Professional Documents

Culture Documents

Capita PLC Policy: Treating Customers Fairly

Capita PLC Policy: Treating Customers Fairly

Uploaded by

Rohan NOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capita PLC Policy: Treating Customers Fairly

Capita PLC Policy: Treating Customers Fairly

Uploaded by

Rohan NCopyright:

Available Formats

CAPITA PLC POLICY

Treating Customers Fairly

Classification Commercial in Confidence

Version 7.1

Date of Issue December 2015

Date of Next Review June 2016

Capita plc Policy

Treating Customers Fairly

Contents

1. Key Matters...................................................................................................................................3

2. Purpose and Scope........................................................................................................................3

3. Regulatory Background.................................................................................................................3

4. Policy Statement...........................................................................................................................6

5. Procedural Requirements.............................................................................................................8

6. Document Control.......................................................................................................................11

Appendix 1: Definitions......................................................................................................................12

Appendix 2: TCF Culture ‘key drivers’.................................................................................................14

Appendix 3: TCF self-assessment checklist.........................................................................................15

Appendix 4: TCF dashboard/MI..........................................................................................................16

Appendix 5 TCF MI - Use and Review.................................................................................................17

Appendix 6: Complaint handling as part of

TCF.....................................................................................19

Page 2 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

1. Key Matters

1.1. TCF is about putting yourself in the place of the Customer and considering whether you

would regard yourself as having been treated fairly.

1.2. Evidence of practices, measurement of and actions relating to delivery of the consumer

outcomes is key to the demonstration of TCF.

2. Purpose and Scope

2.1. The purpose of this Policy is to set out the high level approach which all UK Financial

Conduct Authority (FCA) regulated firms (Firms) within the Capita plc group of Companies

(Group) must follow and what Management Information (MI) must be monitored in

relation to the FCA’s principle of Treating Customers Fairly (TCF). When reading this Policy,

Employees should refer to ‘Appendix 1: Definitions’ for a glossary of defined terms.

2.2. Capita Firms provide a wide range of services to a large number of Customers and Business

Partners and their Customers. Customer and Business Partner satisfaction relies on high

quality service and an ongoing commitment to improve the way in which Firms operate. A

successful TCF environment should create stronger Customer and Business Partner

relationships, which should lead to improved Customer loyalty and more efficient service

provision. This Policy applies to a Firm’s Customers and those of a Business Partner unless

the Customer is an Eligible Counterparty.

3. Regulatory Background

3.1. The FCA is the conduct regulator for financial services firms and financial markets in the UK.

One of its three operational objectives is to secure an appropriate degree of protection for

consumers. As a conduct regulator, the FCA looks at the way firms carry out their business

and how they treat customers. It expects firms to have their customers at the heart of how

they do business and of the products and services, they offer 1. The requirement for firms to

treat customer fairly is firmly rooted in the FCA’s eleven principles of business.

3.2. The FCA’s eleven principles are rules which must be observed in addition to the detailed

rules and guidance set out elsewhere in the FCA Handbook. Principle 6 drives the fair

treatment of customers: “A firm must pay due regard to the interests of its customers and

treat them fairly”, although the following Principles are also relevant:

Principle 1: A firm must conduct its business with integrity.

Principle 2: A firm must conduct its business with due skill, care and diligence.

1

FCA Approach – Advancing Objectives 2015

Page 3 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Principle 3: A firm must take reasonable care to organise and control its affairs

responsibly and effectively, with adequate risk management systems.

Principle 7: A firm must pay due regard to the information needs of its clients, and

communicate information to them in a way which is clear, fair and not misleading.

Principle 8: A firm must manage conflicts of interest fairly, both between itself and its

customers and between a customer and another client.

Principle 9: A firm must take reasonable care to ensure the suitability of its advice and

discretionary decisions for any customer who is entitled to rely upon its judgment.

Principle 10: A firm must arrange adequate protection for clients' assets when it is

responsible for them.

3.3. To aid firms further, the FCA uses six consumer outcomes which explain what it wants TCF

to achieve for consumers:

Outcome 1: Consumers can be confident that they are dealing with firms where the fair

treatment of customers is central to the corporate culture. The ‘key drivers’ of culture

recognised by the FCA can be found in Appendix 2.

Outcome 2: Products and services marketed and sold in the retail market are designed

to meet the needs of identified consumer groups and are targeted accordingly

Outcome 3: Consumers are provided with clear information and are kept appropriately

informed before, during and after the point of sale

Outcome 4: Where consumers receive advice, the advice is suitable and takes account

of their circumstances

Outcome 5: Consumers are provided with products that perform as firms have led them

to expect, and the associated service is both of an acceptable standard and as they have

been led to expect

Outcome 6: Consumers do not face unreasonable post-sale barriers imposed by firms

to change product, switch provider, submit a claim or make a complaint

3.4. Not all outcomes will be relevant to all Firms or Businesses and precisely how the outcome

is achieved will vary dependent on the relationship with the Customer and the service being

provided. The approach taken to achieve an outcome should be appropriate and

proportionate to the circumstances, taking into account the capabilities of the consumer.

