Professional Documents

Culture Documents

The Impact of Local Government Investment On Corporate Decisions

Uploaded by

Meet KataraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Impact of Local Government Investment On Corporate Decisions

Uploaded by

Meet KataraCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/328865413

The Impact of Local Government Investment On Corporate Decisions

Article in Journal of Corporate Finance Research / Корпоративные Финансы | ISSN 2073-0438 · May 2011

DOI: 10.17323/j.jcfr.2073-0438.5.1.2011.83-93

CITATION READS

1 311

2 authors:

Pina Puntillo Paolo Tenuta

Università della Calabria Università della Calabria

22 PUBLICATIONS 257 CITATIONS 27 PUBLICATIONS 88 CITATIONS

SEE PROFILE SEE PROFILE

Some of the authors of this publication are also working on these related projects:

CLIMATE CHANGE AND ACCOUNTING View project

All content following this page was uploaded by Pina Puntillo on 19 February 2021.

The user has requested enhancement of the downloaded file.

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 83

THE IMPACT OF LOCAL GOVERNMENT INVESTMENT ON

CORPORATE DECISIONS14

Part 1

Puntillo Pina15, Tenuta Paolo16

This work aims to provide evidence on the impact of public investment on local business

decisions. In particular we want to see the effect of public investment on the development of local

area - measured by GDP and employment - and therefore the effect that the development of the

area determines the location decisions of businesses.

In other words, we therefore wish to demonstrate how the infrastructure is one of the

determinants of competitiveness and development potential of an area of active firms. A good level

of infrastructure produces significant advantages (so-called positive externalities) for the local

economy because, not only allows to increase the productivity of factors of production, reducing

costs, but also influences the degree of attraction of the area (residents, tourists, businesses,

funders), the location decisions of new businesses, the strengthening of existing ones.

The conceptual framework draws on the contributions made by many national and

international literature on the role that public investment play in economic growth in the territories

and the attractiveness of the territory.

The paper is organized in two parts. Part 1 discusses the concept of local public investment,

which is under a legal entity, examines the issue of investment planning and illustrates how the

literature has suggested and tested empirically with reference to the role of public investment in the

dynamics of growth and competitiveness of the territories. In the Part 2, is empirically tested the

research hypothesis, through an econometric analysis, describing the models and variables used in

the application of panel techniques, and presents the results of the estimates, while last section

concludes with summary of some considerations.

JEL: G380

Keywords: public investment, government, corporate decisions, policy making, local business

decisions, development

1. Introduction

Italian local authorities are more than a decade at the center of an extensive reform process

that has profoundly changed the conditions of operation, the reference is the so-called process of

“decentralization” which involved, among other things, not only Italy but other countries [Hankla

C., Downs W., 2010]. In applying the principles of subsidiarity, not only administrative functions,

but even those of a planning are the responsibility of lower levels of government. Is attributed to

local authorities, therefore, the responsibility to plan for investments in the territory. [Farneti F.,

1998].

Together with the process of administrative federalism, is being implemented also the process

of fiscal federalism, and the resulting shift from a centralized system of public finance to public

finance system independent. In this context, the strategic viability of local plays a crucial role in

promoting economic development in the area [Smith B., 2008].

In light of this premise, the present work aims to provide evidence on the impact of public

14

This paper is the result of shared thoughts of the authors. However, when drafting, the paragraphs 1, 5, 6 are to be

attributed to Pina Puntillo and the paragraphs 2, 3, 4 are to be attributed to Paolo Tenuta.

15

Researcher in Business Economics University of Calabria Department of business science.

16

Research Fellow in Business Economics University of Calabria Department of business science.

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 84

investment decisions have on local business. In particular we want to see the effect of public

investment on the development of local area - measured by GDP and employment - and therefore

the effect that the development of the area determines the location decisions of businesses.

It will illustrate the economic theory to support research that would lead, I will explain the

concepts of current expenditure and capital expenditure, and after specifying the differences, not

only in terminology, between investment spending and capital spending, will be analyzed

management aspects, accounting and financial investment decisions by local authorities. It will then

detail the importance, in terms of policy, for careful planning and prior assessment of the

investment. Finally, the main effort was put into empirical research and analysis of results that have

resulted.

The provision of infrastructure is therefore one of the determinants of competitiveness and

development potential of an area of active firms. A good supply of infrastructure in fact have

positive externalities17 for the local economy, increasing the productivity of factors of production

and reducing costs. Moreover, the presence of good service quality influences the degree of

attraction of the area (residents, tourists, businesses, donors): the infrastructure is therefore crucial

for the location of new businesses, strengthening existing ones and the attractiveness of the

territories.

In light of the interest that these studies raise the scientific community, and given the current

and practical implications on local economic systems (we refer to the forecasts of the central

government to reduce transfers to local authorities) the quantitative analysis focuses directly on

capacity of local public expenditure for investments “to determine” the economic growth of regions.

In other words, the econometric analysis aims to demonstrate that the main local public

investment “determine”, “influence” the levels of development of territories.

The main assumption is that you want to verify that an increase in investment spending

increases the wealth of the territories. Moreover, whereas in recent years has been adopted the

political strategy of using the civil service employment as a driver, it is believed that employees of

public institutions has absorbed most of the available financial resources that could instead be

devoted to investment and that could favor economic development, so it is assumed that staff costs

have a negative impact on growth of the area and therefore on the location decisions of businesses.

If you look at the budgets of public administrations, in fact, the amount allocated for current

expenditure always exceeds that of capital expenditure, in other words, public authorities allocate

financial resources to pay the costs of mandatory (including almost all the costs current), to the

detriment of those discretionary which are precisely the costs of investment.

It is therefore considered that if the investment costs are a driving force of economic

development, because they are “held back”, “bound” by the staff costs, then the public sector is a

major constraint to local development in the light of this argument it is assumed that staff costs

negatively determine the levels of development.

Through a multivariate linear regression model estimated by OLS using panel data techniques

the research hypotheses that we want to prove are the following:

Hypothesis H1: the increase of the surface, increases the level of regional development.

Hypothesis H2: the increase of investment spending, raise the level of regional development.

Hypothesis H3: the increase of personnel expenses, decreases the level of regional

development.

Hypothesis H4: in Center North geographical macro-area shows a higher level of

development, thus determining the location of the joint development of the territory.

2. Public expenditure in the laws of accounting and accounting theory

The term "public expenditure" means the disbursement of economic assets by the state and

other public bodies to produce goods and services to meet the needs of the community. [Farneti F.,

17

The positive externalities consist in a particular activity produces benefits in the hands of other parties not directly

involved in that activity.

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 85

1998].

