Professional Documents

Culture Documents

The Effect of Return On Assets and Price Earning Ratio Toward Stock Prices

Uploaded by

syifa frOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effect of Return On Assets and Price Earning Ratio Toward Stock Prices

Uploaded by

syifa frCopyright:

Available Formats

Berliana S & Nanu H Page 23 of 28

The Effect Of Return On Assets And Price Earning Ratio Toward Stock Prices

Berliana Sinaga, Nanu Hasanuh

Universitas Singaperbangsa Karawang

Correspondence: nanu.hasanuh@fe.unsika.ac.id

Received: March 2020, Revised: March 2020, Published: April 2020

Abstract

This study aims to determine the effect of Return on Assets (ROA) and Price Earning Ratio

(PER) on stock prices. The population in this study was the construction and building sub-

sector companies listed on the Indonesia Stock Exchange (BEI) for the 2014-2019 period.

Through the purposive sampling method then obtained a sample of 7 companies and

obtained 42 data. The data analysis technique used multiple linear regression and

hypothesis testing. The results showed that partially Return On Asset has no significant

effect on stock prices.

Keywords: PER (Price Earning Ratio), Return On Assets (ROA), Stock Prices

A. INTRODUCTION

In this era, many companies received funding or additional capital from

investment activities carried out by investors. One of the investment sites that can be

chosen by the public is the capital market. The capital market is a place to sell and buy

various financial instruments such as stocks, bonds, rights, warrants, mutual funds, and

other financial instruments (Fakhruddin, H. M; 2008).

Indonesia's capital market growth in the past 42 years has increased, it can be seen

from the Indeks Harga Saham Gabungan (IHSG) which experienced growth reaching

6,282,132 or continued to strengthen since 1977, wherein 1977 IHSG position was at 98

points. The growth of the capital market in Indonesia can also be seen from the number

of companies that continue to register their names on the Indonesia Stock Exchange

(IDX). In mid-2019 32 new companies stated their names on the IDX, bringing the total

number of listed companies to 649.

One sector that is on the Indonesia Stock Exchange (IDX) is the construction and

building sector. Building construction companies are companies that build public

facilities. According to the Indonesia Central Bureau of Statistics (Badan Pusat

Statistik) in 2018, the construction sector in Indonesia was in third place as a source of

economic growth. One of the reasons is because of energy projects, high houses, and

infrastructure investment in several big cities throughout Indonesia. With this continued

development, it will have an encouraging impact on equity and economic growth,

therefore the shares of this sector are suitable for long-term investment. The stock price

is one of the determinants used by market participants (investors) to conduct demand

and supply in the capital market. If the demand for shares is high then the share price

will go up, on the contrary, if the stock offer is high then the share price will also fall.

Stock prices are also used as a benchmark for the success of a company's performance.

If a company's stock price is high, then the value of the company will be good

(Rahmadewi & Abudanti, 2018).

The occurrence of fluctuations in stock prices illustrates the level of changes in

stock prices in the capital market is influenced by several factors, namely external

EKSIS, Vol 15, No 1, April-September 2020 Page 23 - 28

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

Berliana S & Nanu H Page 24 of 28

factors, and internal factors. The research uses internal factors (fundamental) which are

thought to have influenced the changes in stock prices, namely Return On Asset (ROA)

and Price Earning Ratio (PER)

ROA is a ratio that explains how much the company's ability to use all of its

assets to generate profits (Sudana, 2011) The higher this ratio, the better the company's

performance in managing its assets, and vice versa. This also makes the company more

attractive to investors. PER is obtained from the price of shares outstanding divided by

earnings per share (EPS), so the higher the PER will mean that the company's

performance is also getting better according the investors, otherwise if the PER is too

high can also mean that the stock price offered is already very high or irrational

(Sugianto, 2008).

The results of the study (Safitri, 2016) that ROA significantly influence stock

prices. However, ROA did not significantly influence to stock prices (Prillyastuti &

Stella, 2017). And also PER has a significant effect (Yumia & Khairunnisa, 2015).

Meanwhile PER has no significant effect on stock prices (Rahmani, 2019). This study

aims to determine the effect of Return on Assets (ROA) and Price Earning Ratio (PER)

toward stock prices. in Construction and Building Sub-Sector Companies listed on the

IDX period 2014 – 2019.

