Professional Documents

Culture Documents

Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimen

Uploaded by

layla scotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimen

Uploaded by

layla scotCopyright:

Available Formats

INCOME TAXES FOR INDIVIDUALS

CA5109 Income Taxation

Prepared by: Joseph Angelo B. Ogrimen

Individual Taxpayers are natural persons with income derived from WITHIN territorial jurisdiction of

a taxing authority.

SUMMARY OF CLASSIFICATIONS OF INDIVIDUAL TAXPAYER

INDIVIDUAL CLASSIFICATION RESIDENCE (lives in PH) CITIZENSHIP (citizen of PH)

Resident Citizen YES YES

Nonresident Citizen NO YES

Resident Alien* YES NO

Nonresident Alien** NO NO

*if the intention of the alien is INDEFINITE, he shall be considered as RA for taxation purposes

**can be further classified into NRA-ETB or NRA-NETB depending if they are earning income in PH

Special Cases on classifications of Individuals:

1. Overseas Filipino Workers (OFW)/Overseas Contract Workers (OCW)

o Usually classified as NONRESIDENT CITIZEN (NRC)

o OFWs returning to PH with DEFINITE INTENTION TO RESIDE HERE shall be considered

RESIDENT CITIZEN from the time of ARRIVAL IN PH

o Previously RC who leaves PH during taxable year FOR EMPLOYMENT ON A PERMANENT

BASIS/”MOST OF THE TIME” DURING THE TAXABLE YEAR shall be considered as NRC

2. Immigrants

✓ Previously RC WITH DEFINITE INTENTION to reside ABROAD shall be considered as NRC

from the time of DEPARTURE FROM PH

3. Aliens

SITUS OF INCOME

✓ Situs = “Place” of Taxation

✓ There are certain types of income that are taxable specifically on certain “situs”/place

INCOME SOURCE SITUS OF TAXATION

Interest Income Debtor’s Residence (i.e. Interest on loans

granted to foreigners are taxable here if bank is

in PH)

CA5109 Income Taxation Reviewer

2A3

Royalties Where the intangible is employed (i.e. Books

published here are taxable in PH)

Services Where the services are rendered (i.e. services

rendered abroad are NOT TAXABLE here unless

RC)

SOURCES OF INCOME

✓ Sources refer to “where the income was earned”

TAXPAYER SOURCE OF TAXABLE INCOME TAX BASE

RC WITHIN & WITHOUT PH (worldwide)** NET Income

RA, NRC, NRA-ETB WITHIN ONLY NET Income

NRA-NETB WITHIN ONLY GROSS Income*

*NRA-NETB are NOT ALLOWED TO DEDUCT EXPENSES

**Symbiotic relationship is the reason why RCs are taxable on worldwide income. RCs often

enjoy preferential (lower) tax rates than other taxpayer classifications.

TYPES OF INCOME

• MAIN three types of income:

1. Capital Gains

2. Passive Income

3. Ordinary/Regular Income

CAPITAL GAINS – income from sale of CAPITAL ASSETS

CAPITAL ASSET VS ORDINARY ASSET

1. CAPITAL ASSET – held for PERSONAL USE or NOT HELD FOR SALE (i.e. House & Lot, Principal

Residence) – gives rise to CAPITAL GAINS which may be subject to:

a) CAPITAL GAINS TAX

❖ Sale of shares of DOMESTIC CORPORATION NOT TRADED IN PSE

➢ Subject to 15% NET CAPITAL GAIN (Selling Price – Cost) – applicable to ALL

classifications of taxpayer

➢ If TRADED THROUGH PSE, subject to STT (refer to next section)

➢ If FOREIGN CORPORATION, subject to Basic Tax

Selling Price

(Cost)

(Selling Expenses)

NET CAPITAL GAIN (LOSS)*

*The Net Capital Gain is the TAX BASE FOR 15% CGT (hence, if loss, NO CGT AT

ALL)

CA5109 Income Taxation Reviewer

2A3

❖ Sale of real property held as CAPITAL ASSET located in PH

➢ Subject to 6% CGT on HIGHEST of FMV, ZV, & SP – applicable to ALL

classifications of taxpayer

➢ If Capital Loss (i.e. Cost > Selling Price), there is STILL CGT because gain in sale of real

property is presumed

➢ Sale of Real Property to GOV’T/GOCC

▪ Taxpayer has OPTION to be either at 6% CGT or Basic Tax (Graduated Rates)

Sale of Principal Residence

▪ Residential Address shown in latest ITR filed by vendor shall raise CONCLUSIVE PRESUMPTION

about his true residential address

▪ REQUISITES FOR CGT EXEMPTION:

a) Proceeds must be UTILIZED WITHIN 18 calendar months from DATE OF SALE

➢ Any expenses incurred (i.e. Documentary Stamp Tax, Transfer Taxes,

Broker’s Commission) in effecting the sale shall be CONSIDERED AS PART OF

AMOUNT UTILIZED

➢ WHAT IF proceeds are NOT FULLY UTILIZED?

o Taxable Amount is the UNUTILIZED PORTION

Unutilized Portion

Taxable Amount = x CGT ORIGINALLY DUE

GROSS SELLING PRICE

b) BIR shall be notified WITHIN 30 DAYS from the date of sale

c) Can be availed only ONCE EVERY 10 YEARS

d) Historical cost/adjusted basis of real property sold shall be carried over to the new

principal residence built

TIMELINE FOR EXEMPTION FROM CGT UPON SALE OF PRINCIPAL RESIDENCE

CA5109 Income Taxation Reviewer

2A3

b) OTHER PERCENTAGE TAX (Sec. 127) – “Stock Transaction Tax (STT)”

❖ Sale of shares of DOMESTIC CORPORATION TRADED IN PSE

➢ Subject to 0.6% STT based on GROSS SELLING PRICE

➢ If Capital Loss, there is STILL CGT because tax base is the Selling Price

➢ Refer to illustration in CGT

c) BASIC TAX

❖ Sale of shares of FOREIGN CORPORATION

➢ Subject to Basic Tax (hence part of ITR ONLY IF taxpayer is RC)

