Professional Documents

Culture Documents

Enhanced Security System

Uploaded by

simranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enhanced Security System

Uploaded by

simranCopyright:

Available Formats

Enhanced Security System

Credit card companies, as well as credit card accounts, are the most

preferable weak links to malicious hackers for gaining sufficient money

without any immediate notice. It is highly risky for credit card issuers to

use the credit system on multiple online sites without confirming its

authenticity. Leveraging Artificial Intelligence provides an enhanced

security system of credit cards and utmost protection from frauds and

hackers. Fraud detection functionality is also utilized by these credit card

companies for immediate alerts of any unusual activity in any account for

a better credit system.

Better Customer Service

Credit card companies fall under the category of banks and other

financial institutions. Thus, here also Artificial Intelligence and machine

learning help these credit card companies in better customer service and

generate insights for customer-centric marketing campaigns. These

machines analyze demographic data and historical data of consumers

and help to offer any essential and attractive targeted promotions to

attract potential customers with better customer service.

Chatbots for Hyper-personalisation

Credit card users always tend to have some unique and different queries

regarding their credit card accounts and services. Implementing Artificial

Intelligence-based Chatbots can provide hyper-personalized services to

these customers for a better understanding of their queries through NLP.

Chatbots provide personalized solutions to each customer and also help

them to check the remaining balance, due amount, deadline, and many

more in any place at any time for a better credit system.

Approval of Transactions in Any Network

Machine learning algorithms can now approve credit card transactions

seamlessly without depending on a bank’s network. Visa has recently

created this advanced algorithm that can mimic a bank’s decision for

approval or denial of any transaction in a credit card. VISA has also

utilized deep learning neural networks to make a connection with a

human user and the past habits to study any unusual activity faster.

Thus, it is easier to receive approval of any transaction despite the

network status of that particular bank.

Offering Personalised Rewards

Implementing Artificial Intelligence into a credit card system can provide

personalized rewards to credit card users regularly to motivate them in

paying the spent amount within a specific date with interests. These

personalized rewards and offers are relevant and useful to these users

that also help to drive incremental returns for the advertisers. Some

restaurants and retailers offer massive discounts to disciplined users

who pay back the money in time for a better credit system. Some users

redeem rewards for one specific award in a category, especially

recommended by Artificial Intelligence. It analyses the historical data and

recommends useful and favorable products and services to each credit

card used as a reward. It also helps to offer rewards within a specific

location of a credit card user so that the person can utilize the reward

effectively without traveling long distances.

Alerts for Bill Payments

Providing constant reminders or alerts for bill payments is one of the

most important benefits of leveraging Artificial Intelligence in the credit

card system. It may be impossible for human employees to detect the

nearby bill payment due dates of hundreds of customers and provide

alerts to their phones through SMS or email. An Artificial Intelligence

model is known for its expertise in automating mundane tasks for human

employees. Thus, it helps to give reminders to customers for due dates,

renewal of a subscription, reward pending, and so on.

Effective targeting and retention: Consumers today have a problem of too many

credit card options to choose from. Issuers can feed first and third party data to

machine learning systems to come up with a target audience profile and the

relevant channels to share most appropriate card options. The same principle can

also be applied to timely target disgruntled customers and reduce churn.

Customer care: The advancements in machine learning are helping Natural

Language Processing (NLP) applications such as chatbots become more

contextual. Through chatbots, credit card issuers can ensure round the clock

assistance across all stages of customer interaction including product selection,

on-boarding, payments and usage. Smarter chatbots can also learn to detect irate

human behaviour and accordingly escalate queries to customer care executives.

Personalized rewards: Rewards are most important reasons for keeping a credit

card on top of the wallet. Machine learning can help issuing banks get a true

understanding of each customer and follow it up with tailored reward

experiences. American Express for example uses machine learning to recommend

restaurants to its card members. HSBC in the US has experimented with

predicting how customers are likely to use their reward points and accordingly

market its reward programs more effectively.

New revenue opportunities: Machine learning capabilities can help banks open-

up new monetization avenues. “Predictive spending insights", built on transaction

and third-party data is one such example. Case in point is American Express’s

AmexAdvance, that combines transactional and third-party data to brand

marketers and media partners deliver personalization services.

Implementing machine learning capabilities

Implementing machine learning is more feasible today because of the vast

improvements in computing power, the abundance of data as well as storage and

algorithmic advances. Like most other emerging technologies though, it is no

panacea, and to get the most benefit, issuers need to build the right capabilities.