3.5. The FCA’s TCF Principle applies to all Customers unless they are Eligible Counterparties (i.e.

retail customers and commercial customers that are not Eligible Counterparties).

3.6. The FCA recognises differing levels of risk associated with different products and services

offered by the financial services industry. TCF is a key element of the FCA’s consumer

Page 4 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

protection agenda and consequently focus is given to areas identified where there is

significant potential for customer detriment.

3.7. The FCA's website provides more information about TCF, for example:

1. Culture framework2

2. Guide to MI3

3. Responsibilities of providers and distributors 4

4. Guidance for NEDs5

Eligible Counterparty:

5. Glossary6

6. Rule7

3.8. The FCA’s TCF principle is underpinned by requirements such as the Unfair Terms in

Consumer Contracts Regulations and the Financial Ombudsman Service arrangements.

3.9. The FCA has said “TCF, with its focus on consumer outcomes, is central to our work in

ensuring a fair deal for consumers. It underpins the delivery of our statutory consumer

protection objective and the future objectives of the FCA. The FCA will put consumers’

needs at its heart and it will focus even more on ensuring there is a fair deal between firms

and their customers.”

3.10. In its 2013 ‘Risk Outlook’ document the FCA says “Firms need to ensure they are

putting the consumer and the integrity of markets at the heart of their business models and

strategies. This includes making cultural changes that promote good conduct outcomes

throughout the business; establishing appropriate oversight and governance around the

design and innovation of products and services; and ensuring they are transparent in their

dealings with consumers”.

3.11. TCF is therefore a key aspect of meeting our commitments as a business to act

in the interest of customers and manage the risks which may prevent this in line with Capita’s

Conduct Risk Policy.

2

http://www.fca.org.uk/firms/being-regulated/meeting-your-obligations/fair-treatment-of-customers/Culture

3

http://www.fca.org.uk/your-fca/documents/fca--treating-customers-fairly--guide-to-management-information

4

http://www.fca.org.uk/your-fca/documents/fsa-ps0711

5

http://www.fca.org.uk/static/FsaWeb/Shared/Documents/pubs/guidance/gc11_30.pdf

6

http://fshandbook.info/FS/html/handbook/Glossary/E

7

http://fshandbook.info/FS/html/handbook/PRIN/1/Annex1#DES25

Page 5 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

4. Policy Statement

Consumer outcomes

4.1. Businesses must treat Customers fairly through the consistent delivery of the consumer

outcomes defined by the FCA. Senior management within the Business (with guidance from

Compliance) must identify which and how the TCF outcomes apply to their business. Where

operations are outsourced, each party must be clear about its TCF responsibilities (see 4.9 and

4.10).

Risks and controls

4.2. Senior management must identify the risks associated with each of the applicable consumer

outcomes. Systems and controls which mitigate the risks must be implemented and maintained,

and senior management must ensure these remain effective in the fair treatment of Customers.

Definition of ‘fairness’

4.3. Compliance will advise senior management on FCA expectations and TCF approaches taken

elsewhere within the industry by similar businesses, however senior management must decide

for themselves what fairness means to their business, bearing in mind the size, structure and

nature of their business and customer base.

Culture

4.4. Senior management must fully embed the Capita culture in their business. ‘Respecting our

customers and treating them fairly’ and ‘Delivering what we promise’ are key elements of

Capita’s value set. It is in Capita’s interests to have satisfied Customers, so the interests and

expectations of Customers must be aligned with and not secondary to Capita’s financial and

reputational interests. Culture is about behaviour so senior management must lead by example.

Governance and oversight

4.5. Governance and oversight arrangements must involve staff at sufficiently senior levels within

the Business in order to adequately deliver the consumer outcomes, manage TCF risks,

challenge TCF practices and take action to resolve issues identified. Senior management must

ensure all relevant parts of the Business are involved in their arrangements so the escalation

and cascade of information through the Business and decision-making is effective.

4.6. The FSA published guidance for NEDs (as part of the wider Board of Directors), setting out its

expectations of them in the management of TCF risk and delivering fair outcomes to customers;

this guidance (available via the FCA’s website) is still relevant.

MI or measures

4.7. MI or measures which demonstrate the ongoing and consistent delivery of the consumer

outcomes and management of TCF risks must be identified by senior management. There must

Page 6 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

be evidence of regular monitoring of the results and records must be kept of decisions,

investigations and actions taken following review of the results.

Continuous improvement

4.8. Operational structures, products, services, customers and their expectations change, so TCF

must be seen as a continuous process. Businesses must therefore undertake a self-assessment

exercise at appropriate times of change (e.g. when making an acquisition, changing strategic

direction, or launching a new product), using the checklist provided in Appendix 3.

4.9. Businesses must use complaint and breach analysis reports to ensure lessons learned are used

to continuously improve TCF outcomes (see 5.11 and 5.12).

