Professional Documents

Culture Documents

Car Manufacturing in India June 2021: Marketline Industry Profile

Uploaded by

Sarthak ChincholikarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Car Manufacturing in India June 2021: Marketline Industry Profile

Uploaded by

Sarthak ChincholikarCopyright:

Available Formats

MarketLine Industry Profile

Car Manufacturing in India

June 2021

Reference Code: 0102-2010

Publication Date: June 2021

WWW.MARKETLINE.COM

MARKETLINE. THIS PROFILE IS A LICENSED PRODUCT

AND IS NOT TO BE PHOTOCOPIED

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 1

Car Manufacturing in India

Industry Profiles

1. Executive Summary

1.1. Market value

The Indian car manufacturing industry shrank by 23.1% in 2020 to reach a value of $22.6 billion.

1.2. Market value forecast

In 2025, the Indian car manufacturing industry is forecast to have a value of $41.1 billion, an increase of

81.9% since 2020.

1.3. Market volume

The Indian car manufacturing industry shrank by 28.6% in 2020 to reach a volume of 2,608.4 thousand

units.

1.4. Market volume forecast

In 2025, the Indian car manufacturing industry is forecast to have a volume of 4,438.1 thousand units, an

increase of 70.1% since 2020.

1.5. Geography segmentation

India accounts for 4.3% of the Asia-Pacific car manufacturing industry value.

1.6. Market share

Suzuki is the leading player in the Indian car manufacturing industry, generating a 38.8% share of the

industry's volume.

1.7. Market rivalry

2020 was an incredibly tough year for car manufacturers amid the COVID-19 pandemic, which served to

intensify the rivalry level.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 2

Car Manufacturing in India

Industry Profiles

1.8. Competitive Landscape

The four leading players in the Indian car manufacturing industry, Suzuki, Tata, Renault and Hyundai Kia

Automotive Group, accounted for a combined 58% share of production volume in 2020. The leading

players in this industry are tapping into the growing demand for hybrid and electric vehicles, while alliances

within the industry are a common strategy. The COVID-19 pandemic temporarily halted production in

many countries in 2020, as well as disrupting the supply chain, and as such the leading players have been

negatively impacted.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 3

Car Manufacturing in India

Industry Profiles

TABLE OF CONTENTS

1. Executive Summary 2

1.1. Market value ................................................................................................................................................2

1.2. Market value forecast ..................................................................................................................................2

1.3. Market volume.............................................................................................................................................2

1.4. Market volume forecast...............................................................................................................................2

1.5. Geography segmentation.............................................................................................................................2

1.6. Market share................................................................................................................................................2

1.7. Market rivalry...............................................................................................................................................2

1.8. Competitive Landscape ................................................................................................................................3

2. Market Overview 9

2.1. Market definition .........................................................................................................................................9

2.2. Market analysis ............................................................................................................................................9

3. Market Data 11

3.1. Market value ..............................................................................................................................................11

3.2. Market volume...........................................................................................................................................12

4. Market Segmentation 13

4.1. Geography segmentation...........................................................................................................................13

5. Market Outlook 14

5.1. Market value forecast ................................................................................................................................14

5.2. Market volume forecast.............................................................................................................................15

6. Five Forces Analysis 16

6.1. Summary ....................................................................................................................................................16

6.2. Buyer power...............................................................................................................................................17

6.3. Supplier power ...........................................................................................................................................18

6.4. New entrants .............................................................................................................................................20

6.5. Threat of substitutes ..................................................................................................................................22

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 4

Car Manufacturing in India

Industry Profiles

6.6. Degree of rivalry.........................................................................................................................................24

7. Competitive Landscape 26

7.1. Market share..............................................................................................................................................26

7.2. Who are the leading players? ....................................................................................................................26

7.3. How are strategic alliances used by the leading companies? ....................................................................27

7.4. How is new technology opening up competition?.....................................................................................27

7.5. How are leading players progressing in the hybrid and electric cars segment? ........................................28

7.6. What impact has the COVID-19 pandemic had on leading players?..........................................................28

8. Company Profiles 29

8.1. Suzuki Motor Corporation..........................................................................................................................29

8.2. Tata Motors Limited...................................................................................................................................34

8.3. Hyundai Motor Company...........................................................................................................................38

8.4. Renault SA ..................................................................................................................................................42

9. Macroeconomic Indicators 50

9.1. Country data ..............................................................................................................................................50

Appendix 52

Methodology ...........................................................................................................................................................52

9.2. Industry associations..................................................................................................................................53

9.3. Related MarketLine research .....................................................................................................................53

About MarketLine....................................................................................................................................................54

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 5

Car Manufacturing in India

Industry Profiles

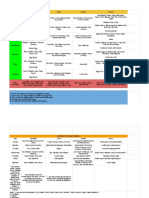

LIST OF TABLES

Table 1: India car manufacturing industry value: $ billion, 2016–20 11

Table 2: India car manufacturing industry volume: thousand units, 2016–20 12

Table 3: India car manufacturing industry geography segmentation: $ billion, 2020 13

Table 4: India car manufacturing industry value forecast: $ billion, 2020–25 14

Table 5: India car manufacturing industry volume forecast: thousand units, 2020–25 15

Table 6: India car manufacturing industry share: % share, by volume, 2020 26

Table 7: Suzuki Motor Corporation: key facts 29

Table 8: Suzuki Motor Corporation: Annual Financial Ratios 31

Table 9: Suzuki Motor Corporation: Key Employees 32

Table 10: Suzuki Motor Corporation: Key Employees Continued 33

Table 11: Tata Motors Limited: key facts 34

Table 12: Tata Motors Limited: Annual Financial Ratios 36

Table 13: Tata Motors Limited: Key Employees 37

Table 14: Hyundai Motor Company: key facts 38

Table 15: Hyundai Motor Company: Annual Financial Ratios 40

Table 16: Hyundai Motor Company: Key Employees 41

Table 17: Renault SA: key facts 42

Table 18: Renault SA: Annual Financial Ratios 44

Table 19: Renault SA: Annual Financial Ratios (Continued) 45

Table 20: Renault SA: Key Employees 46

Table 21: Renault SA: Key Employees Continued 47

Table 22: Renault SA: Key Employees Continued 48

Table 23: Renault SA: Key Employees Continued 49

Table 24: India size of population (million), 2016–20 50

Table 25: India gdp (constant 2005 prices, $ billion), 2016–20 50

Table 26: India gdp (current prices, $ billion), 2016–20 50

Table 27: India inflation, 2016–20 50

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 6

Car Manufacturing in India

Industry Profiles

Table 28: India consumer price index (absolute), 2016–20 51

Table 29: India exchange rate, 2016–20 51

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 7

Car Manufacturing in India

Industry Profiles

LIST OF FIGURES

Figure 1: India car manufacturing industry value: $ billion, 2016–20 11

Figure 2: India car manufacturing industry volume: thousand units, 2016–20 12

Figure 3: India car manufacturing industry geography segmentation: % share, by value, 2020 13

Figure 4: India car manufacturing industry value forecast: $ billion, 2020–25 14

Figure 5: India car manufacturing industry volume forecast: thousand units, 2020–25 15

Figure 6: Forces driving competition in the car manufacturing industry in India, 2020 16

Figure 7: Drivers of buyer power in the car manufacturing industry in India, 2020 17

Figure 8: Drivers of supplier power in the car manufacturing industry in India, 2020 18

Figure 9: Factors influencing the likelihood of new entrants in the car manufacturing industry in India, 2020 20

Figure 10: Factors influencing the threat of substitutes in the car manufacturing industry in India, 2020 22

Figure 11: Drivers of degree of rivalry in the car manufacturing industry in India, 2020 24

Figure 12: India car manufacturing industry share: % share, by volume, 2020 26

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 8

Car Manufacturing in India

Industry Profiles

2. Market Overview

2.1. Market definition

The passenger cars manufacturers market value is calculated in terms of manufacturer selling price (MSP), and

excludes all taxes and levies.