In our financial system, the payment of any expenditure should be a substantive law that is the

source of legal expenses, as well as a special appropriation in the budget that has as a necessary tool

for the material implementation of the substantive law imposing an obligation or entitles it to make

the same expenditure [Buscema S., 1971].

Public expenditure can be distinguished by different criteria and the influence of such

distinctions, of course, influences the allocation of the burden.

Among the various classification criteria the distinction between current expenditure and

capital expenditure is of particular importance. First, the mandatory financial statements for local

governments, issued by DPR 194/1996, reproduce this categorization, representing, respectively,

the Title I and Title II of Part I of the annual budget expenditure. Therefore the distinction between

current expenditure and capital expenditure in terms of the notes first budget balances (whether

partial or total). Moreover, it is particularly important in relation to hedging of financial needs

generated by such fees: it is known that the first constitutional law in 2001 decided that the

borrowing is permitted only to finance capital expenditure. It is, therefore, necessary to clarify what

is meant by investment spending.

3. Public spending for local investments. Accounting and financial aspects

The issue of investment and, consequently, that of the related sources of funding has always

been one of the most interesting aspects of the management of local resources, as will be detailed in

paragraph 6, and the effects directly and indirectly determine the relevant territory [D'Aristotile E.,

2009]. Nevertheless, the legislature has long declined to provide a clear and full definition of the

term "investment" [Puddu L., 2005].

Regarding Italian commercial law, in fact, the concept of "investment" has been fully defined

only recently.

The legislature originally introduced the distinction between current expenditure and

investment expenditure in 1964 with Law No 62, c.d. Curtis Law, in place of the distinction

between ordinary expenses and extraordinary expenses, simply define the cost of investment (or

capital account) as those expenses related to direct investments and indirect, as well as in operations

for granting loans. The same position was adopted by the legislature in 1979 when the accounting

reform of Local Government of the DPR No 421. Even the Legislative Decree No 267 of 2000

provides a precise definition of the criteria necessary to distinguish from those in current

expenditure and capital investment by the latter.

It was not until 2001 that the Constitutional Court began to initiate a process of clarifying the

concept of local public investment.

The exact definition of investment expenditure is relevant when the financing of this

expenditure does not provide you with the ordinary means, having put the constitutional law No.

3/2001 (reform of Title V of the Constitution) an absolute prohibition on borrowing for purposes

other than investment.

In particular, the new art. 119, paragraph 6 of the Constitution to provide for municipalities,

provinces, metropolitan cities and regions the opportunity to borrow only to fund "investment

expenditure".

However, while identifying the cost of investment as the only type of expenditure for which

shall be no borrowing from local government, the legislature does not dwell on their exact

specification.

Consequently, just as a result of the ban on borrowing costs for non-investment posed by

constitutional law No. 3/2001, was now the subject of debate the exact definition of "investment

expenditure."

The Legislature returned to the issue with two further initiatives:

1) The Finance Law 2003 which introduced a penalty system that provides for the nullity of

the acts and agreements adopted in violation of Art. 119 6 ° c. Constitution, and the possibility of

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 86

the Court of Auditors to impose a financial penalty to the administrators who take the relevant

decision;

2) The Finance Law 2004 (Law No. 350/2003) which was due to give practical effect to the

prohibition of borrowing for investment expenditure, providing for the first time a complete

definition of "debt" and "investment". This law is an important step because it sheds light on a topic

of discussion among theorists and operators of the sector in recent years.

In the legislature, in particular, art. 3 of FL 2004, paragraphs 16 to 21, listed the types of debt

eligible for the purposes of Article 119, paragraph 6 of the Constitution and listed the items of

expenditure to be considered investments for the same purposes.

The list of types of investment and debt was previously subject to change by decree of the

Ministry of Economy and Finance, after Istat: this is available to paragraph 17, fourth period, and

paragraph 20, art. 3 of the Finance Law 2004; these paragraphs, however, were later declared

unconstitutional by the Constitutional Court ruling No. 425/2004.

The opinion expressed by the sentence no 425/2004 originated is found in art. 3, paragraphs

16 to 21 of Law No 350/2003 by certain provinces and regions [Barbero M., 2005], the Court

declared the legitimate contested paragraphs, with the exception of Section 17, last sentence, and

20, which give the Minister of Economy and Finance after hearing the ISTAT, the power to have a

decree with modifications to the types of "debt" and "investment" for the purposes set out in Article.

119, sixth paragraph of the Constitution.

Beyond the judgments of constitutionality it is important to remember that the sentence in

question has, however, strengthened the prohibition on borrowing for investment expenditure for

the smaller local authorities (with the exclusion, then, the central government) already placed with

the law Constitution of 2001.

4. The distinction between investment expenditure and capital expenditure

In the light of legislative changes on local authority borrowing for investment expenditure it is

useful to make a careful examination of the classification of capital expenditure and investment.

It is wrong to think that capital expenditure and investment are identical. When it comes to

investment in the local budget means essentially public works, as defined by art. 2 of Law

109/1994: "Activities of construction, demolition, restoration, renovation and maintenance of

services and facilities ..." and their acquisition and sale, exchange, maintenance, renovation

[Marotta G., 2004].

The concept of capital expenditure instead assumes a broader meaning. It includes, in addition

to investment costs (over the cost of public works), but all other expenses and deferred expenses

that increase the fixed assets of the entity, such as purchases of motor vehicles, equipment,

investments, contributions, capital transfers and in general all the costs that constitute two essential

criteria [ODCEC Ivrea, Pinerolo and Turin, 2008]:

1) the recurrence,

2) the object of expenditure and its place in the budget.

The first criterion is generally used to distinguish in the current account balance from the

capital. The definition of capital expenditure actually derives from the definition of current

expenditure which is characterized by normal conditions [Circular of the Ministry of the Interior No

11/1978]: capital expenditures are therefore in the nature of extraordinary expenses ie those that do

not occur with a high degree of regularity and continuity.

The second criterion refers instead to the nature of expenditure on the basis of the following

"interventions" allocated to Title II, which are identified by the DPR 194/1996:

01 acquisition of real estate

02 onerous expropriation and services

03 purchases of specific achievement in economics

04 use of third party assets for achievements in economy

05 acquisitions chattels, machinery and technical scientific equipment

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 87

06 external professional contracts

07 capital transfers

08 shares

09 injections

10 concessions of credits and advances

These items constitute the then capital spending, broader category than the investment costs,

according to the doctrine for a proper allocation of an event management including the cost of

investment is necessary to determine, for each intervention of Title II capital expenditures, if you

take charge of the characteristics of “investment” [Baldi L., 2005].