FCA rules and guidance

4.10. Rules and guidance set out in the FCA Handbook must be followed. Aspects such as

financial promotions and best execution carry detailed rules which are intended to ensure a

minimum standard in the treatment of Customers. Compliance will advise senior management

on rules and guidance relevant to their Business, but senior management is responsible for

ensuring compliance with FCA rules and guidance.

Outsourcing to a Capita Firm

4.11. Where a Business Partner outsources operations to a Capita Firm, the Business Partner

must have a clear understanding of Capita’s TCF activities so it can ensure alignment with its

own approach and values. Capita and the Business Partner must establish clear responsibilities,

agree how together they will demonstrate the Business Partner’s Customers are treated fairly

and ensure records of commitments made to or by the Business Partner are maintained e.g. in

the Service Level Agreement (SLA). Where the Business Partner’s operating practices conflict

with the TCF Principle, this must be escalated using Capita’s internal procedures (e.g. to the Risk

Committee) and the governance process for the contract. Where possible, Capita should try to

influence the Business Partner, keeping records of any discussions. Capita must consider the

significance of the conflict and whether the relationship with the Business Partner is one it

wishes to pursue.

Outsourcing by a Capita Firm

4.12. Where a Capita Firm outsources operations, either to an external party or intra-Group

(such as for the provision of IT services), it must have a clear understanding of the outsourcee’s

TCF activities so it can ensure alignment of approach. Capita and the outsourcee must agree

how together they will demonstrate Customers are treated fairly. Capita must regularly review

the outsourcee’s operating practices to ensure they remain appropriate. Capita must not

undertake an outsourcing arrangement if the outsourcee’s operating practices conflict with the

TCF Principle.

Page 7 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

5. Procedural Requirements

Risk management

5.1. The risks associated with TCF like any other risks must be assessed and reported on using the

Group’s risk management framework. Management of TCF risks must be evidenced through

monitoring of MI, so businesses must consider whether it is appropriate for them to maintain

records of TCF risks at a consumer outcome level (and what MI is used to monitor these risks).

Systems and controls

5.2. Systems and controls which mitigate TCF risks and deliver the consumer outcomes must be

documented and regularly reviewed to ensure they remain appropriate.

Definition of ‘fairness’

5.3. Businesses must articulate their definition of fairness with a ‘success looks like’ statement for

each applicable consumer outcome, or by setting a ‘fairness level’ or benchmark for the key

measures used to monitor TCF performance, or by a combination of these methods.

‘Vulnerable customers’

5.4. Businesses must take account of the needs of customers who could be considered to be

‘vulnerable’ in the context of providing financial and non-financial services/products. In 2015

the FCA issued ‘Occasional Paper 8 - Vulnerable Consumer’s’ which provides useful guidance

and further reading that should be taken into account by firms when considering their

vulnerable customer approach.

5.5. In the paper the FCA provide a definition of vulnerable consumers as “A vulnerable consumer is

someone who, due to their personal circumstances, is especially susceptible to detriment,

particularly when a firm is not acting with appropriate levels of care.” Examples include

customers who are visually impaired or who have limited financial capability, or customers with

mental illness/incapacity.

Culture

5.6. Businesses must take account of the culture ‘key drivers’ outlined in Appendix 2 and the self-

assessment checklist provided in Appendix 3. Specifically, they must ensure:

Business strategy and objectives do not conflict with (but instead support delivery of) the

TCF outcomes.

Senior management reinforce the importance of TCF in internal communications.

Staff are encouraged to identify and report potential TCF issues and improvements.

Job descriptions and personal objectives include TCF behaviours and tasks relevant to the

individual’s role.

Staff feedback is sought and acted upon to improve the treatment of customers.

Customer feedback is sought (where the circumstances are suitable to do so), with action

taken as appropriate to manage the Customer’s expectations.

Page 8 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Significant decisions that impact customers are documented, with a clear indication of the

considerations which informed the decision, who was involved in the decision making

process, and the date of the decision.

Quality assurance activities are undertaken e.g. call reviews and letter sampling, where this

aspect is fundamental to delivery of an outcome, and the results are acted upon as

appropriate.

Service levels are regularly reviewed to ensure both the time and quality standards

represent fairness.

Recruitment procedures include an assessment of TCF related behaviours, and senior

appointments are compatible with TCF aims.

TCF training is provided to staff, their understanding of it is tested, and shortfalls are

addressed.

Staff are competent to fulfil their roles and performance is assessed in line with the Group’s

performance management system, and training and competence policy/scheme where

applicable.

Resource is sufficient to deliver the outcomes.

Reward and recognition structures do not encourage behaviour contrary to (but instead

encourage behaviour conducive to) TCF.

Management Information

5.7. TCF MI must be produced at least monthly, in line with the requirements outlined in Appendix

4. MI must be provided by appropriate people and responsibilities for the provision of

information must be documented. Businesses must ensure MI is used and reviewed in

accordance with Appendix 5.

Governance and oversight

5.8. Responsibilities in relation to TCF must be apportioned and documented. Businesses must

consider whether it is appropriate to delegate responsibility for certain controls to a committee

such as a New Product Development or a TCF Committee, or to an individual such as a TCF

Champion. Policies and significant decisions must be referred to these committees or individuals

as appropriate. Adequate oversight of TCF means MI must be escalated through Businesses for

analysis and consideration at different management levels.

