Professional Documents

Culture Documents

Introduction As 26

Introduction As 26

Uploaded by

simmb0 ratings0% found this document useful (0 votes)

3 views1 pageAn intangible asset is a non-physical asset used to produce goods and services, including goodwill, brands, patents and copyrights. AS 26 outlines the accounting treatment for intangible assets. It states that intangible assets must be identifiable, provide future economic benefits, and have a cost that can be measured reliably to be recognized. The cost of purchased intangible assets includes the purchase price, and internally-generated intangible assets include development costs. Amortization should begin when the asset is available for use over its useful life, presumed to be no more than ten years unless otherwise demonstrated. Intangible assets are derecognized upon disposal or when no future benefits are expected.

Original Description:

Original Title

Introduction as 26

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn intangible asset is a non-physical asset used to produce goods and services, including goodwill, brands, patents and copyrights. AS 26 outlines the accounting treatment for intangible assets. It states that intangible assets must be identifiable, provide future economic benefits, and have a cost that can be measured reliably to be recognized. The cost of purchased intangible assets includes the purchase price, and internally-generated intangible assets include development costs. Amortization should begin when the asset is available for use over its useful life, presumed to be no more than ten years unless otherwise demonstrated. Intangible assets are derecognized upon disposal or when no future benefits are expected.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageIntroduction As 26

Introduction As 26

Uploaded by

simmbAn intangible asset is a non-physical asset used to produce goods and services, including goodwill, brands, patents and copyrights. AS 26 outlines the accounting treatment for intangible assets. It states that intangible assets must be identifiable, provide future economic benefits, and have a cost that can be measured reliably to be recognized. The cost of purchased intangible assets includes the purchase price, and internally-generated intangible assets include development costs. Amortization should begin when the asset is available for use over its useful life, presumed to be no more than ten years unless otherwise demonstrated. Intangible assets are derecognized upon disposal or when no future benefits are expected.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

AS 26 Intangible Assets

An intangible asset is an asset that is not physical in nature. Goodwill, brand

recognition and intellectual property, such as patents, trademarks, and copyrights, are all

intangible assets. Intangible assets exist in opposition to tangible assets, which include land,

vehicles, equipment, and inventory.

Intangible asset is a non-physical non-monetary asset which is held for use in the production

or supply of goods and services, or for rentals to others, etc. AS 26 should be applied by all

enterprises in accounting of intangible assets, except: 1. Intangible assets that are within the

scope of another standard financial assets 2. Rights and expenditure on the exploration for or

development of minerals, oil, natural gas and similar non-regenerative resources 3. Intangible

assets arising in insurance enterprise from contracts with policyholders, 4. Expenditure in

respect of termination benefits.

It applies when an item meets the criteria of an Intangible asset and it is probable that the

future economic benefits will flow to the enterprise and the cost of the asset can be measured

reliably. These recognition criteria apply to cost of acquiring and generating an intangible

asset internally. If an intangible asset is acquired separately, that should be measured initially

at cost, which includes purchase price that includes import duty, non-refundable purchase

taxes, after deducting trade discount and related direct cost. If an asset is acquired in a

business combination, the cost of that asset should be its fair value at the acquisition date

which depends on market expectations. When the asset is acquired free of charge or for a

normal consideration, by way of government grant, then it is recognized at a nominal value or

at the acquisition cost. The cost of an internally generated intangible asset includes all direct

expenditures related to creating, producing and making the asset ready for its intended usage

from the time it meets the first recognition criteria.

Expenditure on an intangible item should be recognized as an expense when it is incurred,

Subsequent expenditure (after purchase or completion of assets) should be added to the cost

of the intangible asset, when there is a probability that the expenditure will generate future

economic benefits and the expenditure can be measured reliably.

Amortization should start when the asset is available for use. The depreciable amount of an

intangible asset should be allocated on the basis of useful life. This AS adopts a presumption

that the useful life of intangible assets does not exceed ten years. In some cases, it would be

longer than ten years.

An intangible asset should be derecognized on disposal or when no future economic benefits

are expected from its use, any gain and loss (difference between the net disposal proceeds and

the carrying amount of the asset) arising should be recognized as income or expenses in

statement of P & L.

