Professional Documents

Culture Documents

Groups With Associates

Uploaded by

Tawanda Tatenda HerbertOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Groups With Associates

Uploaded by

Tawanda Tatenda HerbertCopyright:

Available Formats

GROUPS WITH ASSOCIATES

Question 1

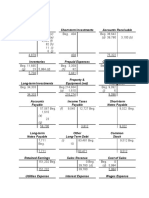

Format for consolidated SCI (including associates)

Operating profit (H Ltd + S Ltd operating profit) xxx

Share of associate’s profit before tax xxx

Profit before tax xxx

Group tax (H Ltd + S Ltd) (xxx)

Share of associate’s tax (xxx)

Profit after tax xxx

Attributable to:

Owners of the parent (determined as a residual) xxx

NCI (S Ltd’s profit after tax x NCI %) xxx

Calculation of the carrying amount of investment in associate (Equity method)

Cost of investment in an associate xxx

Add: Share of post-acquisition reserves xxx

xxx

OR

Proportion of net assets xxx

Add: Goodwill (premium) or less negative goodwill (discount) xxx

xxx

Question 1

The following financial statements relate to Harry, Stanley and Agrippa Limited.

Statement of Profit or Loss & Other Comprehensive Income for the year ended 30 June 2015

Harry Ltd Stanley Ltd Agrippa Ltd

$ $ $

Sales 980 200 490 100 245 050

Cost of goods sold (245 050) (147 030) 98 020

Gross profit 735 150 343 070 147 030

Distribution costs (98 020) (24 505) (29 406)

Administration costs (49 010) (29 406) (34 307)

1 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

Operating profits 588 120 289 159 83 317

Dividends receivable

Stanley Ltd 70 000 - -

Agrippa Ltd 12 500 - -

Profit before tax 670 620 289 159 83 317

Company tax (245 000) (107 800) (39 200)

Net profit after tax 425 620 181 359 44 117

Statements of Changes in Equity for the year ended 30 June 2015

Harry Ltd Stanley Ltd Agrippa Ltd

$ $ $

Balance b/d 946 400 283 920 185 920

Net profit after tax 425 620 181 359 44 117

1 372 020 465 279 230 037

Proposed dividends (250 000) (100 000) (50 000)

Balance c/d 1 122 020 365 279 180 037

Statement of financial position as at 30 June 2015

Harry Ltd Stanley Ltd Agrippa Ltd

Assets $ $ $

Tangible non-current assets 980 000 295 000 260 000

Investment in quoted Companies

Stanley Ltd (175,000 shares) 344 000

Agrippa Ltd (25,000 shares) 63 000

Current assets

Stock 343 070 396 981 39 208

Debtors 352 872 88 218 34 307

Dividends receivable 82 500 - -

Cash at bank 85 300 42 600 52 460

2 250 742 822 799 384 975

Equity and Liabilities

Ordinary share capital ($1 each) 500 000 250 000 100 000

Retained profits 1 122 020 365 279 180 037

Long-term liabilities 378 722 107 520 54 938

Proposed dividends 250 000 100 000 50 000

2 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

2 250 742 822 799 384 975

Additional information

When Harry Ltd acquired its shares in the other companies many years ago, the retained profits

of these companies were $150 000 and $86 200 for Stanley Ltd and Agrippa Ltd respectively.

Required

a) A consolidated statement of profit or loss and OCI for the year ended 30 June 2015 [8]

b) A consolidated statement of changes in equity for the year ended 30 June 2015 [5]

c) A consolidated statement of financial position as at 30 June 2015 [7]

[Total 20 marks]

Question 2

On 1 January 2016, May Limited acquired 75% of Bet Limited’s equity shares by means of a

share exchange of two shares in May Limited for every three Bet Limited shares acquired. On

that date, further consideration was also issued to the shareholders of Bet Limited in the form

of a $100 8% loan note for every 100 shares acquired in Bet Limited.

None of the purchase consideration, nor the outstanding interest on the loan notes at 31

March 2016, has yet been recorded by May Limited. At the date of acquisition, the share price

of May Limited and Bet Limited were $3.20 and $1.80 respectively.

The summarised statements of financial position of the two companies as at 31 March 2016

are:

May Limited Bet Limited

$’000 $’000

Assets

Non-current assets

Property, plant and equipment (note (i)) 75,200 31,500

Investment in Ano Ltd. at 1 April 2015 (note (iv)) 4,500 0

79,700 31,500

Current assets

Inventory (note (iii)) 19,400 18,800

Trade receivables (note (iii)) 14,700 12,500

Bank 1,200 600

Total assets 115,000 63,400

EQUITY AND LIABILITIES

3 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

Equity

Equity shares of $1 each 50,000 20,000

Retained earnings – at 1 April 2015 20,000 19,000

– for year ended 31 March 2016 16,000 8,000

86,000 47,000

Non-current liabilities

8% loan notes 5,000 nil

Current liabilities (note (iii)) 24,000 16,400

Total equity and liabilities 115,000 63,400

The following information is relevant:

(i) At the date of acquisition, the fair values of Bet Limited’s assets were equal to their

carrying amounts. However, Bet Limited operates a mine which requires to be

decommissioned in five years’ time. No provision has been made for these

decommissioning costs by Bet Limited. The present value (discounted at 8%) of the

decommissioning is estimated at $4m and will be paid five years from the date of

acquisition (the end of the mine’s life).