Spending takes on the characteristic of investment expenditure if it is on all the assets,

tangible and intangible-owned repeated participating for several years paid and productive

processes of local authorities and that, as such, are shown as the balance sheet [Di Massa P., 1989;

D'Aries C., D'Atri A., Mazzara L., 1998], and also participate in the determination of income for the

year with their depreciation. In other words it can be assumed that the 'investment expenditure' are

all those incurred by local authorities for construction and/or acquisition of property, not for normal

consumption and, therefore, are permanent facilities available to local communities, which would

increase the assets [Falcone G., 1998; D'Aristotile E., 2000].

This will come to the conclusion that the cost "investment" are a subset of capital expenditure

are characterized by these fundamental elements just mentioned.

Among the measures of expenditure of Title II, the ones that no transactions can not give rise

to an investment are transfers of capital and credit allocation.

The first recorded disbursements to institutions with a special agencies, companies and

households in the form of grants, allocations, subsidies characterized by the absence of a

countervailing obligation on the recipient and the purpose for which they are granted (or

construction works Repeated acquisition of property in fertility). However, if capital transfers are

provided for the benefit of persons belonging to public administrations, they are considered

investments.

The second, however, collect the payments in favor of special and associates and subsidiaries

for operations in support of cash imbalances which occurred during the year, the same intervention

as to include those "movements of funds" for the transfer of funds out of cash only. Again we

cannot talk because the logic of investment income and balance sheet amounts reported in the

intervention and then paid for the shares are paid credits [D'Aristotile E., 2004].

It can be argued therefore that the distinction between investment and expenditure in capital

account is limited to transfers of capital to private entities not included within the government

sector, and granting of loans and advances. These two cases are capital expenditures but

investments financed through debt, all other cases of investments are properly capital expenditures.

5. Investment planning in a logic of policy

The implementation of public investment that generates revenue and expenses is reflected in

the annual budgets of local government as a result of the physical, economic and environmental

aspects related to the location of infrastructure.

The choice of investments, the responsibility of policy makers, must be based on two types of

analysis, one on historical data and the other on prospective data. The first will establish the status

quo before the investment: the financial and fiscal health, any leeway in the budget concerning

government infrastructure, the stock of heritage buildings (residential, industrial, commercial) and

the estimates of urban development, the level of public services offered, and the main difficulties to

cope with the effects caused by the infrastructure (increased needs of the area), the second will

simulate the projection of the main items of income and expenditure based on assumptions on the

effects on the administration in an appropriate timeframe. In particular, we should check whether

the entity will incur additional costs in the future or the need for new investment in urban

development and its financial capacity to fulfill them [Morese F., 1982].

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 88

In addition, the financial analysis should consider the time dimension. The temporal

dimension concerns the timing of payments. The determination of the time horizon should be made

on the basis of the timing of the effects induced by the infrastructure, divided into three phases:

1) the stages prior to implementation;

2) the lifetime of the infrastructure;

3) an initial period of operation in which they begin to manifest the territorial changes

brought about by the infrastructure, modification of urban development, location of new industrial

facilities etc..

From a macroeconomic perspective, the choices inherent in large infrastructure projects have

to meet strategic logic multi-level (regional interests, national and EU) and require the sharing of

information between stakeholders and their involvement in the construction of consensus. From a

business point of view but their implementation requires, in addition to the evaluation of design

alternatives, a careful evaluation of policies for financing the work. The investment choices are in

fact a decisive influence on economic and financial balance of future budgets of the institution

[Giacomelli P., 1998].

A body or board was thus set up to approve the business plan, which is a legal requirement for

the resolutions approving the execution of investment projects and for decision-taking on mortgages

[Article 200 Tuel]. The business plan must be drawn to determine the price for the service are able

to ensure balance both economic and financial investment. An investment is characterized by

economic equilibrium when, in the time chosen for its assessment, the discounted stream of

revenues from the investment is at least sufficient to cover the amount of discounted costs,

including depreciation charges technically and financially.

An investment is characterized by financial stability when, in the period chosen it is able to

produce, for each financial year, a volume of financial resources that can help you meet the amount

of cash outlay for the reimbursement of the funds received and management of 'invested in the

The overall assessment of a proposed investment therefore requires:

1. Analysis of user needs which fall on the technical and economic feasibility of various

financial and investment alternatives. The choice will fall on that project whose benefits outweigh

the costs incurred;

2. Analysis of capital expenditure inclusive of VAT, the period in respect of which express an

opinion of convenience, financial charges and capital repayments in relation to the choice of

financing, management and financial burdens on indirect entity's financial statements, once the

investment, and any major or minor resources for the benefit and / or the budget itself;

3. The timetable for the drafting of the final and executive projects, procurement of funding

sources, and the procedures for the identification and choice of partner, foster care and the start of

work and closure of work and testing;

4. Time to feature the work, and / or system.

6. The role of public investment in the dynamics of growth and competitiveness of the

territories

The empirical economic literature to support the axiom that the allocation of public works,

infrastructure, physical capital and in general public, is a positive factor for the development and

competitiveness of regional economies is significant, both nationally and internationally. Are

numerous and related to various land areas that are empirical work support the idea that the growth

of capital generated by public spending on infrastructure to provide a positive and significant

contribution (although greater or lesser extent depending on the circumstances) to productivity local

private sector [Atukeren E., 2005], and to output growth and production [Romp W., De Haan J.,

2007; Sanchez-Robles B., 2007].

This seems to have happened in the U.S. during the 70s and 80s of last century [Eberts, 1986;

Eberts, 1990], in regions and large areas Metropolitan Germany and France [Aubert and Stephan,

2000; Kemmerling and Stephan, 2002] and in the Spanish [Boscà et al., 2001].

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 89

In fact from the thirties, the economic literature array Keynesian had sealed the importance of

investment in infrastructure for their ability to trigger a multiplier effect on the demand side and

create the preconditions for the growth of a country [Tondini E., 2008]. In particular, Keynesian

models predict that in the short term infrastructure spending has a positive impact on GDP and

employment and spending that very purpose is to support employment in the early stages of adverse

cyclical, passing the long-term capital investments provide a public positive contribution to GDP

thanks to the stimulus given to investment in private capital, public and private capital would

therefore be complementary (crowding in) and not substitutes. [Di Giacinto V., Micucci, G.

Montanaro P., 2009].

On the issue of the macroeconomic impact of infrastructure is important to remember the

empirical literature of Aschauer: in his studies on the productivity of public capital for the U.S.

[1989a; 1989b], he introduced an aggregate production function approach with static single

equation, in which the public capital was treated the same as the input of labor and private capital.

The author was a large positive effect of public capital on U.S. GDP, suggesting that public

investment would be self-financing through higher tax revenue.

