Professional Documents

Culture Documents

Assignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022

Uploaded by

aishu0 ratings0% found this document useful (0 votes)

14 views3 pagesOriginal Title

Assignment_DBB2203_BBA 4_Set 1 and 2_Aug-Sep_2022 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views3 pagesAssignment - DBB2203 - BBA 4 - Set 1 and 2 - Aug-Sep - 2022

Uploaded by

aishuCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

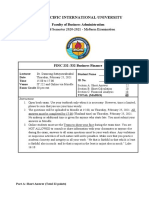

Directorate of Online Education

ASSIGNMENT

SESSION AUG/SEP 2022

PROGRAM BACHELOR OF BUSINESS ADMINISTRATION (BBA)

SEMESTER IV

COURSE CODE & NAME DBB2203 & MANAGEMENET ACCOUNTING

CREDITS 4

NUMBER OF ASSIGNMENTS & 02

MARKS 30 Marks each

Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of

400 - 450 words.

Q. No Assignment Set – 1 Marks Total Marks

Questions

1. “Management Accounting collect, analyses and presents the accounting 10 10

information in such a way as to assist the management in the creation of

policy and in day-to day operations of an undertaking”. Elucidate.

2. From the following forecast of income and expenditure, prepare a Cash 10 10

budget for three months ending on June, 2021

Month Sales (Rs.) Purchases Wages (Rs.) Misc.

(Rs.) (Rs.)

February 120000 84000 10000 7000

March 130000 100000 12000 8000

April 80000 104000 8000 6000

May 116000 106000 10000 12000

June 88000 80000 8000 6000

Additional Information:

1. Sales :20% realised in the month of sales, discount allowed 2%,

balance realised equally in two subsequent months

2. Purchases: These are paid in the month following the month of

supply.

3. Wages:25% paid in arrears following month

4. Misc. expenses: Paid a month in arrears

5. Rent: Rs.1000 per month paid quarterly in advance due in April.

6. Income Tax: First instalment of advance tax of Rs.25000 due on or

before 15th June to be paid within the month

7. Income from investment: Rs.5000 received quarterly in April, July

etc.

8. Cash in hand: Rs.5000 on 1st April 2021

3. The following are the balance sheet of ABC ltd. for the years 2020 and 10

2021. Prepare a comparative Balance sheet and comment on the financial

position of the company

Liabilities 2020 2021 Assets 2020 2021

Equity 600000 800000 Land & 370000 270000

share Buildings

Directorate of Online Education

capital

Reserves 330000 222000 Plant & 400000 600000

& Surplus Machinery

Debentures 200000 300000 Furniture 20000 25000

& fixtures

Long-term 150000 200000 Other 25000 30000

loans on fixed

mortgage assets

Bills 50000 45000 Cash in 20000 80000

Payable hand & at

bank

Sundry 100000 120000 Bills 150000 90000

creditors receivable

Other 5000 10000 Sundry 200000 250000

current debtors

Liabilities

Stock 250000 350000

Prepaid 2000

expenses

1435000 1697000 1435000 1697000

Q. Assignment Set – 2 Marks Total Marks

No. Questions

4. Ratio analysis is widely used as a tool of financial analysis, yet it suffers 5+5 10

from various limitations. Explain the importance and limitations of ratio

analysis using examples wherever suitable.

5. A chemical company is considering investment in a project that costs 3+3+4 10

Rs.500000. The life of the project is 5 years and estimated salvage value is

zero. Tax rate is 55%. The company uses straight line depreciation and

proposed project has earnings before depreciation and before tax as follows:

Year Earnings before depreciations & Tax PV factor @15%

(Rs.)

