Professional Documents

Culture Documents

Daily Equity Market Report - 19.01.2022

Uploaded by

Fuaad Dodoo0 ratings0% found this document useful (0 votes)

75 views1 pageDaily Equity Market Report_19.01.2022

Original Title

Daily Equity Market Report_19.01.2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDaily Equity Market Report_19.01.2022

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

75 views1 pageDaily Equity Market Report - 19.01.2022

Uploaded by

Fuaad DodooDaily Equity Market Report_19.01.2022

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

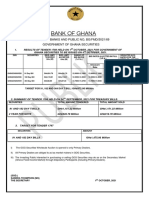

19TH JANUARY 2022

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI gained 23.68 points Indicator Current Previous Change

GSE-Composite Index 2,789.52 2,765.84 23.68 pts

to close at 2,789.52; returns 0.01% YTD

YTD (GSE-CI) 0.01% -0.84% -101.19%

The benchmark GSE Composite Index (GSE-CI) closed in the green for the GSE-Financial index 2,154.03 2,153.68 0.35 pts

YTD (GSE-FSI) 0.10% 0.09% 11.11%

first time in 2022 as it gained 23.68 points to close at 2,789.52 representing

Market Cap. (GH¢ MN) 64,501.06 64,253.25 247.81

a YTD return of 0.01%. The GSE Financial Stock Index (GSE-FSI) also gained Volume Traded 1,609,189 549,258 192.98%

0.35 points to close trading at 2,154.03 also translating into a YTD return of Value Traded (GH¢) 1,916,233.16 588,622.16 225.55%

0.10%. TOP TRADED EQUITIES

Scancom PLC. (MTNGH) and Trust Bank Gambia Ltd. (TBL) each Ticker Volume Value (GH¢)

appreciated in price by 1.83% and 2.70% to close at GH¢1.11 and GH¢0.38 MTNGH 1,566,955 1,739,180.95

GCB 30,000 157,147.49

respectively. Market Capitalization also improved by GH¢247.81 million to

EGL 5,185 15,555.00

close at GH¢64.50 billion. ETI 3,200 448.00

TBL 2,019 767.22 90.7% value traded

A total of 1,609,189 shares valued at GH¢1,916,233.16 were traded in nine (9)

GAINERS

equities compared to 549,258 shares valued at GH¢588,622.16 which

Ticker Close Price Open Price Change YTD

exchanged hands yesterday with Scancom PLC. (MTNGH) recording again (GH¢) (GH¢) Change

MTNGH 1.11 1.09 1.83% 0.00%

the lion’s share of trades as it accounted for 90.7% of the total value traded.

TBL 0.38 0.37 2.70% 11.76%

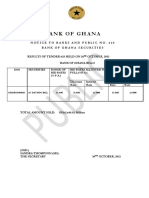

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

Share Price GH¢1.09

Price Change (YtD) -1.80% KEY ECONOMIC INDICATORS

Market Capitalization GH¢13.39 billion Indicator Current Previous

Dividend Yield 0.00% Monetary Policy Rate November 2021 14.50% 13.50%

Earnings Per Share GH¢0.1532 Real GDP Growth Q3 2021 6.6% 3.9%

Avg. Daily Volume Traded 2,559,521 Inflation December 2021 12.6% 12.2%

Value Traded (YtD) GH¢ 30,084,890 Reference rate December 2021 13.89% 13.46%

Source: GSS, BOG, GBA

GSE AGAINST SELECTED AFRICAN STOCK MARKETS

SBL RECOMMENDED PICKS

Country As at 31-12-21 YTD

Equity Price Outlook (Reason)

2,789.34 43.66%

MTN GHANA GH¢ 1.11 Strong 2021 Q3 Financials (Ghana) GSE-CI

BOPP GH¢ 6.65 Strong 2021 Q3 Financials (Botswana) BGSMDC 7,009.61 1.89%

CAL BANK GH¢ 0.82 Strong 2021 Q3 Financials (Egypt) EGX-30 11,949.18 8.59%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials (Kenya) NSE ASI 166.46 9.43%