B. LITERATURE REVIEW

1. Financial Accounting

A process of recording, classifying, summarizing processing, and presenting data

is an understanding of accounting. The logging of the transaction data as well as

financial-related events are used for good information for decision making for interested

parties. A process of recording, classifying, summarizing processing, and presenting

data is an understanding of accounting. The logging of the Transition data, as well as

financial-related events, are used for good information for decision making for

interested parties. Accounting is the reporting of information about the activities of

those interested in the company's performance (Rudianto, 2012)

Financial accounting is a type of accounting that addresses and contains

information about the company's financial statements to the internal and external parties

of the company. Financial accounting is the recording and reporting of data from all

economic activities of a company (Reeve et., Al., 2012). Besides being useful for

company managers, the report also becomes the main report for business owners,

creditors, government agencies, and the public. Financial accounting is activities related

to the information to investors, creditors and authorities are usually quantitative and

often presented in monetary units for decision making, planning, sourcing, and financial

reporting (Ahmad, 2011)

2. Analysis of Financial Ratio

Financial ratio analysis is an element of business analysis of the company's

performance prospects and risks for the benefit of decision making by compiling an

analysis task through evaluating its financial performance (Subramanyam & Wild,

2014). The ratio of financial ratios is a ratio that describes a relationship or

consideration between a certain number and another, using a ratio analysis tool that

explains the description to the analysis of the good or poor financial situation of the

company especially when the ratio number is compared with the comparison ratio

number used as standard (Munawir, 2010)

EKSIS, Vol 15, No 1, April-September 2020

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

Berliana S & Nanu H Page 25 of 28

3. Return On Assets (ROA)

Return on Assets (ROA) is one of the profitability ratios. In the analysis of

financial statements, this ratio is most often highlighted, as it can demonstrate the

success of the company generating profits. The term ROA with the Net Earning Power

Ratio (Rate of Return on Investment / ROI), which is the company's management ability

to manage all assets in generating net profits after tax (Riyanto, 2013). ROA is the ratio

of net profit to total assets measures the return on total assets (ROA) after interest and

taxes (Bringham & Houston, 2010)

H1: Return On Assets (ROA) significantly influences stock prices.

4. Price Earning Ratio (PER)

Price Earning Ratio is the most widely made by the investor to analyze whether

the investment is being done profitably or adversely. Price Earning Ratio (PER) is

information that identifies the amount of rupiah that must be paid by investors to obtain

profits from the company (Tandelilin, 2017). In the Price Earning Ratio (PER) approach

it can also be called a multiplier approach, with this approach the investor can count the

number of times the value of the company's earnings. According to, PER is the ratio

gained from the usual stock market price divided by the company's profit (Sugianto,

2008). The higher the ratio indicates that the company's performance is getting better,

otherwise if PER is too high it can also indicate that the price of the stock has been high

or irrational.

H2: Price Earning Ratio (PER) affects the stock price

5. Stock

Stocks are traded securities of Indonesian equities. Stock are proof of ownership

of the purchase of company shares (Kasmir, 2016). Shares can be transferred (traded) to

other parties. The stock is a piece of paper proving the rights of Financial to get part of

the company's performance profit that publishes the stock (Husnan & Pudjiastuti, 2012).

Stock prices reflect the value of the company, the higher the share price the higher the

company's value and vice versa. Every company that publishes stocks is very attentive

to its stock price. Stock prices are formed from interactions between companies '

performance and the market situation of capital markets. The price of a stock at a certain

time will depend on the cash flow that is expected to be received in the future by the

"average" investor if the investor buys the stock. The price of the stock is the price

generated by the demand and bidding by market participants of the capital markets at a

certain time (Hartono, 2011)

H3: Return On Assets (ROA) and Price Earning Ratio (PER) significantly influence

stock prices

C. RESEARCH METHODS

The research method used in this research is quantitative research with

descriptive and verification approaches.The population in this study are companies in

the sub-sector and building sectors listed on the Indonesia Stock Exchange (IDX) during

2014-2019. The sample in this study were 7 construction and building sub-sector

companies and taken by purposive sampling technique.

EKSIS, Vol 15, No 1, April-September 2020

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

Berliana S & Nanu H Page 26 of 28

D. RESULTS AND DISCUSSION

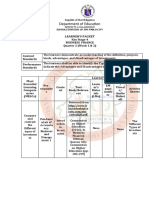

1. Multiple regression analysis

This multiple linear regression analysis aims to measure the strength of the

relationship between two or more variables. In addition, the results of this regression

analysis show the direction of the relationship between the dependent variable and the

Independent variable.

