Professional Documents

Culture Documents

Investor Digest: Equity Research - 24 January 2022

Uploaded by

Radityo Hari WibowoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor Digest: Equity Research - 24 January 2022

Uploaded by

Radityo Hari WibowoCopyright:

Available Formats

INVESTOR DIGEST

Equity Research | 24 January 2022

Economic Data

Latest 2021F

7-DRRR (%), eop 3.50 4.25

Inflation (YoY %) 1.87 3.30

US$ 1 = Rp, period avg 14,338 14,388

Stock Market Data

(21 January2022)

JCI Index 6,726.4 1.50%

Trading T/O ( Rp bn ) 9,570.8

Market Cap ( Rp tn ) 8,460.2

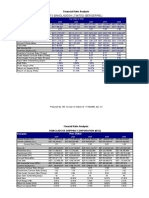

Market Data Summary*

2022F 2023F

P/E (x) 17.1 14.9

P/BV (x) 2.2 2.0

EV/EBITDA (x) 13.1 12.1

Div. Yield (%) 2.8 3.1

Net Gearing (%) 19.2 14.6

ROE (%) 13.4 14.2

EPS Growth (%) 14.4 14.3

EBITDA Growth (%) 4.0 6.7

Earnings Yield (%) 5.9 6.7

* Aggregate of 73 companies in MS research universe,

representing 65.1%of JCI’s market capitalization

Please see important disclosure at the back of this report Page 1 of 5

This report is intended exclusively for Information.center@mandirisek.co.id. Unauthorized distribution is prohibited.

Equity Research | 24 January 2022

Indices and Fund Flows Currencies and Bonds Major Commodities

YTD Chg YTD YTD

Indices Last Chg (%) Currency Last Chg (%) Last Chg (%)

(%) Chg (%) Chg (%)

JCI 6,726.4 +1.5 +2.2 Rp/US$ 14,338 +0.00 -0.6 Crude Oil, WTI (US$/bl) 85.14 -2.0 +13.2

Dow Jones 34,265.4 -1.3 -5.7 US$/EUR 1.134 +0.28 +0.2 Copper (US$/mt) 9,941 -0.5 +2.3

Nikkei 27,522.3 -0.9 -4.4 YEN/US$ 113.68 -0.38 +1.2 Nickel (US$/mt) 24,028 +1.0 +15.8

Hang Seng 24,965.6 +0.1 +6.7 SGD/US$ 1.345 -0.19 +0.3 Gold (US$/oz) 1,835 -0.2 +0.3

STI 3,294.9 +0.0 +5.5 Tin 3-month (US$/mt) 43,955 +1.1 +13.1

Ishares indo 23.5 +1.0 +2.2 CPO futures (Ringgit/ton) 5,322 +2.6 +13.3

Coal (US$/ton) 224.6 -0.5 +32.4

Foreign YTD

YTD Gov. Bond Chg

Fund Flows Last Chg Last Chg Rubber forward (US¢/kg) 199.0 -0.1 -0.1

Chg Yield (bps)

(US$mn) (bps)

Soybean oil

Equity Flow +68.0 +419 5Yr 5.23 -0 +13 63.00 +0.2 +11.9

(US$/100gallons)

Bonds Flow -21.2 -167 10Yr 6.43 +1 +4 Baltic Dry Index 1,415.0 -4.0 -36.2

Please see important disclosure at the back of this report Page 2 of 5

This report is intended exclusively for Information.center@mandirisek.co.id. Unauthorized distribution is prohibited.

Equity Research | 24 January 2022

Equity Valuation

Price Price % of Mkt Cap Net Profit PER (x) P/BV (x) EV/EBITDA (x) EPS Growth Div.Yield

Code Rating (Rp) Target PT (Rp Bn) 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022

MANSEK universe 6,726 7,400 10.0 4,900,018 250,882 287,131 19.5 17.1 2.4 2.2 13.6 13.1 62.9% 14.4% 2.6% 2.8%

Banking 2,200,291 86,321 111,661 25.4 19.7 2.7 2.4 N.A. N.A. 39.2% 29.2% 1.6% 2.1%

BBCA Buy 7,950 7,600 (4.4) 980,037 30,524 34,015 32.1 28.8 5.2 4.7 N.A. N.A. 12.5% 11.4% 1.5% 1.5%

BBNI Buy 7,175 8,000 11.5 133,804 9,021 15,727 14.8 8.5 1.1 1.0 N.A. N.A. 175.0% 74.3% 0.6% 1.7%

BBRI Buy 4,170 5,200 24.7 616,581 28,840 39,497 21.4 15.6 2.2 2.0 N.A. N.A. 28.2% 37.0% 2.8% 3.8%

BBTN Buy 1,670 2,200 31.7 17,685 2,153 2,660 8.2 6.6 0.9 0.8 N.A. N.A. 34.4% 23.5% 0.1% 0.0%

BDMN Buy 2,330 3,600 54.5 22,772 2,075 2,924 10.8 7.6 0.5 0.5 N.A. N.A. 105.9% 41.0% 1.5% 3.2%

BJBR Buy 1,305 1,800 37.9 12,840 1,888 2,044 6.8 6.3 1.0 0.9 N.A. N.A. 11.9% 8.3% 7.3% 7.5%

BJTM Neutral 745 800 7.4 11,177 1,392 1,595 8.0 7.0 1.0 1.0 N.A. N.A. -6.5% 14.6% 6.6% 6.6%