1 1,00,000 0.870

2 1,00,000 0.756

3 1,50,000 0.658

4 1,50,000 0.572

5 2,50,000 0.497

Calculate the following: -

1. Payback period

2. Average rate of return

3. Net present value @15%

6. Prepare cash flow statement from the following Balance sheet as on 31 st 10 10

March 31, 2021

Particulars 31st March 2021 31st March 2020

I. Equity & Liabilities

1. Shareholders fund:

Share capital 600000 500000

Reserves & Surplus:

General reserve 25000 10000

Balance in statement of P & L A/c 120000 80000

2. Non-Current Liabilities:

Directorate of Online Education

Long term Borrowings

10% debentures 30000 80000

Current liabilities:

Trade payables 25000 30000

Total 800000 700000

II. Assets

1. Non-Current assets:

Tangible assets:

Land & Building 350000 275000

Machinery 345000 290000

Intangible assets:

Goodwill 5000 25000

2. Current assets:

Inventories 45000 85000

Trade receivables 25000 10000

Cash 30000 15000

Total 800000 700000

Adjustment:

1. Depreciation provided on machinery during the year Rs.12000

2. New shares issued on 31st March 2021

3. 10% debentures were redeemed on 31st March 2021

You might also like

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Management Accounting QBDocument31 pagesManagement Accounting QBrising dragonNo ratings yet

- BEFA IMPORTANT QUESTIONS UNIT WISE FOR MID-II JULY-2021Document4 pagesBEFA IMPORTANT QUESTIONS UNIT WISE FOR MID-II JULY-2021ravi tejaNo ratings yet

- Mba 104 PDFDocument2 pagesMba 104 PDFSimanta KalitaNo ratings yet

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocument3 pagesInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNo ratings yet

- Accounting For ManagementDocument4 pagesAccounting For ManagementShabana ShabzzNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Alliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Document5 pagesAlliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Rahul RavindranathanNo ratings yet

- Assignment: Financial Management Unit 1Document2 pagesAssignment: Financial Management Unit 1sachinNo ratings yet

- April 2020-2Document3 pagesApril 2020-2amjuamjath10No ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Financial and Management AccountingDocument2 pagesFinancial and Management AccountingHarshithNo ratings yet

- Module 3-WCM-Cash Budget Problems For LMS 2020Document2 pagesModule 3-WCM-Cash Budget Problems For LMS 2020sandeshNo ratings yet

- Project Class 12 AccountancyDocument21 pagesProject Class 12 AccountancyHemay SinghNo ratings yet

- BC 502 Management Accounting 908088840Document8 pagesBC 502 Management Accounting 908088840Saibal SandhirNo ratings yet

- Mcom AnnualDocument140 pagesMcom AnnualKiran TakaleNo ratings yet

- ACCOUNTANCY+2 B0ardDocument12 pagesACCOUNTANCY+2 B0ardlakshmanan2838No ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- MBA Summer 2021 Exam Accounting for Managers QuestionsDocument4 pagesMBA Summer 2021 Exam Accounting for Managers QuestionsPacific TigerNo ratings yet

- Luqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsDocument5 pagesLuqman Auto Part Company Has Authorized Capital of Rs. 1000000 of Rs. 100 Each. The Following Trial Balance IsQasim KhokharNo ratings yet

- Management Programme: Assignment First Semester 2009Document4 pagesManagement Programme: Assignment First Semester 2009gkmishra2001 at gmail.com100% (2)

- Test TB Final Ac Single EntryDocument2 pagesTest TB Final Ac Single EntryMegha BhargavaNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Afm 2810001 Dec 2019Document4 pagesAfm 2810001 Dec 2019PILLO PATELNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Single Entry (Accounts From Incomplete Records)Document11 pagesSingle Entry (Accounts From Incomplete Records)hk7012004No ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Model Question Paper Accountancy Class XIIDocument5 pagesModel Question Paper Accountancy Class XIISukoon StatusNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- AMF 2202 Test 2 2022-2023 - 221111 - 085401Document3 pagesAMF 2202 Test 2 2022-2023 - 221111 - 085401mugenyi DixonNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- II Puc Acc Second Test MQP-1Document3 pagesII Puc Acc Second Test MQP-1yashasbn0No ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Co-operative Accounting Course AssignmentDocument3 pagesCo-operative Accounting Course AssignmentTitus Clement100% (2)

- Elimination RoundDocument11 pagesElimination RoundDeeNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Cash Flow Part 2 For ClassDocument9 pagesCash Flow Part 2 For ClassKgothatso ArnanzaNo ratings yet

