Professional Documents

Culture Documents

PGDA July 2019 Final Exam Question 2 Scenario and Required

Uploaded by

Valerie Verity MarondedzeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PGDA July 2019 Final Exam Question 2 Scenario and Required

Uploaded by

Valerie Verity MarondedzeCopyright:

Available Formats

SCENARIO

Introduction

Volkswagen AG (“VW”) is a German multinational automotive1 manufacturing

company and the largest company in Germany.

In the last decade, VW has established itself as the global automotive leader. In terms

of its 2019 revenue, VW was the largest automotive company in the world with a 15%

share of the global automotive market and, in terms of units sold, was the second

largest at 10.22 million vehicles sold, with only Toyota selling more motor vehicles.

VW sells motor vehicles in approximately 150 countries and operates production

facilities in 27 of these countries. It sells motor vehicles under 12 well-known brands

including VW, Audi, Bentley, Lamborghini and Bugatti. VW directly employs over 35%

of all employees in Germany that work for automotive companies, this excludes the

indirect employment through VW suppliers.

VW’s global operations are divided primarily into two divisions, the Automotive

Division and the Financial Services Division.

• The Automotive Division designs, manufactures and distributes passenger and

commercial vehicles, motorcycles, engines, and turbo machinery.

• The Financial Services Division offers financial services that include automotive

financing, leasing and fleet management.

Strategy

VW’s strategy focuses on positioning itself as the global economic and environmental

leader among automotive manufacturers. Its strongly positioned global brands are

key factors allowing it to leverage value and to systematically increase its competitive

advantages. VW’s strategy to expand its customer base is to enter into new markets

around the world, particularly in the global growth markets and markets with low VW

presence.

VW believes it will only successfully meet these objectives if all employees – from

juniors to senior executives – consistently deliver excellence in their roles to ensure

the long-term quality of innovation and products.

From a financial perspective, disciplined cost and investment management play a

major role in ensuring that VW reaches its long-term profitability targets and

maintains strong long-term liquidity.

1

Related to motor vehicles and motor bikes.

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 2 of 8

Emissions Scandal2

On 18 March 2020, the United States Environmental Protection Agency (“EPA”) issued

a clean air violation notice to VW. This notice revealed that VW had designed computer

software for its diesel vehicles to detect when they were being tested for emissions

and to deceptively change emissions to improve results. This has become known as

the “defeat device”.

The United States (US) is a key potential growth market for VW, as it only has around

a 3% share of this market. VW has had a major push to sell diesel cars in the United

States using their efficiency as a competitive advantage. This US strategy has been

backed by a huge marketing campaign proudly highlighting its cars' low emissions.

The EPA's findings implicate only 482 000 cars in the US, the discovery has however

led to VW admitting that about 11 million cars worldwide are fitted with the defeat

device.

The consequences of this scandal have been quick with the VW share price losing 41%

of its value since the 20 March public announcement, dropping from a pre-scandal

peak of €172.38 per share to a current, 19 April 2020, price of €100.90. VW’s bonds

have been placed on a negative watch3 by the three main credit rating agencies.

Newspapers claim that VW’s top management have been aware of the use of the

defeat devices from as early as 2012. VW’s long serving CEO, Martin Winterkorn,

resigned on 23 March 2020 following the exposure of the scandal. VW has stopped

any further sales of motor vehicles with the defeat device and has issued an apology

for breaking customers’ trust.

VW’s newly appointed CEO, Mathias Müller, has remained positive, telling VW

managers in a speech that the business can come back from the scandal declaring,

“We have a good chance of shining again in two to three years.” VW has announced

that it plans to recover from the scandal by increasing its focus on electric cars.

2

Note: this scenario is based off an actual scandal that hit VW in 2015

3

A status that the credit-rating agencies give a company while they are deciding whether

to lower that company's credit rating.

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 3 of 8

Costs of scandal

VW has set aside cash of €6.5 billion to cover the expected direct and indirect costs

of the scandal, which is expected to damage VW’s business significantly, primarily in

the following 4 ways:

1. Auto Recall Costs: It is estimated that Volkswagen has 11 million vehicles that it

might have to recall and refit. VW has said that a recall and refit of the affected

vehicles will begin later in 2020 and should be completed within a year. Some of

the vehicles that need to be recalled and refitted can be modified through software

changes, but others will need new parts, such as fuel injectors, to be installed.

