Professional Documents

Culture Documents

Demand & Recovery: Proceeding in Case Where

Uploaded by

Khader MohammedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Demand & Recovery: Proceeding in Case Where

Uploaded by

Khader MohammedCopyright:

Available Formats

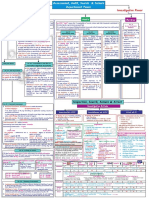

DEMAND & RECOVERY

Proceeding in case where

| Non-Payment of Tax Short Payment of Tax Erroneous Refund Wrong - availment or utilisation of ITC | F 7 Excess collection of Tax

Ks PY a y Cases other than fraud, wilful misstatement Cases by reason of fraud wilful misstatement

AY-Yeau/-4 Tax collected but not paid to Government

or suppression of facts (Bonafide intension) or suppression of facts(malafide intension)

or

73(5) | 730) J wm © 74())

| | 4 7468) ) Tax collected from any person to be paid to the CG:- Every

person collected tax and has not paid it to Govt.= shall

v v Voluntary Payment Before SCN immediately pay the said amount to Govt.. (Irrespective of

Voluntary Payment before SCN Issue of SCN Issue of SCN

whether relevant supplies are taxable or not).

Time for SCN . ; Time for SCN

Pay = Tax + Interest 3 Months before | Specify the Specify the| ¢ months before Pay = Tax + Interest + IS% Penalty of Tax Issue of SCN:- If above amount 76(I) has not been paid,

(Ascertained by tax raver or PO) last date of D.O. | Amt. of Tax + Tax +| last date of D.O. (Ascertained by tax payer or PO) PO = may serve a SCN = on the person liable to pay such

amount Tax & Penalty,

J | (i.e. 2 yrs. & | Interest + Interest +| Cie. 4 yrs. & t 1

Note- There is no time limit for Serving SCN under this

4 months from 6 months from section

Full Payment Short Payment pip of A.R) Penalty 100% Penalty D/> of AR) Short Payment Full Payment

| Inform to P.O. Demand Order:- After considering representation,

Inform to P.O. |

the PO = determine the amount due from such person ,

SCN Shall not*bejissued SCN Shall not be issued & thereupon, such person shall pay the amount so

determined.

Interest Payment:- Person= pay interest @

Payment of Tax + Interest Payment of Tax + Interest I3%/24%PA Euls $0F, from the date of collection - to

as mentioned in SCN as mentioned in SCN the date of payment to Govt.

Opportunity of being heard:- Opportunity =granted

v v v (where request in written, received from such person)

If Payment is If Payment is not made within If Payment is not If Payment is paid

paid within 30 days of SCN within 30 ‘tT of SCN Time limit for Issuance of Order:- Within one year- from

Made within 30 days of 30 days & representation is

the date of issue of SCN. ENo time limit for issue of SCNF

|

given in his defense

[|

SCN

Amt. Tax + Interest + penalty Period of stay excluded:- Where issuance of order-

All proceeding will be Payable = equal to 25% of tax stayed by an order of the Court/Appellate Tribunal

stay period-excluded from period of| Year.

concluded

All proceeding shall

Order must be a speaking order:- PO = set out relevant

be concluded

facts & the basis of his decision.

Liability to pay_ Tax + Interest + Penalty Period - within 3 yrs. Period-within S yrs. Liability to pay Tax + Interest

tax as D.O. 10% of tax or %10,000 Wit from the due date of from the due date of tax as D.O. + 100% Penalty Adjustment of amount payable u/s 76(1) & (3):- Amount

Annual Return Annual Return paid to Govt. (Sub-sec.I/3)=adjusted against tax

v payable by person, i.r.t. supplies Csub-sec.I)

Penalty is payable irrespective of the fact that whether Amt. of tax If payment is not made If payment is 10 Surplus after adjustment:- Amount of surplus Cafter adj.

& Interest is paid within 30 days or not from the date of within 30 “ye of Serving D.O. within 30 days serving D.0. above)= “Credited to the Welfare Fund, Cor) “Refunded

Communication of order

Amt. payable = Tax + Interest Amt. payable = Tax + Interest to the person, borne the incidence of such amount.

