Professional Documents

Culture Documents

FEECO Basic Export Finance Info

Uploaded by

Moussa DieneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FEECO Basic Export Finance Info

Uploaded by

Moussa DieneCopyright:

Available Formats

FLEXIBLE

INTERNATIONAL FINANCING

In a time when emerging and credit-strained markets are looking to flourish, they are facing restrictive financing

with costly interest rates, inflexible repayment methods, and limited credit availability. We can help you secure

flexible financing that works for you.

We work with global leaders to provide the best in international financing options:

• 1 to 7 year financing terms.

• Competitive interest rates, often more favorable than those offered by institutions in your home country.

• Option to select either fixed or variable interest rates.

• Accommodation of existing financing with your local bank.

• Financing extended directly to the importer without the need of a local bank guarantee or letter of credit.

• Semi-annual payments.

• Grace periods for installation and setup of equipment.

• Improved rate of return on investment.

BASIC INFORMATION NEEDED FOR AN EXPORT FINANCE TRANSACTION

In order to proceed with an application, the following information will be needed.

• Buyer’s full legal name full notes) on Importer and/or the bank contact person with telephone and

(or a link to publicly available audited email address.

• Buyer’s full legal address

financial statements). These should be in • Letter from the local commercial bank

• Estimated Contract Value of export sale English. indicating their intent to provide a

• Estimated down payment to be paid • The most recent interim financials on the guarantee (if applicable). This letter

prior to shipment Importer and/or Guarantor if applica- should reference the Exporter’s

• Percentage of USA content of contract ble. These should be at least in most equipment, the term of the loan, the

value current quarter, but not older than six contract price of the equipment, the

months. name of the borrower, and express their

• Estimated shipment period and number

willingness to provide an unconditional

of shipments • Current credit report on the Importer/

and irrevocable guarantee assuming

company buying the equipment and

• Description of equipment (including the bank approves the financing.

named as the borrower on the loan.

model numbers) to be sold and how

• One or two references from bank(s) who

the Importer/borrower intends to use it. • Bank references and two trade

have a corresondent relationship with

Percentage of USA content of the references on the Importer/borrower.

the guarantor. These can be other local

goods. • Corporate background/history on the banks, US banks, European banks, etc.

• Details on the origin of this transaction, Importer/borrower. Last on-site visit by

• Pro forma invoice from the Exporter,

i.e., how did the Exporter meet this the Exporter to the Buyer’s business

copies of sales contracts and/or POs.

customer and who (if anyone) is the offices.

intermediary helping to arrange this sale. • Exporter’s opinion on the buyer’s

• Name of the local commercial bank

Past experience with buyer. management and operational skills

providing the guarantee (if applicable),

based on prior knowledge of the buyer.

• Three years of audited financials (with including full name, address, and

3913 Algoma Rd. Green Bay, WI 54311, USA • Phone: (920)468.1000 • Fax: (920)469.5110 • Email: sales@feeco.com • www.FEECO.com

You might also like

- Notary Signing Agent ScriptDocument5 pagesNotary Signing Agent ScriptMyaW731100% (4)

- Letter of Credit ExplainedDocument20 pagesLetter of Credit ExplainedSushant Verma100% (1)

- Getting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageFrom EverandGetting to Closing!: Insider Information to Help You Get a Good Deal on Your MortgageNo ratings yet

- Purchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!From EverandPurchase and Refinance Mortgage Process: A Handbook and Guide for Real Estate Mortgage!No ratings yet

- Audit of Foreign Assisted Projects ManualDocument129 pagesAudit of Foreign Assisted Projects ManualAehruj Blet100% (4)

- Types of Letter of CreditDocument5 pagesTypes of Letter of CreditVasant Kothari100% (1)

- Letters of Credit and Documentary Collections: An Export and Import GuideFrom EverandLetters of Credit and Documentary Collections: An Export and Import GuideRating: 1 out of 5 stars1/5 (1)

- Bank GuaranteeDocument3 pagesBank GuaranteeBidhan AcharyaNo ratings yet

- Draft Loan AgreementDocument3 pagesDraft Loan AgreementWilma PereñaNo ratings yet

- MBA Topics Related To MBA HR, Marketing, Finance ProjectsDocument13 pagesMBA Topics Related To MBA HR, Marketing, Finance Projectssonyselvin100% (1)

- There Are Two Target Groups That Use Information From Financial AccountingDocument9 pagesThere Are Two Target Groups That Use Information From Financial AccountingHari Chandan100% (1)

- Working Capital & Letter of Credit Project ReportDocument95 pagesWorking Capital & Letter of Credit Project Reportkamdica100% (2)

- Setups by Feature FAQ For Oracle Lease ManagementDocument17 pagesSetups by Feature FAQ For Oracle Lease Managementmk_k80No ratings yet

- Your Unifi Home Bill For Feb 2023 Is Ready! (Account No 1067185528) PDFDocument5 pagesYour Unifi Home Bill For Feb 2023 Is Ready! (Account No 1067185528) PDFOUR.HIJENNNo ratings yet

- Trade Finance - Week 7-2Document15 pagesTrade Finance - Week 7-2subash1111@gmail.comNo ratings yet