❖ Sale of real properties LOCATED ABROAD

➢ Subject to Basic tax (hence part of ITR ONLY IF taxpayer is RC)

❖ Sale of Personal Assets OTHER THAN Real Property and Shares

➢ Subject to Basic Tax (if Personal Asset was SOLD IN PH)

OVERALL VIEW OF CAPITAL GAINS AND THEIR RESPECTIVE TAXES

“NOT ALL Capital Gains will be subject to Capital Gains Tax”

2. ORDINARY ASSET – held for BUSINESS USE or HELD FOR SALE (i.e. Inventories, PPE) – gives

rise to ORDINARY GAINS (subject to Basic Tax)

PASSIVE INCOME earned from sources within PH

• Another type of income is PASSIVE INCOME which is earned with MINIMAL EFFORT (kahit

natutulog ka, pwede mong ma-earn)

• “CERTAIN” Passive Income subject to Final Withholding Tax

1. INTEREST INCOME

2. DIVIDENDS

3. ROYALTIES

4. PRIZES & OTHER WINNINGS

CA5109 Income Taxation Reviewer

2A3

NOTE: Such passive income are ONLY SUBJECT TO FWT if earned WITHIN THE PHILIPPINES.

If earned ABROAD, it is subject to BASIC TAX

• FINAL WITHHOLDING TAX – Under Final Withholding Tax System, the payee received

income NET of tax. The one liable for payment is the PAYOR, who shall remit the same to BIR.

FWT is only applicable to “certain” passive income as listed above, assuming the same are

earned WITHIN THE PHILIPPINES. (“Kung sino ang nag-withhold, siya ang mag-reremit”)

NOTE: “Certain” Passive income already subjected to FWT can NO LONGER BE SUBJECTED TO

BASIC TAX (hence NOT part of Taxable Income if already subject to FWT); if NOT SUBJECT TO

FWT, on the other hand, then such is the time where Passive Income can be subject to Basic

Tax (i.e. Interest Income from Foreign Banks)

1. INTEREST INCOME

✓ Income earned from DEBT SECURITIES/SIMILAR ARRANGEMENTS (i.e. Deposit Substitutes,

Long-Term Investments)

Interest Income from SHORT-TERM CURRENCY BANK DEPOSITS/DEPOSIT SUBSTITUTES

o “SHORT TERM” refers to a holding period of NOT MORE THAN FIVE YEARS.

o Currency Bank Deposits can be further classified into:

a) Currency Bank Deposits/Deposit Substitutes

b) Foreign Currency Deposit System

CURRENCY BANK DEPOSITS / DEPOSIT SUBSITUTES (in PHP Currency)

❖ i.e. PHP Accounts in BDO

❖ CURRENCY BANK DEPOSITS are deposits in Local Banks (i.e. BDO, BPI, etc.)

❖ DEPOSIT SUBSTITUTES are an alternative form of obtaining funds from the public OTHER THAN

deposits. It can be in the form of Government Debt Instruments such as T-Bills, T-Bonds, etc.

❖ USUALLY subject to 20% FWT (25% for NRA-NETB)

FOREIGN CURRENCY DEPOSIT SYSTEM (in currency OTHER THAN PHP)

❖ i.e. Dollar Accounts in BDO

❖ If under FCDS, there is NO LONG-TERM/SHORT-TERM DISTINCTION

❖ ONLY RESIDENTS (RA & RC) & NRA-NETB are subject to this tax (NONRESIDENTS, except

NRA-NETB, are EXEMPT FROM THIS TAX in order to BUILD UP DOLLAR RESERVES which would

be good for the economy of the country)

RESIDENTS (RC & RA) NONRESIDENTS (NRC & NRA-ETB) NRA-NETB

15%* EXEMPT 25%

*7.5% BEFORE January 1, 2018 (TRAIN Law)

CA5109 Income Taxation Reviewer

2A3

“NOT ALL interest income is subject to FWT~”

NOTE: Interest Income from NOTES RECEIVABLE & ACCOUNTS RECEIVABLE (NON-BANK institutions)

are NOT SUBJECT TO WITHHOLDING TAX (such interest is subject to BASIC TAX)

Interest Income from LONG-TERM DEPOSITS/INVESTMENT CERTIFICATE

❖ “LONG-TERM” refers to holding period of MORE THAN FIVE YEARS

❖ MAY BE EXEMPT FROM FWT ASSUMING ALL REQUISITES ARE MET: - Sec 22(F) of Tax Code

A. Depositor is an INDIVIDUAL CITIZEN – Corporations CANNOT AVAIL OF THIS

EXEMPTION

B. The investment certificate/LT deposit should be UNDER THE NAME OF THE INDIVIDUAL

(should NOT be under name of corporation/bank)

C. Must be in the form of savings, common or individual trust funds, deposit substitutes,

investment management accounts that are evidenced by BSP

D. Investments must be ISSUED BY BANKS ONLY and not by other financial institutions

(Interest income from investments in Insurance, Mutual Funds, etc. are NOT EXEMPT)

E. Maturity Period is MORE THAN FIVE YEARS

F. NO PRE-TERMINATION/TRANSFER BEFORE THE FIFTH YEAR by original investor

5-12-20 RULE if pre-terminated before fifth year:

HOLDING PERIOD WITHHOLDING TAX RATE

Less than 3 years 20%*

3 years – less than 4 years 12%

4 years – less than 5 years 5%

*if Holding Period is LESS THAN 3 YEARS, same tax as Short-Term Deposit (20% FWT

on ALL previous years interest income

❖ Pre-termination will subject ALL interest income earned from the BEGINNING OF THE

LONG-TERM DEPOSIT to Withholding Tax (retrospective application)

SUMMARY OF PRE-TERMINATION OF LONG-TERM DEPOSITS

CA5109 Income Taxation Reviewer

2A3

❖ NRA-NETBs CANNOT AVAIL of this exemption!!

