Professional Documents

Culture Documents

Annual Investments Are Being Made So That $20,000 ...

Uploaded by

Ahmad AbdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Investments Are Being Made So That $20,000 ...

Uploaded by

Ahmad AbdCopyright:

Available Formats

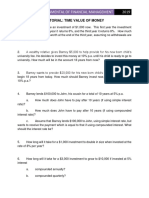

Annual investments are being made so that $20,000 will be accumulated at the end of 10 years.

the interest rate on

these investments is initially expected to be 4 percent compounded annually. After 4 years, the rate of the interest is

unexpectedly increased to 5 percent, so that payments for the remaining 6 years can be reduced. What amounts

should be invested annually for the first 4 years and what sums for the last 6? Please provide steps in your answer

Answer

First, we need to nd the annual payment at the rate of 4%, then need to take the accumulated value of

the annual payments for 4 years at the end of 10 years and deduct it from the total required accumulated

value and need to nd the yearly payment of the remaining amount required.

The formula is:

FV=future value=20000

A=anual payments

n=years=10

r=interest rate=4%

Using values and formula:

The annual payment for the rst 4 years is $1665.81889

Now, we need to nd the future value of this 4 payments at the end of 10 years

The formula for it:

n=4 years and m=10-4=6 years and i=5%

Using the formula and values:

The value of the 4 annual payments is $9479.62208. we need to make it $20000, so the remaining amount

to accumulate in the account is

=20000-9479.62208=10520.3779

Now, we need to nd the annual payment for the remaining 6 years, which can accumulate $10520.3779 at

5% interest rate.

Using the values and the rst formula used for the annual payment:

The last 6 yearly payments will be $1546.68

The amount required to invest for the rst 4 years is $1665.82 and the amount required invest for last 6

years is $1546.68

Comment

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Problem SolvingDocument7 pagesProblem SolvingSantos, Kimberly R.No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- A Smaller Power Plant Produces Steam at 3 MPa, 600...Document3 pagesA Smaller Power Plant Produces Steam at 3 MPa, 600...Ahmad AbdNo ratings yet

- Engecon ReviewerDocument2 pagesEngecon Reviewerdaday el machoNo ratings yet

- TUTORIAL TVM Feb17Document15 pagesTUTORIAL TVM Feb17Phong DươngNo ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Plates Annuity, Gradient, PerpetuityDocument7 pagesPlates Annuity, Gradient, PerpetuityMarianne Nicole DespiNo ratings yet

- ECONDocument11 pagesECON22-00248No ratings yet

- ESC 411 Problem Set #1 NAME: - SCHEDULEDocument1 pageESC 411 Problem Set #1 NAME: - SCHEDULECeazar Justine FuluganNo ratings yet

- Work SheetDocument3 pagesWork Sheetkassa hilemnehNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- 4 Arithmatic Gradient SeriesDocument21 pages4 Arithmatic Gradient SeriesShashvat TiwariNo ratings yet

- Sums Time ValueDocument2 pagesSums Time ValueMavani snehaNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Nominal & EffectiveDocument20 pagesNominal & EffectivesandhurstalabNo ratings yet

- Excel TemplateDocument48 pagesExcel TemplateigfhlkasNo ratings yet

- Compound InterestDocument3 pagesCompound InterestmirkazimNo ratings yet

- Econ Project FinalDocument9 pagesEcon Project FinalMharco Colipapa0% (2)

- Chapter 1c - Time Value of MoneyDocument16 pagesChapter 1c - Time Value of MoneyOdysseYNo ratings yet

- Tutorial questions-DCF-solved in ClassDocument6 pagesTutorial questions-DCF-solved in ClassLaiba RazaNo ratings yet

- Amount at Changing Rates and Finding I and TDocument3 pagesAmount at Changing Rates and Finding I and TAnonymous jZc1vv2No ratings yet

- CompoundDocument3 pagesCompoundRytchad XplodeNo ratings yet

- Engineering Economics 1-HandoutsDocument2 pagesEngineering Economics 1-HandoutsYden C SilvestreNo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- Time Value of MoneyDocument35 pagesTime Value of MoneysandhurstalabNo ratings yet

- Chapter 2: The Present ValueDocument4 pagesChapter 2: The Present ValueVân ĂnggNo ratings yet

- Sample Problems Engineeri G EconomyDocument2 pagesSample Problems Engineeri G Economysaleh gaziNo ratings yet

- Compound Interest: Simple Interest vs. Compound Interest Formula Sample ProblemsDocument46 pagesCompound Interest: Simple Interest vs. Compound Interest Formula Sample ProblemsRoselle Malabanan100% (1)

- Exam in StatDocument11 pagesExam in StatA-nn Castro NiquitNo ratings yet

- DraftDocument2 pagesDraftYUDITA NUR'AININNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- BM2.MOD2 in Class Problems 12152010Document2 pagesBM2.MOD2 in Class Problems 12152010Pollie Jayne ChuaNo ratings yet

- ps#1Document1 pageps#1Archieval Baltazar Oconer0% (1)

- 5 Nominal and Effective Interest Rates RSDocument32 pages5 Nominal and Effective Interest Rates RSAkshat PradhanNo ratings yet

- FINMA1 - Time Value of Money Practice ProblemsDocument1 pageFINMA1 - Time Value of Money Practice Problemseath__No ratings yet