Develop an AI roadmap: Credit card issuers should clearly define the purpose,

context and scope of why they would be using machine learning. In the short-term,

issuers can focus on proven application areas such as fraud detection and over a

period of time look at relatively more advanced use cases such as automated

rewards recommendation. Moreover, issuers can also work with academia and

technology partners to identify more futuristic use-cases.

Assess and build capabilities: According to a Harvard Business review analysis,

companies that have strong experience in digitization have a 50% higher chance of

generating profit from AI implementation. Issuing banks must therefore have a

robust digital foundation, especially big data analytics and cloud capabilities.

Finding the right talent, especially data scientists is also a big challenge and issuers

can work with their technology partners or collaborate with fintechs to bridge the

skill gap.

Stay on the right side of the regulation: Regulations such as GDPR have put

entire onus on protecting customer data with businesses, imposing stringent fines

for defaulters. Banks therefore must ensure complete compliance when venturing

into data dependent application of AI. Equally vital is to communicate with

customers on how their data is going to be used. This will also reinforce the trust

consumers have in their brands.

Be cautious about bias: Decisions of machine learning algorithms can be prone to

bias, one because they are designed by humans and second, because of the limited

available test data. Any resulting bias, for example in the form a denial of credit

card or inappropriate messaging may lead to regulatory sanctions and invite

consumers’ backlash. Choosing the appropriate data samples that minimize bias is

essential. Moreover, the insights generated by the system should be regularly

monitored, especially because such systems learn over time and may offer

unfavourable results in future.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Section 52, 53, 53A TPADocument16 pagesSection 52, 53, 53A TPARana RiyaNo ratings yet

- Strict and Absolute LiabilityDocument8 pagesStrict and Absolute LiabilitysimranNo ratings yet

- Indian Contract Act, 1872Document302 pagesIndian Contract Act, 1872Neha Kalra100% (3)

- Nesonbail: Criminal Procedure Code (CRPC)Document4 pagesNesonbail: Criminal Procedure Code (CRPC)Maria QadirNo ratings yet

- ISSN 2581-5369: The Rule of Strict Liability and Absolute Liability in Indian PerspectiveDocument11 pagesISSN 2581-5369: The Rule of Strict Liability and Absolute Liability in Indian PerspectivesimranNo ratings yet

- Final Version Stephan MichelDocument202 pagesFinal Version Stephan MichelsimranNo ratings yet

- Main QDocument36 pagesMain QsimranNo ratings yet

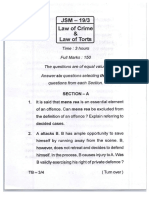

- OJS-2019 - Main - Law of Crime & Law of TortsDocument4 pagesOJS-2019 - Main - Law of Crime & Law of TortssimranNo ratings yet

- Money LaunderingDocument14 pagesMoney LaunderingsimranNo ratings yet

- Insider TradingDocument16 pagesInsider TradingsimranNo ratings yet

- Listing AgreementDocument18 pagesListing AgreementsimranNo ratings yet

- Loan Application FormDocument4 pagesLoan Application FormsimranNo ratings yet

- Insider TradingDocument16 pagesInsider TradingsimranNo ratings yet

- Arbitration ProjectDocument22 pagesArbitration Projectsimran0% (1)

- Overview of Marine Insurance Law Prof. Dr. Marko PavlihaDocument51 pagesOverview of Marine Insurance Law Prof. Dr. Marko PavlihasimranNo ratings yet

- An Introduction To International Commercial Arbitration FinalDocument17 pagesAn Introduction To International Commercial Arbitration Finalarihant_219160175100% (1)

- Land Law ProjectDocument13 pagesLand Law Projectsimran100% (2)

- Land Law Project (Abhash Kumar Padhi)Document13 pagesLand Law Project (Abhash Kumar Padhi)simranNo ratings yet

- Land Law ProjectDocument13 pagesLand Law Projectsimran100% (2)

- D-Minimum Wages ActDocument13 pagesD-Minimum Wages ActsimranNo ratings yet

- Re Insurance & Double InsuranceDocument36 pagesRe Insurance & Double InsuranceNimish PatankarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SWVA Second Harvest Food Bank Spring Newsletter 09Document12 pagesSWVA Second Harvest Food Bank Spring Newsletter 09egeistNo ratings yet

- Marathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For PracticeDocument1 pageMarathi Typing 30 WPM Passage PDF For Practice Arathi Typing 30 WPM Passage PDF For Practiceshankar jonwalNo ratings yet

