Professional Documents

Culture Documents

Tech Mahindra LTD: Growth Trajectory To Sustain

Uploaded by

AaryanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tech Mahindra LTD: Growth Trajectory To Sustain

Uploaded by

AaryanCopyright:

Available Formats

Tech Mahindra Ltd Growth trajectory to sustain

We maintain our ‘Tactical Buy’ call on Tech Mahindra and raise TP to INR2,050 by Sushil Sharma

rolling over to FY24 earnings estimate (from TP of INR1,670 earlier, refer Research Analyst

September-2021 note). Our thesis of pick up in 5G deal momentum aid to already SushilK.Sharma@edelweissfin.com

strong growth momentum in the Enterprise segment driven by digitization along

with stable margins is playing out along expected lines. The company indicated

that ~20% of Communications business is now 5G based and is likely to increase

further. We estimate FY22E, FY23E and FY24E EPS to be INR62, INR73 and INR82,

CMP INR: 1,806

respectively. We maintain our ‘Tactical Buy’ call and raise target price to

INR2,050. Rating: Tactical BUY

Target Price: INR 2,050

Continued momentum in deal wins, strong traction across markets in Q3FY22 Upside: 14%

Tech Mahindra posted a sequential growth rate of 6.4% in USD terms and 7.2% in

CC terms in Q3FY22. Net new deal wins remained elevated at USD750mn for

Q3FY22 on the back of traction across key markets and verticals. Deal wins

remained elevated over the past three quarters (USD1050mn, USD815mn and

USD750mn in Q4FY21, Q1FY22 and Q2FY22, respectively), resulting in a cumulative Bloomberg: TECHM:IN

deal win of USD2.6bn in the past nine months versus USD1.7bn over Q4FY20–

Q3FY21. 52-week

915 / 1,823

range (INR):

Continued investment in building capabilities to ensure Tech Mahindra remains M cap (INR Cr): 1,75,298

ahead of the curve

Promoter

Tech Mahindra maintained its strategy to undertake M&A activities with the 35.50

Holding (%)

intention to acquire specific capabilities or capture identified opportunities. The

company closed three acquisitions in Q3FY22, strengthening its competence in

digital product engineering, customer experience solutions and e-commerce

capabilities.

Scale-up of Enterprise business likely to complement pickup in CME segment

Tech Mahindra targets to achieve USD1bn in annual revenue from its BFSI and

Manufacturing businesses, while adding substantial revenue from its Healthcare

and Hi-tech businesses. Excluding CME business, the company expects its

businesses to add USD1.5–2bn to its top-line, increasing at a 12–14% CAGR over

FY21–25 versus 9.7% over FY16–21.

Valuation and outlook

With robust demand driven by digital transformation in the Enterprise business and

uptick in 5G deals in the CME vertical, investment in building capabilities and strong

deal wins and pipeline, we expect Tech Mahindra to deliver 14% revenue and 17%

PAT CAGR over FY21–23E. The stock trades at 29x/24x/22x FY22E/FY23E/FY24E

earnings estimate and maintain our ‘Tactical Buy’ call and raise target price to

INR2,050.

(INR mn) FY21 FY22E FY23E

Revenue 3,78,551 4,32,612 4,88,224

Revenue Growth (%) 2.7% 14.3% 12.9%

EBITDA 68,470 82,192 1,00,107

EBITDA Margin (%) 18.10% 19% 21%

EPS 50 62 73

Diluted P/E (x) 36.0 29.0 24.0

EV/EBITDA (x) 22.9 19.0 15.6

RoE (%) 19.0 20.6 20.9

Date: December 29, 2021

Edelweiss Wealth Research 1

Tech Mahindra Ltd Investment Hypothesis

I. Continued momentum in deal wins, strong traction across markets in Q3FY22

Tech Mahindra posted a sequential growth rate of 6.4% in USD terms and 7.2% in CC terms in

Q3FY22. Net new deal wins remained elevated at USD750mn for the quarter on the back of traction

across key markets and verticals. Deal wins remained elevated over the past three quarters

(USD1050mn, USD815mn and USD750mn in Q4FY21, Q1FY22and Q2FY22, respectively), resulting

in a cumulative deal win of USD2.6bn in the past nine months versus USD1.7bn over Q4FY20–

Q3FY21.

Exhibit 2: Operating leverage helped sustain operating

Exhibit 1: Revenue up 6.4% QoQ and 16.4% YoY in Q3FY22 margin at 15%, negating lower utilisation and higher

subcontracting costs

1,500 1,473 20% 16,522 17%

17,000 16,037

15,370 15,453

1,384 15% 15,500

1,400 15%

1,353

(USDmn)

(INRmn)

1,330 14,000 13,313

1,309 10% 11,785

1,287 1,295

1,300 1,265 12,500 11,594 13%

1,247

5%

1,208 11,000 9,928

1,200 9,4969,173 11%

0% 9,500

8,000 9%

1,100 -5% Jun-19

Jun-20

Jun-21

Dec-19

Dec-20

Sep-19

Sep-20

Sep-21

Mar-20

Mar-21

Jun-19

Dec-19

Jun-20

Dec-20

Jun-21

Sep-19

Sep-20

Sep-21

Mar-20

Mar-21

EBIT (LHS) EBIT Margin (RHS)