BNGA Buy 955 1,400 46.6 24,001 3,766 4,398 6.4 5.5 0.6 0.5 N.A. N.A. 87.1% 16.8% 4.6% 8.6%

BNLI Neutral 1,400 1,800 28.6 50,654 1,097 1,630 41.0 31.1 1.4 1.3 N.A. N.A. 32.8% 31.9% 0.0% 0.0%

PNBN Buy 755 1,100 45.7 18,182 2,956 3,375 6.2 5.4 0.4 0.4 N.A. N.A. -4.8% 14.2% 0.0% 0.0%

BTPS Buy 3,430 4,000 16.6 26,424 1,449 2,030 18.2 13.0 3.8 3.1 N.A. N.A. 69.5% 40.2% 0.9% 1.6%

BFIN Buy 1,260 1,200 (4.8) 18,855 1,076 1,363 17.5 13.8 2.5 2.3 N.A. N.A. 53.4% 26.7% 1.4% 2.3%

ARTO Buy 19,000 22,000 15.8 263,269 -34 242 -7,793.3 1,085.9 32.0 31.1 N.A. N.A. 86.0% N/M 0.0% 0.0%

AMOR Buy 1,805 2,350 30.2 4,011 100 139 40.3 28.8 12.8 12.6 31.0 22.5 18.9% 39.8% 2.4% 3.3%

Construction & materials 192,973 5,965 8,954 32.0 21.6 1.5 1.4 13.4 11.4 N/M 48.3% 2.9% 2.1%

AVIA Buy 890 1,080 21.3 55,139 1,385 1,859 37.8 29.7 5.8 5.2 26.0 22.1 15.5% 27.5% 4.3% 1.3%

INTP Buy 10,775 16,230 50.6 39,665 1,764 2,255 22.5 17.6 1.9 1.9 10.2 8.9 -2.4% 27.9% 6.7% 6.6%

SMGR Buy 6,925 12,590 81.8 41,076 2,755 3,328 14.9 12.3 1.1 1.0 7.2 6.3 -1.3% 20.8% 0.7% 1.3%

ADHI Neutral 840 890 6.0 2,991 93 234 32.1 12.8 0.5 0.5 8.6 7.5 288.0% 151.3% 0.2% 0.6%

PTPP Neutral 930 1,050 12.9 5,766 274 348 21.0 16.6 0.5 0.5 9.3 8.1 112.9% 26.9% 0.7% 1.4%

WIKA Neutral 1,060 1,100 3.8 9,498 282 470 33.6 20.2 0.7 0.7 14.0 11.4 52.0% 66.5% 0.6% 1.0%

WSKT Neutral 585 1,030 76.1 7,828 -1,261 -1,909 -6.2 -4.1 1.2 1.8 63.1 40.7 82.9% -51.4% 0.0% 0.0%

WTON Neutral 232 270 16.4 2,022 95 190 21.2 10.6 0.6 0.5 6.8 5.3 -25.6% 99.8% 1.9% 1.4%

WSBP Neutral 103 140 35.9 2,715 -510 -484 -5.3 -5.6 4.2 6.5 37.3 29.7 89.3% 5.1% 0.0% -9.4%

JSMR Buy 3,620 6,640 83.4 26,273 1,087 2,663 24.2 9.9 1.3 1.2 11.4 9.9 117.0% 145.0% 0.4% 0.8%

Consumer staples 683,981 38,990 45,145 17.5 15.2 3.3 3.1 11.1 10.1 -8.2% 15.8% 4.7% 4.4%

CMRY Buy 3,350 4,330 29.3 26,581 757 996 35.1 26.7 5.7 4.9 22.3 16.9 -63.7% 31.6% 1.5% 0.9%

ICBP Buy 8,675 12,250 41.2 101,167 6,674 7,670 15.2 13.2 3.1 2.7 11.3 10.4 1.3% 14.9% 3.2% 3.3%

INDF Buy 6,475 9,800 51.4 56,850 5,558 6,207 10.2 9.2 1.3 1.2 7.2 7.0 -13.9% 11.7% 6.8% 5.8%

