Professional Documents

Culture Documents

Transaction Debit Account Title Credit Account Title Amount Computation

Transaction Debit Account Title Credit Account Title Amount Computation

Uploaded by

Shane dela CruzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transaction Debit Account Title Credit Account Title Amount Computation

Transaction Debit Account Title Credit Account Title Amount Computation

Uploaded by

Shane dela CruzCopyright:

Available Formats

Debit Credit

Transaction Account Account Amount Computation

Title Title

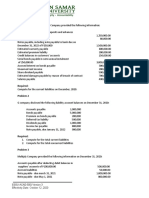

1. On December1, 2019, Insurance Unearned Insurance ₱ 2, 885 Insurance

Company received ₱34,620 from GMA Insurance Income Premium 34, 620

Company as insurance premium for one Income

year. The bookkeeper recorded the Divide: # of

payment with a debit to Cash and credit months 12

to Unearned Insurance Income for

Monthly

₱34620.

Insurance 2,885

2. On October 15, 2020, MDF Company Utilities Accrued ₱ 1, 400 Used Internet service from

subscribed to the Globe internet Expense Utilities December 16 - December 31 =

services. The monthly fee of ₱2,800 is Expense ₱ 1, 400

paid every 15th of the month. The

payment on December 15, 2020 has

been recorded by a debit to Utilities

Expense and credit to Cash for ₱5,600.

3. Supplies debited to the store Store Store ₱ 7, 550 Total Store

supplies account during the year, Supplies Supplies Supplies 10, 750

₱10,750. As of December 31, 2019, Expense

₱3,200 is unused. Less: Unused

Store Supplies 3, 200

Used Store

Supplies 7, 550

4. JTC Company paid ₱36,000 on Insurance Prepaid ₱ 3, 000 Insurance 36, 000

December 1, 2020, to ManuLife Expense Insurance

Insurance Company for a year. The Divide: # of

bookkeeper recorded the payment with months 12

a debit to Prepaid Insurance and credit

to Cash for ₱36,000. Monthly

Insurance 3, 000

5. On December 1, 2019, ABS Company Interest Interest ₱ 2, 000 Principal 240, 000

issued a ₱240,000 promissory note to its Expense Payable

supplier, EMC Trading. The note bears Multiply: Annual

an annual interest rate of 10%. No Interest Rate

interest or principal has been made until 10%

the due date. ABS Company prepares its Monthly Interest

monthly financial statements.

Divide: # of 24, 000

months

Monthly Interest 12

2, 000

You might also like

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Prac 1 Tua LiabilitiesDocument7 pagesPrac 1 Tua LiabilitiesKrisan Rivera0% (1)

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Recruitment and Selection Process For GSKDocument24 pagesRecruitment and Selection Process For GSKTM75% (4)

- Joint VentureDocument133 pagesJoint VentureArindom MukherjeeNo ratings yet

- 07 Activity 1 - ARGDocument4 pages07 Activity 1 - ARGIvan Mendoza100% (11)

- ACCO 20063 Homework 4 Review of Accounting CycleDocument3 pagesACCO 20063 Homework 4 Review of Accounting CycleVincent Luigil Alcera100% (1)

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- IA2 Prelim ExamDocument7 pagesIA2 Prelim ExamJohn FloresNo ratings yet

- U.S. Trade and Investment PolicyDocument134 pagesU.S. Trade and Investment PolicyCouncil on Foreign RelationsNo ratings yet

- Fundamental Analysis of TATA MOTORSDocument4 pagesFundamental Analysis of TATA MOTORSNikher Verma100% (1)

- KYC Analyst Training Programme: i-KYC, Financial Crime SpecialistsDocument9 pagesKYC Analyst Training Programme: i-KYC, Financial Crime SpecialistsVeerendra ReddyNo ratings yet

- Quiz Notes and Loans Receivable SY 2022 2023 SolutionDocument4 pagesQuiz Notes and Loans Receivable SY 2022 2023 Solutionreagan blaireNo ratings yet

- FAR-01 Trade & Other PayableDocument3 pagesFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Liabilities - ManuDocument7 pagesLiabilities - ManuClara MacallingNo ratings yet

- SIP - REPORT - Project FinanceDocument37 pagesSIP - REPORT - Project FinanceJay Modi100% (2)

- Adjusting Entries NotesDocument19 pagesAdjusting Entries NotesAnnika TrishaNo ratings yet

- (TEST BANK and SOL) Current LiabilitiesDocument5 pages(TEST BANK and SOL) Current LiabilitiesJhazz DoNo ratings yet

- FIDIC Model Ugovora o Pruzanju UslugaDocument50 pagesFIDIC Model Ugovora o Pruzanju UslugaJelena Peric100% (7)

- Problems: Problem 6-1Document122 pagesProblems: Problem 6-1Vip BigbangNo ratings yet

- Fabm1 PPT Q2W3Document43 pagesFabm1 PPT Q2W3giselle100% (2)

- Fabm1 PPT Q2W1Document62 pagesFabm1 PPT Q2W1giselle100% (1)

- Exercise LiabilitiesDocument2 pagesExercise LiabilitiesAlaine Milka GosycoNo ratings yet

- FAR-07 Trade & Other PayableDocument3 pagesFAR-07 Trade & Other PayableKim Cristian MaañoNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Guided Exercises 1 Current LiabilitiesDocument2 pagesGuided Exercises 1 Current Liabilitiescharizza.ashleyNo ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- Current LiabilitiesDocument9 pagesCurrent LiabilitiesErine ContranoNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- H05.FA2-01 Trade & Other Payables - HernandezDocument5 pagesH05.FA2-01 Trade & Other Payables - HernandezBea GarciaNo ratings yet