The volume represents the quantity of completely built up (CBU) cars in the particular country/region.

Passenger cars are defined as motor vehicles with at least four wheels, used for the transport of passengers, and

comprising no more than eight seats in addition to the driver's seat. Passenger cars are defined as motor vehicles

with at least four wheels, used for the transport of passengers, and comprising no more than eight seats in

addition to the driver's seat. The market includes both petrol and diesel passenger cars, as well as hybrid and

electric. Passenger cars include mini, small, medium, large, exclusive and luxury cars, as well as mini, compact, mid

and full size SUV/crossover. The compact, small and large MPVs and mini, compact, mid and full size pickups are

included as are sport coupe cars. Any sort of light or heavy commercial vehicles e.g. vans or HGVs are excluded.

Market shares refer to the volume - not value - of built units in a particular country in the respective calendar year.

Note that this is respesentative of the number of cars manufactured.

All market data and forecasts are represented in nominal terms (i.e. without adjustment for inflation) and all

currency conversions used in the creation of this report have been calculated using constant 2020 annual average

exchange rates.

Car manufacturing can be a highly concentrated industry, and in some countries there is only one significant

manufacturer. Forecasts made in this profile should not be interpreted as predictions of any individual company's

performance.

COVID-19: The assumption has been made that after the pandemic is over the global economy will gradually go

back to the levels recorded before. It is also assumed that there is no widespread economic crisis as seen in 2008

due to announced financial support packages from governments around the world. In January 2021, at the time of

the preparation of this report, the economic implications of national and local lockdowns of many economies are

difficult to predict as there is no indication how long the pandemic will last, nor how many industries will be forced

to stay closed and the scale of the governmental aid involved.

For the purposes of this report, the global market consists of North America, South America, Europe, Asia-Pacific,

Middle East, South Africa and Nigeria.

North America consists of Canada, Mexico, and the United States.

South America comprises Argentina, Brazil, Chile, Colombia, and Peru.

Europe comprises Austria, Belgium, the Czech Republic, Denmark, Finland, France, Germany, Greece, Ireland, Italy,

Netherlands, Norway, Poland, Portugal, Russia, Spain, Sweden, Switzerland, Turkey, and the United Kingdom.

Scandinavia comprises Denmark, Finland, Norway, and Sweden.

Asia-Pacific comprises Australia, China, Hong Kong, India, Indonesia, Kazakhstan, Japan, Malaysia, New Zealand,

Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

Middle East comprises Egypt, Israel, Saudi Arabia, and United Arab Emirates.

2.2. Market analysis

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 9

Car Manufacturing in India

Industry Profiles

The Indian car manufacturing industry has fluctuated between growth and decline in value and volume terms in

recent years. The industry suffered a particularly steep decline in 2020 amid the COVID-19 pandemic. The industry

looks set to recover in the forecast period.

A key feature of the Indian industry during the historic period was the Indian government’s sudden decision to

announce demonetization. The economic alarm that was ignited as a consequence of the government’s actions

ultimately struck the country’s car manufacturing industry, as the sale of cars hit a 16-year low in December 2016.

Though sales have recovered, it was on the back of heavy discounts in order to boost demand. As such, even

though volume consumption levels recovered in the aftermath of the demonetization, the value of the market was

not able to grow at the same pace.

The Indian car manufacturing industry had total revenues of $22.6bn in 2020, representing a compound annual

rate of change (CARC) of -7.1% between 2016 and 2020. In comparison, the South Korean and Chinese industries

declined with CARCs of -7.9% and -8.4% respectively, over the same period, to reach respective values of $56.4bn

and $274.4bn in 2020.

A huge drop in volume and value was seen in 2020 amid the COVID-19 pandemic. There has been severe

disruption in the export of Chinese parts and widespread manufacturing plant closures around the world. This

meant that the manufacturing of cars was impacted. What’s more, consumer confidence is lowered as jobs are

placed at risk and the economy stalls. As such, spend on new cars has been constrained, which reduces demand in

the car manufacturing industry.

Industry production volumes declined with a CARC of -8.6% between 2016 and 2020, to reach a total of 2,608.4

thousand units in 2020. The industry's volume is expected to rise to 4,438.1 thousand units by the end of 2025,

representing a compound annual growth rate (CAGR) of 11.2% for the 2020-2025 period.

The performance of the industry is forecast to accelerate, with an anticipated CAGR of 12.7% for the five-year

period 2020 - 2025, which is expected to drive the industry to a value of $41.1bn by the end of 2025.

Comparatively, the South Korean and Chinese industries will grow with CAGRs of 5.2% and 5.9% respectively, over

the same period, to reach respective values of $72.6bn and $365.0bn in 2025.

The industry is expected to see recovery in 2021, as the immunization of the population will allow a gradual return

to normal from the second half of 2021 with the recovery of consumer spending. Improving macroeconomic

conditions, such as rising average annual wages and household consumption levels, coupled with declining

unemployment rates, has been bolstering the country’s middle-class population. Their financial ability to purchase

cars has grown strongly in recent years, which should help to drive domestic demand.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 10

Car Manufacturing in India

Industry Profiles

3. Market Data

3.1. Market value

The Indian car manufacturing industry shrank by 23.1% in 2020 to reach a value of $22.6 billion.

The compound annual rate of change of the industry in the period 2016–20 was -7.1%.

Table 1: India car manufacturing industry value: $ billion, 2016–20

Year $ billion Rs. billion € billion % Growth

2016 30.3 2,248.6 26.6

2017 29.8 2,208.2 26.1 (1.8%)

2018 29.9 2,215.3 26.2 0.3%

2019 29.3 2,174.4 25.7 (1.8%)

2020 22.6 1,673.2 19.8 (23.1%)

CAGR: 2016–20 (7.1%)

SOURCE: MARKETLINE MARKETLINE

Figure 1: India car manufacturing industry value: $ billion, 2016–20

SOURCE: MARKETLINE MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 11

Car Manufacturing in India

Industry Profiles

3.2. Market volume

The Indian car manufacturing industry shrank by 28.6% in 2020 to reach a volume of 2,608.4 thousand units.

The compound annual rate of change of the industry in the period 2016–20 was -8.6%.

Table 2: India car manufacturing industry volume: thousand units, 2016–20

Year thousand units % Growth

2016 3,736.6

2017 3,995.0 6.9%

2018 4,085.0 2.3%

2019 3,651.6 (10.6%)

2020 2,608.4 (28.6%)

CAGR: 2016–20 (8.6%)

SOURCE: MARKETLINE MARKETLINE

Figure 2: India car manufacturing industry volume: thousand units, 2016–20

SOURCE: MARKETLINE MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 12

Car Manufacturing in India

Industry Profiles

4. Market Segmentation

4.1. Geography segmentation

India accounts for 4.3% of the Asia-Pacific car manufacturing industry value.

China accounts for a further 51.7% of the Asia-Pacific industry.

Table 3: India car manufacturing industry geography segmentation: $ billion, 2020

Geography 2020 %

China 274.4 51.7

Japan 129.8 24.5

South Korea 56.4 10.6

India 22.6 4.3

Taiwan 4.1 0.8

Rest Of Asia-pacific 43.1 8.1

Total 530.4 100%

SOURCE: MARKETLINE MARKETLINE

Figure 3: India car manufacturing industry geography segmentation: % share, by value, 2020

SOURCE: MARKETLINE MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 13

Car Manufacturing in India

Industry Profiles

5. Market Outlook

5.1. Market value forecast

In 2025, the Indian car manufacturing industry is forecast to have a value of $41.1 billion, an increase of 81.9%

since 2020.

