Professional Documents

Culture Documents

Selected Financial Information (Consolidate ($ Millions) )

Uploaded by

Kshitish0 ratings0% found this document useful (0 votes)

17 views2 pagesUniversal Circuits, Inc.

Original Title

Universal Circuits, Inc.

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUniversal Circuits, Inc.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesSelected Financial Information (Consolidate ($ Millions) )

Uploaded by

KshitishUniversal Circuits, Inc.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

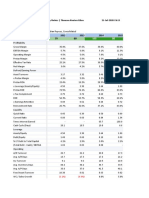

Selected Financial Information (Consolidate ($ Millions))

Particulars 1978 1979 1980 1981 1982 1983

Sales 66 100 136 156 174 214

Net Income 4.5 7 9.3 4.6 9.9 18.4

Net Profit Margin 6.82% 7.00% 6.84% 2.95% 5.69% 8.60%

EPS 0.32 0.47 0.59 0.27 0.55 0.97

Dividend 0 0 0 0 0 0

BV per share 1.72 2.23 3.05 4.02 4.69 7.79

Share Price (H) 4.5 8.5 16.5 15.375 19.75 41.75

Share Price (L) 2.25 3.25 6.5 8.375 8.75 17.5

Price/ EPS 7-14 7-18 11-28 31-57 16-36 18-43

ROA 9% 10% 9% 3% 6% 9%

ROC 14 15 15 8 10 13

ROE 21 25 23 8 13 16

LT Debt % cap 38% 45% 51% 42% 37% 15%

Equity Ratio 62% 55% 49% 58% 63% 85%

EBIT / Interest 5x 5x 3x 3x 3x 6x

Equity Book Value 22.704 33.45 48.19 69.144 84.42 148.01

Enterprise Value 37 61 98 119 134 174

Equity Value 23 33 48 69 84 148

Debt Value 14 27 50 50 50 26

Shares O/S 13.2 15 15.8 17.2 18 19

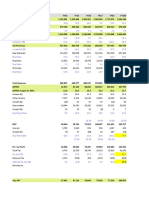

Irish Plant Estimations Based on Consolidated Statement ( of 1983)

Amount ($ Millions) % of Sales

Consolidated Sales (2013) 214

Irish Plant % 0.25

Estimated Sales of Irish Plant 53.5 100%

Direct Cost of Sales 25.7 48%

Direct Margin 27.8 52%

Operating Expenses 18.2 34%

Contribution Margin 9.6 18%

Other Income/expense 1.6 3%

Profit Before Tax 8.0 15%

Equivalent Calculaions Impact of exchange rate fluctuation

Amount ($ Millions) Amount ($ Millions)

Estimated Sales of Irish Plant 53.5 53.5

Total Cost/Expense (in US $) 18.0 18.0

Total Cost/Expense (in punts) 27.5 40.6

Profit Before Tax 8.0 -5.0

You might also like

- Eastboro Machine Tools - Class (Version 1)Document12 pagesEastboro Machine Tools - Class (Version 1)Shriniwas Nehete100% (1)

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Purchases / Average Payables Revenue / Average Total AssetsDocument7 pagesPurchases / Average Payables Revenue / Average Total AssetstannuNo ratings yet

- Gainesboro SolutionDocument7 pagesGainesboro SolutionakashNo ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Key Operating Financial DataDocument1 pageKey Operating Financial DataShbxbs dbvdhsNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- Earnings Highlight - DANGSUGAR PLC 9M 2016Document1 pageEarnings Highlight - DANGSUGAR PLC 9M 2016LawNo ratings yet

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Document4 pagesSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareNo ratings yet

- GP PetroleumsDocument44 pagesGP Petroleumssingh66222No ratings yet

- Likhitha InfraDocument26 pagesLikhitha InfraMoulyaNo ratings yet

- CG Ratio-Analysis-UnsolvedDocument15 pagesCG Ratio-Analysis-Unsolvedsumit3902No ratings yet

- Woof-JunctionDocument13 pagesWoof-Junctionlauvictoria29No ratings yet

- %sales Discount %yoy 18.5% 22.5% 1.8%Document2 pages%sales Discount %yoy 18.5% 22.5% 1.8%Linh NguyenNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDocument9 pagesWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- Colgate Ratio Analysis SolvedDocument12 pagesColgate Ratio Analysis Solved2442230910No ratings yet

- NOCILDocument44 pagesNOCILsingh66222No ratings yet

- Adidas Group Consolidated Income Statement (IFRS) : Net SalesDocument4 pagesAdidas Group Consolidated Income Statement (IFRS) : Net SalesPranit ShahNo ratings yet

- Iblf Excel (Mehedi)Document12 pagesIblf Excel (Mehedi)Md. Mehedi HasanNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Income Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2Document9 pagesIncome Statement Balance Sheet Cash Flow Ratios FCFF Eva & Roic News Analysis 1 News Analysis 2ramarao1981No ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- BAJAJ AUTO LTD - Quantamental Equity Research ReportDocument1 pageBAJAJ AUTO LTD - Quantamental Equity Research ReportVivek NambiarNo ratings yet