Table 1: Results of multiple regression analysis

Based on table above, there is a constant value of the equation of 1177,203. The

ROA variable has a negative regression coefficient. This negative coefficient value

indicates that in case of a ROA increase then the stock price is decrease

The PER variable has a positive regression coefficient. The value of this positive

coefficient indicates that in the event of an increase then PER the stock price increase.

2. Coefficient of Determination (R2)

The coefficient of determination (R2) is used to measure the extent of the ability

of the dependent variables. The coefficient of determination (R2) is between zero and

one. A small value (R2) means that the ability of independent variables to explain the

dependent variable is very limited. If the coefficient of determination is zero, then the

independent variable has no effect

Table 2: Determination Coefficient Test Results (R2)

From the above table the results of the analysis of the coefficient of determination

above can be seen from the R square of 0.162 which shows that the Stock Price was

influenced by Return on Asset, PER of 16.2% and the remaining 83.8% was influenced

by other variables not examined in this study.

3. Hypothesis testing

Table 3: Partial Test Results (t-test)

Based on the test results insignificance of 5% or 0.05. it is obtained that ROA

significance of 0.420, which is greater than 0.05. So it can be concluded that partially

EKSIS, Vol 15, No 1, April-September 2020

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

Berliana S & Nanu H Page 27 of 28

ROA has no significant effect on stock prices. And also base on the above test results, it

is obtained that PER significance of 0.034, which is smaller than 0.05. So it can be

concluded that partially PER has a significant effect on stock prices.

4. Simultaneous Test (F-Test)

Table 4: Simultaneous test results (f Test)

From the above table shows that the results of simultaneous test calculated value

of 3.765. The significance value of 0.032 is smaller than 0.05. Thus, it can be concluded

that ROA and PER simultaneously has a significant effect on Share Price.

5. Discussion

Based on these results, it is concluded that ROA partially has no significant

effect on stock prices. This shows that investors do not see ROA in making decisions

when buying shares or investing because ROA in construction and building subsectors

have weaknesses. This is due to the decreasing number of government projects

undertaken by several constructions and building companies, resulting in a decrease in

net profit, which causes ROA in this sector to decline. Where the declining ROA shows

that the rate of return on investors will also decline so ROA in this sector is less

attractive to investors (Prillyastuti & Stella, 2017; Agustina & Dr. Hendratno, 2019)

Price Earning Rtaio (PER) partially has a significant effect on stock prices. This

shows that investors see the PER as a ratio that investors need to consider in an

investment decision because the ratio shows how much of the available funds paid by

investors for each profit received in a certain period. The higher PER ratio shows that

investors have good expectations of the company's development (Yumia & Khairunnisa,

2015; Sapariyah, et., Al., 2016). And Simultaneously, Return On Asset (ROA) and

Price Earning Ratio (PER) affect toward the stock price.

E. CONCLUSION

Based on data analysis Return On Asset (ROA) partially does not affect toward the

price of shares. This is caused by investors not seeing Return On Asset (ROA) as a

decision in buying shares. Price Earning Ratio (PER) partially influences the price of

shares. And simultaneously, Return on Asset (ROA) and Price Earning Ratio (PER)

have a significant effect on share prices.

REFERENCES

Agustina, S., & Dr. Hendratno, S. A. (2019). Pengaruh CR,DAR,DER,ROA,PER

Terhdap Harga Saham Pada Perusahaan Sub Sektor Plastik dan Kemasan Yang

Terdaftar di BEI. e-proceeding management.

Ahmad, K. (2011). Akuntansi Manajemen. Jakarta: Rajawali Press.

EKSIS, Vol 15, No 1, April-September 2020

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

Berliana S & Nanu H Page 28 of 28

Bringham, E. F., & Houston, J. F. (2010). Dasar - Dasar Manajemen Keuangan Buku 1

Edisi Ke 10,Alih Bahasa Ali Akbar Yulianto . Jakarta: Salemba empat.

Fakhruddin, H. M. (2008). Istilah pasar modal AZ: berisi kumpulan istilah populer

pasar modal khususnya di pasar modal Indonesia, mencakup berbagai istilah

seputar perdagangan saham, obligasi, reksa dana, instrumen derivatif dan

berbagai istilah terkait lainnya. Elex Media Komputindo.