Self-assessment

5.9. A self-assessment must be completed at appropriate times of change within the Business, or if

additional guidance is provided by the FCA or Compliance. When undertaking the self-

assessment using the document found in Appendix 3, Businesses must identify additional

Business specific systems and controls or contractual requirements relevant to their TCF

environment. Records of the assessment exercise must be maintained, including details of

action plans arising from the findings.

Other Policies

5.10. Where applicable, the Due Diligence and Integration Policy must be followed to ensure

TCF arrangements are assessed as part of an acquisition or contract for the provision of third

party administration services. Where applicable, the Outsourcing Policy must be followed to

Page 9 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

ensure TCF arrangements are assessed as part of the consideration of operational risk. Other

Group and local Policies which affect how customers are treated must also be followed.

Procedure documentation

5.11. Processes and procedures with direct relevance to TCF must be documented e.g. when

producing Customer communications, when selling or giving advice, or when handling

complaints. Procedures must be regularly reviewed and an ‘end-to-end’ review of procedures

must be completed to ensure TCF arrangements flow through the product lifecycle e.g. ensure

the claims procedure corresponds to the policy document issued as part of the sales process.

Complaint handling

5.12. Complaints can be a key indicator of unfair Customer treatment and a robust procedure

to deal with them must therefore be in place. Root cause analysis must be conducted to identify

systemic issues which can be addressed to prevent or reduce future complaints; staff training or

procedural changes must be considered as part of actions taken following the root cause

analysis. Records of complaints and decisions and actions taken must be maintained. Relevant

information must form part of the TCF MI pack. The list provided in Appendix 6 should be used

by Businesses to ensure their complaint handling procedures are appropriate.

Breach, incident, error and issue escalation

5.13. There must be a procedure for staff to escalate breaches, incidents, errors and issues

identified with TCF implications. Records of escalations and decisions and actions taken must be

maintained. Relevant information must form part of the TCF MI pack.

Adherence to this Policy

5.14. Senior management must ensure staff comply with this Policy as part of their standard

day-to-day supervisory arrangements; this includes staff employed in non-regulated parts of

Capita involved in activities relating to a Firm.

Local policy

5.15. Senior management must decide if a local or divisional TCF policy is needed outlining the

detailed approach to be taken locally, and if so, it must ensure consistency with the Group

Policy.

Compliance monitoring

5.16. TCF must be considered as part of Compliance monitoring programmes as appropriate

to the risks identified and in the wider context of conduct risk.

Page 10 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

6. Document Control

Document History

Issue Date Purpose Author

1.0 December 2008 Policy Creation Wendy Owen

2.0 January 2009 Annual Review Wendy Owen

3.0 December 2009 Annual Review Wendy Owen

4.0 January 2011 Annual Review Wendy Owen

5.0 January 2012 Annual Review Wendy Owen

6.0 January 2013 Annual Review Wendy Owen

7.0 January 2014 Annual Review Wendy Owen

7.1 December 2015 Annual Review Martin Hince

Distribution

Name Organisation Role

Capita Connections Capita plc Corporate Intranet

Reviewers

Name Organisation Role

Chris Terry Capita plc Group Risk and Compliance

Director

Page 11 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Appendix 1: Definitions

A number of words and phrases have particular meanings in this Policy, as set out below. Defined terms

are capitalised and appear in bold when first used in the Policy, for example, Customer.

Business Partner The party with whom a Capita Firm has contracted to provide services

on an outsourced basis. The Customer relationship in the context of

TCF is indirect i.e. the Customer ‘belongs’ to Capita’s Business Partner

where the Business Partner has direct regulatory responsibility for the

Customer.

Business(es) The operating units or sites which comprise a Firm.

Capita Capita plc and any of its affiliates.

Customer(s) The person(s) who ultimately receive(s) the service being provided by

a Capita Firm unless they are an Eligible Counterparty. The Customer

relationship in the context of TCF may either be direct i.e. the

Customer ‘belongs’ to Capita where Capita has direct regulatory

responsibility for the Customer, or indirect i.e. the Customer ‘belongs’

to Capita’s Business Partner where the Business Partner has direct

regulatory responsibility for the Customer. The TCF Principle applies to

activities carried out from establishments in the UK; this includes

activities carried out from UK establishments with overseas customers.

Eligible Counterparty Click here for the FCA Glossary definition (and scroll down)

Click here for the associated FCA rule

Firms may categorise certain clients as an eligible counterparty for the

purposes of the Principles for Businesses. The most likely reason for

this categorisation by a Capita Firm is where it is dealing with another

Firm or an associate of a Firm. If this categorisation is to be relied

upon, the definition and rule must be read and the required steps

taken.

Page 12 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Employee(s) Full-time, part-time, temporary and contract staff of the Group,

including Board Directors, whether Executive or Non-Executive.

Firm(s) Companies within the Group who are authorised and regulated in the

UK by the FCA to conduct regulated activities.