Revenues (LHS) YoY (RHS)

Source: Company Data, Edelweiss Wealth Research

Exhibit 3: Communications segment witnessed 23% YoY Exhibit 4: Net new deal bookings worth USD3bn in LTM,

growth in deal wins in Q3FY22 with 2x growth in win rates

1,079 4,200 60%

1,100 275% 3,700

3,606 3,515

225% 3,500 3,063 40%

900 2,816 2,734

175% 2,800 2,443

2,209

(USDmn)

20%

700

125% 2,100 1,877 1,668

(USDmn)

518

0%

500 75% 1,400

352

255 25% 700 -20%

300 208

150 174 110

100 106 -25%

0 -40%

100

Jun-19

Dec-19

Jun-20

Dec-20

Jun-21

Sep-21

Sep-19

Sep-20

Mar-20

Mar-21

-75%

(100) Jun-19 Mar-20 Dec-20 Sep-21 -125%

Communications deal wins (LHS) YoY Growth Deal wins, LTM (LHS) Growth (%)

Source: Company Data, Edelweiss Wealth Research

Edelweiss Wealth Research 2

Tech Mahindra Ltd Investment Hypothesis

II. Continued investment in building capabilities to ensure Tech Mahindra

remains ahead of the curve

Tech Mahindra maintained its strategy to undertake M&A activities with the intention to acquire

specific capabilities or capture identified opportunities. The company closed three acquisitions in

Q3FY22, strengthening its competence in digital product engineering, customer experience

solutions and e-commerce capabilities.

Exhibit 5: Acquisitions in Q3FY22

Date Acquired asset Competency area Value (USDmn)

Oct-21 Lodestone, The US Product and data quality assurance solutions 105

Oct-21 We Make Websites, The UK Shopify – focused e-commerce agency 13

Dec-21 Activus, The US Customer experience management solutions 62

Source: Company, Edelweiss Wealth Research

Exhibit 6: M&A strategy: acquire capabilities, gain access

Exhibit 7: Focus on business integration and unlocking value

and scale-up across business segments

Exhibit 8: Synergies driven by acquisition led to large deal

Exhibit 9: Substantial value created via inorganic means

wins and a robust pipeline in Q3FY22

Exhibit 10 Key investment themes of Tech Mahindra

Edelweiss Wealth Research 3

Tech Mahindra Ltd Investment Hypothesis

Scale up of Enterprise business likely to complement pickup in CME business

Tech Mahindra targets to achieve USD1bn in annual revenue from its BFSI and Manufacturing

businesses, while adding substantial revenue from its Healthcare and Hi-tech businesses. Excluding

CME business, the company expects its businesses to add ~USD1.5–2bn to its top-line, increasing at

a 12–14% CAGR over FY21–25 versus 9.7% over FY16–21.

Exhibit 11: Manufacturing and BFSI verticals set to surpass USD1bn annual revenue, with mid- to

high-teens growth registered in H1FY22, and likely to accelerate in H2FY22

1,000 40%

800 30%

20%

(USDmn)

600

10%

400

0%

200 -10%

- -20%

FY17 FY18 FY19 FY20 FY21 H1FY22

Manufacturing (LHS) BFSI (LHS) Mfg. Growth (RHS) BFSI Growth (RHS)

Exhibit 12: 3x growth in manufacturing pipeline through the past four quarters, forming 30% of

current pipeline

Exhibit 13: BFSI business expanded at a 16% CAGR over the past five years, with 1/3rd of Tech

Mahindra’s top 10 clients from the BFSI space

Source: Company Data, Edelweiss Wealth Research

Edelweiss Wealth Research 4

Tech Mahindra Ltd Outlook and Valuation

With robust demand driven by digital transformation in the Enterprise business and uptick in 5G

deals in the CME vertical, investment in building capabilities and strong deal wins and pipeline, we

expect Tech Mahindra to deliver 14% revenue and 17% PAT CAGR over FY21–23E. The stock trades

at 29x/24x/22x FY22E/FY23E/FY24E earnings estimate and maintain our ‘Tactical Buy’ call and raise

target price to INR2,050.