2. DIVIDENDS

✓ Cash/Property Dividends ACTUALLY/CONSTRUCTIVELY received from a DOMESTIC

CORPORATION, Share from net income after tax of a PARTNERSHIP (except GPP), and share in

net income of an ASSOCIATION, JOINT VENTURE

✓ Dividends are USUALLY subject to:

PAYEE (Recipient)

PAYOR

RC, NRC, RA NRA-ETB NRA-NETB

Domestic Corporation 10% 20% 25%

Foreign Corporation BASIC TAX (RC only)* EXEMPT**

*RC is taxable WITHIN & WITHOUT PH

**All other classifications of taxpayer are taxable on income earned WITHIN PH ONLY

In summary, Dividends paid by:

DOMESTIC CORPORATION are subject to FWT (rates depend on classification of taxpayer)

FOREIGN CORPORATION are subject to BASIC TAX (assuming taxpayer is RC)

3. ROYALTIES

4. PRIZES & OTHER WINNINGS

PRIZES – usually A RESULT OF EFFORT (i.e. Prize from The Voice PH)

✓ IF MORE THAN P10,000, subject to 20% FWT (except NRA-NETB – 25%)

✓ IF LESS THAN OR EQUAL TO P10,000, subject to BASIC TAX (except NRA-NETB – 25%)

CA5109 Income Taxation Reviewer

2A3

WINNINGS – usually due to CHANCE (i.e. Winnings from PBB, Winnings from PCSO)

✓ OTHER WINNINGS, subject to 20% FWT regardless of amount (except NRA-NETB)

✓ PSCO/LOTTO WINNINGS,

o IF LESS THAN P10,000, EXEMPT

o IF MORE THAN P10,000, SUBJECT TO 20% FWT (except NRA-ETB (EXEMPT);

NRA-NETB (25%)

5. INFORMER’S REWARD

❖ SUBJECT TO 10% FINAL WITHHOLDING TAX

❖ Cash reward for may be given to any person INSTRUMENTAL IN DISCOVERY OF:

o Violations of National Internal Revenue Code (NIRC)

▪ The LOWER of 10% of revenues recovered OR P1,000,000

o Discovery and Seizure of Smuggled Goods

▪ The LOWER of 10% of FMV of smuggled goods OR P1,000,000

❖ REQUISITES FOR INFORMER REWARD:

1. Info must NOT BE IN POSSESSION OF BIR YET (hindi pa alam ng BIR)

2. Led to discovery of FRAUD

3. Enforcement results in REVENUES, SURCHARGES, AND/OR FEES BE ACTUALLY

RECOVERED (NO REVENUE COLLECTED = NO REWARD)

4. Informer MUST NOT BE:

o BIR official/employee

CA5109 Income Taxation Reviewer

2A3

o Other public official/employee

o Relative within the 6th degree of consanguinity of the above.

REGULAR INCOME

❖ Basic tax is used as a “filler” for income NOT SUBJECTED TO CGT & FWT

❖ There are three types of Earners of Regular/Ordinary Income:

o Individuals earning PURELY Compensation Income – employer-employee relationship

▪ LIABLE FOR INCOME TAX ONLY (No Business Tax)

o Individuals that are PURELY Self-Employed and/or Professional (SEP)

▪ LIABLE FOR INCOME TAX & BUSINESS TAX

o Mixed Income Earners

▪ LIABLE FOR INCOME TAX & BUSINESS TAX

TYPE OF REGULAR INCOME EARNER

TAX

Purely Compensation Purely SEP Mixed Income Earner

Income Taxes (based on YES YES YES

NET INCOME)

Business Taxes (based on NO* YES YES

GROSS SALES/RECEIPTS &

OTHER OPERATING

INCOME)

*NO BUSINESS TAX FOR PURELY COMPENSATION INCOME EARNER because they are simply

under an employer-employee relationship – option to be taxed at 8% is NOT AVAILABLE for Purely

Compensation Income Earners

8% OPTION IN LIEU OF BUSINESS TAX AND INCOME TAX

• This option is available only for PURELY SEPs & MIXED INCOME EARNERS (this is not available

for Purely Compensation Income Earners because they are NOT liable for Business Taxes)

• The 8% option is IN LIEU of Business Taxes & Income Taxes (imbes na dalawang taxes yung

babayaran mo, isang tax nalang which is 8%)

• Requirements for Availing 8% Tax Rate

1. GROSS SALES/RECEIPTS MUST NOT EXCEED the P3,000,000 VAT threshold

CA5109 Income Taxation Reviewer

2A3

o The taxpayer must NOT exceed P3,000,000 in Gross Sales/Receipts because once

exceeding such threshold, the taxpayer is already LIABLE FOR 12% VAT. Below the

P3,000,000 VAT threshold, the taxpayer is LIABLE FOR 3% PERCENTAGE TAX (SEC.

116, NIRC). Exceeding P3,000,000 VAT threshold means that taxpayer DOES NOT HAVE

THE OPTION TO BE TAXED AT 8%

o

2. Taxpayer must be NON-VAT REGISTERED

o If taxpayer is VAT-registered, he is ALREADY LIABLE FOR 12% VAT, REGARDLESS of his

gross sales/receipts. The option to be taxed at 8% is NOT AVAILABLE if taxpayer is

subject to VAT

3. Taxpayer does NOT ENGAGE IN VAT-EXEMPT SALES

4. Taxpayer is ONLY SUBJECT TO SEC. 116 PERCENTAGE TAX

o The option to be taxed at 8% is NOT AVAILABLE for taxpayers who are engaged in

certain businesses such as common carriers (Sec. 117 & 118), amusement – i.e. night

clubs, bars, PBA Games (Sec. 125), banking institutions (Sec. 122), etc. (refer to Other

Percentage Taxes)

5. Taxpayer signifies the option to be taxed at 8% IN FIRST QUARTER ITR (BIR Form

1701A). If NOT, the taxpayer is assumed to avail of the graduated tax rates (and as

such, still liable for BOTH business & income tax)

8% OPTION FOR PURELY SEPs

NOTES:

• IF GROSS SALES/RECEIPTS EXCEEDED P3.000,000 – NO OPTION TO BE TAXED AT 8%

• For PURELY SEPs, the first P250,000 of GROSS SALES/RECEIPTS is NOT TAXABLE because under

the 8% Option, they can NO LONGER AVAIL OF THE INCOME TAX EXEMPTION for the first

P250,000 because they would no longer pay income taxes separately.