FCA The Financial Conduct Authority; responsible for the conduct

regulation and supervision of all authorised financial services firms in

the UK and for the prudential regulation of those firms not authorised

by the PRA.

FSA The Financial Services Authority; the FCA’s predecessor.

Group Capita plc and any of its affiliates.

MI Management Information.

Policy This TCF Policy.

TCF Treating Customers Fairly. Because of the wide range of activities Firms

carry out, the FCA feels it is not possible to define ‘fairness’ in a way

that applies to everyone. Firms must decide for themselves what

fairness and TCF means to them, bearing in mind the size, structure

and nature of their business, and the FCA’s six consumer outcomes.

Page 13 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

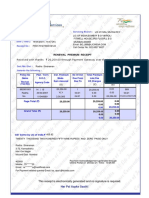

Appendix 2: TCF Culture ‘key drivers’

The following table is taken from the FSA’s July 2007 publication ‘Treating customers fairly - culture’.

The FCA believes that if the culture of a Firm is good, then Customers are likely to be treated fairly.

Page 14 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Appendix 3: TCF self-assessment checklist

Operational structures, products, services, customers and their expectations change, so Businesses

must undertake a TCF self-assessment exercise at appropriate times of change. Records of the

assessment exercise must be maintained, including details of action plans arising from the findings.

TCF self-assessment

checklist - Jan 14.doc

Page 15 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Appendix 4: TCF dashboard/MI

The attached dashboard is an example of an approach taken within Capita in respect of TCF

reporting; the format is not mandatory however, its use is encouraged. Businesses that choose to

use another style of reporting must ensure:

1. Measures are reported for each of the applicable consumer outcomes.

2. Where a consumer outcome is not relevant, a statement explaining why this is the case is

included in the report, for example, Capita is not authorised to give advice - if Capita becomes

aware of information relevant to this outcome, it will pass this on to external parties such as

Business Partners.

3. The type and number of measures used are aligned with the example as appropriate to the

Business and the TCF risks faced.

4. If the measures are not presented by outcome, which measure(s) relate(s) to which outcome is

recorded somewhere (normally within the MI pack being used to monitor TCF).

5. Why a measure demonstrates delivery of an outcome has been recorded, bearing in mind the

criticism of Firms measuring ‘process’ not ‘outcome’.

6. The ‘fairness benchmark’ for each measure is recorded and why this standard is being used e.g.

industry standard. Industry standards must be used to inform decisions rather than lead them.

When setting benchmarks consideration must be given to the degree of control the Business has

over the aspect being measured (with the higher the degree of control, the higher the likely

benchmark).

7. Results for at least 3 months are reported so trends can be seen.

8. There is qualitative commentary in respect of the results which have been analysed.

Example TCF

dashboard - Jan 14.xls

Page 16 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Appendix 5: TCF MI – Use and Review

The list below has been compiled from feedback Capita is aware the regulators have given Firms and

Business Partners following visits to assess delivery of TCF outcomes. Issues such as the frequency of

TCF risk reviews must be discussed with your local Compliance team.

1. Ensure top-down TCF risk reviews are regularly undertaken in order to assess whether your

existing MI/measures sufficiently monitor delivery of the outcomes. Ensure consumer protection

issues previously raised by the regulators with Capita and known regulatory ‘hot spots’ are

addressed. Projects present risks and corresponding MI should therefore be considered.

2. Ensure your MI/measures monitor outputs and you have recorded why a measure demonstrates

fairness/delivery of an outcome, particularly in respect of SLA reporting.

3. Ensure your MI includes both proactive measures such as customer feedback surveys, and

reactive measures such as numbers and types of complaints received.

4. Use the ‘wider’ information you hold (in addition to the results regularly reported on your

dashboard) to identify potential TCF issues. So, for example, if a database of customer

communications is maintained, analyse it periodically to see what it tells you – how long is it

since you last corresponded with a certain group of customers?

5. Ensure you have a TCF MI pack which draws together information on all your key risks, which is

then considered from a fairness angle.

6. Ensure results for an appropriate timeframe are reported so trends can be seen.

7. Ensure appropriate people receive appropriate TCF MI so that decision making is informed by it.

8. Ensure results are analysed and challenged (particularly where they are inaccurate, inconsistent,

anomalous or unexpected) and there is ongoing assessment of the success of actions taken.

9. Ensure summaries of MI allow adequate senior management oversight.

10. Ensure the escalation and cascade of information through the business, to/from governance and

oversight forums, and to/from external parties such as Business Partners, is as agreed and

effective.

11. Ensure approaches and results are shared across businesses where appropriate.

12. Ensure there is a clear and consistent process for setting RAG ratings/benchmarks for

MI/measures. Where distinct criteria are not set, provide guidance to individuals on the factors

to take into account when determining a rating.

Page 17 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

13. Ensure the content and presentation of your TCF MI pack is regularly reviewed to consider what

further enhancements can be made, and ensure RAG ratings/benchmarks are reviewed to

ensure levels remain appropriate.