The compound annual growth rate of the industry in the period 2020–25 is predicted to be 12.7%.

Table 4: India car manufacturing industry value forecast: $ billion, 2020–25

Year $ billion Rs. billion € billion % Growth

2020 22.6 1,673.2 19.8 (23.1%)

2021 28.7 2,128.9 25.2 27.2%

2022 33.5 2,480.0 29.3 16.5%

2023 35.9 2,661.3 31.5 7.3%

2024 39.2 2,903.5 34.3 9.1%

2025 41.1 3,047.5 36.0 5.0%

CAGR: 2020–25 12.7%

SOURCE: MARKETLINE MARKETLINE

Figure 4: India car manufacturing industry value forecast: $ billion, 2020–25

SOURCE: MARKETLINE MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 14

Car Manufacturing in India

Industry Profiles

5.2. Market volume forecast

In 2025, the Indian car manufacturing industry is forecast to have a volume of 4,438.1 thousand units, an increase of

70.1% since 2020.

The compound annual growth rate of the industry in the period 2020–25 is predicted to be 11.2%.

Table 5: India car manufacturing industry volume forecast: thousand units, 2020–25

Year thousand units % Growth

2020 2,608.4 (28.6%)

2021 3,337.7 28.0%

2022 3,868.8 15.9%

2023 4,073.9 5.3%

2024 4,346.1 6.7%

2025 4,438.1 2.1%

CAGR: 2020–25 11.2%

SOURCE: MARKETLINE MARKETLINE

Figure 5: India car manufacturing industry volume forecast: thousand units, 2020–25

SOURCE: MARKETLINE MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 15

Car Manufacturing in India

Industry Profiles

6. Five Forces Analysis

The car manufacturing market will be analyzed taking car manufacturers as players. The key buyers will be taken as

car dealerships, and suppliers of commodities as the key suppliers.

6.1. Summary

Figure 6: Forces driving competition in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

2020 was an incredibly tough year for car manufacturers amid the COVID-19 pandemic, which served to intensify the

rivalry level.

Car dealerships, which are the main buyers in this industry, serve as intermediaries between car manufacturers and end

users. Car dealerships generally have exclusive contractual agreements with one particular manufacturer, which

reduces buyer power. Suppliers in this industry provide commodity items such as metals or technological pieces and

fabricated components. Typical suppliers are likely to sell to a wide variety of manufacturing companies, with the car

industry accounting for only a small share of total supplier revenues, increasing supplier power.

Brand strength, goodwill, and reputation are exceptionally important in the car manufacturing industry, and it is

therefore quite difficult for new players to directly enter a particular country's industry. Where there is already a strong

manufacturing presence, it can be particularly off-putting for potential new entrants. Used cars and personal contract

purchase (PCP) related deals form the main substitutes to the car manufacturing industry. The emerging trend of car

sharing has also negatively impacted growth.

Rivalry in the car manufacturing industry is reduced through differentiation, with several defined segments within the

industry, such as luxury and budget vehicles. Most companies service a number of different segments, either through

different models or through different brands, in order to diversify their product portfolio and reduce competition.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 16

Car Manufacturing in India

Industry Profiles

6.2. Buyer power

Figure 7: Drivers of buyer power in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

Car dealerships, which are the main buyers in this industry, serve as intermediaries between car manufacturers and end

users (consumers). These dealerships tend to be relatively large and few in number, which increases buyer power.

However, these companies are usually linked to one specific manufacturer via exclusive contractual agreements,

meaning that the reliance on car manufacturers is increased. Therefore, buyer power is somewhat weakened as once

the dealership has agreed to sell a particular manufacturer’s cars, it is difficult to renege on that agreement. Buyers can

attempt to negotiate their exit from the contract with the manufacturer or wait for the contract to expire. The cost of

switching between manufacturers is high, due to the expense of rebranding and physically restocking the dealerships.

Buyers in this industry attempt to differentiate their products by offering new features (sat-nav, parking sensors or a

stop-start system). However, rival players generally offer a similar range of products, which reduces buyer power as

undifferentiated products can spark a price war between players (and suppliers). Increasing concern for the

environment will mean that hybrid and electric car manufacturers will grow in popularity. Players such as Tesla can

appeal to this segment of the industry.

Customers in this industry tend not to be loyal. Even though many customers buy cars from manufacturers they know

and trust or have been recommended, the industry is largely feature driven. Buyers are part of a price-driven industry,

which raises buyer power. Companies in this industry usually partner with multi-national corporations (industry players)

that have large financial backing. While the profit margin on new cars tends to be low, buyer power is raised by selling

in bulk or on a long-term deal (PCP deal). Conversely, buyer power is undermined, as while buyers are unlikely to

backwards integrate due to a dependence on manufacturers, industry players can potentially forward integrate to

become retailers. Buyers in the car manufacturing industry are dependent on manufacturers' products as operations

would halt without them, which also reduces buyer power.

Buyer power in the car manufacturing industry is assessed as weak overall.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 17

Car Manufacturing in India

Industry Profiles

6.3. Supplier power

Figure 8: Drivers of supplier power in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

Key inputs required by car manufacturers include commodity items, such as metals, as well as more differentiated

inputs, such as fabricated components produced by other companies, rather than being manufactured in-house.

Raw materials companies are unlikely to forward integrate into component production or new car production because

of their very different business set ups. Companies such as Arcelor Mittal and BP are major suppliers for a whole host of

industries and tend to concentrate on expanding geographically and improving their current operations rather than

vertically integrating their supply chains.

A notable feature at this stage is contract manufacturing. This is where manufacturing companies make parts and

components but do not put their own branding on them, instead selling them to other parts manufacturers and OEMs.

In this way, parts manufacturers are a key supplier to one another. Component producers can often secure contracts

with car manufacturers to ensure bulk purchases. However, as the car manufacturers have a lot of financial muscle,

prices could be driven down and the suppliers can lose out as a result.

The largest automotive manufacturers are also original equipment manufacturers (OEMs), producing some of the

vehicle-components on their own, but specialized parts and components are supplied by specialized manufacturers.

Automotive manufacturers assemble components, such as electronics and tires, which are manufactured by large

companies engaged in other industries. Some of the largest suppliers in electronics and other mechanical parts include

Bosch, Denso, Magna International, Aisin Seiki and Mahle. In tires, Bridgestone, Goodyear, Continental, Michelin, and

Pirelli are some of the largest suppliers for the automotive industry. Accordingly, limited backwards integration in the

manufacturing of such specialized components is in favor of these suppliers. Moreover, the fact that some of these

typical suppliers sell to a range of automotive manufacturers, as well as to other industries, enhances their bargaining

power as the new cars market contributes only part of their supplier revenues. Toyota achieves greater backwards

integration through a controlling stake in Denso and Aisin Seki. Hyundai and PSA have similar advantages through

Hyundai Mobis (a wholly-owned subsidiary of Hyundai) and Faurecia (controlled by PSA, but run independently), which

belong to the largest mechanical parts manufacturers in the automotive industry.

Players require operational and logistics excellence from suppliers, including rapid part identification and availability

checks, timely delivery, flexible replenishment and return logistics. These stringent requirements can only be met by a

few large manufacturers which favors concentration, and thus supplier power. Moreover, suppliers that are able to

meet these requirements can enter into long-term relationships with international players, increasing switching costs.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 18

Car Manufacturing in India

Industry Profiles

However, supplier power is reduced by the fact that there is often little to distinguish between suppliers, with raw

materials offering low differentiation. Despite this, the high importance of the quality of raw materials and components

to the car manufacturers (particularly when safety-critical) can enhance supplier power.