(ii) May Limited’s policy is to value the non-controlling interest at fair value at the date of

acquisition. Bet Limited’s share price at that date can be deemed to be representative of

the fair value of the shares held by the non-controlling interest.

(iii) The inventory of Bet Limited includes goods bought from May Limited for $2·1m. May

Limited applies a consistent mark-up on cost of 40% when arriving at its selling prices.

On 28 March 2016, May Limited dispatched goods to Bet Limited with a selling price of

$700,000. These were not received by Bet Limited until after the year end and so have

not been included in the above inventory at 31 March 2016.

At 31 March 2016, May Limited’s records showed a receivable due from Bet Limited of

$3m, this differed to the equivalent payable in Bet Limited’s records due to the goods in

transit.

The intra-group reconciliation should be achieved by assuming that Bet Limited had

received the goods in transit before the year end.

(iv) The investment in Ano Limited represents 30% of its voting share capital and May

Limited uses equity accounting to account for this investment. Ano Limited’s profit for

4 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

the year ended 31 March 2016 was $6m and Ano Limited paid total dividends during the

year ended 31 March 2016 of $2m. May Limited has recorded its share of the dividend

received from Ano Limited in investment income (and cash).

(v) All profits and losses accrued evenly throughout the year.

(vi) There were no impairment losses within the group for the year ended 31 March 2016.

Required:

Prepare the consolidated statement of financial position for May Limited and its subsidiaries as

at 31 March 2016. (30marks)

5 Compiled by T T Herbert (0773 038 651 / 0712 560 772)

You might also like

- Accounting 2B Final Assessment OpportunityDocument8 pagesAccounting 2B Final Assessment OpportunityThulani NdlovuNo ratings yet

- Full goodwill method consolidated financial statementsDocument29 pagesFull goodwill method consolidated financial statementsWang ChoiNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Business Accounting (LO 03,4,5) - Alternative AssessmentDocument7 pagesBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- Bacc204-Financial Accounting Iii Assignment 1Document4 pagesBacc204-Financial Accounting Iii Assignment 1Tawanda Tatenda HerbertNo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- Consolidated Financial Statements of Prather Company and SubsidiaryDocument7 pagesConsolidated Financial Statements of Prather Company and SubsidiaryImelda100% (1)

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Ac2091 ZB - 2019Document15 pagesAc2091 ZB - 2019duong duongNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Cash FlowDocument8 pagesCash FlowTarmak LyonNo ratings yet

- Analyzing Consolidated Financial StatementsDocument3 pagesAnalyzing Consolidated Financial StatementsBryle Jay LapeNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- FR 2019 Paper FinalDocument58 pagesFR 2019 Paper FinalshashalalaxiangNo ratings yet

- Ac2091 Za - 2019Document14 pagesAc2091 Za - 2019Isra WaheedNo ratings yet

- Q5 Vikings LimitedDocument2 pagesQ5 Vikings Limitedamosmalusi5No ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- Analysis and Interpretation of Financial Statements PDFDocument11 pagesAnalysis and Interpretation of Financial Statements PDFKudakwashe MujungwaNo ratings yet

- Fin Mid Fall 2020Document2 pagesFin Mid Fall 2020Shafiqul Islam Sowrov 1921344630No ratings yet

- Advanced Accounting QN August 2018 Group AssignmentDocument9 pagesAdvanced Accounting QN August 2018 Group AssignmentGift MoyoNo ratings yet

- Chow2019 SIM AC2091 MockExamA StudentDocument23 pagesChow2019 SIM AC2091 MockExamA StudentPadamchand PokharnaNo ratings yet

- 04 Extra Question Pack For Chapter 4 After Initial AcquisitionDocument3 pages04 Extra Question Pack For Chapter 4 After Initial AcquisitionhlisoNo ratings yet

- ASS ON FCI III IND OWN REV QsDocument7 pagesASS ON FCI III IND OWN REV QsJesavil SinghbalNo ratings yet