You might also like

- Clintons, Mena, CIA, Guns & Cocaine-28Document28 pagesClintons, Mena, CIA, Guns & Cocaine-28Vincent50% (2)

- Intangible Assets NotesDocument6 pagesIntangible Assets NotesRaizel RamirezNo ratings yet

- Intangible Assets and LiabilitiesDocument13 pagesIntangible Assets and LiabilitiesApril ManjaresNo ratings yet

- Intangible AssetsDocument6 pagesIntangible Assetsmark fernandezNo ratings yet

- TEODORO ACAP Vs CADocument1 pageTEODORO ACAP Vs CAJennebeth Kae CaindayNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyAnn SarmientoNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- Investment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldDocument7 pagesInvestment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldMark Anthony SivaNo ratings yet

- Accounting For Property Plant and EquipmentDocument6 pagesAccounting For Property Plant and EquipmentmostafaNo ratings yet

- Psak 19Document8 pagesPsak 19Nadia NathaniaNo ratings yet

- Chapter 9 Investment PropertyDocument4 pagesChapter 9 Investment Propertymaria isabellaNo ratings yet

- Ias 38 Intangible Assets SummaryDocument8 pagesIas 38 Intangible Assets SummaryPandu WiratamaNo ratings yet

- Chapter 7 Intangible AssetsDocument70 pagesChapter 7 Intangible AssetsLovely AbadianoNo ratings yet

- As 26Document2 pagesAs 26Prasad IngoleNo ratings yet

- Farap 4505Document7 pagesFarap 4505Marya NvlzNo ratings yet

- Accounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DateDocument6 pagesAccounting Standard 26 - Intangible Assets Issuing Authority: Status: Effective DatePiyush AgarwalNo ratings yet

- IntangiblesDocument7 pagesIntangiblesWertdie stanNo ratings yet

- Intangible AssetsDocument99 pagesIntangible AssetsXNo ratings yet

- Accounting For Property, Plant and Equipment, Intangibles and Impairment of Assets Week 12-13 AssessmentsDocument13 pagesAccounting For Property, Plant and Equipment, Intangibles and Impairment of Assets Week 12-13 AssessmentsAllia LandigNo ratings yet

- Kas 15 - Intangible Assets Explanatory Note: Page 1 of 6Document6 pagesKas 15 - Intangible Assets Explanatory Note: Page 1 of 6r4inbowNo ratings yet

- Accounting Policy As Per FSDocument17 pagesAccounting Policy As Per FSShubham TiwariNo ratings yet

- Accounting For Intangibles ACC C205 202A INTERMEDIATE ACCTG 1 PDFDocument5 pagesAccounting For Intangibles ACC C205 202A INTERMEDIATE ACCTG 1 PDFAsdfghjkl LkjhgfdsaNo ratings yet

- Module 4 - INTACC2 Intangible AssetsDocument20 pagesModule 4 - INTACC2 Intangible AssetsKhan TanNo ratings yet

- Intangible Assets: International Accounting Standard 38Document19 pagesIntangible Assets: International Accounting Standard 38ZayaNo ratings yet

- Advance AccountsDocument6 pagesAdvance Accountsashish.jhaa756No ratings yet

- Chapter 21 INTANGIBLE ASSSETSDocument38 pagesChapter 21 INTANGIBLE ASSSETSmarj ponceNo ratings yet

- Accounting Standard NotesDocument8 pagesAccounting Standard NotesGayathri DhandapaniNo ratings yet

- Iac23 C23 DalidaDocument4 pagesIac23 C23 DalidaEdith DalidaNo ratings yet

- CFAS Notes For FINALS PDFDocument26 pagesCFAS Notes For FINALS PDFMarife PangesbanNo ratings yet

- Accounting Policies of Havells India Ltd. CompanyDocument22 pagesAccounting Policies of Havells India Ltd. CompanyRutvik HNo ratings yet

- Intangible Assets: Indian Accounting Standards 8Document2 pagesIntangible Assets: Indian Accounting Standards 8Kristen HuntNo ratings yet

- Accounting PoliciesDocument3 pagesAccounting PoliciesSatish Ranjan PradhanNo ratings yet