CA5109 Income Taxation Reviewer

2A3

• As evident in the table above, assuming the taxpayer DID NOT OPT TO BE TAXED AT 8%, his

first P250,000 is EXEMPT, while the excess over P250,000 is the taxable amount. If the

taxpayer OPTED TO BE TAXED AT 8%, HINDI NYA MA-AAVAIL yung exemption na first P250,000

kasi hindi na siya liable for income tax separately (and business taxes).

• As such, “in-integrate” na yung first P250,000 exemption sa Tax Table sa 8% OPTION for Purely

SEPs para ma-avail pa rin nila yung first P250,000 tax exemption.

8% OPTION FOR MIXED INCOME EARNERS (MIEs)

• Mixed Income Earners have TWO SOURCES OF INCOME:

a) Compensation Income – NO OPTION to be taxed at 8%

b) Business/Professional Income – OPTION to be taxed at 8% is AVAILABLE

• Regardless of their choice, MIEs are STILL LIABLE FOR INCOME TAX FOR THEIR COMPENSATION

INCOME

• The option to be taxed at 8% is ONLY AVAILABLE FOR THEIR BUSINESS INCOME.

Graphical Illustration of

Mixed Income Earners’

8% Flat Rate

CA5109 Income Taxation Reviewer

2A3

• IMPORTANT: ALSO, hindi na “naka-integrate” yung P250,000 exemption sa 8% Flat Rate kasi

MA-AAVAIL NA YUNG FIRST P250,000 sa COMPENSATION INCOME PORTION. Unlike Purely SEPs

na HINDI NILA MA-AAVAIL YUNG FIRST P250,000 sa 8% Flat Rate kasi they do not have

compensation income, kaya “in-integrate” sa 8% yung P250,000 exemption. Pag dineduct pa

yung P250,000 sa 8% Flat Rate for MIEs, ma-dodoble yung tax exemption, which would be

unfavorable sa government.

BREACH OF VAT THRESHOLD DURING THE YEAR UNDER 8% OPTION

• Under RR-8-2018 dated January 25, 2018, assuming taxpayer opted to be taxed at 8% in his

first quarter ITR (BIR Form 1701A), and he BREACHES THE P3,000,000 VAT threshold during

the year, he will ALREADY BE LIABLE FOR INCOME TAX AND BUSINESS TAXES SEPARATELY

• INCOME TAX PORTION:

o Taxpayer shall be ALLOWED AN INCOME TAX CREDIT for all previous quarter payments

under the 8%

TOTAL INCOME TAX DUE (Graduated Rates)

(PREVIOUS QUARTER PAYMENTS UNDER 8%)

TOTAL INCOME TAX PAYABLE

• BUSINESS TAX PORTION:

o VAT shall be imposed PROSPECTIVELY

o 3% Percentage Tax will be imposed on the first P3,000,000

o 12% VAT will be imposed on the P3M EXCESS

o i.e. if the gross sales/receipts for the year is P6.5 Million:

▪ P3,000,000 x 3% Percentage Tax = P90,000

▪ P3,500,000 x 12% VAT = P420,000

▪ The total business tax due is P510,000

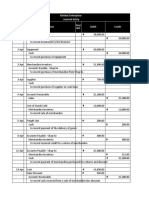

ILLUSTRATIVE PROBLEM (adapted from RR-8-2018) – Mixed Income Earners

Mr. MAG, a Financial Comptroller of JAB Company, earned annual compensation income in 2018 of

P1,500,000, inclusive of 13th month and other benefits in the amount of P120,000 but net of mandatory

contributions to SSS and PhilHealth. Aside from employment income, he owns a convenience store, with

gross sales of P2,400,000. His cost of sales and operating expenses are P1,000,000 and P600,000, and

with non-operating income of P100,000.

✓ His tax due for 2018 shall be computed as follows if he opted to be taxed at 8% income tax rate

on his gross sales for his income from business:

Total Compensation Income ₱ 1,500,000

Less: Non-taxable 13th month pay and other benefits (MAX) -90000

Taxable Compensation Income ₱ 1,410,000

Income Tax DUE:

1. On Compensation

On first P800,000 ₱ 130,000

On excess (P1,410,000 - P800,000) x 30% 180,000

Tax Due on Compensation Income ₱ 310,000

2. On Business Income

Gross Sales ₱ 2,400,000

Add: Non-Operating Income 100,000

CA5109 Income Taxation Reviewer

2A3

Taxable Gross Receipts/Sales 2,500,000

Multiply:Flat Rate 8%

Tax Due on Business Income ₱ 200,000

CREDITABLE WITHHOLDING TAXES

Final Withholding Tax vs Creditable Withholding Tax

Final Withholding Tax Creditable Withholding Tax

TAX WITHHELD AT SOURCE Method of collecting INCOME TAX IN ADVANCE

NOT deductible to income tax due DEDUCTIBLE to income tax due of taxpayer

Applicable to CERTAIN PASSIVE INCOME (i.e. Applicable to CERTAIN ORDINARY INCOME (i.e.

