Professional Documents

Culture Documents

Managerial Accounting Notes

Uploaded by

Marilou GabayaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Accounting Notes

Uploaded by

Marilou GabayaCopyright:

Available Formats

Cost Volume Profit Analysis:

A tool for management to come up with a relationship between the three (CVP)

a. Selling price per unit - ↑↑ profit

b. Volume (quantity) - ↑↑

c. Variable Cost/Unit – changes in total amount

d. Fixed Cost – changes in unit ↓

e. Sales Mix

Contribution Margin Approach:

Sales 25 per unit 100% 300, 000

Variable Cost (15 per unit) 60% (180, 000)

Contribution Margin 10 40% 120, 000

Fixed Cost (100, 000) (100, 000)

Profit 20, 000

Number of units sold: 12, 000

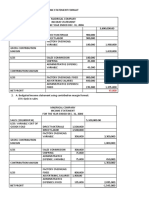

What “IF” Analysis:

a. Selling Price increased by 10%, quantity decreased by 10%:

Sales 27.50 (25 x 110%) 297, 000

Variable Cost (15) (162, 000) (12,000x90%) x 15

Contribution Margin 12.50 135, 000

Fixed Cost (100, 000) (100, 000)

Profit 35, 000

*12, 000 x 90% = 10, 800

b. Selling Price is decreased by 10%, quantity increases by 20%:

Sales 22.50 (25 x 90%) 324, 000 (14,400 x 22.50)

Variable Cost (15) (216, 000) (12,000x120%) x 15

Contribution Margin 7.50 108, 000

Fixed Cost (100, 000) (100, 000)

Profit 8, 000

*12, 000 x 20% = 14, 400

c. The same Selling Price, Quantity, and Variable Cost increased by 10%:

Sales 25 330, 000 (12,000 x 110%22.50)

Variable Cost (16.50) (217, 800) (15 x 110%) x 13, 200

Contribution Margin 8.50 112, 200

Fixed Cost (100, 000) (100, 000)

Profit 12, 200

d. Selling Price and Quantity increased by 10%, variable cost decreased by 10%:

Sales 27.50 (25x110%) 363, 000 (13,200 x 27.50)

Variable Cost (13.50) (178, 200) (15 x 90%) x 13, 200

Contribution Margin 14 184, 800

Fixed Cost (100, 000) (100, 000)

Profit 84, 800

*12, 000 x 10% = 13, 200

e. Selling Price decreased by 10%, Variable Cost increased by 10%, Volume 20%, and Fixed Cost

10%:

Sales 22.50 330, 000 (14, 400 x 22.50)

Variable Cost (16.50) (237, 600) (16.50 x 14, 400)

Contribution Margin 8.50 86,400

Fixed Cost (90, 000) (90, 000)

Profit (Loss) (3, 600)

*12, 000 x 20% = 14, 400

Breakeven Analysis

Breakeven:

- level of profit is 0

- contribution margin is equal to fixed cost

Fixed cost

Breakeven in units:

Contribution Margin/Unit

120,000

Breakeven in units:

10

= 12, 000 units

Proof: Exceeds BE by 3, 250, 15, 250 units

Sales 300, 000 Sales 381, 250 (25 x 15, 250)

Variable Cost 180, 000 Variable Cost 228, 750

Contribution Margin 120, 000 Contribution Margin 152, 500 (15,250 x 10)

Fixed Cost 120, 000 Fixed Cost 120, 000

Profit (Loss) 0 Profit (Loss) 32, 500 (3, 250 x 10)

Fixed cost

Breakeven in Peso:

Contribution Margin Percent

100, 000

Breakeven in units:

40%

= 250, 000

Proof: Exceeds BEP by 75, 000

Sales 250, 000 Sales

Variable Cost 150, 000 (250, 000 x 60%) Variable Cost

Contribution Margin 120, 000 Contribution Margin

Fixed Cost 120, 000 Fixed Cost

Profit (Loss) 0 Profit (Loss)

Breakeven in Units Fixed cost + Desired Profit

with Desired Profit: Contribution Margin/Unit

Breakeven in Units 120,000 + 150,000

with Desired Profit: 10

= 27, 000 units

Sales 675, 000 (27,000 x 25)

Variable Cost 405, 000

Contribution Margin 270, 000 (27, 000 x 10)

Fixed Cost 120, 000

Profit (Loss) 150, 000

How many sales to generate?