- Tagamabja-Cfas Activity Set 3FDocument6 pagesTagamabja-Cfas Activity Set 3FBerlyn Joy TagamaNo ratings yet

- Intangible Assets1Document22 pagesIntangible Assets1hamarshi2010No ratings yet

- Fixed AssetsDocument46 pagesFixed AssetsSprancenatu Lavinia0% (1)

- ICDS - 5 Fixed AssetsDocument14 pagesICDS - 5 Fixed Assetskavita.m.yadavNo ratings yet

- IAS 38 Intangible Assets: Technical SummaryDocument5 pagesIAS 38 Intangible Assets: Technical SummaryFoititika.net100% (2)

- Notes AccountingDocument5 pagesNotes AccountingSoleil SierraNo ratings yet

- Reliance Industries Limited: Name - Pooja Deotale PRN - 21021241098 Under The Guidance of Dr. Veerma PuriDocument26 pagesReliance Industries Limited: Name - Pooja Deotale PRN - 21021241098 Under The Guidance of Dr. Veerma Purinisha deotaleNo ratings yet

- Chapter 1 Property Plant and EquipmentDocument26 pagesChapter 1 Property Plant and EquipmentJellai TejeroNo ratings yet

- IAS 38 Intangible Assets: Technical SummaryDocument5 pagesIAS 38 Intangible Assets: Technical Summaryanon-553693100% (2)

- Summary NAS 40Document6 pagesSummary NAS 40sitoulamanish100No ratings yet

- 2.1 Goodwill and Other Intangible AssetsDocument53 pages2.1 Goodwill and Other Intangible Assetstirodkar.sneha13No ratings yet

- AS 26 - 123 To 138Document16 pagesAS 26 - 123 To 138love chawlaNo ratings yet

- IAS 38 Intangible AssetsDocument20 pagesIAS 38 Intangible AssetsEmon EftakarNo ratings yet

- CH 12Document13 pagesCH 12Hanif MusyaffaNo ratings yet

- Intangible Assets Under Pfrs ScopeDocument12 pagesIntangible Assets Under Pfrs ScopeYsabella ChenNo ratings yet

- PPE and BORROWING COSTDocument21 pagesPPE and BORROWING COSTmeemisuNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyMarj ManlagnitNo ratings yet

- Indian Accounting Standard (Ind AS) 16 Property, Plant and EquipmentDocument20 pagesIndian Accounting Standard (Ind AS) 16 Property, Plant and EquipmentSandeepPusarapuNo ratings yet

- Summary PpeDocument8 pagesSummary PpeJenilyn CalaraNo ratings yet

- Week 5 C35 - MFRS 138 IntangiblesDocument26 pagesWeek 5 C35 - MFRS 138 IntangiblesYong Arifin0% (1)

- Accounting GuidanceDocument5 pagesAccounting GuidanceVibha MittalNo ratings yet

- Intangible Assets Lecture and ExercisesDocument16 pagesIntangible Assets Lecture and ExercisesRNo ratings yet

- I. Objective: Property Held Under An Operating LeaseDocument5 pagesI. Objective: Property Held Under An Operating Leasemusic niNo ratings yet

- Verification MergedDocument10 pagesVerification MergedVarun jajalNo ratings yet

- IAS 23 - Borrowing CostDocument4 pagesIAS 23 - Borrowing CostMuhammad QamarNo ratings yet

- Ipsas 31-Intangable Assets IpsasDocument6 pagesIpsas 31-Intangable Assets IpsasSolomon MollaNo ratings yet

- Chapter 23 PPEDocument5 pagesChapter 23 PPERose AysonNo ratings yet

- 21 - Investment PropertyDocument7 pages21 - Investment PropertyYudna YuNo ratings yet

- Accounting For Intangible Asset IAS 38Document2 pagesAccounting For Intangible Asset IAS 38MIKIYAS BERHENo ratings yet

- Bemol Mos2 MsdsDocument4 pagesBemol Mos2 MsdsCarlos BrachoNo ratings yet

- "Military-Industrial Complex" of The USA Task 1. Read The Text, Translate The Words, Answer The QuestionsDocument5 pages"Military-Industrial Complex" of The USA Task 1. Read The Text, Translate The Words, Answer The QuestionsДенис ЧертковNo ratings yet

