Professional Documents

Culture Documents

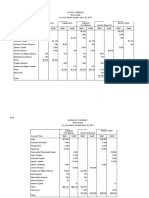

Tahum Company Contribution Margin Income Statement Sales ($ 100 12,000) $1,200,000 Less: Variable Costs

Uploaded by

Gretchen Montoya0 ratings0% found this document useful (0 votes)

6 views3 pagesThis document contains a managerial accounting problem involving Tahum Company. It provides cost estimates for the semester including cost of goods sold of $35 per unit, advertising expense of $210,000, sales commissions of 6% of sales, shipping expenses of $28,000 plus $5 per unit. It asks to prepare a contribution format income statement and traditional income statement.

The solution shows a contribution format income statement with contribution margin of $648,000 and net income of $104,000. It also shows a traditional income statement with gross profit of $780,000 and same net income of $104,000.

Original Description:

Original Title

_FA1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a managerial accounting problem involving Tahum Company. It provides cost estimates for the semester including cost of goods sold of $35 per unit, advertising expense of $210,000, sales commissions of 6% of sales, shipping expenses of $28,000 plus $5 per unit. It asks to prepare a contribution format income statement and traditional income statement.

The solution shows a contribution format income statement with contribution margin of $648,000 and net income of $104,000. It also shows a traditional income statement with gross profit of $780,000 and same net income of $104,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesTahum Company Contribution Margin Income Statement Sales ($ 100 12,000) $1,200,000 Less: Variable Costs

Uploaded by

Gretchen MontoyaThis document contains a managerial accounting problem involving Tahum Company. It provides cost estimates for the semester including cost of goods sold of $35 per unit, advertising expense of $210,000, sales commissions of 6% of sales, shipping expenses of $28,000 plus $5 per unit. It asks to prepare a contribution format income statement and traditional income statement.

The solution shows a contribution format income statement with contribution margin of $648,000 and net income of $104,000. It also shows a traditional income statement with gross profit of $780,000 and same net income of $104,000.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

Managerial Accounting

Formative Assessment 1

MET: Managerial Accounting Concepts and Principles

Problem:

Tahum Company plans to sell 12,000 units during the next semester at a selling prices of $100

per unit sold. Below are the relevean cost estimates for the next semester.

a. Cost of good sold $ 35 per unit sold

b. Advertising Expense $ 210,000 per semester

c. Sales Commissions $ 6% of sales

d. Shipping Expense $ 28,000 per semester + $5 per unit sold

e. Administrative Salaries $ 145,000 per semester

f. Insurance Expense $ 9,000 per semester

g. Depreciation Expense $ 76,000 per semester

Required:

1. Prepare a contribution format income statement.

2. Prepare a tradition format income statement.

Solution:

TAHUM COMPANY

CONTRIBUTION MARGIN INCOME STATEMENT

Sales ($ 100*12,000) $1,200,000

Less: Variable Costs

Cost of Goods Sold ($35*12,000) 420,000

Sales Commission ($6%*1,200,000) 72,000

Shipping Expense ($5*12,000) 60,000

Contribution Margin 648,000

Less: Fixed Costs

Advertising Expennse 210,000

Shipping Expense 28,000

Administrative Salaries 145,000

Insurance Expense 9,000

Depreciation Expense ($76,000*2) 152,000

Net Income 104,000

TAHUM COMPANY

TRADITIONAL INCOME STATEMENT

Sales ($ 100*12,000) $1,200,000

Cost of Goods Sold ($35*12,000) $420,000

Gross Profit $780,000

General and Administrative Expenses

Administrative Salaries 145,000

Insurance Expense 9,000

Selling and Distribution Expenses

Advertising Expense 210,000

Sales Commissions ($6% *1,200,000) 72,000

Shipping Expenses ($28000 + ($5*12,000) 88,000

Depreciation Expense ($76,000*2) 152,000

Net Income 104,000

2. MINI CASE: CHEAP PART COSTS GENERAL MOTORS A FORTUNE

2. Mini Case: CHEAP PART COSTS GENERAL MOTORS A FORTUNE

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- D Mercer - Private Client Case Study-V1Document5 pagesD Mercer - Private Client Case Study-V1kapoor_mukesh4uNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Outreach Networks Case Study SolutionDocument2 pagesOutreach Networks Case Study SolutionEaston Griffin0% (1)