Breakeven in Peso Fixed cost + Desired Profit

with Desired Profit: Contribution Margin %

Breakeven in Peso 100, 000 + 150, 000

with Desired Profit: 40%

= 625, 000

Sales 625, 000

Variable Cost 375, 000

Contribution Margin 250, 000

Fixed Cost 100, 000

Profit (Loss) 150, 000

Breakeven in Units Fixed cost + Desired Profit

with Desired Profit 1 – Tax Rate_______

after tax: Contribution Margin/unit

Desired Profit is 150, 000 net of 40% tax

How many number of units?

Breakeven in Units 120, 000 + 150, 000

with Desired Profit 60%______

after tax: 10

Breakeven in Units 120, 000 + 250, 000

with Desired Profit 10

after tax:

= 37, 000

Sales 925, 000 (37, 000 x 25)

Variable Cost 555, 000

Contribution Margin 370, 000 (37, 000 x 10)

Fixed Cost 120, 000

Profit before tax 250, 000

100, 000 (250, 000 x 40%)

Profit after tax 150, 000

How much peso sales?

Breakeven in Peso Fixed cost + Desired Profit

with Desired Profit 1 – Tax Rate_______

after tax: Contribution Margin %

Breakeven in Units 100, 000 + 150, 000

with Desired Profit 60%______

after tax: 40%

Breakeven in Units 100, 000 + 250, 000

with Desired Profit 40%

after tax:

= 875, 000

Sales 875, 000

Variable Cost 525, 000

Contribution Margin 350, 000

Fixed Cost 120, 000

Profit before tax 250, 000

100, 000 (250, 000 x 40%)

Profit after tax 150, 000

Desired Profit is Php 4.00

Number of units to sell?

Fixed Cost

Contribution Margin/Unit – Profit/Unit

120, 000

10 – 4

120, 000

6

= 20, 000

Sales 500, 000 (20, 000 x 25)

Variable Cost 300, 000

Contribution Margin 200, 000

Fixed Cost 120, 000

Profit 80, 000

80, 000/20, 000 = 4

Desired Profit is 15% of Sales

Fixed Cost

Contribution Margin % – Profit%

100, 000

40% – 15%

100, 000

25%

= 400, 000

Sales 400, 000

Variable Cost 240, 000

Contribution Margin 160, 000

Fixed Cost 100, 000

Profit 60, 000

60, 000/400, 000 = 15%

You might also like

- Crib Sheet FinalDocument2 pagesCrib Sheet FinalJordanDouce100% (2)

- Distribution Channel at Coca-ColaDocument11 pagesDistribution Channel at Coca-Colaabhi_03873% (30)

- Corporate Strategy ReportDocument7 pagesCorporate Strategy ReportsanjuNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- KPL Swing Trading SystemDocument6 pagesKPL Swing Trading SystemRushank ShuklaNo ratings yet

- Exercises (Decision Theory)Document2 pagesExercises (Decision Theory)Celestial VortexNo ratings yet

- Chapter 1 Kotler Keller 2016Document93 pagesChapter 1 Kotler Keller 2016luthfi190100% (1)

- Student Solutions Chapter 8 Cost Volume Profit AnalysisDocument7 pagesStudent Solutions Chapter 8 Cost Volume Profit AnalysisAasir NaQvi100% (1)

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- Exercise 5-8Document8 pagesExercise 5-8Kaye MagbirayNo ratings yet

- Cost Volume Profit Analysis - CVP ExmaplesDocument32 pagesCost Volume Profit Analysis - CVP ExmaplesMuhammad azeemNo ratings yet

- Learning Activity 3 Sensitivity AnalysisDocument3 pagesLearning Activity 3 Sensitivity AnalysisjessNo ratings yet

- 15 Marginal Costing PDFDocument14 pages15 Marginal Costing PDFSupriyoNo ratings yet

- 15 Marginal CostingDocument14 pages15 Marginal CostingHaresh KNo ratings yet

- Module 3 Practice ProblemsDocument13 pagesModule 3 Practice ProblemsLiza Mae MirandaNo ratings yet

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- Sba SemDocument9 pagesSba SemChelsa Mae AntonioNo ratings yet