- Consolidated financial statements of Bells LtdDocument2 pagesConsolidated financial statements of Bells LtdShaikh Hafizur RahmanNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Fall FIN 254.10 Mid QuestionsDocument2 pagesFall FIN 254.10 Mid QuestionsShariar NehalNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- FAC 2602 - 2023 - S1 - Assessment 4 SolutionDocument13 pagesFAC 2602 - 2023 - S1 - Assessment 4 SolutionlennoxhaniNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- 105 - Activity 1 - Cash FlowDocument11 pages105 - Activity 1 - Cash FlowElla DavisNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Consolidation BasicsDocument5 pagesConsolidation Basicspoonamemrith22No ratings yet

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- HI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsDocument24 pagesHI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsFeku RamNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Singapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice QuestionsDocument6 pagesSingapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice Questionsduong duongNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- FAC 2602 - 2023 - S1 - Assessment 3 SolutionDocument9 pagesFAC 2602 - 2023 - S1 - Assessment 3 SolutionlennoxhaniNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- ROCE, profit margin and financial analysis of Enn LtdDocument7 pagesROCE, profit margin and financial analysis of Enn LtdKccc siniNo ratings yet

- AdvancDocument4 pagesAdvancDerick cheruyotNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Week 7 Seminar QuestionsDocument4 pagesWeek 7 Seminar QuestionsBhanu TejaNo ratings yet

- ADVANCED ACCOUNTING 2DDocument5 pagesADVANCED ACCOUNTING 2DHarusiNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Questions - ConsolidatedDocument8 pagesQuestions - ConsolidatedMo HachimNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- Accounting Advanced Level Test#1: Section A Anwser All The QuestionsDocument6 pagesAccounting Advanced Level Test#1: Section A Anwser All The QuestionsHuzaifa AbdullahNo ratings yet

- Groups With Rights Issue (2021)Document3 pagesGroups With Rights Issue (2021)Tawanda Tatenda HerbertNo ratings yet

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- ACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertDocument35 pagesACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertTawanda Tatenda HerbertNo ratings yet

- Corporate Law 2016 MAY QSNDocument5 pagesCorporate Law 2016 MAY QSNTawanda Tatenda HerbertNo ratings yet

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- ACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertDocument35 pagesACCA Corporate & Business Law - Zimbabwe (LW-ZWE) Revision Kit 2022 by T. T. HerbertTawanda Tatenda HerbertNo ratings yet

- Ifrs 5 (2021)Document9 pagesIfrs 5 (2021)Tawanda Tatenda HerbertNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- ACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertDocument30 pagesACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertTawanda Tatenda Herbert100% (1)

- Financial Instruments (2021)Document17 pagesFinancial Instruments (2021)Tawanda Tatenda Herbert100% (1)

- ACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertDocument30 pagesACCA Corporate & Business Law (LW-ZWE) Study Text 2022 by T. T. HerbertTawanda Tatenda Herbert100% (1)

- IAS 40 Investment Property (2021)Document7 pagesIAS 40 Investment Property (2021)Tawanda Tatenda HerbertNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- Ias 37 Provisions, Contingent Liabilities & Contingent AssetsDocument12 pagesIas 37 Provisions, Contingent Liabilities & Contingent AssetsTawanda Tatenda HerbertNo ratings yet

- IFRS 15 Revenue From Contracts With Customers (2021)Document20 pagesIFRS 15 Revenue From Contracts With Customers (2021)Tawanda Tatenda HerbertNo ratings yet

- Ifrs 2 Share Based Payment (2021)Document7 pagesIfrs 2 Share Based Payment (2021)Tawanda Tatenda HerbertNo ratings yet

- IAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Document5 pagesIAS 29 FINANCIAL REPORTING IN HYPERINFLATIONERY ECONOMIES (2021 Latest)Tawanda Tatenda HerbertNo ratings yet

- IAS 36 Impairment of Assets (2021)Document12 pagesIAS 36 Impairment of Assets (2021)Tawanda Tatenda HerbertNo ratings yet

- IAS 12 Income Tax GuideDocument18 pagesIAS 12 Income Tax GuideTawanda Tatenda HerbertNo ratings yet

- IAS 19 Employee Benefits (2021)Document6 pagesIAS 19 Employee Benefits (2021)Tawanda Tatenda Herbert100% (1)

- IAS 20 Government Grants (2021)Document5 pagesIAS 20 Government Grants (2021)Tawanda Tatenda HerbertNo ratings yet

- Change in Ownership (2021)Document13 pagesChange in Ownership (2021)Tawanda Tatenda HerbertNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Ias 21 Effects of Changes in Foreign Exchange RatesDocument8 pagesIas 21 Effects of Changes in Foreign Exchange RatesTawanda Tatenda HerbertNo ratings yet

- IAS 7 With Notes (2021) - GZU MastersDocument16 pagesIAS 7 With Notes (2021) - GZU MastersTawanda Tatenda HerbertNo ratings yet

- Groups With Rights Issue (2021)Document3 pagesGroups With Rights Issue (2021)Tawanda Tatenda HerbertNo ratings yet