- Automatic Account Assignment OKB9 Does Not Work - SAP BlogsDocument18 pagesAutomatic Account Assignment OKB9 Does Not Work - SAP BlogsgirijadeviNo ratings yet

- Arizona Judges Make War On Free SpeechDocument4 pagesArizona Judges Make War On Free SpeechRoy WardenNo ratings yet

- Copyright and Music Publishing in The ChurchDocument7 pagesCopyright and Music Publishing in The ChurchLucas SantanderNo ratings yet

- Bonifacio V Bragas A.C. No. 11754Document17 pagesBonifacio V Bragas A.C. No. 11754patriciaNo ratings yet

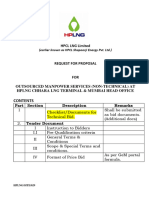

- Scope 2 Saurabh - Rampal@hplng - inDocument137 pagesScope 2 Saurabh - Rampal@hplng - inTENDER AWADH GROUPNo ratings yet

- (Case Digest) Barretto v. Sta. Marina, G.R. No 8238, December 2, 1913Document5 pages(Case Digest) Barretto v. Sta. Marina, G.R. No 8238, December 2, 1913Shella LandayanNo ratings yet

- Kristaps7777 Contract-SignedDocument3 pagesKristaps7777 Contract-SignedKris TheVillainNo ratings yet

- Case Study Practice QuestionDocument8 pagesCase Study Practice QuestionSashin NaidooNo ratings yet

- FV Relocation Memo Final DraftDocument12 pagesFV Relocation Memo Final DraftA.W. CarrosNo ratings yet

- Company Profile: WWW - Secureroot.co - inDocument19 pagesCompany Profile: WWW - Secureroot.co - inSumit KumarNo ratings yet

- Corps FilingDocument44 pagesCorps FilingRob PortNo ratings yet

- Architect'S Schedule of Minimum Basic FeeDocument3 pagesArchitect'S Schedule of Minimum Basic FeeMarlon NiduazaNo ratings yet

- Cis289 Network Documents Nickolas McbrideDocument6 pagesCis289 Network Documents Nickolas Mcbrideapi-360746625No ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- Decision-Making On Incoterms 2020 of Automotive Parts Manufacturers in ThailandDocument10 pagesDecision-Making On Incoterms 2020 of Automotive Parts Manufacturers in ThailandNguyễn Văn HuyNo ratings yet

- Jadewell Parking Systems v. LiduaDocument3 pagesJadewell Parking Systems v. LiduaKyle DionisioNo ratings yet

- Consent Form and Terms of Use For Applicant Services Provided by Vfs Global Operated Canada Visa Application Centres (Cvac)Document4 pagesConsent Form and Terms of Use For Applicant Services Provided by Vfs Global Operated Canada Visa Application Centres (Cvac)ISHAN TRAYANo ratings yet

- Filipino Great Men and Women: Miriam Defensor SantiagoDocument6 pagesFilipino Great Men and Women: Miriam Defensor SantiagoGlyddelNo ratings yet

- Wanted Person of The Week-MillerDocument1 pageWanted Person of The Week-MillerHibbing Police DepartmentNo ratings yet

- Legislative History, Pole Attachment Act of 1978Document5 pagesLegislative History, Pole Attachment Act of 1978StimulatingBroadband.comNo ratings yet

- IMG - 0213 PSME Code 2008 201Document1 pageIMG - 0213 PSME Code 2008 201Hnqr584hNo ratings yet

- Organization BehaviorDocument23 pagesOrganization Behaviorkosal.meanNo ratings yet

- Mental Illness and Crime. Full DocumentDocument3 pagesMental Illness and Crime. Full Documentragi100% (2)

- BridgeDocument1 pageBridgeapi-3711938No ratings yet

- Mambog Elementary School - Annex: Republic of The PhilippinesDocument3 pagesMambog Elementary School - Annex: Republic of The PhilippinesJOSEPHINE HUNTERNo ratings yet

- Isolated Part of CyprusDocument119 pagesIsolated Part of CyprusMuhittin Tolga OzsaglamNo ratings yet