Professional Documents

Culture Documents

Activities For OM 103

Uploaded by

Trina Mae BarrogaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activities For OM 103

Uploaded by

Trina Mae BarrogaCopyright:

Available Formats

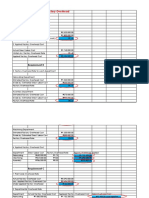

Activities for OM 103: Job order costing and Cost Behavior (Straight Problems)

Problem 1:

Data about Annabelle Company’s production and inventories for June are as follows:

Purchases – direct materials Php 143,440

Freight in 5,000

Direct Labor 175,000

Actual Factory Overhead 120,000

Inventories: June 1 June 30

Finished Goods 68,000 56,000

Work in Process 110,000 135,000

Direct Materials 52,000 44,000

Annabelle Company applies factory overhead to production at 80% of direct labor cost. Over- or

underapplied overhead is closed to cost of goods sold at year-end. The company’s accounting period is

on the calendar year basis.

Direct Material Let x be the value of total DM used:

Beg. 52,000

X = (52,000 + 143,440 + 5,000) – 44,000

143,440 x

5,000 = 200,440 – 44,000

End. 44,000

= 156,440

Work-In-Process X = (11,000 + 156,440 + 175,000 + 140,000) –

Beg. 110,000 135,000

156,440 x = 581,440 – 135,000

175,000

140,000 = 446,440

End. 135,000

Let x be the total Cost of goods manufactured:

Beg. 68,000

446,440 x

End. 56,000

Let x be the total cost of goods sold:

X = (68,000 + 446,440) – 56,000

Finished goods

= 514,440 – 56,000

= 458,440

Factory overhead to production at 80% of direct labor cost:

Given:

Direct labor cost = 175,000

Factory overhead 80% of direct labor cost

Factory overhead applied = ?

Solution:

Factory overhead applied = Direct labor cost * 80%

= 175,000 * 0.8

= 140,000

Compute for:

1. Annabelle Company’s prime cost for June

Given:

Direct Material used = 156,440

Direct Labor = 175,000

Prime cost for June = ?

Solution:

Prime cost = Direct Material + Direct Labor

= 156,440 + 175,000

= Php 331,440

2. Annabelle Company’s conversion for June

Given:

Direct Labor = 175,000

Factory overhead applied = 140,000

Conversion cost for June = ?

Solution:

Conversion cost = Direct Labor + overhead applied

= 175,000 + 140,000

= Php 315,000

3. Annabelle Company’s total manufacturing cost for June

Given:

Direct Material used = 156,440

Direct Labor = 175,000

Factory overhead applied = 140,000

Total manufacturing cost for June = ?

Solution:

Total manufacturing cost = Direct Material used + Direct Labor + Factory overhead

= 156,440 + 175,000 + 140,000

= Php 471,440

4. For June, Annabelle Company’s cost of goods transferred to the finished goods inventory

account

Given:

Total Manufacturing cost = 471,440

Work-In-Process Beginning = 110,000

Work-In-Process Ending = 135,000

Cost of goods manufactured = ?

Solution:

Cost of goods manufactured = Total Manufacturing cost + WIP Beginning – WIP Ending

= 471,440 + 110,000 - 135,000

= Php 446,440

5. Annabelle Company’s cost of goods sold for June

Given:

Cost of goods manufactured = 446,440

Finished goods beginning = 68,000

Finished goods ending = 56,000

Cost of goods sold for June = ?

Solution:

Cost of goods sold = Cost of goods manufactured + FG beginning - FG ending

= 446,440 + 68,000 - 56,000

= Php 458,440

6. The amount of over/under applied overhead factory for June

Given:

Direct labor cost = 175,000

Factory overhead 80% of direct labor cost

Factory overhead applied = ?

Solution:

Factory overhead applied = Direct labor cost * 80%

= 175,000 * 0.8

= 140,000

Problem 2

Meng Company is preparing a flexible budget for next year and requires a breakdown of the factory

maintenance cost into fixed and variable elements.