- Latihan Soal Akm 3 Asistensi UasDocument8 pagesLatihan Soal Akm 3 Asistensi UasStephanie Felicia TiffanyNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- Question Bank - Management AccountingDocument7 pagesQuestion Bank - Management Accountingprahalakash Reg 113No ratings yet

- 2016-01-08 Exame enDocument6 pages2016-01-08 Exame enbarbaraNo ratings yet

- Practice Paper-June 2020: Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document5 pagesPractice Paper-June 2020: Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- ACCB2003 Midterm ExamDocument2 pagesACCB2003 Midterm Exammuhammad muzzammilNo ratings yet

- Accounting For Managers Trimester 1 Mba Ktu 2016Document3 pagesAccounting For Managers Trimester 1 Mba Ktu 2016Mekhajith MohanNo ratings yet

- Accounting Ratios Problems and SolutionsDocument7 pagesAccounting Ratios Problems and SolutionsVinay H V MBA100% (1)

- MANAGEMENT ACCOUNTING RATIO ANALYSIS QUESTIONSDocument10 pagesMANAGEMENT ACCOUNTING RATIO ANALYSIS QUESTIONSNaveen ReddyNo ratings yet

- DBB1104-Unit 04 Marketing MixDocument17 pagesDBB1104-Unit 04 Marketing MixaishuNo ratings yet

- DBB1104-Unit 03 Marketing EnvironmentDocument16 pagesDBB1104-Unit 03 Marketing EnvironmentaishuNo ratings yet

- Legal Environment of Business in IndiaDocument17 pagesLegal Environment of Business in Indiajazz440No ratings yet

- DBB1104-Unit 01 Marketing – An OverviewDocument20 pagesDBB1104-Unit 01 Marketing – An OverviewaishuNo ratings yet

- DBB1104-Unit 02 Marketing ConceptsDocument10 pagesDBB1104-Unit 02 Marketing ConceptsaishuNo ratings yet

- Economic Systems: Capitalism, Socialism and Mixed Economies ComparedDocument17 pagesEconomic Systems: Capitalism, Socialism and Mixed Economies ComparedaishuNo ratings yet

- India, WTO, Trading Blocs, and Economic IntegrationDocument20 pagesIndia, WTO, Trading Blocs, and Economic IntegrationaishuNo ratings yet

- DBB1103-Unit 09-New Economic PolicyDocument21 pagesDBB1103-Unit 09-New Economic PolicyaishuNo ratings yet

- Government's Economic Roles and India's ReformsDocument19 pagesGovernment's Economic Roles and India's ReformsaishuNo ratings yet

- DBB1103-Unit 10-PrivatizationDocument17 pagesDBB1103-Unit 10-PrivatizationaishuNo ratings yet

- DBB1103-Unit 06-Financial EnvironmentDocument20 pagesDBB1103-Unit 06-Financial EnvironmentaishuNo ratings yet

- DBB1103-Unit 11-GlobalizationDocument16 pagesDBB1103-Unit 11-GlobalizationaishuNo ratings yet

- Business Environment Unit 2: Economic FactorsDocument22 pagesBusiness Environment Unit 2: Economic FactorsaishuNo ratings yet

- Business Environment FactorsDocument22 pagesBusiness Environment FactorsaishuNo ratings yet

- DBB1103-Unit 03-Socio Cultural EnvironmentDocument18 pagesDBB1103-Unit 03-Socio Cultural EnvironmentaishuNo ratings yet

- Unit 4final PDFDocument20 pagesUnit 4final PDFAnonymous bTh744z7E6No ratings yet

- Script - Sales Details - SDSDocument5 pagesScript - Sales Details - SDSjose3m33santanaNo ratings yet

- HousingDocument3 pagesHousingManalo ArnelNo ratings yet

- RFM Lecture 1-Introduction To Fin Mkts-CompleteDocument55 pagesRFM Lecture 1-Introduction To Fin Mkts-CompleteUmme HaniNo ratings yet

- Security Analysis and Portfolio ManagementDocument8 pagesSecurity Analysis and Portfolio Managementnaved katuaNo ratings yet