- August 20 DiscussionDocument26 pagesAugust 20 DiscussionJOSCEL SYJONGTIANNo ratings yet

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- TradesDocument3 pagesTradesAlber Howell MagadiaNo ratings yet

- Laura Kartika Puspa - C1G021032 - AccountingDocument1 pageLaura Kartika Puspa - C1G021032 - AccountingLaura Kartika PuspaNo ratings yet

- MUF0022 Test2 Sample QB NCFDocument6 pagesMUF0022 Test2 Sample QB NCFeldrianxu18No ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- Ae 211 Solutions-PrelimDocument10 pagesAe 211 Solutions-PrelimNhel AlvaroNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- 2019 Intacc2A MA1 CLiabilitiesDocument1 page2019 Intacc2A MA1 CLiabilitiesAlyssa MabalotNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- Current Liabilities StudentsDocument7 pagesCurrent Liabilities StudentsEmmanuelNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- Taxation - Assignment #1 Winter 2021: UestionsDocument8 pagesTaxation - Assignment #1 Winter 2021: UestionsAssignment &ExamsNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- AP Long Test 3 - LiabilitiesDocument9 pagesAP Long Test 3 - LiabilitiesjasfNo ratings yet

- CE On FranchiseDocument2 pagesCE On FranchisealyssaNo ratings yet

- Module 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFDocument13 pagesModule 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFJesievelle Villafuerte NapaoNo ratings yet

- Self Exercise No. 2Document4 pagesSelf Exercise No. 2Pola PolzNo ratings yet

- Activity 1 - Audit of LiabilitiesDocument2 pagesActivity 1 - Audit of LiabilitiesChristian AbieraNo ratings yet

- AccrualsDocument4 pagesAccrualsschool of schoolNo ratings yet

- Worksheet-11 Death of A PartnerDocument6 pagesWorksheet-11 Death of A PartnerPriyankadevi PrabuNo ratings yet

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- Adjusting Entries: Fifth Step of The Accounting CycleDocument12 pagesAdjusting Entries: Fifth Step of The Accounting CyclealtaNo ratings yet

- ACC111 Finals ExaminationDocument4 pagesACC111 Finals ExaminationVan De LeonNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- 9706 m19 QP 12Document12 pages9706 m19 QP 12Ryan Xavier M. BiscochoNo ratings yet

- Audit of LiabilitiesDocument6 pagesAudit of LiabilitiesandreamrieNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- Financial Statement RevisonDocument4 pagesFinancial Statement RevisonZaara AshfaqNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Terms, Conditions & DisclosuresDocument8 pagesTerms, Conditions & Disclosuresapi-285070305No ratings yet

- Leveraged BuyoutDocument9 pagesLeveraged BuyoutcarlosdondadaNo ratings yet

- The Basic Pay Followed by The CompanyDocument2 pagesThe Basic Pay Followed by The CompanySuny ChowdhuryNo ratings yet

- ICPA Final Pre-Board - TaxationDocument31 pagesICPA Final Pre-Board - TaxationAlexis SosingNo ratings yet

- Hotel Transactions: 2019 EuropeanDocument16 pagesHotel Transactions: 2019 EuropeanMarco PoloNo ratings yet

- PERMATA ILTIZAM SDN BHD-SME ScoreDocument8 pagesPERMATA ILTIZAM SDN BHD-SME ScoreFazlisha ShaharizanNo ratings yet

- Registering A Company in Latvia Fact Sheet 2021Document2 pagesRegistering A Company in Latvia Fact Sheet 2021Sri KanthNo ratings yet

- Kenya - Renew Sugar Miller RegistrationDocument5 pagesKenya - Renew Sugar Miller RegistrationIan Ochieng'No ratings yet

- MANAGING INVENTORY IN SUPPLY CHAINS QnsDocument1 pageMANAGING INVENTORY IN SUPPLY CHAINS QnsKoyel BanerjeeNo ratings yet

- Salesforce B2C Commerce Developer Academy: Partner EnablementDocument25 pagesSalesforce B2C Commerce Developer Academy: Partner EnablementPrabhuYechhiNo ratings yet

- Buy Back Policy of EquipmentsDocument1 pageBuy Back Policy of Equipmentsshipra damir100% (1)

- Determinants of FDIDocument11 pagesDeterminants of FDIshulukaNo ratings yet

- Basic Accounting Reviewer Step 1 To 3Document12 pagesBasic Accounting Reviewer Step 1 To 3Mary Gleyne100% (1)

- Chapter 26Document17 pagesChapter 26Digvijay Kumar TiwariNo ratings yet

- Internal Auditing Module 1Document21 pagesInternal Auditing Module 1kapaymichelleNo ratings yet

- EFQM Application Form 2019Document8 pagesEFQM Application Form 2019umtNo ratings yet

- Mep Assignment 1Document4 pagesMep Assignment 1sarangpetheNo ratings yet

- Request For Deviation, Process Change or ReworkDocument5 pagesRequest For Deviation, Process Change or ReworkJayant Kumar JhaNo ratings yet

- Ross 10e Chap002 PPTDocument34 pagesRoss 10e Chap002 PPTAramis SantanaNo ratings yet

- Assignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022Document3 pagesAssignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022aishuNo ratings yet

- A Closer Look at Overhead Costs: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eDocument32 pagesA Closer Look at Overhead Costs: Langfield-Smith, Thorne, Smith, Hilton Management Accounting, 7eBành Đức HảiNo ratings yet

- SWOT SMEsDocument6 pagesSWOT SMEslyk_91No ratings yet