Exhibit 14: Tech Mahindra 1-year forward P/E multiple likely to sustain as valuations track

revenue growth

26

20%

23

15%

20

17 10%

14

5%

11

8 0%

01-04-2015

01-04-2017

01-04-2014

01-08-2014

01-12-2014

01-08-2015

01-12-2015

01-04-2016

01-08-2016

01-12-2016

01-08-2017

01-12-2017

01-04-2018

01-08-2018

01-12-2018

01-04-2019

01-08-2019

01-12-2019

01-04-2020

01-08-2020

01-12-2020

01-04-2021

01-08-2021

01-12-2021

Mcap/PAT (LHS) -2 SD -1 SD

Mean 1 SD 2 SD

Revenue Growth (RHS)

Source: Company, Edelweiss Wealth Research

Exhibit 15: Tech Mahindra reasonably valued across large cap and midcap IT universe

Mcap Revenue (INRmn) EBIT Margins EPS P/E ROCE ROE

CMP

(INRmn) FY21 FY22E FY23E FY21 FY22E FY23E FY21 FY22E FY23E FY21 FY22E FY23E FY21 FY22E FY23E FY21 FY22E FY23E

TCS 3,671 1,35,78,840 16,41,770 18,69,050 21,25,927 26% 26% 27% 91 107 125 40 34 29 12% 13% 14% 40% 43% 44%

Infosys 1,864 78,38,000 10,04,730 11,94,628 14,07,169 25% 25% 25% 46 54 65 41 34 29 9% 10% 12% 27% 31% 34%

HCL Tech 1,265 34,33,000 7,53,790 8,68,094 9,73,678 21% 20% 21% 46 51 61 28 25 21 27% 27% 32% 22% 22% 26%

Wipro 698 38,16,000 6,19,430 7,92,133 9,07,928 19% 19% 19% 20 25 28 36 28 25 21% 26% 24% 20% 24% 24%

Tech M 1,724 16,72,000 3,78,551 4,32,612 4,88,224 14% 15% 17% 50 62 73 34 29 24 24% 27% 2% 19% 21% 21%

LTI 7,166 12,56,000 1,23,698 1,54,934 1,85,225 19% 19% 22% 110 141 186 65 51 39 41% 42% 48% 31% 32% 36%

Mindtree 4,621 7,61,821 79,678 1,03,522 1,25,975 17% 18% 19% 67 93 115 69 50 40 41% 43% 44% 30% 32% 33%

Coforge 5,646 3,43,748 46,628 64,163 79,966 14% 15% 19% 79 118 184 72 48 31 26% 34% 42% 19% 25% 32%

LTTS 5,343 5,63,593 54,497 66,884 82,465 15% 19% 22% 65 98 141 82 55 38 29% 37% 44% 22% 28% 33%

Persistent Systems

5,501 3,42,617 41,879 56,022 73,991 12% 14% 16% 59 89 129 93 62 43 23% 31% 37% 18% 23% 28%

Birlasoft 531 1,47,704 35,557 41,872 51,831 13% 14% 15% 11 17 23 47 31 24 20% 26% 29% 16% 21% 24%

Cyient 991 1,09,155 41,325 46,335 53,118 10% 13% 13% 33 45 54 30 22 18 15% 19% 20% 14% 16% 17%

eClerx 2,359 79,793 15,645 20,605 22,966 23% 24% 23% 81 109 118 29 22 20 25% 29% 29% 19% 23% 21%

Source: Company, Edelweiss Wealth Research

Edelweiss Wealth Research 5

Tech Mahindra Ltd Financials

Income Statement (INR mn)

Year to March FY21A FY22E FY23E

Total operating income 3,78,551 4,32,612 4,88,224

Gross profit 1,19,996 1,39,958 1,64,553

Employee costs 0 0 0

Other expenses 0 0 0

EBITDA 68,470 82,192 1,00,107

Depreciation 15,084 15,170 18,064

Less: Interest expense 1,740 3,079 4,688

Add: Other income 7,871 9,699 7,810

Profit before tax 59,517 73,641 85,165

Prov for tax 15,999 19,208 21,291

Less: Other adjustment 0 0 0

Reported profit 44,268 55,183 64,623

Less: Excp.item (net) 0 0 0

Adjusted profit 44,268 55,183 64,623

Diluted shares o/s 880 885 886

Adjusted diluted EPS 50 62 73

DPS (INR) 17 17 17

Tax rate (%) 26.9 26.1 25.0

Important Ratios (%)

Year to March FY20A FY21 FY22E

Cost of revenues (%) 68.3 67.6 66.3

SG&A expenses (%) 13.6 13.4 13.2

Depreciation (%) 4.0 3.5 3.7

EBITDA margin (%) 18.1 19 20.5

Net profit margin (%) 11.7 12.8 13.2

Revenue Growth (% YoY) 2.7 14.3 12.9

EBITDA growth (% YoY) 19.6 20 21.8

Adj. profit growth (%) 9.6 24.7 17.1

Valuation Metrics

Year to March FY20A FY21 FY22E

Diluted P/E (x) 36 29 24

Price/BV (x) 6.4 5.6 4.8

EV/EBITDA (x) 22.9 19 15.6

Dividend yield (%) 1.1 1.1 1.1

Edelweiss Wealth Research 6

Tech Mahindra Ltd Financials

Balance Sheet (INR mn)