MYOR Neutral 2,020 2,500 23.8 45,165 1,285 1,530 35.1 29.5 4.1 3.7 16.8 14.9 -37.6% 19.1% 2.6% 1.4%

UNVR Neutral 4,150 5,400 30.1 158,323 5,800 6,120 27.3 25.9 45.4 42.6 18.9 17.9 -19.0% 5.5% 4.5% 3.7%

GGRM Buy 31,750 37,800 19.1 61,090 5,328 6,591 11.5 9.3 1.0 1.0 7.0 6.3 -30.3% 23.7% 8.2% 8.2%

HMSP Buy 955 1,750 83.2 111,084 8,189 9,964 13.6 11.1 3.7 3.5 8.8 7.4 -4.6% 21.7% 7.8% 7.5%

KLBF Buy 1,705 2,050 20.2 79,922 3,109 3,356 25.7 23.8 4.2 3.8 17.0 15.6 15.0% 7.9% 2.0% 1.9%

SIDO Buy 935 1,060 13.4 28,050 1,226 1,413 22.9 19.9 8.1 7.6 16.8 14.5 31.3% 15.2% 3.7% 4.2%

MLBI Buy 7,475 13,250 77.3 15,750 1,063 1,299 14.8 12.1 12.1 10.2 9.5 8.0 656.9% 22.1% 0.9% 6.8%

Healthcare 61,459 2,707 1,990 22.7 30.9 4.0 3.8 10.7 13.1 89.1% -26.5% 1.3% 1.4%

MIKA Buy 2,220 3,200 44.1 31,627 1,165 1,036 27.2 30.5 5.7 5.2 17.9 19.9 38.4% -11.1% 1.6% 1.5%

SILO Buy 8,000 12,000 50.0 13,006 634 461 20.5 28.2 2.0 2.0 5.9 6.8 445.8% -27.3% 1.7% 1.9%

HEAL Buy 1,130 1,520 34.5 16,826 908 493 18.5 34.1 5.1 4.6 9.3 13.9 -61.6% -45.7% 0.4% 0.8%

Consumer discretionary 324,321 24,334 28,785 13.3 11.3 1.5 1.4 9.0 7.9 29.2% 18.3% 2.7% 3.2%

ACES Buy 1,275 1,750 37.3 21,866 779 1,027 28.1 21.3 4.0 3.7 18.6 14.5 6.3% 31.8% 2.5% 2.7%

LPPF Buy 3,700 2,000 (45.9) 9,717 224 839 43.4 11.6 12.1 5.9 11.2 5.3 N/M 274.6% 0.0% 0.0%

MAPA Buy 2,510 3,500 39.4 7,155 385 693 18.6 10.3 2.1 1.8 8.6 5.2 18405.2% 80.2% 0.0% 0.0%

MAPI Buy 750 1,157 54.2 12,450 605 1,023 20.6 12.2 2.1 1.8 6.0 4.3 N/M 69.1% 0.0% 1.0%

RALS Neutral 625 900 44.0 4,435 -41 148 -107.2 29.9 1.2 1.2 54.1 9.1 70.2% N/M 0.0% 0.0%

ERAA Buy 545 950 74.3 8,665 894 1,000 9.7 8.7 1.4 1.3 5.4 5.2 -70.8% 11.9% 3.7% 4.1%

ASII Buy 5,600 6,300 12.5 226,708 18,223 19,950 12.4 11.4 1.4 1.3 9.4 8.8 12.7% 9.5% 3.2% 3.6%

SCMA Neutral 310 430 38.7 19,609 1,131 1,387 17.3 14.1 5.2 4.4 12.3 10.4 -80.3% 22.7% 1.7% 2.5%

Please see important disclosure at the back of this report Page 3 of 5

This report is intended exclusively for Information.center@mandirisek.co.id. Unauthorized distribution is prohibited.

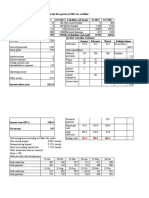

Equity Research | 24 January 2022

Price Price % of Mkt Cap Net Profit PER (x) P/BV (x) EV/EBITDA (x) EPS Growth Div.Yield

Code Rating (Rp) Target PT (Rp Bn) 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022 2021 2022

MNCN Buy 885 1,300 46.9 11,708 2,005 2,516 5.8 4.7 0.7 0.7 3.9 3.1 14.7% 25.5% 2.6% 4.3%

PZZA Buy 665 750 12.8 2,010 130 202 15.5 9.9 1.5 1.3 5.9 4.7 N/M 55.5% -0.1% 3.2%

Commodities 436,774 38,761 38,276 11.3 11.4 1.8 1.7 5.0 5.1 197.9% -1.3% 4.1% 3.6%

UNTR Buy 23,500 33,300 41.7 87,658 11,448 10,422 7.7 8.4 1.3 1.2 3.1 2.8 90.7% -9.0% 3.9% 3.6%