14. Ensure quantitative results are supported with corresponding qualitative commentary.

15. Ensure ‘green’ results are also reviewed to consider emerging or low level risks.

16. Assign ownership and deadlines to investigations or actions identified from TCF MI/measures

and ensure records are kept of actions taken to improve customer treatment.

Page 18 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

Capita plc Policy

Treating Customers Fairly

Appendix 6: Complaint handling as part of TCF

The quality of a Firm’s complaint handling is an important aspect of TCF. In 2010 the FSA published a

report containing the results from its review of complaint handling in banking groups, and the

assessment template used as part of its review.

The following diagram describes in simple terms some of the key elements of fair complaint handling and

how they should link together.

Attached is a list which should be used by Capita Businesses to ensure their complaint handling

procedures are appropriate:

Further information on treating complainants fairly can be found in the following documents:

1. Review of complaint handling8

2. Complaint-handling file review template9

Complaint handling

as part of TCF - Jan 14.doc

8

http://www.fca.org.uk/your-fca/documents/fsa-review-of-complaint-handling-in-banking-groups

9

http://www.fsa.gov.uk/pubs/other/ch_assess_template.pdf , http://www.fsa.gov.uk/pubs/other/ch_assess.xls

Page 19 of 19 COMMERCIAL IN CONFIDENCE © 2015 Capita plc

Date of Issue: December 2015

Date of Next Review: June 2016

You might also like

- SACCO Savings PolicyDocument12 pagesSACCO Savings PolicyKivumbi William100% (5)

- PeopleSoft Component Interface - A Complete GuideDocument73 pagesPeopleSoft Component Interface - A Complete Guidevasubandi8100% (3)

- Pgfc1911 Bharti GovindaniDocument5 pagesPgfc1911 Bharti Govindani...No ratings yet

- Axis Bank (H.R.)Document99 pagesAxis Bank (H.R.)Priya NotInterested SolankiNo ratings yet

- Case 1Document22 pagesCase 1Let it be100% (1)

- Proposals & Competitive Tendering Part 1: Strategy & Positioning to Win (Second Edition)From EverandProposals & Competitive Tendering Part 1: Strategy & Positioning to Win (Second Edition)No ratings yet

- Iso TC 25 N 292Document70 pagesIso TC 25 N 292marcotulio123No ratings yet

- Shaughnessy v. Duke UniversityDocument25 pagesShaughnessy v. Duke UniversitythedukechronicleNo ratings yet

- Fsa TCF TowardsDocument64 pagesFsa TCF TowardsGrishmaNo ratings yet

- Ifrs 15 Solutions Retail Consumer Industry PWCDocument58 pagesIfrs 15 Solutions Retail Consumer Industry PWCjuna madeNo ratings yet

- 05 - LLMIT CH 5 Feb 08 PDFDocument22 pages05 - LLMIT CH 5 Feb 08 PDFPradyut TiwariNo ratings yet

- Standards of Lending Practice July 16Document12 pagesStandards of Lending Practice July 16nuwany2kNo ratings yet

- Fca Consultation Paper ResearchDocument5 pagesFca Consultation Paper Researchc9r0s69n100% (1)

- 2014 L3 PM 2 QuestionsDocument34 pages2014 L3 PM 2 QuestionssamNo ratings yet

- Marketing Strategy Notes Prof Kalim KhanDocument94 pagesMarketing Strategy Notes Prof Kalim KhanPraveen PraveennNo ratings yet

- ANewConsumerDuty FocusAreasDocument7 pagesANewConsumerDuty FocusAreasprakhar agrawalNo ratings yet

- Broking Ops 1Document9 pagesBroking Ops 1MM MMNo ratings yet

- Advanced Audit and AssuranceDocument9 pagesAdvanced Audit and AssuranceMamunur Rashid50% (2)

- ANA Media Transparency PrinciplesDocument36 pagesANA Media Transparency Principles邹 ZOU圣嘉 FayeNo ratings yet

- The Business Plan: ABI Priorities For 2010-2011Document19 pagesThe Business Plan: ABI Priorities For 2010-2011jaggu619No ratings yet

- Improving and Monitoring Customer Retention: Jacqueline Urquizo November, 2006Document35 pagesImproving and Monitoring Customer Retention: Jacqueline Urquizo November, 2006Guru PahwaNo ratings yet

- Telecom and Broadcasting Notice of Consultation CRTC 2018-246, Report Regarding The Retail SalesDocument26 pagesTelecom and Broadcasting Notice of Consultation CRTC 2018-246, Report Regarding The Retail SalesSameer ChhabraNo ratings yet

- Developing Customer Satisfaction - Value, and LoyaltyDocument17 pagesDeveloping Customer Satisfaction - Value, and LoyaltyDeepak AhujaNo ratings yet

- Bica Panel Notes (Final)Document6 pagesBica Panel Notes (Final)lucky mishraaNo ratings yet

- PM Exercise: Solution DocumentDocument4 pagesPM Exercise: Solution DocumentNidhi HassanNo ratings yet