Year to March FY21A FY22E FY23E

Share capital 4,370 4,370 4,370

Reserves 2,44,280 2,81,795 3,28,733

Shareholders funds 2,48,650 2,86,165 3,33,103

Minority interest 3,795 3,045 2,295

Borrowings 16,618 15,288 14,124

Trade payables 27,850 32,072 35,471

Other liabs & prov 59,965 65,962 72,558

Total liabilities 3,96,780 4,45,193 5,03,248

Net block 24,632 16,645 6,000

Intangible assets 64,662 66,937 69,212

Capital WIP 1,183 1,420 1,704

Total fixed assets 90,477 85,001 76,916

Non current inv 891 891 891

Cash/cash equivalent 1,23,523 1,72,298 2,37,752

Sundry debtors 64,728 80,596 90,957

Loans & advances 0 0 0

Other assets 1,17,161 1,06,407 96,732

Total assets 3,96,780 4,45,193 5,03,248

Free Cash Flow (INR mn)

Year to March FY21A FY22E FY23E

Reported profit 44,268 55,183 64,623

Add: Depreciation 15,084 15,170 18,064

Interest (net of tax) -45,034 -77,231 -1,12,512

Others 50,985 69,861 1,08,640

Less: Changes in WC 15,635 7,864 12,345

Operating cash flow 80,938 70,848 91,161

Less: Capex -17,065 -9,695 -9,979

Free cash flow 63,873 61,153 81,182

Valuation Drivers

Year to March FY21A FY22E FY23E

EPS growth (%) 10.1 24 17

RoE (%) 19.0 20.6 20.9

EBITDA growth (%) 19.6 20 21.8

Payout ratio (%) 33.9 27.4 23.4

Edelweiss Wealth Research 7

Edelweiss Broking Limited, 1st Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W)

Board: (91-22) 4272 2200

Vinay Khattar

Head Research

VINAY Digitally signed by

VINAY KHATTAR

vinay.khattar@edelweissfin.com KHATTAR Date: 2021.12.29

13:57:35 +05'30'

400

350

300

(Indexed)

250

200

150

100

50

0

Nov-18

Nov-19

Nov-20

Nov-21

Jul-18

Jul-19

Jul-20

Jul-21

Sep-18

Sep-19

Sep-20

Sep-21

Mar-18

May-18

Mar-19

May-19

Mar-20

May-20

Mar-21

May-21

Jan-18

Jan-19

Jan-20

Jan-21

Tech Mahindra Sensex

Edelweiss Wealth Research 8

Disclaimer

Edelweiss Broking Limited ("EBL" or "Research Entity") is regulated by the Securities and Exchange Board of India ("SEBI") and is licensed to carry on the business of broking, depository

services and related activities. The business of EBL and its associates are organized around five broad business groups – Credit including Housing and SME Finance, Commodities, Financial

Markets, Asset Management and Life Insurance. There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and material

disciplinary action during the last three years. This research report has been prepared and distributed by Edelweiss Broking Limited ("Edelweiss") in the capacity of a Research Analyst

as per Regulation 22(1) of SEBI (Research Analysts) Regulations 2014 having SEBI Registration No. INH000000172.

Broking services offered by Edelweiss Broking Limited under SEBI Registration No.: INZ000005231 (Member of NSE, BSE, MCX and NCDEX). EBL CIN: U65100GJ2008PLC077462. Research

services offered by Edelweiss Broking Ltd. under SEBI Registration No. INH000000172. Depository participant with NSDL having SEBI registration no: IN-DP-NSDL-314-2009 and DP ID:

IN302201 and IN303719. Depository participant with CDSL having DP ID- 12032300. Investor grievance resolution team: 040-41151621; Email ID: Helpdesk@edelweiss.in. Name of the

Compliance Officer for Trading & DP - Mr. Pranav Tanna, Email IDs: complianceofficer.ebl@edelweissfin.com / ebl.dpcompliance@edelweissfin.com. Corporate Office: Edelweiss House,

Off CST Road, Kalina, Mumbai - 400098; Tel. 18001023335/022-42722200/022-40094279. Registered Office: 2nd Floor, Office No. 201 to 203, Zodiac Plaza, Xavier College Road, Off C G

Road, Ahmedabad, Gujarat - 380009. Contact: (079) 40019900 / 66629900.

This Report has been prepared by Edelweiss Broking Limited in the capacity of a Research Analyst having SEBI Registration No.INH000000172 and distributed as per SEBI (Research

Analysts) Regulations 2014. This report does not constitute an offer or solicitation for the purchase or sale of any financia l instrument or as an official confirmation of any transaction.

The information contained herein is from publicly available data or other sources believed to be reliable. This report is provided for assistance only and is not intended to be and must

not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such

investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or

indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or

entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribut ion, publication, availability or use would be contrary to law,

regulation or which would subject EBL and associates / group companies to any registration or licensing requirements within such jurisdiction. The distribution of this report in certain

jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date of

this report and there can be no assurance that future results or events will be consistent with this information. This information is subject to change without any prior notice. EBL reserves

the right to make modifications and alterations to this statement as may be required from time to time. EBL or any of its associates / group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EBL is committed to providing independent and transparent

recommendation to its clients. Neither EBL nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct,

indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the us e of the information. Our proprietary trading and investment

businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Past performance is not necessarily a guide to future performance .The

disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the

report. The information provided in these reports remains, unless otherwise stated, the copyright of EBL. All layout, design, original artwork, concepts and other Intellectual Properties,

remains the property and copyright of EBL and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

EBL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system,

break down of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the EBL to present the data. In no

event shall EBL be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the

data presented by the EBL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at

the same time. We will not treat recipients as customers by virtue of their receiving this report.