ADRO* Buy 2,310 2,500 8.2 73,888 538 535 9.7 9.7 1.3 1.2 3.8 3.8 266.4% -0.6% 4.2% 3.7%

INDY* Buy 1,585 2,250 42.0 8,258 66 119 8.8 4.9 0.7 0.6 1.7 2.1 N/M 80.2% 2.8% 5.1%

ITMG* Buy 20,800 35,000 68.3 22,808 410 302 3.9 5.3 1.8 1.7 2.2 2.8 938.2% -26.4% 21.6% 15.9%

PTBA Buy 2,830 3,700 30.7 32,609 6,261 4,966 5.2 6.5 1.5 1.5 4.3 5.9 162.3% -20.7% 14.4% 11.4%

HRUM* Buy 10,975 13,500 23.0 28,169 92 169 21.5 11.7 4.4 3.5 13.8 8.7 56.5% 83.3% 2.6% 4.7%

ANTM Buy 1,945 3,300 69.7 46,740 2,269 2,355 20.6 19.9 2.0 1.8 12.7 11.9 97.4% 3.8% 1.7% 1.8%

INCO* Neutral 5,025 5,400 7.5 49,930 163 210 21.6 16.8 1.6 1.5 8.0 6.5 96.6% 28.8% 0.0% 0.0%

MDKA* Buy 3,960 4,500 13.6 86,714 55 113 110.5 54.0 10.4 8.7 31.3 21.2 52.9% 104.8% 0.0% 0.0%

Property & Industrial Estate 101,914 5,015 6,619 20.3 15.4 0.9 0.8 7.8 8.7 N/M 32.0% 1.8% 1.6%

ASRI Buy 149 250 67.8 2,928 485 524 6.0 5.6 0.3 0.3 7.1 6.5 N/M 8.0% 1.3% 1.3%

BSDE Buy 975 1,630 67.2 20,642 956 1,638 21.6 12.6 0.7 0.6 11.4 7.9 27.8% 71.2% 0.0% 0.0%

CTRA Buy 935 1,360 45.5 17,354 1,096 1,111 15.8 15.6 1.1 1.0 9.3 9.4 -17.0% 1.4% 1.2% 1.0%

SMRA Buy 725 1,100 51.7 11,969 353 559 33.9 21.4 1.4 1.3 11.1 9.7 72.0% 58.4% 0.6% 0.7%

JRPT Buy 500 750 50.0 6,875 917 891 7.5 7.7 0.8 0.8 6.5 6.4 -0.9% -2.8% 4.0% 4.0%

PWON Buy 468 630 34.6 22,539 1,486 1,661 15.2 13.6 1.4 1.3 10.3 9.5 46.4% 11.8% 1.3% 1.3%

LPKR Sell 133 110 (17.3) 9,389 -1,047 -479 -9.0 -19.6 0.5 0.5 4.2 8.8 88.2% 54.2% 0.0% 0.0%

DMAS Neutral 190 220 15.8 9,158 962 753 9.5 12.2 1.7 1.7 9.1 12.3 -28.6% -21.8% 11.1% 7.9%

BEST Neutral 110 140 27.3 1,061 -194 -38 -5.5 -27.8 0.3 0.3 -275.3 12.4 -68.0% 80.3% -1.8% -0.2%

Telecom 692,129 37,283 36,175 18.6 19.2 3.4 3.1 7.1 6.7 44.3% -3.0% 3.0% 3.0%

EXCL Buy 3,050 3,600 18.0 32,481 1,293 1,429 25.1 22.7 1.6 1.5 4.7 4.6 247.9% 10.5% 0.6% 0.8%

TLKM Buy 4,330 4,400 1.6 428,939 23,109 25,586 18.6 16.8 4.0 3.7 6.6 6.3 11.1% 10.7% 4.0% 3.9%

ISAT Buy 6,000 8,000 33.3 32,604 5,948 1,368 5.5 23.8 1.8 1.7 4.1 4.0 N/M -77.0% 0.0% 0.0%

LINK Buy 4,380 5,500 25.6 12,052 996 1,096 13.0 11.8 2.3 2.0 5.6 5.2 5.7% 10.1% 2.5% 2.7%

MTEL Buy 795 970 22.0 66,395 1,368 1,890 48.5 35.1 2.0 2.0 13.7 12.3 127.3% 38.2% 1.4% 2.0%

TBIG Buy 3,050 3,600 18.0 65,975 1,246 1,310 52.9 50.4 7.1 6.6 18.3 17.2 23.4% 5.1% 0.9% 0.9%

TOWR Buy 1,075 1,750 62.8 53,683 3,323 3,496 16.2 15.4 4.6 4.0 10.2 9.6 17.2% 5.2% 3.2% 3.4%