A large empirical literature has taken the building on the work of Aschauer and some authors

[Baxter and King, 1993] have explored the complex channels through which public capital exerts its

effects on the wealth produced in a general equilibrium framework: directly, because the investment

in infrastructure is part of GDP, indirectly, as the public capital can influence the level of other

inputs, such as employment and private capital.

Also with regard to Italy, Fabiani and Pellegrini [1997] show that in addition to training and

geographical location, infrastructure spending has been a determining factor for economic growth

both for the convergence of the Italian provinces during the period 1952-1992.

In light of the above and supported by the different economic theories can therefore be said

that public investment in infrastructure have a significant impact on GDP, employment and overall

economic growth in the territories. At local level the implementation of the investment produces

widespread benefits: in general increases the competitive differentiation of the territories and thus

the degree of attractiveness of those relying on the effects of Keynesian type.

In particular the provision of local public investment on the one hand affects the economic,

social, environmental (changes in residential property settlement and productive system of mobility,

environmental framework, labor markets and real estate, increase/decrease of population) and

secondly generates growth in demand for and supply of public services caused by changes in

infrastructure and changes the tax and local government involved [Barman TR, Gupta MR, 2010].

Essentially, therefore, the infrastructure is one of the determinants of competitiveness and

development potential of an area of active firms: the presence of infrastructure of good quality

affects the level of development and consequently on the location of new businesses the

reinforcement of existing ones and the degree of attractiveness of the territories.

It is necessary and proper to make a further clarification and to dwell on another aspect: the

role of adequate infrastructural facilities is crucial not only economic growth but also in reducing

regional imbalances.

The reasons given to support a policy of expansion of infrastructure facilities are in fact

generally focus on the objective of creating conditions that promote growth, expansion and

efficiency of the economy, on the one hand, and the reduction of inequalities and achieving greater

economic and social cohesion, on the other [Di Palma M., Mazziotta C., 2003].

An extensive analysis of literature has attempted to interpret the economic and territorial

disparities and to develop policies and actions to create conditions for achieving a substantial

economic and territorial cohesion among countries and between regions within each country.

Theories of the fifties and sixties, with the important work of Hirschmann [1958], Perloff [1963],

Hansen [1965], followed in subsequent years based on significant contributions empirical-

quantitative analysis, including remember those Biehl [1986] and more recent ones of Barro [1991],

Barro and Sala-i-Martin [1992], Costa-Font J., Rodriguez-Oreggia E., [2005] and Giuranno MG

[2009].

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 90

All these authors essentially argue a theory of skiing: the infrastructure plays a significant role

(along with other variables, of course) when determining a growth process more pronounced in the

lagging regions, such as to reduce the existing regional disparities and enable the start of a process

of convergence of regional economies with different levels of development.

Own public investment can be the engine of economic and social development, to activate the

lever to overcome or at least reduce the territorial duality of our country. Italy is one of the

countries where it persists a long time the territorial divide between North and South.

He even notes that the Italian case is the only example of a country where internal differences

have never been significantly reduced: between 1955 and 2005, unlike what happened in all other

nations, the Italian regions lagging in development have not been able to show growth rates

significantly above the national average [Iuzzolino G., 2009].

Ultimately, the Italian economic dualism, which sees a significant proportion of the

population reside in a very poor than the national average, is far more serious than other countries

with similar levels of development and approaches, however, to an uneven playing field that

characterize the less economically advanced countries.

Spatial inequalities in Italy are of a structural nature. The internal disparities of income now

appear significantly higher than all nations in comparison with levels of development comparable to

ours. That is to say that the question of southern Italy is placed on dimensions of particular gravity,

not only in the economic history of our country, but also by international standards.

For the purposes of comparison, it is significant to consider the case of Germany, another

country with strong traits of territorial dualism.

It is to be noted that the government action of Germany in the years after reunification

(October 3, 1990) was characterized by tenacity and consistency in the point towards the goal of

recovery of the gap between the two parts of the country in terms of production, infrastructure and

Wellness, a non-negligible costs.

PROBLEMS: While recognizing the considerable efforts made in an attempt to restore the

eastern Länder in the united Germany, but you can not hide the fact that the result has not yet been

reached: the process of rapid growth in the first years after reunification was followed by a growth

phase slow and insufficient to fill the gap with the western regions in a short time. However, it

acknowledged the success of the policies offered to the public in having the reunification of the

Eastern Länder an allocation of infrastructure level equivalent to that of the rest of the country,

which has not yet happened in Southern Italy [Martinez Oliva JC, 2009].

The comparison between the German experience and our South, but with due caution related

to the different historical and institutional conditions and different initial factor endowment, it is

therefore instructive in that it allows to confirm the anomaly of the Italian dualism in the European

market. The Italian dualism is presented in relation to productivity, income, employment and also

with regard to public investment: in particular, in Italy there is a gap in infrastructure is strong

compared to other industrialized European countries, both within and between the South and the

Center North.

The causes underlying these differences are many and not all be controlled at national level

between the various causes is important to remember above all the need to contain public spending

that occurs every year more and more relentless with the Pact of Stability and Budget Laws. Also at

European level, the analysis shows that the level of public investment has been determined in recent

years by income taxation policies and particularly the need to contain expenditure and the budget

appropriations, which were found to be higher than for current expenditure expenditure in capital

account [Agenor P.-R., 2009; Mehrotra A., Valila T., 2006].

Different analysis, among others, have shown that the expenditure in capital account are

positively and significantly correlated with economic growth, unlike the current expenses [Bose N.,

Haque ME, Osborn DR, 2007].

In this context, it is interesting to investigate the determinants of land development in order to

understand based on the assumptions made and the search through the construction of an

econometric model, what kind of spending most conducive to economic growth: in other words, if

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 91

are true hypothesis under which the cost of investments encourage the development costs for staff

and hinder the growth of the territories.

References

1. Agenòr, P.-R. (2009), Infrastructure Investment and Maintenance Expenditure: Optimal

Allocation Rules in a Growing Economy, Journal of Public economic Theory, 11(2) (2009)

233-250.

2. Aschauer, D. (1989a), Is Public Expenditure Productive?, Journal of Monetary Economics,

23 (1989a) 177-200.

3. Aschauer, D. (1989b), Does Public Capital Crowd Out Private Capital?, Journal of

Monetary Economics, 24 (1989b) 171-188.

4. Atukuren, E. (2005), Interactions Between Public and Private Investment: Evidence from

Developing Countries, Kyklos, 58(3) (2005) 307-330.

5. Aubert, S., Stephan, A. (2000), Regionale Infrastruktur Politik und ihre Auswirkung auf die

Produktivität: ein Vergleich von Deutschland und Frankreich, Berlin:

Wissenschaftszentrum, (2000).

6. Baldi, L. (2005), Investimenti: le disposizioni della finanziaria 2005 in materia di

finanziamento, Azienditalia, 8 (2005) 509.

7. Baltagi, Badi, H. (2001), Econometric Analysis of Panel Data, Chichester: John Wiley &

Sons, (2001).

8. Barbero, M. (2005), Golden Rule: non è tutt’oro quel che luccica!, Le Regioni, 4 (2005)

675.

9. Barman, TR, Gupta, MR (2010), Public Expenditure. Environment and Economic Growth,

Journal of Public economic Theory, 12(6) (2010) 1109-1134.

10. Barro, RJ (1991), Economic Growth in a Cross Section of Countries, The Quarterly Journal

of Economics, 106(2) (1991) 407-443.

11. Barro, RJ, Sala-I-Martin, X. (1992), Convergence, The Journal of Political Economy, 100(2)

(1992) 223-251.

12. Baxter, M., King, RG (1993), Fiscal Policy in General Equilibrium, American Economic

Review, 83(3) (1993) 315-333.

13. Biehl, D. (1986), The contribution of infrastructure to regional development: final report,

Luxembourg: Office for Official Publications of the European Communities, (1986).

14. Bose, N., Haque, ME, Osborn, DR (2007), Public Expenditure and Economic Growth: a

disaggregated Analisys for Developing Countries, The Manchester School, 75(5) (2007)

533-556.

15. Buscema, S. (1971), Il bilancio, 1, Milano: Giuffrè, (1971).

16. Costa-Font, J., Rodriguez-Oreggia, E. (2005), Trade and the Effect of Pubic Investment on

Regional Inequalities in Heterogeneously Integrated Areas, The World Economy, 28(6)

(2005) 873-891.

17. D’Aries, C., D’Atri, A., Mazzara, L. (1998), Enti locali – Il sistema informativo contabile,

Milano: Ipsoa, (1998).

18. D’Aristotile, E. (2000), Gli investimenti negli enti locali: la programmazione, la valutazione,

la contabilizzazione, la scelta della fonte di finanziamento, Gorle: Cel, (2000).

19. D’Aristotile, E. (2004), La nozione di investimento e indebitamento dopo la legge

finanziaria 2004, Azienditalia, 5 (2004) 323.

20. D’Aristotile, E. (2009), La nozione di investimento e di indebitamento nelle disposizioni

normative riguardanti gli enti locali, in Amatucci, F., Pezzani, F., Vecchi, V. (a cura di)

(2009), Le scelte di finanziamento negli enti locali, Milano: Egea, (2009).

21. Di Giacinto, V., Micucci, G., Montanaro, P. (2009), Effetti macroeconomici del capitale

pubblico: un’analisi su dati regionali, Mezzogiorno e politiche regionali, Banca d’Italia, 2

(2009) 279-317.

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 92

22. Di Massa, P. (1989), Il finanziamento e la realizzazione delle opere pubbliche negli enti

locali, Ceranesi: Maggi, (1989).

23. Di Palma, M., Mazziotta, C. (2003), Infrastrutture, competitività e sviluppo: il caso italiano,

Economia Italiana, 3 (2003) 534.

24. Eberts, RW (1986), Estimating the contribution of urban public infrastructure to regional

growth, Working Paper, URL: http://www.clevelandfed.org/research/Workpaper

25. Eberts, RW (1990), Public infrastructure and regional economic development, Economic

Review, 90(Q1) (1990) 15-27.

26. Fabiani, S., Pellegrini, G. (1997), Education, infrastructure, geography and growth: an

empirical analysis of the development of italian provinces, Temi di discussione, Roma:

Banca d’Italia, 323 (1997).

27. Farneti, F. (1998), Gestione e Contabilità dell’ente locale, Santarcangelo di Romagna:

Maggioli, (1998).

28. Falcone, G. (1998), Il finanziamento degli investimenti negli enti locali, Guida normativa,

Gorle: Cel, (1998).

29. Giacomelli, P. (1998), Programmazione e finanziamento degli investimenti, Azienditalia,

5(3) (1998) 135-136.

30. Giuranno, MG (2009), Regional income Disparity and the Size of the public sector, Journal

of Public economic Theory, 11(5) (2009) 667-873.

31. Hankla, C., Downs, W. (2010), Decentralisation. Governance and the Structure of Local

Political Institutions: Lessons for Reform?, Local Government Studies, 36 (6) (2010) 759-

783.

32. Hansen, M. (1965), Unbalanced Growth and Regional Development, Western Economic

Journal, 4 (1965) 3-14.

33. Hirschmann, OA (1958), The Strategy of Economic Development, London: Yale University

Press, (1958).

34. Iuzzolino, G. (2009), I divari territoriali di sviluppo in Italia nel confronto internazionale,

Mezzogiorno e politiche regionali, Banca d’Italia, 2 (2009) 428.

35. Kemmerling, A., Stephan, A. (2002), The Contribution of Local Public Infrastructure to

Private Productivity and its Political Economy: Evidence from a Panel of Large German

Cities, Public Choice, 113(3-4) (2002) 403-424.

36. Marotta, G. (2004), La definizione di spesa in conto capitale e di investimento dopo la legge

finanziaria 2004, La Finanza Locale, 5 (2004) 42.

37. Martinez Oliva, JC (2009), Riunificazione intertedesca e politiche per la convergenza,

Mezzogiorno e politiche regionali, Banca d’Italia, 2 (2009) 479-502.

38. Mehrotra, A., Valila, T. (2006), Public Investment in Europe: Evolution and determinants in

perspective, Fiscal Studies, 27(4) (2006) 443-471.

39. Morese, F. (1982), Metodologia decisionale nella programmazione degli investimenti

pubblici, Economia pubblica, 9 (1982) 395.

40. ODCEC di Ivrea, Pinerolo e Torino (2008), Il finanziamento degli investimenti negli enti

locali, Corso di formazione in materia di enti locali, VI^ giornata, URL:

http://www.odc.torino.it/public/convegni/con15541.ppt

41. Perloff, HS (1963), How a region grows: area development in the U.S. economy, New York:

Committee for economic development, (1963).

42. Romp, W., De Haan, J. (2007), Public Capital and Economic Growht: a Critical Survey,

Perspektiven der Wirtschaftspolitik, 8(S1) (2007) 6-52.

43. Sanchez-Robles, B. (2007), Infrastructure Investment and Growth: some empirical evidence,

Contemporary Economic Policy, 16(1) (2007) 98-108.

44. Smith, B. (2008), Good governance and development, Public Administration and

Development, 28(3) (2008) 251.

45. Stock, JH., Watson, MW (2009), Introduzione all’Econometria, Milano: Pearson Education

Italia, (2009).

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

ЖУРНАЛ "КОРПОРАТИВНЫЕ ФИНАНСЫ" №1(17) 2011 93

46. Tondini, E. (2008), Infrastrutture e sviluppo: un legame ancora da esplorare, AUR&S, 11

(2008) 243.

Выпуск #1(17), 2011 © Электронный журнал Корпоративные Финансы, 2011

View publication stats

You might also like

- ACC308 Final Project WorkbookDocument18 pagesACC308 Final Project WorkbookCarly Goldmann100% (5)

- Business PlanDocument27 pagesBusiness PlanHannaniah Pabico81% (36)

- Castrol Case AnalysisDocument5 pagesCastrol Case AnalysisSourav Padhi33% (3)

- Section 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled PersonsDocument19 pagesSection 80DD, Section 80DDB, Section 80U - Tax Deduction For Disabled Personsvvijayaraghava100% (1)

- Buget Utilization ResearchDocument11 pagesBuget Utilization ResearchhailemariamNo ratings yet

- Capital Expenditure of Local GovernmentsDocument14 pagesCapital Expenditure of Local GovernmentsAbid KhawajaNo ratings yet

- Vision and Guiding Principles for Philippine Urban DevelopmentDocument8 pagesVision and Guiding Principles for Philippine Urban DevelopmentHazel May Agagas EstrellaNo ratings yet

- Zelalem Bogale Proposal 1 New OneDocument17 pagesZelalem Bogale Proposal 1 New Oneferewe tesfayeNo ratings yet

- Intan InvestDocument56 pagesIntan InvestSina ÇolakNo ratings yet

- Wangand Wu 2020 PreprintDocument17 pagesWangand Wu 2020 PreprintTestingNo ratings yet

- What Have We Learned About The Effectiveness of Infrastructure Investment 2022Document41 pagesWhat Have We Learned About The Effectiveness of Infrastructure Investment 2022Pablo MartinezNo ratings yet

- Working Paper No. 2010/22: Infrastructure and City Competitiveness in IndiaDocument17 pagesWorking Paper No. 2010/22: Infrastructure and City Competitiveness in IndiaYokendran KugathasNo ratings yet

- Alternatives To FOR: Development Charges Growth-Related Capital CostsDocument52 pagesAlternatives To FOR: Development Charges Growth-Related Capital CostssladurantayeNo ratings yet

- Acconcia, Corsetti and Simonelli - 2014 - Mafia and Public Spending - Evidence On The Fiscal Multiplier From A Quasi-EsperimentDocument26 pagesAcconcia, Corsetti and Simonelli - 2014 - Mafia and Public Spending - Evidence On The Fiscal Multiplier From A Quasi-EsperimentNicholas YiNo ratings yet

- Cuenca, Efficiency of Local Gov in Health Service DeliveryDocument34 pagesCuenca, Efficiency of Local Gov in Health Service DeliveryAdrian DoctoleroNo ratings yet

- Impact of Investment Banking on India's Economic GrowthDocument8 pagesImpact of Investment Banking on India's Economic GrowthNeelNo ratings yet

- FDI Effects on Host EconomiesDocument13 pagesFDI Effects on Host Economiesthi100% (1)

- Esrf FdiDocument26 pagesEsrf FdiJoel ChikomaNo ratings yet

- Aulia - Tugas ASPDocument14 pagesAulia - Tugas ASPPTL Keruda Tomohon 2022No ratings yet

- Role of Budgeting in GhanaDocument12 pagesRole of Budgeting in GhanaMike TeeNo ratings yet

- The Impacts of Industrial Parks To Socio Economic Development Experimental Research 1528 2635 23-4-437Document19 pagesThe Impacts of Industrial Parks To Socio Economic Development Experimental Research 1528 2635 23-4-437Shubhranshu NayakNo ratings yet

- Factors Affecting Capital Expenditure Allocation: Empirical Evidence From Regency/City Government in IndonesiaDocument23 pagesFactors Affecting Capital Expenditure Allocation: Empirical Evidence From Regency/City Government in IndonesiaBrian PramaharjanNo ratings yet

- Vol: 01, No. 02, Oct-Nov 2021: Journal of Production, Operations Management and Economics ISSN: 2799-1008Document45 pagesVol: 01, No. 02, Oct-Nov 2021: Journal of Production, Operations Management and Economics ISSN: 2799-1008jifri syamNo ratings yet

- Jethon & Reichard 2020Document9 pagesJethon & Reichard 2020dewi sartikaNo ratings yet

- Scope of StudyDocument9 pagesScope of StudySukanya DeviNo ratings yet

- FDI Policy Instruments:: Advantages and DisadvantagesDocument42 pagesFDI Policy Instruments:: Advantages and DisadvantagesSushree MishraNo ratings yet

- Financial Statement ImportanceDocument18 pagesFinancial Statement Importance409005091No ratings yet

- FDI Impacts China's EconomyDocument18 pagesFDI Impacts China's EconomyTheodor Octavian GhineaNo ratings yet

- Financial Determinants of Public Investment Strategic ManagementDocument11 pagesFinancial Determinants of Public Investment Strategic ManagementredalouziriNo ratings yet

- 1 PBDocument9 pages1 PBTariku KolchaNo ratings yet

- Capital Spending in Local Government: Providing Context Through The Lens of Government-Wide Financial StatementsDocument14 pagesCapital Spending in Local Government: Providing Context Through The Lens of Government-Wide Financial StatementsMahbub AlamNo ratings yet

- Aafonso Ms Investment Returns enDocument18 pagesAafonso Ms Investment Returns enWagner TorresNo ratings yet

- BUSM4091: International Business Strategy: DiscussionDocument9 pagesBUSM4091: International Business Strategy: DiscussionMichealshellNo ratings yet

- Chapter 1Document18 pagesChapter 1HanaNo ratings yet

- Jose DissertationDocument57 pagesJose Dissertationjosepv333No ratings yet

- An Ecosystem For Social Entrepreneurship and Innovation: How The State Integrates Actors For Developing Impact Investing in PortugalDocument25 pagesAn Ecosystem For Social Entrepreneurship and Innovation: How The State Integrates Actors For Developing Impact Investing in PortugalEriicpratamaNo ratings yet

- Crescenzi Di Cataldo Giua 2021 Journalof International EconomicsDocument30 pagesCrescenzi Di Cataldo Giua 2021 Journalof International EconomicsTeuku RezaNo ratings yet

- Looking Beyond Conventional Intergovernmental Fiscal Frameworks: Principles, Realities, and Neglected IssuesDocument33 pagesLooking Beyond Conventional Intergovernmental Fiscal Frameworks: Principles, Realities, and Neglected IssuesADBI PublicationsNo ratings yet

- Enhancing FDI Flows to Nepal during Global RecessionDocument21 pagesEnhancing FDI Flows to Nepal during Global RecessionIsmith PokhrelNo ratings yet

- Economic and Institutional Factors Driving FDI in PortugalDocument39 pagesEconomic and Institutional Factors Driving FDI in PortugalGizachewNo ratings yet

- Cost and Time Overruns in Public Sector ProjectsDocument51 pagesCost and Time Overruns in Public Sector Projectsskp23No ratings yet

- Real Exchange Rate Appreciation in Emerging Markets: Can Fiscal Policy Help?Document23 pagesReal Exchange Rate Appreciation in Emerging Markets: Can Fiscal Policy Help?TBP_Think_TankNo ratings yet

- Paananen 2020Document17 pagesPaananen 2020jifri syamNo ratings yet

- How Capital Budgeting Impacts Public Sector OrganizationsDocument54 pagesHow Capital Budgeting Impacts Public Sector OrganizationsDaniel ObasiNo ratings yet

- Regional Social Accounting ImpactsDocument6 pagesRegional Social Accounting ImpactscarolsaviapetersNo ratings yet

- 2020.A4.071.20D - Final Report - DR LiDocument85 pages2020.A4.071.20D - Final Report - DR LiJing LiNo ratings yet

- 48 HyytinenDocument19 pages48 HyytinenWendy SequeirosNo ratings yet

- Dhrifi 2015Document20 pagesDhrifi 2015salma.akhterNo ratings yet

- 1 Chapter 1 Overview of Project Program and Development Plan FinalDocument18 pages1 Chapter 1 Overview of Project Program and Development Plan Finaltsi55derNo ratings yet

- Fiscalnews Newspapers VARDocument68 pagesFiscalnews Newspapers VARNicolas AragonNo ratings yet

- Do Special Economic Zones Induce Local Development? Evidence from India's StatesDocument61 pagesDo Special Economic Zones Induce Local Development? Evidence from India's StatesSD RanaNo ratings yet

- The Effect of Public Subsidies On Firms' Investment-Cash Flow Sensitivity: Transient or Persistent?Document49 pagesThe Effect of Public Subsidies On Firms' Investment-Cash Flow Sensitivity: Transient or Persistent?Tommaso MarossiNo ratings yet

- LAB AssignmentDocument24 pagesLAB AssignmentNishant BiswalNo ratings yet

- GRIPS MS10 Public Sector InnovationDocument51 pagesGRIPS MS10 Public Sector InnovationGuilherme RosaNo ratings yet

- Investment PromotionDocument7 pagesInvestment PromotionJordan ReynoldsNo ratings yet

- Seeing Like An Investor Urban Development Planning Financialisation and Investors Perceptions of London As An Investment SpaceDocument20 pagesSeeing Like An Investor Urban Development Planning Financialisation and Investors Perceptions of London As An Investment SpacecritpoleconNo ratings yet

- Bis Working Papers: The Fintech OpportunityDocument33 pagesBis Working Papers: The Fintech OpportunityazeNo ratings yet

- Intro-Lit Review DraftDocument9 pagesIntro-Lit Review Draftapi-3706508No ratings yet

- Pio 2020 Efeitos Da Inovacao e Do Capit 56579Document19 pagesPio 2020 Efeitos Da Inovacao e Do Capit 56579Thaína RochaNo ratings yet

- Webdiae20091 enDocument29 pagesWebdiae20091 enJocelyn Mae CabreraNo ratings yet

- 3 EditedDiss SummuryandConclusionsENfinal6Document7 pages3 EditedDiss SummuryandConclusionsENfinal6Khaled MamdouhNo ratings yet

- Multi National Enterprises and Their Significance in Economic Growth in Emerging EconomisDocument11 pagesMulti National Enterprises and Their Significance in Economic Growth in Emerging Economisdevam chandraNo ratings yet

- 1.0 Introduction of StudyDocument23 pages1.0 Introduction of StudyUnit Audit DalamNo ratings yet

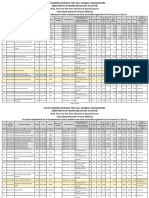

- R1-BEd-Alphabetic Merit List - MSDocument1,498 pagesR1-BEd-Alphabetic Merit List - MSMeet KataraNo ratings yet

- Agr Oth Lib 17Document38 pagesAgr Oth Lib 17bharat sachdevaNo ratings yet

- Effectiveness of Economic Sanctions Empirical ReseDocument12 pagesEffectiveness of Economic Sanctions Empirical ReseMeet KataraNo ratings yet

- View FileDocument43 pagesView FileMeet KataraNo ratings yet

- AustralianJournalofBasicandAppliedSciences3 PDFDocument9 pagesAustralianJournalofBasicandAppliedSciences3 PDFAnirban DuttaNo ratings yet

- What Went Wrong at TheranosDocument13 pagesWhat Went Wrong at TheranosManu Mallikarjun NelagaliNo ratings yet

- Narsee Monjee Institute of Management Studies, Hyderabad: Placement Report 2019-2021Document10 pagesNarsee Monjee Institute of Management Studies, Hyderabad: Placement Report 2019-2021Meet KataraNo ratings yet

- MDI Murshidabad Achieves Record Summer Placements for PGDM 2020-22 BatchDocument9 pagesMDI Murshidabad Achieves Record Summer Placements for PGDM 2020-22 BatchMeet KataraNo ratings yet

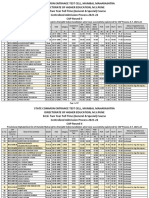

- Provisional Alphabetical List of Outside Maharashtra State (All India) Candidates Who Have Successfully Registered For CAP Process A.Y. 2021-22Document67 pagesProvisional Alphabetical List of Outside Maharashtra State (All India) Candidates Who Have Successfully Registered For CAP Process A.Y. 2021-22Meet KataraNo ratings yet

- Bad Blood: Secrets and Lies in A Silicon Valley StartupDocument9 pagesBad Blood: Secrets and Lies in A Silicon Valley StartupMeet KataraNo ratings yet

- Bad Blood: Secrets and Lies in A Silicon Valley StartupDocument9 pagesBad Blood: Secrets and Lies in A Silicon Valley StartupMeet KataraNo ratings yet

- The Realities of Trade After Brexit: A New Perspective From Baker MckenzieDocument20 pagesThe Realities of Trade After Brexit: A New Perspective From Baker MckenzieMeet KataraNo ratings yet

