Professional Documents

Culture Documents

Madrigal Company Case Study

Uploaded by

Chleo EsperaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Madrigal Company Case Study

Uploaded by

Chleo EsperaCopyright:

Available Formats

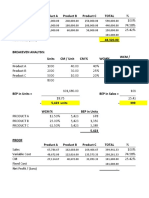

MADRIGAL COMPANY

Contribution Income Statement

For the Year ended December 31, 2006

Cost per Unit %

Sales (90,000 units x 40.00) 3,600,000.00 40.00 100%

Variable Costs:

Direct Materials 900,000.00

Direct Labor 900,000.00

Variable Factory Overhead 180,000.00

Sales Commissions 180,000.00

Shipping 45,000.00

Variable Admin. Expense 45,000.00 2,250,000.00 25.00 62.50%

Contribution Margin 1,350,000.00 15.00 37.50%

Fixed Costs:

Fixed Factory Overhead 800,000.00

Advertising, Salaries, etc. 400,000.00

Fixed Admin. Expenses 195,000.00 1,395,000.00 15.50

Net Loss (45,000.00) (0.50)

MADRIGAL COMPANY

Contribution Income Statement

For the Year ended December 31, 2006

A. Cost per unit %

Sales 5,100,000.00 34.00 100%

Variable Costs:

Direct Materials 1,500,000.00

Direct Labor 1,500,000.00

Variable Factory Overhead 300,000.00

Sales Commissions 255,000.00

Shipping 75,000.00

Variable Admin. Expense 75,000.00 3,705,000.00 24.70 44.12%

Contribution Margin 1,395,000.00 9.30 55.88%

Fixed Costs:

Fixed Factory Overhead 800,000.00

Advertising, Salaries, etc. 400,000.00

Fixed Admin. Expenses 195,000.00 1,395,000.00

Net Profit / (Loss) -

A. 15% slash in the selling price

SP = 40 x 15% SP = 40 - 6

‘=6 ‘= 34

MADRIGAL COMPANY

Contribution Income Statement

For the Year ended December 31, 2006

A. Cost per unit %

Sales 6,750,000.00 50.00 100%

Variable Costs:

Direct Materials 1,350,000.00

Direct Labor 1,350,000.00

Variable Factory Overhead 270,000.00

Sales Commissions 675,000.00

Shipping 67,500.00

Variable Admin. Expense 67,500.00 3,780,000.00 28.00 43.34%

Contribution Margin 2,970,000.00 22.00 56.66%

Fixed Costs:

Fixed Factory Overhead 800,000.00

Advertising, Salaries, etc. 1,900,000.00

Fixed Admin. Expenses 195,000.00 2,895,000.00

Net Profit / (Loss) 75,000.00

Price Increase of 25% Unit Volume to increase by 50%

SP = 40 x 25% Units = 90000 x 50%

SP = 10 Units = 45000

SP = 40 + 10 Units = 90000 + 45000

SP = 50 Units = 135,000

3.) Breakeven Point in Units & Peso Sales

Fixed Cost 1,395,000.00 BEP in Units = 93,000

CM / Unit 15.00

Fixed Cost 1,395,000.00 BEP in Sales = 3,720,000.00

CM % 37.50%

Sales 3,720,000.00

Variable Cost 2,325,000.00

CM 1,395,000.00

Fixed Cost 1,395,000.00

Net Income -

4.) Desired Profit of 450,000 affter 40% Tax

Proof:

DP = 1,395,000 + 450,000 / 1-0.40 Sales 5,720,000.00

37.50% Variable Cost 4,325,000.00

DP = 1,395,000 + 750,000 CM 2,145,000.00

37.50% Fixed Expenses 1,395,000.00

Net Profit 750,000.00

DP = 2,145,000 Tax 300,000.00

37.50% Profit 450,000.00

DP = 5,720,000.00

5.) Profit is 15% of Sales

Sales = 1,395,000.00 Proof:

37.5% - 15%

Sales 6,200,000.00

1,395,000.00 Variable Cost 3,875,000.00

22.50% CM 2,325,000.00

Fixed Expenses 1,395,000.00

= 6,200,000.00 Net Profit 930,000.00

In Units = 6,200,000/40

155,000

6.) Mail order firm is willing to buy 60,000 units of product if the price is right

Proof:

Direct Materials 11.00 Sales 1,770,000.00

Direct Labor 11.00 Variable Cost 1,530,000.00

Variable FOH 3.00 CM 240,000.00

Admin. Expenses 0.50 Fixed Cost 240,000.00

Variable Cost/unit 25.50 Net Income -

60,000 x 25.50 = 1530000 + 240000 = 1770000

1,770,000 / 60,000

Selling Price 29.50

7.) Advertising is increased; Target Profit is 5% of sales

Proof:

Sales = 130,000 units x 40

= 5,200,000 Sales 5,200,000.00

Target Profit percent 5% Variable Cost 3,250,000.00

Target Proft 260,000.00 CM 1,950,000.00

Fixed Cost 1,690,000.00

Net Income 260,000.00

Fixed Cost:

Fixed FOH 800,000.00

Selling Exp 400,000.00

Fixed Admin, Exp 195,000.00

1,395,000.00

Total Fixed Cost 1,690,000.00

Advertising Expense 295,000.00

8.) Target profit of 200,000; Changes in prices of DM, DL

Cost / Unit

Sales 40.00 Proof:

Direct Materials 12.50

Direct Labor 10.90 Sales 5,500,000.00

FOH 2.00 Variable Cost 3,905,000.00

Selling Exp. 2.50 CM 1,595,000.00

Admin. Expense 0.50 Fixed Cost 1,395,000.00

Net Income 200,000.00

CM/Unit 11.60

CM % 29%

= 1,395,000 + 200,000

29.00%

= 1,595,000.00

29.00%

Sales = 5,500,000.00

Selling Price / Unit 40.00

Units to Sell = 137,500.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Strama Activity 2 SolmanDocument7 pagesStrama Activity 2 SolmanPaupauNo ratings yet

- Margin 60% 50,000 Interest Cost (20,000)Document7 pagesMargin 60% 50,000 Interest Cost (20,000)hijab zaidiNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- 9 4 CVP Feu 2022Document58 pages9 4 CVP Feu 2022Angelica Jasmine ReyesNo ratings yet

- Financial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Document7 pagesFinancial and Management and Accouting MBA0041 Assingment FALL 2014 LC-02009 Name: Nandeshwar Singh ROLL NO.1408001255Nageshwar singhNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Sales Contribution Margin Break Even AnalysisDocument10 pagesSales Contribution Margin Break Even AnalysisHarold Beltran DramayoNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- Flexible Budget and Variance Analysis for Production VolumeDocument5 pagesFlexible Budget and Variance Analysis for Production VolumeRameshNo ratings yet

- Rose CorpDocument6 pagesRose CorpTimberly MangayayamNo ratings yet

- CVP Solution (Quiz)Document9 pagesCVP Solution (Quiz)Angela Miles DizonNo ratings yet

- TLA 4 Answers For DiscussionDocument21 pagesTLA 4 Answers For DiscussionTrisha Monique VillaNo ratings yet

- BT Chapter 1Document10 pagesBT Chapter 1Thanh Tâm Lê ThịNo ratings yet

- Cost Management Accounting Assignment Bill French Case StudyDocument5 pagesCost Management Accounting Assignment Bill French Case Studydeepak boraNo ratings yet

- 12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Document5 pages12-9 Levin Co.: A. Break Even in Units/Q ($ 9.75 - 6.75) (Contribution Margin Per Unit)Hijab ZaidiNo ratings yet

- Assignment 1-1Document19 pagesAssignment 1-1mishal zikriaNo ratings yet

- CVP SolutionDocument11 pagesCVP SolutionGmail FixNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- Problem 1 SolutionDocument1 pageProblem 1 SolutionJona kelssNo ratings yet