Transportation 3,553 6 217 622.6 16.4 0.7 0.7 8.6 5.9 N/M N/M 0.0% 1.2%

BIRD Buy 1,420 1,530 7.7 3,553 6 217 622.6 16.4 0.7 0.7 8.6 5.9 N/M 3703.9% 0.0% 1.2%

Poultry 129,055 7,683 5,626 16.8 22.9 3.1 2.9 10.1 12.3 62.8% -26.8% 1.7% 2.5%

CPIN Buy 6,525 7,500 14.9 106,997 4,610 3,757 23.2 28.5 4.1 3.9 14.9 17.2 20.0% -18.5% 1.8% 2.2%

JPFA Buy 1,755 2,700 53.8 20,580 2,778 1,672 7.4 12.3 1.5 1.5 4.8 6.4 203.0% -39.8% 1.3% 4.0%

MAIN Buy 660 1,125 70.5 1,478 296 198 5.0 7.5 0.6 0.6 4.3 4.4 N/M -33.1% 0.0% 2.7%

Oil and Gas 35,642 5,224 4,661 6.8 7.6 0.8 0.8 5.0 4.4 N/M -10.8% 4.0% 5.0%

AKRA Buy 800 5,000 525.0 3,158 1,104 1,279 2.9 2.5 0.3 0.3 4.0 3.3 20.1% 15.8% 19.2% 24.3%

PGAS* Buy 1,340 2,000 49.3 32,484 291 239 7.9 9.6 0.9 0.9 5.1 4.6 N/M -17.9% 2.5% 3.1%

Internet 37,927 -1,406 -979 -27.0 -38.8 1.7 1.8 -10.7 -14.8 0.4% -30.4% 0.0% 0.0%

BUKA Buy 368 1,400 280.4 37,927 -1,406 -979 -27.0 -38.8 1.7 1.8 -10.7 -14.8 100.0% 30.4% 0.0% 0.0%

Note:

- *) net profit in USD mn

- U/R means Under Review

- n/a means Not Available

- N/M means Not Meaningful

- N.A means Not Applicable

Please see important disclosure at the back of this report Page 4 of 5

This report is intended exclusively for Information.center@mandirisek.co.id. Unauthorized distribution is prohibited.

Mandiri Sekuritas A subsidiary of PT Bank Mandiri (Persero) Tbk

Menara Mandiri Tower I, 25th floor, Jl. Jend. Sudirman Kav. 54 – 55, Jakarta 12190, Indonesia

General: +62 21 526 3445, Fax : +62 21 527 5374 (Equity Sales)

RESEARCH

Adrian Joezer Head of Equity Research, adrian.joezer@mandirisek.co.id +6221 5296 9415

Strategy, Consumer, Internet

Tjandra Lienandjaja Deputy Head of Equity Research tjandra.lienandjaja@mandirisek.co.id +6221 5296 9617

Ariyanto Kurniawan Automotive, Coal, Metal Mining, Chemical ariyanto.kurniawan@mandirisek.co.id +6221 5296 9682

Kresna Hutabarat Banking, Telecom kresna.hutabarat@mandirisek.co.id +6221 5296 9542

Robin Sutanto Property, Building Material robin.sutanto@mandirisek.co.id +6221 5296 9572

Silvony Gathrie Banking silvony.gathrie@mandirisek.co.id +6221 5296 9544

Inggrid Gondoprastowo, CFA Healthcare, Consumer, Retail inggridgondoprastowo@mandirisek.co.id +6221 5296 9450

Henry Tedja, CFA Media, Oil & Gas henry.tedja@mandirisek.co.id +6221 5296 9434

Wesley Louis Alianto Research Assistant wesley.alianto@mandirisek.co.id +6221 5296 9510

Boby Kristanto Chandra Research Assistant boby.chandra@mandirisek.co.id +6221 5296 9673

Ryan Aristo Naro Research Assistant ryan.aristo@mandirisek.co.id +6221 5296 9580

Eimi Setiawan Research Assistant eimi.setiawan@mandirisek.co.id +6221 5296 9549

Leo Putera Rinaldy Chief Economist leo.rinaldy@mandirisek.co.id +6221 5296 9406

Imanuel Reinaldo Economist imanuel.reinaldo@mandirisek.co.id +6221 5296 9651

INSTITUTIONAL SALES

Feliciana Ramonda Institutional Sales feliciana.ramonda@mandirisek.co.id +6221 527 5375

Henry Pranoto Institutional Sales henry.pranoto@mandirisek.co.id +6221 527 5375

Kevin Giarto Institutional Sales kevin.giarto@mandirisek.co.id +6221 527 5375

Sharon Anastasia Tjahjadi Institutional Sales sharon.tjahjadi@mandirisek.co.id +6221 527 5375

Talitha Medha Anindya Institutional Sales medha.talitha@mandirisek.co.id +6221 527 5375