- Colgate Financial Model SolvedDocument36 pagesColgate Financial Model SolvedSundara MoorthyNo ratings yet

- Βequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%Document10 pagesΒequity = Βasset (1+ (1-Tc) X B/S) : Asset Beta 0.71 0.63 0.8 Average 0.725 Tax 40%AkashNachraniNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Werner - Financial Model - Final VersionDocument2 pagesWerner - Financial Model - Final VersionAmit JainNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- Activity 3 123456789Document7 pagesActivity 3 123456789Jeramie Sarita SumaotNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Financial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMDocument35 pagesFinancial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMahmad syaifudinNo ratings yet

- Corporate Break-Up CalculationDocument5 pagesCorporate Break-Up CalculationNachiketaNo ratings yet

- Session 1 RatiosDocument1 pageSession 1 Ratios100507861No ratings yet

- Sunpharma EditedDocument6 pagesSunpharma EditedBerkshire Hathway coldNo ratings yet

- ST BK of IndiaDocument42 pagesST BK of IndiaSuyaesh SinghaniyaNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Veto SwitchgearsDocument44 pagesVeto Switchgearssingh66222No ratings yet

- Matrimony Fact Sheet Q2fy18 PDFDocument1 pageMatrimony Fact Sheet Q2fy18 PDFKanchanNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Análisis Equipo Nutresa Lina - Caso HanssenDocument24 pagesAnálisis Equipo Nutresa Lina - Caso HanssenSARA ZAPATA CANONo ratings yet

- Millions of Dollars Except Per-Share DataDocument23 pagesMillions of Dollars Except Per-Share DataPedro José ZapataNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Financial Analysis OrascomDocument11 pagesFinancial Analysis OrascomMahmoud Elyamany100% (1)

- Ashok Leyland Kotak 050218Document4 pagesAshok Leyland Kotak 050218suprabhattNo ratings yet

- Final Sheet DCF - With SynergiesDocument4 pagesFinal Sheet DCF - With SynergiesAngsuman BhanjdeoNo ratings yet

- Berkley 2009 AnnualReportDocument122 pagesBerkley 2009 AnnualReportbpd3kNo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- FIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadDocument3 pagesFIN 3512 Fall 2019 Quiz #1 9.18.2019 To UploadgNo ratings yet

- Hoàng Lê Hải Yến-Internal AuditDocument3 pagesHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Document68 pagesCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishNo ratings yet

- Firm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearDocument9 pagesFirm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearKshitishNo ratings yet

- The Teuer Furniture CaseDocument7 pagesThe Teuer Furniture CaseKshitish100% (9)

- Nestle & AlconDocument5 pagesNestle & AlconKshitishNo ratings yet

- CGT19008, 19018, 19024, 19027, 19029 - EMI GroupDocument5 pagesCGT19008, 19018, 19024, 19027, 19029 - EMI GroupKshitishNo ratings yet

- CGT19008, 19018, 19024, 19027, 19029 - Medfield PharmaDocument9 pagesCGT19008, 19018, 19024, 19027, 19029 - Medfield PharmaKshitishNo ratings yet

- Nuclear, Coal Case StudyDocument14 pagesNuclear, Coal Case StudyKshitishNo ratings yet

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDocument7 pagesCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishNo ratings yet

- Firm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearDocument2 pagesFirm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearKshitishNo ratings yet

- UST Case Study As of 1993: March 2016Document19 pagesUST Case Study As of 1993: March 2016KshitishNo ratings yet

- Teuer IntroductionDocument1 pageTeuer IntroductionKshitishNo ratings yet

- UST FinancialDocument1 pageUST FinancialKshitishNo ratings yet

- Company Background: Teuer FurnitureDocument5 pagesCompany Background: Teuer FurnitureKshitishNo ratings yet

- Teuer ReportDocument1 pageTeuer ReportKshitishNo ratings yet

- UstDocument1 pageUstKshitishNo ratings yet

- Debt Policy at UST Inc - 1Document6 pagesDebt Policy at UST Inc - 1KshitishNo ratings yet

- UST CaseDocument1 pageUST CaseKshitishNo ratings yet

- Case Introduction USTDocument1 pageCase Introduction USTKshitishNo ratings yet

- Company's Growth Prospective:: Analysis and InterpretationDocument4 pagesCompany's Growth Prospective:: Analysis and InterpretationKshitishNo ratings yet

- UST RecommendationDocument1 pageUST RecommendationKshitishNo ratings yet

- Valuation Impact of Recapitalization Existing Condition (12/31/1998) $1 Billion Recap PlanDocument1 pageValuation Impact of Recapitalization Existing Condition (12/31/1998) $1 Billion Recap PlanKshitishNo ratings yet

- UST AnalysisDocument1 pageUST AnalysisKshitishNo ratings yet

- UST Business IssueDocument1 pageUST Business IssueKshitishNo ratings yet

- The Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyDocument12 pagesThe Noble Group: Brienne Bowen, Emily Phipps, Adam Foley, Jeff Schroeder, Michael MalloyKshitishNo ratings yet

- Polaroid Corporation - MP19006, 19015, 19016,19026Document8 pagesPolaroid Corporation - MP19006, 19015, 19016,19026KshitishNo ratings yet

- Analysis and InterpretationDocument3 pagesAnalysis and InterpretationKshitishNo ratings yet

- Case Background NobleDocument1 pageCase Background NobleKshitishNo ratings yet

- Analysis Report USTDocument1 pageAnalysis Report USTKshitishNo ratings yet

- Capital Equity Preference SharesDocument5 pagesCapital Equity Preference SharesKshitishNo ratings yet

- Case BackgroundDocument5 pagesCase BackgroundKshitishNo ratings yet

- Week - 2 Assignment ADocument1 pageWeek - 2 Assignment AJulan Calo CredoNo ratings yet

- Rashid Ahmed Barkat Ali V.Rossay NTN: 00000000000: Web Generated BillDocument1 pageRashid Ahmed Barkat Ali V.Rossay NTN: 00000000000: Web Generated BillfahidNo ratings yet

- Invoice HruthikDocument1 pageInvoice Hruthikhhruti6No ratings yet

- E-Way Bill System 4416Document1 pageE-Way Bill System 4416Lazzieey RahulNo ratings yet

- G.R. No. 169507 Air Canada Vs Cir FactsDocument2 pagesG.R. No. 169507 Air Canada Vs Cir FactsLizzette Dela PenaNo ratings yet

- Invoice Baby Cart LLP: GST No:27ADXFS4779C1ZBDocument8 pagesInvoice Baby Cart LLP: GST No:27ADXFS4779C1ZBSuryapratap Singh SikarwarNo ratings yet

- Illustrative Costing Guideline 2022-2023 (Reviewed 26 May 2022)Document1 pageIllustrative Costing Guideline 2022-2023 (Reviewed 26 May 2022)SamanthaNo ratings yet

- TAX 2202E TBS01 03.solutionDocument3 pagesTAX 2202E TBS01 03.solutionZhitong LuNo ratings yet

- Case Digest in Taxation, GoncenaDocument15 pagesCase Digest in Taxation, GoncenaMaRites GoNcenANo ratings yet

- SA300535Document1 pageSA300535JEFF WONNo ratings yet

- 861 EvidenceDocument5 pages861 Evidencelegalmatters100% (1)

- Invoice TNTDocument1 pageInvoice TNTAbas AbasariNo ratings yet

- Past Paper 2015 BCom Part 2 Business Taxation PDFDocument3 pagesPast Paper 2015 BCom Part 2 Business Taxation PDFdilbaz karimNo ratings yet

- Payslip 20200731Document1 pagePayslip 20200731Sg BalajiNo ratings yet

- Foreign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromDocument9 pagesForeign Trade Policy: - Listing and Describing of Incentives Provided For Exports FromShubham SinghNo ratings yet

- MACEDA v. MACARAIGDocument2 pagesMACEDA v. MACARAIGRose De JesusNo ratings yet

- 4995628Document5 pages4995628mohitgaba19100% (1)

- Set ADocument11 pagesSet ALizi100% (1)

- XLS EngDocument3 pagesXLS EngSalmaNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalaryANKIT_JAIN84No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)DRAGO GAMINGNo ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- Order Invoice RD16939771751917681Document3 pagesOrder Invoice RD16939771751917681Archana MtaNo ratings yet

- How To Find Help With Rent For Single MomsDocument6 pagesHow To Find Help With Rent For Single MomsSingleNo ratings yet

- BIR Ruling DA-058-08 (Reimbursement - Affiliates)Document4 pagesBIR Ruling DA-058-08 (Reimbursement - Affiliates)joefieNo ratings yet

- Prestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Document1 pagePrestige Atlas 3.0 Induction Cooktop: Grand Total 999.00Alok KumarNo ratings yet

- M Y Singhania and Co. - Individual TaxationDocument6 pagesM Y Singhania and Co. - Individual TaxationYogesh Kumar SinghaniaNo ratings yet

- ACCOUNTING EQUATION, JOURNAL LEDGER - SolutionDocument4 pagesACCOUNTING EQUATION, JOURNAL LEDGER - SolutionRitika Das100% (1)

- FED (Federal Excise Duty)Document4 pagesFED (Federal Excise Duty)Imran UmarNo ratings yet

- Income Tax Calculator - FY 2011-12 (FINAL)Document16 pagesIncome Tax Calculator - FY 2011-12 (FINAL)hamzabashamNo ratings yet