Professional Documents

Culture Documents

Islamic Law of Business: International Islamic University, Islamabad Faculty of Management Sciences

Islamic Law of Business: International Islamic University, Islamabad Faculty of Management Sciences

Uploaded by

Muhammad Bilawal0 ratings0% found this document useful (0 votes)

4 views10 pagesIslamic law

Original Title

18th Lecture

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIslamic law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views10 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management Sciences

Islamic Law of Business: International Islamic University, Islamabad Faculty of Management Sciences

Uploaded by

Muhammad BilawalIslamic law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

International Islamic University, Islamabad

Faculty of Management Sciences

Islamic Law of Business

Lecture 18

Dr. Asad Ullah

PhD Islamic Law & Jurisprudence

Lecturer, Faculty of Shariah & Law, IIUI

Layout of Presentation

Loan (Qard)

1. Definition

2. Elements

3. Rules for Excess Benefit

4. Current Accounts

Definition

Qard is the transfer of ownership in fungible

wealth to a person on whom it is binding to

return wealth similar to it.

Elements (Arkan) of a Loan (Qard) Contract and its

Conditions

• The contract of loan (Qard) is concluded through offer and acceptance by

the use of the words Qard or any other word or act that conveys the

meaning of Qard.

• It is stipulated for the subject-matter of the contract that it be known

fungible (Mithli) marketable wealth.

• The borrower comes to own the subject-matter of Qard (the wealth

loaned) through possession, and he becomes liable for (the repayment of)

a similar subject-matter.

• The applicable rule is the return Qard at the place where it was delivered.

However, It is permissible to stipulate a place other than that.

Rules for Excess Benefit Stipulated in the Qard

Contract

• The stipulation of an excess for the lender in loan is prohibited, and it amounts

to Riba, whether the excess is in terms of quality or quantity or whether the

excess is a tangible thing or a benefit, and whether the excess is stipulated at

the time of the contract or while determining the period of delay for repayment,

whether the stipulation is in writing or is part of customary practice.

• It is not permissible to the borrower to offer tangible property or extend a

benefit to the lender during the period of the Qard when this is done for the

sake of Qard, unless giving of such benefits is a practice continuing among the

parties from a time prior to the contract of Qard.

• An excess over Qard is permissible at the time of repayment when it is not

stipulated or is part of custom.

Stipulation of a Period in Qard

It is permissible to stipulate a period in Qard. The

borrower is, therefore, under no obligation to return it

prior to the termination of the period nor can the lender

demand it back prior to the end of the period. If,

however, no period is stipulated, it is binding upon the

borrower to return it on demand.

Stipulation of a Contract in Qard

It is not permissible to stipulate a contract of Bay’

(exchange, sale) or Ijarah or other commutative

contract within the contract of Qard.

The Prophet (peace be upon him) said: “A Salaf (loan)

and sale (in one contract) are not permitted”.

Current Accounts

• The reality of current accounts is that these are loans and not deposits. Thus, the

institution comes to own the amounts and a liability to repay the amount is

established against it.

• It is permissible for the institution to demand wages for services rendered to the

holders of the current accounts.

• It is not permitted to the institution to present to the owners of current accounts, in

lieu of such accounts, material gifts, financial incentives, services or benefits that

are not related to deposits and withdrawals. Among these are exemptions from

charges in whole or in part, like exemption from credit card charges and transfer

charges.

• The incentives that are not specific to current accounts are not governed by this

rule.