+ 100% of tax Penalty + S0% of tax Penalty

Nn Refund :- Person- borne incidence of the amount= may

Important Notes :- apply for refundf£uls $43.

i) all proceedings in respect of the said notice” shall not include proceedings under section 132

ii) proceedings against the main person have been concluded under section 73 or section 74, the proceedings against all the persons liable to pay penalty under sections 122, 12S, 129 and 130 are deemed to be concluded.

Gii) For the purposes of this Act, the expression “suppression” shall mean

> non-declaration of facts or information which a taxable person is required to declare in the return, statement, report or any other document furnished under this Act or the rules made thereunder, or

2failure to furnish any information on being asked for, in writing, by the proper officer.

Sec 73(I) :- Where amount of self -assessed tax is not paid within 30 days from the due date of payment of tax

then mandatory penalty = 10% of tax or = 10,000 Wik

AY-Ya AQ §=Determination of Tax (General prov.)

Short Payment or non-payment of self assess tax within due date ! Period of stay- If issueance of SCN/DO is stayed by Court/AT= excluded from period of SCN/DO for

fraud/other than fraud.

y 2 | IFAA/AT concludes that charges of fraud are not sustainable- SCN u/s 74(I)= SCN uls 73).

Tax is self assessed(in GSTR-1) but not paid Tax is not self assessed & also not paid within 3 | Order on direction of Court= such order shall be issued within 2 yr from the date of communication of direction.

within 30 days of due date 30 days of due date (not declare in GSTR-I)

| ¥ 4 | Opprtunity of being heard to aggreived person.

See 73 : cases other than fraud S | Adjornment(for reasons in written) =Upto 3times to a person

GSTR-3B is filed (with payment If proceeding U/s 73 is invoked {

of tax or intrest) after 30 days before furnishing GSTR-3B & v 6 |Order=Speaking (set out relevant facts & basis for his decisions)

of due date but before issue of SCN payment of tax + interest Sec 73(6) Sec 73(8) 7 | Amount to be paid(D/0)=<Amount to be paid(SCN)

¥ + Voluntary payment Payment of 8 | IFAA/AT/court modifies amount of tax- modify Interest/penalty accordingly.

Sec 73(N) is not applicable Sec 73(1) is applicable i.e.

fee. no penalty is payable penalty (10% of tax or = 10,000 (Tax + Intrest) (Tax + Interest) 9 |Interest= mandatory (even if not specified in SCN)

A

as proceeding u/s 73Y is not peg

invoked WIH) is payable mandatorily before SCN

30 deus ne Sen 10 | no DO is issued withing 3 years (other than fraud)

or S years (in case

of fraud) then proceeding deemed

to be concluded

Note- Circular No. - 76/N'S/2013 as proceeding u/s 73 is invoked ¥ y | 1F appeal filed by dept.,against decision of AT/AA/court= Period bw date of decision of higher authority &

Note - Benefit of Sec 73(6) & 73(3) allowed & No

allowed & no lower authority= excluded from period of SCN/DO

is not available as 73(Il) override penalty

penalty 12 | lf any amount of self assessed tax(in return)/amount of nterest=remains unpaid=recovered u/s74.

these subsections

13 | If penalty u/s 73/74 imposed= no other penalty applies.

AY SL Ae Ce TAY)

to be an inter-State supply, but which is subsequently held to be an intra-State supply,

shall not be:required to pay any interest on the amount of central tax and State tax or, as the

Transfer of property to be void in certain cases:-

case may be, the central tax and the Union territory tax payable. Provisional Attatchment to protect revenue in certain casesi-

Note : Similar provision are contained in Sec 19 of IGST Act

Where a person- (after any amount has become due from I- Cireumstances:- where during pendency of any proceedings under- Best Judg.

him) Cwith the intention of defrauding the Govt. revenue) Assessment for non-filers of return (u/s 62) Cor) for unregistered person (u/s

creates a charge on or parts with the property belonging to 63)/ Summary Assessment in special cases (u/s 64)/ Inspection, search,

him, or in his possession, seizure (u/s 67)/ SCN and DO for a cases other than fraud(u/s 73) Cor) cases