EBL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the

securities thereof, of company(ies), mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market

maker in the financial instruments of the subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other potential/material

conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. EBL may

have proprietary long/short position in the above mentioned scrip(s) and therefore should be considered as interested. The vi ews provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This should not be construed

as invitation or solicitation to do business with EBL.

EBL or its associates may have received compensation from the subject company in the past 12 months. EBL or its associates may have managed or co-managed public offering of

securities for the subject company in the past 12 months. EBL or its associates may have received compensation for investment banking or merchant banking or brokerage services from

the subject company in the past 12 months. EBL or its associates may have received any compensation for products or services other than investment banking or merchant banking or

brokerage services from the subject company in the past 12 months. EBL or its associates have not received any compensation or other benefits from the Subject Company or third party

in connection with the research report. Research analyst or his/her relative or EBL’s associates may have financial interest in the subject company. EBL, its associates, research analyst

and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of

research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange rates can be volatile and are subject to large fluctuations;

( ii) the value of currencies may be affected by numerous market factors, including world and national economic, political and regulatory events, events in equity and debt markets and

changes in interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the value of the currency. Investors in securities

such as ADRs and Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

EBL has financial interest in the subject companies: No

EBL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of

research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of

publication of research report: No

EBL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Edelweiss Wealth Research 9

Disclaimer

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their

securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

Additional Disclaimer for U.S. Persons

Edelweiss is not a registered broker – dealer under the U.S. Securities Exchange Act of 1934, as amended (the“1934 act”) and under applicable state laws in the United States. In addition

Edelweiss is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under

applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Edelweiss, including the

products and services described herein are not available to or intended for U.S. persons.

This report does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered

as an advertisement tool. "U.S. Persons" are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United

States. US Citizens living abroad may also be deemed "US Persons" under certain rules.

Transactions in securities discussed in this research report should be effected through Edelweiss Financial Services Inc.

Additional Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional experience in matters relating to investments falling

within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the “Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and

unincorporated associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this research report relates is available

only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents.

This research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person.

Additional Disclaimer for Canadian Persons

Edelweiss is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements

under such law. Accordingly, any brokerage and investment services provided by Edelweiss, including the products and services described herein, are not available to or intended for

Canadian persons.

This research report and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment

services.

Disclosures under the provisions of SEBI (Research Analysts) Regulations 2014 (Regulations)

Edelweiss Broking Limited ("EBL" or "Research Entity") is regulated by the Securities and Exchange Board of India ("SEBI") and is licensed to carry on the business of broking, depository

services and related activities. The business of EBL and its associates are organized around five broad business groups – Credit including Housing and SME Finance, Commodities,

Financial Markets, Asset Management and Life Insurance. There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and

material disciplinary action during the last three years. This research report has been prepared and distributed by Edelweiss Broking Limited ("Edelweiss") in the capacity of a Research

Analyst as per Regulation 22(1) of SEBI (Research Analysts) Regulations 2014 having SEBI Registration No.INH000000172.

Edelweiss Wealth Research 10

You might also like

- LT Tech - 4qfy19 - HDFC SecDocument12 pagesLT Tech - 4qfy19 - HDFC SecdarshanmadeNo ratings yet

- Mirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Document9 pagesMirae Asset Sekuritas Indonesia SCMA 3 Q22 697cf1eab1Ira KusumawatiNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- InfosysDocument13 pagesInfosysreena21a9No ratings yet

- PT M Cash Integrasi TBK: Charting A Digital TransformationDocument7 pagesPT M Cash Integrasi TBK: Charting A Digital TransformationHamba AllahNo ratings yet

- Sterlite Technologies (STETEC) : Export Demand Drives GrowthDocument10 pagesSterlite Technologies (STETEC) : Export Demand Drives Growthsaran21No ratings yet

- Prabhudas DmartDocument8 pagesPrabhudas DmartGOUTAMNo ratings yet

- NH Korindo CTRA - Focus On Existing ProjectsDocument6 pagesNH Korindo CTRA - Focus On Existing ProjectsHamba AllahNo ratings yet

- Media Release RIL Q3 FY23 20012023Document38 pagesMedia Release RIL Q3 FY23 20012023Riya ThakurNo ratings yet

- Motilal Oswal 2022 Stock PicksDocument13 pagesMotilal Oswal 2022 Stock Pickskp_05No ratings yet

- Intellect Design Arena LTD: Stock Price & Q4 Results of Intellect Design Arena Limited - HDFC SecuritiesDocument11 pagesIntellect Design Arena LTD: Stock Price & Q4 Results of Intellect Design Arena Limited - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Financial ResultsDocument56 pagesFinancial ResultsoverkillNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- Dixon Technologies Q4 Result Update Nirmal BangDocument8 pagesDixon Technologies Q4 Result Update Nirmal BangSwati 45No ratings yet