- Advanced Financial Management - Unit 2Document21 pagesAdvanced Financial Management - Unit 2KALYANI JAYAKRISHNAN 2022155No ratings yet

- Purchasing Hints and Tips: What You Need To Know To Get A Closing Package Purchased On The First TryDocument21 pagesPurchasing Hints and Tips: What You Need To Know To Get A Closing Package Purchased On The First TryNye LavalleNo ratings yet

- 2 1 DocumentationDocument26 pages2 1 DocumentationRagini VermaNo ratings yet

- Banking Project NewDocument77 pagesBanking Project NewMohit PaleshaNo ratings yet

- Factoring & IngDocument17 pagesFactoring & IngAbhik BiswasNo ratings yet

- Tip TopDocument8 pagesTip Topmani samiNo ratings yet

- Letters of CreditDocument8 pagesLetters of CreditCzarPaguioNo ratings yet

- Terms of PaymentDocument27 pagesTerms of Paymentsubash1111@gmail.comNo ratings yet

- What Is FortfaitingDocument3 pagesWhat Is FortfaitingRAMESHBABUNo ratings yet

- WIHCON Road To Homeownership EbookDocument9 pagesWIHCON Road To Homeownership EbookAnn VictoriaNo ratings yet

- Export Finance-Countertrade and ForfaitingDocument26 pagesExport Finance-Countertrade and ForfaitingRajat LoyaNo ratings yet

- Emmert-IBTChap03 FinancingDocument95 pagesEmmert-IBTChap03 FinancingZviagin & CoNo ratings yet

- ITF 1 Lecture 2. Applying For CreditDocument25 pagesITF 1 Lecture 2. Applying For CreditMarlen ParraguezNo ratings yet

- Procedure For Loan With TitleDocument12 pagesProcedure For Loan With TitleKelvin PoptaniNo ratings yet

- Summary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiDocument76 pagesSummary - Corporate Banking and Credit Analysis - Ugo Rigoni e Caterina CrucianiMax KatzensternNo ratings yet

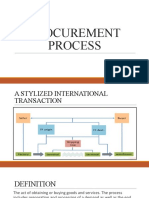

- ProcurementDocument44 pagesProcurementtahaNo ratings yet

- International Trade Operational and Financial RIsksDocument51 pagesInternational Trade Operational and Financial RIskslifeNo ratings yet

- LC SRS-2Document20 pagesLC SRS-2puku90No ratings yet

- Chapter 7 Trade FinanceDocument25 pagesChapter 7 Trade FinancedhitalkhushiNo ratings yet

- Import Finance: Directors' Briefing Exporting and ImportingDocument4 pagesImport Finance: Directors' Briefing Exporting and ImportingtomudassarNo ratings yet

- International Payment: Presentation OutlineDocument32 pagesInternational Payment: Presentation OutlineTran Minh TuNo ratings yet

- ImpEx 04 - 05Document40 pagesImpEx 04 - 05Nasir HussainNo ratings yet

- Buyer's Credit - Supplier's CreditDocument3 pagesBuyer's Credit - Supplier's CreditHarshita ThaparNo ratings yet

- Debt Funding Proposal - Dubai CompaniesDocument5 pagesDebt Funding Proposal - Dubai CompaniesKunal SoniNo ratings yet

- Buyer'S C Redit: Ion For E Xporte Rstof Inance Goods and Se RvicesDocument2 pagesBuyer'S C Redit: Ion For E Xporte Rstof Inance Goods and Se RvicesSalah AyoubiNo ratings yet

- Buyers's Credit and Suppliers Credit: DR Navneet GeraDocument21 pagesBuyers's Credit and Suppliers Credit: DR Navneet GeraRahul PatelNo ratings yet

- Sourcing Documentation & Inco TermDocument8 pagesSourcing Documentation & Inco TermpriyaNo ratings yet

- LC ProjectDocument101 pagesLC ProjectZubair ChNo ratings yet

- Characteristics of Letter of CreditDocument24 pagesCharacteristics of Letter of CreditKim EngNo ratings yet

- Export FinancingDocument61 pagesExport FinancingkanikaNo ratings yet

- Topic:-Factoring Vs Forfaiting: Dr. Dileep Kumar SinghDocument20 pagesTopic:-Factoring Vs Forfaiting: Dr. Dileep Kumar SinghDileep SinghNo ratings yet

- Import Factor Information Sheet (IFIS) : Guarantee For International Factoring TransactionsDocument12 pagesImport Factor Information Sheet (IFIS) : Guarantee For International Factoring TransactionsHueNo ratings yet

- LCDocument18 pagesLCAshish KumarNo ratings yet

- PAPS 1000 Inter-Bank Confirmation ProceduresDocument1 pagePAPS 1000 Inter-Bank Confirmation ProceduresJJ LongnoNo ratings yet

- Fin 624Document4 pagesFin 624Majid Shahzaad KharralNo ratings yet

- Discrepancies (Business Credit)Document7 pagesDiscrepancies (Business Credit)Dr M R aggarwaalNo ratings yet

