other Life Insurance Companiesdixit mittalNo ratings yet

- Government Federal Per Diem 845,000 1,690,000 IDR 1,690,000 Government Federal Per Diem 845,000Document1 pageGovernment Federal Per Diem 845,000 1,690,000 IDR 1,690,000 Government Federal Per Diem 845,000John DaneNo ratings yet

- Assets Liabilities Owner'S Equity Income ExpensesDocument2 pagesAssets Liabilities Owner'S Equity Income ExpensesRalph Christer Maderazo0% (1)

- General Banking KnowledgeDocument696 pagesGeneral Banking Knowledgerajeev naikNo ratings yet

- Print Queue Inquiry: Menu Show Memo Pad CCY ConverterDocument11 pagesPrint Queue Inquiry: Menu Show Memo Pad CCY ConverterNarendra AtreNo ratings yet

- FIM Exercise AnsDocument6 pagesFIM Exercise AnsSam MNo ratings yet

- Infra Debt FundDocument3 pagesInfra Debt FundMana Bhanjan BeheraNo ratings yet

- The Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With CustomersDocument31 pagesThe Real Effects of A New Accounting Standard The Case of IFRS 15 Revenue From Contracts With Customersaccount.oswald.o.20No ratings yet

- Application: Account Receivables Title: Receipt Remittance: OracleDocument31 pagesApplication: Account Receivables Title: Receipt Remittance: OraclesureshNo ratings yet

- 2nd Quater - Gen Math - Quiz No 1Document1 page2nd Quater - Gen Math - Quiz No 1MA. JEMARIS SOLISNo ratings yet

- Icp Receipt - Icp 129309Document1 pageIcp Receipt - Icp 129309Sadiq KhattakNo ratings yet

- Insolvency Law and Corporate RehabilitationDocument33 pagesInsolvency Law and Corporate RehabilitationElizar JoseNo ratings yet

- A Study On Cooperative Banks in India With Special Reference To Lending PracticesDocument6 pagesA Study On Cooperative Banks in India With Special Reference To Lending PracticesSrikara Acharya100% (1)

- Additional Illustrations-13Document9 pagesAdditional Illustrations-13Gulneer LambaNo ratings yet

- PassbookDocument42 pagesPassbookCharles OkwalingaNo ratings yet

- 15 Code of Ethics For Professional Accountants in The PhilippinesDocument11 pages15 Code of Ethics For Professional Accountants in The PhilippinesDia Mae GenerosoNo ratings yet

- ESENECO 2 Interest Money Time Relationship Rev1Document49 pagesESENECO 2 Interest Money Time Relationship Rev1Irah BonifacioNo ratings yet

- International Financial Management: by Jeff MaduraDocument47 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- RL360° FundsDocument4 pagesRL360° FundsRL360°100% (2)

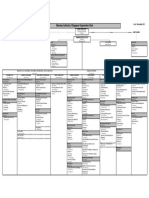

- MAS Org Chart 1 Nov 2015Document1 pageMAS Org Chart 1 Nov 2015muhjaerNo ratings yet

- Home Assignment - JUNK BOND Subject: Corporate FinanceDocument3 pagesHome Assignment - JUNK BOND Subject: Corporate FinanceAsad Mazhar100% (1)

- Acc106 AssignmentDocument16 pagesAcc106 AssignmentNNNAJ89% (94)

- Industrial Finance Corporation of IndiaDocument2 pagesIndustrial Finance Corporation of IndiaShruti Goyal100% (1)

- Shinhan Bank Circular Dated 22 June 2009Document348 pagesShinhan Bank Circular Dated 22 June 2009eureka8No ratings yet

- Accounting For Certain Investments in Debt and Equity Securities (Statement of FAS No. 115)Document29 pagesAccounting For Certain Investments in Debt and Equity Securities (Statement of FAS No. 115)XNo ratings yet

- 8.handbook On Microfinance InstitutionsDocument122 pages8.handbook On Microfinance InstitutionsAditya100% (1)

- Structured and Project Finance Structured and Project FinanceDocument22 pagesStructured and Project Finance Structured and Project FinanceLelin DasNo ratings yet

- Stop Payment LetterDocument11 pagesStop Payment Letterpraveen100% (1)

- MOSt Market Roundup 27 TH Aug 21Document7 pagesMOSt Market Roundup 27 TH Aug 21vikalp123123No ratings yet