Hartono, J. (2011). Teori Portofolio dan Analisis Investasi Edisi Ketujuh. Yogyakarta:

BPFE.

Husnan, & Pudjiastuti. (2012). Dasar- Dasar Manajemen Keuangan (6th ed) .

Yogyakarta: UPP STIM YKPN.

Kasmir. (2016). Pengantar Manajemen Keuangan . Jakarta: Prenada Media Group.

Munawir, S. (2010). Analisis laporan Keuangan Edisi keempat. Cetakan Kelima.

Yogyakarta: Liberty.

Prillyastuti, N., & Stella. (2017). PENGARUH CURRENT RATIO, DEBT TO ASSET,

DEBT TO EQUITY, RETURN ON ASSETS DAN PRICE EARNINGS RATIO

TERHADAP HARGA SAHAM. JURNAL BISNIS DAN AKUNTANSI.

Rahmadewi, P. W., & Abudanti, N. (2018). PENGARUH EPS, PER, CR, DAN ROE

TERHADAP HARGA SAHAM DI BURSA EFEK INDONESIA. Manajemen

Unud.

Rahmani, H. F. (2019). Pengaruh ROA, PER, EPS, DER dan PBV Terhadap Harga

Saham Pada BANK NEGARA INDONESIA(PERSERO) ,TBK pada tahun

2005-2016.

Riyanto, B. (2013). Dasar - Dasar Pembelanjaan Perusahaan Edisi 4. Yogyakarta:

BPFE.

Rudianto. (2012). Pengantar Akuntansi. Yogyakarta: Grasindo.

Safitri. (2016). Pengaruh PER, ROA dan DER Terhadap Harga Saham Pada Perusahaan

Lembaga Pembiayaan Di Bursa Efek Indonesia. Administrasi Bisnis.

Sapariyah, R. A., Khristian, Y., & Juwanto. (2016). RETURN ON ASSET, DEBT TO

EQUITY RATIO, PRICE EARNING RATIO, KURS DAN INFLASI

TERHADAP HARGA SAHAM. ADVANCE.

Sinaga, N. S. (2018). Pengaruh Return on Assets dan Price Earning Ratio Terhadap

Harga Saham pada Perusahaan Sub Sektor Otomotif yang Terdaftar di Bursa

Efek Indonesia Periode 2012-2016. journal USU.

Subramanyam, K. R., & Wild, J. J. (2014). Analisis Laporan Keuangan. Edisi 10 Dialih

Bahasakan oleh Dewi Yanti. Jakarta: Salemba empat.

Sudana, I. M. (2011). Manajemen Keuangan;Teori dan Praktik Edisi 2. Jakarta:

Erlangga.

Sugianto. (2008). Pasar Modal; cetakan 2. Bandung: Alfabeta.

Tandelilin, E. (2017). PASAR MODAL : Manajemen Portopolio & Investassi. Depok:

kanisius.

Yumia, M. N., & Khairunnisa. (2015). PENGARUH RETURN ON EQUITY (ROE),

EARNING PER SHARE (EPS),DAN PRICE EARNING RATIO(PER)

TERHADAP HARGA SAHAM PADA PERUSAHAAN PERTAMBANGAN

LOGAM DAN MINERAL YANG TERDAFTAR DIBEI TAHUN 2010-2014.

e-procedding management.

EKSIS, Vol 15, No 1, April-September 2020

https://ejournal.stiedewantara.ac.id/index.php/001/issue/view/

You might also like

- Journal Int 4Document6 pagesJournal Int 4Jeremia Duta PerdanakasihNo ratings yet

- NI LUH 2021 Company Value Profitability ROADocument11 pagesNI LUH 2021 Company Value Profitability ROAFitra Ramadhana AsfriantoNo ratings yet

- Ilomata - Roa Der Eps TatoDocument12 pagesIlomata - Roa Der Eps TatoHans Surya Candra DiwiryaNo ratings yet

- Dok Mi J Ku GTRDocument2 pagesDok Mi J Ku GTRSena WehlNo ratings yet

- Investment, Funding Decisions, and Activity Ratios Impact on Indonesian Firm ValueDocument16 pagesInvestment, Funding Decisions, and Activity Ratios Impact on Indonesian Firm ValueGONZALO ANDRE RIVERO MALATESTANo ratings yet