The manufacturing stage requires in-depth knowledge and precise technology in order to ensure the end product is

both safe and functional. The main body is assembled before the mechanical and electrical components are added;

each car must then go through testing before the finishing touches can be added. These processes mean that only

large, experienced companies tend to prosper in the new cars market.

Suppliers’ margins have been affected by globally fluctuating raw material prices, such as steel and aluminum, during

recent years. In order to minimize operating costs and distinguish themselves from rivals, suppliers can make changes

which decrease margins and increase turnover, while improving customer service. Faced with increasingly stringent

quality requirements, the industry is trying to achieve shorter delivery times. A key success factor for automotive

suppliers is the effective collaboration between themselves and market players, and the integration of processes

throughout the supply chain.

Labor is another major supplier-input for players in this market as the automotive industry is labor-intensive. Labor

unions can have strong bargaining power, impacting the cost and the efficiency of the manufacturing process. That

being said, increasing automation threatens the jobs of many production line workers in this market. Robotics and AI-

based technologies are becoming more mainstream in factories across the world, and innovations such as the 3D

printer, while expensive at the outset, are likely to save time and money once established.

Overall, supplier power is moderate.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 19

Car Manufacturing in India

Industry Profiles

6.4. New entrants

Figure 9: Factors influencing the likelihood of new entrants in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

Brand strength and reputation are highly important in the car manufacturing industry. As such, it is difficult for new

players to directly enter the industry, particularly given the dominance of incumbents such as Suzuki and Hyundai. Due

to the high fixed costs of car design and manufacture, as well as the economies of scale gained from mass production,

new start-up companies are rare as the capital requirements for a manufacturing facility of feasible scale are simply too

high. Scale is vastly important within this industry as high financial is backing required for new entrants.

The SAIC Motor Corporation, a Chinese car manufacturer, began production in India in 2019 under a newly registered

company, MG Motor India. MG is actually a British brand that is now owned by SAIC. Silicon Valley-based electric

carmaker Tesla was mulling over the idea of entering the Indian industry in 2018 and 2019, while reports in February

2021 suggest that this move is close to materializing.

Electric vehicles are becoming more prominent as many countries attempt to tackle climate change. As electrification

becomes mainstream, there are a number of ground-breaking changes all happening at once. These changes are not

just technological, as electric vehicles move to replace internal combustion engines, but also impact ownership models

as car ownership becomes less aspirational and fully autonomous vehicles move closer to becoming a reality. The

widespread adoption of electric vehicles is not only providing challenges for existing automakers, but is also creating

lanes for new companies to enter into the market. Tesla, for example, positioned itself in the electric vehicle market as

an early adopter of TWI’s friction stir welding technology. These changes in the automotive sector mean that new parts

and materials are in demand, not just when it comes to batteries to power the next generation of vehicles, but right

across the vehicle manufacturing process.

The production of electric vehicles is relatively easier than fuel based engines, giving rise to a number of new entrants,

although the capital requirements are still vast and incumbents are already diversifying into this segment. Players such

as Volvo (Geely), General Motors, Aston Martin, and Jaguar Land Rover have all announced plans to switch over to

manufacturing only electric or hybrid cars at some point within the coming decade. This means that space for entry and

growth in this segment is limited over the forecast period, reducing the threat of new entrants.

Self-driving technology is seeing an abundance of new entrants within the industry. Google announced a partnership

with Fiat Chrysler Automobiles in 2016, Uber worked with Toyota in 2018 through a $500m deal and Amazon

purchased self-driving car company Aurora in 2019. Apple has also been rumored to be lining up a car manufacturing

project but this may only be in relation to infotainment systems for existing brands. The car manufacturing industry is

semi-differentiated due to the introduction of new technology and an increasing range of vehicles with varying levels of

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 20

Car Manufacturing in India

Industry Profiles

features, in which more expensive vehicles tend to have the most features. Evidently, there are a number of firms

looking to capitalize on the industry, outside of the traditional industry players, thus increasing the risk of new entrants.

However, the self-driving segment is not without its problems. A new company looking to enter this segment would

require considerable capital in order to invest in R&D and the manufacture of a vehicle with self-driving technology.

Despite considerable investment and a huge amount of effort from established brands such as General Motors,

Google’s Waymo, Toyota, and Honda, fully autonomous cars currently remain out of reach.

Increasing consolidation in the car manufacturing industry in India serves to reduce the threat of new entrants as

manufacturers tend to work with a small range of suppliers and these are usually tied together with contractual

agreements that are costly to break. The same can be said for distribution channels. Manufacturers will attempt to hold

their share of the industry, preventing access to distributors and further reducing the potential threat. In fact, Suzuki

alone accounts for over 38% of all cars that are manufactured in India.

Intellectual property (IP) in the original car manufacturing industry is strong and relies on the ideas generated by design

engineers. Financial protection is required to ensure designs and components are not copied unlawfully. The need for

this financial backing serves to weaken the threat of new entrants.

The Indian car manufacturing industry witnessed a contraction in its value during the historical period. The COVID-19

pandemic led to car production being suspended or slowed in many countries in 2020, which raised a huge barrier to

entry. The steep decline in car manufacturing output as a result meant that 2020 was a difficult year for the industry,

which will have proved further off-putting to potential new entrants.

Overall, the threat of new entrants is weak.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 21

Car Manufacturing in India

Industry Profiles

6.5. Threat of substitutes

Figure 10: Factors influencing the threat of substitutes in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

Used cars are the main substitute to the car manufacturing industry. Car dealerships which sell both new and used cars

are likely to have sold more of the latter during the global economic downturn as consumers avoided making big

purchases. What’s more, uncertain times are almost certainly ahead as the world faces the economic impact of the

widespread outbreak of COVID-19. Car manufacturers should be wary of the possibility of dealerships agreeing to sell

cars from rival manufacturers. Car manufacturers that have long-standing contractual agreements with loyal car

dealerships will be better protected from this threat. However, those with short-term contracts or those where

agreements are close to expiry are more vulnerable.

It is, however, difficult for car dealers to switch between manufacturers due to the contractual agreements and the

switching costs of completely re-branding the showroom and removing and replacing existing stock. Manufacturers can

sometimes stipulate in contracts with dealers that only new cars may be sold, eliminating the threat posed by used

cars. Initiatives such as scrappage schemes, which have been offered in many countries, have incentivized customers to

purchase new cars. This mitigating factor has the potential to reduce the threat posed by used cars, although it is only a

short-term solution.

Increasing fuel prices have been pushing some urban drivers to use public transportation. Most vehicle owners still

agree that the convenience of using a personal vehicle offsets increases in fuel prices; however, if this trend continues

and automobile manufacturers are not able to provide a more cost-efficient solution, this threat will increase.

A growing indirect threat to this industry is the growth of car sharing. Whilst car sharing companies utilize cars as their

medium for operations, the sharing element results in a lower number of new cars being sold. According to a study

conducted by UC Berkeley’s Transportation Sustainability Research Center (TSRC), car2go car sharing reduced the

number of cars in Washington DC seven cars for each car2go shared vehicle. The equivalent figure in Calgary is 11 cars,

highlighting the strong substitution threat that car sharing poses to the car manufacturing industry. In India, car sharing

companies such as BlaBlaCar and Zoomcar have been growing in popularity in recent years.