Sec 78 :- Any amount payable by a taxable person in order passed under this Act shall be paid within a of fraud (u/s 74),

period of 3 months from the date of service of such order failing which recovery proceedings shall be > by way of sale/ mortgage/ exchange/ any other mode 2 - Provisional Attachment :- Commissioner may (by order in writing)

initiated. of T/f,

attach provisionally any property + bank account of the taxable person.(to

Sec 79 :- Proper officer may recover the dues U/s 78 in following manner :- of any of his properties in favour of any other person, protect interest of Govt revenue)

I) | Reduction of dues from the amount by the tax authorities to such person. (Deduction 3- Time period - Every such provisional attachment= cease to have effect, after

from the refund payable) Such charge ftransfer= Void, as against any claim i.ro.

any tax /other sum payable by said person. the expiry of lyear - from date of order under subsec-l.

2) | Recovery by way of detaining / selling any goods belonging to such person.

3) | Recovery from third person from whom money is due or may become due to such person or Proviso- Such charge/transfer= not be void, if made for

recovery from person who holds or may subsequently hold money (banks) for such person. Adequate Consideration, in good faith, &

4) | Detain / Seize any movable / immovable property belon ing to such person until amount is paid - without notice of the pendency of such proceedings under Continuation & Validation of certain recovery proceedings:-

& if the dues are not paid within 30 days then the said property is to be sold and the amount this Act

payable including cost of sale will be recovered from sale proceeds & balance is refundable. * Where any notice of demand = served upon any taxable/ other person, &

S) | Officer will prepare the certificate of dues & send it to the collector of district in - without notice of such tax/ other sum payable by the said iro. "Govt. dues = any appeal/ revision application is filed / any other

which such person owns any property / resides / carries the business & the collector person, or proceedings is initiated, iro. Govt. dues, Then-

will recover such amount as arrears of land revenue.

- with the previous permission of the PO. a) Where = Commissioner = Any recovery proceedings i.r.t. such dues,

6) | By way of making application to Appropriate Magistrate who in turn shall proceed to

recover the amount as if it was a fine imposed by him. such dues shall serve another covered by notice before the disposal of

7) | By enforcing bond /instrument executed under this act / Rules / Registration. Enhanced notice, of demand such appeal etc, may be continued from

iro, the amount, by the stage at which such proceedings stood

Explanation:- for the purpose of this sec, the word person shall include distinct persons as

| referred in sub sec (4) or as the case may be, sec 25(S). J which such Govt. immediately before such disposal.

Tax to be first charged on property:-

dues are enhanced (Without serving fresh notice of demand)

Sec 30 Payment of Tax & other amount in instalments:- Overriding any law for the time being in force, (other than

The Insolvency and Bankruptcy Code, 2016), b) Where = Commissioner = Any recovery proceedings initiated on the

* The provisions for payment of Tax & other amounts in Instalments= allowed Cother than self shall give Intimation

assessment tax) > Any amount payable by a taxable person/ any other such dues basis of demand served upon him, before

of such reduction to

* This benefit can be availed= by making an application to the Commissioner by specifying person, Reduced the disposal of such appeal, etc, may be

him & to appropriate

reasons for such requests. > On account of tax/ interest/ penalty, which he is liable authority with continued i.rt. the amount so reduced,

* Commissioner may- allow the payment in instalments fSubject to maximum 24 monthly to pay to Govt., whom recovery from the stage at which such proceedings

instalments + applicable interest} shall be a First charge on the property, of such taxable/other proceedings is stood immediately before such disposal.