- To Sell Is HumanDocument13 pagesTo Sell Is HumanGretchen MontoyaNo ratings yet

- Understanding Fischer BlackDocument39 pagesUnderstanding Fischer BlackxarkhamNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeAbdulmajed Unda MimbantasNo ratings yet

- Ma Mod4 W08Document221 pagesMa Mod4 W08Randy KuswantoNo ratings yet

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- Chapter 12 SolutionsDocument10 pagesChapter 12 Solutionshassan.murad100% (2)

- Solution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionDocument35 pagesSolution Manual For Financial Statements Analysis Subramanyam Wild 11th EditionJenniferPalmerdqwf100% (35)

- Hapter: Income TaxesDocument40 pagesHapter: Income TaxesGray JavierNo ratings yet

- GR No. 78133Document1 pageGR No. 78133ElleNo ratings yet

- Pambansang KaunlaranDocument41 pagesPambansang KaunlaranAntonio Delgado100% (3)

- BOH JW Marriot ReportDocument10 pagesBOH JW Marriot Reporttenzin dhaselNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- MBA641 Managerial Accounting Case Study #3Document3 pagesMBA641 Managerial Accounting Case Study #3risvana rahimNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- Estimate How Much of The: Problem 3-15Document7 pagesEstimate How Much of The: Problem 3-15Cheveem Grace EmnaceNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Costs of Production For Go Pirates CorpDocument6 pagesCosts of Production For Go Pirates CorpAshleyNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- Course Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Document4 pagesCourse Code: ACT 201 Course Title: Cost & Management Accounting Section: 2Wild GhostNo ratings yet

- CVP Analysis SolutionsDocument6 pagesCVP Analysis SolutionsAlaine Milka GosycoNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Notes CVP 2009, 2017Document13 pagesNotes CVP 2009, 2017Aaron ForbesNo ratings yet

- Chapter 4 Practice SolutionsDocument24 pagesChapter 4 Practice SolutionstolatillerNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Session 4 Practice ProblemsDocument11 pagesSession 4 Practice ProblemsRishika RathiNo ratings yet

- A1C019011 - Alifia Aprizila Putri - Tugas AKL.Document5 pagesA1C019011 - Alifia Aprizila Putri - Tugas AKL.Alifia AprizilaNo ratings yet

- Business Decisions Using Cost Behaviour: Cost-Volume-Profit AnalysisDocument11 pagesBusiness Decisions Using Cost Behaviour: Cost-Volume-Profit Analysismishabmoomin1524No ratings yet

- Acc2002 PPT FinalDocument53 pagesAcc2002 PPT FinalSabina TanNo ratings yet

- CF 12th Edition Chapter 02Document38 pagesCF 12th Edition Chapter 02Ashekin MahadiNo ratings yet

- Feb 7Document7 pagesFeb 7naxahejNo ratings yet

- Problem 8-35 Hansen Mowen Cornerstone of Managerial AccountingDocument4 pagesProblem 8-35 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- ACCT - Break Even Buy or Sell Budgeting Operation AnalysisDocument19 pagesACCT - Break Even Buy or Sell Budgeting Operation AnalysisTavakoli MehranNo ratings yet

- COST BEHAVIOR (Solution)Document4 pagesCOST BEHAVIOR (Solution)Omer SiddiquiNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Class Case 4 - Whitney CompanyDocument3 pagesClass Case 4 - Whitney Company9ry5gsghybNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- CHAPTER 4 DERIVATIONS 7 PGDocument7 pagesCHAPTER 4 DERIVATIONS 7 PGzee abadillaNo ratings yet

- Margin 60% 50,000 Interest Cost (20,000)Document7 pagesMargin 60% 50,000 Interest Cost (20,000)hijab zaidiNo ratings yet

- Problem Solving FinmanDocument4 pagesProblem Solving FinmanJenina Rose SalvadorNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Group AssignmentDocument6 pagesGroup AssignmentMuzie Bhengu GoqoloNo ratings yet

- Practice Exam Chapters 6-9 Solutions: Problem IDocument4 pagesPractice Exam Chapters 6-9 Solutions: Problem IAtif RehmanNo ratings yet

- Managerial Accounting - 1Document4 pagesManagerial Accounting - 1Layla AfidatiNo ratings yet