The maintenance costs and machine hours (the selected cost driver) for the past six months are as

follows:

Maintenance Cost Machine Hours

January 15,500 1,800

February 10,720 1,230

Maintenance Cost Machine Hours

March 15,100 1,740

April 15,840 2,190

May 14,800 1,602

June 10,600 1,590

Required:

1. If Meng Company uses the High-Low Method of analysis, the estimated variable rate of

maintenance cost per machine hour is?

Given:

Highest activity level = 2,190

Highest costs = 15,840

Lowest activity level = 1,230

Lowest costs = 10,720

Variable rate of maintenance cost per machine hour = ?

Solution:

Highest Activity Cost - Lowest Activity Cost

Variable Cost Per Unit =

Highest Activity Units - Lowest Activity Units

= 15,840 - 10,720 / 2,190 - 1,230

= 5, 120 / 960

= 5.333333333 0r 5.33 per unit or machine hour

2. Using the high-low method, compute the average fixed maintenance cost.

Given:

Variable cost per unit = 5.333333333 or 5.33

Highest activity level = 2,190

Highest costs = 15,840

Average fixed maintenance cost = ?

Solution:

Fixed Cost = Highest Activity Cost - (Variable Cost Per Units x Highest Activity Units)

= 15,840 – (5.33333333 * 2,190)

= 15,840 – 11,680

= 4,160

3. Using the high-low method, what is the total cost maintenance at a level of 1,500 machine

hours?

Given:

Variable cost per unit = 5.333333333 or 5.33

New machine hours = 1,500

Fixed costs = 4,160

Total cost maintenance = ?

Solution:

Total Variable costs = variable costs per unit x new activity

= 5.333333333 * 1,500

= 8,000

Total Cost = Fixed cost + Variable cost

= 4,160 + 8,000

= 12,160

You might also like

- Precalculus With Limits A Graphing Approach Texas Edition 6th Edition Larson Test BankDocument25 pagesPrecalculus With Limits A Graphing Approach Texas Edition 6th Edition Larson Test BankDianaChangmtyx100% (35)

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- ManAcc Exercise 1Document5 pagesManAcc Exercise 1Althea Marie LazoNo ratings yet

- Introduction To Management AccountingDocument10 pagesIntroduction To Management AccountingPatrick Panlilio RetuyaNo ratings yet

- Job Order Costing Work SheetDocument11 pagesJob Order Costing Work SheetEllah MaeNo ratings yet

- Miranda, Sweet (FactoryOverhead)Document5 pagesMiranda, Sweet (FactoryOverhead)Sweet Jenesie MirandaNo ratings yet

- Cost Behavior & Activity-Based Costing and ManagementDocument5 pagesCost Behavior & Activity-Based Costing and ManagementRandom Ac100% (1)

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- Chapter5 JustinTimeandBackflushAccountingDocument21 pagesChapter5 JustinTimeandBackflushAccountingFaye Nepomuceno-Valencia0% (1)

- Factory Overhead PDFDocument18 pagesFactory Overhead PDFANDI TE'A MARI SIMBALANo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- RCA Solutions Mod3 PDFDocument13 pagesRCA Solutions Mod3 PDFdiane camansagNo ratings yet

- Chapter 3 Job Order CostingDocument31 pagesChapter 3 Job Order CostingzamanNo ratings yet

- Accounting For Factory OverheadDocument29 pagesAccounting For Factory OverheadEmmanuel Hong100% (2)

- Final Exam SBAC 2B 1 Cost CCTG ControlDocument5 pagesFinal Exam SBAC 2B 1 Cost CCTG ControlMaria Erica TorresNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Service Cost AllocationDocument2 pagesService Cost AllocationdamdamNo ratings yet

- Question No 2 Relevant Company Schedule For Direct Material UsedDocument15 pagesQuestion No 2 Relevant Company Schedule For Direct Material Usedyasir shahNo ratings yet

- Assembly Department Equivalent Units of Production Month of May 2018Document9 pagesAssembly Department Equivalent Units of Production Month of May 2018Gileah Ymalay ZuasolaNo ratings yet