Thank You

You might also like

- Understand Trading in 2 Hours SteveRyanDocument63 pagesUnderstand Trading in 2 Hours SteveRyanAkash Biswal100% (2)

- Chapter 2 Notes and MortgagesDocument24 pagesChapter 2 Notes and Mortgagesnazmul islamNo ratings yet

- Securities and CollateralDocument101 pagesSecurities and CollateralNurfashihahNo ratings yet

- Safe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesFrom EverandSafe Guarding Your Future: Financial Literacy How a Trusts Can Shield Your Assets & Reduce TaxesNo ratings yet

- PPT - Truth in Lending ActDocument23 pagesPPT - Truth in Lending ActGigiRuizTicar100% (1)

- INDORSEMENTDocument71 pagesINDORSEMENTFrancezedric CruzNo ratings yet

- Short-Form Contract Farming AgreementDocument3 pagesShort-Form Contract Farming Agreementiqra akram100% (1)

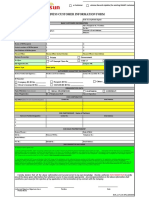

- Business Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade NameDocument2 pagesBusiness Customer Information Form: Registered Business Name: Store/Shop/Outlet Name/Trade Namelhuk banaag100% (2)

- Credit and Collection PrelimsDocument7 pagesCredit and Collection PrelimsMeloy ApiladoNo ratings yet

- Banking Law NotesDocument5 pagesBanking Law NotesBilal Ahmed Bilal AhmedNo ratings yet

- Assignments of DebtsDocument17 pagesAssignments of DebtsWahanze RemmyNo ratings yet

- Once A Mortgage, Always A Mortgage 20208201558100Document14 pagesOnce A Mortgage, Always A Mortgage 20208201558100UMANG COMPUTERSNo ratings yet

- DebenturesDocument28 pagesDebenturesdeepaksinghalNo ratings yet

- Cred Trans DoctrinesDocument6 pagesCred Trans DoctrinesAshaselenaNo ratings yet

- UNIT II Tax RemediesDocument17 pagesUNIT II Tax RemediesAl BertNo ratings yet

- Global Motor Market - Outlook 2020Document151 pagesGlobal Motor Market - Outlook 2020Mudit KediaNo ratings yet

- GuaranteeDocument48 pagesGuaranteeAadhitya NarayananNo ratings yet

- DbsDocument2 pagesDbsKevo Karis100% (1)

- Consumer Satisfaction in Iob BankDocument124 pagesConsumer Satisfaction in Iob BankRiya Jain100% (1)

- Week 5 (A) - Contract 1Document21 pagesWeek 5 (A) - Contract 1nur sheNo ratings yet

- Continuing Guarantee AnsDocument5 pagesContinuing Guarantee AnsSwarna LathaNo ratings yet

- DR Habeebullah Zakariyah Week11Document19 pagesDR Habeebullah Zakariyah Week11Siti Noraisyah NorizanNo ratings yet

- Group 6 PresentationDocument9 pagesGroup 6 Presentationcbuba1999No ratings yet

- Debentures 1Document10 pagesDebentures 1AKOSUA SAFOAH KANTIMPONo ratings yet

- Benefitting From LoanDocument35 pagesBenefitting From LoanSharifah Faizah As SeggafNo ratings yet

- Unit 8n9Document7 pagesUnit 8n92050221 KUSHAGRA SHAHINo ratings yet

- CHARGESDocument60 pagesCHARGESW. Kevin MichukiNo ratings yet

- 2 RahnuDocument12 pages2 RahnuAhmadUmairIlyasNo ratings yet

- Slides - Banking LawDocument44 pagesSlides - Banking LawRentsenjugder NaranchuluunNo ratings yet

- LAW OF PROPERTY AnishaDocument23 pagesLAW OF PROPERTY Anishadeshwaltanu6No ratings yet

- Glossary of Islamic Banking TermsDocument7 pagesGlossary of Islamic Banking Termssunnykhan bwnNo ratings yet

- Glossary of Islamic Banking TermsDocument8 pagesGlossary of Islamic Banking TermsPriyonggo SusenoNo ratings yet

- Insolvent Shall Refer To The Financial Condition of A Debtor That Is GenerallyDocument27 pagesInsolvent Shall Refer To The Financial Condition of A Debtor That Is GenerallyJessa May MendozaNo ratings yet

- Ismalic Finance GROUP 1Document39 pagesIsmalic Finance GROUP 1Muhammad HasnainNo ratings yet

