Professional Documents

Culture Documents

Sun Pharma's financial performance analysis

Uploaded by

Berkshire Hathway cold0 ratings0% found this document useful (0 votes)

15 views6 pagesOriginal Title

Sunpharma-edited

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views6 pagesSun Pharma's financial performance analysis

Uploaded by

Berkshire Hathway coldCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 6

A C E F H

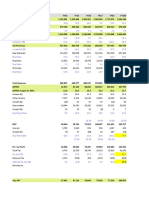

1 Sun Pharmaceutical Industries Ltd

2 Financial (Rs million) Mar-19 y-o-y change Mar-18 y-o-y change

(%) (%)

3 Net sales 97,833 27.1 76,962 3.7

4 Other operating income 5,651 116.0 2,616 -8.5

5 Total Operating Revenue 103,484 30.0 79,578 3.3

6 Total cost of sales 85,002 8.5 78,355 3.2

7 Raw material consumed 41,095 3.7 39,632 4.7

8 Power & fuel 4,073 8.3 3,762 9.0

9 Labour cost 15,713 -2.9 16,177 8.8

10 Selling & distribution 6,460 17.2 5,510 -17.4

11 Other cost 17,660 33.0 13,275 1.4

12 Expenditure capitalised - - - -

13 EBITDA 18,482 n.m. 1,223 8.7

14 Interest & Finance charges 5,409 39.3 3,883 73.7

15 Depreciation 5,530 27.9 4,322 3.3

16 OPBT 7,543 208.0 (6,983) -31.8

17 Non operating income 10,022 3.9 9,642 280.4

18 Cash/Non-cash adjustment 183 -34.2 278 993.3

19 Extra-ordinary (10,553) -29.7 (8,137) -437.5

Income/(Expenses)

20 PBT 7,194 238.4 (5,200) n.m.

21 Tax (972) -282.6 (254) n.m.

22 PAT 8,166 265.1 (4,946) n.m.

23 Key Ratios Mar-19 Mar-18

24 Net sales growth Per cent 27.1 3.7

25 EBITDA growth Per cent 1,411.3 8.7

26 EBITDA margins Per cent 17.9 1.5

27 Net profit margins Per cent 7.9 (6.2)

28 RoCE Per cent 4.7 (0.5)

29 Tangible Net Worth Rs Million 223,881 195,435

30 Capital Employed Rs Million 280,731 256,758

31 Gearing Times 0.3 0.4

32 Net Cash Accrual/total debt Times 0.1 (0.1)

33 Interest coverage Times 3.4 0.8

34 Assets turnover ratio Times 1.7 1.5

35 Current ratio Times 1.0 0.6

36 Debtor Days Days 188 135

37 Creditor Days Days 191 229

38 Days Inventory Days 120 99

39 n.m. : Not meaningful

40 Source : CRISIL Research

Verticle Analysis

Financial (Rs million) Mar-19 Mar-18 Mar-17 Mar-16

Total cost of sales 85,002 78,355 75,928 81,015

Raw material consumed 41,095 39,632 37,861 34,170

Power & fuel 4,073 3,762 3,452 3,705

Labour cost 15,713 16,177 14,862 14,767

Selling & distribution 6,460 5,510 6,668 8,241

Other cost 17,660 13,275 13,086 20,132

Cost Part

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Mar-19 Mar-18 Mar-17 Mar-16 Mar-15

Total cost of sales Raw material consumed Power & fuel

Labour cost Selling & distribution Other cost

I K M

Mar-17 y-o-y Mar-16 y-o-y Mar-15

change change

(%) (%)

74,195 4 71,098 8 77,436

2,859 -53 6,131 -55 3,945

77,054 0 77,230 5 81,381

75,928 -6 81,015 4 84,824

37,861 11 34,170 11 38,589

3,452 -7 3,705 3 3,825

14,862 1 14,767 1 14,867

6,668 -19 8,241 10 9,136

13,086 -35 20,132 -9 18,407

- - - - -

1,125 -130 (3,785) -10 (3,443)

2,236 -61 5,741 -4 5,513

4,186 -10 4,643 24 6,115

(5,296) -63 (14,169) 6 (15,070)