- EconomicsDocument1 pageEconomicsMoneca MillerNo ratings yet

- Eng Econ QuestionaireDocument3 pagesEng Econ Questionairederping lemonNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Time Value of MoneyDocument4 pagesTime Value of Moneynreid2701No ratings yet

- Time Value of Money 1Document27 pagesTime Value of Money 1Namaku ImaNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Chapter 2 Time Value of MoneyDocument2 pagesChapter 2 Time Value of MoneyPik Amornrat SNo ratings yet

- Standard of Presenting It. Illustrate The Cash Flow Diagram If Necessary. and Write It On A Clean Sheet of Paper. No Need To Copy The ProblemDocument1 pageStandard of Presenting It. Illustrate The Cash Flow Diagram If Necessary. and Write It On A Clean Sheet of Paper. No Need To Copy The ProblemWaleed OsmanNo ratings yet

- Quarter 2 Simply AnnuityDocument36 pagesQuarter 2 Simply Annuitycatherine saldeviaNo ratings yet

- BONDS and STOCK 33Document3 pagesBONDS and STOCK 33Bloody HunterNo ratings yet

- Group Worksheet and AssignmentDocument10 pagesGroup Worksheet and AssignmentmohammedNo ratings yet

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Engineering Economy 2Document6 pagesEngineering Economy 2Michael Angelo MontebonNo ratings yet

- AnnuityDocument30 pagesAnnuityDivaNo ratings yet

- Test - Chapter 2 Time Value of MoneyDocument18 pagesTest - Chapter 2 Time Value of Moneyk60.2112150055No ratings yet

- Econ 1 November 2022 GEDocument2 pagesEcon 1 November 2022 GEGie Marie GuarinoNo ratings yet

- Solved ProblemsDocument44 pagesSolved ProblemsGlyzel Dizon0% (1)

- Excel Co BanDocument14 pagesExcel Co BanAnh Ngô BảoNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- CH 04 EOC Solutions 4e StudentDocument15 pagesCH 04 EOC Solutions 4e StudentMary Shannon DeeringNo ratings yet

- Thermo Chapter 6 ExamplesDocument1 pageThermo Chapter 6 ExamplesAhmad AbdNo ratings yet

- Measurements: InstructorDocument27 pagesMeasurements: InstructorAhmad AbdNo ratings yet

- Thermo Chapter 6 ExamplesDocument5 pagesThermo Chapter 6 ExamplesAhmad AbdNo ratings yet

- ACFrOgAlSbXHol7X5DCh7AxhfktcUDPYrfN3azOCdL8n w0uIfRwG5eExpx5o5M39eBr6flbL4jKbJQr5lHThcZBkyXMxp-ToA0tTBR4-0kpI 0Pvs52jZmo JZy6vTDinXL3OiGxJSHKeOq WwoDocument290 pagesACFrOgAlSbXHol7X5DCh7AxhfktcUDPYrfN3azOCdL8n w0uIfRwG5eExpx5o5M39eBr6flbL4jKbJQr5lHThcZBkyXMxp-ToA0tTBR4-0kpI 0Pvs52jZmo JZy6vTDinXL3OiGxJSHKeOq WwoAhmad AbdNo ratings yet

- Measurements: InstructorDocument42 pagesMeasurements: InstructorAhmad AbdNo ratings yet

- Measurements: InstructorDocument38 pagesMeasurements: InstructorAhmad AbdNo ratings yet

- 3) A 20 Year Mortgage Set Up For Uniform Monthly Payments With 6 Percent Interest Compounded MonthlyDocument4 pages3) A 20 Year Mortgage Set Up For Uniform Monthly Payments With 6 Percent Interest Compounded MonthlyAhmad AbdNo ratings yet

- 4.9. The Pumping Capacity of A Refrigerating Compr...Document2 pages4.9. The Pumping Capacity of A Refrigerating Compr...Ahmad AbdNo ratings yet

- Measurements: Instructor: InstructorDocument34 pagesMeasurements: Instructor: InstructorAhmad AbdNo ratings yet

- A 20 Year Mortgage Set Up For Uniform Monthly Paym...Document3 pagesA 20 Year Mortgage Set Up For Uniform Monthly Paym...Ahmad AbdNo ratings yet

- Measurements: InstructorDocument33 pagesMeasurements: InstructorAhmad AbdNo ratings yet

- 3.14. The Packing in A Cooling Tower That Cools Co...Document3 pages3.14. The Packing in A Cooling Tower That Cools Co...Ahmad Abd0% (1)

- A Sum of Su Cient Magnitude Is To Be Invested Now So That..Document2 pagesA Sum of Su Cient Magnitude Is To Be Invested Now So That..Ahmad AbdNo ratings yet

- 4.10. The Data in Table 4.4 Are To Be Fit To An Eq...Document1 page4.10. The Data in Table 4.4 Are To Be Fit To An Eq...Ahmad AbdNo ratings yet

- 76958144Document2 pages76958144Ahmad AbdNo ratings yet

- The Passive Voice: To BeDocument9 pagesThe Passive Voice: To BeAhmad Abd0% (1)

- The Effects of Advertising: Critical CartoonsDocument8 pagesThe Effects of Advertising: Critical CartoonsAhmad AbdNo ratings yet

- Subject: Computer Application 3rd Level: Northern Technical University Technical Engineering College/mosulDocument4 pagesSubject: Computer Application 3rd Level: Northern Technical University Technical Engineering College/mosulAhmad AbdNo ratings yet