- Loan Defaults and Operations of MicrofinDocument54 pagesLoan Defaults and Operations of Microfinomara reddington0% (1)

- Best Strategic Management For Dhaka Bank (12!08!17)Document14 pagesBest Strategic Management For Dhaka Bank (12!08!17)tazreeNo ratings yet

- Non-Banking Financial Institutions Types UPSC NotesDocument3 pagesNon-Banking Financial Institutions Types UPSC NotesBappaditya RoyNo ratings yet

- Lecture 4. Banks Performance and Financial RatioDocument7 pagesLecture 4. Banks Performance and Financial RatioAruzhan BekbaevaNo ratings yet

- GSIS v. CFI of Iloilo, Branch IIIDocument2 pagesGSIS v. CFI of Iloilo, Branch IIIJSCasilanNo ratings yet

- Taxes TransferDocument52 pagesTaxes TransferGrayl TalaidNo ratings yet

- Busana 1 Pe FinalsDocument3 pagesBusana 1 Pe FinalsKim TNo ratings yet

- Assignment 2: Measuring and Reporting Assets and LiabilitiesDocument9 pagesAssignment 2: Measuring and Reporting Assets and LiabilitiesDerek DalgadoNo ratings yet

- TAXATION REVIEW: KEY CONCEPTS AND SITUATIONSDocument113 pagesTAXATION REVIEW: KEY CONCEPTS AND SITUATIONSDaryl Mae Mansay100% (1)

- CCRA Final Brochure PDFDocument4 pagesCCRA Final Brochure PDFYogesh LassiNo ratings yet

- CASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsDocument1 pageCASE #19 Consolacion P. Chavez, Et - Al. Vs Maybank Philippines, Inc. G.R. No. 242852, July 29, 2019 FactsHarlene HemorNo ratings yet

- Mutual Savings Banks: Are Very Similar To Saving and Loan AssociationsDocument3 pagesMutual Savings Banks: Are Very Similar To Saving and Loan Associationssamuel debebeNo ratings yet

- Project Report)Document38 pagesProject Report)Swathi JNo ratings yet

- Module 1 - Introduction To Credit and CollectionDocument23 pagesModule 1 - Introduction To Credit and CollectionAllan Cris RicafortNo ratings yet

- Present Value, Annuity, and PerpetuityDocument42 pagesPresent Value, Annuity, and PerpetuityEdwin OctorizaNo ratings yet

- CGTMSEDocument4 pagesCGTMSEPrasath KumarNo ratings yet

- What Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?Document71 pagesWhat Is Synergy?: Why Is There A Large Difference Between Share Value and Stockholders' Equity?vinodhategirlsNo ratings yet

- Summer Internship Project Working Capital Finance From BankDocument33 pagesSummer Internship Project Working Capital Finance From Bankpranjali shindeNo ratings yet

- ATUL Project Report On Study On Home Loans of HDFC BankDocument47 pagesATUL Project Report On Study On Home Loans of HDFC Bankabhijit05580% (45)

- Lecture 9 - Due Diligence in Conveyancing Transaction (Revised)Document53 pagesLecture 9 - Due Diligence in Conveyancing Transaction (Revised)Business DayNo ratings yet

- Taxpayer Information Sheet PDFDocument2 pagesTaxpayer Information Sheet PDFEjay AbanteNo ratings yet

- Banc One Case Study PDF FreeDocument10 pagesBanc One Case Study PDF FreeFathima KamalNo ratings yet

- Loan Risk in Bank Prediction Using Data ScienceDocument24 pagesLoan Risk in Bank Prediction Using Data Sciencethor100% (1)

- 2008 Global Economic Crisi1Document8 pages2008 Global Economic Crisi1Carlos Rodriguez TebarNo ratings yet

- Letters of Credit and Trust Receipts LawDocument7 pagesLetters of Credit and Trust Receipts Lawpaul esparagozaNo ratings yet

- Nil-Comm Law Rev-4c-Sbca-Case DigestsDocument104 pagesNil-Comm Law Rev-4c-Sbca-Case DigestsFaithy Darna100% (1)