- CVP Analysis - 2020 - BUKCDocument35 pagesCVP Analysis - 2020 - BUKCMehwish ziad0% (1)

- CVP AnalysisDocument40 pagesCVP AnalysisFatima's WorldNo ratings yet

- CVP Analysis - 2018Document23 pagesCVP Analysis - 2018Ali KhanNo ratings yet

- 06 Incremental AnalysisDocument11 pages06 Incremental AnalysisannarheaNo ratings yet

- Selling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRDocument6 pagesSelling Price 25 Variable Cost 12 Fixed Cost 65000 FIND Break Even Point CSRSoumya Ranjan PandaNo ratings yet

- Margin 60% 50,000 Interest Cost (20,000)Document7 pagesMargin 60% 50,000 Interest Cost (20,000)hijab zaidiNo ratings yet

- 2020 Session 6 CVP MBA CompleteDocument42 pages2020 Session 6 CVP MBA CompleteAbhishek BaruaNo ratings yet

- Solution Post-Test3Document6 pagesSolution Post-Test3Shienell PincaNo ratings yet

- Diskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Document3 pagesDiskusi Akuntansi Manajemen Oleh Kelompok 6 (EX 1&2 Variable Costing)Hafizd FadillahNo ratings yet

- Some More Problems On Application of Marginal Costing in Decision MakingDocument10 pagesSome More Problems On Application of Marginal Costing in Decision MakingBharat ThackerNo ratings yet

- Cost Volume Profit Analysis and Cost Behavior SDocument2 pagesCost Volume Profit Analysis and Cost Behavior SMary Faith SullezaNo ratings yet

- Cost Accounting II - 2Document6 pagesCost Accounting II - 2Koolknight M05No ratings yet

- Salma Banu, Department of Commerce and Management, Paper: Cost Accounting Ii, 4 Sem Bcom E SectionDocument6 pagesSalma Banu, Department of Commerce and Management, Paper: Cost Accounting Ii, 4 Sem Bcom E SectionRocky BhaiNo ratings yet

- Midway Greasy 2002 2003 2002 2003Document6 pagesMidway Greasy 2002 2003 2002 2003Pang SiulienNo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- CVP Analysis 2 Amp Ratios ExcelDocument53 pagesCVP Analysis 2 Amp Ratios ExcelSoahNo ratings yet

- CH 2 Cost-Volume-Profit RelationshipsDocument24 pagesCH 2 Cost-Volume-Profit RelationshipsMona ElzaherNo ratings yet

- Stratma 3.2Document2 pagesStratma 3.2Patrick AlvinNo ratings yet

- CVP AnalysisDocument40 pagesCVP Analysissbjafri0No ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- Solution Post-Test4Document5 pagesSolution Post-Test4Shienell PincaNo ratings yet

- 13 BEP F/C Per Unit: Selling Price 25 Variable Cost 12 Fixed Cost 65000 Find BEP CSRDocument7 pages13 BEP F/C Per Unit: Selling Price 25 Variable Cost 12 Fixed Cost 65000 Find BEP CSRSoumya Ranjan PandaNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Accounting 202 Chapter 7 NotesDocument15 pagesAccounting 202 Chapter 7 NotesnitinNo ratings yet

- SolutionDocument3 pagesSolutionHilary GaureaNo ratings yet

- CVP Analysis Q.1-10Document28 pagesCVP Analysis Q.1-10James WisleyNo ratings yet

- Cost Volume Profit Analysis (CVP) / Break Even AnalysisDocument10 pagesCost Volume Profit Analysis (CVP) / Break Even AnalysisTaymoor AliNo ratings yet

- Chapter 3 ExercisesDocument12 pagesChapter 3 ExercisesNico RegalaNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- Madrigal Company Case StudyDocument4 pagesMadrigal Company Case StudyChleo EsperaNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Assignment 2 - CVP AnalysisDocument1 pageAssignment 2 - CVP AnalysisInke RentandatuNo ratings yet

- 157 635652264260446926 Practice ManagerialDocument13 pages157 635652264260446926 Practice Manageriallisa lheneNo ratings yet

- Cost Volume Profit (CVP) AnalysisDocument40 pagesCost Volume Profit (CVP) AnalysisAnne PrestosaNo ratings yet