The total cost of a recall will depend on whether VW is required by the EPA to

recall and refit all 11 million vehicles, or only those that customers voluntarily

bring in.

2. Legal Costs: VW customers and shareholders are already preparing to file class

action lawsuits against VW for damages. Several countries are also considering

claiming back VW’s tax breaks and other incentives allowed on the basis of tested

emissions.

3. Penalties and fines: The penalties and fines imposed by various governments and

regulators for deception will likely be large, it is however difficult to estimate how

large the fines could be. The maximum total fine that regulators are theoretically

allowed to charge is estimated at €26 billion, most analysts however expect the

reality to be a lot lower.

4. Reputation / brand impact: VW could face considerable losses in future sales,

especially for diesel vehicles, due to the damaged brand image and a loss in

customer trust — all of which could play into the hands of its rivals.

Currently the total estimated scandal costs are subject to significant uncertainty, but

the market has built in a view of the cost through the price drop. The table below

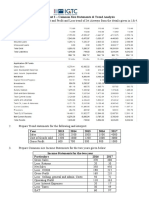

represents your best estimate of expected costs:

Scenario

Worst case Likely case Best case

Probability of 20% 50% 30%

occurrence

1 and 2 above. Car € 6 billion € 2.5 billion € 1.2 billion

recall costs and car

owner lawsuits.

3. above. Government € 26 billion € 14 billion € 2 billion

penalties and fines

(not tax deductible).

4. above. Reputation / 20% loss in EBIT for 20% loss in EBIT for 15% loss in EBIT for

brand impact 5 years before 3 years before 2 years before

recovering to original recovering to original recovering to original

expectation. expectation. expectation.

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 4 of 8

Financial information

The schedules below show selected VW financial information for the last 12 months:

Volkswagen AG - Summarised Management Balance

Sheet as at 31 March 2020

€ million

Liabilities 277 857

Trade Payables 18 338

Finance Division financial liabilities 2 73 817

Long-Term Debt 7 10 220

Other Current Liabilities 47 869

Total Current Liabilities 150 244

Long-Term Debt 7 31 620

Finance Division financial liabilities 2 68 195

Pension & Other Post-Retirement Benefits 27 798

Total Non-current Liabilities 127 613

Equity 96 162

Common Stock 1 218

Additional Paid in Capital 14 616

Retained Earnings 75 704

Other Reserves 4 417

Total Common Equity 6 95 955

Minority Interest 207

Assets 374 019

Cash and cash equivalents 15 479

Short Term Investments 3 12 191

Trade and other Receivables 28 760

Inventory 35 262

Finance Division financial assets 2 51 883

Total Current Assets 143 575

Property, Plant & Equipment 5 48 197

Long-term Investments 4 23 106

Intangible assets 5 60 127

Finance Division financial assets 2 99 014

Total Non-current Assets 230 444

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 5 of 8

Volkswagen AG – Summarised Management

Income Statement for the

last 12 months ending 31 March 2020

€ million

Revenue 1 212 426

Gross Profit 37 391

Operating expenses 5 (24 505)

Operating Income 2 12 886

Net Interest Expense (1 880)

Income from Investments 3 147

Currency Exchange Gains 529

Net profit before tax 14 682

Income Tax Expense (3 665)

Net profit 11 017

Minority Interest’s share (16)

Net profit attributable to parent equity 11 001

Supplemental information

Current number of ordinary shares

outstanding (19 April 2020) 475.7 million

Share price immediately prior to scandal

(15 March 2020) € 172.38 per share

Current share price

(19 April 2020) € 100.90 per share

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 6 of 8

Notes

1. The automotive industry in general is cyclical, with ups and downs that reflect

economic cycles. However, even after allowing for economic cycles, the industry

is in a mature phase, reflected in automotive companies’ average growth in

revenues of over the last 10 years of 5.63% per annum. Historically, growth has

been boosted by emerging economy growth, which is not expected to continue

and, as a result, the long-term VW revenue growth forecast is 3% per annum.

2. VW’s financial services division is significant in its size with a total recorded net

asset value of €8 885 million and contributes €1 917 million to the VW EBIT4

above. The net asset value is made up in full of financial instruments all classified

at fair value though profit or loss (with no impact on other comprehensive

income).

3. Short-term investments represent investments in money market deposits, which

have original maturities of between three months and twelve months.

4. Long-term investments relate to non-influential equity interests in various

strategic businesses in the automotive industry.