A secondary substitute to the car manufacturing industry is the recent implementation of finance packages such as PCP

deals for new cars. These deals typically tie customers into a three-year deal, paying a monthly fee for the vehicle, with

a lump sum payable at the end of the deal to purchase the vehicle or to renegotiate the deal for a newer vehicle. The

ability to increase customer loyalty through long term deals increases the threat of this substitute, as customers may

see the long-term deal as a more affordable option. However, at the end of the deal the customer will not own the

vehicle, and has the ability to return it to the dealership. Dealerships are therefore able to continue re-leasing the same

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 22

Car Manufacturing in India

Industry Profiles

vehicle to numerous customers (generally in the region of two to three different customers) increasing the possible

profit margins per vehicle. PCP deals are offered by a range of car manufacturers such as Ford, General Motors,

Renault, Toyota, and Fiat Chrysler, which serve a diverse range of countries globally.

Overall, the threat of substitutes is weak.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 23

Car Manufacturing in India

Industry Profiles

6.6. Degree of rivalry

Figure 11: Drivers of degree of rivalry in the car manufacturing industry in India, 2020

SOURCE: MARKETLINE MARKETLINE

With the rise of international competitors, rivalry in the automotive industry has become far more intense as firms

compete on both price and non-price dimensions. Companies offer distinct incentives to differentiate themselves and

to attract customers to purchase their own vehicles. The four major players in this industry, Suzuki, Tata, Renault and

Hyundai Kia Automotive Group, account for 58% of the car manufacturing industry’s volume.

The degree of product differentiation is a fundamental aspect of competition in the car manufacturing industry. Firstly,

there is differentiation in terms of product attributes: there are several different segments within the market, such as

luxury and economy cars, including subcategories related to the size (subcompact/city cars, compact/family cars, SUVs,

minivans), type of fuel (gasoline, diesel and electric cars), and utility of a car (4x4, sports cars). Differentiation in the

industry also takes the form of brand discrimination, which is more or less adopted by the largest manufacturers. In

some cases, brand differentiation is tied to the product differentiation in terms of attributes, in other words, brands

may vary according to the size and value-segment of the car. Most importantly, the level of brand differentiation affects

the type of competitive advantage employed by the manufacturer. For example, Toyota, which adopts limited brand

and model differentiation, has higher profit margins – twice as high as Volkswagen. This reveals the different types of

strategies used in the industry. The differentiation strategy incurs increased production costs due to the variety of

different models that are produced, compared to the cost efficiencies of producing a few specific models, but it may

lead to bigger sales volumes. Volkswagen has managed to gain global market share leadership through differentiation

and price discrimination over its various brands. However, Toyota has been more profit-efficient based on cost-

efficiency, which is further enhanced by its backwards integration. Indeed, both strategies can be successful or a failure

depending on the industry context. In times of industry downturn, players with low differentiation which compete

based on lower costs have greater competitive capacity to sustain rivalry. On the other hand, the reliance on the

success of a few brands/models could be a disadvantage in terms of the reception of these products by consumers or

manufacturing flaws, as significant changes in production can be detrimental to the manufacturing process and the

manufacturer’s revenues.

Exit barriers for the industry players are high, making it difficult to leave, which increases rivalry. If a product fails, the

heavy initial investment in research and design, alongside the production of the car, mean that it is extremely difficult

to end the production and transition to a new product. Additionally, the production line is often taken up by a new

model, which has incurred large costs to be achieved. The heavy investment and focus upon a single model further

increases rivalry, as competitors cannot simply exit.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 24

Car Manufacturing in India

Industry Profiles

Offering extended warranties or service agreements with new cars is very common these days. To maintain low costs,

companies consistently have to make manufacturing improvements to keep the business competitive. This requires

additional capital expenditure which tends to eat up a company's earnings. On the other hand, if no one else offers the

same products/services, then the company may enjoy a monopoly. For example, the Tato NANO enjoyed the monopoly

of a small car which appealed to motorcyclists, of which there are no competitors in this segment. As such, the

company was able to maintain the same model throughout its life span without having to invest a large chunk capital

into research and development.

Buyers’ ability to switch between manufacturers is an expensive prospect, reducing rivalry between players, as the

costs associated with returning old stock and the arrival of new stock is likely to present a significant financial upheaval.

The weak performance of the Indian industry during the historical period serves to increase the degree of rivalry

amongst players, as they have to compete more intensely in order to maintain market share. The COVID-19 pandemic

ensured that 2020 was a particularly difficult year for car manufacturers, intensifying the rivalry level.

Overall, the degree of rivalry is assessed as strong.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 25

Car Manufacturing in India

Industry Profiles

7. Competitive Landscape

The four leading players in the Indian car manufacturing industry, Suzuki, Tata, Renault and Hyundai Kia

Automotive Group, accounted for a combined 58% share of production volume in 2020. The leading players in this

industry are tapping into the growing demand for hybrid and electric vehicles, while alliances within the industry

are a common strategy. The COVID-19 pandemic temporarily halted production in many countries in 2020, as well

as disrupting the supply chain, and as such the leading players have been negatively impacted.

7.1. Market share

Table 6: India car manufacturing industry share: % share, by volume, 2020

Company % Share

Suzuki 38.8%

Hyundai Kia Automotive Group 11.9%

Tata Group 4.1%

Renault-nissan Aliance 3.3%

Other 42.0%

Total 100%

SOURCE: MARKETLINE MARKETLINE

Figure 12: India car manufacturing industry share: % share, by volume, 2020

SOURCE: MARKETLINE MARKETLINE

7.2. Who are the leading players?

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 26

Car Manufacturing in India

Industry Profiles

The leading player in the Indian car manufacturing industry is Suzuki, accounting for 38.8% of production volumes in

India in 2020. The company is headquartered in Japan, but has an Indian subsidiary – Maruti Suzuki India. The company

has three manufacturing plants in India.

Hyundai is a leading player in this industry, accounting for 11.9% of Indian car manufacturing output in 2020. The

company produces vehicles under its Hyundai and Kia brands. The company has two manufacturing facilities in India.

Tata Motors operates as a leading player in the Indian car manufacturing industry, accounting for 4.1% of all cars

produced in the country in 2020. The company is headquartered in India and has manufacturing, R&D and design

facilities in more than 26 sites across Asia, Africa and Europe.

Renault is a leading player in this industry, accounting for around 3.3% of the cars produced in India in 2020. The

company is headquartered in France and has manufacturing facilities located across Europe, South America, parts of

Africa and Asia-Pacific. The company’s manufacturing site in India is dedicated to the production of vehicles as part of

the Renault-Nissan-Mitsubishi alliance.

7.3. How are strategic alliances used by the leading companies?

Strategic partnerships are a common strategy in this industry as companies share technology and intellectual property

to achieve greater economies of scale. Globally, many players in the car manufacturing industry have already

established alliances that help them fend off outside threats and ensure safe avenues of growth for the alliance

members. The Renault-Nissan-Mitsubishi Alliance is a prime example of such an alliance. Renault and Nissan initially

entered into a strategic alliance in 1999, with Mitsubishi joining in 2016. As part of the alliance, Renault holds 43.4% of

Nissan, while Nissan holds 15% of Renault and 34% of Mitsubishi. In 2018, the Alliance sold more than 10.76 million

vehicles. The alliance maintains company independence while ensuring cost savings and scale benefits for all

participants. Parts procurement savings and engineering technologies sharing have been successful, but the pressures

for even closer integration of Renault and Nissan – with the logical ultimate destination of a full merger – have been

building. These pressures appear to have culminated in political tensions between Renault and Nissan – accentuated by

government interference in the background – that led to alliance founder and leader Carlos Ghosn’s arrest on charges

of financial misconduct. A big question going forward is whether the alliance can survive.

In August 2019, Toyota and Suzuki announced that they had deepened their alliance with a Capital Alliance Agreement,

to establish a long-term collaboration in new fields including autonomous vehicles. It is hoped that the combined

strengths of the companies will enable faster and more successful development.

