Professional Documents

Culture Documents

Margin 60% 50,000 Interest Cost (20,000)

Uploaded by

hijab zaidi0 ratings0% found this document useful (0 votes)

35 views7 pagesOriginal Title

Sales 20 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views7 pagesMargin 60% 50,000 Interest Cost (20,000)

Uploaded by

hijab zaidiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

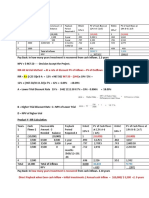

Sales 20,000 X$ 5 100% $ 100,000

T. variable costs $ 2 x20000 40% ( 40,000)

Contribution Margin 60% 60,000

T. Fixed Cost (10,000)

EBIT 50,000

Interest Cost (20,000)

Profit before Tax 30,000

Tax Rate 40% (12,000)

Profit After Tax 18,000

Pref Dividend (12,000)

Earnings to Common stocks 6,000

EPS = 6,000/5000 = $ 1.20

T. variable costs

Factory related variable cost item to item

Selling Expenses variable cost item to item

T. Fixed Cost Fixed Cost: Factory + Admin +

Selling + Financial

Break Even ($) Overall/total = T. Fixed Cost/ C/M

Ratio

10000+20000+12000/.60= 70,000/=

Check/proof

Sales at breakeven $ 70,000

T. variable Cost 40%0f sales (70,000) (28,000)

Contribution Margin 42,000

T. Fixed Cost (42,000)

Profit/Loss -0-

GOOD EBIT $ 55,000/ 55,000- I-5,000(PD-O)=

DFL = 55,000/50,000 = 1.1 > 1 Plan B

90,000/90000-7000 = 90000/83,000 –( 80,000 x

1/1-.4)or ( 80,000 x 1/.6) or (80000x 1.66) 0r

( 132800)= 90000/83,000 –132800 = 90000/ = -1.86

<1

55,000/30000 = 1.8 > 1

12-9 Levin Co.

Fixed Operating Cost $ 72,000, Variable Cost $ 6.75 pu Selling Price $ 9.75 pu

a. Break Even in Units/Q = T. Operating Fixed Cost/ Selling Price PU- Variable PU

$ 72,000/ ($ 9.75 – 6.75) {Contribution Margin Per Unit}

$ 72,000/ 3 = 24000 units

Check : Sales in units Break Even 24000 x $ 9.75 $ 234,000 100%

Less total Variable Cost 24000x $6.75 ($162000) 69% 162/234

Contribution Margin (# 3x 24,000) $ 72,000 31%

T. Operational Fixed Cost ($72,000)

Profit/ Loss NIL

Units sold 25,000 30,000 40,000 24,000 (d) Increase/

Decrease

$/ %

Unit Price $ 9.75

T. Sales $ 243,750 $ 292,500 $ 390,000 234,000 156,000

66%

T. Variable Cost $ 6.75 ($168750) ($202,500 ($270,000) ($162000)

)

Contribution Margin $ 75,000 $90,000 $ 120,000 72,000

T. Fixed Cost ($ 72,000) ($ 72,000) ($ 72,000) ($72,000)

EBIT $ 3,000 $ 18,000 $ 48,000 NIL 48,000

125% say

DOL = % change in EBIT/ % Change in Sales = 125/66 = 2.1 > 1

DOL = Sales 292,500 – 243,750 = 48750/243750 x100 = 20%

EBIT 18,000 -3,000 = $ 15,000/3000 x100 = 500%

DOL = % change in EBIT/ % Change in Sales = 500/20 = 25 > 1

12-10 South Company

EBIT $ 24,600 $ 30,600 $ 35,000

Interest Bond $ 60,000 x16% 9,600 9,600 9,600

Earnings Before Tax $ 15,000 $ 21,000 $ 25,400

Tax Rate .40 6,000 8,400 10,160

Profit After Tax 9,000 12,600 15,240

Pref. Dividend $ 5 x 1,500 7,500 7,500 7,500

Earning to common Stockholder 1,500 5,100 7,740

No. on common shares 4,000 4,000 4,000

EPS 5100/4000=1.275 7740/4000=1.945

1500/4000=0.37

5

I- 24600 – 30600 = - 6000/ 24600x100 = 24% ; EPS = 0.375 – 1.275 = - .90/.375x100 = 240%