5. Historically, the automotive industry has always required significant investment in

plant and equipment but, in recent years, the increasing use of technology has

also pushed up research and development (R&D) costs in the industry. A good

measure of the impact of Capital Expenditure (including R&D expenditure) on free

cash flows are to look at Net Capital Expenditure5 as a percentage of EBIT. VW’s

net capital expenditure is 35% of its EBIT.

6. The following table provides information extracted relating to the cost of equity

for VW prior to the scandal.

Global automotive industry German automotive industry

Unlevered beta 0.84 0.80

Equity market risk premium 6.74% 5.58%

7. VW’s long-term debt is made up of various listed bonds and VW had, prior to the

scandal, an average credit spread of 100 basis point (i.e. 1%) more than the risk-

free rate. German government bond information is detailed below.

German government bond yields

Bond name Yield to

maturity

GTDEM2Y:GOV - 2 Year Yield -0.27%

GTDEM5Y:GOV - 5 Year Yield -0.04%

GTDEM10Y:GOV - 10 Year Yield 0.55%

GTDEM30Y:GOV - 30 Year Yield 0.80%

4

EBIT – earnings before interest and tax

5

Capital expenditure (including R&D expenditure) in excess of depreciation and

amortisation charges

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 7 of 8

Assumptions

• You should ignore the economic impact of the Coronavirus in your discussion.

• You should assume that the carrying amount of debt is the same as its market

value, and that VW’s current capital structure represents the targeted long run

optimal capital structure.

• Volkswagen’s marginal tax rate is 25%.

• Cash flows should be assumed to occur at the end or the beginning of each year

to which they relate depending on which assumption makes the most sense.

• The Hamada formula to lever and un-lever betas:

(1 − 𝑡)

𝐵𝑢 = 𝐵𝑙 ⁄[1 + ]

𝐷 ⁄𝐸

© Milpark Education PGDA MACF01-8 Final Exam 2020 Page 8 of 8

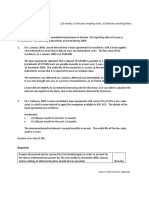

REQUIRED - AFTERNOON SESSION

Marks

Sub- Total

total

Communication skills – structure and layout, clarity of

expression and appropriate style. All throughout the question. 5

a. Critically analyse and discuss the appropriateness of VW’s

capital structure before the impact of the emissions scandal

relative to what you feel is optimal. 12

b. Calculate a weighted average cost of capital that would have

been appropriate to use in valuing VW before the emissions

scandal. Justify why you choose to exclude any items from the

capital structure (if any). 12

For the remainder of the question use a weighted average cost of capital of 6.2%.

c. Briefly discuss how the emissions scandal, and the

consequential drop in VW’s share price will impact VW’s

weighted average cost of capital. 4

d. Calculate the estimated value of a VW share before the impact

of the emissions scandal using a discounted cash flow

valuation.

• An explicit period of forecasting is not required

i.e. use 1 year for the forecast period. 14

e. Calculate the current estimated value of a VW share after

including the expected financial impact of the emissions

scandal using discounted cash flows.

• Simply adjust your answer in part d) by the expected

impact of the emissions scandal.

• Hint: Calculate a separate value for each scenario before

probability weighting. 14

f. Assuming your calculations determined that the VW shares are

worth more than their current listed price, identify and briefly

discuss any other relevant issues you would consider before

investing in VW. 9

g. Assuming you have already invested in VW. Briefly discuss how

you could, in this context, use an option financial instrument to

strategically add value to your investment. 5

TOTAL MARKS 75

© Milpark Education MACF01-8 Final Exam 2020 Page 2 of 2

You might also like

- Ey Aarsrapport 2021 22Document40 pagesEy Aarsrapport 2021 22IrinaElenaCososchiNo ratings yet

- Joaxjill NotesDocument6 pagesJoaxjill NotesAlliah Czyrielle Amorado PersinculaNo ratings yet

- Erste Group Posts Net Profit of EUR 235.3 Million in Q1 2020Document4 pagesErste Group Posts Net Profit of EUR 235.3 Million in Q1 2020Neculai CristianNo ratings yet

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- Financial Planning - ForecastingDocument4 pagesFinancial Planning - ForecastingPrathamesh411No ratings yet

- Arab Bank SwitzerlandDocument7 pagesArab Bank Switzerlandumar sohailNo ratings yet

- Financials of Fleet Power Inc. 2020 - V2Document53 pagesFinancials of Fleet Power Inc. 2020 - V2john markNo ratings yet

- Treasury MGT Assignment 2022Document3 pagesTreasury MGT Assignment 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- FM ReportDocument6 pagesFM ReportKAIF KHANNo ratings yet

- Please Find Correct Answers (Only One Answer Is Correct)Document4 pagesPlease Find Correct Answers (Only One Answer Is Correct)kevinNo ratings yet

- En Randco 2021 Agm Slideshow 20210520Document65 pagesEn Randco 2021 Agm Slideshow 20210520Xolani Radebe RadebeNo ratings yet

- Valuations Remvest - ScenarioDocument6 pagesValuations Remvest - ScenarioMoses Nhlanhla MasekoNo ratings yet

- T Systems (Report)Document219 pagesT Systems (Report)Prachi SaklaniNo ratings yet

- I. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreDocument4 pagesI. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreRahul GargNo ratings yet

- Second Quarter Fiscal Update and Economic Statement: November 2012Document16 pagesSecond Quarter Fiscal Update and Economic Statement: November 2012pkGlobalNo ratings yet

- Lobj19 - 0000052 CR Pre Sit 19 Q PDFDocument11 pagesLobj19 - 0000052 CR Pre Sit 19 Q PDFqqqNo ratings yet

- AR201920Document185 pagesAR201920utkarsh tripathiNo ratings yet

- Toyota Pakistan Ibf WordDocument20 pagesToyota Pakistan Ibf Wordifrahri123No ratings yet

- Separate Financial Statements Ferrovial 2022 DefDocument44 pagesSeparate Financial Statements Ferrovial 2022 Defyamesh.angoelal.idblvvNo ratings yet

- Hellas Telecommunications II Sca Windgr 2011 05 11 Hellas III Hellas IVDocument31 pagesHellas Telecommunications II Sca Windgr 2011 05 11 Hellas III Hellas IVabuknan5502007No ratings yet

- 01-Financial PlanningDocument18 pages01-Financial Planningyouss efNo ratings yet

- International Financial Reporting Cases Topic 1: Case 1: Transactions and Accounting EntriesDocument6 pagesInternational Financial Reporting Cases Topic 1: Case 1: Transactions and Accounting EntriesAnmol SinghNo ratings yet

- Pilipinas Shell Petroleum CorporationDocument115 pagesPilipinas Shell Petroleum Corporationkiema katsutoNo ratings yet

- CIA Cia3 AppbDocument4 pagesCIA Cia3 AppbertugrulrizvanNo ratings yet

- In CroreDocument12 pagesIn CroreGrimisha BandagaleNo ratings yet

- Bank of America Q1 2009 SlidesDocument40 pagesBank of America Q1 2009 SlidesWall Street FollyNo ratings yet

- Financial Proposal of UNITED CONSTRUCTION COMPANYDocument5 pagesFinancial Proposal of UNITED CONSTRUCTION COMPANYfayoNo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- Afm Paper DalmiaDocument5 pagesAfm Paper DalmiaasheetakapadiaNo ratings yet

- Cases Master PDFDocument11 pagesCases Master PDFSam PskovskiNo ratings yet

- Class Question 20 April 2023Document4 pagesClass Question 20 April 2023lesediNo ratings yet

- Insurance Stress TestingDocument12 pagesInsurance Stress Testingbonno28No ratings yet

- Performance Analysis - EditedDocument31 pagesPerformance Analysis - EditedAshley WoodNo ratings yet

- Investor Presentation Q4Document20 pagesInvestor Presentation Q4Anirban BhattacharyaNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- AQ - 20221114142637 - Aquila SA EN Report For Third Quarter 2022 30 09 2022Document29 pagesAQ - 20221114142637 - Aquila SA EN Report For Third Quarter 2022 30 09 2022Georgiana-Roxana VanceaNo ratings yet

- ACCA P2 Mock Exam QuestionsDocument10 pagesACCA P2 Mock Exam QuestionsGeo DonNo ratings yet

- Finance, Accounting and Risk Management: Code: AMIL38Document9 pagesFinance, Accounting and Risk Management: Code: AMIL38ilayanambiNo ratings yet

- Dec09 Inv Presentation GAAPDocument23 pagesDec09 Inv Presentation GAAPOladipupo Mayowa PaulNo ratings yet