- Mergers and Acquisitions in Pharmaceutical SectorDocument37 pagesMergers and Acquisitions in Pharmaceutical SectorAnjali Mehra100% (2)

- Misuse of InternetDocument22 pagesMisuse of InternetPushparaj100% (1)

- Operation - Manual Cubase 5Document641 pagesOperation - Manual Cubase 5Samiam66682% (17)

- Maluno Integrated School: Action Plan On Wins ProgramDocument1 pageMaluno Integrated School: Action Plan On Wins ProgramSherlymae Alejandro Avelino100% (2)

- Ijrcm 2 Cvol 2 Issue 9Document181 pagesIjrcm 2 Cvol 2 Issue 9com-itNo ratings yet

- Bc-6800plus Series Auto Hematology Analyzer Operator's ManualDocument322 pagesBc-6800plus Series Auto Hematology Analyzer Operator's ManualHenock MelesseNo ratings yet

- Section 2 Structure and FunctionDocument42 pagesSection 2 Structure and FunctionRached Douahchua100% (1)

- Norma MAT2004Document12 pagesNorma MAT2004Marcelo Carvalho100% (1)

- Rule 88 Case Digest #2 Santos vs. Manarang Facts: Don Lucas de Ocampo Died On November 18, 1906Document1 pageRule 88 Case Digest #2 Santos vs. Manarang Facts: Don Lucas de Ocampo Died On November 18, 1906Diane Dee YaneeNo ratings yet

- Farm LeaseDocument5 pagesFarm LeaseRocketLawyer100% (1)

- Trade Secrets Lawsuit V ReebokDocument17 pagesTrade Secrets Lawsuit V ReebokDarren Adam HeitnerNo ratings yet

- CIMB-Financial Statement 2014 PDFDocument413 pagesCIMB-Financial Statement 2014 PDFEsplanadeNo ratings yet

- Low Carb Diabetic RecipesDocument43 pagesLow Carb Diabetic RecipesDayane Sant'AnnaNo ratings yet

- Artificial Intelligence and Applications: Anuj Gupta, Ankur BhadauriaDocument8 pagesArtificial Intelligence and Applications: Anuj Gupta, Ankur BhadauriaAnuj GuptaNo ratings yet

- Tendon Grouting - VSLDocument46 pagesTendon Grouting - VSLIrshadYasinNo ratings yet

- Order ID 4148791009Document1 pageOrder ID 4148791009SHUBHAM KUMARNo ratings yet

- Delhi To Indore Mhwece: Jet Airways 9W-778Document3 pagesDelhi To Indore Mhwece: Jet Airways 9W-778Rahul Verma0% (1)

- The Edge of Disaster - Stephen FlynnDocument6 pagesThe Edge of Disaster - Stephen FlynnFrancisco Jose Torres MedinaNo ratings yet

- Project Planning and Monitoring Tool: Important NoticeDocument13 pagesProject Planning and Monitoring Tool: Important Noticemanja channelNo ratings yet

- Clinical Assignment 1Document5 pagesClinical Assignment 1Muhammad Noman bin FiazNo ratings yet

- Technical Report Documentation PageDocument176 pagesTechnical Report Documentation Pagepacotao123No ratings yet

- A Study On Flywheel Energy Recovery From Aircraft BrakesDocument5 pagesA Study On Flywheel Energy Recovery From Aircraft BrakesRaniero FalzonNo ratings yet

- NAVA - Credit TransactionsDocument79 pagesNAVA - Credit Transactionscarrie navaNo ratings yet

- NURS FPX 6218 Assessment 4 Advocating For Lasting ChangeDocument8 pagesNURS FPX 6218 Assessment 4 Advocating For Lasting Changefarwaamjad771No ratings yet

- Building ProcessDocument25 pagesBuilding Processweston chegeNo ratings yet

- Assessment E - Contract - LaundryDocument5 pagesAssessment E - Contract - LaundrySiddhartha BhusalNo ratings yet

- Laser Ignition ReportDocument26 pagesLaser Ignition ReportRaHul100% (2)

- Caso Contra Ángel Pérez: Respuesta de La Fiscalía A Moción de La Defensa Sobre Uso de FotosDocument8 pagesCaso Contra Ángel Pérez: Respuesta de La Fiscalía A Moción de La Defensa Sobre Uso de FotosEl Nuevo DíaNo ratings yet