Interest, Dividends) Compensation, Professional Fees)

In order to further understand the distinguishment between the two, it is important to distinguish

between tax deduction vs tax credit

Gross Taxable Income

(Allowable Deductions)

Net Taxable Income

Graduated Rate

Tax DUE

(Tax Credit)

Tax PAYABLE

Creditable Withholding Tax is a DEDUCTION TO THE TAX DUE of the taxpayer. Hence, in problems, if

the income is reported NET OF CWT, you need to GROSS IT UP and report the same in GROSS AMOUNT

in the taxable income portion and report the tax credit as a CREDIT TO TAX DUE SEPARATELY

Creditable Withholding Tax is USUALLY APPLIED TO PURELY COMPENSATION INCOME EARNERS for

“Substituted Filing,” wherein taxpayers would NO LONGER HAVE TO FILE TAX RETURNS because the

employer ALREADY WITHHELD HIS TAX IN ADVANCE and REMITTED THE SAME TO BIR (Tax Due = Tax

Credit, hence NO TAX PAYABLE)

MAIN DIFFERENCE: FWT on Passive Income CANNOT BE USED AS A TAX CREDIT to tax liability of an

individual. Such is NOT TRUE for CWT on Certain Income which CAN BE USED AS A TAX CREDIT to tax

liability of an individual.

However, CWT is also applicable to CERTAIN PURCHASE OF GOODS, SERVICES, AND/OR RENTALS under

RR-11-2018:

CA5109 Income Taxation Reviewer

2A3

PROFESSIONAL FEES

Individual Payee (i.e. Sole Proprietorship)

o Gross income for the current year NOT GREATER THAN P3M – 5%

o Gross income for the current year GREATER THAN P3M – 10%

Non-Individual Payee (i.e. Corporations)

o Gross income for the current year NOT GREATER THAN P720,000 – 10%

o Gross income for the current year GREATER THAN P720,000 – 15%

*CWT rate depends upon payee’s (recipient) gross income for the current year. Payees are required to

submit a Sworn Statement of Declaration of Gross Income to ALL PAYORS. Once the payees breach the

P3M (for individuals) or P720,000 (for corporations) at any time during the years, payors shall

WITHHOLD THE HIGHER RATE after the point of the breach.

RENTALS – 5% (for properties USED IN BUSINESS)

GOODS – 1%

SERVICES– 2% (CERTAIN CONTRACTORS)

Income payments to beneficiaries of estates/trusts – 15%

Income payments to partners of GPP (same rate as NON-INDIVIDUAL PAYEES & SAME THRESHOLD)

OTHER NOTES:

o It is important for the PAYEE to secure BIR Form 2307 (for CWT) so that he may claim the tax

credit in order to reduce his tax liability

o Obligation to withhold is imposed upon BUYER but the BURDEN STILL FALLS ON THE

SELLER/PAYEE. Unjustifiable refusal by the latter is ground for mandatory audit of all internal

revenue liabilities

QUARTERLY TAX RETURNS

o Purely SEPs and MIXED INCOME EARNERS (being involved in business) are required to FILE

QUARTERLY RETURNS through BIR Form 1701Q)

1st Quarter May 15

2nd Quarter August 15 (45 days after end of Quarter)

3rd Quarter November 15 (45 days after end of Quarter)

Final adjusted/annual return April 15 of succeeding year

o Purely Compensation Income Earners, unlike the two above, are required ONLY TO FILE

ANNUALLY every April 15 of the following taxable year

o Prior quarterly payments CAN BE USED AS A TAX CREDIT for succeeding quarter, until the

ANNUAL RETURN in which payment for three previous quarters can be used as TAX CREDIT for

TAX PAYABLE

INCOME TAX FOR MARRIED TAXPAYERS

o Husband and wife shall compute SEPARATELY their individual income tax based on their

respective total taxable income

CA5109 Income Taxation Reviewer

2A3

o HOWEVER, if certain income CANNOT BE ATTRIBUTED EXCLUSIVELY TO EITHER OF THE

SPOUSES, the same shall be DIVIDED EQUALLY BETWEEN THE SPOUSES for the purpose of

determining their taxable income

ILLUSTRATIVE PROBLEM (adapted from CPA Reviewer in Taxation, Tabag)

Mr. and Mrs. Dela Cruz, both CPAs and residents of the Philippines, with 5 minor children, had the

following data for 2020 taxable year.

Salaries, Wife P1,200,000

13th month pay and other benefits 140,000

Professional Fees (net of 5% CWT) 1,710,000

Expenses – Practice of profession (15% nondeductible) 800,000

Rental Income (net of 5% CWT) 190,000

Rental Expenses 80,000

Other Income, Husband (20% non-taxable) 80,000

The taxable income of both can be computed as follows:

Husband Wife

Salaries 1,200,000

Excess of 13th month pay over tax exempt benefit (140k-90k) 50,000

Professional Fees (P1,710,000 / 95%)/2 900,000 900,000

Professional Expenses (P800,000 x 85%) / 2 -340,000 -340,000

Rental Income (P190,000 / 95%) / 2 100,000 100,000

Rental Expenses (P80,000) / 2 -40,000 -40,000

Other Income (P80,000 x 80%) 64,000 -

TAXABLE NET INCOME ₱684,000 ₱1,870,000

NOTES:

o The 13th month pay and other benefits is ONLY EXEMPT FOR THE FIRST P90,000. Any excess of

this amount is TAXABLE

o The professional fees and rental income were NET OF CWT. In determining taxable income, the

same shall be GROSSED UP because the tax credit is a DEDUCTION TO THE TAX DUE, NOT THE

TAXABLE INCOME

o As evident above, some items (i.e. Rent & Professional Income) are NOT ATTRIBUTABLE to

either of the spouses. As such, they are EQUALLY DIVIDED

o ONLY the deductible portion of professional expenses are divided between the spouses. The

same goes for the NON-TAXABLE portion of husband’s other income.

o In computing tax payable of both spouses, and applying the CWT:

Tax PAYABLE

1. Of Husband

On first P400,000 ₱ 30,000

Excess (P684,000-P400,000) x 25% 71,000

Tax DUE ₱ 101,000

CWT applicable (ALSO DIVIDED) -50,000

Tax PAYABLE of Husband ₱ 51,000

2. Of Wife

On first P800,000 ₱ 130,000

Excess (P1,870,000 - P800,000) x 30% 321,000

Tax DUE ₱ 451,000

CWT applicable (ALSO DIVIDED) -50,000

Tax PAYABLE of Wife ₱ 401,000

CA5109 Income Taxation Reviewer

2A3

CWT on Professional Fees P90,000

CWT on Rental Income 10,000

Total CWT of BOTH spouses P100,000

Divide: Two spouses 2

Total CWT of EACH SPOUSE P50,000

MINIMUM WAGE EARNERS, SENIOR CITIZENS AND PWDs

Statutory Minimum Wage

o Rate fixed by Regional Tripartite Wage and other concerned agencies regarding the minimum

wage for each region

o SMWs differ DEPENDING ON REGION and shall be the basis of exemption from income Tax

Minimum Wage Earner

o Worker in PRIVATE SECTOR paid the SMW; OR

o Worker in PUBLIC SECTOR with compensation income of NOT MORE THAN SMW in the non-

agricultural sector where he/she is assigned

o NOT AN MWE if paid MORE THAN THE SMW

o Purely MWE

➢ EXEMPT FROM INCOME TAXES & CREDITABLE WITHHOLDING TAXES

o MWE with “additional” COMPENSATION INCOME in excess of P90,000

➢ EXEMPT ONLY on SMW and P90,000 NON-TAXABLE PORTION

➢ EXCESS of P90,000 BENEFITS is TAXABLE (provided that the same and other excess

de minimis adds up to more than P250,000 – Graduated Rates on Tax Table)

o MWE with “additional” BUSINESS INCOME

➢ EXEMPT on SMW and P90,000 NON-TAXABLE PORITON

➢ EXCESS OF P90,000 BENEFITS IS TAXABLE

➢ Business Income is TAXABLE

Senior Citizens & PWDs

o Taxed in the SAME MANNER AS INDIVIDUAL TAXPAYERS (“Pay as you file ITR”)

o However, if SC or PWD has a gross income of LESS THAN P250,000 or an MWE, they shall be

EXEMPT FROM INCOME TAXES

o However, such income tax exemption DOES NOT EXEMPT THEM FROM FINAL WITHHOLDING

TAXES & CAPITAL GAINS TAXES, etc.

FILING OF INCOME TAX RETURNS

A. Basic Tax

o For PURELY COMPENSATION: April 15 (Annually) – BIR Form 1700

o For BUSINESS INCOME EARNERS (Purely SEPs & MIEs) – BIR Form 1701Q & BIR Form

1701A

1st Quarter May 15

2nd Quarter August 15 (45 days after end of Quarter)

3rd Quarter November 15 (45 days after end of Quarter)

Final adjusted/annual return April 15 of succeeding year

B. Final Withholding Tax on Passive Income

o For FWT (BIR Form 2316) and CWT (BIR Form 2307), return shall be filed and paid

NOT LATER than the last day of the month following the close of taxable year.

(JANUARY 31) – Beginning 2018

CA5109 Income Taxation Reviewer

2A3

C. Capital Gains Tax

o Shares of Stock

▪ Ordinary Return (BIR Form 1707) – WITHIN 30 days from sale

▪ Annual Return (BIR Form 1707A) – on or before April 15

o Real Property (BIR Form 1706)

▪ WITHIN 30 days from sale

❖ MANNER OF FILING

1. Manual Filing

2. Electronic Filing and Payment System (ePFS)

3. eBIR Forms

❖ PAYMENT – “Pay as you file”

o There is an option to PAY TAX IN TWO EQUAL ANNUAL INSTALLMENTS assuming that

tax due is MORE THAN P2,000

1st Installment: at the time of filing annual ITR

2nd Installment: ON or BEFORE OCTOBER 15

❖ PLACE OF FILING ITR

1. Authorized Agent Banks (AAB) of place where taxpayer is registered (RDO)

2. Revenue District Officer

3. Collection Agent

4. Duly Authorized City/Municipal Treasurer

❖ PERSONS REQUIRED/NOT REQUIRED TO FILE ITR

1. REQUIRED

a. Individuals engaged in business REGARDLESS OF RESULTS OF OPERATONS

b. Individuals with TWO OR MORE EMPLOYERS during taxable year

c. Individuals with two or more employers where tax was NOT WITHHELD CORECTLY

(tax due is NOT equal to tax withheld) resulting to COLLECTIBLE/REFUNDABLE

return

d. Individuals deriving other NON-BUSINESS RELATED INCOME (i.e. Capital Gains

Tax)

e. Individuals receiving PURELY COMPENSATION from a SINGLE EMPLOYER, the

income tax of which was WITHHELD CORRECTLY. However, SPOUSE IS REQUIRED

TO FILE ITR (NOT QUALIFIED for Substituted Filing if Spouse of Taxpayer is STILL

required to file ITR)

f. NRA-ETB deriving income in the PH (business/non-business related income)

2. NOT REQUIRED TO FILE ITR

a. MWEs or gross income during the year DID NOT EXCEED P250,000

b. Individuals qualified for SUBSTITUTED FILING

c. Individual whose SOLE INCOME has been subjected to final tax

❖ SUBSTITUTED FILING OF ITR – individual taxpayers may NO LONGER FILE ITR assuming

they meet ALL requirements:

a. PURELY COMPENSATION Income Earner (MUST NOT BE MIE or Purely SEP)

CA5109 Income Taxation Reviewer

2A3

b. Tax Due = Tax Withheld (CORRECTLY WITHHELD)

c. ONLY ONE EMPLOYER during the taxable year

d. If MARRIED, spouse must ALSO BE QUALIFIED FOR SUBSTITUTED FILING

REFERENCES:

Banggawan, R. (2019) Income Taxation: Laws, Principles, and Applications. Real Excellence Publishing

Tabag, E.D. (2020) CPA Reviewer in Taxation: With Special Topics and Properly Filled BIR Forms. EDT

Book Shop

Tabag, E.D., & Garcia, E.J. (2020) Income Taxation: With Special Topics and Properly Filled BIR Forms.