- Research of Healthcare Facility in USADocument4 pagesResearch of Healthcare Facility in USATanmoy NaskarNo ratings yet

- Lloyds Bank PLC Q1 2019 Interim Management Statement 2 May 2019Document6 pagesLloyds Bank PLC Q1 2019 Interim Management Statement 2 May 2019saxobobNo ratings yet

- DocxDocument18 pagesDocxmarwan omarNo ratings yet

- Earning Report - 2023Document33 pagesEarning Report - 2023Molnár BálintNo ratings yet

- Group - Assignment - 2 - Fall - 20214 MICHALDocument16 pagesGroup - Assignment - 2 - Fall - 20214 MICHALhalelz69No ratings yet

- EYFR - Budget Briefing - 2022Document75 pagesEYFR - Budget Briefing - 2022Tariq HussainNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- Ifrs December 2020 Key WebDocument10 pagesIfrs December 2020 Key Webjad NasserNo ratings yet

- Premium Crm2023 New-2Document136 pagesPremium Crm2023 New-2Toyosi OlugbenleNo ratings yet

- Financial Analysis of Telecommunication SectorDocument26 pagesFinancial Analysis of Telecommunication SectorVipul Gupta100% (1)

- Corporation Finance Valuation: Valuate A Company: Amazon IncDocument11 pagesCorporation Finance Valuation: Valuate A Company: Amazon IncMinh Thu TrầnNo ratings yet

- Carvana Kerrisdale Feb 2024Document14 pagesCarvana Kerrisdale Feb 2024Armaghan AhmedNo ratings yet

- Capital Financial Services Limited Annual Report 2021-22Document403 pagesCapital Financial Services Limited Annual Report 2021-22PrabhatNo ratings yet

- Board's ReportDocument32 pagesBoard's ReportJiya ChawlaNo ratings yet

- Please Find Correct Answers (Only One Answer Is Correct)Document4 pagesPlease Find Correct Answers (Only One Answer Is Correct)kevinNo ratings yet

- Hbce 2020 Annual Report enDocument289 pagesHbce 2020 Annual Report enDheeraj BatraNo ratings yet

- FSA - Tutorial 6-Fall 2021Document5 pagesFSA - Tutorial 6-Fall 2021Ging freexNo ratings yet

- 2021-09-09 Morrisons Interim AnnouncementDocument48 pages2021-09-09 Morrisons Interim AnnouncementBassel HagagNo ratings yet

- Interim Release Q3I9M 2021Document19 pagesInterim Release Q3I9M 2021Shivanshu RaizadaNo ratings yet

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Combinations - Ifrs 3Document39 pagesBusiness Combinations - Ifrs 3Valerie Verity MarondedzeNo ratings yet

- Complex Group Statements 2022Document47 pagesComplex Group Statements 2022Valerie Verity MarondedzeNo ratings yet

- IAS 12 Income TaxDocument62 pagesIAS 12 Income TaxValerie Verity MarondedzeNo ratings yet

- Interim AcquisitionsDocument13 pagesInterim AcquisitionsValerie Verity MarondedzeNo ratings yet

- SU12 - Revenue From Contracts With Customers - 2018 - Part 2ADocument21 pagesSU12 - Revenue From Contracts With Customers - 2018 - Part 2AValerie Verity MarondedzeNo ratings yet

- SU12 - Revenue From Contracts With Customers - 2018 - Part 1Document26 pagesSU12 - Revenue From Contracts With Customers - 2018 - Part 1Valerie Verity MarondedzeNo ratings yet

- Study Unit 5.1Document26 pagesStudy Unit 5.1Valerie Verity MarondedzeNo ratings yet

- Study Unit 5.2 SlidesDocument37 pagesStudy Unit 5.2 SlidesValerie Verity MarondedzeNo ratings yet

- SU12 - Revenue From Contracts With Customers - 2018 - Part 2BDocument25 pagesSU12 - Revenue From Contracts With Customers - 2018 - Part 2BValerie Verity MarondedzeNo ratings yet

- Study Unit 6 2017Document50 pagesStudy Unit 6 2017Valerie Verity MarondedzeNo ratings yet

- Study Unit 6.1 Multiple Products 2017Document46 pagesStudy Unit 6.1 Multiple Products 2017Valerie Verity MarondedzeNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument188 pagesF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNo ratings yet

- Study Unit 5 Multiple ProductsDocument34 pagesStudy Unit 5 Multiple ProductsValerie Verity MarondedzeNo ratings yet