- Chapter 13-1, 13-7 & 13-9Document5 pagesChapter 13-1, 13-7 & 13-9Elaine Fiona VillafuerteNo ratings yet

- Problem AFOHDocument6 pagesProblem AFOHAllysa kim RubisNo ratings yet

- Cost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Document7 pagesCost Accounting and Control Activity 2-Finals (Manufacturing Overhead: Actual and Applied)Saarah KylueNo ratings yet

- Assigment Sample ProblemsDocument5 pagesAssigment Sample ProblemsRamainne RonquilloNo ratings yet

- Job Order CostingDocument12 pagesJob Order CostingDanna ClaireNo ratings yet

- Accounting ProblemDocument3 pagesAccounting ProblemSuvaamNo ratings yet

- Unit 8: Activity Based Costing and Back-FlushDocument5 pagesUnit 8: Activity Based Costing and Back-FlushCielo PulmaNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- Module 3 QuizDocument9 pagesModule 3 QuizjmjsoriaNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- 3.1 Assignment - Job Order CostingDocument3 pages3.1 Assignment - Job Order CostingRoselyn LumbaoNo ratings yet

- Managerial Set 2Document5 pagesManagerial Set 2Dan OrbisoNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- Cost AccountingDocument5 pagesCost AccountingBella0% (1)

- Gitana - Vanessa Project in CostDocument5 pagesGitana - Vanessa Project in Costvanessamae.gitanaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Factory OverheadDocument2 pagesFactory OverheadKeanna Denise GonzalesNo ratings yet

- Cost Accounting Quiz 2 PDFDocument10 pagesCost Accounting Quiz 2 PDFangel hello-helloNo ratings yet

- Chapter 3 Income Measurement and ReportingDocument13 pagesChapter 3 Income Measurement and ReportingPrakashNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- Solution To Assignment 1Document3 pagesSolution To Assignment 1Khyla DivinagraciaNo ratings yet

- Managerial Accounting Final ExamDocument14 pagesManagerial Accounting Final ExamatifNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- CAC C5M1 Accounting For Factory OverheadDocument6 pagesCAC C5M1 Accounting For Factory OverheadKyla Mae AllamNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Discussion 3 Accounting Cycle For Manufacturing BusinessDocument12 pagesDiscussion 3 Accounting Cycle For Manufacturing BusinessRHEGIE WAYNE PITOGONo ratings yet

- Chapters 1 To 3 (Answers)Document8 pagesChapters 1 To 3 (Answers)Cho AndreaNo ratings yet

- Exercise 6.6 To 6.9Document6 pagesExercise 6.6 To 6.9sajjadNo ratings yet

- Questions and Answers For MGT 3 000 Level 23Document15 pagesQuestions and Answers For MGT 3 000 Level 23Monsonedu IkechukwuNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingKaye Angelie UsogNo ratings yet

- Cost AccDocument27 pagesCost AccAngel PulvinarNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Acct1 8 (1Document9 pagesAcct1 8 (1Thu V A NguyenNo ratings yet

- Cost Accounting Cost Control FinalsDocument12 pagesCost Accounting Cost Control FinalsCindy Dela CruzNo ratings yet

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- C. Overhead Has Been UnderappliedDocument6 pagesC. Overhead Has Been UnderappliedTrine De LeonNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Introduction to Python Programming: Do your first steps into programming with pythonFrom EverandIntroduction to Python Programming: Do your first steps into programming with pythonNo ratings yet

- Python Programming for Beginners Crash Course with Hands-On Exercises, Including NumPy, Pandas and MatplotlibFrom EverandPython Programming for Beginners Crash Course with Hands-On Exercises, Including NumPy, Pandas and MatplotlibNo ratings yet

- Top 10 Spoken English Tips PDFDocument7 pagesTop 10 Spoken English Tips PDFVvgNo ratings yet

- Radiography Dissertation ProjectsDocument4 pagesRadiography Dissertation ProjectsPaperWritingCompanyEugene100% (1)