- THE MEDIATING ROLE OF PROFITABILITY ON THE RELATIONSHIP FREE CASH FLOWANDLEVERAGE ON STOCK PRICING (Case Study On Manufacture Company, SubSectorsofConsumer in 2016 - 2019)Document15 pagesTHE MEDIATING ROLE OF PROFITABILITY ON THE RELATIONSHIP FREE CASH FLOWANDLEVERAGE ON STOCK PRICING (Case Study On Manufacture Company, SubSectorsofConsumer in 2016 - 2019)AJHSSR JournalNo ratings yet

- Analysis of The Effect of Profitability, Solvability, and Dividend Policy On Banking Firm ValueDocument10 pagesAnalysis of The Effect of Profitability, Solvability, and Dividend Policy On Banking Firm ValueverenNo ratings yet

- Denijuliasari, 12-17 Aditya Teguh NugrohoDocument6 pagesDenijuliasari, 12-17 Aditya Teguh Nugrohoanhnp21409No ratings yet

- 885-Article Text-4162-1-10-20231205Document7 pages885-Article Text-4162-1-10-20231205Rinanti DANo ratings yet

- Analysis of Factors Affecting Stock ReturnsDocument11 pagesAnalysis of Factors Affecting Stock ReturnsMelisa SuyandiNo ratings yet

- Melpa Riani: Keywords:-Stock Prices, CR, DER, TATO, NPM, ROEDocument8 pagesMelpa Riani: Keywords:-Stock Prices, CR, DER, TATO, NPM, ROEInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1 SMDocument8 pages1 SMJonathan SangimpianNo ratings yet

- Effect of Profitability, Solvency and Market Ratios on Stock ReturnsDocument22 pagesEffect of Profitability, Solvency and Market Ratios on Stock ReturnsClaudia PalaciosNo ratings yet

- 391-Article Text-2781-1-10-20220620Document19 pages391-Article Text-2781-1-10-20220620bagas samuelNo ratings yet

- The Effect of Dividend Policy (DPR) and Debt To Equity Ratio On Company Value (PBV) in The Consumer Non-Cyclicals SecDocument12 pagesThe Effect of Dividend Policy (DPR) and Debt To Equity Ratio On Company Value (PBV) in The Consumer Non-Cyclicals SecHENGKI SAPUTRANo ratings yet

- Effects of Price Earnings RatiDocument13 pagesEffects of Price Earnings RatiharyaNo ratings yet

- THESIS SUMMARY - Akhsa Sinaga - 008201400007Document15 pagesTHESIS SUMMARY - Akhsa Sinaga - 008201400007Andreas SebastianNo ratings yet

- CR Der Roa Dividend PolicyDocument12 pagesCR Der Roa Dividend Policyumar YPUNo ratings yet

- Capital StuctureDocument9 pagesCapital StuctureSyahrial SarafuddinNo ratings yet

- Ijbel24.isu 6 929Document6 pagesIjbel24.isu 6 929MaissyNo ratings yet

- Factors Influencing Share Returns in Property CompaniesDocument19 pagesFactors Influencing Share Returns in Property CompaniesPrama AjiNo ratings yet

- On Indonesian Stock Exchange 2013 2017Document19 pagesOn Indonesian Stock Exchange 2013 2017muhammad masyhuriNo ratings yet

- The Effect of Return On Assets, Return On Equity and Earning Per Share On Stock PriceDocument10 pagesThe Effect of Return On Assets, Return On Equity and Earning Per Share On Stock PriceIsnaynisabilaNo ratings yet

- Pengaruh Profitabilitas Terhadap Harga Saham Pada PerusahaanDocument9 pagesPengaruh Profitabilitas Terhadap Harga Saham Pada Perusahaanaldapermatasari021No ratings yet

- 2 PBDocument14 pages2 PBSri Nodia RahnaNo ratings yet

- Effect of Financial Performance On Stock Prices in Producing Product of Raw Materials Registered in Indonesia Stock ExchangeDocument5 pagesEffect of Financial Performance On Stock Prices in Producing Product of Raw Materials Registered in Indonesia Stock ExchangeaijbmNo ratings yet

- Effect of Capital Structure, Size and Profitability on Mining Firm ValueDocument18 pagesEffect of Capital Structure, Size and Profitability on Mining Firm Valuerahmat fajarNo ratings yet