2,535 145 1,035 47 1,944

25 -49 49 125 (199)

2,411 7 2,263 189 (2,550)

(324) -97 (10,821) 32 (15,874)

25 -55 55 105 (1,133)

(349) -97 (10,875) 26 (14,741)

Mar-17 Mar-16 Mar-15

4.4 (8.2) 184.3

(70.3) (210.0) (231.4)

1.5 (4.9) (4.2)

(0.5) (14.1) (18.1)

0.7 (1.8) (5.2)

207,777 218,301 227,120

260,726 269,072 295,227

0.3 0.3 0.3

0.0 (0.3) (0.3)

2.7 (0.1) (0.8)

1.8 1.6 2.1

0.6 0.7 0.7

132 101 83

202 189 140

110 96 94

Mar-15

84,824 Cost Part

38,589

3,825

90,000

14,867

80,000

9,136

70,000

18,407

60,000

50,000

40,000

30,000

20,000

10,000

0

Mar-19 Mar-18 Mar-17 Mar-16 Mar-15

Total cost of sales Raw material consumed Power & fuel

Labour cost Selling & distribution Other cost

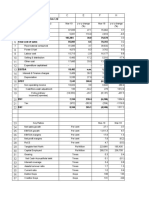

COMMON SIZE STATEMENT

Mar-19 18-Mar 17-Mar 16-Mar 15-Mar

95% 97% 96% 92% 95%

5% 3% 4% 8% 5%

100% 100% 100% 100% 100%

82% 98% 99% 105% 104%

40% 50% 49% 44% 47%

4% 5% 4% 5% 5%

15% 20% 19% 19% 18%

6% 7% 9% 11% 11%

17% 17% 17% 26% 23%

18% 2% 1% -5% -4%

5% 5% 3% 7% 7%

5% 5% 5% 6% 8%

7% -9% -7% -18% -19%

10% 12% 3% 1% 2%

0% 0% 0% 0% 0%

-10% -10% 3% 3% -3%

7% -7% 0% -14% -20%

-1% 0% 0% 0% -1%

8% -6% 0% -14% -18%

Mar-16 Mar-15

Power & fuel

Other cost

You might also like

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document17 pagesFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Berkshire Hathway coldNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)tarun lahotiNo ratings yet

- Financial (Rs Million) Mar-20 Mar-19 Mar-18 Mar-17 Mar-16 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-20 Mar-19 Mar-18 Mar-17 Mar-16 Y-O-Y Change (%) Y-O-Y Change (%)saifrahmanNo ratings yet

- Jindal Steel & Power Financial Performance OverviewDocument1 pageJindal Steel & Power Financial Performance OverviewsaifrahmanNo ratings yet

- Ashok LeylandDocument27 pagesAshok LeylandBerkshire Hathway coldNo ratings yet

- Financial Statement: Bajaj Auto LTDDocument20 pagesFinancial Statement: Bajaj Auto LTDrohanNo ratings yet

- Akash Cost AssignmentDocument10 pagesAkash Cost AssignmentAkash HedaooNo ratings yet

- Bajaj AnalysisDocument64 pagesBajaj AnalysisKetki PuranikNo ratings yet

- Financial Ratios of Home Depot and Lowe'sDocument30 pagesFinancial Ratios of Home Depot and Lowe'sM UmarNo ratings yet

- Pidilite Industries Income StatementDocument4 pagesPidilite Industries Income StatementRehan TyagiNo ratings yet

- Company DataDocument10 pagesCompany DataAvengers HeroesNo ratings yet

- Referensi Keuangan GreenfreshDocument5 pagesReferensi Keuangan GreenfreshTaufik HidayatNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- Hero-MotoCorp - Annual ReportDocument40 pagesHero-MotoCorp - Annual ReportAdarsh DhakaNo ratings yet

- Chapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Document6 pagesChapter:-3 Finance Department: 3.1. Trading and P&L Account (How They Maintain, What Is The Present Status Etc.)Ashfaq ShaikhNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Group 2 employee detailsDocument20 pagesGroup 2 employee detailsReeja Mariam MathewNo ratings yet

- A E L (AEL) : Mber Nterprises TDDocument8 pagesA E L (AEL) : Mber Nterprises TDdarshanmadeNo ratings yet

- Vodafone Idea Limited: PrintDocument1 pageVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Housing - PandL PDFDocument1 pageHousing - PandL PDFAbdul Khaliq ChoudharyNo ratings yet

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Ruchi, Purvi & Anam (FM)Document7 pagesRuchi, Purvi & Anam (FM)045Purvi GeraNo ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- Acova Radiateurs SolutionDocument14 pagesAcova Radiateurs SolutionSarvagya Jha100% (1)

- MERCURY ACTION ATHLETIC Synergies & Assumptions AnalysisDocument10 pagesMERCURY ACTION ATHLETIC Synergies & Assumptions AnalysisSimón SegoviaNo ratings yet

- Tech MahindraDocument11 pagesTech MahindraDakshNo ratings yet

- Financial Ratio Analysis Nestle India 2018: Akash Singh Niraj Abhijeet Pande Ramya EDocument14 pagesFinancial Ratio Analysis Nestle India 2018: Akash Singh Niraj Abhijeet Pande Ramya Eabhijeet pandeNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- CAGRDocument7 pagesCAGRAsis NayakNo ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- Company 1 Yr1 Yr2 EPS 10 11 Price 100 110Document38 pagesCompany 1 Yr1 Yr2 EPS 10 11 Price 100 110Bhaskar RawatNo ratings yet

- COMPARATIVE STATEMENT ANALYSISDocument4 pagesCOMPARATIVE STATEMENT ANALYSISTARVEEN DuraiNo ratings yet

- Balancesheet - Tata Motors LTDDocument9 pagesBalancesheet - Tata Motors LTDNaveen KumarNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- Corporate Valuation: Tata Motors LTDDocument10 pagesCorporate Valuation: Tata Motors LTDUTKARSH PABALENo ratings yet

- DCF Valuation ExerciseDocument18 pagesDCF Valuation ExerciseAkram MohiddinNo ratings yet

- DCFValuation JKTyre1Document195 pagesDCFValuation JKTyre1Chulbul PandeyNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- UltraTech Cements and Jaiprakash AssociatesDocument8 pagesUltraTech Cements and Jaiprakash AssociatesanushaNo ratings yet

- Mett International Pty LTD Financial Forecast 3 Year SummaryDocument134 pagesMett International Pty LTD Financial Forecast 3 Year SummaryJamilexNo ratings yet

- Common Size Analysis: Hul Profit and Loss StatementDocument7 pagesCommon Size Analysis: Hul Profit and Loss Statementamlan dasNo ratings yet

- ACC EPS and Valuation ReportDocument25 pagesACC EPS and Valuation ReportprathamNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Tata ChemicalsL LEVERAGEDocument2 pagesTata ChemicalsL LEVERAGEsarangdharNo ratings yet

- Condensed Consolidated Statements of Operations (Unaudited)Document1 pageCondensed Consolidated Statements of Operations (Unaudited)Heng SokhaNo ratings yet

- Persistent KPIT - Merger ModelDocument86 pagesPersistent KPIT - Merger ModelAnurag JainNo ratings yet

- Almarai's Quality and GrowthDocument128 pagesAlmarai's Quality and GrowthHassen AbidiNo ratings yet

- 07. Nke Model Di VincompleteDocument10 pages07. Nke Model Di VincompletesalambakirNo ratings yet

- Hero Model - Equivalue 2Document48 pagesHero Model - Equivalue 2Neha RadiaNo ratings yet

- Profit and LossDocument2 pagesProfit and LossSourav RajeevNo ratings yet

- Annual Report 2016: Financial SectionDocument39 pagesAnnual Report 2016: Financial SectionAlezNgNo ratings yet

- "A Comprehensive Study of Currency Market in India.": A Dissertation Report ONDocument64 pages"A Comprehensive Study of Currency Market in India.": A Dissertation Report ONBerkshire Hathway coldNo ratings yet

- Simulation Monte Carlo TechniqueDocument16 pagesSimulation Monte Carlo TechniqueBerkshire Hathway coldNo ratings yet