- Hacc423 Question Bank 2021Document13 pagesHacc423 Question Bank 2021Tawanda Tatenda HerbertNo ratings yet

- Tax Question Bank 2020Document37 pagesTax Question Bank 2020Tawanda Tatenda HerbertNo ratings yet

- Horizontal Groups (2021)Document5 pagesHorizontal Groups (2021)Tawanda Tatenda HerbertNo ratings yet

- Master Template v1Document79 pagesMaster Template v1KiranNo ratings yet

- Business Income IllustrationsDocument12 pagesBusiness Income IllustrationsPatricia NjeriNo ratings yet

- US Market Recap November 29Document3 pagesUS Market Recap November 29eldime06No ratings yet

- Eternal Images General Journals Date Account Title Debit CreditDocument4 pagesEternal Images General Journals Date Account Title Debit CreditAngelica PatagNo ratings yet

- AIA SOLITAIRE PERSONAL ACCIDENTDocument16 pagesAIA SOLITAIRE PERSONAL ACCIDENTmailer68650% (2)

- Accounting for Share Capital TransactionsDocument16 pagesAccounting for Share Capital TransactionsLee Suarez100% (1)

- Zimbabwe Revenue AuthorityDocument4 pagesZimbabwe Revenue AuthorityNyasha MakoreNo ratings yet

- Kona Grill 1Q10 Earnings Beat; SSS Turn PositiveDocument6 pagesKona Grill 1Q10 Earnings Beat; SSS Turn PositiveDsp AlphaNo ratings yet

- Tutorial 10-2021-PIT2 ProblemsDocument8 pagesTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18No ratings yet

- 8908 - Installment Consignment SalesDocument5 pages8908 - Installment Consignment Salesxara mizpahNo ratings yet

- Ascertaining What Constitutes A Permanent Establishment: An Analysis of DIT vs. M/S Samsung Heavy Industries Co. LTDDocument3 pagesAscertaining What Constitutes A Permanent Establishment: An Analysis of DIT vs. M/S Samsung Heavy Industries Co. LTDplag scan0% (1)

- Final Exam, s1, 2019 FINALDocument12 pagesFinal Exam, s1, 2019 FINALShivneel NaiduNo ratings yet

- Intrinsic Value Discounted Cash Flow CalculatorDocument18 pagesIntrinsic Value Discounted Cash Flow CalculatorAndrew LeeNo ratings yet

- BAS Template PDFDocument2 pagesBAS Template PDFrajkrishna03No ratings yet

- Mar 2019 SGVDocument24 pagesMar 2019 SGVBien Bowie A. CortezNo ratings yet

- LONG TERM INVESTMENT MANAGEMENT - KesoramDocument9 pagesLONG TERM INVESTMENT MANAGEMENT - KesoramKhaisarKhaisar0% (1)

- 10 Commandments of Investing in The Stock MarketDocument9 pages10 Commandments of Investing in The Stock MarketcptnnemoNo ratings yet

- de Neeve On Lonergan Baseball DiagramDocument29 pagesde Neeve On Lonergan Baseball DiagramThomist AquinasNo ratings yet

- Overview of Financial Reporting, Financial Statement Analysis, and ValuationDocument32 pagesOverview of Financial Reporting, Financial Statement Analysis, and ValuationVũ Việt Vân AnhNo ratings yet

- LUCKY TRUCKING SERVICES - Worksheet (10column)Document3 pagesLUCKY TRUCKING SERVICES - Worksheet (10column)Bernice Jayne MondingNo ratings yet

- (B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Document3 pages(B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Kavya GopakumarNo ratings yet

- Finman 1Document49 pagesFinman 1Khai Supleo PabelicoNo ratings yet

- Chapter 1 NotesDocument16 pagesChapter 1 NotesAnnShott100% (1)

- Mba Sem - 2 M O D U L E - 4 (MCQ) Financial Management Module - 4 Dividend DecisionsDocument2 pagesMba Sem - 2 M O D U L E - 4 (MCQ) Financial Management Module - 4 Dividend DecisionsKeyur PopatNo ratings yet

- ESTATE TAXATION KEY POINTSDocument4 pagesESTATE TAXATION KEY POINTSChincel G. ANI50% (2)

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocument33 pagesComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNo ratings yet

- Sukhvinder SinghDocument2 pagesSukhvinder SinghBhavesh PopatNo ratings yet

- Summative-Test - Louise Peralta - 11 - FairnessDocument3 pagesSummative-Test - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Gross Profit Method Inventory EstimationDocument11 pagesGross Profit Method Inventory EstimationJo MalaluanNo ratings yet

- FAR.2847 Operating-Segments PDFDocument4 pagesFAR.2847 Operating-Segments PDFPhoeza Espinosa VillanuevaNo ratings yet