SOGEGH GH¢ 1.20 Strong 2021 Q3 Financials (Nigeria) NGSE ASI 42,716.44 6.07%

FANMILK GH¢ 3.95 Positive Sentiment 71,570.64 20.47%

(South Africa) JSE ASI

(WAEMU) BRVM 202.28 39.15%

Source: Bloomberg

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Foreign Exchange MarketDocument24 pagesForeign Exchange MarketGaurav DhallNo ratings yet

- Tradingview ScriptsDocument3 pagesTradingview ScriptsAlex LeongNo ratings yet

- Corpo Law Review (Codal and Notes From Aquino) by Ruth Cepe - 1Document48 pagesCorpo Law Review (Codal and Notes From Aquino) by Ruth Cepe - 1Ruth CepeNo ratings yet

- Mutual Fund Insight - Apr 2022Document94 pagesMutual Fund Insight - Apr 2022Mn ReddyNo ratings yet

- Sponsor - Candle - 2 37981Document5 pagesSponsor - Candle - 2 37981CapRa Xubo100% (1)

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- IAS 36 - Impairment of AssetsDocument6 pagesIAS 36 - Impairment of AssetsStanley RobertNo ratings yet

- Net Present Value and Other Investment CriteriaDocument14 pagesNet Present Value and Other Investment CriteriaDeepika PadukoneNo ratings yet

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- Fairway Group Holdings Corp - Form S-1A (Apr-04-2013)Document327 pagesFairway Group Holdings Corp - Form S-1A (Apr-04-2013)gtg414gNo ratings yet

- Inter AccDocument6 pagesInter AccshaylieeeNo ratings yet

- Unit-6 Investment AccountingDocument37 pagesUnit-6 Investment Accountingkawanalavesh4No ratings yet

- Financial Markets Meaning, Types and WorkingDocument15 pagesFinancial Markets Meaning, Types and WorkingRainman577100% (1)

- PADI - Annual Report - 2017 PDFDocument158 pagesPADI - Annual Report - 2017 PDFRina KusumaNo ratings yet

- Feasibility AnalysisDocument16 pagesFeasibility AnalysissauravNo ratings yet

- Final Assignment Forex MarketDocument6 pagesFinal Assignment Forex MarketUrvish Tushar DalalNo ratings yet

- AccountingDocument72 pagesAccountingOmar SanadNo ratings yet

- How Fed Became The Dealer of Last Resort PaperDocument9 pagesHow Fed Became The Dealer of Last Resort PaperMichael Joseph KellyNo ratings yet

- Objection Letter - 7Document4 pagesObjection Letter - 7stockboardguyNo ratings yet

- Statement of Account: Tran Date Value Date CHQ/Ref No Particulars Debit Credit BalanceDocument32 pagesStatement of Account: Tran Date Value Date CHQ/Ref No Particulars Debit Credit BalanceNael SwedanNo ratings yet

- FM-Dividend PolicyDocument9 pagesFM-Dividend PolicyMaxine SantosNo ratings yet

- Uas Distribusi 8Document1 pageUas Distribusi 8riocahNo ratings yet

- PSAK 41-RevDocument6 pagesPSAK 41-Revapi-3708783No ratings yet

- SFMmegerDocument5 pagesSFMmegerKiran MinhasNo ratings yet

- Lecture 1 - IntroductionDocument47 pagesLecture 1 - IntroductionYara AzizNo ratings yet

- MGT 4160 Fall 2012 Assignment 1Document3 pagesMGT 4160 Fall 2012 Assignment 1sirocco87No ratings yet

- ACT312 Quiz1 Online-1 PDFDocument6 pagesACT312 Quiz1 Online-1 PDFCharlie Harris0% (1)

- Final Corporate Finance GROUP 4Document10 pagesFinal Corporate Finance GROUP 4sudipta shrivastavaNo ratings yet

- BA7106-Accounting For Management Question Bank - Edited PDFDocument10 pagesBA7106-Accounting For Management Question Bank - Edited PDFDhivyabharathiNo ratings yet

- Chapter 6: Equity: Concepts and TechniquesDocument5 pagesChapter 6: Equity: Concepts and TechniquesJason YP KwokNo ratings yet

- UntitledDocument28 pagesUntitledUNNATINo ratings yet