- (A) Investor Protection: Attention Needs To Be Given To The Following Four AspectsDocument2 pages(A) Investor Protection: Attention Needs To Be Given To The Following Four AspectsShreyansh RavalNo ratings yet

- Banking Consumer Protection EnglishDocument28 pagesBanking Consumer Protection EnglishMoz Kamal100% (1)

- From Open Banking To Open Financial Services Website FINAL 002Document28 pagesFrom Open Banking To Open Financial Services Website FINAL 002terrygoh100% (1)

- Mifid ClassificationDocument57 pagesMifid ClassificationfizzNo ratings yet

- Competition Annual Report 2018/19Document20 pagesCompetition Annual Report 2018/19Je LevelNo ratings yet

- Document 1Document11 pagesDocument 1laukkeasNo ratings yet

- Assignment 01 - 2017010000078Document3 pagesAssignment 01 - 2017010000078Istiak HasanNo ratings yet

- The Seven Principles of Supply Chain ManagementDocument15 pagesThe Seven Principles of Supply Chain Managementsnandhni510No ratings yet

- Vetting and Screening PolicyDocument22 pagesVetting and Screening PolicyRohan NNo ratings yet

- Assessment Task 1Document12 pagesAssessment Task 1Sourav SarkarNo ratings yet

- CRM For Existing Customers - Eng Version - EditedDocument28 pagesCRM For Existing Customers - Eng Version - Editednguyen16023No ratings yet

- Cgma Customer Value Part1Document7 pagesCgma Customer Value Part1gerardkokNo ratings yet

- Credit Collection Policy Procedures and PracticesDocument28 pagesCredit Collection Policy Procedures and Practicescheska.movestorageNo ratings yet

- Delivering Excellence in Insurance Claims HandlingDocument15 pagesDelivering Excellence in Insurance Claims HandlingBui Xuan PhongNo ratings yet

- General Insurance PricingDocument8 pagesGeneral Insurance PricingSilver StoneNo ratings yet

- McKinsey Improving Capital Markets ProfitabilityDocument20 pagesMcKinsey Improving Capital Markets Profitabilitysss1453No ratings yet

- Revising For Your Strategic Business Reporting (SBR) ExamDocument9 pagesRevising For Your Strategic Business Reporting (SBR) ExamMyo NaingNo ratings yet

- MC 2022 25 CooperativesDocument79 pagesMC 2022 25 CooperativesRonnell Vic Cañeda YuNo ratings yet

- Consumer Duty Implementation - Good Practice and Areas For ImprovementDocument10 pagesConsumer Duty Implementation - Good Practice and Areas For ImprovementwNo ratings yet

- PM Guide Module 06Document38 pagesPM Guide Module 06Hossam ElsayedNo ratings yet

- Free CFA Level 3 Mock Exam (300hours)Document22 pagesFree CFA Level 3 Mock Exam (300hours)Glenn NgNo ratings yet

- Efa 09Document10 pagesEfa 09thuong13123No ratings yet

- Payment Services Directive 2 General Data Protection RegulationDocument10 pagesPayment Services Directive 2 General Data Protection RegulationchrisNo ratings yet

- Sub64 - 7eleven Stores - 4 May 2018Document16 pagesSub64 - 7eleven Stores - 4 May 2018Tan BuiNo ratings yet

- Statement of Purpose FinalDocument2 pagesStatement of Purpose FinalMohammad Dayyan KhanNo ratings yet

- Economic and Legal Feasibility Analysis RevisedDocument6 pagesEconomic and Legal Feasibility Analysis RevisedJackson KasakuNo ratings yet

- Research 2Document39 pagesResearch 2Andile MlotsaNo ratings yet

- CPP Card ProtectionDocument33 pagesCPP Card ProtectionLawrence SykesNo ratings yet

- Aberdeen SC Opitimization 1206Document34 pagesAberdeen SC Opitimization 1206Madhya BarrónNo ratings yet

- SC Finance JP Morgan PDFDocument34 pagesSC Finance JP Morgan PDFPrashanth ChidambaramNo ratings yet

- Introduction To Customer SatisfactionDocument3 pagesIntroduction To Customer SatisfactionhatebookNo ratings yet

- Debt Management Guidance Compliance Review: September 2010Document107 pagesDebt Management Guidance Compliance Review: September 2010judgmanNo ratings yet

- Customer Relationship Management at Capital One (UKDocument25 pagesCustomer Relationship Management at Capital One (UKRakesh SharmaNo ratings yet

- Accounting For Customer Loyalty Programmes - IFRS PerspectiveDocument5 pagesAccounting For Customer Loyalty Programmes - IFRS PerspectiveFauzi Al-lakadarnyaNo ratings yet

- 2 The AFCA Approach To Financial Difficulty Legal Principles, Industry Codes and Good Industry PracticeDocument10 pages2 The AFCA Approach To Financial Difficulty Legal Principles, Industry Codes and Good Industry PracticeGabriel TangNo ratings yet

- Service StrategyDocument53 pagesService StrategyHardhalwinderNo ratings yet

- The Mechanics of Law Firm Profitability: People, Process, and TechnologyFrom EverandThe Mechanics of Law Firm Profitability: People, Process, and TechnologyNo ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- LIC Receipt - RadhaDocument1 pageLIC Receipt - RadhaRohan NNo ratings yet

- Vetting and Screening PolicyDocument22 pagesVetting and Screening PolicyRohan NNo ratings yet

- IS - PROC - 007 - File Naming Convention Guideline Ver.7.0Document7 pagesIS - PROC - 007 - File Naming Convention Guideline Ver.7.0Rohan NNo ratings yet

- IS - PROC - 012 - Procedure For Data Disposal Ver.6.0Document10 pagesIS - PROC - 012 - Procedure For Data Disposal Ver.6.0Rohan NNo ratings yet

- Learning Objectives: After Studying This Chapter You Should Be Able ToDocument39 pagesLearning Objectives: After Studying This Chapter You Should Be Able ToIntan DahliaNo ratings yet

- Gospel Song Lyrics (Booklet 4)Document16 pagesGospel Song Lyrics (Booklet 4)Victor Du BoisNo ratings yet

- Analyzing A Play: CharacterDocument2 pagesAnalyzing A Play: CharacterddteoNo ratings yet

- College Recommendation SystemDocument6 pagesCollege Recommendation SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electronics Fundamentals and Applications D Chattopadhyay and P C RakshitDocument152 pagesElectronics Fundamentals and Applications D Chattopadhyay and P C RakshitBidyut RoyNo ratings yet

- b4391 QuantumDocument8 pagesb4391 QuantumlailiNo ratings yet

- Good Morning : Dharwad, Dec 2009Document222 pagesGood Morning : Dharwad, Dec 2009Dhanusha SreedharanNo ratings yet

- Biometric Based Classroom AttendenceDocument19 pagesBiometric Based Classroom AttendenceAnonymous hynO2soNo ratings yet

- Applied Economics - Quarter 1Document12 pagesApplied Economics - Quarter 1Gladys Angela ValdemoroNo ratings yet

- AKL - Pert 2-2Document2 pagesAKL - Pert 2-2Astri Ririn ErnawatiNo ratings yet

- Jee Main 2014 Solution Code E EnglishDocument23 pagesJee Main 2014 Solution Code E Englishsaneer123No ratings yet

- Assess 1 IMC Background and Creative Brief TemplateDocument3 pagesAssess 1 IMC Background and Creative Brief TemplatesudarshanNo ratings yet

- Test Bank For Sociology in Action A Canadian Perspective 2nd Edition by SymbalukDocument30 pagesTest Bank For Sociology in Action A Canadian Perspective 2nd Edition by SymbalukFern Jara100% (26)

- Influence of Inquiry-Based Science Activities On Students' AchievementDocument14 pagesInfluence of Inquiry-Based Science Activities On Students' AchievementPsychology and Education: A Multidisciplinary Journal100% (2)

- Business Objects QuestionsDocument43 pagesBusiness Objects QuestionsalgomodNo ratings yet

- YAYC Mod 2 Career Pursuit PDFDocument15 pagesYAYC Mod 2 Career Pursuit PDFSyrine Regachuelo OrcajadaNo ratings yet

- Negolas - Death House PCDocument11 pagesNegolas - Death House PCgarrett kirkNo ratings yet

- Coping Mechanisms of Students and Teachers During The CoViD-19 PandemicDocument47 pagesCoping Mechanisms of Students and Teachers During The CoViD-19 PandemicgracieNo ratings yet

- Assert Yourself - 07 - Dealing With Criticism AssertivelyDocument14 pagesAssert Yourself - 07 - Dealing With Criticism Assertivelystefanm2510No ratings yet

- Mailath - Economics703 Microeconomics II Modelling Strategic BehaviorDocument264 pagesMailath - Economics703 Microeconomics II Modelling Strategic BehaviorMichelle LeNo ratings yet

- I'jaz Al-Qur'anDocument10 pagesI'jaz Al-Qur'anhujjatunaNo ratings yet

- Complaint To Thane Police On The Sakal Hindu SamajDocument10 pagesComplaint To Thane Police On The Sakal Hindu SamajThe WireNo ratings yet

- Analisis Yuridis Terhadap Tindak Pidana Penipuan Dan Penggelapan (Studi Kasus Putusan Pengadilan Negeri Medan Nomor: 2019/Pid.B//2018/PN - MDN)Document10 pagesAnalisis Yuridis Terhadap Tindak Pidana Penipuan Dan Penggelapan (Studi Kasus Putusan Pengadilan Negeri Medan Nomor: 2019/Pid.B//2018/PN - MDN)riska agisNo ratings yet

- English QuechuaDocument3 pagesEnglish QuechuaDanteFriasNo ratings yet

- ATM For 3G - NSNDocument50 pagesATM For 3G - NSNEko MardiantoNo ratings yet

- My Final Research PaperDocument23 pagesMy Final Research PaperyenpalerNo ratings yet

- Power Plant EngineeringDocument5 pagesPower Plant EngineeringSyedNadeemAhmedNo ratings yet