Professional Documents

Culture Documents

Business and Profession

Uploaded by

Sakshi JainCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business and Profession

Uploaded by

Sakshi JainCopyright:

Available Formats

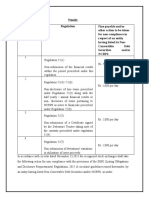

Section 28-44: Business and Profession

Charging Section :

Section 28 provides that Profits and gains of any business carried on by the assessee shall be

charged to tax under the head ‘Income from Business & Profession’

Essential factors-

Business 2 (13) must exist.

The term 'business' includes any trade, commerce or manufacture or any adventure

or concern in the nature of trade, commerce or manufacture. It must be carried on at any

time during the year.

Economic activity carried on for earning profit in the year

Sec 2(13) – An inclusive definition

Systematic & organized course of activity with a purpose of earning profit

Connotes some real, substantial or systematic course of activity for making profit.

Profit motive must

May even consist of rendering services to others.

Single transaction may give rise to business income.

Trade

Exchange of goods for money or goods

Activity of buying & selling.

Commerce

Trade on a large scale

Manufacture

Producing articles commercially different from basic components, by manual or

mechanical process

The identity of the goods changes completely

Adventure in the nature of trade

Normally an isolated transaction

A commercial enterprise having a considerable risk of loss as well as a fair chance of

gain.

Characterised by some essential features that make up trade or business but may not

be trade or business by itself.

Onus of proof: - On the Assessing Officer

Profession : intellectual skill

Sec. 2(36) – Profession includes vocation,

Activity requiring intellectual skill and knowledge

Composite activity possible

A doctor having a hospital

Consultation fee – Income from profession

Income from hospital – Income from business

Vocation : a way of living for which one has special fitness

Earning by natural ability for particular work like carpenter, mechanic, etc.

Govindalji Ramachandji v. CIT (practice of religion)

C.Rajagopalachriar v. CIT (Writing of articles)

1. Commencement of business : 28(i)

The profits and gains of any business or profession which was carried on by the assessee

at any time during the previous year shall be chargeable to income-tax under the head

"Profits and gains of business or profession”

Trader : With the first purchase of stock-in-trade.

Manufacturer: When the first of the several activities required for manufacturing is

undertaken

Illegal Business: Income arising from illegal activity which is in the nature of business,

is taxable as business income.

Expenditure for any purpose which is an offence or is prohibited by law shall not be

allowed as deduction [Expln. To sec. 37(1)]

Business loss: Allowable as deduction if it arises out of and is incidental to the business

of the assessee. The loss should take place in the ordinary course of conducting of the

business.

2. Compensation of specified nature : 28(ii) a, b, c

However compensation for termination of or modification in the terms & conditions

of-

Management of company (Indian company or any other company)

Agency, relating to business of any person

Section 28(ii) (d) : Compensation for acquisition of property is usually a capital

receipt but compensation received for vesting the management of property or

business in the government or any government owned corporation shall be treated as

business income.

3. Income of Trade/Professional associations: [Section 28(iii)]

Income from specific service rendered by Trade/Professional associations, for

members is business income.

What are specific services?

Conditions-

Specific services to be rendered by the association

Remuneration was paid by the members for such services.

Exception to the concept of mutuality

4. Export benefits [Section 28(iiia), (iiib), (iiic)]

Following export benefits are taxable as business income

Profit on sale of import license,

Cash assistance in any form

Duty drawback

5. Value of any benefit or perquisite arising from business or profession is income

from business or profession - Section 28 (iv)

Valuation of perquisites may be done in accordance with Rule 3

(CIT vs. Sir Padampat Singhania [2000] 111 Taxman 223 (All))

6. Salary, interest, etc., received by partner: [Section 28 (v) ]

Only to the extent allowed as deduction in the hands of the firm u/s 40(b)

7. Amount received in cash or kind for (Section 28 (va) )

For not carrying on any activity in relation to any business.

Not sharing know how, patent, copyright, etc.

Is income from business

Exceptions - (Otherwise taxable as Capital gains)

8. Key man insurance policy :Section 28 (vi)

9. Speculative business:

Transactions in the nature of speculation but constituting a business activity.

Speculative transaction [Sec. 43 (5)]

Contract for purchase or sale is settled, periodically or ultimately, without

delivery of goods.

Section 32: Depreciation

Not defined in the Act

Depreciation is the decrease in the value of an asset due to its wear and tear and

passage of time.

It is the process of allocating the cost of a long term asset to the time period in which it

is used in a systematic manner.

Treated as a business expenditure and debited to Profit & Loss A/C of the Assessee

Main object :

To arrive at the real business profits by charging the monetary value of

decrease in efficiency of any asset which is used for the business.

To determine the book value of asset at any given time so as to assess the net

worth of the business.

To know the real position about the asset to arrange for its replacement or

renewal by setting aside a specified sum out of each year’s profit.

Depreciation can be divided into three parts:

Normal Depreciation

Depreciation is allowed only on capital asset

Assets which are used during the year

Asset must be owned by the assessee

Asset actually used for the business in the previous year

No depreciation in the year of sale of asset

Full particulars of the assets on which the depreciation is to be charged

must be furnished to the assessing officer

Claim of depreciation is not optional (mandatory)

Method of depreciation

Additional Depreciation

20% of the actual cost of Plant & Machinery

Asset on which this AD is claimed is engaged in the business of

manufacture or production of any article or thing

It is allowed in addition to the Normal Depreciation and shall be take

into the consideration for calculating the written down value

It should be used for 180 days during Previous year, if it is less than 180

days then one can only claim 10% in that previous year and rest of the

10% can be claimed in the PY

Plant & Machinery should be new. Should not have been used before in

India or outside India

Not eligible to be written off @ 100% of its actual cost in any PY

Not in the nature of a road transport or a office appliances

Where Additional Depreciation cannot be claimed (exception):

i. Ships and Aircrafts

ii. Old Plants or Machinery

iii. Any Plant or Machinery installed in office premises, residential

accommodation or guest houses

iv. Office appliances or road transport vehicles

Unabsorbed Depreciation 32(2)

Depreciation allowance is deductible from the profits and gains of the

business for that assessment year

It any portion of depreciation remains unadjusted it will be set off from

any other income except salary

Section 32(2) provides for carry forward of unabsorbed depreciation.

Where, in any previous year the profits or gains chargeable are not

sufficient to give full effect to the depreciation, it shall be added to the

depreciation allowance for the following previous year and shall be

deemed to be part of that allowance. It becomes the depreciation

allowance of the following previous year.

Calculation of Depreciation = Written down value of the block asset x Rate

You might also like

- Profit Gains of Business and Profession PDFDocument43 pagesProfit Gains of Business and Profession PDFYogita VishwakarmaNo ratings yet

- Profit and Gain of Business ProfessionDocument21 pagesProfit and Gain of Business ProfessionSamar GautamNo ratings yet

- Profits and Gains Tax CalculationDocument18 pagesProfits and Gains Tax CalculationSurya MuruganNo ratings yet

- Business & Profession Theory-AY0910Document52 pagesBusiness & Profession Theory-AY0910Vijaya MandalNo ratings yet

- Business and ProfessionDocument21 pagesBusiness and ProfessionKailash MotwaniNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Income From Profits and Gains of Business and ProfessionDocument1 pageIncome From Profits and Gains of Business and ProfessionShinam JainNo ratings yet

- Unit 2 - Income From Business or ProfessionDocument13 pagesUnit 2 - Income From Business or ProfessionRakhi DhamijaNo ratings yet

- PROFITS AND GAINS OF BUSINESS OR PROFESSIONDocument42 pagesPROFITS AND GAINS OF BUSINESS OR PROFESSIONKr KvNo ratings yet

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocument5 pages"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530No ratings yet

- Income From Profits and Gains of Business and Profession: (A) (B) (C) (D)Document9 pagesIncome From Profits and Gains of Business and Profession: (A) (B) (C) (D)Harshit YNo ratings yet

- Basics of Income From Business & ProfessionDocument30 pagesBasics of Income From Business & ProfessionKiran BendeNo ratings yet

- Unit 3 Income from PGBP NotesDocument10 pagesUnit 3 Income from PGBP NotesKhushi SinghNo ratings yet

- Profits and Gains of Business or ProfessionDocument148 pagesProfits and Gains of Business or ProfessionSuvadip PalNo ratings yet

- PGBP Book NotesDocument41 pagesPGBP Book NoteskrishnaNo ratings yet

- Income From Business or ProfessionDocument7 pagesIncome From Business or ProfessionSwathi JayaprakashNo ratings yet

- Bcom 06 Block 03Document108 pagesBcom 06 Block 03Prabhu SahuNo ratings yet

- Profits and Gains of Business or Profession Sections 28 to 44Document27 pagesProfits and Gains of Business or Profession Sections 28 to 44Shubhankar ThakurNo ratings yet

- Tax Management NotesDocument21 pagesTax Management NotesChetan GKNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPDhandu RanjithNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPJuhi MarmatNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPdeepajagadishgowda532003No ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPalex v.m.No ratings yet

- Unit I: Income From Profits and Gains of Business or Profession'Document20 pagesUnit I: Income From Profits and Gains of Business or Profession'anuNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPHarsiddhi KotilaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPAchut GoreNo ratings yet