* If default in payment of any instalment = whole outstanding balance payable on such date -become person. pending (Without serving fresh notice of demand)

due and payable immediately, & shall be liable for recovery (without any further notice being served)

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Unit 6 - Preparation of Annua ITR BIR Compliance RequirementsDocument13 pagesUnit 6 - Preparation of Annua ITR BIR Compliance RequirementsRomero Joseph AnthonyNo ratings yet

- Sabka Vishwas Scheme, An Official Farewell To Pre-GST EraDocument3 pagesSabka Vishwas Scheme, An Official Farewell To Pre-GST EraAravindNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- GST Icai 15072023Document98 pagesGST Icai 15072023Selvakumar MuthurajNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Summary of Payment Details: Details of The Policy Premium Paid For Financial Year 2021 - 2022Document2 pagesSummary of Payment Details: Details of The Policy Premium Paid For Financial Year 2021 - 2022Santosh SrNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationJonNo ratings yet

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- Referencer For Quick Revision: Intermediate Course Paper-4: TaxationDocument24 pagesReferencer For Quick Revision: Intermediate Course Paper-4: TaxationHinduja KumarNo ratings yet

- Scope of TaxDocument12 pagesScope of TaxHajra MalikNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument2 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationDeebees Marie Erazo TumulakNo ratings yet

- Goods and Services Tax - Negative Liablity StatementDocument2 pagesGoods and Services Tax - Negative Liablity StatementANAND AND COMPANYNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. CIRDocument54 pagesAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloNo ratings yet

- 1601c FormDocument8 pages1601c FormPingLomaadEdulanNo ratings yet

- 2011 - Consolidated Tax CasesDocument15 pages2011 - Consolidated Tax CasesZairah Nichole PascacioNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument3 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationKatherine OlidanNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument16 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationAnonymous KcI919LNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- Calamba Steel Center Inc Vs CIR GR151857Document17 pagesCalamba Steel Center Inc Vs CIR GR151857AnonymousNo ratings yet

- UPSIMI V CIR (2018) Justice MartiresDocument5 pagesUPSIMI V CIR (2018) Justice MartiresJesimiel CarlosNo ratings yet

- Joana GlobeDocument2 pagesJoana GlobeDon HirtzNo ratings yet

- Income TaxationDocument15 pagesIncome TaxationHabib SimbanNo ratings yet

- Paseo Realty v. CADocument2 pagesPaseo Realty v. CAzacNo ratings yet

- Payment of Tax: FAQ'sDocument23 pagesPayment of Tax: FAQ'smun1barejaNo ratings yet

- RMC No. 9-2024Document1 pageRMC No. 9-2024Anostasia NemusNo ratings yet

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- Eopt Act Comparative SummaryDocument6 pagesEopt Act Comparative Summarybbc.moniqueNo ratings yet

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)11priyagargNo ratings yet

- Demand and RecoveryDocument7 pagesDemand and RecoveryDebaNo ratings yet

- B4 Nov MSDocument13 pagesB4 Nov MSCerealis FelicianNo ratings yet

- Tax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentDocument9 pagesTax 3 - Unit 3 Chapter 9 Tax Remedies of The GovernmentJeni ManobanNo ratings yet

- Adobe Scan Mar 11, 2021Document14 pagesAdobe Scan Mar 11, 2021Jul A.No ratings yet

- Tax Inter Quick Referencer by ICAIDocument17 pagesTax Inter Quick Referencer by ICAITushar kumarNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- 41Document2 pages41KennethAnthonyMagdamitNo ratings yet

- 2011 Consolidated Tax CasesDocument34 pages2011 Consolidated Tax CasesMarivicTalomaNo ratings yet

- TaxRev Case University PhysiciansDocument15 pagesTaxRev Case University Physiciansj guevarraNo ratings yet

- Kenya Tax CardDocument2 pagesKenya Tax Cardwebryan2kNo ratings yet

- Ind As 12: Income Taxes: Definitions Concept Insight ExamplesDocument2 pagesInd As 12: Income Taxes: Definitions Concept Insight ExamplesDeepak singhNo ratings yet

- Case Digest #3 - CIR Vs - Mirant PagbilaoDocument3 pagesCase Digest #3 - CIR Vs - Mirant PagbilaoMark AmistosoNo ratings yet

- Republic Act No. 11976 (EOPT) - Infographics - SGVDocument3 pagesRepublic Act No. 11976 (EOPT) - Infographics - SGVAlbert SantiagoNo ratings yet