Jaguar Land Rover (Tata) works in alliance with BMW to develop electrified powertrains, but has recently stated that it

is open to more partnerships following rumors that Tata could be looking for a buyer. The company has ruled out a sale

but it is open to finding more partners for the automaker.

As car manufacturing costs have increased in recent years, an increasing number of players within the industry have

sought to intensify the movement of manufacturing facilities towards Asia, especially since growth in the wider car

manufacturing industry has been the strongest on this continent in recent years. A growing number of major global car

manufacturing players have therefore sought to enter into joint ventures (JVs) with local Asian players to manufacture

their vehicles in more cost efficient manufacturing facilities in Asia. This includes Hyundai, which has agreed to establish

a JV with local conglomerate Nishat Group, located in Pakistan.

7.4. How is new technology opening up competition?

Technology within the car manufacturing industry has been evolving rapidly. With the advent of commercially viable

electric cars, hydrogen technology and now autonomous vehicles, many impressive advances have been made in the

automotive industry. Self-driving technology is seeing a lot of investment from many car manufacturers, although fully

autonomous cars remain out of reach at present. Many of the world’s leading automotive manufacturers are in a race

to create the first fully autonomous car that can be sold to the public. However, tech giants including Apple and Google

have now entered the industry and are putting the leading players under pressure.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 27

Car Manufacturing in India

Industry Profiles

Arguably, the current industry leader is Google's Waymo. It is building a self-driving fleet in preparation for commercial

service. In December 2018, it became the first company to launch a limited commercial robotaxi service in Phoenix,

Arizona – stealing a march over Cruise and similar rivals. That said, the service is still in the testing stages and makes use

of safety drivers. The might of Google’s financial and technical resources mean Waymo can make developments faster

than the current mainstream industry leaders, and purchase the vehicles, components and facilities needed to support

its operations.

The rapid technological change is also forcing a shift in traditional supply chain relationships in the industry. The need

for ever-more advanced on-board software has seen software developers, telecommunications and telematics service

providers jostling to become Tier 1s. At the same time, OEMs and traditional Tier 1s are seeking alliances to rethink the

way their systems are designed, developed and brought to market.

7.5. How are leading players progressing in the hybrid and electric cars

segment?

Players operating within the car manufacturing industry have been facing greater pressure in recent years to become

more environmentally friendly. In response, car manufacturers from all over the world have made significant promises

to deliver only hybrid and electric vehicles in the future. The hybrid and electric cars market in India grew with a

compound annual growth rate (CAGR) of 9.6% between 2016 and 2020, compared to a compound annual rate of

change (CARC) of -7.1% seen in the overall car manufacturing industry over the same period. As such, the switch to

hybrid and electric vehicles not only pacifies growing environmental concerns, but it also makes good business sense to

tap into a growing market.

Electric cars are a strategic choice for Renault. The company has been one of the early innovators in electric cars, and in

contrast to most manufacturers, it first started making electric cars rather than hybrids, with the launch of the all-

electric mini-compact Renault Zoe in 2012. With a starting price at slightly less than $35,000, it has targeted a large part

of the market, that of upper-medium incomes driven by demand for small family cars. The Renault Zoe became a

success thanks to its best-selling point of 200 miles of range, becoming one of the best-selling electric cars worldwide.

Hyundai is one of the few car manufacturers that develops all types of electrified vehicles, from hybrid and plug-in

hybrid to all-electric. Hyundai has mainly focused on producing relatively affordable sub-compact and compact cars; its

first plug-in, the Hyundai Sonata compact sedan, was followed by the electric mass-market Hyundai IONIQ compact –

also available as a PHEV – followed by the most recent Hyundai Kona, all with starting prices around $30,000–35,000.

Although these offerings have been more price competitive to similar models in the market, their electric range has

been relatively smaller, something which Hyundai has sought to improve by launching updates of its existing models.

The Hyundai Kona electric SUV was the company’s breakthrough in this field with a range of up to 280 miles. Most

recently, Hyundai has decided to shift towards full electrification of its models, and aims to expand its range across all

class-sizes so it can tailor its supply to local demand in key markets. In terms of market positioning, the company aims

to target younger demographics and enterprise customers with affordable battery electric vehicles.

7.6. What impact has the COVID-19 pandemic had on leading players?

The 2020 global COVID-19 pandemic had a significant impact on the automotive industry globally. There was severe

disruption in the export of Chinese parts and widespread manufacturing plant closures. Automakers in India enforced

temporary shutdowns at production plants. All of the leading players in this industry were impacted by the pandemic,

with some more severely hit than others.

Between January and June 2020, Renault saw its worldwide vehicle sales fall by 34.9% compared to the same period in

2019, while revenue tumbled by 34.3%. During 2020 as a whole, this loss had been lowered slightly, with vehicle sales

registering a 21.3% decline and revenue falling by 21.7%. Between the beginning of April and end of June 2020, Tata

Motors experienced a revenue decline of 48%, while its Jaguar Land Rover vehicles saw unit sales drop by 42%.

Meanwhile, in the first six months of 2020, Hyundai saw its revenue fall by 47%. During 2020 as a whole, Hyundai’s

revenue declined by 1.7%.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 28

Car Manufacturing in India

Industry Profiles

8. Company Profiles

8.1. Suzuki Motor Corporation

8.1.1. Company Overview

Suzuki Motor Corporation (Suzuki or ‘the company’) is a provider of automobiles, motorcycles, and all-terrain

vehicles (ATV), and outboard motor equipment. It also offers aftersales maintenance kits to customers across

the globe. The company’s product portfolio includes cars, motorized wheelchairs, electro senior vehicles,

motorcycles, all-terrain vehicles, outboards, maintenance kits and others. It also provides after sales and

maintenance services to customers across the globe. The company’s business operations are spread across

many countries including Hungary, Germany, the UK, France, India, Pakistan, Indonesia, Thailand, Australia,

Mexico, Colombia and the US. Suzuki has established offices in several locations worldwide to distribute its

products efficiently and to reach out to a large customer base. The company is headquartered in Hamamatsu

City, Shizuoka, Japan.

The company reported revenues of (Yen) JPY3,178,209 million for the fiscal year ended March 2021 (FY2021), a

decrease of 8.9% over FY2020. In FY2021, the company’s operating margin was 5.5%, compared to an operating

margin of 6.1% in FY2020. In FY2021, the company recorded a net margin of 4.6%, compared to a net margin of

3.8% in FY2020.

8.1.2. Key Facts

Table 7: Suzuki Motor Corporation: key facts

Head office: 300 Takatsuka-cho, Minami-ku, , HAMAMATSU-SHI, Shizuoka, Japan

Telephone: 81534402061

Fax: 81534450040

Number of Employees: 68499

Website: www.suzuki.co.jp

Financial year-end: March

Ticker: 7269

Stock exchange: Tokyo Stock Exchange

SOURCE: COMPANY WEBSITE MARKETLINE

8.1.3. Business Description

Suzuki Motor Corporation (Suzuki or ‘the company’) is engaged in manufacturing and selling automobiles,

motorcycles, and all-terrain vehicles (ATV), and outboard motor equipment. It also offers aftersales maintenance

kits to customers across the globe. Suzuki’s business operations are spread across many countries including

Hungary, Germany, the UK, France, India, Pakistan, Indonesia, Thailand, Australia, Mexico, Colombia and the US.

The company has established offices in several locations worldwide to distribute its products efficiently and to

reach out to a large customer base.

Suzuki primarily operates in three reportable business segments: Automobile, Motorcycle and Marine.