- BSE Limited National Stock Exchange of India Limited: Savithri ParekhDocument57 pagesBSE Limited National Stock Exchange of India Limited: Savithri ParekhAmit BahriNo ratings yet

- MindTree Kotak Institutional-Q4FY22Document14 pagesMindTree Kotak Institutional-Q4FY22darshanmadeNo ratings yet

- HCL Tech Q4 FY22 Investor ReleaseDocument25 pagesHCL Tech Q4 FY22 Investor ReleaseNddd NnbNo ratings yet

- TSLA Q2 2023 UpdateDocument27 pagesTSLA Q2 2023 UpdateSimon Alvarez100% (1)

- CMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeDocument14 pagesCMP: INR3,210: FY23 AR Analysis - Re-Energising The Core in A Tough TimeSameer MaradiaNo ratings yet

- Infosys: Digital Trajectory Intact, Revises Guidance UpwardsDocument11 pagesInfosys: Digital Trajectory Intact, Revises Guidance UpwardsanjugaduNo ratings yet

- IDBI Capital Century Plyboards Q4FY22 Result UpdateDocument10 pagesIDBI Capital Century Plyboards Q4FY22 Result UpdateTai TranNo ratings yet

- Zensar Technologies: Digital Led RecoveryDocument12 pagesZensar Technologies: Digital Led Recoverysaran21No ratings yet

- Dilip Buildcon Q3FY18 - Result Update - Axis Direct - 20022018 - 20!02!2018 - 16Document6 pagesDilip Buildcon Q3FY18 - Result Update - Axis Direct - 20022018 - 20!02!2018 - 16MiteshNo ratings yet

- FY 2022 Earnings Call Deck 3 - 13 - 2023 For PostDocument27 pagesFY 2022 Earnings Call Deck 3 - 13 - 2023 For PostCesar AugustoNo ratings yet

- Tata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDDocument8 pagesTata Consultancy Services: Lacks Acceleration Trigger Downgrade To HOLDAshokNo ratings yet

- Angel One Q4FY22 ResultsDocument6 pagesAngel One Q4FY22 ResultsdarshanmadeNo ratings yet

- Digital Value Spa: Italy - It Services A Resilient Highly Cash Flow Generative StockDocument16 pagesDigital Value Spa: Italy - It Services A Resilient Highly Cash Flow Generative StockJuan Jose Barrios OsorioNo ratings yet

- SHri 9M FY22Document27 pagesSHri 9M FY2253crx1fnocNo ratings yet

- Tech Mahindra (Announces One of Its Largest-Ever Deals) - MOStDocument10 pagesTech Mahindra (Announces One of Its Largest-Ever Deals) - MOStdarshanmaldeNo ratings yet

- Edenred - 2023 02 21 Fy 2022 Results Presentation VdefDocument70 pagesEdenred - 2023 02 21 Fy 2022 Results Presentation VdefaugustocestariraizenNo ratings yet

- Stock Update - HCL Tech - HSL - 061221Document12 pagesStock Update - HCL Tech - HSL - 061221GaganNo ratings yet

- Mahindra & Mahindra: Smooth Ride AheadDocument10 pagesMahindra & Mahindra: Smooth Ride Aheadarun_algoNo ratings yet

- IDirect Titan Q1FY23Document10 pagesIDirect Titan Q1FY23AKHILESH HEBBARNo ratings yet

- Reliance Industries - Q1FY23 - HSIE-202207250637049258859Document9 pagesReliance Industries - Q1FY23 - HSIE-202207250637049258859tmeygmvzjfnkqcwhgpNo ratings yet

- Trent 10 08 2023 IscDocument7 pagesTrent 10 08 2023 Iscaghosh704No ratings yet

- Danareksa Company Update 3Q22 CTRA 2 Nov 2022 Maintain Buy TP Rp1Document5 pagesDanareksa Company Update 3Q22 CTRA 2 Nov 2022 Maintain Buy TP Rp1BrainNo ratings yet

- Infosys: Strong Revenue, Margin Resilience Is KeyDocument8 pagesInfosys: Strong Revenue, Margin Resilience Is KeyKrish JNo ratings yet

- Maxs Sec 17-q Report q3 2022 11nov2022Document61 pagesMaxs Sec 17-q Report q3 2022 11nov2022Rachel VillanoNo ratings yet

- KPITTECH 03082020160338 KPITInvestorUpdateSEuploadDocument28 pagesKPITTECH 03082020160338 KPITInvestorUpdateSEuploadSreenivasulu Reddy SanamNo ratings yet

- ICICI Direct - Astec Lifesciences - Q3FY22Document7 pagesICICI Direct - Astec Lifesciences - Q3FY22Puneet367No ratings yet

- Infosys 140422 MotiDocument10 pagesInfosys 140422 MotiGrace StylesNo ratings yet

- 2019 Final Results, Dividend and Closure of Register of MembersDocument55 pages2019 Final Results, Dividend and Closure of Register of MembersGINYNo ratings yet