240%/ 24 % = 10 times > 1

I- 24,600/ 24600- 9600- ( 7500 x 1/1-.4) = ( 7,500 x 1/.6)= 12,500;

24,600/24,600-9600-12,500 = 24,600/2500= 9.84 or 10 > 1

II. 30,600/30600- 9,600- (7,500x1/1-.4)

30,600/30,600-9,600-12,500= 30,600/7,900 = 3.87>1

III. 35,000/35,000 -9,600 -12,500 = 1.09 >1

14-1, 6, 10, 12

For Assignment

Total Sales $ 10,000,000 100%

Total Variable cost 1620000 16%

CM 8380000 84%

T. Fixed Cost ($ 72,0000)

EBIT 7,660,000

Break Even $Total Sales = T. Fixed Cost/ CM Ratio=

$ 720,000/ .84 (CM Ratio) = $ 857,143

Check: Sales $ at break even 857,143

T. Variable Cost 16% of 857,143 ( 137,143)

Contribution Margin 720,000

Total Fixed Cost (720,000)

Profit/ loss NIL

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Document5 pages12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Hijab ZaidiNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Tugas 4 ManKeu - Bella Fatma P - 2011070511Document4 pagesTugas 4 ManKeu - Bella Fatma P - 2011070511Bella FatmaNo ratings yet

- Cost Management Accounting Assignment Bill French Case StudyDocument5 pagesCost Management Accounting Assignment Bill French Case Studydeepak boraNo ratings yet

- Pertemuan 10Document7 pagesPertemuan 10jennifer christieNo ratings yet

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Volume Profit AnalysisDocument24 pagesVolume Profit AnalysisJean MaltiNo ratings yet

- Module 3 Practice Problems(2)Document13 pagesModule 3 Practice Problems(2)Liza Mae MirandaNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Calculate leverage and cost of capital from financial statementsDocument4 pagesCalculate leverage and cost of capital from financial statementsbonitaNo ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Madrigal Company Case StudyDocument4 pagesMadrigal Company Case StudyChleo EsperaNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- T10_CVP_aDocument11 pagesT10_CVP_amishabmoomin1524No ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- VARAIBLE COSTING (Solutions)Document8 pagesVARAIBLE COSTING (Solutions)Mohammad UmairNo ratings yet

- Managerial Accounting NotesDocument6 pagesManagerial Accounting NotesMarilou GabayaNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- LeverageDocument6 pagesLeverageOoi Yeung YeeNo ratings yet

- 04 FAR04-answersDocument12 pages04 FAR04-answersBea GarciaNo ratings yet

- The Contribution Margin Ratio Will DecreaseDocument7 pagesThe Contribution Margin Ratio Will DecreaseSaeym SegoviaNo ratings yet

- MA Assignment 3Document3 pagesMA Assignment 3SumreeenNo ratings yet

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahNo ratings yet

- Answer c22Document3 pagesAnswer c22Võ Huỳnh BăngNo ratings yet

- FIT BUS 5431 Homework Week 3 Chapter 4 ExercisesDocument8 pagesFIT BUS 5431 Homework Week 3 Chapter 4 ExercisesSue Ming FeiNo ratings yet

- Tugas Manajemen Keuangan II (P13-9, P13-12, P13-17)Document7 pagesTugas Manajemen Keuangan II (P13-9, P13-12, P13-17)L RakkimanNo ratings yet

- 320C03Document33 pages320C03ArjelVajvoda100% (3)

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- CVP Solutions and ExercisesDocument8 pagesCVP Solutions and ExercisesGizachew NadewNo ratings yet

- Calculating degrees of financial and operating leverage, break-even analysis, and profit planningDocument4 pagesCalculating degrees of financial and operating leverage, break-even analysis, and profit planningJenina Rose SalvadorNo ratings yet

- CVP Analysis Chapter Review SolutionsDocument7 pagesCVP Analysis Chapter Review SolutionsAasir NaQvi100% (1)

- Decentralized Operations and Segment Reporting - Discussion Problems - SolutionsDocument16 pagesDecentralized Operations and Segment Reporting - Discussion Problems - SolutionsK IdolsNo ratings yet

- Tugas Manajemen Keuangan IIDocument8 pagesTugas Manajemen Keuangan IIL RakkimanNo ratings yet

- Afar SolutionsDocument8 pagesAfar Solutionspopsie tulalianNo ratings yet

- Answer Key MAS MidtermDocument2 pagesAnswer Key MAS MidtermJaime II LustadoNo ratings yet

- Cost AccountingDocument14 pagesCost Accountingblueviolet21No ratings yet

- Unit Sales Analysis and Break-Even CalculationDocument4 pagesUnit Sales Analysis and Break-Even CalculationChryshelle LontokNo ratings yet

- Variable CostingDocument4 pagesVariable CostingKhairul Ikhwan DalimuntheNo ratings yet

- Accounting Managers Assignment 2 Contribution MarginDocument1 pageAccounting Managers Assignment 2 Contribution MarginInke RentandatuNo ratings yet

- CVP Analysis SolutionDocument4 pagesCVP Analysis Solutionmohammad bilalNo ratings yet

- Solution Post-Test3Document6 pagesSolution Post-Test3Shienell PincaNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- Cost Accounting Ass 1Document7 pagesCost Accounting Ass 1lordNo ratings yet

- Accounting calculations and journal entriesDocument6 pagesAccounting calculations and journal entriesZatsumono YamamotoNo ratings yet

- Pokok Dalam Menyusun Laporan Laba-Rugi Sebuah Perusahaan: Merupakan Tiga ElemenDocument18 pagesPokok Dalam Menyusun Laporan Laba-Rugi Sebuah Perusahaan: Merupakan Tiga ElemenAndi Annisa DianputriNo ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Project X-ConcludedDocument7 pagesProject X-Concludedhijab zaidiNo ratings yet

- Hijab Zaidi Exam Sheet Roll No 09Document12 pagesHijab Zaidi Exam Sheet Roll No 09hijab zaidiNo ratings yet

- Allied Foods Integrated CaseDocument32 pagesAllied Foods Integrated Casehijab zaidiNo ratings yet

- Broward Manufacturing ROA, ROE, and ROIC CalculationsDocument11 pagesBroward Manufacturing ROA, ROE, and ROIC Calculationshijab zaidiNo ratings yet

- Chap 4 Important PointsDocument1 pageChap 4 Important Pointshijab zaidiNo ratings yet

- Week Chapter 5Document21 pagesWeek Chapter 5hijab zaidiNo ratings yet

- Week Chapter 5Document21 pagesWeek Chapter 5hijab zaidiNo ratings yet

- Week 9 CH 7 Training DevelopmentDocument24 pagesWeek 9 CH 7 Training Developmenthijab zaidiNo ratings yet

- Week 9 CH 7 Training DevelopmentDocument24 pagesWeek 9 CH 7 Training Developmenthijab zaidiNo ratings yet

- Subject Business Finance Project Company: Ferozsons LaboratoriesDocument25 pagesSubject Business Finance Project Company: Ferozsons Laboratorieshijab zaidiNo ratings yet

- Strategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidDocument17 pagesStrategies in Action: Strategic Management: Concepts & Cases 13 Edition Fred DavidTauseef QaziNo ratings yet

- TOYOTA Indus Motor Co FinalDocument8 pagesTOYOTA Indus Motor Co FinalImran Memon0% (1)

- Investment portfolio performance reportDocument2 pagesInvestment portfolio performance reporthijab zaidiNo ratings yet

- Tax Comparison With Different Countries On BusinessDocument1 pageTax Comparison With Different Countries On Businesshijab zaidiNo ratings yet

- Group Ratio Analysis and Financial Ratios 2020Document11 pagesGroup Ratio Analysis and Financial Ratios 2020hijab zaidiNo ratings yet

- StatementDocument62 pagesStatementisaac ellisNo ratings yet

- Final SFM 1.5 Days StrategyDocument3 pagesFinal SFM 1.5 Days Strategyanandsundaramurthy10No ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- Capital Structure of Jindal Steel and PowerDocument2 pagesCapital Structure of Jindal Steel and PowerAshok VenkatNo ratings yet

- PT Adaro Energy Indonesia TBK (ADRO)Document15 pagesPT Adaro Energy Indonesia TBK (ADRO)Arief RahmatullahNo ratings yet

- GRC FinMan Cost of Capital ModuleDocument13 pagesGRC FinMan Cost of Capital ModuleJasmine FiguraNo ratings yet

- Altzman Z ScoreDocument2 pagesAltzman Z ScoreShiv GMNo ratings yet

- University of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Document6 pagesUniversity of The Cordilleras College of Accountancy Quiz On Partnership Formation 1Ian Ranilopa100% (1)

- Kuliah 1Document9 pagesKuliah 1Aina OyenNo ratings yet

- Business Finance Guide WK 3Document6 pagesBusiness Finance Guide WK 3Efren Grenias JrNo ratings yet

- Main Exam 2014-Sol-1Document7 pagesMain Exam 2014-Sol-1Diego AguirreNo ratings yet

- PST Quiz PA Chap 2Document5 pagesPST Quiz PA Chap 2Phuong PhamNo ratings yet

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- EACC 1614 - Test 1Document7 pagesEACC 1614 - Test 1sandilefanelehlongwaneNo ratings yet

- Telegram FA Set 2Document17 pagesTelegram FA Set 2pnityanandanNo ratings yet

- Unit Viii - Audit of Equity Accounts T1 2014-2015 PDFDocument9 pagesUnit Viii - Audit of Equity Accounts T1 2014-2015 PDFSed ReyesNo ratings yet

- $100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceDocument4 pages$100 Forex Planning: Primary Account Size Profit Per Week (%) Max Lot Per Trade Weeks BalanceAli RidhaNo ratings yet

- Governmental and Nonprofit Accounting 10th Edition Smith Solution ManualDocument27 pagesGovernmental and Nonprofit Accounting 10th Edition Smith Solution Manualconsuelo100% (21)

- AccountingDocument2 pagesAccountingJahanzaib ButtNo ratings yet

- Forum ACC WM - Sesi 5Document8 pagesForum ACC WM - Sesi 5Windy MartaputriNo ratings yet

- Firoz MBA 4 Sem Final PRJCTDocument21 pagesFiroz MBA 4 Sem Final PRJCTFiroz Shaikh100% (1)

- Chapter 1 Lecture Slides 9eDocument32 pagesChapter 1 Lecture Slides 9ecolinmac8892No ratings yet

- Comparative Financial Position and Income Statement 2020Document2 pagesComparative Financial Position and Income Statement 2020Eva Ruth MedilloNo ratings yet

- AnswerQuiz - Module 10Document4 pagesAnswerQuiz - Module 10Alyanna Alcantara100% (1)

- Case 1 XeroxDocument2 pagesCase 1 XeroxEvelyn Alessandra Mayo LisboaNo ratings yet

- Accounting Final Notes on Liabilities and ProvisionsDocument29 pagesAccounting Final Notes on Liabilities and ProvisionsDhruv DarjiNo ratings yet

- Accounting TextbookDocument498 pagesAccounting Textbookeli.israel07No ratings yet

- Part 2Document37 pagesPart 2Raquibul Hassan0% (1)

- AFAR - Partnership DissolutionDocument36 pagesAFAR - Partnership DissolutionReginald ValenciaNo ratings yet

- Introduction to financial managementDocument37 pagesIntroduction to financial managementBritney BowersNo ratings yet