Automobile segment manufactures and markets mini vehicles, sub-compact vehicles, standard-sized vehicles

under various brand names including Celerio, Ignis, Swift, Dzire, Baleno, Vitara, S-Cross, Jimny, Ciaz, Ertiga, APV

and others. In FY2020, the company’s total automobile production was 3,400,000 units. In FY2020, the Automobile

segment reported revenue of JPY3,157,434 million, which accounted for 90.5% of the company’s total revenue.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 29

Car Manufacturing in India

Industry Profiles

The Motorcycle Business segment offers motorcycles, all-terrain vehicles (ATV), motor-driven bicycles and related

products. In FY2020, the company’s total production was 2,000,000 units. In FY2020, the Motorcycle business

segment reported revenue of JPY242,561 million, which accounted for 7% of the company’s total revenue.

Under Marine business segment Suzuki offers outboard motors, motorized wheelchairs, electro senior vehicles

and houses. In FY2020, the Marine business segment reported revenue of JPY88,437 million, which accounted for

2.5% of the company’s total revenue.

Geographically, the company classifies its business operations into three regions: Japan, India and others. In

FY2020, Others accounted for 34% of the company’s revenue, followed by Japan (33.8%) and India (32.1%).

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 30

Car Manufacturing in India

Industry Profiles

Table 8: Suzuki Motor Corporation: Annual Financial Ratios

Key Ratios 2015 2016 2017 2018 2019

Growth Ratios

Sales Growth % -0.35 18.54 3.04

Operating Income Growth % 17.17 63.90 -36.23

EBITDA Growth % 7.82 33.89 -26.13

Net Income Growth % 37.11 34.87 -17.14

EPS Growth % 78.15 12.39 15.13

Working Capital Growth % 57.78 -24.77 -51.07

Equity Ratios

EPS (Earnings per Share) JPY 234.92 362.48 473.74 395.20

Dividend per Share JPY 32.00 44.00 74.00 74.00

Dividend Cover Absolute 7.34 8.24 6.40 5.34

Book Value per Share JPY 2171.16 2538.41 2937.63 3018.65

Profitability Ratios

Gross Margin % 27.25 28.64 29.43 29.25

Operating Margin % 6.07 7.14 9.87 6.11

Net Profit Margin % 3.67 5.05 5.74 4.62

Profit Markup % 37.47 40.13 41.70 41.35

PBT Margin (Profit Before Tax) % 7.72 9.31 10.22 7.71

Return on Equity % 12.18 14.28 16.62 12.84

Return on Capital Employed % 12.41 11.74 17.67 11.47

Return on Assets % 8.64 5.50 6.68 5.30

Return on Working Capital % 39.68 29.47 64.21 83.67

Operating Costs (% of Sales) % 93.93 92.86 90.13 93.89

Administration Costs (% of Sales) % 16.99 16.07 15.76 16.79

Liquidity Ratios

Current Ratio Absolute 1.42 1.65 1.47 1.21

Quick Ratio Absolute 1.17 1.37 1.18 0.95

Cash Ratio Absolute 0.68 0.87 0.76 0.52

Leverage Ratios

Debt to Equity Ratio Absolute 0.56 0.58 0.46 0.28

Net Debt to Equity Absolute -0.25 -0.34 -0.27 -0.22

Debt to Capital Ratio Absolute 0.26 0.33 0.28 0.18

Efficiency Ratios

Asset Turnover Absolute 2.35 1.09 1.16 1.15

Fixed Asset Turnover Absolute 8.40 4.19 4.82 4.53

Inventory Turnover Absolute 16.16 7.32 7.74 7.77

Current Asset Turnover Absolute 3.90 1.77 1.99 2.25

Capital Employed Turnover Absolute 2.04 1.64 1.79 1.88

Working Capital Turnover Absolute 6.54 4.13 6.50 13.70

SOURCE: COMPANY FILINGS MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 31

Car Manufacturing in India

Industry Profiles

Table 9: Suzuki Motor Corporation: Key Employees

Name Job Title Board

Hideaki Domichi Director Non Executive Board

Hideaki Doumichi Director Non Executive Board

Hirofumi Nagao Managing Officer Senior Management

Hisanori Takashiba Managing Officer Senior Management

Hisashi Takeuchi Managing Officer Senior Management

Ichizo Aoyama Senior Managing Officer Senior Management

Katsuhiro Kato Managing Officer Senior Management

Kazuki Yamaguchi Managing Officer Senior Management

Kazunobu Hori Managing Officer Senior Management

Keiichi Asai Managing Officer Senior Management

Keiji Miyamoto Managing Officer Senior Management

Kenichi Ayukawa Executive Vice President Senior Management

Kenichirou Toyofuku Managing Officer Senior Management

Kinji Saito Director Executive Board

Senior Managing Officer -Global Automobile

Kinji Saito Executive Board

Marketing

Masahiko Nagao Director Executive Board

Masahiko Nagao Senior Managing Officer Executive Board

Masahiro Ikuma Managing Officer Senior Management

Masamichi Suzuki Managing Officer Senior Management

Masayuki Fujisaki Managing Officer Senior Management

Naoki Suzuki Managing Officer Senior Management

Executive General Manager, Corporate

Naomi Ishii Senior Management

Planning Office

Naomi Ishii Senior Managing Officer Senior Management

Osamu Honda Chief Technology Officer Executive Board

Osamu Honda Director Executive Board

Osamu Honda Senior Technical Executive Executive Board

Osamu Kawamura Director Non Executive Board

Satoshi Uchida Managing Officer Senior Management

Shigeo Yamagishi Managing Officer Senior Management

Shigetoshi Tori Managing Officer Senior Management

SOURCE: COMPANY FILINGS MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 32

Car Manufacturing in India

Industry Profiles

Table 10: Suzuki Motor Corporation: Key Employees Continued

Name Job Title Board

Shinichi Akama Managing Officer Senior Management

Shinichi Imaizumi Managing Officer Senior Management

Taisuke Toyoda Managing Officer Senior Management

Toshiaki Suzuki Director Executive Board

Executive General Manager, Domestic

Toshiaki Suzuki Executive Board

Marketing I, Domestic Marketing

Toshiaki Suzuki Senior Managing Officer Executive Board

Toshihiro Suzuki Chairman Executive Board

Toshihiro Suzuki Director Executive Board

Toshihiro Suzuki President Executive Board

Yoshikazu Ozawa Managing Officer Senior Management

Yukihiro Yamashita Director Executive Board

Executive General Manager, Automobile

Yukihiro Yamashita Executive Board

Powertrain Engineering

Yukihiro Yamashita Senior Managing Officer Executive Board

Yuriko Katou Director Non Executive Board

Yutaka Kikukawa Managing Officer Senior Management

SOURCE: COMPANY FILINGS MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 33

Car Manufacturing in India

Industry Profiles

8.2. Tata Motors Limited

8.2.1. Company Overview

Tata Motors Limited (Tata Motors or 'the company') is an automotive manufacturing company engaged in the

development, design, manufacture and assembly, sale, and financing of vehicles, as well as sale of auto parts

and accessories. Its product portfolio includes passenger vehicles and commercial vehicles. It operates through

the brands such as GenxNano, Tiago, Zest, Nexon, Sumo Gold, Bolt, Tigor, Hexa, Safari Storme, Range Rover, Rr

Sport, Velar, Evoque, Discovery and Discovery Sport.It also distributes and markets Fiat branded cars in India.

The company operates across Europe, the Middle East, North America, Africa, Asia, Russia, Central America,

and South America. The company is headquartered in Mumbai, India.

The company reported revenues of (Rupee) INR2,497,947.5 million for the fiscal year ended March 2021

(FY2021), a decrease of 4.3% over FY2020. The operating loss of the company was INR67,876.1 million in

FY2021, compared to an operating loss of INR41,801.5 million in FY2020. The net loss of the company was

INR134,513.9 million in FY2021, compared to a net loss of INR120,708.5 million in FY2020.