- Activity 11Document3 pagesActivity 11UchayyaNo ratings yet

- Cost Accounting Ass 1Document7 pagesCost Accounting Ass 1lordNo ratings yet

- Suggested Solution To CVP TutorialDocument5 pagesSuggested Solution To CVP TutorialLiyendra FernandoNo ratings yet

- Oss Profit Retail Inventory MethodDocument4 pagesOss Profit Retail Inventory MethodLily of the ValleyNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Break-Even Occurs Between The Production Volume Interval of 20,000 To 30,000Document6 pagesBreak-Even Occurs Between The Production Volume Interval of 20,000 To 30,000kripsNo ratings yet

- Assignment 111Document20 pagesAssignment 111Mary Ann F. MendezNo ratings yet

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Document12 pagesAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- Solution For Chapter 22 - Part2Document4 pagesSolution For Chapter 22 - Part2Dương Xuân ĐạtNo ratings yet

- Leverages MaterialDocument15 pagesLeverages MaterialsreevardhanNo ratings yet

- Business Decisions Using Cost Behaviour: Cost-Volume-Profit AnalysisDocument11 pagesBusiness Decisions Using Cost Behaviour: Cost-Volume-Profit Analysismishabmoomin1524No ratings yet

- Strat CostDocument8 pagesStrat CostJerome B. MenorNo ratings yet

- True or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipDocument3 pagesTrue or False: Basadre, Jessa G. Bsa 3 Yr Managerial Accounting Assignment No. 2 - CVP RelationshipJessa BasadreNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- To Management AND Organizations: © Prentice Hall, 2002 1-1Document26 pagesTo Management AND Organizations: © Prentice Hall, 2002 1-1Marilou GabayaNo ratings yet

- The Nogo RailroadDocument8 pagesThe Nogo RailroadMarilou GabayaNo ratings yet

- Case Study-Del Monte vs. Hunt'sDocument7 pagesCase Study-Del Monte vs. Hunt'sMarilou GabayaNo ratings yet

- Human Resource ManagementDocument6 pagesHuman Resource ManagementMarilou GabayaNo ratings yet

- Cash FlowDocument2 pagesCash FlowMarilou GabayaNo ratings yet

- CASE EXAM Chapter 1 TGIFDocument6 pagesCASE EXAM Chapter 1 TGIFMarilou GabayaNo ratings yet

- Four Aces To SuccessDocument18 pagesFour Aces To SuccessMarilou GabayaNo ratings yet

- Demand and Supply NotesDocument4 pagesDemand and Supply NotesMarilou GabayaNo ratings yet

- Demand and Supply NotesDocument4 pagesDemand and Supply NotesMarilou GabayaNo ratings yet

- Present Value Factors For 1.000 at Compound Interest Rounded To Three Decimal PlacesDocument1 pagePresent Value Factors For 1.000 at Compound Interest Rounded To Three Decimal PlacesMarilou GabayaNo ratings yet

- Pvoa TableDocument1 pagePvoa TableMarilou GabayaNo ratings yet

- Problem Exercises On Cost AnalysisDocument1 pageProblem Exercises On Cost AnalysisMarilou GabayaNo ratings yet

- Marginal and Incremental PrincipleDocument1 pageMarginal and Incremental PrincipleMarilou GabayaNo ratings yet

- 2551Q LboDocument2 pages2551Q Lboava1234567890No ratings yet

- Problem Exercises On Consumer BehaviorDocument3 pagesProblem Exercises On Consumer BehaviorMarilou GabayaNo ratings yet

- Problem Exercises On Profit MaximizationDocument2 pagesProblem Exercises On Profit MaximizationMarilou GabayaNo ratings yet

- Materials: Bond Paper and Ballpens For Attendees What To Do? 1. Distribute 1 Bond Paper and Pen Per AttendeeDocument8 pagesMaterials: Bond Paper and Ballpens For Attendees What To Do? 1. Distribute 1 Bond Paper and Pen Per AttendeeMarilou GabayaNo ratings yet

- MADRIGALDocument6 pagesMADRIGALMarilou GabayaNo ratings yet

- June 13Document1 pageJune 13Marilou GabayaNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyMarilou GabayaNo ratings yet

- Demand and Supply NotesDocument4 pagesDemand and Supply NotesMarilou GabayaNo ratings yet