- Analysis of The Effecr of Return On Asset, Debt To Equity Ratio, and Total Asset Turnover On Share ReturnDocument9 pagesAnalysis of The Effecr of Return On Asset, Debt To Equity Ratio, and Total Asset Turnover On Share ReturnverenNo ratings yet

- Determinant Analysis of Stock ReturnDocument11 pagesDeterminant Analysis of Stock ReturnIrman KknNo ratings yet

- 37406-Article Text-97964-1-10-20200618Document13 pages37406-Article Text-97964-1-10-20200618ardhozuhrifalahNo ratings yet

- Ijsred V2i1p36Document14 pagesIjsred V2i1p36IJSREDNo ratings yet

- 513 1071 2 PBDocument8 pages513 1071 2 PBRoyhan Malik PulunganNo ratings yet

- International Journal of Humanities and Social Science Invention (IJHSSI)Document6 pagesInternational Journal of Humanities and Social Science Invention (IJHSSI)inventionjournalsNo ratings yet

- 3620-15431-1-PBDocument20 pages3620-15431-1-PBsekar raniNo ratings yet

- 5722 17470 1 PBDocument11 pages5722 17470 1 PB29 - Nguyen Thi Anh TramNo ratings yet

- The Effect of Intellectual Capital and Profitability On Firm ValueDocument10 pagesThe Effect of Intellectual Capital and Profitability On Firm ValueAJHSSR JournalNo ratings yet

- Factors Affecting Stock Prices in LQ45 CompaniesDocument13 pagesFactors Affecting Stock Prices in LQ45 CompaniesDaffa AdityaNo ratings yet

- Journal Int 5Document12 pagesJournal Int 5Jeremia Duta PerdanakasihNo ratings yet

- 3152-Article Text-12695-3-10-20240320Document11 pages3152-Article Text-12695-3-10-20240320usdeldi akNo ratings yet

- Roa CR Der THP Hs Inter DividenDocument15 pagesRoa CR Der THP Hs Inter Dividenumar YPUNo ratings yet

- Impact of Profitability, Size, Growth on Firm ValueDocument8 pagesImpact of Profitability, Size, Growth on Firm ValueSiwi SariNo ratings yet

- The Effect of Financial Performance On Stock Price at Pharmaceutical Sub-Sector Company Listed in Indonesia Stock ExchangeDocument14 pagesThe Effect of Financial Performance On Stock Price at Pharmaceutical Sub-Sector Company Listed in Indonesia Stock ExchangeYumimura YoshimoriNo ratings yet

- (CR, Der, Eps) (2020)Document10 pages(CR, Der, Eps) (2020)Sito Resmi Kusuma DewiNo ratings yet

- The Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableDocument8 pagesThe Influence of Financial Performance On Company Value With Capital Structure As A Mediation VariableInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 128-Article Text-227-1-10-20190703Document5 pages128-Article Text-227-1-10-20190703sojeli4261No ratings yet

- Keywords: Financial Statements, Profitability Ratios, Capital Structure, and Stock PricesDocument22 pagesKeywords: Financial Statements, Profitability Ratios, Capital Structure, and Stock PricesalimsumarnoNo ratings yet

- 25053-Md Shofiqul IslamDocument21 pages25053-Md Shofiqul IslamMd Shofiqul IslamNo ratings yet

- Factors Affecting Stock Prices of Indonesian Construction CompaniesDocument15 pagesFactors Affecting Stock Prices of Indonesian Construction CompaniesSandraNo ratings yet

- The Influence of Leverage Sales Growth A Fae2c17bDocument14 pagesThe Influence of Leverage Sales Growth A Fae2c17bRicalyn VillaneaNo ratings yet

- 3117-Article Text-11862-3-10-20230107Document9 pages3117-Article Text-11862-3-10-20230107michael odiemboNo ratings yet

- Revisi - 4 Sept 2023Document11 pagesRevisi - 4 Sept 2023Erliana BanjarnahorNo ratings yet

- Effect of Profitability, and Sales Growth, With The Control Variable Asset Structure On Capital Structure in Various Industry Sectors Listed On The Indonesia Stock Exchange For The Period 2014-2018Document9 pagesEffect of Profitability, and Sales Growth, With The Control Variable Asset Structure On Capital Structure in Various Industry Sectors Listed On The Indonesia Stock Exchange For The Period 2014-2018Andrya VioNo ratings yet