8.2.2. Key Facts

Table 11: Tata Motors Limited: key facts

Head office: 24 Homi Mody St Hutatma Chowk, , MUMBAI, India

Telephone: 912262407101

Fax: 912266657799

Number of Employees: 78906

Website: www.tatamotors.com

Financial year-end: March

Ticker: TATAMOTORS

Stock exchange: National Stock Exchange of India

SOURCE: COMPANY WEBSITE MARKETLINE

8.2.3. Business Description

Tata Motors Limited (Tata Motors or 'the company') is an Indian automobile manufacturer with a portfolio

comprising of light commercial vehicles, medium and heavy commercial vehicles, utility vehicles, and passenger

cars. It has automotive operations in India, South Korea, South Africa, Thailand, Bangladesh, Singapore, Spain, and

the UK. The company is a part of the Tata Group, one of the leading business groups in India.

The company operates through two reportable business segments: Automotive Operations and Others.

The automotive segment is sub-divided into four sub-segments: Tata Commercial Vehicles, Tata Passenger

Vehicles, Jaguar Land Rover and Vehicle Financing. The automotive segment includes all activities relating to

development, design, manufacture, assembly and sale of vehicles including financing and sales of related parts and

accessories. It provides financing for vehicles sold by dealers in India. Tata and other brand vehicles, including

financing thereof, division includes the development, design, manufacture, assembly, and sale of vehicles. The

division also includes the sale of related parts and accessories as well as the financing for vehicles sold by dealers

in India. The division offers a wide range of automotive products, including passenger cars, utility vehicles, light

commercial vehicles, and medium and heavy commercial vehicles. Its passenger vehicle category consists of the

brands such as Tiago, Bolt, Tigor, Zest, Nexon, Hexa, Safari Storme. The commercial vehicle category comprises

brands including Ace Range, Xl Range, Yodha Range, Coaches, Urban Buses, Contract Carriages, Vans, Ultra Range,

Sfc&Lp Range, Cargo Range and Construck Range.In addition, through Tata Daewoo Commercial Vehicle (TDCV),

the company manufactures a range of high horsepower trucks ranging from 215 horsepower to 560 horsepower,

including dump trucks, tractor-trailers, mixers and cargo vehicles. The company operates seven automotive

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 34

Car Manufacturing in India

Industry Profiles

manufacturing facilities for Tata Motors brand located in Jamshedpur (Jharkhand), Pune (Maharashtra), Lucknow

(Uttar Pradesh), Pantnagar (Uttarakhand), Dharwad (Karnataka), and Sanand (Gujarat) in India. TDCV has a

manufacturing facility in Gunsan, South Korea. The company's sales and distribution network in India includes

approximately 5,528 sales contact points for its passenger and commercial vehicle business. In FY2020, the

company sold a total of 961,463 vehicles. including 613876,730 passenger cars, and 347,587 Commercial

Vehicles. The Jaguar Land Rover division consists of the Jaguar Land Rover business operations that the company

acquired from Ford Motor in 2008. The sub segment operates, designs, manufactures, and sells Jaguar luxury

performance cars and Land Rover premium all-terrain vehicles (ATVs). Jaguar's principal products include three car

lines, the XF and XJ sedans, the F-TYPE two-seater sports cars and the XK coupe and convertible. Land Rover's

range of products includes the Range Rover, Range Rover Sport, including the Range Rover Sport SVR, the Range

Rover Evoque, Land Rover Discovery, including the Discovery 4 which features 7-seat capacity, the Discovery Sport

and the Defender. Jaguar Land Rover markets products in 175 countries, through a global network of 23 national

sales companies, 77 importers, 2 export partners, and 2,874 franchise sales dealers, of which 1,323 are dealers for

both Jaguar and Land Rover. In FY2020, the company sold 475,952 units of Jaguar Land Rover vehicles including

125,820 units of Jaguar and 153,757 units of Land Rover vehicles. The segment also has two product development

facilities in the UK at Gaydon and Whitley. In FY2020, the automotive operations segment reported revenue of

INR2,592,916.3 million, which accounted for 99.3% of company’s total revenue.

Tata Motors other operations business division includes information technology and machine tools and factory

automation solutions. Through its other subsidiary and associate companies, the company is engaged in providing

engineering and automotive solutions, construction equipment manufacturing, and automotive vehicle

components manufacturing and supply chain activities. In addition, it provides machine tools and factory

automation solutions, high-precision tooling and plastic and electronic components for automotive and computer

applications, and automotive retailing and service operations. In FY2020, others segment reported revenue of

INR17,763.4 million , which accounted for 0.7% of company’s total revenue.

Geographically, the company has operations across six regions that include the US, India, Rest of Europe, the UK,

China and Rest of World which accounted for 19.9%, 18%, 16.6%, 16.3%, 11.4% and 17.8% respectively of

company’s total revenue in FY2020.

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 35

Car Manufacturing in India

Industry Profiles

Table 12: Tata Motors Limited: Annual Financial Ratios

Key Ratios 2014 2015 2016 2017 2018

Growth Ratios

Sales Growth % -1.14 7.62 2.21

Operating Income Growth % -19.06 -25.23 -333.19

EBITDA Growth % -7.39 -1.73 -116.95

Net Income Growth % -35.62 20.59 -420.69

EPS Growth % -48.62 15.66 -219.62

Working Capital Growth % -82.94 -1578.21 203.95

Equity Ratios

EPS (Earnings per Share) INR 34.26 21.95 26.46 -84.89

Dividend per Share INR 0.20

Dividend Cover Absolute 171.28

Book Value per Share INR 232.51 170.98 281.01 177.21

Profitability Ratios

Gross Margin % 44.74 41.95 41.00 39.20

Operating Margin % 7.50 6.14 4.26 -9.73

Net Profit Margin % 4.17 2.72 3.04 -9.55

Profit Markup % 80.95 72.26 69.49 64.48

PBT Margin (Profit Before Tax) % 5.09 3.39 3.78 -10.39

Return on Equity % 14.67 12.84 9.42 -47.90

Return on Capital Employed % 13.00 10.66 6.70 -18.16

Return on Assets % 8.67 2.76 2.97 -9.03

Return on Working Capital % 724.29 3437.00

Operating Costs (% of Sales) % 92.50 93.86 95.74 109.73

Administration Costs (% of Sales) % 29.31 28.45 28.91 29.78

Liquidity Ratios

Current Ratio Absolute 1.03 1.00 0.95 0.85

Quick Ratio Absolute 0.71 0.69 0.64 0.57

Cash Ratio Absolute 0.46 0.44 0.34 0.29

Leverage Ratios

Debt to Equity Ratio Absolute 0.88 1.35 0.93 1.76

Net Debt to Equity Absolute 0.26 0.48 0.42 1.07

Debt to Capital Ratio Absolute 0.42 0.53 0.43 0.59

Efficiency Ratios

Asset Turnover Absolute 2.08 1.01 0.98 0.95

Fixed Asset Turnover Absolute 7.77 3.89 3.70 3.53

Inventory Turnover Absolute 9.14 4.59 4.35 4.34

Current Asset Turnover Absolute 5.05 2.43 2.34 2.33

Capital Employed Turnover Absolute 1.73 1.74 1.57 1.87

Working Capital Turnover Absolute 96.60 559.93

SOURCE: COMPANY FILINGS MARKETLINE

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED Page | 36

Car Manufacturing in India

Industry Profiles

Table 13: Tata Motors Limited: Key Employees

Name Job Title Board

Girish Wagh President Commercial Vehicles Business Unit Senior Management

Guenter Butschek Chief Executive Officer Executive Board

Guenter Butschek Managing Director Executive Board

Hanne Sorensen Director Non Executive Board

Mitsuhiko Yamashita Director Non Executive Board