- COSMAN2 Final ExamDocument18 pagesCOSMAN2 Final ExamRIZLE SOGRADIELNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- Mô HìnhDocument7 pagesMô HìnhThanh Tâm Lê ThịNo ratings yet

- StratCost Quiz 2Document6 pagesStratCost Quiz 2ElleNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Cost Volume Profit Analysis - CVP ExmaplesDocument32 pagesCost Volume Profit Analysis - CVP ExmaplesMuhammad azeemNo ratings yet

- Basic Cost Accounting DefinitionsDocument8 pagesBasic Cost Accounting Definitionsbritonkariuki97No ratings yet

- CAC - COMPUTATIONS analysisDocument9 pagesCAC - COMPUTATIONS analysisrochelle lagmayNo ratings yet

- Exercise 5-8Document8 pagesExercise 5-8Kaye MagbirayNo ratings yet

- Solution AccountDocument12 pagesSolution Accountbikaspatra89No ratings yet

- Cost Volume Profit (CVP) AnalysisDocument40 pagesCost Volume Profit (CVP) AnalysisAnne PrestosaNo ratings yet

- Variable Costs and Product CombinationsDocument23 pagesVariable Costs and Product CombinationsEy GuanlaoNo ratings yet

- Learning Activity 3 Sensitivity AnalysisDocument3 pagesLearning Activity 3 Sensitivity AnalysisjessNo ratings yet

- Chapter 6 - Class ActivitiesDocument5 pagesChapter 6 - Class Activitiesmauricio ricardoNo ratings yet

- Decentralized Operations and Segment Reporting - Discussion Problems - SolutionsDocument16 pagesDecentralized Operations and Segment Reporting - Discussion Problems - SolutionsK IdolsNo ratings yet

- Villanueva, JaneDocument14 pagesVillanueva, JaneVillanueva, Jane G.No ratings yet

- Lê Thị Thanh Tâm - 31211020994Document10 pagesLê Thị Thanh Tâm - 31211020994Thanh Tâm Lê ThịNo ratings yet

- Allocating Support Costs Using Direct, Step and Reciprocal MethodsDocument5 pagesAllocating Support Costs Using Direct, Step and Reciprocal MethodsRic John Naquila CabilanNo ratings yet

- Ke Toan Quan Tri FinalDocument13 pagesKe Toan Quan Tri Finalkhanhlinh.vuha02No ratings yet

- Conviser Company: Joint Cost Product C Product L Product T TotalDocument6 pagesConviser Company: Joint Cost Product C Product L Product T TotalKiyo KoNo ratings yet

- Variable CostingDocument4 pagesVariable CostingKhairul Ikhwan DalimuntheNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Cost Volume Profit Analysis Cost Accounting 2022 P1Document6 pagesCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogNo ratings yet

- Class Discussion BLEMBA 31A Day2Document27 pagesClass Discussion BLEMBA 31A Day2Bayu Aji PrasetyoNo ratings yet

- Solution Post-Test3Document6 pagesSolution Post-Test3Shienell PincaNo ratings yet

- CVP AnalysisDocument3 pagesCVP AnalysisTERRIUS AceNo ratings yet

- Requirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPDocument9 pagesRequirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPYahya ZafarNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Module 3 Practice Problems(2)Document13 pagesModule 3 Practice Problems(2)Liza Mae MirandaNo ratings yet

- Requirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPDocument12 pagesRequirement 1 Hypothetical Data Assumption: Company Name: Super Glass Bangles LLPYahya ZafarNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Last Assign.Document5 pagesLast Assign.Ahmed Youssri TeleebaNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Bud GettingDocument8 pagesBud GettingLorena Mae LasquiteNo ratings yet

- Problems in Relevant CostingDocument20 pagesProblems in Relevant CostingJem ValmonteNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisDwain pinakapogiNo ratings yet

- STAR Engineering CASEDocument5 pagesSTAR Engineering CASEChleo EsperaNo ratings yet

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Quick Lunch CaseDocument4 pagesQuick Lunch CaseChleo EsperaNo ratings yet

- Raiden Paper CompanyDocument11 pagesRaiden Paper CompanyChleo EsperaNo ratings yet

- Browning Cash BudgetDocument1 pageBrowning Cash BudgetChleo EsperaNo ratings yet

- Alaire CorporationDocument2 pagesAlaire CorporationChleo EsperaNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Toward Effective Use of The Statement of The Cash FlowsDocument18 pagesToward Effective Use of The Statement of The Cash Flowsmuslih SE,MMNo ratings yet

- Wipro Form 16 Details for Muthuraj KrishnanDocument6 pagesWipro Form 16 Details for Muthuraj KrishnanSanjay RamuNo ratings yet

- PropertyDocument8 pagesPropertyVaibhav MukhraiyaNo ratings yet

- 15.963 Management Accounting and Control: Mit OpencoursewareDocument25 pages15.963 Management Accounting and Control: Mit OpencoursewareNur AuFha KhazNhaNo ratings yet

- Case Digest STATCONDocument6 pagesCase Digest STATCONLegal Division DPWH Region 6No ratings yet

- Unit Cost Direct Costing Absorption CostingDocument11 pagesUnit Cost Direct Costing Absorption CostingMURREE YTNo ratings yet

- Block 3 ECO 08 Unit 1Document18 pagesBlock 3 ECO 08 Unit 1ThiruNo ratings yet

- Lesson On Financial AnalysisDocument3 pagesLesson On Financial AnalysiscassieNo ratings yet

- PNB 12Document212 pagesPNB 12BharatAIMNo ratings yet

- Ittehad ChemicalsDocument50 pagesIttehad ChemicalsAlizey AhmadNo ratings yet

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocument20 pagesTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (40)

- CH 10 AnswersDocument3 pagesCH 10 AnswersEl YangNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Pioneer Self Storage Fund Oct 15 PDSDocument60 pagesPioneer Self Storage Fund Oct 15 PDSAnonymous 6tuR1hzNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- PPE Accounting Guide: Depreciation, Revaluation, and DerecognitionDocument21 pagesPPE Accounting Guide: Depreciation, Revaluation, and Derecognitionemman neriNo ratings yet

- PAL0022 T1transaction&Double EntryDocument6 pagesPAL0022 T1transaction&Double EntrySamuel Koh0% (1)

- BSNL salary slip detailsDocument1 pageBSNL salary slip detailsDipankar Mandal100% (3)

- Understanding the taxable nature of baling chargesDocument4 pagesUnderstanding the taxable nature of baling chargesjessapuerinNo ratings yet

- PepsiCo and Coca Cola - Financial AnalysisDocument15 pagesPepsiCo and Coca Cola - Financial Analysisashishkumar14100% (2)

- 1 Hour Business PlanDocument35 pages1 Hour Business PlanjwmpscriNo ratings yet

- Preferred Stock Primer 2009Document9 pagesPreferred Stock Primer 2009oliverzzeng1152No ratings yet

- Case StudyDocument7 pagesCase Studycristinejoy.mendez17No ratings yet

- Managerial Accounting 08Document55 pagesManagerial Accounting 08Dheeraj SunthaNo ratings yet

- Concept of Financial InclusionDocument12 pagesConcept of Financial InclusionMohitAhujaNo ratings yet

- MS Excel Exercises for BIS202Document8 pagesMS Excel Exercises for BIS202Mrinal DasGupta50% (2)

- Cash Flow Statement ExplainedDocument6 pagesCash Flow Statement ExplainedNhel AlvaroNo ratings yet

- List of Financial RatiosDocument9 pagesList of Financial RatiosPrinces Aliesa BulanadiNo ratings yet

- Translation of Foreign Financial StatementsDocument34 pagesTranslation of Foreign Financial Statementsandrearys100% (2)