- Km. 14 East Service Road, South Superhighway, Western Bicutan, Taguig City 1630Document5 pagesKm. 14 East Service Road, South Superhighway, Western Bicutan, Taguig City 1630sherylyn lea eteaNo ratings yet

- Time Value of MoneyDocument47 pagesTime Value of MoneyCyrus ArmamentoNo ratings yet

- McDonalds V EasterbrookDocument18 pagesMcDonalds V EasterbrookCrainsChicagoBusinessNo ratings yet

- Shutdown System in PFBRDocument8 pagesShutdown System in PFBRCuddalore J ShanthakumarNo ratings yet

- CSC128 - Test - 8 July 2021 (Question) UiTM PENANGDocument8 pagesCSC128 - Test - 8 July 2021 (Question) UiTM PENANGMuhd Alif MikhailNo ratings yet

- Resource Booklet - Nov 2016 SL Paper 2Document13 pagesResource Booklet - Nov 2016 SL Paper 2Aditya AgarwalNo ratings yet

- Fuel Purchase OrderDocument4 pagesFuel Purchase OrderMichael GarciaNo ratings yet

- K N Rao - Char Dasha Example of LadyDocument47 pagesK N Rao - Char Dasha Example of LadyAnonymous KpVxNXsNo ratings yet

- Creating A Web Page Lab Assignment: Get VerifyDocument20 pagesCreating A Web Page Lab Assignment: Get VerifyscribdpdfsNo ratings yet

- Chapter 5Document4 pagesChapter 5Daisuke InoueNo ratings yet

- STPM Maths T Sem 1 Trial 2014 P1 Port Dickson AnswerDocument2 pagesSTPM Maths T Sem 1 Trial 2014 P1 Port Dickson AnswerKenneth ChanNo ratings yet

- 26 - Design Principles of Trussed BeamsDocument5 pages26 - Design Principles of Trussed BeamsMUTHUKKUMARAMNo ratings yet

- Numerical MethodsDocument43 pagesNumerical Methodsshailaja rNo ratings yet

- Introduction To Human Anatomy and Physiology 4th Edition Solomon Test BankDocument25 pagesIntroduction To Human Anatomy and Physiology 4th Edition Solomon Test BankHeatherFisherpwjts100% (44)

- CV Amartya BFT DelhiDocument2 pagesCV Amartya BFT Delhiamartya tiwariNo ratings yet

- Java Garbage CollectionsDocument7 pagesJava Garbage CollectionskasimNo ratings yet

- UCS617Document1 pageUCS617Lets clear Jee mathsNo ratings yet

- LTE RF PlanningDocument2 pagesLTE RF PlanningSham DegiggsyNo ratings yet

- List of Indian Medical Devices ExportersDocument42 pagesList of Indian Medical Devices ExportersWellexy Pharma Healthcare Private LimitedNo ratings yet

- Topic 6 Internship ReflectionDocument4 pagesTopic 6 Internship Reflectionapi-490976435No ratings yet

- Class X Science PaperDocument4 pagesClass X Science PaperJitendra Karn RajputNo ratings yet

- Online Smart Service System Data SheetDocument2 pagesOnline Smart Service System Data Sheetti bc energiaNo ratings yet

- Exam1 s16 SolDocument10 pagesExam1 s16 SolVũ Quốc NgọcNo ratings yet

- Lenovo Z370Z470Z570 Hardware Maintenance Manual V1.0Document120 pagesLenovo Z370Z470Z570 Hardware Maintenance Manual V1.0Anna Lissa PilapilNo ratings yet

- Mircom DH24120FPC Data SheetDocument2 pagesMircom DH24120FPC Data SheetJMAC SupplyNo ratings yet

- 4112-4127 Color Scan KitDocument3 pages4112-4127 Color Scan KitxcopytechNo ratings yet

- Postmodern Feminism in Nadine Gordimer's Novel The Pickup: "Who Is The Enemy? Female Self-Image Mirrored in Non-Conformity"Document6 pagesPostmodern Feminism in Nadine Gordimer's Novel The Pickup: "Who Is The Enemy? Female Self-Image Mirrored in Non-Conformity"IJELS Research JournalNo ratings yet