Angga Aditya Assaf Institutional Sales angga.assaf@mandirisek.co.id +6221 527 5375

Ilona Carissa Institutional Sales Ilona.simanungkalit@mandirisek.co.id +6221 527 5375

Kusnadi Widjaja Equity Dealing kusnadi.widjaja@mandirisek.co.id +6221 527 5375

Edwin Pradana Setiadi Equity Dealing edwin.setiadi@mandirisek.co.id +6221 527 5375

Jane Theodoven Sukardi Equity Dealing jane.sukardi@mandirisek.co.id +6221 527 5375

Michael Taarea Equity Dealing michael.taarea@mandirisek.co.id +6221 527 5375

RETAIL SALES

Andreas M. Gunawidjaja Head Retail Equities andreas@mandirisek.co.id 6221 5296 9693

Boy Triyono Jakarta boy.triyono@mandirisek.co.id 6221 5296 5678

Care Center Online Jakarta care_center@mandirisek.co.id 14032

Ruwie Medan ruwie@mandirisek.co.id 6261 8050 1825

Linawati Surabaya linawati@mandirisek.co.id 6231 535 7218

Maulidia Osviana Lampung maulidia.osviana@mandirisek.co.id 62721 476 135

Aidil Idham Palembang aidil.idham@mandirisek.co.id 62711 319 900

Yudhistira Putra Pradana Bandung yudhistira.pradana@mandirisek.co.id 6222 426 5088

Yuri Ariadi Pontianak yuri.ariadi@mandirisek.co.id 62561 582 293

Yogiswara Perdana Yogyakarta yogiswara.perdana@mandirisek.co.id 62274 560 596

Achmad Rasyid Bali achmad.rasyid@mandirisek.co.id 62361 475 3066

www.most.co.id care_center@mandirisek.co.id 14032

INVESTMENT RATINGS: Indicators of expected total return (price appreciation plus dividend yield) within the 12-month period from the date of the last

published report, are: Buy (15% or higher), Neutral (-15% to15%) and Sell (-15% or lower).

DISCLAIMER: This report is issued by PT. Mandiri Sekuritas, a member of the Indonesia Stock Exchanges (IDX) and Mandiri Sekuritas is registered and

supervised by the Financial Services Authority (OJK). Although the contents of this document may represent the opinion of PT. Mandiri Sekuritas, deriving its

judgement from materials and sources believed to be reliable, PT. Mandiri Sekuritas or any other company in the Mandiri Group cannot guarantee its

accuracy and completeness. PT. Mandiri Sekuritas or any other company in the Mandiri Group may be involved in transactions contrary to any opinion herein

to make markets, or have positions in the securities recommended herein. PT. Mandiri Sekuritas or any other company in the Mandiri Group may seek or will

seek investment banking or other business relationships with the companies in this report. For further information please contact our number

62-21-5263445 or fax 62-21-5275374.

ANALYSTS CERTIFICATION: Each contributor to this report hereby certifies that all the views expressed accurately reflect his or her views about the

companies, securities and all pertinent variables. It is also certified that the views and recommendations contained in this report are not and will not be

influenced by any part or all of his or her compensation.

This report is intended exclusively for Information.center@mandirisek.co.id. Unauthorized distribution is prohibited.

You might also like

- Money Master The GameDocument48 pagesMoney Master The GameSimon and Schuster72% (18)

- Amtrak Weighs Acela Financing OptionsDocument32 pagesAmtrak Weighs Acela Financing OptionsAngela Thornton67% (3)

- Cathay PacificDocument3 pagesCathay PacificSachin SuryavanshiNo ratings yet

- Jwi 530 Assignment 4Document3 pagesJwi 530 Assignment 4gadisika0% (1)

- Cultivating The Affluent ClientDocument12 pagesCultivating The Affluent ClientSummer K. LeeNo ratings yet

- Morning Cuppa 22-FebDocument2 pagesMorning Cuppa 22-FebNitin ChauhanNo ratings yet

- INVESTMENT PRODUCTS: Equity, Debt, Commodities UpdatesDocument2 pagesINVESTMENT PRODUCTS: Equity, Debt, Commodities UpdatesSaroNo ratings yet

- Morning Cuppa 30-OctDocument2 pagesMorning Cuppa 30-OctKeshavNo ratings yet

- Industrial and Commercial Bank of China Limited SEHK 1398 FinancialsDocument49 pagesIndustrial and Commercial Bank of China Limited SEHK 1398 FinancialsJaime Vara De ReyNo ratings yet

- Morning Cuppa 11-MayDocument2 pagesMorning Cuppa 11-MayShashank MisraNo ratings yet

- Morning Cuppa 05-JanDocument2 pagesMorning Cuppa 05-Jankishan.p.borivaliNo ratings yet