- L&T Technology Services (LTTS IN) : Q3FY19 Result UpdateDocument9 pagesL&T Technology Services (LTTS IN) : Q3FY19 Result UpdateanjugaduNo ratings yet

- IDirect TCS Q1FY23Document11 pagesIDirect TCS Q1FY23uefqyaufdQNo ratings yet

- Smart Task 3Document8 pagesSmart Task 3Tushar GuptaNo ratings yet

- Edelstar HDFC LTDDocument5 pagesEdelstar HDFC LTDBandaru NarendrababuNo ratings yet

- Divis RRDocument10 pagesDivis RRRicha P SinghalNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- Kajaria Ceramics - IC - HSIE-202101232125474239802Document22 pagesKajaria Ceramics - IC - HSIE-202101232125474239802bharat ratnaNo ratings yet

- Iifl - M-Reit - Kyc - 20200915Document37 pagesIifl - M-Reit - Kyc - 20200915Saatvik ShettyNo ratings yet

- HCL Tech Q1 FY23 Investor ReleaseDocument25 pagesHCL Tech Q1 FY23 Investor ReleasedeepeshNo ratings yet

- Prabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDocument8 pagesPrabhudas Lilladher Sees 7% UPSIDE in Pidilite Industries StrongDhaval MailNo ratings yet

- ITC AnalysisDocument7 pagesITC AnalysisPRASHANT ARORANo ratings yet

- Zee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingDocument13 pagesZee Entertainment (ZEEENT) : Strong Show Future Portends Heavy SpendingAshokNo ratings yet

- 3M India: Strong Recovery in Healthcare Safety & Industrials Continue To UnderperformDocument7 pages3M India: Strong Recovery in Healthcare Safety & Industrials Continue To UnderperformJayendra KulkarniNo ratings yet

- Asian-Paints Broker ReportDocument7 pagesAsian-Paints Broker Reportsj singhNo ratings yet

- Fortinet Ov Brochure Q4 2020Document12 pagesFortinet Ov Brochure Q4 2020Alejandra VasquesNo ratings yet

- SChand Analyst CoverageDocument7 pagesSChand Analyst CoverageMohan KNo ratings yet

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- F6 - Taxation BPP Workbook 2021-22Document100 pagesF6 - Taxation BPP Workbook 2021-22Aaryan0% (1)

- 11 Economics sp01Document14 pages11 Economics sp01DËV DÃSNo ratings yet

- 26 Agenda 1 17Document248 pages26 Agenda 1 17AaryanNo ratings yet

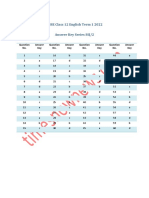

- CBSE Answer Key Class 12 English Ssj2Document1 pageCBSE Answer Key Class 12 English Ssj2AaryanNo ratings yet

- Class Wise Xi & Xii 2021-22Document2 pagesClass Wise Xi & Xii 2021-22AaryanNo ratings yet

- ECONOMICS (Code No. 030) : RationaleDocument11 pagesECONOMICS (Code No. 030) : RationaleHARMAN KAUR BABBARNo ratings yet

- FDocument1 pageFAaryanNo ratings yet

- Key Terms and Chapter Summary-9Document5 pagesKey Terms and Chapter Summary-9AaryanNo ratings yet

- F6 - Taxation BPP Workbook 2021-22Document100 pagesF6 - Taxation BPP Workbook 2021-22Aaryan0% (1)

- Letter Writing - Class 11Document11 pagesLetter Writing - Class 11AaryanNo ratings yet

- Class Wise Xi & Xii 2021-22Document2 pagesClass Wise Xi & Xii 2021-22AaryanNo ratings yet

- Pfizer References - November 2015Document5 pagesPfizer References - November 2015Nadeen PujaNo ratings yet

- Flow Charts 9Document2 pagesFlow Charts 9AaryanNo ratings yet

- +919605920850 5 APRIL 1999: Computer ProficiencyDocument1 page+919605920850 5 APRIL 1999: Computer ProficiencyAaryanNo ratings yet

- Obu ExamplerDocument11 pagesObu Examplerahsan1379No ratings yet

- FDocument1 pageFAaryanNo ratings yet

- FDocument1 pageFAaryanNo ratings yet

- F6 - Taxation BPP Workbook 2021-22Document759 pagesF6 - Taxation BPP Workbook 2021-22AaryanNo ratings yet

- Excel Formulas & FunctionsDocument100 pagesExcel Formulas & FunctionsBaldau Gupta100% (7)

- FDocument1 pageFAaryanNo ratings yet

- Oxford Brookes University: Research and Analysis ProjectDocument37 pagesOxford Brookes University: Research and Analysis ProjectAaryanNo ratings yet

- OBU Research Analysis ProjectDocument59 pagesOBU Research Analysis ProjectAaryanNo ratings yet

- Pfizer Skills and Learning Statement - December 2015Document10 pagesPfizer Skills and Learning Statement - December 2015Nadeen PujaNo ratings yet

- FDocument10 pagesFsoundar RanjanNo ratings yet

- Sarva Siksha AbhiyanDocument28 pagesSarva Siksha AbhiyanArvind GRNo ratings yet