- Leases PQ1 Question - Lessee (Pty) LTDDocument1 pageLeases PQ1 Question - Lessee (Pty) LTDValerie Verity MarondedzeNo ratings yet

- 1 MAF P20F Exam Q2 Scenario and RequiredDocument8 pages1 MAF P20F Exam Q2 Scenario and RequiredValerie Verity MarondedzeNo ratings yet

- QUESTION 3 - Polokwane Pliers Pty Ltd-SolutionDocument3 pagesQUESTION 3 - Polokwane Pliers Pty Ltd-SolutionStaid LynxNo ratings yet

- Homework Week 7 - Revisión Del IntentoDocument5 pagesHomework Week 7 - Revisión Del IntentoRobertico LirianoNo ratings yet

- Istilah Ekonomi Dalam Bahasa InggrisDocument3 pagesIstilah Ekonomi Dalam Bahasa InggrisJuharNo ratings yet

- Fundamentals OF Investment: As Per CBCS SyllabusDocument31 pagesFundamentals OF Investment: As Per CBCS Syllabus2018 01097No ratings yet

- InvestmentDocument9 pagesInvestmentJade Malaque0% (1)

- Chapter 1 Fundamental Principles of ValuationDocument22 pagesChapter 1 Fundamental Principles of ValuationEmilyn MagoltaNo ratings yet

- Class 7 NotesDocument66 pagesClass 7 NotestimckjkjdfdNo ratings yet

- FI/CO Frequently Used Reports: ControllingDocument9 pagesFI/CO Frequently Used Reports: ControllingfinerpmanyamNo ratings yet

- Putri Anjjawati - G72217047 - P4-3Document4 pagesPutri Anjjawati - G72217047 - P4-3Putri anjjarwatiNo ratings yet

- Ratio Analysis of BMWDocument16 pagesRatio Analysis of BMWRashidsarwar01No ratings yet

- BhaskarJha, CQF, FRMProfileDocument3 pagesBhaskarJha, CQF, FRMProfileyezdiarwNo ratings yet

- BMMF5103 QuestionDocument7 pagesBMMF5103 QuestionAbdurahman Isse IgalNo ratings yet

- General Electric Company S Worldwide Performance Evaluation System Is Based OnDocument2 pagesGeneral Electric Company S Worldwide Performance Evaluation System Is Based OnAmit PandeyNo ratings yet

- 3rd Sem MBA - International FinanceDocument1 page3rd Sem MBA - International FinanceSrestha ChatterjeeNo ratings yet

- Module - 1: Planning & Analysis Overview: PhasesDocument43 pagesModule - 1: Planning & Analysis Overview: Phaseslakshmipriya_mcNo ratings yet

- May 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyDocument7 pagesMay 2020 - AP Drill 3 (Investments and Inventories) - Answer KeyROMAR A. PIGANo ratings yet

- Blackstone 1 Q 20 Earnings Press ReleaseDocument40 pagesBlackstone 1 Q 20 Earnings Press ReleaseZerohedgeNo ratings yet

- KskdraftDocument356 pagesKskdraftadhavvikasNo ratings yet

- Final Group 2Document17 pagesFinal Group 2Asnia Fuentabella ImamNo ratings yet

- Annex A (Cir1030 - 2019)Document2 pagesAnnex A (Cir1030 - 2019)Dax LorenaNo ratings yet

- Book Value Per ShareDocument18 pagesBook Value Per ShareRechelleNo ratings yet

- Insider Strategies For Profiting With Options Max AnsbacherDocument13 pagesInsider Strategies For Profiting With Options Max AnsbacherbelewjoNo ratings yet

- CH 13Document97 pagesCH 13Noheul KimNo ratings yet

- Rise and Fall of Lehman BrothersDocument4 pagesRise and Fall of Lehman BrothersMuneer Hussain100% (1)

- Fixed Exchange RateDocument7 pagesFixed Exchange RateGlenNo ratings yet

- ITFG - Bulletin 9Document7 pagesITFG - Bulletin 9TanviNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Week 7Document29 pagesWeek 7Zhaslan HamzinNo ratings yet

- FDGFDSGDFGDocument3 pagesFDGFDSGDFGJesus Colin CampuzanoNo ratings yet

- Session 7 - Equity - For Students and MoodleDocument74 pagesSession 7 - Equity - For Students and Moodless9723No ratings yet