Professional Documents

Culture Documents

New Strategies For Reducing Corporate Fraud: by Jaclyn Jaeger

Uploaded by

Akuw AjahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Strategies For Reducing Corporate Fraud: by Jaclyn Jaeger

Uploaded by

Akuw AjahCopyright:

Available Formats

Enforcement & Litigation

New Strategies for Reducing Corporate Fraud

By Jaclyn Jaeger can detect when something doesn’t make ing on in the business,” he said.

sense and try to figure out why it doesn’t. Peter Saparoff, a partner at the law firm

A ttendees at the annual CFO Sum-

mit at the Massachusetts Institute of

Technology in November heard from fed-

“To the extent that something is going on,

you’ll find it if you understand what’s go-

Mintz Levin, echoed Haydu’s advice. Too

Continued on Page 71

eral regulators promising no end to their

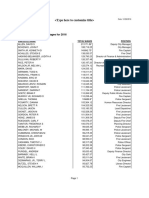

fraud crackdown of recent years, as well as SOME BIG NAMES IN FRAUD

from other corporate executives offering

their ideas on how to maintain ethical op- The following are some significant fraud cases pursued by the FBI:

erations amid difficult economic circum-

stances. BROCADE COMMUNICATIONS SYSTEMS, INC. (SAN FRANCISCO): Brocade Communications

Neil Power, a supervisory agent at the Systems, Inc. (Brocade), a technology company based in San Jose, California, routinely used stock

FBI, told the crowd that the FBI is cur- options to compensate its employees. In July 2006, former Chief Executive Officer (CEO) Gregory L.

rently investigating 592 corporate fraud Reyes and former Vice-President of Human Resources Stephanie Jensen were charged in connection

cases—60 more than the caseload two with a scheme to backdate stock option grants. The two executives made fraudulent entries into

years ago. Securities fraud, such as Ponzi Brocade’s financial books and records, made false statements to auditors, and filed false financial

schemes or other high-investment scams, statements with the SEC in furtherance of the scheme. After internal auditors restated earnings for the

have also seen “an alarming increase” from years 1999 through 2004, it was estimated that the cost to Brocade exceeded $400 million. On August

1,200 cases in 2007 to roughly 1,500 cases 7, 2007, a jury convicted Reyes of ten counts of conspiracy and securities fraud. Reyes was the first

today, he said. person to be tried on charges related to stock options backdating and was sentenced to 21 months

To help its investigation efforts, the FBI in prison. On December 5, 2007, a jury convicted Jensen of conspiracy to commit securities fraud and

works in parallel with the Securities and falsifying corporate records. Jensen is currently awaiting sentencing.

Exchange Commission, Power said. He

stressed that neither agency has authority QWEST COMMUNICATIONS (DENVER): Qwest Communications (Qwest) is a Fortune 500 compa-

over the other: “They do not direct us. We ny and one of the largest providers of telecommunications services in the U.S. In 2000 and 2001, the

do not direct them.” But given that fraud company reported sales revenues of $16 billion and $19 billion, respectively, in its published financial

investigations can span across multiple lo- statements. In 2002, Qwest issued a press release that acknowledged the company had improperly

cations and be “very document-intense,” recorded $1.1 billion in revenue since 1999, and the FBI opened a criminal investigation. Five execu-

the two do collaborate, he continued. The tives were indicted and either pled guilty or were convicted of securities fraud or insider trading. This

actual report of investigations, however, included the former CEO Joseph Nacchio, who was convicted of insider trading on April 19, 2007. He

is written by only one to avoid conflict- was sentenced to six years in prison, ordered to forfeit $52 million gained as a result of his illegal stock

ing viewpoints that could hinder civil or sales, and fined $19 million.

criminal proceedings in court.

The FBI is also looking to expand its HOLLINGER INTERNATIONAL, INC. (CHICAGO): Hollinger International (Hollinger) is an inter-

sources of information to include hedge national newspaper holding company and owner of the Chicago Sun Times and The Daily Telegraph

funds, private equity firms, and the Big newspapers. This case was initiated based on allegations that $32 million in non-competition pay-

4 auditing firms to help the agency bet- ments were made to CEO and Chairman of the Board Conrad Black and three other corporate execu-

ter address fraud before it happens, Power tives in conjunction with newspaper sales without proper authority. It was also alleged that news-

added. paper circulation numbers were overstated for the purpose of misleading advertising companies and

Despite the current increase in fraud in- causing them to pay more in advertising fees. In November 2005, Black and three others were indicted

vestigations, however, fraud itself is a con- on 15 counts of racketeering, mail and wire fraud, money laundering, obstruction of justice, and tax

stant threat, warned a panel of executives fraud. On July 13, 2007, Black and the three other co-defendants were convicted after a four-month

speaking at the event. “Fraud happens in jury trial. On December 10, 2007, Black was sentenced to 78 months imprisonment.

good times, but it’s recovered in bad times,”

said Frank Haydu, a chairman of the audit BRITISH PETROLEUM, INC. (ANCHORAGE): On October 25, 2007, British Petroleum (BP) and

committee for retailer iParty. That means several of its subsidiaries agreed to pay $373 million in fines and restitution for environmental viola-

financial executives must treat fraud miti- tions stemming from a fatal explosion at a Texas refinery that occurred in March 2005 and from leaks

gation as an ongoing effort, he said. of crude oil from pipelines in Alaska in March 2006, as well as for conspiring to manipulate the price

To that end, Haydu said, he tries to of propane.

“understand the business case” of a trans-

action or set of performance results, rather Source: Federal Bureau of Investigation. For additional information, go to www.complianceweek.com

than look for specific types or incidents of and enter Print Reference Code: 011007.

fraud. That means investing the time so he

16 WWW.COMPLIANCEWEEK.COM » 888.519.9200 JANUARY 2010

New Strategies for Reducing Corporate Fraud

Continued from Page 16

without checks and balances, or is ex- facing an SEC probe, for example, compa-

often, he said, he sees directors who clear- tremely profit-driven from the executive- nies will often tout their compliance pro-

ly don’t understand a transaction, “but level down, where numbers are constantly grams as proof of their ethical attitudes,

they’re afraid to ask and have it explained, being fudged whether it’s to increase rev- “but I don’t think the inquiry will stop

because they don’t want to look stupid. In enue or hide losses, he said. there,” he said. “You can have the best com-

terms of risk control, that’s a problem.” One attendee lamented that fraud whis- pliance program in the world, but the SEC

Understanding the culture of the busi- tleblowers often are the ones who suffer, is still going to want to know why it was

ness is also critical, Haydu added. “There’s since they are bucking the will of top ex- that this person was able to get around it.”

nothing more important than the qual- ecutives and then face retaliation for mak- Saparoff said putting someone in charge

ity and the integrity of the people you are ing the right ethical decision. of enforcing compliance is vital. If no clear

dealing with,” he said. “I’ve left companies Power agreed. “Each one is afraid to enforcement person exists, the SEC will

because I didn’t trust the CEO or CFO. If lose their job if they don’t go along with start to wonder: Was the compliance de-

I get a nervous feeling like that, that’s the making money for the company,” he said. partment not paying attention? Are its

one thing I will not ignore.” “These days in the recession, when there staffers underpaid? Is the compliance

John Tus, corporate treasurer of Hon- are not many jobs out there, it’s even more function itself not large enough to handle

eywell, agreed. “There are no people in a pressure on that follower.” the challenges the company faces?

company that are more well-positioned Haydu, however, put the choice for whis- In summary, with all the headaches

than the leaders of the company to drive tleblowers in more stark terms. “If you’re brought on by an FBI and SEC investi-

that integrity in the organization,” he said. in a situation where people are breaking the gation, compliance with laws and regula-

“One of the first rules you learn in account- law … you have to either leave, or you need tions is critical, Tus said, and to invest in

ing is that you can’t audit a company where to do something about it,” he said, “be- fraud mitigation is “money that’s very well

management doesn’t have integrity.” cause you’ll not get another job eventually spent.”

Indeed, Power said, many cases come to if it ever hits the light of day.” For more information, including re-

the attention of the FBI thanks to “greedy Saparoff also warned that having a cor- lated coverage, please go to www.compli-

executives who will do anything for a porate compliance program in place isn’t anceweek.com and enter Print Reference

buck.” Usually the company is operating always enough to please regulators. When Code: 011007. ■

Debt, Lease Restructurings Pose Fresh Challenges

Continued from Page 24

sue in your banking relationships that you Hepp says. “Even the whole decision of

agreement would change the classification weren’t counting on,” Montague says. whether to lease or buy may change. If it’s

of a lease from operating to capital or vice- John Hepp, a partner in the national going to be on the balance sheet, particu-

versa, says David Grubb, a partner with professional standards group at Grant larly in today’s market, you may be able to

regional accounting firm Plante & Moran. Thornton, says lease accounting has plenty purchase that asset at relatively favorable

An operating lease is reflected as an expense of complexity generally, and accounting for terms.”

as lease payments are made, with no asset modifications is no different. “If you mod- According to Grubb, companies will

or liability appearing on the balance sheet; ify a lease, some of the debits and credits typically pursue lease modifications after

a capital lease appears as an asset and a li- don’t work out intuitively,” he says. “You they’ve exhausted other debt modifica-

ability over the life of the lease. ASC Topic need to be careful.” tions that might produce some cash relief.

840 addresses lease accounting, and gener- Companies renegotiating leases now “If the economic turnaround is slow, we’ll

ally tells companies what to do if the terms would be wise to consider not only existing see more” companies pursuing new leases,

of a lease are modified. It’s also an area of rules, but also new lease standards that are he says.

complexity, Grubb says. percolating in both the United States and Gary says retailers, who typically lease a

Chris Montague, a managing part- internationally, Hepp says. In a few years, lot of property, likely will ride out the holi-

ner with Plante & Moran, says companies it’s won’t be so easy to keep leases off the day shopping season and see how that im-

should pay attention to whether a change in balance sheet, he says. proves their situation before pursuing new

lease terms could trip changes in metrics that There may be good business reasons to lease agreements.

are important to other loan covenants, such lease property or equipment rather than to For more information on lease and debt

as debt-to-equity ratios or capital require- buy, “but if keeping the obligation off the accounting, please go to www.compliance-

ments, among others. “If you’ve not thought balance sheet is one of those, you have to week.com and enter Print Reference Code:

that through, you could end up with an is- start anticipating that that will go away,” 011009. ■

JANUARY 2010 WWW.COMPLIANCEWEEK.COM » 888.519.9200 71

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission.

You might also like

- 1 - 5G Technology Development and Application 202107Document62 pages1 - 5G Technology Development and Application 202107Akuw AjahNo ratings yet

- Corporate Fraud and Employee Theft: Impacts and Costs On BusinessDocument15 pagesCorporate Fraud and Employee Theft: Impacts and Costs On BusinessAkuw AjahNo ratings yet

- Part I. Inputs: AssetsDocument4 pagesPart I. Inputs: AssetsAkuw AjahNo ratings yet

- Per Share.: Year Devidends $ Annual GrowthDocument10 pagesPer Share.: Year Devidends $ Annual GrowthAkuw AjahNo ratings yet

- Barry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Document11 pagesBarry Computer Company: Balance Sheet As of December 31, 2015 ($.000)Akuw AjahNo ratings yet

- Tugas 8-20 Kelompok 3Document4 pagesTugas 8-20 Kelompok 3Akuw AjahNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Poetry UnitDocument212 pagesPoetry Unittrovatore48100% (2)

- Seabank Statement 20220726Document4 pagesSeabank Statement 20220726Alesa WahabappNo ratings yet

- 1916 South American Championship Squads - WikipediaDocument6 pages1916 South American Championship Squads - WikipediaCristian VillamayorNo ratings yet

- 2016 W-2 Gross Wages CityDocument16 pages2016 W-2 Gross Wages CityportsmouthheraldNo ratings yet

- Bacacay South Hris1Document7,327 pagesBacacay South Hris1Lito ObstaculoNo ratings yet

- Alternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSDocument16 pagesAlternative Network Letter Vol 7 No.1-Apr 1991-EQUATIONSEquitable Tourism Options (EQUATIONS)No ratings yet

- Ring and Johnson CounterDocument5 pagesRing and Johnson CounterkrsekarNo ratings yet

- Product Manual 26086 (Revision E) : EGCP-2 Engine Generator Control PackageDocument152 pagesProduct Manual 26086 (Revision E) : EGCP-2 Engine Generator Control PackageErick KurodaNo ratings yet

- DMIT - Midbrain - DMIT SoftwareDocument16 pagesDMIT - Midbrain - DMIT SoftwarevinNo ratings yet

- CS-6777 Liu AbsDocument103 pagesCS-6777 Liu AbsILLA PAVAN KUMAR (PA2013003013042)No ratings yet

- Transportasi Distribusi MigasDocument25 pagesTransportasi Distribusi MigasDian Permatasari100% (1)

- Sankranthi PDFDocument39 pagesSankranthi PDFMaruthiNo ratings yet

- CiscoDocument6 pagesCiscoNatalia Kogan0% (2)

- HepaDocument1 pageHepasenthilarasu5100% (1)

- Binge Eating Disorder ANNADocument12 pagesBinge Eating Disorder ANNAloloasbNo ratings yet

- Espree I Class Korr3Document22 pagesEspree I Class Korr3hgaucherNo ratings yet

- Bba VDocument2 pagesBba VkunalbrabbitNo ratings yet

- SecuritizationDocument46 pagesSecuritizationHitesh MoreNo ratings yet

- CH 04Document19 pagesCH 04Charmaine Bernados BrucalNo ratings yet

- Statistics and Probability: Quarter 4 - (Week 6)Document8 pagesStatistics and Probability: Quarter 4 - (Week 6)Jessa May MarcosNo ratings yet

- National Football League FRC 2000 Sol SRGBDocument33 pagesNational Football League FRC 2000 Sol SRGBMick StukesNo ratings yet

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDocument8 pagesTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotNo ratings yet

- NIQS BESMM 4 BillDocument85 pagesNIQS BESMM 4 BillAliNo ratings yet

- Odisha State Museum-1Document26 pagesOdisha State Museum-1ajitkpatnaikNo ratings yet

- Elpodereso Case AnalysisDocument3 pagesElpodereso Case AnalysisUsama17100% (2)

- Iaea Tecdoc 1092Document287 pagesIaea Tecdoc 1092Andres AracenaNo ratings yet

- Previous Year Questions - Macro Economics - XIIDocument16 pagesPrevious Year Questions - Macro Economics - XIIRituraj VermaNo ratings yet

- Pulmonary EmbolismDocument48 pagesPulmonary Embolismganga2424100% (3)

- Open Letter To Hon. Nitin Gadkari On Pothole Problem On National and Other Highways in IndiaDocument3 pagesOpen Letter To Hon. Nitin Gadkari On Pothole Problem On National and Other Highways in IndiaProf. Prithvi Singh KandhalNo ratings yet

- 24 DPC-422 Maintenance ManualDocument26 pages24 DPC-422 Maintenance ManualalternativblueNo ratings yet