EDT Book Shop

CA5109 Income Taxation Reviewer

2A3

You might also like

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- 4 Sources of IncomeDocument16 pages4 Sources of IncomeRommel Espinocilla Jr.No ratings yet

- Introduction to Income TaxationDocument34 pagesIntroduction to Income TaxationKaryl Magno Pajaroja100% (1)

- Lumbera NotesDocument41 pagesLumbera Notesthinkbeforeyoutalk67% (3)

- Taxation ReviewerDocument6 pagesTaxation ReviewerNinaSharaBermudezReyesNo ratings yet

- Income Taxation Lesson 3Document6 pagesIncome Taxation Lesson 3DYLANNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Northern CPAR Chapter on Capital Gains TaxDocument11 pagesNorthern CPAR Chapter on Capital Gains TaxEarth PirapatNo ratings yet

- Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Income Taxation: Income Tax System Features of Philippine Income Tax LawDocument38 pagesIncome Taxation: Income Tax System Features of Philippine Income Tax LawTrisha MariaNo ratings yet

- Individual Income Tax GuideDocument15 pagesIndividual Income Tax GuideChristelle JosonNo ratings yet

- Black Panther Notes Income Taxation Part1Document27 pagesBlack Panther Notes Income Taxation Part1Malvin Aragon BalletaNo ratings yet

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Final Income TaxationDocument44 pagesFinal Income TaxationKimberly Ann Romero100% (2)

- Module 2 - Part 1Document6 pagesModule 2 - Part 1trixie maeNo ratings yet

- Introduction To Income TaxationDocument10 pagesIntroduction To Income TaxationKatrina MaglaquiNo ratings yet

- LUMBERA NOTES TAX SUPPLEMENTDocument67 pagesLUMBERA NOTES TAX SUPPLEMENTTan Concepcion & QueNo ratings yet

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- Income TaxationDocument10 pagesIncome Taxationjay arr s. mirandaNo ratings yet

- Module 1 Internal Revenue TaxesDocument11 pagesModule 1 Internal Revenue TaxesSophia De GuzmanNo ratings yet

- Income Taxation (F-L1)Document3 pagesIncome Taxation (F-L1)Trishia MariNo ratings yet

- Week 3 Income Taxation Individual TaxpayersDocument58 pagesWeek 3 Income Taxation Individual TaxpayersJulienne Untalasco100% (1)

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- Notes in Tax On Individuals 1. Income Subject To Tax and Types of TaxDocument7 pagesNotes in Tax On Individuals 1. Income Subject To Tax and Types of TaxAprilyn VidalNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- PH Income Tax: Types, Taxpayers, and Taxable PeriodsDocument84 pagesPH Income Tax: Types, Taxpayers, and Taxable PeriodsEric GarciaNo ratings yet

- Assignment No. 4Document7 pagesAssignment No. 4HannahPauleneDimaanoNo ratings yet

- Lesson 3 - Fundamentals of Income Taxation PDFDocument9 pagesLesson 3 - Fundamentals of Income Taxation PDFErika ApitaNo ratings yet

- CTT ReviewerDocument28 pagesCTT ReviewerAlexa Mae BuenafeNo ratings yet

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- CHAPTER 7Document7 pagesCHAPTER 7Chariess CasanovaNo ratings yet

- Tax 2Document38 pagesTax 2Richard AsentistaNo ratings yet

- Review TaxDocument2 pagesReview TaxRose May AdanNo ratings yet

- Return GuidelinesDocument13 pagesReturn GuidelinesHasan MurtazaNo ratings yet

- Original Issuance of Shares of Stocks: Documentary Stamp TaxDocument4 pagesOriginal Issuance of Shares of Stocks: Documentary Stamp TaxJohn Paul EslerNo ratings yet

- ACCO 20133 - UNIT IX - UpdatedDocument29 pagesACCO 20133 - UNIT IX - UpdatedHarvey AguilarNo ratings yet

- TX Chapter 2 PITDocument45 pagesTX Chapter 2 PITLinh LeNo ratings yet

- Lumbera The Tax QueenDocument29 pagesLumbera The Tax QueenKristine MagbojosNo ratings yet

- HQ03 - 6th BATCH - General Principles of Income TaxationDocument13 pagesHQ03 - 6th BATCH - General Principles of Income TaxationJimmyChaoNo ratings yet

- Individual Income TaxationDocument76 pagesIndividual Income TaxationRoronoa ZoroNo ratings yet

- Dealings in PropertyDocument1 pageDealings in PropertyRonnie TolentinoNo ratings yet

- HQ04 - Final Income TaxationDocument5 pagesHQ04 - Final Income TaxationJimmyChaoNo ratings yet

- Introduction of Income TaxDocument29 pagesIntroduction of Income TaxKathlyn PostreNo ratings yet

- DEDUCTION PRINCIPLES FOR BUSINESS INCOMEDocument30 pagesDEDUCTION PRINCIPLES FOR BUSINESS INCOMEyuliNo ratings yet

- Capital Assets - Any Other Assets That Does Not Fall Under The Definition of Ordinary AssetsDocument4 pagesCapital Assets - Any Other Assets That Does Not Fall Under The Definition of Ordinary Assetsdaenielle reyesNo ratings yet

- Income TaxationDocument31 pagesIncome TaxationJuanVictorNo ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Learn key income reporting principlesDocument15 pagesLearn key income reporting principlesRoligen Rose PachicoyNo ratings yet

- Individual Income Tax and Capital Gains Tax ExplainedDocument12 pagesIndividual Income Tax and Capital Gains Tax ExplainedJames GuiruelaNo ratings yet