- Morning Cuppa 20-DecDocument3 pagesMorning Cuppa 20-DecSaroNo ratings yet

- Morning Cuppa 31-OctDocument2 pagesMorning Cuppa 31-OctKeshavNo ratings yet

- Bank of Baroda Q1FY04 Result HighlightsDocument5 pagesBank of Baroda Q1FY04 Result HighlightsAmit JainNo ratings yet

- Morning Cuppa 12-JanDocument2 pagesMorning Cuppa 12-JanSaroNo ratings yet

- Bank of China Limited SEHK 3988 FinancialsDocument47 pagesBank of China Limited SEHK 3988 FinancialsJaime Vara De ReyNo ratings yet

- FIN254 ExcelTeam DynamicDocument20 pagesFIN254 ExcelTeam Dynamicfarah zarinNo ratings yet

- Dangote CementDocument9 pagesDangote CementGodfrey BukomekoNo ratings yet

- Nepal Rastra Bank Report on Current Macroeconomic SituationDocument84 pagesNepal Rastra Bank Report on Current Macroeconomic SituationMohan PudasainiNo ratings yet

- Bonds - December 7 2022Document3 pagesBonds - December 7 2022Lisle BlythNo ratings yet

- Berger Paints Bangladesh Ltmited (Bergerpbl) : ElementsDocument4 pagesBerger Paints Bangladesh Ltmited (Bergerpbl) : Elementskowsar088No ratings yet

- INVESTMENT PRODUCTS MORNING CUPPADocument2 pagesINVESTMENT PRODUCTS MORNING CUPPASaroNo ratings yet

- c4905fa3279d8473105c27e20cb57487Document5 pagesc4905fa3279d8473105c27e20cb57487brian butarNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument31 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- ASIAN PAINTS FINANCIAL ANALYSISDocument15 pagesASIAN PAINTS FINANCIAL ANALYSISDeepak NechlaniNo ratings yet

- Morning Cuppa 12-DecDocument2 pagesMorning Cuppa 12-DecSaroNo ratings yet

- United Bank Limited United Bank Limited United Bank Limited United Bank LimitedDocument34 pagesUnited Bank Limited United Bank Limited United Bank Limited United Bank LimitedZeeshan YaqubNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Two Months Data of 2021.22 2Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Two Months Data of 2021.22 2shyam karkiNo ratings yet

- NSE India - Nov22 - EUDocument9 pagesNSE India - Nov22 - EUpremalgandhi10No ratings yet

- Jan FileDocument1 pageJan FileAshwin GophanNo ratings yet

- Ambuja Cements 1QCY10 Results Update EBITDA GrowthDocument8 pagesAmbuja Cements 1QCY10 Results Update EBITDA Growth张迪No ratings yet

- Morning Cuppa 06-JanDocument2 pagesMorning Cuppa 06-JanSaroNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Six Months Data of 2021.22Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Six Months Data of 2021.22Sashank GaudelNo ratings yet

- 22 2Q Earning Release of LGEDocument18 pages22 2Q Earning Release of LGEThảo VũNo ratings yet

- Kotak Mahindra Bank Limited Consolidated Financials FY18Document60 pagesKotak Mahindra Bank Limited Consolidated Financials FY18Kunal ObhraiNo ratings yet

- MOIL 07feb20 Kotak PCG 00210 PDFDocument6 pagesMOIL 07feb20 Kotak PCG 00210 PDFdarshanmadeNo ratings yet

- Morning Cuppa 14-DecDocument2 pagesMorning Cuppa 14-DecKeshav KhetanNo ratings yet

- Chapter Three: Capital Marker Analysis of BangladeshDocument29 pagesChapter Three: Capital Marker Analysis of BangladeshGolam Samdanee TaneemNo ratings yet

- B D E (BDE) : LUE ART XpressDocument18 pagesB D E (BDE) : LUE ART XpresshemantNo ratings yet

- Trent - Q4FY22 Result - DAMDocument6 pagesTrent - Q4FY22 Result - DAMRajiv BharatiNo ratings yet

- Morning Cuppa 09-JanDocument2 pagesMorning Cuppa 09-JanWhaosidqNo ratings yet

- Bonds - June 1 2022Document3 pagesBonds - June 1 2022Lisle Daverin BlythNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23acharya.arpan08No ratings yet

- SBI - 3QFY19 - HDFC Sec-201902031901526172690Document14 pagesSBI - 3QFY19 - HDFC Sec-201902031901526172690HARDIK SHAHNo ratings yet

- Morning Cuppa 30-MayDocument2 pagesMorning Cuppa 30-MayAkshay ChaudhryNo ratings yet

- Morning Cuppa 21-NovDocument2 pagesMorning Cuppa 21-NovSarvjeet KaushalNo ratings yet

- Morning Cuppa 14-JulyDocument2 pagesMorning Cuppa 14-JulyAjish CJ 2015No ratings yet

- Sanghi Industries: CMP: Inr56 TP: INR80 (+44%)Document10 pagesSanghi Industries: CMP: Inr56 TP: INR80 (+44%)Positive ThinkerNo ratings yet

- Rain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImproveDocument8 pagesRain Industries: CMP: INR381 TP: INR480 (+26%) Carbon Prices and Margins Continue To ImprovedidwaniasNo ratings yet

- Q3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleDocument12 pagesQ3FY21 Result Update Axis Bank: Towards End of Peak Credit Cost CycleSAGAR VAZIRANINo ratings yet

- Ongc - 1qfy15 - HDFC SecDocument8 pagesOngc - 1qfy15 - HDFC Secsatish_xpNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4shyam karkiNo ratings yet

- Morning Cuppa 27-OctDocument2 pagesMorning Cuppa 27-OctKeshavNo ratings yet

- 0 - 3qfy20 - HDFC SecDocument11 pages0 - 3qfy20 - HDFC SecGirish Raj SankunnyNo ratings yet

- O&G Analysis Mar 2017Document9 pagesO&G Analysis Mar 2017Anonymous C8mcpc8uNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21SuZan TimilsinaNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireNo ratings yet

- Half-Year Financial: Interim Report AS OF JUNE 30, 2020Document54 pagesHalf-Year Financial: Interim Report AS OF JUNE 30, 2020Rathawit SingpanjanateeNo ratings yet

- Current Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1Document85 pagesCurrent Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1gharmabasNo ratings yet

- Q1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit CostDocument12 pagesQ1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit Costforgi mistyNo ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- Morning Cuppa 08-Oct-202110080838430715214Document2 pagesMorning Cuppa 08-Oct-202110080838430715214flying400No ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Ityukta - MECCADocument31 pagesItyukta - MECCAAditi100% (1)

- Module Guide: Module BM3309 International Business Semester: October 2015Document40 pagesModule Guide: Module BM3309 International Business Semester: October 2015Nor Ashikin IsmailNo ratings yet

- LSF PresentationDocument18 pagesLSF PresentationkgaaNo ratings yet

- Majid Al Futtaim's Employment Conditions PolicyDocument6 pagesMajid Al Futtaim's Employment Conditions PolicyFilms PointNo ratings yet

- C1 Introduction To AuditDocument24 pagesC1 Introduction To AuditTan Yong Feng MSUC PenangNo ratings yet

- Organizational Strategies and The Sales FunctionDocument25 pagesOrganizational Strategies and The Sales FunctionHriday PrasadNo ratings yet

- 20211018-Chapter 4 - PPT MarxismDocument25 pages20211018-Chapter 4 - PPT Marxismuzair hyderNo ratings yet

- Role of Governments and Nongovernmental Organizations: Chapter OverviewDocument29 pagesRole of Governments and Nongovernmental Organizations: Chapter OverviewKaete CortezNo ratings yet

- ENGG650 Assignment 1Document1 pageENGG650 Assignment 1Jihan BerroNo ratings yet

- LE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIDocument20 pagesLE-TRA - Config Guide For Shipment & Shipment Cost Document - Part IIIАвишек СенNo ratings yet

- Communication Strategies For The Asia PacificDocument25 pagesCommunication Strategies For The Asia PacificfahadaijazNo ratings yet

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet

- Petrol Prices in IndiaDocument24 pagesPetrol Prices in IndiaRakhi KumariNo ratings yet

- Step: 1Document24 pagesStep: 1LajukNo ratings yet

- International Business Machines Corporation or IBM, Is An AmericanDocument35 pagesInternational Business Machines Corporation or IBM, Is An AmericanmanishaNo ratings yet

- ASSG CargillsDocument3 pagesASSG Cargillslakmal_795738846No ratings yet

- Case Study RajeevDocument1 pageCase Study Rajeevyatin rajput100% (1)

- MO QuestionDocument2 pagesMO Questionlingly justNo ratings yet

- ITC Hotels - Responsible LuxuryDocument35 pagesITC Hotels - Responsible LuxurySaurabh VermaNo ratings yet

- Chapter 11 Snell ManagingHumanResources 19e PPT CH11Document43 pagesChapter 11 Snell ManagingHumanResources 19e PPT CH11J Manuel BuenoNo ratings yet

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- Chapter 11 Partnership FormationDocument10 pagesChapter 11 Partnership FormationJo Faula BelleNo ratings yet

- Barcelona PDFDocument165 pagesBarcelona PDFHector Alberto Garcia LopezNo ratings yet

- Acctg180 W02 Problems Accounting CycleDocument9 pagesAcctg180 W02 Problems Accounting CycleAniNo ratings yet

- Dsr April 2024Document10 pagesDsr April 2024vapatel767No ratings yet