- Open Account : A Mode of Payment in International TradeDocument10 pagesOpen Account : A Mode of Payment in International TradeAkash das100% (1)

- WBG Form Application Purchase Invoice FinanceDocument3 pagesWBG Form Application Purchase Invoice FinancevetrivelrajaselviNo ratings yet

- LOAN DOCUMENTS AtAGlanceDocument10 pagesLOAN DOCUMENTS AtAGlanceksw10712No ratings yet

- International Trade Finance: - Topics To Be Discussed in ChapterDocument14 pagesInternational Trade Finance: - Topics To Be Discussed in ChapterMohammed ThanishNo ratings yet

- Factoring AND Forfaitin GDocument35 pagesFactoring AND Forfaitin GChinmayee ChoudhuryNo ratings yet

- Factoring and ForfaitingDocument31 pagesFactoring and Forfaitingpuchkisheno100% (1)

- Mortgage FAQbrochureDocument2 pagesMortgage FAQbrochureJ HerbertNo ratings yet

- Factoring Vs ForfeitingDocument27 pagesFactoring Vs ForfeitingShruti AshokNo ratings yet

- Dealing With LC Discrepancies PDFDocument6 pagesDealing With LC Discrepancies PDFsutomoNo ratings yet

- Understanding and Using Letters of Credit: PurposeDocument7 pagesUnderstanding and Using Letters of Credit: PurposePhani KumarNo ratings yet

- Chapter VII-Credit Administration, Monitoring and ReviewDocument9 pagesChapter VII-Credit Administration, Monitoring and ReviewPradeep GautamNo ratings yet

- Commercial DocumentationDocument19 pagesCommercial DocumentationAnibal LagoNo ratings yet

- ARAG Guidebook Buying A HomeDocument16 pagesARAG Guidebook Buying A HomeJamal AbunahelNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- HDFC MF COMMON & SIP FORMDocument6 pagesHDFC MF COMMON & SIP FORMMadhu SudhananNo ratings yet

- Crowdfunding in India: An Emerging TrendDocument14 pagesCrowdfunding in India: An Emerging TrendYA100% (1)

- Esco in IndonesiaDocument22 pagesEsco in IndonesiaJudianto HasanNo ratings yet

- 2) Mellon Bank vs. MagsinoDocument15 pages2) Mellon Bank vs. Magsinoa_v_04156931No ratings yet

- WHLP FABM2 Week 3 4 Q2Document1 pageWHLP FABM2 Week 3 4 Q2Ailyn AriasNo ratings yet

- Applicability of Section 297Document2 pagesApplicability of Section 297Parth SharmaNo ratings yet

- Indian EconomyDocument44 pagesIndian Economymejokgk100% (1)

- Thesis On Indian BanksDocument4 pagesThesis On Indian Bankslizbrowncapecoral100% (2)

- Principles of Banking PDFDocument4 pagesPrinciples of Banking PDFRashmi SharmaNo ratings yet

- E - One-to-One FormDocument2 pagesE - One-to-One Formahsan_tpsNo ratings yet

- Imprest & Sub ImprestDocument16 pagesImprest & Sub Imprestmiyuru_jNo ratings yet

- Comparative Analysis of Demat Services of Broking FirmsDocument48 pagesComparative Analysis of Demat Services of Broking FirmsdraviNo ratings yet

- IDBI Federal Life Insurance and TATA AIG General InsuranceDocument51 pagesIDBI Federal Life Insurance and TATA AIG General InsuranceAnonymous llMYrqnNo ratings yet

- 1623315571-Papers For SCOPUS Journals - Series 1Document20 pages1623315571-Papers For SCOPUS Journals - Series 1Arifa PratamiNo ratings yet

- Cmat GK 500Document172 pagesCmat GK 500Khyati DhabaliaNo ratings yet

- Securitisation 2013 GuideDocument144 pagesSecuritisation 2013 GuideEmir KarabegovićNo ratings yet

- Value Chart For YES PROSPERITY CASHBACK Credit CardDocument1 pageValue Chart For YES PROSPERITY CASHBACK Credit CardMITALI DASNo ratings yet

- Chapter 4 - The Balance of Payments - BlackboardDocument28 pagesChapter 4 - The Balance of Payments - BlackboardCarlosNo ratings yet

- Counsel For in Re Kitec Fitting Litigation Class Plaintiffs: Certificate of ServiceDocument6 pagesCounsel For in Re Kitec Fitting Litigation Class Plaintiffs: Certificate of ServiceChapter 11 DocketsNo ratings yet

- Habib MetroDocument50 pagesHabib MetroMuhammad Fazal SaeedNo ratings yet

- New Special Penal Laws of 2018 and 2019Document4 pagesNew Special Penal Laws of 2018 and 2019TAU MU OFFICIALNo ratings yet

- (FINA1303) (2014) (F) Midterm Yq5j8 42714Document19 pages(FINA1303) (2014) (F) Midterm Yq5j8 42714sarah shanNo ratings yet

- Results Press Release For September 30, 2016 (Result)Document3 pagesResults Press Release For September 30, 2016 (Result)Shyam SunderNo ratings yet