- Chapter 4 Subject Matter of A ContractDocument35 pagesChapter 4 Subject Matter of A ContractKepala AcikNo ratings yet

- W10 - Supplementary Contracts (Condensed)Document37 pagesW10 - Supplementary Contracts (Condensed)Mubashir KhanNo ratings yet

- Exam Prep Is Law of ContractDocument2 pagesExam Prep Is Law of Contractcbuba1999No ratings yet

- Discharge and Termination of SuretyshipDocument5 pagesDischarge and Termination of SuretyshipmbinamajeNo ratings yet

- Introduction To Sale of Goods Act & Contract ACT: by J.Michael Sammanasu JIMDocument34 pagesIntroduction To Sale of Goods Act & Contract ACT: by J.Michael Sammanasu JIMRakesh VarunNo ratings yet

- Akriti Sinha 10 Property LawDocument12 pagesAkriti Sinha 10 Property LawAKRITI SINHANo ratings yet

- MBTC vs. ChiokDocument46 pagesMBTC vs. ChiokEhlla MacatangayNo ratings yet

- Al-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BankDocument14 pagesAl-Rahnu VS Conventional Pawn Broking: Group 12 Maybank Islamic BanknghingliungNo ratings yet

- Ijarah 4 Month-CompleteDocument62 pagesIjarah 4 Month-CompleteHasan Irfan SiddiquiNo ratings yet

- File 319334Document23 pagesFile 319334louise carinoNo ratings yet

- Salam & Parallel Salam Transactions-CH.7Document36 pagesSalam & Parallel Salam Transactions-CH.7Yusuf Hussein0% (1)

- Impeachable+dispositions SummaryDocument7 pagesImpeachable+dispositions SummaryJoshua OnckerNo ratings yet

- UntitledDocument2 pagesUntitledGabieNo ratings yet

- Uqud in Islamic Financial TransactionsDocument40 pagesUqud in Islamic Financial Transactionsmohamed saidNo ratings yet

- Presentation 18Document15 pagesPresentation 18Rohith BidadiNo ratings yet

- IjaraDocument15 pagesIjarakamranp1No ratings yet

- Metropolitan Bank and Trust Company vs. ChiokDocument33 pagesMetropolitan Bank and Trust Company vs. ChiokClaudia LapazNo ratings yet

- Topic 9 Corporate Finance Debentures-1Document16 pagesTopic 9 Corporate Finance Debentures-1Bernard ChrillynNo ratings yet

- Group 2 Presentation - Law of SuretyDocument91 pagesGroup 2 Presentation - Law of SuretyROMEO CHIJENANo ratings yet

- Re Bank of Credit and Commerce International SADocument49 pagesRe Bank of Credit and Commerce International SAMeera HayatNo ratings yet

- Islamic Banking GlossaryDocument8 pagesIslamic Banking Glossarylahem88100% (4)

- Contacting UFOs in The SkyDocument6 pagesContacting UFOs in The SkyJulian Rey Odyssey HernandezNo ratings yet

- Al RahnDocument17 pagesAl RahnMahyuddin Khalid100% (1)

- Pledge of SharesDocument8 pagesPledge of Sharesshubhamgupta04101994No ratings yet

- Ship Finance Essentials: Professor Alkis John CorresDocument41 pagesShip Finance Essentials: Professor Alkis John Corresprafful sahareNo ratings yet

- DEBENTURESDocument9 pagesDEBENTURESKajal RaiNo ratings yet

- RahnDocument27 pagesRahnNurul 'Aqilah HhrifinNo ratings yet

- The Parameters of Forward IjarahDocument43 pagesThe Parameters of Forward IjarahRamah Le BelNo ratings yet

- Financial Rehabilitation Insolvency ActDocument105 pagesFinancial Rehabilitation Insolvency ActRizzabeth Joy MaalihanNo ratings yet

- Discharge of Contract by AgreementDocument11 pagesDischarge of Contract by AgreementAadhitya NarayananNo ratings yet

