Professional Documents

Culture Documents

Financial Markets I Final Project Rubric: Need Improvement Meets Expectations Exceptional

Financial Markets I Final Project Rubric: Need Improvement Meets Expectations Exceptional

Uploaded by

Vignesh KannanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Markets I Final Project Rubric: Need Improvement Meets Expectations Exceptional

Financial Markets I Final Project Rubric: Need Improvement Meets Expectations Exceptional

Uploaded by

Vignesh KannanCopyright:

Available Formats

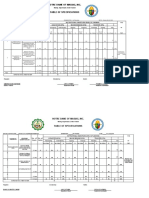

Financial Markets I Final Project Rubric

% Pts <69% 70- 89% >90%

Need Improvement Meets Expectations Exceptional

Option Pricing Black Scholes Model Black Scholes Model Black Scholes Model

in Excel 1. Basic knowledge about Excel 1. Basic knowledge about Excel 1. Basic knowledge about

(open/close/save a file). Excel

2. Introduce data into the Excel

2. Introduce data into the Excel file 2. Introduce data into the

file Excel file

3. Introduce data about the

150 pts 3. Introduce data about the parameters of Black-Scholes 3. Introduce data about the

parameters of Black-Scholes model: stock price, exercise parameters of Black-

model: stock price, exercise price, volatility, risk free rate Scholes model: stock price,

price, volatility, risk free rate and maturity exercise price, volatility,

and maturity risk free rate and maturity

4. Obtain d1 and d2 parameters

4. Obtain d1 and d2 parameters dynamically by using a 4. Obtain d1 and d2

dynamically by using a formula that includes the parameters dynamically by

formula that includes the following Excel functions: using a formula that

following Excel functions: LN, LN, SQRT, / and +. includes the following

SQRT, / and +. Excel functions: LN, SQRT,

5. Obtain N(d1), N(d2), N(-d1)

/ and +.

5. Incorrect or incomplete and N(-d2) parameters using

information about N(d1), NORM.S.DIST Excel function 5. Obtain N(d1), N(d2), N(-

N(d2), N(-d1) and N(-d2). d1) and N(-d2) parameters

6. Obtain the call and put

Does not know NORM.S.DIST using NORM.S.DIST Excel

option prices by applying the

Excel function function

formula in Excel. Know how

6. Incorrect or incomplete to use EXP function. 6. Obtain the call and put

formulas about call and put option prices by applying

option prices. 7. Search Microsoft stock price the formula in Excel. Know

information on Yahoo how to use EXP function.

7. Search Microsoft stock price Finance

information on Yahoo Finance 7. Search Microsoft stock

8. Introduce the specified

price information on Yahoo

8. Introduce the specified parameters in Excel (point 2)

Finance

parameters in Excel (point 2)

9. Obtain the call and put

8. Introduce the specified

9. Incorrect or incomplete option prices as required in parameters in Excel (point

information about call and put point 2

2)

option price

9. Obtain the call and put

option prices as required in

point 2

Binomial Option Pricing

Binomial Option Pricing Model Model in Excel 10. Provides other solution for

implementing Black-

in Excel Scholes Model than the one

indicated the example file

1. Introduce the parameters of 11. Implements Black Scholes

1. Introduce the parameters of BOPM in Excel: stock price, Model in VBA

BOPM in Excel: stock price, exercise price, volatility, risk

exercise price, volatility, risk free rate and maturity

free rate and maturity

2. Calculate upward movement Binomial Option Pricing

2. Calculate upward movement (u) and downward movement

(u) and downward movement (d) using EXP, SQRT and / Model in Excel

(d) using EXP and SQRT and / functions.

functions.