- Neale Corporation Financial StatementDocument4 pagesNeale Corporation Financial StatementkerryNo ratings yet

- CH 11Document35 pagesCH 11তি মিNo ratings yet

- Intermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsDocument13 pagesIntermediate Accounting: Assignment 4: Exercise 4-6: Multiple-Step and Extraordinary ItemsMuhammad MalikNo ratings yet

- Garrison 14e Practice Exam - Chapter 6Document4 pagesGarrison 14e Practice Exam - Chapter 6Đàm Quang Thanh TúNo ratings yet

- Chapter 10 - Capital Budgeting - SolutionsDocument10 pagesChapter 10 - Capital Budgeting - Solutionsbraydenfr05No ratings yet

- At Wid SolDocument4 pagesAt Wid SolglamfactorsalonspaNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Chapter 9 Bucaloy, Romel B.Document8 pagesChapter 9 Bucaloy, Romel B.Romel BucaloyNo ratings yet

- More On Capital BudgetingDocument56 pagesMore On Capital BudgetingnewaznahianNo ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Practice Exam Chapters 1-5 (1) Solutions: Problem IDocument5 pagesPractice Exam Chapters 1-5 (1) Solutions: Problem IAtif RehmanNo ratings yet

- Ch11 ShowDocument63 pagesCh11 ShowMahmoud AbdullahNo ratings yet

- (Done) Activity-Chapter 2Document8 pages(Done) Activity-Chapter 2bbrightvc 一ไบร์ทNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- FA2 - ExcelDocument1 pageFA2 - ExcelGretchen MontoyaNo ratings yet

- Fa3 ExcelDocument6 pagesFa3 ExcelGretchen MontoyaNo ratings yet

- Chapter 5Document10 pagesChapter 5Gretchen MontoyaNo ratings yet

- 3rd Journal Critique - Montoya, GretchenDocument5 pages3rd Journal Critique - Montoya, GretchenGretchen MontoyaNo ratings yet

- Hsslive-2.National Income Accounting-SignedDocument75 pagesHsslive-2.National Income Accounting-SignedNusrat JahanNo ratings yet

- c2 2Document3 pagesc2 2Kath LeynesNo ratings yet

- Worksheet-The Brilliant CompanyDocument15 pagesWorksheet-The Brilliant Companytristan ignatiusNo ratings yet

- HumanitieDocument42 pagesHumanitieChemutai EzekielNo ratings yet

- Feedback - MOCKP1B1Document24 pagesFeedback - MOCKP1B1Raman ANo ratings yet

- Bram PDFDocument3 pagesBram PDFElis priyantiNo ratings yet

- 13 ConsolidationDocument118 pages13 Consolidationjoshua ChiramboNo ratings yet

- Year Plan XII Eco 2024 25Document4 pagesYear Plan XII Eco 2024 25TOMY PERIKOROTTE CHACKONo ratings yet

- Bestfriend Sisig FriesDocument9 pagesBestfriend Sisig FriesRynjeff Lui-Pio0% (1)

- Chapter 13 - IAS 12Document54 pagesChapter 13 - IAS 12Bahader AliNo ratings yet

- E4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Document7 pagesE4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Quynh Cao PhuongNo ratings yet

- Bab 8 Costing by Product and Joint ProductDocument5 pagesBab 8 Costing by Product and Joint ProductAntonius Sugi Suhartono100% (1)

- Minicase 246Document2 pagesMinicase 246Ngọc Minh Nguyễn100% (1)

- Key Answer Financial Statement - TP1Document7 pagesKey Answer Financial Statement - TP1Riza AdiNo ratings yet

- TAX-801 (Sources of Income)Document2 pagesTAX-801 (Sources of Income)Ciarie SalgadoNo ratings yet

- Faisalabad Electric Supply Company Last Pay Certificate: ReverseDocument70 pagesFaisalabad Electric Supply Company Last Pay Certificate: ReverseChief Of AuditNo ratings yet

- Inequality in Latin America Is Fuelling A New Wave of PopulismDocument3 pagesInequality in Latin America Is Fuelling A New Wave of PopulismisabelvillarroeltaberNo ratings yet

- HouseholdsDocument13 pagesHouseholdsChan Myae KhinNo ratings yet

- IAR Auditing ConclusionDocument23 pagesIAR Auditing Conclusionmarlout.sarita100% (1)

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet