Professional Documents

Culture Documents

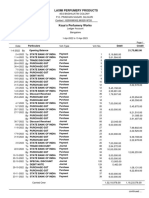

Tax File 8

Uploaded by

joyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax File 8

Uploaded by

joyCopyright:

Available Formats

SURVEY OF PHILIPPINE TAXES

A. Internal revenue taxes imposed under the NIRC

1. Income tax

2. Transfer taxes

a. Estate Tax

b. Donor’s Tax

3. Percentage taxes

a. Value Added Tax

b. Other Percentage Taxes

4. Excise taxes

5. Documentary stamp tax

B. Local/Municipal Taxes

C. Tariff and Customs Duties

D. Taxes/Tax incentives under special laws

making body, imposes burdens for the purpose of raising revenues to carry

out legitimate objects of the government

TAXES – the enforced contributions levied by the law-making body of the

state for the support of the government and all the public needs.

3 INHERENT POWERS OF THE STATE

1. Police Power- the power of promoting public welfare and regulating

the use of liberty and property.

2. Power of Taxation – the power which raises revenue for the

expenses of the government

3. Power of Eminent Domain – the power to acquire private property

for public purpose upon payment of just compensation

PURPOSES OF TAXATION

1. Primary: Revenue or Fiscal Purpose

- to provide funds or property with which to promote general welfare and

protection of its citizens

2. Secondary: Regulatory Purpose

- employed as a devise for regulation or control

Effects: ● Promotion of General Welfare

● Reduction of Social Inequality

● Economic Growth

THEORIES OF TAXATION

1. Necessity Theory

- to preserve the state’s sovereignty

- a means to give for protection and facilities

2. Lifeblood Theory

- used to continue to perform the government’s basic function of serving

and protecting its people

- give tangible and intangible benefits

Basis of Taxation – The government may be able to perform its functions

while the citizens may be secured in the enjoyment of the benefits.

MANIFESTATION OF LIFEBLOOD THEORY

1. Rule of “No Estoppel against the government”

2. Collection of taxes cannot be stopped by injunction

Court of Tax Appeals – have the authority to grant injunction to restrain

collection of internal revenue tax, fee or charge

3. Taxes could not be the subject of compensation or set-off

Tax is compulsory not bargain.

4. Right to select objects (subjects) of taxation

a)Subject or object to be taxed

b)Purpose of the tax (as long as it is a public purpose)

c) Amount or rate of the tax

d)Kind of tax

e)Apportionment of the tax

f) Situs (place) of taxation

g)Manner, means, and agencies of collection of the tax

5. A valid tax may result in the destruction of the taxpayer’s property.

Lawful tax cannot be defeated.

Bring out the insolvency of the taxpayer

Forfeiture of property through police power

SCOPE OF TAXATION

The power of taxation is the most absolute of all the powers of the

government.

a)Comprehensive – covers all (persons, businesses, professions)

b)Unlimited – absence of limitations

c) Plenary – it is complete

d)Supreme –

ESSENTIAL ELEMENTS OF TAX

a)It is an enforced contribution.

b)It is generally payable in money.

c) It is proportionate in character.

d)It is levied on persons, property or right.

e)It is levied by the law-making body of the state.

f) It is levied for public purpose.

ASPECTS OF TAXATION

a)Levying or imposition of tax

b)Assessment or determination of the correct amount

c) Collection of tax

You might also like

- A. General Concepts and Principles of TaxationDocument4 pagesA. General Concepts and Principles of TaxationAngelica EsguireroNo ratings yet

- A. General Concepts and Principles of TaxationDocument25 pagesA. General Concepts and Principles of TaxationMarinella GonzalesNo ratings yet

- Fundamental Principles of Taxation: ObjectivesDocument12 pagesFundamental Principles of Taxation: ObjectivesChristelle JosonNo ratings yet

- FIRS Handbook on Reforms in the Tax System 2004-2011From EverandFIRS Handbook on Reforms in the Tax System 2004-2011No ratings yet

- Chapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyDocument11 pagesChapter 1 - Fundamental Principles: TAXATION - The Process by Which The Sovereign, Through Its Law-Making BodyLiRose SmithNo ratings yet

- Taxation - ch1Document5 pagesTaxation - ch1Jannah CayabyabNo ratings yet

- Taxation (Basic Principles)Document8 pagesTaxation (Basic Principles)Mariah Jans SasumanNo ratings yet

- Principles of TaxationDocument29 pagesPrinciples of TaxationannyeongchinguNo ratings yet

- Income Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)Document40 pagesIncome Taxation (Principles of Taxation) : Fritz A. Perez, Cpa, CTT, Mritax, Mba (O.G)JessaNo ratings yet

- Bukidnon State University Alubijid Satellite CampusDocument16 pagesBukidnon State University Alubijid Satellite CampusJames Bryle GalagnaraNo ratings yet

- Basic Concepts of Taxation1Document6 pagesBasic Concepts of Taxation1Angela CanayaNo ratings yet

- Chapter 1 Basic PrinciplesDocument5 pagesChapter 1 Basic PrinciplesJuvy Jane DuarteNo ratings yet

- Tax 311 Topic PDFDocument22 pagesTax 311 Topic PDFAnnie Mae YnotNo ratings yet

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- INCTAXA - Module 1Document26 pagesINCTAXA - Module 1JOVIE KATE MARIE MOLINANo ratings yet

- Lecture 1 - General PrinciplesDocument5 pagesLecture 1 - General PrinciplesLovenia Magpatoc100% (1)

- Chapter 1Document4 pagesChapter 1Christian LadesmaNo ratings yet

- TAXATION - PrelimsDocument8 pagesTAXATION - PrelimsPrincess Dianne CamachoNo ratings yet

- TaxationDocument82 pagesTaxationCherry Ann LayuganNo ratings yet

- Illustrations of Lifeblood TheoryDocument8 pagesIllustrations of Lifeblood TheoryMay AbiaNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- Tax ReviewerDocument12 pagesTax Reviewerashleykate.hapeNo ratings yet

- Taxation 1Document63 pagesTaxation 1Ella Joy MataNo ratings yet

- BAM 031 Part 1 - HandoutDocument25 pagesBAM 031 Part 1 - HandoutEuli Mae SomeraNo ratings yet

- TAXATION-General Principles: 3. Based Ability To PayDocument11 pagesTAXATION-General Principles: 3. Based Ability To PayJudy Ann Matos DiaganNo ratings yet

- General Principles of TaxationDocument5 pagesGeneral Principles of TaxationClaude Peña100% (1)

- Taxatio N: Avecilla, Eunice. M. Banjaon, Jan Trace ADocument25 pagesTaxatio N: Avecilla, Eunice. M. Banjaon, Jan Trace ANorielyn AustralNo ratings yet

- Taxation and Income TaxationDocument71 pagesTaxation and Income TaxationPortly RespirationNo ratings yet

- Module 1 - Part 2Document4 pagesModule 1 - Part 2trixie maeNo ratings yet

- General Principles: Power of TaxationDocument21 pagesGeneral Principles: Power of TaxationCarl MurphyNo ratings yet

- Taxation LawDocument127 pagesTaxation LawCarl MurphyNo ratings yet

- Taxation LawDocument127 pagesTaxation Lawtheia28No ratings yet

- Fundamentals of Accounting Q2 Wk3 5 1 1Document17 pagesFundamentals of Accounting Q2 Wk3 5 1 1Kimverlee Anne GarciaNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDALiezl Oreilly VillanuevaNo ratings yet

- Illustrations of Lifeblood TheoryDocument11 pagesIllustrations of Lifeblood TheoryDarwin Ilustre BacayNo ratings yet

- Chapter 1 TaxationDocument6 pagesChapter 1 TaxationCharlotte CañeteNo ratings yet

- Taxation (Lecture 1)Document10 pagesTaxation (Lecture 1)Criselda TeanoNo ratings yet

- Income-Taxation-Notes - 01 06 24Document6 pagesIncome-Taxation-Notes - 01 06 24Gregzilla YoloMcswaginsNo ratings yet

- Module 1 - TaxationDocument9 pagesModule 1 - TaxationYan DelfinNo ratings yet

- Chapter 1: Introduction To Income TaxationDocument12 pagesChapter 1: Introduction To Income TaxationBeggie BucagNo ratings yet

- General Principles of Taxation-HandoutDocument11 pagesGeneral Principles of Taxation-HandoutJhovet Christian M. CariÑoNo ratings yet

- Introduction To TaxationDocument47 pagesIntroduction To TaxationAlrac Garcia100% (1)

- Module 1 Lecture TAXationDocument7 pagesModule 1 Lecture TAXationJagi KimNo ratings yet

- MITERM Reviewer (Chap 1-4)Document17 pagesMITERM Reviewer (Chap 1-4)Necy Adeline GenogalingNo ratings yet

- Taxation Reviewer SAN BEDADocument129 pagesTaxation Reviewer SAN BEDARitch LibonNo ratings yet

- Income TaxationDocument10 pagesIncome TaxationRocel Domingo100% (1)

- Chapter 1 IntaxDocument7 pagesChapter 1 IntaxrarerawrolesNo ratings yet

- Basic Principles of Taxation HandoutsDocument15 pagesBasic Principles of Taxation HandoutsbernadetheNo ratings yet

- A Review of The General Principles of TaxationDocument10 pagesA Review of The General Principles of TaxationRommel Mirasol100% (1)

- Abm 11 - Fabm2 2ND Semester Finals Module 3 (Pielago)Document13 pagesAbm 11 - Fabm2 2ND Semester Finals Module 3 (Pielago)edjay.mercado85No ratings yet

- TX01 General Principles of TaxationDocument9 pagesTX01 General Principles of TaxationAce DesabilleNo ratings yet

- Taxation Memaid (Beda)Document132 pagesTaxation Memaid (Beda)Maria Jennifer Yumul BorbonNo ratings yet

- General Principles of TaxationDocument24 pagesGeneral Principles of TaxationPines MacapagalNo ratings yet

- TX01 GeneralPrinciplesofTaxationDocument9 pagesTX01 GeneralPrinciplesofTaxationARISNo ratings yet

- TAXATIONDocument16 pagesTAXATIONJaime ClemeniaNo ratings yet

- Tax Notes Under Atty GaleraDocument18 pagesTax Notes Under Atty GaleraArahbellsNo ratings yet

- Basic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Document30 pagesBasic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Renalyn ParasNo ratings yet

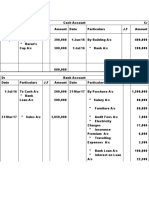

- Ledger 1Document2 pagesLedger 1joyNo ratings yet

- Adjusting Journal Entries Part 09Document2 pagesAdjusting Journal Entries Part 09joyNo ratings yet

- Journal BookDocument2 pagesJournal BookrmpremsNo ratings yet

- New EntriesDocument1 pageNew EntriesrmpremsNo ratings yet

- ABC Trial BalanceDocument1 pageABC Trial BalancermpremsNo ratings yet

- Ledger 4Document2 pagesLedger 4joyNo ratings yet

- Trial Balance MarchDocument2 pagesTrial Balance MarchrmpremsNo ratings yet

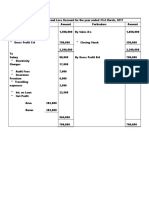

- Profit and Loss StatementDocument1 pageProfit and Loss StatementjoyNo ratings yet

- Chart of AccountsDocument1 pageChart of AccountsrmpremsNo ratings yet

- Operational EfficiencyDocument1 pageOperational EfficiencyrmpremsNo ratings yet

- Ledger 5Document2 pagesLedger 5joyNo ratings yet

- Assets Liabilities Owner's Equity Real AccountsDocument1 pageAssets Liabilities Owner's Equity Real AccountsjoyNo ratings yet

- Ledger 3Document2 pagesLedger 3joyNo ratings yet

- Problem 4.5Document1 pageProblem 4.5joyNo ratings yet

- Problem 4Document1 pageProblem 4joyNo ratings yet

- True or False 1Document1 pageTrue or False 1joyNo ratings yet

- Requisites of CompensationDocument4 pagesRequisites of CompensationjoyNo ratings yet

- Purposes of Taxation: What Is BIR?Document2 pagesPurposes of Taxation: What Is BIR?joyNo ratings yet

- Criteria For Determining License Fees: What Is BIR?Document3 pagesCriteria For Determining License Fees: What Is BIR?joyNo ratings yet

- Transactions From DecDocument2 pagesTransactions From DecjoyNo ratings yet

- SYLLABUSDocument1 pageSYLLABUSjoyNo ratings yet

- Caltex v. Commissioner, 208 SCRA 755: Received Principle."Document3 pagesCaltex v. Commissioner, 208 SCRA 755: Received Principle."joyNo ratings yet

- Tax File 9Document11 pagesTax File 9joyNo ratings yet

- Illustrations of Lifeblood Theory: "Symbiotic Relation"Document2 pagesIllustrations of Lifeblood Theory: "Symbiotic Relation"joyNo ratings yet

- Tax File 7Document17 pagesTax File 7joyNo ratings yet

- License or Regulatory Fee v. TaxDocument3 pagesLicense or Regulatory Fee v. TaxjoyNo ratings yet

- S TO Subject Matter OR ObjectDocument11 pagesS TO Subject Matter OR ObjectjoyNo ratings yet

- Toll v. Tax: What Is BIR?Document4 pagesToll v. Tax: What Is BIR?joyNo ratings yet

- AKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Document2 pagesAKSINDO (Mr. Ferlian), 11 - 13 Mar 2016 (NY)Sunarto HadiatmajaNo ratings yet

- Taxation Homework 1 PDFDocument4 pagesTaxation Homework 1 PDFKNVS Siva KumarNo ratings yet

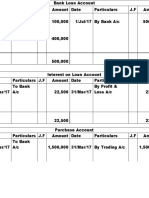

- 3RD SemDocument34 pages3RD SemMohan kumar K.SNo ratings yet

- Account Statement 100323 280323Document5 pagesAccount Statement 100323 280323Mainak BhattacharjeeNo ratings yet

- Incotax MaterialsDocument6 pagesIncotax MaterialsPeachy CamNo ratings yet

- Statement of Account: No 63 Jalan Seroja 12 Taman Seroja Bandar Baru Salak Tinggi 43900 Sepang, SelangorDocument2 pagesStatement of Account: No 63 Jalan Seroja 12 Taman Seroja Bandar Baru Salak Tinggi 43900 Sepang, Selangorroro cocoNo ratings yet

- Blank BillDocument1 pageBlank BillManzoor IqbalNo ratings yet

- Writeup Circular 86-05-2019Document3 pagesWriteup Circular 86-05-2019Mithun KhatryNo ratings yet

- Inv 6818Document1 pageInv 6818AISHANI DASNo ratings yet

- Income Tax - ElaineDocument11 pagesIncome Tax - ElaineSamsung AccountNo ratings yet

- HDFCDocument1 pageHDFCGaurav VermaNo ratings yet

- BBS Citizen's Charter A5 FA Rev081319 PDFDocument19 pagesBBS Citizen's Charter A5 FA Rev081319 PDFHerbey John NoblesNo ratings yet

- Tax Law 1 ProjectDocument22 pagesTax Law 1 ProjectJashaswee MishraNo ratings yet

- Chandul Kumar V-6411 PDFDocument1 pageChandul Kumar V-6411 PDFSamNo ratings yet

- VJH AWMy Vy N6 M2 C 4 ZDocument33 pagesVJH AWMy Vy N6 M2 C 4 ZRajkumarNo ratings yet

- Sample Tax Question (Solution and Answer)Document18 pagesSample Tax Question (Solution and Answer)FRITZ JANN CERANo ratings yet

- STP Quick Guide Usd Mt202Document2 pagesSTP Quick Guide Usd Mt202codeblackNo ratings yet

- Soal-Soal LatihanDocument5 pagesSoal-Soal LatihanAldoNo ratings yet

- 0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFDocument7 pages0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFV TravelNo ratings yet

- MCIAA v. Marcos DigestDocument2 pagesMCIAA v. Marcos DigestJai HoNo ratings yet

- Vouchers Holiday Homework 2Document4 pagesVouchers Holiday Homework 2khushiNo ratings yet

- 13 37Document2 pages13 37mynameisjca1No ratings yet

- Ebook Contemporary Mathematics For Business and Consumers 7Th Edition Brechner Test Bank Full Chapter PDFDocument45 pagesEbook Contemporary Mathematics For Business and Consumers 7Th Edition Brechner Test Bank Full Chapter PDFJenniferHalltceiq100% (11)

- Proposal LemongrassDocument2 pagesProposal LemongrassSivakumar VeerappanNo ratings yet

- MergedDocument185 pagesMergedIQBAL MAHMUDNo ratings yet

- LLP Agreement Format For Removal of PartnerDocument2 pagesLLP Agreement Format For Removal of PartnersureshkumarNo ratings yet

- VAT and SD Act 2012 EnglishDocument91 pagesVAT and SD Act 2012 EnglishMonjurul HassanNo ratings yet

- Abakada Guro Party List v. Ermita (General Principles On Taxation)Document3 pagesAbakada Guro Party List v. Ermita (General Principles On Taxation)kjhenyo218502No ratings yet

- Koyas PerfumeryDocument2 pagesKoyas PerfumeryTANUJ CHAKRABORTYNo ratings yet

- DepreciationDocument9 pagesDepreciationPriyank JainNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- LLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.From EverandLLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.No ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)