- Prefits and Gains-7Document52 pagesPrefits and Gains-7s4sahithNo ratings yet

- 3 Business IncomeDocument14 pages3 Business IncomeShreyas BhadaneNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Unit 3 Profits On Business ADocument19 pagesUnit 3 Profits On Business AAnshu kumarNo ratings yet

- PGBP, Ifos, Deduction, Nti Ay 2018-19-1Document38 pagesPGBP, Ifos, Deduction, Nti Ay 2018-19-1Anonymous ckTjn7RCq80% (1)

- Presentation Taxation LawsDocument8 pagesPresentation Taxation LawsVineet GuptaNo ratings yet

- Income Business Profession Section 28-44Document21 pagesIncome Business Profession Section 28-44jack2529007No ratings yet

- Profits and Gains of Business - JBIMSDocument85 pagesProfits and Gains of Business - JBIMSSwapnil ManeNo ratings yet

- PGBPDocument14 pagesPGBPSaurav MedhiNo ratings yet

- Income From BusinessDocument14 pagesIncome From BusinessPreeti ShresthaNo ratings yet

- PGBP NotesDocument38 pagesPGBP Noteskryptone 1No ratings yet

- Income from Business and Profession Section 28,29&30Document14 pagesIncome from Business and Profession Section 28,29&30imdadul haqueNo ratings yet

- PGBP Complete TheoryDocument21 pagesPGBP Complete TheoryNirbheek Doyal100% (4)

- Profits and Gains of Business or Profession.Document79 pagesProfits and Gains of Business or Profession.Mandira PriyaNo ratings yet

- Accounting ExamplesDocument124 pagesAccounting ExamplesGirish KhareNo ratings yet

- PGBP NotesDocument13 pagesPGBP NotesAyush AwasthiNo ratings yet

- Module Direct TaxDocument52 pagesModule Direct Taxmanu.bNo ratings yet

- UntitledDocument12 pagesUntitledsuyash dugarNo ratings yet

- Profits and Gains of Business or ProfessionDocument35 pagesProfits and Gains of Business or ProfessionnikkiNo ratings yet

- Income From Business and ProfessionDocument23 pagesIncome From Business and ProfessionAmit KumarNo ratings yet

- Section 35ADDocument2 pagesSection 35ADNilesh RoyNo ratings yet

- Income Tax Chapter-10 NoteDocument6 pagesIncome Tax Chapter-10 NoteRAGIB SHAHRIAR RAFINo ratings yet

- Income under the head "Profits & Gain of Business or ProfessionDocument56 pagesIncome under the head "Profits & Gain of Business or ProfessionNiraj Kumar SinhaNo ratings yet

- 1 Income From PGBPDocument20 pages1 Income From PGBPIshani MukherjeeNo ratings yet

- Ind AS 18 Ravi V1Document34 pagesInd AS 18 Ravi V1raviNo ratings yet

- TM 07Document31 pagesTM 07Rohan KawaleNo ratings yet

- Income From Business or Profession or Vocation by TarikaDocument11 pagesIncome From Business or Profession or Vocation by TarikaTwinkling starNo ratings yet

- PGBP1Document6 pagesPGBP1SHALINI JHANo ratings yet

- PGBP1 2Document7 pagesPGBP1 2SHALINI JHANo ratings yet

- Financial, Assessment and Previous Years ExplainedDocument6 pagesFinancial, Assessment and Previous Years ExplainedVijayant DalalNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Capital Gains: Movable/immovable Tangible/ IntangibleDocument10 pagesCapital Gains: Movable/immovable Tangible/ IntangibleSakshi JainNo ratings yet

- 30 Oct - EviDocument4 pages30 Oct - EviSakshi JainNo ratings yet

- Judgment), The Delhi High Court Restrained Future Group From Proceeding With TheDocument3 pagesJudgment), The Delhi High Court Restrained Future Group From Proceeding With TheSakshi JainNo ratings yet

- What is Arbitration? Understanding Key ConceptsDocument5 pagesWhat is Arbitration? Understanding Key ConceptsSakshi JainNo ratings yet

- Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO) v. Competition Commission of IndiaDocument2 pagesTamil Nadu Generation and Distribution Corporation Limited (TANGEDCO) v. Competition Commission of IndiaSakshi JainNo ratings yet

- Waiver or Acquiescence in Insolvency ProceedingsDocument3 pagesWaiver or Acquiescence in Insolvency ProceedingsSakshi JainNo ratings yet

- Refund of Share Application Money Under IBCDocument1 pageRefund of Share Application Money Under IBCSakshi JainNo ratings yet

- Penalty - Reg 52 LODRDocument1 pagePenalty - Reg 52 LODRSakshi JainNo ratings yet