- Demand and Supply NotesDocument4 pagesDemand and Supply NotesMarilou GabayaNo ratings yet

- Contribution Margin Income Statement FormatDocument2 pagesContribution Margin Income Statement FormatMarilou GabayaNo ratings yet

- Case Study #1: Bigger Isn't Always Better!Document4 pagesCase Study #1: Bigger Isn't Always Better!Marilou GabayaNo ratings yet

- Problem Exercises On Cost AnalysisDocument1 pageProblem Exercises On Cost AnalysisMarilou GabayaNo ratings yet

- Economics in Action How Companies Apply ThemDocument3 pagesEconomics in Action How Companies Apply ThemMarilou GabayaNo ratings yet

- Problem Exercises On Consumer BehaviorDocument3 pagesProblem Exercises On Consumer BehaviorMarilou GabayaNo ratings yet

- Contribution Margin Income Statement FormatDocument2 pagesContribution Margin Income Statement FormatMarilou GabayaNo ratings yet

- Process Diagrm 4. 3Document1 pageProcess Diagrm 4. 3Marilou GabayaNo ratings yet

- 9 Health EconomicsDocument42 pages9 Health EconomicsShivangi SharmaNo ratings yet

- Mankiew Chapter 15Document31 pagesMankiew Chapter 15foz100% (1)

- GedaDocument2 pagesGedaशाक्य रश्क्रीनNo ratings yet

- Importance of Marketing of ServicesDocument6 pagesImportance of Marketing of ServicesVishal SinghNo ratings yet

- Commodity Market QuestionnaireDocument86 pagesCommodity Market Questionnairearjunmba119624100% (1)

- Difference Between Fair Value Hedge and Cash Flow HedgeDocument42 pagesDifference Between Fair Value Hedge and Cash Flow Hedgetikki0219No ratings yet

- B.tech Economics For Engineers (MGMT-201)Document2 pagesB.tech Economics For Engineers (MGMT-201)Dev PopliNo ratings yet

- Notes: Limitations of CVP Analysis For Planning and Decision Making Cost Volume Profit Analysis PDFDocument13 pagesNotes: Limitations of CVP Analysis For Planning and Decision Making Cost Volume Profit Analysis PDFNur Shaik MohdNo ratings yet

- Sample Business PlanDocument54 pagesSample Business PlanVikas KumarNo ratings yet

- Upload 9Document3 pagesUpload 9Meghna CmNo ratings yet

- Clean Edge Razor SolutionDocument4 pagesClean Edge Razor SolutionAshish PatelNo ratings yet

- Difference Between Direct & Indirect TaxesDocument3 pagesDifference Between Direct & Indirect TaxesLMRP2 LMRP2No ratings yet

- Questionnaire On Consumer AwarenessDocument2 pagesQuestionnaire On Consumer AwarenessGanesh74% (76)

- L5 SupplyContracts UpdatedDocument44 pagesL5 SupplyContracts Updatedkit_mak_5No ratings yet

- Unilever BangladeshDocument11 pagesUnilever Bangladeshabid746No ratings yet

- ECN 301 - Lecture 1Document21 pagesECN 301 - Lecture 1Parvez Bin KamalNo ratings yet

- McKinsey Marketing Consumer Durables in India A Journey Into The Minds of Digital Age Consumers PDFDocument8 pagesMcKinsey Marketing Consumer Durables in India A Journey Into The Minds of Digital Age Consumers PDFsamyNo ratings yet

- Module APPLIED EcoDocument39 pagesModule APPLIED EcoAngelyn LingatongNo ratings yet

- Thoery of Income and Employment QuestionDocument8 pagesThoery of Income and Employment QuestionKavyansh SharmaNo ratings yet

- Foundations of EconomicsDocument4 pagesFoundations of EconomicsmostafaNo ratings yet

- A STUDY On Online TradingDocument74 pagesA STUDY On Online TradingravikumarreddytNo ratings yet

- Indian Financial System An IntroductionDocument4 pagesIndian Financial System An IntroductionRonan FerrerNo ratings yet

- Value Creation in The Global Apparel IndustryDocument17 pagesValue Creation in The Global Apparel Industrygyanprakashdeb302No ratings yet

- TipsDocument3 pagesTipsMurugan MuthukrishnanNo ratings yet