- The Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesDocument5 pagesThe Effect of Return On Assets (ROA) and Earning Per Share (EPS) On Stock Returns With Exchange Rates As Moderating VariablesInternational Journal of Business Marketing and ManagementNo ratings yet

- 1001-Article Text-2621-1-10-20230118Document12 pages1001-Article Text-2621-1-10-20230118Wilson FedroNo ratings yet

- 3 - Jurnal IntDocument9 pages3 - Jurnal IntdimasNo ratings yet

- Study the Relationship between Financial Ratios and Profitability to Market Value of Companies Listed on the Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryDocument12 pagesStudy the Relationship between Financial Ratios and Profitability to Market Value of Companies Listed on the Stock Exchange of Thailand. Resource Industry Group Energy and Utilities CategoryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- DER, ROE, CR, PBV Factors of Sharia Stock ReturnsDocument12 pagesDER, ROE, CR, PBV Factors of Sharia Stock ReturnsSaniardiNo ratings yet

- NPM and EPS Effect on Stock PricesDocument9 pagesNPM and EPS Effect on Stock PricesNUR SARAH 'ALIAH HAIRUL AZHARNo ratings yet

- Zho Fir Oh 29102023 Jem T 105372Document11 pagesZho Fir Oh 29102023 Jem T 105372karel de klerkNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Klasifikasi Industri Perusahaan TercatatDocument39 pagesKlasifikasi Industri Perusahaan TercatatFz FuadiNo ratings yet

- 1 SMDocument11 pages1 SMsyifa frNo ratings yet

- DER BerpengaruhDocument15 pagesDER BerpengaruhMuhammad KurniawanNo ratings yet

- SSRN Id3044108Document14 pagesSSRN Id3044108syifa frNo ratings yet

- THE EFFECT OF ERM, FIRM SIZE, LEVERAGE, PROFITABILITY AND DIVIDEND POLICY ON FIRM VALUEDocument11 pagesTHE EFFECT OF ERM, FIRM SIZE, LEVERAGE, PROFITABILITY AND DIVIDEND POLICY ON FIRM VALUEsyifa frNo ratings yet

- The Effects of Market Ratios and Macroeconomic Conditions on Stock Price Movements in the Indonesian Property Sector 2007-2012Document16 pagesThe Effects of Market Ratios and Macroeconomic Conditions on Stock Price Movements in the Indonesian Property Sector 2007-2012syifa frNo ratings yet

- MakalahDocument8 pagesMakalahAsyam ArkaNo ratings yet

- The Relationship Between Working Capital Management and Financial Performance - Evidence From JordanDocument8 pagesThe Relationship Between Working Capital Management and Financial Performance - Evidence From Jordansyifa frNo ratings yet

- The Effects of Market Ratios and Macroeconomic Conditions on Stock Price Movements in the Indonesian Property Sector 2007-2012Document16 pagesThe Effects of Market Ratios and Macroeconomic Conditions on Stock Price Movements in the Indonesian Property Sector 2007-2012syifa frNo ratings yet

- Internal Audit Around The WorldDocument153 pagesInternal Audit Around The WorldcvacaNo ratings yet

- THE EFFECT OF ERM, FIRM SIZE, LEVERAGE, PROFITABILITY AND DIVIDEND POLICY ON FIRM VALUEDocument11 pagesTHE EFFECT OF ERM, FIRM SIZE, LEVERAGE, PROFITABILITY AND DIVIDEND POLICY ON FIRM VALUEsyifa frNo ratings yet

- DER BerpengaruhDocument15 pagesDER BerpengaruhMuhammad KurniawanNo ratings yet

- Tugas2 Kelompok3 AKLDocument3 pagesTugas2 Kelompok3 AKLsyifa frNo ratings yet

- Kasiye Questionnery PDFDocument9 pagesKasiye Questionnery PDFAnonymous 7bylYAHXpNo ratings yet

- Interna Auditing Around The WorldDocument54 pagesInterna Auditing Around The Worldarslan681No ratings yet

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Digital-Marketing-Audit-Kinerja MarketingDocument10 pagesDigital-Marketing-Audit-Kinerja Marketingsyifa frNo ratings yet

- International Transfer Pricing A Review of Non-Tax OutlookDocument7 pagesInternational Transfer Pricing A Review of Non-Tax Outlooksyifa frNo ratings yet