- Key Terms in An Investor-State ContractsDocument12 pagesKey Terms in An Investor-State ContractsSakshi JainNo ratings yet

- Solutions for QAT1001912Document3 pagesSolutions for QAT1001912NaveenNo ratings yet

- Enr PlanDocument40 pagesEnr PlanShelai LuceroNo ratings yet

- Giáo Trình LPTD 2Document40 pagesGiáo Trình LPTD 2Hưng Trịnh TrọngNo ratings yet

- 2.e-Learning Chapter 910Document23 pages2.e-Learning Chapter 910ethandanfordNo ratings yet

- Cloud Computing For Industrial Automation Systems - A ComprehensiveDocument4 pagesCloud Computing For Industrial Automation Systems - A ComprehensiveJason FloydNo ratings yet

- Asian Paint FMVRDocument20 pagesAsian Paint FMVRdeepaksg787No ratings yet

- Feedback Control of Dynamic Systems Franklin 7th Edition Solutions ManualDocument36 pagesFeedback Control of Dynamic Systems Franklin 7th Edition Solutions Manualkilter.murk0nj3mx100% (31)

- Aimt ProspectusDocument40 pagesAimt ProspectusdustydiamondNo ratings yet

- Invoice Request for Digitize Global InovasiDocument1 pageInvoice Request for Digitize Global InovasiAsa Arya SudarmanNo ratings yet

- Epoxy HRDocument5 pagesEpoxy HRMuthuKumarNo ratings yet

- Inventory Valiuation Raw QueryDocument4 pagesInventory Valiuation Raw Querysatyanarayana NVSNo ratings yet

- Water Booster Pump Calculations - Plumbing Engineering - Eng-TipsDocument3 pagesWater Booster Pump Calculations - Plumbing Engineering - Eng-TipsNeal JohnsonNo ratings yet

- FLANSI CAP SONDA CatalogsDocument30 pagesFLANSI CAP SONDA CatalogsTeodor Ioan Ghinet Ghinet DorinaNo ratings yet

- Configuration Management and ISO 9001Document7 pagesConfiguration Management and ISO 9001Simone MeschinoNo ratings yet

- Steady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkDocument9 pagesSteady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkZangNo ratings yet

- Rick CobbyDocument4 pagesRick CobbyrickcobbyNo ratings yet

- Super BufferDocument41 pagesSuper Bufferurallalone100% (1)

- SAP MM ReportsDocument59 pagesSAP MM Reportssaprajpal95% (21)

- HE HOUSEKEEPING GR11 Q1 MODULE-6-for-teacherDocument25 pagesHE HOUSEKEEPING GR11 Q1 MODULE-6-for-teacherMikaela YtacNo ratings yet

- GRL+Prosp - EDocument2 pagesGRL+Prosp - Ethoma111sNo ratings yet

- Seminar On: Hadoop TechnologyDocument13 pagesSeminar On: Hadoop TechnologySAV SportsNo ratings yet

- Update 2.9?new Best Sensitivity + Code & Basic Setting Pubg Mobile 2024?gyro On, 60fps, 5 Fingger. - YoutubeDocument1 pageUpdate 2.9?new Best Sensitivity + Code & Basic Setting Pubg Mobile 2024?gyro On, 60fps, 5 Fingger. - Youtubepiusanthony918No ratings yet

- (Nano and Energy) Gavin Buxton - Alternative Energy Technologies - An Introduction With Computer Simulations-CRC Press (2014) PDFDocument302 pages(Nano and Energy) Gavin Buxton - Alternative Energy Technologies - An Introduction With Computer Simulations-CRC Press (2014) PDFmarcosNo ratings yet

- 1 MergedDocument93 pages1 MergedAditiNo ratings yet

- Electrical Experimenter 1915-08Document1 pageElectrical Experimenter 1915-08GNo ratings yet

- Teaching Methods in The PhilippinesDocument2 pagesTeaching Methods in The PhilippinesTonee Marie Gabriel60% (5)

- Diesel fuel system for Caterpillar 3208 engineDocument36 pagesDiesel fuel system for Caterpillar 3208 engineLynda CarrollNo ratings yet

- MT Series User Manual MT4YDocument28 pagesMT Series User Manual MT4YDhani Aristyawan SimangunsongNo ratings yet

- Assessment of Concrete Strength Using Flyash and Rice Husk AshDocument10 pagesAssessment of Concrete Strength Using Flyash and Rice Husk AshNafisul AbrarNo ratings yet

- LV 2000L AD2000 11B 16B Metric Dimension Drawing en 9820 9200 06 Ed00Document1 pageLV 2000L AD2000 11B 16B Metric Dimension Drawing en 9820 9200 06 Ed00FloydMG TecnominNo ratings yet