- KafalahDocument5 pagesKafalahNur IskandarNo ratings yet

- Takaful Chapter 4 A201Document31 pagesTakaful Chapter 4 A201Cck CckweiNo ratings yet

- Topic 6 Debenture and LoanDocument15 pagesTopic 6 Debenture and LoanYEOH KIM CHENGNo ratings yet

- Islamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesDocument12 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesMuhammad BilawalNo ratings yet

- Strategic Training and DevelopmentDocument31 pagesStrategic Training and DevelopmentMuhammad BilawalNo ratings yet

- Islamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesDocument14 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesMuhammad BilawalNo ratings yet

- Islamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesDocument11 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesMuhammad BilawalNo ratings yet

- Islamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesDocument14 pagesIslamic Law of Business: International Islamic University, Islamabad Faculty of Management SciencesMuhammad BilawalNo ratings yet

- IP - Chapter1 - Foreign Exchange and Currency Risk Management - StudentDocument22 pagesIP - Chapter1 - Foreign Exchange and Currency Risk Management - Studentđan thi nguyễnNo ratings yet

- Globalization H-WPS OfficeDocument2 pagesGlobalization H-WPS Officeangelo aquinoNo ratings yet

- Navigating 2H23Document256 pagesNavigating 2H23Phương LinhNo ratings yet

- ch-1 NewDocument11 pagesch-1 NewSAKIB MD SHAFIUDDINNo ratings yet

- Bir TaxDocument157 pagesBir TaxMubarrach MatabalaoNo ratings yet

- Coke Markets Turn To ArgusDocument4 pagesCoke Markets Turn To ArgusAli Suat AnlasNo ratings yet

- Financial Risk Management Final ProjectDocument7 pagesFinancial Risk Management Final ProjectAdil AnwarNo ratings yet

- Your Airbnb ReceiptDocument1 pageYour Airbnb ReceiptPUI MUN CHANGNo ratings yet

- Production of Oxalic AcidDocument2 pagesProduction of Oxalic AcidnoviNo ratings yet

- MGT 109 Chapter 6Document21 pagesMGT 109 Chapter 6MARJORIE SEDROMENo ratings yet

- Solved Children in Poor Neighborhoods Have Bleak Outlooks On Life andDocument1 pageSolved Children in Poor Neighborhoods Have Bleak Outlooks On Life andM Bilal SaleemNo ratings yet

- Bam 040 Cma 04 Reymark L Baldo Module 1Document5 pagesBam 040 Cma 04 Reymark L Baldo Module 1Reymark BaldoNo ratings yet

- Ryterna Modul Architectural Challenge 2021Document11 pagesRyterna Modul Architectural Challenge 2021Pham QuangdieuNo ratings yet

- Merger and AquisitionDocument75 pagesMerger and AquisitionSaurabh Parashar0% (1)

- Buxly Paint: Balance SheetDocument33 pagesBuxly Paint: Balance SheetJarhan AzeemNo ratings yet

- Prof. Okojie AEM 314Document24 pagesProf. Okojie AEM 314Kolawole Victor AnuoluwapoNo ratings yet

- FIN 4930 Midterm 1 PracticeDocument4 pagesFIN 4930 Midterm 1 PracticeSaima KashemNo ratings yet

- We Are Your Partner in Materials Handling: Our People, Products and ServicesDocument16 pagesWe Are Your Partner in Materials Handling: Our People, Products and ServicesMushfique NowrozNo ratings yet

- AA133.AUDIL II Question CMA May 2022 ExaminationDocument7 pagesAA133.AUDIL II Question CMA May 2022 Examinationkm nafizNo ratings yet

- Webinar Invitation Banner Templates-CreativeDocument34 pagesWebinar Invitation Banner Templates-CreativeCherrie Mae FloresNo ratings yet

- Enterprononship DevelopmentDocument5 pagesEnterprononship DevelopmentVasu ThakurNo ratings yet

- Goldman Sachs and Its Reputation: Acad Group - 7Document7 pagesGoldman Sachs and Its Reputation: Acad Group - 7Shubham AgrawalNo ratings yet