% Pts <69% 70- 89% >90%

3. Calculate probability of 3. Calculate probability of

upward movement (Pu) and upward movement (Pu) and 1. Introduce the parameters

of BOPM in Excel: stock

probability of downward probability of downward

price, exercise price,

movement (Pd) using EXP, * movement (Pd) using EXP, *

volatility, risk free rate and

and – functions and - functions

maturity

4. Calculate the simulated stock 4. Calculate the simulated stock

2. Calculate upward

price considering the upward price considering the upward

movement. Use EXP function movement. Use EXP function movement (u) and

downward movement (d)

5. Calculate the simulated stock 5. Calculate the simulated stock using EXP, SQRT and /

price considering downward price considering downward functions.

movement. movement.

3. Calculate probability of

6. Calculate payoffs. Use MAX 6. Calculate payoffs. Use MAX upward movement (Pu)

function function and probability of

downward movement (Pd)

7. Incorrect or incomplete call 7. Obtain call and put option using EXP, * and -

and put option price according price using BOPM functions

to BOPM model

8. 4. Calculate the simulated

stock price considering the

upward movement. Use

EXP function

5. Calculate the simulated

stock price considering

downward movement.

6. Calculate payoffs. Use

MAX function

7. Obtain call and put option

price using BOPM

8. Implements BOPM in VBA

% Pts <69% 70- 89% >90%

Forecast Oil Price 1. Download data about oil price 1. Download data about oil 1. Download data about oil

Evolution evolution from Quandl. price evolution from Quandl. price evolution from

Download in Excel format. Download in Excel format Quandl. Download in Excel

2. Make an Excel graph with oil 2. Make an Excel graph with oil format.

price evolution price evolution 2. Make an Excel graph with

3. Identify a possible trend 3. Identify a possible trend oil price evolution

150 pts 4. Calculate MIN, MAX and 4. Calculate MIN, MAX and 3. Identify a possible trend

AVERAGE oil price AVERAGE oil price 4. Calculate MIN, MAX and

5. Incorrect or incomplete 5. Factors that influenced oil AVERAGE oil price

information about factors that price evolution 5. Factors that influenced oil

influenced oil price evolution 6. Strategy for oil trading price evolution

6. Incomplete strategy for 7. Provides forecasts based on 6. Strategy for oil trading

projecting oil price evolution its expert judgement 7. Provides forecasts based on

7. Does not provide forecasts 8. Forecasts oil price evolution its expert judgement

based on his expert judgement using Excel. Implements a 8. Forecasts oil price

8. Does not provide a final regression, moving average, evolution using Excel.

forecast using Excel models or trendline or other statistical Implements a regression,

functions methods moving average, trend line

9. The final forecast is far from 9. 0.10< ((forecasted value – or other statistical methods

the real value. real value)/forecasted value) 9. ((forecasted value – real

10. ((forecasted value – real < 0.25 value)/forecasted value) <

value)/forecasted value) > 0.10

0.25 10. Combines with success its

expert judgment and Excel

forecasts

11. Forecasts oil price using

VBA

You might also like

- STP 21-1-SMCTDocument468 pagesSTP 21-1-SMCTNicole Parisio100% (1)

- IT SKILL LAB-2 MBA-1st Yr NKYDocument15 pagesIT SKILL LAB-2 MBA-1st Yr NKYNavneet Yaduvanshi100% (3)

- Black-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDocument8 pagesBlack-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDickson phiriNo ratings yet

- Backbase The ROI of Omni Channel WhitepaperDocument21 pagesBackbase The ROI of Omni Channel Whitepaperpk8barnesNo ratings yet

- Option Pricer Black Scholes VB ADocument6 pagesOption Pricer Black Scholes VB AgarycwkNo ratings yet

- Lab02 Excel ManualDocument40 pagesLab02 Excel ManualShenan TamNo ratings yet

- VBA ModellingDocument39 pagesVBA ModellingThiagoSilvaOliver100% (2)

- Pre Lab TasksDocument2 pagesPre Lab Tasksf2022065342No ratings yet

- Advance Excel - Syllabus and BooksDocument2 pagesAdvance Excel - Syllabus and BooksSaloni BaisNo ratings yet

- Simple Additive WeightingDocument6 pagesSimple Additive Weightingbayu_ssuryaNo ratings yet

- Machine Learning - Project Group 3Document17 pagesMachine Learning - Project Group 3Tangirala AshwiniNo ratings yet

- Options Analysis ToolkitsDocument26 pagesOptions Analysis ToolkitsAlberico CarluccioNo ratings yet

- Advanced MS Excel 2013 - 2 DaysDocument1 pageAdvanced MS Excel 2013 - 2 DaysAshish KolambkarNo ratings yet

- OOP Lab LabModuleDocument78 pagesOOP Lab LabModuleTalha rajpootNo ratings yet

- Arrow96 Es6Document2 pagesArrow96 Es6Mário Sésso JúniorNo ratings yet

- Excel Training Program For EmployeeDocument3 pagesExcel Training Program For EmployeeYogesh KhanvilkarNo ratings yet

- Excel FunctionsDocument13 pagesExcel Functionsfhlim2069No ratings yet

- Lesson 4 FormattingDocument74 pagesLesson 4 Formattingkeerthika MaheshNo ratings yet

- C++ Programming ExercisesDocument6 pagesC++ Programming Exercisesragunath32527117No ratings yet

- ReportingquesDocument28 pagesReportingquesanushaNo ratings yet

- Business Analytics Spreadsheet Modeling Syllabus 20210701Document3 pagesBusiness Analytics Spreadsheet Modeling Syllabus 20210701Alok PatilNo ratings yet

- Topics Covered For MS EXCELDocument5 pagesTopics Covered For MS EXCELMckevin CadanoNo ratings yet

- BI L3 BEx Query Designer Unit 3Document16 pagesBI L3 BEx Query Designer Unit 3sand100% (1)

- 3.0 - Passing and Returing An Array To - From A FunctionDocument15 pages3.0 - Passing and Returing An Array To - From A FunctionsangeethaNo ratings yet

- Analytics On SpreadsheetDocument18 pagesAnalytics On Spreadsheetcdaquiz81No ratings yet

- Lecture 3: Storing Multidimensional Data In: Relational DatabasesDocument38 pagesLecture 3: Storing Multidimensional Data In: Relational DatabasesxainshahNo ratings yet

- ICT 10 - LectureDocument16 pagesICT 10 - LectureRonSky CalingasanNo ratings yet

- Object Oriented Programming Using C++Document17 pagesObject Oriented Programming Using C++ykr007No ratings yet

- Selenium Open Source Test Automation Framework: September 2009Document18 pagesSelenium Open Source Test Automation Framework: September 2009raj_esh_0201No ratings yet

- Design Pattern in Option Pricing Part IDocument3 pagesDesign Pattern in Option Pricing Part IShefali AgarwalNo ratings yet

- Object Oriented Programming Using C++Document16 pagesObject Oriented Programming Using C++prassuNo ratings yet

- Computer II: Counting Numeric CellsDocument12 pagesComputer II: Counting Numeric Cellschhay_vicheth100% (2)

- Week 8 - OOPDocument14 pagesWeek 8 - OOPJhon AlmendrasNo ratings yet

- Advance MS Excel 2013Document1 pageAdvance MS Excel 2013Ashish KolambkarNo ratings yet

- Notes: Unit 4: FunctionsDocument23 pagesNotes: Unit 4: FunctionsNaveen NagalingamNo ratings yet

- Adv ML Lab RecordDocument36 pagesAdv ML Lab Record21131A4232 CHUKKALA PRUDHVI RAJNo ratings yet

- Feature Engineering / Feature SelectionDocument33 pagesFeature Engineering / Feature SelectionBikramaditya SharmaNo ratings yet

- Ansys Workbench 14.5 Driven by A 3 AppDocument14 pagesAnsys Workbench 14.5 Driven by A 3 Appsatymu3No ratings yet

- Managing & Tabulating Data in Microsoft ExcelDocument184 pagesManaging & Tabulating Data in Microsoft Excelsanjeev_kaushik2579No ratings yet

- Visual Basic For Applications TrainingDocument38 pagesVisual Basic For Applications Traininganuj SinghNo ratings yet

- 09 - Utilizarea Domeniilor de CeluleDocument5 pages09 - Utilizarea Domeniilor de Celulegcostea32No ratings yet

- New Perspectives On Microsoft Excel 2002 Tutorial 1 1Document19 pagesNew Perspectives On Microsoft Excel 2002 Tutorial 1 1saimaNo ratings yet

- House Price Prediction Using Machine LearningDocument6 pagesHouse Price Prediction Using Machine Learningphani phaniiiNo ratings yet

- Excel & Advance Excel With VBA & MacrosDocument4 pagesExcel & Advance Excel With VBA & MacrosTushar SuvarnaNo ratings yet

- New FunctionsDocument5 pagesNew FunctionskrkamaNo ratings yet

- Data Structures & Algorithms - Week 1 To 7Document105 pagesData Structures & Algorithms - Week 1 To 7MohamudhajiNo ratings yet

- G-3 Functions Study Material FinalDocument4 pagesG-3 Functions Study Material Finalsayyed safirNo ratings yet

- User Defined FunctionsDocument66 pagesUser Defined FunctionsGayu SivamNo ratings yet

- A. V. Parekh Technical Institute, Rajkot Basic Object Oriented Programming (4320702) Practical List Unit 1: Principles of Object Oriented ProgrammingDocument3 pagesA. V. Parekh Technical Institute, Rajkot Basic Object Oriented Programming (4320702) Practical List Unit 1: Principles of Object Oriented ProgrammingNidhi PatelNo ratings yet

- Zybooks Notes: Section One (1.1-1.6)Document7 pagesZybooks Notes: Section One (1.1-1.6)Michael MichaudNo ratings yet

- Question Bank & Solutions-Module-1Document41 pagesQuestion Bank & Solutions-Module-1abcNo ratings yet

- Faculty of Technology and Engineering: U & P U Patel Department of Computer Engineering Practical ListDocument20 pagesFaculty of Technology and Engineering: U & P U Patel Department of Computer Engineering Practical ListPrime asdfNo ratings yet

- Cleaning Data in Python: Worksheet 2.5Document1 pageCleaning Data in Python: Worksheet 2.5Emely GonzagaNo ratings yet

- C++ VTU NotesDocument59 pagesC++ VTU Notesarmyraj0981% (16)

- Black-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDocument8 pagesBlack-Scholes Excel Formulas and How To Create A Simple Option Pricing Spreadsheet - MacroptionDickson phiriNo ratings yet

- Lab Course Outline-CS143Document5 pagesLab Course Outline-CS143muhammadrizNo ratings yet

- IP Main QuestionDocument20 pagesIP Main QuestionAman SinghNo ratings yet

- Fnal+Report Advance+StatisticsDocument44 pagesFnal+Report Advance+StatisticsPranav Viswanathan100% (1)

- Queries Effective Date FieldDocument5 pagesQueries Effective Date Fieldnareshkumar09No ratings yet

- AgendaDocument9 pagesAgendaMayank SharmaNo ratings yet

- The Ultimate Guide To Master Excel Features & Formulas. Become A Pro From Scratch in Just 7 Days With Step-By-Step InstructionsFrom EverandThe Ultimate Guide To Master Excel Features & Formulas. Become A Pro From Scratch in Just 7 Days With Step-By-Step InstructionsNo ratings yet

- 2019 Rules On Evidence Dean Ma. Soledad Deriquito-MawisDocument124 pages2019 Rules On Evidence Dean Ma. Soledad Deriquito-MawisBenjamin Jr VidalNo ratings yet

- Pranic Healing For HOPE Info Pack 2020Document11 pagesPranic Healing For HOPE Info Pack 2020Behiye YılmazNo ratings yet