- Session 5 TDSDocument67 pagesSession 5 TDSsinthiakarim17No ratings yet

- Income Tax and PF, ESIC Due DatesDocument40 pagesIncome Tax and PF, ESIC Due DatesEXELIENT TAX SERVICESNo ratings yet

- Atlas Consolidated Mining vs. CIRDocument51 pagesAtlas Consolidated Mining vs. CIRCamille Yasmeen SamsonNo ratings yet

- Post Registration Returns Filing and Payments LeafletDocument2 pagesPost Registration Returns Filing and Payments LeafletArthur ShimotweNo ratings yet

- Recovery of Tax: (Goods and Services Tax)Document3 pagesRecovery of Tax: (Goods and Services Tax)sridharanNo ratings yet

- Referencer For Quick Revision: Intermediate Course Paper-4: TaxationDocument15 pagesReferencer For Quick Revision: Intermediate Course Paper-4: TaxationRamNo ratings yet

- Tax-Remedies (Govt-Remedies-Highlights)Document38 pagesTax-Remedies (Govt-Remedies-Highlights)Yves Nicollete LabadanNo ratings yet

- Tax I CasesDocument119 pagesTax I CasesJANINE MARIE BERNADETTE CASTRONo ratings yet

- TaxreviewerDocument3 pagesTaxreviewerVincent NifasNo ratings yet

- 2011 Consolidated Tax CasesDocument35 pages2011 Consolidated Tax CasesFritzie BayauaNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument9 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityNash LedesmaNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Leanne GlobeDocument2 pagesLeanne GlobeDon HirtzNo ratings yet

- 48 CIR V IsabelaDocument4 pages48 CIR V IsabelaYodh Jamin OngNo ratings yet

- Tax Sheth MergedDocument79 pagesTax Sheth MergedUtsav MehtaNo ratings yet

- Withholding: Develop Malawi, Pay TaxesDocument2 pagesWithholding: Develop Malawi, Pay TaxesSam FlaggNo ratings yet

- Globe Bill Null PDFDocument2 pagesGlobe Bill Null PDFRen DiocalesNo ratings yet

- Assessment - Audit - Inspection Search, SeizureDocument1 pageAssessment - Audit - Inspection Search, SeizureKhader MohammedNo ratings yet

- SFM SGSTD Dec 21Document23 pagesSFM SGSTD Dec 21Khader MohammedNo ratings yet

- Dec 2021 Law New Syllabus MCQ Topic Coverage (Hints) Sebi LodrDocument18 pagesDec 2021 Law New Syllabus MCQ Topic Coverage (Hints) Sebi LodrKhader MohammedNo ratings yet

- Idt MCQ - QuestionsDocument3 pagesIdt MCQ - QuestionsKhader MohammedNo ratings yet

- View - Print Submitted FormDocument2 pagesView - Print Submitted FormKhader MohammedNo ratings yet

- Paper 6D - Appeals & Days Time Limits (By Khader)Document6 pagesPaper 6D - Appeals & Days Time Limits (By Khader)Khader MohammedNo ratings yet

- City of Pasig vs. RepublicDocument23 pagesCity of Pasig vs. RepublicUfbNo ratings yet

- Raleigh's Neuse River Greenway: Nice Place To Visit, But You Wouldn't Want To Live Next To ItDocument8 pagesRaleigh's Neuse River Greenway: Nice Place To Visit, But You Wouldn't Want To Live Next To ItJohn Locke FoundationNo ratings yet

- Nature of TaxesDocument3 pagesNature of TaxesCaliboso DaysieNo ratings yet

- FL Con Law - Case BriefsDocument23 pagesFL Con Law - Case BriefsassiramufNo ratings yet

- (RPT) Mamalateo. Reviewer On TaxationDocument16 pages(RPT) Mamalateo. Reviewer On TaxationRoldan Giorgio P. PantojaNo ratings yet

- A4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicsDocument38 pagesA4 Principles of Taxation and Tax Remedies Reviewer: 1.1 Nature, Scope, Classifications and Essential CharacteristicscharlesjoshdanielNo ratings yet

- Rajamahendravaram Municipal Corporation: OriginalDocument4 pagesRajamahendravaram Municipal Corporation: OriginalAbhishek saiNo ratings yet

- Local Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetDocument20 pagesLocal Taxation G.R. No. 209303 November 14, 2016 NAPOCOR vs. Provincial Treasurer of BenguetcharmainejalaNo ratings yet

- Group 4 - Case DigestsDocument26 pagesGroup 4 - Case DigestsRikka Cassandra ReyesNo ratings yet

- Taxation LawDocument13 pagesTaxation LawkullsNo ratings yet

- G.R. No. 184145 December 11, 2013 Commissioner of Internal Revenue, Petitioner, Dash Engineering Philippines, Inc., RespondentDocument80 pagesG.R. No. 184145 December 11, 2013 Commissioner of Internal Revenue, Petitioner, Dash Engineering Philippines, Inc., RespondentMichael Renz PalabayNo ratings yet

- City Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGDocument2 pagesCity Gov't of QC vs. Bayan Telecom, Inc Tax1 #49 KPGKenneth GeolinaNo ratings yet

- Today Is Sunday, March 17, 2019: Melquiades P. de Leon For Plaintiff-AppellantDocument3 pagesToday Is Sunday, March 17, 2019: Melquiades P. de Leon For Plaintiff-AppellantEunice SerneoNo ratings yet

- BBMP Contact PointsDocument6 pagesBBMP Contact PointsUttam Hoode100% (1)

- Dvo City Treasurer V RTC (2005)Document10 pagesDvo City Treasurer V RTC (2005)Reyna RemultaNo ratings yet

- Boe 266Document2 pagesBoe 266Ohad Ben-YosephNo ratings yet

- #2. Villanueva Vs City of Iloilo. DigestedDocument3 pages#2. Villanueva Vs City of Iloilo. DigestedeizNo ratings yet

- Province of Abra vs. HernandoDocument2 pagesProvince of Abra vs. HernandoBryce KingNo ratings yet

- FINAL Exhibits For Petition For Original Jurisdiction and Declaratory Judgment 10-26-2023Document56 pagesFINAL Exhibits For Petition For Original Jurisdiction and Declaratory Judgment 10-26-2023NBC MontanaNo ratings yet

- Vda de Albar vs. CarandangDocument3 pagesVda de Albar vs. Carandangjed_sindaNo ratings yet

- The Local Squeeze: Falling Revenues and Growing Demand For Services Challenge Cities, Counties, and School DistrictsDocument32 pagesThe Local Squeeze: Falling Revenues and Growing Demand For Services Challenge Cities, Counties, and School DistrictsJbrownie HeimesNo ratings yet

- Makati City Revenue CodeDocument25 pagesMakati City Revenue CodeJuan Dela CruzNo ratings yet

- Land Use Management (LUMDocument25 pagesLand Use Management (LUMgopumgNo ratings yet

- Republic of The Philippines Represented by The Philippine Reclamation Authority (PRA) Vs City of Paranaque 677 SCRA 246Document4 pagesRepublic of The Philippines Represented by The Philippine Reclamation Authority (PRA) Vs City of Paranaque 677 SCRA 246Khian JamerNo ratings yet

- Multiple Choice For Csec MathematicsDocument218 pagesMultiple Choice For Csec MathematicsLiam JosephNo ratings yet

- Olympia Case Law 2Document5 pagesOlympia Case Law 2prarthana rameshNo ratings yet

- The Recto and Maceda LawDocument61 pagesThe Recto and Maceda LawGenelyn BalancarNo ratings yet

- PUB0 Box 300 EPI198300 June 182014Document521 pagesPUB0 Box 300 EPI198300 June 182014Gelar Digjaya MuhammadNo ratings yet

- 17283final Report VCF Raigarh With SummaryDocument143 pages17283final Report VCF Raigarh With SummaryNeeraj JhaNo ratings yet

- Basic Principles QuizzerDocument16 pagesBasic Principles Quizzerbobo kaNo ratings yet