Professional Documents

Culture Documents

Daily Equity Market Report - 26.01.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 26.01.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

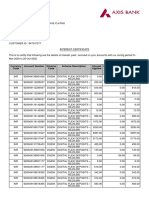

26TH JANUARY 2022

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI slips further by 3.88 Indicator Current Previous Change

GSE-Composite Index 2,781.42 2,785.30 -3.88 pts

points to close at 2,781.42; returns -0.28% YTD.

YTD (GSE-CI) -0.28% -0.14% 100.00%

The benchmark GSE Composite Index (GSE-CI) declined by 3.88 points GSE-Financial index 2,154.03 2,154.03 0.00 pts

YTD (GSE-FSI) 0.10% 0.10% 0.00%

at the third trading day of the week to close at 2,781.42 representing a

Market Cap. (GH¢ MN) 64,416.23 64,456.90 -40.67

YTD return of -0.28%. The GSE Financial Stock Index (GSE-FSI) however Volume Traded 3,283,919 124,661 2,534.2%

remained flat to close trading at 2,154.03 translating into a YTD return Value Traded (GH¢) 3,705,186.5 245,319.99 1,410.35%

of 0.10%. Fan Milk PLC. (FML) declined in prices for the second day in a TOP TRADED EQUITIES

row as it lost GH¢0.35 to close at GH¢3.22. Ticker Volume Value (GH¢)

MTNGH 3,269,060 3,628,656.60

As a result, Market Capitalization shed GH¢40.67 million to close at FML 10,000 32,200.00

GH¢64.41 billion. EGH 1,949 14,812.40

GCB 1,575 8,253.00

SCB 930 18,879.00 97.9% value traded

A total of 3,283,919 shares valued at GH¢3,705,186.50 were traded in six

(06) equities compared to 124,661 shares valued at GH¢245,319.99 DECLINER

Ticker Close Price Open Price Change YTD

which changed hands on Tuesday. Scancom PLC. (MTNGH) recorded (GH¢) (GH¢) Change

the lion’s share of trades as it accounted for 97.9% of the total value FML 3.22 3.57 -9.80% -19.50%

traded on the day. KEY ECONOMIC INDICATORS

Indicator Current Previous

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

Monetary Policy Rate November 2021 14.50% 13.50%

Share Price GH¢1.11

Real GDP Growth Q3 2021 6.6% 3.9%

Price Change (YtD) -1.80%

Inflation December 2021 12.6% 12.2%

Market Capitalization GH¢13.64 billion

Reference rate December 2021 13.89% 13.46%

Dividend Yield 0.00%

Source: GSS, BOG, GBA

Earnings Per Share GH¢0.1532

Avg. Daily Volume Traded 1,968,843

Value Traded (YtD) GH¢ 33,799,791 GSE-CI &GSE FSI

0.50% 0.10%

SBL RECOMMENDED PICKS 0.00% -0.28%

-0.50%

Equity Price Outlook (Reason) -1.00%

MTN GHANA GH¢ 1.11 Strong 2021 Q3 Financials -1.50%

BOPP GH¢ 6.65 Strong 2021 Q3 Financials -2.00%

CAL BANK GH¢ 0.82 Strong 2021 Q3 Financials -2.50%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials -3.00%

SOGEGH GH¢ 1.20 Strong 2021 Q3 Financials -3.50%

FANMILK GH¢ 3.22 Positive Sentiment -4.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDocument1 pageSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNo ratings yet

- Print Reciept RequestDocument1 pagePrint Reciept RequestOgbesetuyi seun AugustineNo ratings yet

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDocument1 page1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaNo ratings yet

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDocument69 pagesAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- Start Day Trading NowDocument44 pagesStart Day Trading Nowfuraito100% (2)

- CL-07 ApplicantDocument29 pagesCL-07 ApplicantShivamp6No ratings yet

- Prulink Elite Protector Series BrochureDocument2 pagesPrulink Elite Protector Series BrochureSakurako ChachamiNo ratings yet

- LESSON PLAN 7 - Saving and InvestingDocument19 pagesLESSON PLAN 7 - Saving and InvestingNikita MundadaNo ratings yet

- Neil Garfield - Expert or Bozo?Document44 pagesNeil Garfield - Expert or Bozo?Bob Hurt50% (2)

- Chapter No. 2Document46 pagesChapter No. 2Muhammad SalmanNo ratings yet

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Interest CertificateDocument2 pagesInterest CertificatesumitNo ratings yet

- How To Secure A Bank Account From Levy 1Document5 pagesHow To Secure A Bank Account From Levy 1api-374440897% (124)

- Pi ECO Vietnam Project Abstract & Summary 7 March 2019Document11 pagesPi ECO Vietnam Project Abstract & Summary 7 March 2019ICT Bảo HànhNo ratings yet

- Objective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisDocument67 pagesObjective 9.1: Chapter 9 Inventory Costing and Capacity AnalysisSamantha Nicole Dela CruzNo ratings yet

- British Lyceum ChallanDocument1 pageBritish Lyceum ChallanKamran JalilNo ratings yet

- The Rothschilds Stage Revolutions in Tunisia and EgyptDocument10 pagesThe Rothschilds Stage Revolutions in Tunisia and EgyptZeka Sumerian OutlawNo ratings yet

- STD 11 Business Studies ModelDocument2 pagesSTD 11 Business Studies ModelArs BokaroNo ratings yet

- Table of Contens (2 Files Merged)Document53 pagesTable of Contens (2 Files Merged)Md Khaled NoorNo ratings yet

- Accounting Intern Cover Letter ExamplesDocument7 pagesAccounting Intern Cover Letter Examplesiyldyzadf100% (2)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Federal Reserve Lien Ammended AgainDocument3 pagesFederal Reserve Lien Ammended AgainCharles Scott0% (1)

- Sample Questions - Mini-Test 1Document4 pagesSample Questions - Mini-Test 1sam heisenbergNo ratings yet

- History of Investment BankingDocument40 pagesHistory of Investment BankingMaritoGuzmanNo ratings yet

- Notes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The NotesDocument5 pagesNotes To Financial Statement Problem 3-1: D. All of These Can Be Considered A Purpose of The Notesjake doinogNo ratings yet

- Quiz in ObligationDocument8 pagesQuiz in ObligationSherilyn BunagNo ratings yet

- My Cash: Balance TotalDocument9 pagesMy Cash: Balance TotalDahlan MuksinNo ratings yet

- Ocbc Ar2016 Full Report English PDFDocument236 pagesOcbc Ar2016 Full Report English PDFMr TanNo ratings yet

- Books of Accounts Double Entry System With Answers by AlagangwencyDocument4 pagesBooks of Accounts Double Entry System With Answers by AlagangwencyHello KittyNo ratings yet

- Nomura Quant JD PDFDocument2 pagesNomura Quant JD PDFLakhan SaitejaNo ratings yet