- Horizontal & Vertical Analysis of Maruti Suzuki India LtdDocument17 pagesHorizontal & Vertical Analysis of Maruti Suzuki India LtdBerkshire Hathway coldNo ratings yet

- Sunpharma UpdatedDocument9 pagesSunpharma UpdatedBerkshire Hathway coldNo ratings yet

- Dissertation Synopsis Project Report OnDocument5 pagesDissertation Synopsis Project Report OnBerkshire Hathway coldNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Berkshire Hathway coldNo ratings yet

- Gold-As Investment Perspective: Dissertation Project Report On " "Document4 pagesGold-As Investment Perspective: Dissertation Project Report On " "Berkshire Hathway coldNo ratings yet

- Gold and Investor's Perspective in Different Market Conditions PDFDocument10 pagesGold and Investor's Perspective in Different Market Conditions PDFBerkshire Hathway coldNo ratings yet

- Hindustan Unilever Limited (Hul)Document2 pagesHindustan Unilever Limited (Hul)Berkshire Hathway coldNo ratings yet

- Dissertation Anagh PDFDocument30 pagesDissertation Anagh PDFBerkshire Hathway coldNo ratings yet

- Snehil CVDocument3 pagesSnehil CVBerkshire Hathway coldNo ratings yet

- Shubham Singhal (BM-019163) ResumeDocument2 pagesShubham Singhal (BM-019163) ResumeBerkshire Hathway coldNo ratings yet

- ProjectionsDocument13 pagesProjectionsBerkshire Hathway coldNo ratings yet

- Kitty PartyDocument1 pageKitty PartyBerkshire Hathway coldNo ratings yet

- Sunpharma UpdatedDocument9 pagesSunpharma UpdatedBerkshire Hathway coldNo ratings yet

- New Doc 2019-08-20 09.40.16 PDFDocument38 pagesNew Doc 2019-08-20 09.40.16 PDFBerkshire Hathway coldNo ratings yet

- Revised Resume SampleDocument2 pagesRevised Resume SampleBerkshire Hathway coldNo ratings yet

- Snehil CVDocument3 pagesSnehil CVBerkshire Hathway coldNo ratings yet

- 10 - Social & Mobile MarketingDocument15 pages10 - Social & Mobile MarketingShubhi jainNo ratings yet

- SSCVDocument2 pagesSSCVBerkshire Hathway coldNo ratings yet

- Revised Resume SampleDocument2 pagesRevised Resume SampleBerkshire Hathway coldNo ratings yet

- UP16300410 Application Number: 200310093206: Test DetailsDocument4 pagesUP16300410 Application Number: 200310093206: Test DetailsBerkshire Hathway coldNo ratings yet

- 4 - Introduction To MarketingDocument45 pages4 - Introduction To MarketingBerkshire Hathway coldNo ratings yet

- Prakshal Jain: Career ObjectiveDocument3 pagesPrakshal Jain: Career ObjectiveBerkshire Hathway coldNo ratings yet

- Portfolio ManagementDocument75 pagesPortfolio Managementsheemankhan82% (17)

- BM 019121Document2 pagesBM 019121Berkshire Hathway coldNo ratings yet

- The Shareholder Wealth Maximization Norm and Industrial OrganizatDocument20 pagesThe Shareholder Wealth Maximization Norm and Industrial OrganizatBerkshire Hathway coldNo ratings yet

- Cab - PGDM I PDFDocument43 pagesCab - PGDM I PDFBerkshire Hathway coldNo ratings yet

- Multiple page document scanned by CamScannerDocument38 pagesMultiple page document scanned by CamScannerBerkshire Hathway coldNo ratings yet

- Argumentative EssayDocument4 pagesArgumentative Essayapi-359901349No ratings yet

- What You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)Document26 pagesWhat You'Ve Been Missing (Pilot) Season 01 Episode 01 (10.22.10)8thestate50% (2)

- Correspondence Between BVAG and CLLR Mark WilliamsDocument12 pagesCorrespondence Between BVAG and CLLR Mark WilliamsBermondseyVillageAGNo ratings yet

- General Rules - APA FormattingDocument3 pagesGeneral Rules - APA FormattingSYafikFikkNo ratings yet

- Metaphysical Foundation of Sri Aurobindo's EpistemologyDocument25 pagesMetaphysical Foundation of Sri Aurobindo's EpistemologyParul ThackerNo ratings yet

- Chapters 1-5Document139 pagesChapters 1-5Deanne Lorraine V. GuintoNo ratings yet

- Römer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Document186 pagesRömer, Schmid, Bühler, Joseph Story BTWN Egypt & Israel 2021Keith Hurt100% (1)

- Critical Infrastructure ProtectionDocument8 pagesCritical Infrastructure ProtectionAndrei Muresan100% (1)

- Humanities Concept PaperDocument6 pagesHumanities Concept PaperGabriel Adora70% (10)

- Introduction To Apollo PharmacyDocument5 pagesIntroduction To Apollo Pharmacyadv_pvtNo ratings yet

- MyselfDocument33 pagesMyselfanupa bhattaraiNo ratings yet

- Student portfolio highlights work immersion experiencesDocument28 pagesStudent portfolio highlights work immersion experiencesJohn Michael Luzaran ManilaNo ratings yet

- Wilkins, A Zurn CompanyDocument8 pagesWilkins, A Zurn CompanyHEM BANSALNo ratings yet

- Affidavit of Loss (Official Receipt)Document5 pagesAffidavit of Loss (Official Receipt)Christian GonzalesNo ratings yet

- Business Cycles & Theories of Business CyclesDocument7 pagesBusiness Cycles & Theories of Business CyclesAppan Kandala VasudevacharyNo ratings yet

- Market StructuresDocument5 pagesMarket StructuresProfessor Tarun DasNo ratings yet

- Sri Venkateswara College - Tech Fest Sponsorship LetterDocument2 pagesSri Venkateswara College - Tech Fest Sponsorship Letterrachitbhatnagar9038100% (5)

- Coleridge's Gothic Style Revealed in PoemsDocument2 pagesColeridge's Gothic Style Revealed in PoemsarushiNo ratings yet

- LiquidityDocument26 pagesLiquidityPallavi RanjanNo ratings yet

- Ann Joo Steel BHD V Pengarah Tanah Dan Galian Negeri Pulau Pinang Anor and Another Appeal (2019) 9 CLJ 153Document24 pagesAnn Joo Steel BHD V Pengarah Tanah Dan Galian Negeri Pulau Pinang Anor and Another Appeal (2019) 9 CLJ 153attyczarNo ratings yet

- Annuities and Sinking FundsDocument99 pagesAnnuities and Sinking Funds张荟萍No ratings yet

- Essay USP B. Inggris 21-22 PDFDocument3 pagesEssay USP B. Inggris 21-22 PDFMelindaNo ratings yet

- Antique Meissen MarksDocument14 pagesAntique Meissen MarksOana Dragoi50% (2)

- David Redman InterviewDocument2 pagesDavid Redman InterviewSue Fenton at F Words Journalism & CopywritingNo ratings yet

- Oil & Gas Industry in Libya 3Document16 pagesOil & Gas Industry in Libya 3Suleiman BaruniNo ratings yet

- Managing CADocument285 pagesManaging CAraghavsarikaNo ratings yet

- Case 1 - Ermita-Malate Hotel and Motel Operators Association Inc Vs City Mayor of ManilaDocument3 pagesCase 1 - Ermita-Malate Hotel and Motel Operators Association Inc Vs City Mayor of ManilaArlen RojasNo ratings yet

- NDMC vs Prominent Hotels Limited Delhi High Court Judgement on Licence Fee DisputeDocument84 pagesNDMC vs Prominent Hotels Limited Delhi High Court Judgement on Licence Fee DisputeDeepak SharmaNo ratings yet

- Finding Buyers Leather Footwear - Italy2Document5 pagesFinding Buyers Leather Footwear - Italy2Rohit KhareNo ratings yet

- Islamic Cultural Centre Architectural ThesisDocument4 pagesIslamic Cultural Centre Architectural Thesisrishad mufas100% (1)