- OBU Essay SampleDocument46 pagesOBU Essay SampleAsif SajibNo ratings yet

- (SAMPLE THESIS) Research and Analysis Project (Obu)Document66 pages(SAMPLE THESIS) Research and Analysis Project (Obu)Murtaza Mansoor77% (35)

- Oxford Brookes University: Research and Analysis ProjectDocument37 pagesOxford Brookes University: Research and Analysis ProjectAaryanNo ratings yet

- Obu ExamplerDocument11 pagesObu Examplerahsan1379No ratings yet

- OBU Essay SampleDocument46 pagesOBU Essay SampleAsif SajibNo ratings yet

- Final Sent Technical Specification 14.03.2019Document16 pagesFinal Sent Technical Specification 14.03.2019harishNo ratings yet

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsDocument2 pagesPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetieNo ratings yet

- Macro Economics A2 Level Notes Book PDFDocument33 pagesMacro Economics A2 Level Notes Book PDFMustafa Bilal50% (2)

- Repro Indo China Conf PDFDocument16 pagesRepro Indo China Conf PDFPavit KaurNo ratings yet

- FoodhallDocument3 pagesFoodhallswopnilrohatgiNo ratings yet

- Material List Summary-WaptechDocument5 pagesMaterial List Summary-WaptechMarko AnticNo ratings yet

- Injection Nozzle Opening Pressure: Lmbo QFKD Fkpqor'qflkDocument1 pageInjection Nozzle Opening Pressure: Lmbo QFKD Fkpqor'qflkAlexanderNo ratings yet

- MCQs + SEQs Medical Physics Midterm Exam Paper-Fall 2020Document3 pagesMCQs + SEQs Medical Physics Midterm Exam Paper-Fall 2020Ali Nouman100% (1)

- Inclusions in Gross IncomeDocument2 pagesInclusions in Gross Incomeloonie tunesNo ratings yet

- 4th Conference ParticipantsDocument14 pages4th Conference ParticipantsmaxNo ratings yet

- Lab 08: SR Flip Flop FundamentalsDocument6 pagesLab 08: SR Flip Flop Fundamentalsjitu123456789No ratings yet

- Bye Laws For MirzapurDocument6 pagesBye Laws For MirzapurUtkarsh SharmaNo ratings yet

- E-Cat35xt014 Xtro PhantomsDocument32 pagesE-Cat35xt014 Xtro PhantomsKari Wilfong100% (5)

- Financial/ Accounting Ratios: Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Accounting Ratios: Sebi Grade A & Rbi Grade Bneevedita tiwariNo ratings yet

- APPSC GR I Initial Key Paper IIDocument52 pagesAPPSC GR I Initial Key Paper IIdarimaduguNo ratings yet

- Study of Bond Properties of Concrete Utilizing Fly Ash, Marble and Granite PowderDocument3 pagesStudy of Bond Properties of Concrete Utilizing Fly Ash, Marble and Granite PowderLegaldevil LlabsNo ratings yet

- Computerised Project Management PDFDocument11 pagesComputerised Project Management PDFsrishti deoli50% (2)

- Steinecker Boreas: Wort Stripping of The New GenerationDocument16 pagesSteinecker Boreas: Wort Stripping of The New GenerationAlejandro Javier Delgado AraujoNo ratings yet

- A Study On Awareness of Mutual Funds and Perception of Investors 2Document89 pagesA Study On Awareness of Mutual Funds and Perception of Investors 2Yashaswini BangeraNo ratings yet

- Eat Something DifferentDocument3 pagesEat Something Differentsrajendr200100% (1)

- Jose André Morales, PH.D.: Ingeniería SocialDocument56 pagesJose André Morales, PH.D.: Ingeniería SocialJYMYNo ratings yet

- MBF100 Subject OutlineDocument2 pagesMBF100 Subject OutlineMARUTI JEWELSNo ratings yet

- 127 Bba-204Document3 pages127 Bba-204Ghanshyam SharmaNo ratings yet

- Legends & Lairs - Giant LoreDocument66 pagesLegends & Lairs - Giant LoreGary DowellNo ratings yet

- Statement 1680409132566Document11 pagesStatement 1680409132566úméshNo ratings yet

- Understand Fox Behaviour - Discover WildlifeDocument1 pageUnderstand Fox Behaviour - Discover WildlifeChris V.No ratings yet

- Erectus Ever Found Within The Boundaries of China. The Two Fossil Teeth Unearthed WereDocument6 pagesErectus Ever Found Within The Boundaries of China. The Two Fossil Teeth Unearthed WereenerankenNo ratings yet

- Denso - History PDFDocument5 pagesDenso - History PDFVenkateswaran KrishnamurthyNo ratings yet

- Cuerpos Extraños Origen FDADocument30 pagesCuerpos Extraños Origen FDALuis GallegosNo ratings yet

- Topic 3 - Analyzing The Marketing EnvironmentDocument28 pagesTopic 3 - Analyzing The Marketing Environmentmelissa chlNo ratings yet