- Taxation On Sale of Real PropertiesDocument9 pagesTaxation On Sale of Real PropertiesIsaac CursoNo ratings yet

- Final Income Tax RulesDocument8 pagesFinal Income Tax RulesJade Ivy GarciaNo ratings yet

- Lumbera NotesDocument7 pagesLumbera NotesElizabeth LotillaNo ratings yet

- Basis of Government’s right to impose tax on income: Partnership theoryDocument191 pagesBasis of Government’s right to impose tax on income: Partnership theoryRAPHNo ratings yet

- Principles of Business TaxationDocument20 pagesPrinciples of Business Taxation林木田No ratings yet

- Income Taxation Finals ReviewerDocument10 pagesIncome Taxation Finals ReviewerMichael SanchezNo ratings yet

- Tax 2 - Finals NotesDocument50 pagesTax 2 - Finals NotesAdi HernandezNo ratings yet

- FABM2 12 Q2 M5 Income and Business Taxation V5 PDFDocument19 pagesFABM2 12 Q2 M5 Income and Business Taxation V5 PDFLady Hara100% (1)

- Adobe Scan Oct 19, 2023Document7 pagesAdobe Scan Oct 19, 2023Renalyn Ps MewagNo ratings yet

- Account Statement From 30 Jun 2018 To 27 Jun 2019Document7 pagesAccount Statement From 30 Jun 2018 To 27 Jun 2019Chiranjibi Behera ChiruNo ratings yet

- Bank Reconciliation 1Document32 pagesBank Reconciliation 1MussaNo ratings yet

- Commissioner of Internal Revenue vs. Mirant Pagbilao CorporationDocument23 pagesCommissioner of Internal Revenue vs. Mirant Pagbilao CorporationToni LorescaNo ratings yet

- Allowing Foreign Vessels to Transport Domestic CargoesDocument6 pagesAllowing Foreign Vessels to Transport Domestic CargoesSa KiNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedPadamNo ratings yet

- Proforma Invoice: Xiamen 3plus Technology Co., LTDDocument3 pagesProforma Invoice: Xiamen 3plus Technology Co., LTDDavid PacoNo ratings yet

- Bank Reconciliation: Reconcile AccountsDocument19 pagesBank Reconciliation: Reconcile AccountsJaneth Bootan ProtacioNo ratings yet

- Plot No: 27, Road No:11, Marol Industrial Area, MIDC, Near Tunga Paradise, Andheri EastDocument1 pagePlot No: 27, Road No:11, Marol Industrial Area, MIDC, Near Tunga Paradise, Andheri Eastsunilsoni2No ratings yet

- 2015 NBFC Membership FormDocument1 page2015 NBFC Membership FormmatthewslodgeNo ratings yet

- Metro Health Patient Financial Brochure 2018Document2 pagesMetro Health Patient Financial Brochure 2018Kaylyn ReneeNo ratings yet

- Perlakuan Perpajakan, Kepabeanan, Dan Cukai Pada KekDocument3 pagesPerlakuan Perpajakan, Kepabeanan, Dan Cukai Pada KekKiki MiawNo ratings yet

- Fringe Benefits Test BankDocument12 pagesFringe Benefits Test BankAB Cloyd100% (1)

- BankDocument1 pageBankSaini VarunNo ratings yet

- N.I 138Document25 pagesN.I 138Nikit BaryaNo ratings yet

- Account Statement 1 Feb 2024 to 25 Mar 2024Document3 pagesAccount Statement 1 Feb 2024 to 25 Mar 2024mbuyimdlaminiacgNo ratings yet

- Scan 589 Mt-Amazon-Pay by Plate (39) - 4-24-2023 (Nko)Document78 pagesScan 589 Mt-Amazon-Pay by Plate (39) - 4-24-2023 (Nko)Wonder AgnesNo ratings yet

- Statement of Account: Transaction DetailsDocument4 pagesStatement of Account: Transaction Detailsshanil naiduNo ratings yet

- Kimkat Enterprise Journal Entry: Date Items Debit Credit Post RefDocument22 pagesKimkat Enterprise Journal Entry: Date Items Debit Credit Post RefGeorge Lubiano PastorNo ratings yet

- Basic Freeway Segments - F11 PDFDocument20 pagesBasic Freeway Segments - F11 PDFMichael RantungNo ratings yet

- Tugas Transportasi Kelompok ITS Ke-5Document144 pagesTugas Transportasi Kelompok ITS Ke-5Ningtyas ShabrinnaNo ratings yet

- Extended Warehouse Management - Flyer - ENDocument2 pagesExtended Warehouse Management - Flyer - ENsapabap403No ratings yet

- Especia Associates Business ProfileDocument13 pagesEspecia Associates Business ProfileHarshil GoyalNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleEliza Cortez Castro50% (2)

- Regional Gov Bank Efficiency GrowthDocument10 pagesRegional Gov Bank Efficiency GrowthBoy NormanNo ratings yet

- Explanation To Nte Unliquidated AdvancesDocument1 pageExplanation To Nte Unliquidated AdvancesGhyn CaladoNo ratings yet

- Account Statement From 1 Dec 2018 To 27 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Dec 2018 To 27 Mar 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBhaskar GoudNo ratings yet

- Delivery Service Invoice: May 15, 2021 Shipped FromDocument12 pagesDelivery Service Invoice: May 15, 2021 Shipped FromDanny Ernesto Bogado LòpezNo ratings yet

- 5010XXXXXX7049 A24c74af 30aug2019 TO 29sep2019 0432074581Document1 page5010XXXXXX7049 A24c74af 30aug2019 TO 29sep2019 0432074581Dhiraj MishraNo ratings yet

- Invoice: Pt. Citra Sarijaya MigasDocument1 pageInvoice: Pt. Citra Sarijaya MigasSehu ZyahputraNo ratings yet

- Calibration Invoice June 20-SignedDocument1 pageCalibration Invoice June 20-SignedDeepak Das0% (1)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet