Professional Documents

Culture Documents

Accounting Managers Assignment 2 Contribution Margin

Uploaded by

Inke Rentandatu0 ratings0% found this document useful (0 votes)

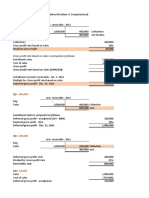

80 views1 pageThe document is an accounting assignment that contains calculations related to contribution margin analysis. It includes an initial contribution margin income statement, definitions of contribution margin ratio and per unit contribution margin. It then shows how to calculate the change in income from operations if sales increase by 3,000 units using either the per unit contribution margin or contribution margin ratio approach. Both approaches show the change in income from operations would be an increase of $90,000.

Original Description:

Original Title

Assignment 2 - CVP Analysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an accounting assignment that contains calculations related to contribution margin analysis. It includes an initial contribution margin income statement, definitions of contribution margin ratio and per unit contribution margin. It then shows how to calculate the change in income from operations if sales increase by 3,000 units using either the per unit contribution margin or contribution margin ratio approach. Both approaches show the change in income from operations would be an increase of $90,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

80 views1 pageAccounting Managers Assignment 2 Contribution Margin

Uploaded by

Inke RentandatuThe document is an accounting assignment that contains calculations related to contribution margin analysis. It includes an initial contribution margin income statement, definitions of contribution margin ratio and per unit contribution margin. It then shows how to calculate the change in income from operations if sales increase by 3,000 units using either the per unit contribution margin or contribution margin ratio approach. Both approaches show the change in income from operations would be an increase of $90,000.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Inke Rentandatu

25/08/2021

Accounting for Managers Assignment 2

Answer

1) Contribution Margin Income statement

Sales (20,000 units x $ 120) $ 2,400,000

(Less) Variable Costs (20,000 units x $90) $ 1,800,000

Contribution Margin (20,000 units x $30) $ 600,000

Fixed Costs $ 250,000

Income from operations $ 350,000

2) Contribution Margin Ratio

= Contributin Margin/sales

$600,000/$2,400,000 = 0.25 or 25%

Contribution margin units

= Sales price per unit - Variable cost per unit

$120-$90=$30

3) How much would income from operations change,

if Toussant's sales increased by 3,000 units

A) We can calculate unit contribution margin Increase in income

= 3,000 units x $30 = $90,000

B) Calculate using contribution margin ratio

Change in sales dollars (3,000 units X $120) = $360,000

Sales x contribution margin ratio = $360,000 X 25% = $90,000

Contribution margin income statement

Sales (23,000 units x $120) $ 2,760,000

(Less) Variable costs (23,000 units x $90) $ 2,070,000

Contribution Margin (23,000 units x $30) $ 690,000

Fixed Costs $ 250,000

Income from operations $ 440,000

$440,000 (new) - $350,000 (old) = $90,000

You might also like

- VARAIBLE COSTING (Solutions)Document8 pagesVARAIBLE COSTING (Solutions)Mohammad UmairNo ratings yet

- Module 3 Practice Problems(2)Document13 pagesModule 3 Practice Problems(2)Liza Mae MirandaNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Cost Accounting Ass 1Document7 pagesCost Accounting Ass 1lordNo ratings yet

- Tugasan 6 Bab 6Document4 pagesTugasan 6 Bab 6azwan88No ratings yet

- Markup On COGSDocument16 pagesMarkup On COGSJack LiuNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- CVP Analysis - 2018Document23 pagesCVP Analysis - 2018Ali KhanNo ratings yet

- CVP AnalysisDocument40 pagesCVP AnalysisFatima's WorldNo ratings yet

- Exercise 5-1: Total Per UnitDocument18 pagesExercise 5-1: Total Per UnitSaransh Chauhan 23No ratings yet

- Margin 60% 50,000 Interest Cost (20,000)Document7 pagesMargin 60% 50,000 Interest Cost (20,000)hijab zaidiNo ratings yet

- CVP Analysis Class Exercise SolutionsDocument4 pagesCVP Analysis Class Exercise Solutionsaryan bhandariNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Managerial Accounting: Assignment: 02Document5 pagesManagerial Accounting: Assignment: 02Asma HatamNo ratings yet

- Problem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000Document6 pagesProblem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000Võ Triệu VyNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Tutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Document3 pagesTutorial No. 3 - CVP Analysis Answer Section: 1. ANS: B 2. ANS: A 3. ANS: B 4. ANS: A 5Hu-Ann KeymistNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Acc2002 PPT FinalDocument53 pagesAcc2002 PPT FinalSabina TanNo ratings yet

- Managerial Accounting NotesDocument6 pagesManagerial Accounting NotesMarilou GabayaNo ratings yet

- Cost Volume Profit Analysis - CVP ExmaplesDocument32 pagesCost Volume Profit Analysis - CVP ExmaplesMuhammad azeemNo ratings yet

- Tutorial 3 - Student AnswerDocument7 pagesTutorial 3 - Student AnswerDâmDâmCôNươngNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Steven CHONGNo ratings yet

- CM Ratio Break Even AnalysisDocument2 pagesCM Ratio Break Even AnalysisPam ZingapanNo ratings yet

- SCM Lec 2Document67 pagesSCM Lec 2Star KerenzaNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Sol. Man. Chapter 10 Installment Sales Method 2020 EditionDocument13 pagesSol. Man. Chapter 10 Installment Sales Method 2020 EditionJam Surdivilla100% (1)