- Lunk H Nay Ki MachineDocument6 pagesLunk H Nay Ki MachineAliRazaNo ratings yet

- Narsee Monjee Institute of Management Studies, Hyderabad: Placement Report 2019-2021Document10 pagesNarsee Monjee Institute of Management Studies, Hyderabad: Placement Report 2019-2021Meet KataraNo ratings yet

- Effectiveness of Social Media As A Marketing ToolDocument13 pagesEffectiveness of Social Media As A Marketing Tool201832097 imtnagNo ratings yet

- The Lifecycle of The Biotech Unicorn TheranosDocument11 pagesThe Lifecycle of The Biotech Unicorn TheranosMeet Katara100% (1)

- Effectiveness of Economic Sanctions Empirical ReseDocument12 pagesEffectiveness of Economic Sanctions Empirical ReseMeet KataraNo ratings yet

- State of Art of Optimization Methods For Assembly Line DesignDocument13 pagesState of Art of Optimization Methods For Assembly Line DesignMeet KataraNo ratings yet

- 78 FileDocument86 pages78 FileMeet KataraNo ratings yet

- Syllabus: Introduction To Principle of CreativityDocument1 pageSyllabus: Introduction To Principle of Creativityvebby adhrianiNo ratings yet

- Allocating Advertising Expenses Using Linear Programming and MS ExcelDocument7 pagesAllocating Advertising Expenses Using Linear Programming and MS ExcelMeet KataraNo ratings yet

- WhatsApp Image 2021-11-10 at 11.35.36 AMDocument3 pagesWhatsApp Image 2021-11-10 at 11.35.36 AMMeet KataraNo ratings yet

- Bus Scheduling PDFDocument6 pagesBus Scheduling PDFAmrendar KumarNo ratings yet

- Engineering and Capital Goods Jan 2019Document44 pagesEngineering and Capital Goods Jan 2019shahavNo ratings yet

- Indian Electrical Equipment Industry Mission Plan 2012-2022Document124 pagesIndian Electrical Equipment Industry Mission Plan 2012-2022ankitgarg13No ratings yet

- Pcit 3000aDocument1 pagePcit 3000aMeet KataraNo ratings yet

- NJPSC 2019 Proceedings-Pages-126-130Document5 pagesNJPSC 2019 Proceedings-Pages-126-130Meet KataraNo ratings yet

- Allocating Advertising Expenses Using Linear Programming and MS ExcelDocument7 pagesAllocating Advertising Expenses Using Linear Programming and MS ExcelMeet KataraNo ratings yet

- Feasibility Study On Quail Egg ProductionDocument31 pagesFeasibility Study On Quail Egg ProductionDr-Muhammad Iftikhar100% (1)

- No. Account Account Name Header Balance Account Type Aset Current AsetDocument2 pagesNo. Account Account Name Header Balance Account Type Aset Current Asetwndy rdvlvtNo ratings yet

- AF Study Material and Practice Questions - Pre Mid TermDocument71 pagesAF Study Material and Practice Questions - Pre Mid TermAkshat Jain100% (1)

- 21.12.07 Jawaban PT SejahteraDocument76 pages21.12.07 Jawaban PT Sejahtera202010415109 ADITYA FIRNANDO100% (1)

- Mahindra and Mahindra Ltd. (2011-12 and 2012-13) : Prepared byDocument17 pagesMahindra and Mahindra Ltd. (2011-12 and 2012-13) : Prepared byAman AgarwalNo ratings yet

- ACCT 213 Exercise (Chapter 10)Document6 pagesACCT 213 Exercise (Chapter 10)MohammedNo ratings yet

- Far270 February 22 FaDocument8 pagesFar270 February 22 FarumaisyaNo ratings yet

- Kaplan CFA Level I Presentation Open House Amsterdam 2016 PDFDocument34 pagesKaplan CFA Level I Presentation Open House Amsterdam 2016 PDFSS SUPRE'MENo ratings yet

- Coc Level 3 4TH RoundDocument15 pagesCoc Level 3 4TH Roundsolomon asfawNo ratings yet

- Treasury RulesDocument25 pagesTreasury Rulesjon snow snowNo ratings yet

- Auditing Chapter 2 Part IIIDocument3 pagesAuditing Chapter 2 Part IIIRegine A. AnsongNo ratings yet

- Schedule 5.1 Milestone Payments and Claims ProcedureDocument20 pagesSchedule 5.1 Milestone Payments and Claims ProcedureKris NauthNo ratings yet

- Basic Financial and Accounting Systems ToolkitDocument78 pagesBasic Financial and Accounting Systems ToolkitAhsin KhanNo ratings yet

- Cash Flow & LiabilitiesDocument143 pagesCash Flow & LiabilitiesOjv FgjNo ratings yet

- XI Pre-BoardDocument7 pagesXI Pre-BoardSamar Singh Rathore0% (1)

- Personal Finance 5th Edition Jeff Madura Test BankDocument26 pagesPersonal Finance 5th Edition Jeff Madura Test BankMarkHalldxaj100% (45)

- Inc Tax Chp. 14Document6 pagesInc Tax Chp. 14Gene'sNo ratings yet

- Pan-Aarca9082e Pan-Aarca9082eDocument4 pagesPan-Aarca9082e Pan-Aarca9082eDilip KumarNo ratings yet

- 49ers Letter To Santa Clara Stadium Authority Regarding LawsuitDocument10 pages49ers Letter To Santa Clara Stadium Authority Regarding LawsuitDavid FucilloNo ratings yet

- 2018 FAR Module2-RecordingBusinessTransactionsDocument4 pages2018 FAR Module2-RecordingBusinessTransactionsIrah LouiseNo ratings yet

- Form SER-C: Statement of Expenses On Public Rally (Candidate)Document2 pagesForm SER-C: Statement of Expenses On Public Rally (Candidate)Ericson Nery Terre BansiloyNo ratings yet

- Accountancy Ms CT Xii Set 1 B 2023Document17 pagesAccountancy Ms CT Xii Set 1 B 2023mendesg4625No ratings yet

- Percentage Completion and Cost Recovery Methods ExplainedDocument20 pagesPercentage Completion and Cost Recovery Methods ExplainedClarize R. Mabiog100% (1)

- Latihan Ratio Keu Okt 2020Document4 pagesLatihan Ratio Keu Okt 2020Athalia ElshaNo ratings yet

- Pre-Feasibility Study Marble Mosaic Development CenterDocument19 pagesPre-Feasibility Study Marble Mosaic Development CenterFaheem MirzaNo ratings yet

- Technical WritingDocument42 pagesTechnical WritingAngeline Joyce RamirezNo ratings yet

- Comprehensive Accounting Cycle Review ProblemDocument10 pagesComprehensive Accounting Cycle Review ProblemAhmer NaeemNo ratings yet