- NCM 107 RLE Topic 5 Nov 9-13, 2020Document13 pagesNCM 107 RLE Topic 5 Nov 9-13, 2020mirai desu100% (2)

- Lapford Lookout - February 2016Document16 pagesLapford Lookout - February 2016StephenWensleyNo ratings yet

- Introduction To HealthDocument15 pagesIntroduction To HealthZabdiel Ann SavellanoNo ratings yet

- Wartsila Power Plants Solutions 2014 BrochureDocument96 pagesWartsila Power Plants Solutions 2014 Brochuretareq.sefatNo ratings yet

- Ent 121 TmaDocument4 pagesEnt 121 TmaMartinTaylor100% (1)

- Notre Dame of Masiag, Inc.: TopicsDocument4 pagesNotre Dame of Masiag, Inc.: TopicsKeneth Rose FagtananNo ratings yet

- Teaching Social Studies in The Primary Grades Lec FBRB 2019Document23 pagesTeaching Social Studies in The Primary Grades Lec FBRB 2019rose ann may100% (1)

- E E E Zn:1.07 E ZN Error × 100 153.9: CHUA, JOHN JOSEPH - 2014-30936 Chem 26.1Document3 pagesE E E Zn:1.07 E ZN Error × 100 153.9: CHUA, JOHN JOSEPH - 2014-30936 Chem 26.1Jj ChuaNo ratings yet

- Kunci Bahasa Inggris 11 Gasal MerdekaDocument5 pagesKunci Bahasa Inggris 11 Gasal MerdekaZuhdy KzNo ratings yet

- 9a PT 1 ListeningDocument2 pages9a PT 1 ListeningChâu VũNo ratings yet

- Skill MatrixDocument25 pagesSkill MatrixHR SPEEVO INDUSTRIES LLPNo ratings yet

- Viral Vector Production Process Intensification: Analytics, Automation, In-Line Testing and MoreDocument16 pagesViral Vector Production Process Intensification: Analytics, Automation, In-Line Testing and MoreAtrocitus RedNo ratings yet

- Quiz 2Document2 pagesQuiz 2Charissa QuitorasNo ratings yet

- GhoshdastidarDocument10 pagesGhoshdastidarAsif Mohammad100% (1)

- Paradigma Penelitian Kualitatif From Creswell Book Ch.1&2Document5 pagesParadigma Penelitian Kualitatif From Creswell Book Ch.1&2Ferial FerniawanNo ratings yet

- Sustainable Agriculture Thesis IdeasDocument6 pagesSustainable Agriculture Thesis Ideasjmvnqiikd100% (2)

- Physics Activity FileDocument10 pagesPhysics Activity FileOjashviji SahuNo ratings yet

- Topic 9.2 Graded QuizDocument8 pagesTopic 9.2 Graded QuizTran WinnerNo ratings yet

- RRU5818 Installation Guide 03 PDF - ENDocument93 pagesRRU5818 Installation Guide 03 PDF - ENmeNo ratings yet

- Grasas ShellDocument42 pagesGrasas ShellheflodNo ratings yet

- Communication Based Train Control SystemDocument25 pagesCommunication Based Train Control SystemArthiNo ratings yet

- BEN 2208 - Business Plan Preparation 2Document122 pagesBEN 2208 - Business Plan Preparation 2Christia Mae AtamosaNo ratings yet

- FortiNAC-9 4 4-Release - NotesDocument73 pagesFortiNAC-9 4 4-Release - NotesHalil DemirNo ratings yet

- Frying Cookware (31 Recipes)Document19 pagesFrying Cookware (31 Recipes)shinsylvateNo ratings yet

- 7th Sem-Web Programming Lab Manual 2009-1Document33 pages7th Sem-Web Programming Lab Manual 2009-1Ravi Kant SharmaNo ratings yet

- Professional Indemnity in ConstructionDocument35 pagesProfessional Indemnity in ConstructionMurat YilmazNo ratings yet