- Problem 1: Cost Volume Profit RelationshipsDocument22 pagesProblem 1: Cost Volume Profit RelationshipsNamir RafiqNo ratings yet

- Ch17 - Guan CM - AISEDocument40 pagesCh17 - Guan CM - AISEIassa MarcelinaNo ratings yet

- DOL Demonstration Problem 2023Document4 pagesDOL Demonstration Problem 2023Zoltan SzarvasNo ratings yet

- CVP Analysis SolutionDocument4 pagesCVP Analysis Solutionmohammad bilalNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- CH 2 Cost-Volume-Profit RelationshipsDocument24 pagesCH 2 Cost-Volume-Profit RelationshipsMona ElzaherNo ratings yet

- CVP Analysis 2 Amp Ratios ExcelDocument53 pagesCVP Analysis 2 Amp Ratios ExcelSoahNo ratings yet

- Volume Profit AnalysisDocument24 pagesVolume Profit AnalysisJean MaltiNo ratings yet

- T10_CVP_aDocument11 pagesT10_CVP_amishabmoomin1524No ratings yet

- Accounting 202 Chapter 7 NotesDocument15 pagesAccounting 202 Chapter 7 NotesnitinNo ratings yet

- Sol ch13Document6 pagesSol ch13Kailash KumarNo ratings yet

- Group 2 - Breakeven AnalysisDocument4 pagesGroup 2 - Breakeven AnalysisCamille VergaraNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Cost, Volume, Profit Analysis - Ex. SoluDocument19 pagesCost, Volume, Profit Analysis - Ex. SoluHimadri DeyNo ratings yet

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Jawaban Assignment#8 - A. JuliadiDocument2 pagesJawaban Assignment#8 - A. JuliadiSubdit KPKPPNo ratings yet

- Question No. 1 - Sol: Cost & Management Accounting (MGT-402) Mc080204098 Assignment # 2Document2 pagesQuestion No. 1 - Sol: Cost & Management Accounting (MGT-402) Mc080204098 Assignment # 2KamranDanish1979_201No ratings yet

- Solution of Chapter 6Document7 pagesSolution of Chapter 6Ahmed RaeisiNo ratings yet

- Chapter 10 Cost-Volume-profit AnalysisDocument39 pagesChapter 10 Cost-Volume-profit AnalysisAddisalem MesfinNo ratings yet

- 320C03Document33 pages320C03ArjelVajvoda100% (3)

- Biasong SCMDocument10 pagesBiasong SCMgeraldine biasongNo ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Problem 2.31 Contribution Margin Variance, Contribution Margin Volume Variance, Sales Mix VarianceDocument2 pagesProblem 2.31 Contribution Margin Variance, Contribution Margin Volume Variance, Sales Mix VarianceSunghoon SsiNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- Intermediate Accounting Midterm Exam KeyDocument10 pagesIntermediate Accounting Midterm Exam KeyRenalyn ParasNo ratings yet

- Tugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)Document5 pagesTugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)irga ayudiasNo ratings yet

- UTECH CVP Income Statement 2010Document8 pagesUTECH CVP Income Statement 2010dcarruciniNo ratings yet

- Alcaide, Daiane L. - Activity 1Document10 pagesAlcaide, Daiane L. - Activity 1Daiane AlcaideNo ratings yet

- Master Minds CA/CWA & MEC/CEC marginal costing solutionsDocument14 pagesMaster Minds CA/CWA & MEC/CEC marginal costing solutionsHaresh KNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 1 The Portfolio Management Process and The Investment Policy StatementDocument3 pagesChapter 1 The Portfolio Management Process and The Investment Policy StatementInke RentandatuNo ratings yet

- 1st MeetingDocument37 pages1st MeetingInke RentandatuNo ratings yet

- Asset Allocation and Investment PlanningDocument44 pagesAsset Allocation and Investment PlanningInke RentandatuNo ratings yet

- Plant Wide MethodDocument1 pagePlant Wide MethodInke RentandatuNo ratings yet

- 1413 CalotaVintilescu-Case Study On Analysis of Financial Statements at A Furniture Manufacturer PDFDocument24 pages1413 CalotaVintilescu-Case Study On Analysis of Financial Statements at A Furniture Manufacturer PDFTHE INDIAN FOOTBALL GUYNo ratings yet

- Answer Sheet Group 5Document8 pagesAnswer Sheet Group 5Inke RentandatuNo ratings yet

- CH 05Document87 pagesCH 05ChristyNo ratings yet

- Complete The Table For Time Vlue of MoneyDocument5 pagesComplete The Table For Time Vlue of MoneyInke RentandatuNo ratings yet

- AnswserAssignment 3 CHP 6 Managerial AccDocument2 pagesAnswserAssignment 3 CHP 6 Managerial AccInke RentandatuNo ratings yet

- CH 01Document43 pagesCH 01Mohammed SamyNo ratings yet

- Case 1, Ethical Dilemma. There Is A Drone in Your Soup QuestionsDocument4 pagesCase 1, Ethical Dilemma. There Is A Drone in Your Soup QuestionsInke Rentandatu100% (3)

- CH 01Document43 pagesCH 01Mohammed SamyNo ratings yet

- Answer Sheet Group 5Document8 pagesAnswer Sheet Group 5Inke RentandatuNo ratings yet