- Challenges Faced by Management Accountants in The 21st Century - Elsevier Enhanced ReaderDocument5 pagesChallenges Faced by Management Accountants in The 21st Century - Elsevier Enhanced Readersyifa frNo ratings yet

- Impact of Good Corporate GovernanceDocument5 pagesImpact of Good Corporate Governancesyifa frNo ratings yet

- BF2 - AnswerDocument34 pagesBF2 - AnswerCherielee FabroNo ratings yet

- 3.5 An Integrated Fuzzy Multi-Criteria Decision Making Approach For Evaluating Suppliers' Co-Design Ability in New Product DevelopmentDocument32 pages3.5 An Integrated Fuzzy Multi-Criteria Decision Making Approach For Evaluating Suppliers' Co-Design Ability in New Product DevelopmentFredy Francisco Sapiéns LópezNo ratings yet

- Reciept of Vehicle Sale Form July 2019Document1 pageReciept of Vehicle Sale Form July 2019Deep MalaNo ratings yet

- TriaDocument15 pagesTriasadeqNo ratings yet

- An Overview of Using Hydrogen as a Vehicle FuelDocument25 pagesAn Overview of Using Hydrogen as a Vehicle FuelAyush RajNo ratings yet

- Documento PDFDocument6 pagesDocumento PDFangye08vivasNo ratings yet

- Canara HSBC Life Insurance Premium ReceiptDocument1 pageCanara HSBC Life Insurance Premium Receiptyogesh bafnaNo ratings yet

- Construction Books & ResourcesDocument2 pagesConstruction Books & Resourcesمحمد إسلام عبابنهNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisKana jillaNo ratings yet

- SATURDAYS Lotte Shopping Avenue Payslip: Take Home Pay Rp5.789.925Document1 pageSATURDAYS Lotte Shopping Avenue Payslip: Take Home Pay Rp5.789.925Dhea Shafira KintanNo ratings yet

- ACI Annual Report 2017-18Document223 pagesACI Annual Report 2017-18Tasnim Tasfia SrishtyNo ratings yet

- EB-5 Guide FinalDocument12 pagesEB-5 Guide FinalPrince Charles MoyoNo ratings yet

- Vic Roads Transfer FormDocument4 pagesVic Roads Transfer Formjikolji0% (1)

- C - TSCM62 - 67 LatestDocument15 pagesC - TSCM62 - 67 LatestPooja SinghNo ratings yet

- HISTORICAL ORIGINS AND FORMS OF UNDERDEVELOPMENT AND DEPENDENCE IN AFRICADocument21 pagesHISTORICAL ORIGINS AND FORMS OF UNDERDEVELOPMENT AND DEPENDENCE IN AFRICAJuma DutNo ratings yet

- Health Care Waste ManagementDocument5 pagesHealth Care Waste ManagementJessa YlaganNo ratings yet

- Game TheoryDocument16 pagesGame TheoryVivek Kumar Gupta100% (1)

- Creative Risk MGMT - AflacDocument2 pagesCreative Risk MGMT - AflacScottNo ratings yet

- Procurement-Forms - SKCC 2022 NEW BASAKDocument22 pagesProcurement-Forms - SKCC 2022 NEW BASAKArniel SaysonNo ratings yet

- Business Finance Lesson 2Document20 pagesBusiness Finance Lesson 2Iekzkad RealvillaNo ratings yet

- IBS301 International Business Work Plan 2023Document19 pagesIBS301 International Business Work Plan 2023sha ve3No ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingAlexis KingNo ratings yet

- Perfect CVDocument2 pagesPerfect CVFahadBinAzizNo ratings yet

- Growing Ampalaya (Bitter Gourd) in The Philippines 2Document29 pagesGrowing Ampalaya (Bitter Gourd) in The Philippines 2kishore_hemlani86% (7)

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Bruh KitchenDocument1 pageBruh KitchenNur HanyNo ratings yet

- Sample Partnership DeedDocument4 pagesSample Partnership DeedShahzad Faisal0% (1)

- AUD 2 Audit of Cash and Cash EquivalentDocument14 pagesAUD 2 Audit of Cash and Cash EquivalentJayron NonguiNo ratings yet

- Prelim Quiz 2Document11 pagesPrelim Quiz 2Sevastian jedd EdicNo ratings yet

- Multiple Choice Problems ChapterDocument1 pageMultiple Choice Problems ChapterJohn Carlos Doringo100% (1)