Professional Documents

Culture Documents

Assignment

Assignment

Uploaded by

Mohd Saddam Saqlaini0 ratings0% found this document useful (0 votes)

2 views5 pagesOriginal Title

assignment (1)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views5 pagesAssignment

Assignment

Uploaded by

Mohd Saddam SaqlainiCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 5

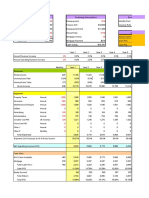

Forecast

Period

2011 2016 2017 2018 2019 2020

Balance Sheet Check OK OK OK OK OK OK

Assumptions

SCENARIO 1

Revenue Growth (% Change) 10.0% 10.0% 10.0% 10.0% 10.0%

Cost of Goods Sold (% of Revenue) 42.0% 47.0% 50.0% 36.0% 35.0%

Salaries and Benefits (% of Revenue) 17.0% 17.0% 17.0% 17.0% 17.0%

Rent and Overhead ($000's) 15,000 15,000

15,000 15,000 15,000

Depreciation & Amortization (% of PP&E) 35.0% 35.0% 35.0% 35.0% 35.0%

Interest (% of Debt) 10.0% 10.0% 10.0% 10.0% 10.0%

Tax Rate (% of Earnings Before Tax) 28.0% 28.0% 28.0% 28.0% 28.0%

Accounts Receivable (Days) 18 18 18 18 18

Inventory (Days) 80 90 100 100 100

Accounts Payable (Days) 37 37 37 37 37

Capital Expenditures ($000's) 15,000 15,000

15,000 15,000 15,000

Debt Issuance (Repayment) ($000's) - - (20,000) - -

Equity Issued (Repaid) ($000's) - - - - -

SCENARIO 2

Revenue Growth (% Change) 5.0% 4.5% 4.0% 3.5% 3.0%

Cost of Goods Sold (% of Revenue) 37.0% 37.0% 36.0% 36.0% 35.0%

Salaries and Benefits (% of Revenue) 17.0% 17.0% 17.0% 17.0% 17.0%

Rent and Overhead ($000's) 10,000 10,000

10,000 10,000 10,000

Depreciation & Amortization (% of PP&E) 40.0% 40.0% 40.0% 40.0% 40.0%

Interest (% of Debt) 5.0% 5.0% 5.0% 5.0% 5.0%

Tax Rate (% of Earnings Before Tax) 28.0% 28.0% 28.0% 28.0% 28.0%

Accounts Receivable (Days) 18 18 18 18 18

Inventory (Days) 73 73 73 73 73

Accounts Payable (Days) 37 37 37 37 37

Capital Expenditures ($000's) 15,000 15,000

15,000 15,000 15,000

Debt Issuance (Repayment) ($000's) - - (20,000) - -

Equity Issued (Repaid) ($000's) - - - - -

Historical Results

2011 2012 2013 2014 2015 2016

Balance Sheet Check OK OK OK OK OK OK

Income Statement

Reveneue 102,007 118,086 131,345 142,341 150,772

Cost of Goods Sold (COGS) 39,023 48,004 49,123 52,654 56,710

Gross Profit 62,984 70,082 82,222 89,687 94,062

Expenses

Salaries and Benefits 26,427 22,658 23,872 23,002 25,245

Rent and Overhead 10,963 10,125 10,087 11,020 11,412

Depreciation & Amortization 19,500 18,150 17,205 16,544 16,080

Interest 2,500 2,500 1,500 1,500 1,500

Total Expenses 59,390 53,433 52,664 52,066 54,237

Earnings Before Tax 3,594 16,649 29,558 37,622 39,825

Taxes 1,120 4,858 8,483 10,908 11,598

Net Earnings 2,474 11,791 21,075 26,713 28,227

Balance Sheet

Assets

Cash 67,971 81,210 83,715 111,069 139,550

Accounts Receivable 5,100 5,904 6,567 7,117 7,539

Inventory 7,805 9,601 9,825 10,531 11,342

Property & Equipment 45,500 42,350 40,145 38,602 37,521

Total Assets 126,376 139,065 140,252 167,319 195,951

Liabilities

Accounts Payable 3,902 4,800 4,912 5,265 5,671

Debt 50,000 50,000 30,000 30,000 30,000

Total Liabilities 53,902 54,800 34,912 35,265 35,671

Shareholder's Equity

Equity Capital 70,000 70,000 70,000 70,000 70,000

Retained Earnings 2,474 14,265 35,340 62,053 90,280

Shareholder's Equity 72,474 84,265 105,340 132,053 160,280

Total Liabilities & Shareholder's Equity 126,376 139,065 140,252 167,319 195,951

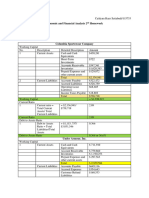

Forecast

2017 Period

2018 2019 2020

OK OK OK OK

Historical Results Forecast

Period

2011 2012 2013 2014 2015 2016 2017

Balance Sheet Check OK OK OK OK OK O O

K K

Cash Flow Statement

Operating Cash Flow

Net Earnings 2,474 11,791 21,075 26,713 28,227

Plus: Depreciation & Amortization 19,500 18,150 17,205 16,544 16,080

Less: Changes in Working Capital 9,003 1,702 775 903 827

Cash from Operations 12,971 28,239 37,505 42,354 43,480

Investing Cash Flow

Investments in Property & Equipment 15,000 15,000 15,000 15,000 15,000

Cash from Investing 15,000 15,000 15,000 15,000 15,000

Financing Cash Flow

Issuance (repayment) of debt - - (20,000) - -

Issuance (repayment) of equity 170,000 - - - -

Cash from Financing 170,000 - (20,000) - -

Net Increase (decrease) in Cash 167,971 13,239 2,505 27,354 28,480

Opening Cash Balance - 67,971 81,210 83,715 111,069

Closing Cash Balance 167,971 81,210 83,715 111,069 139,550

Supporting Schedules

Working Capital Schedule

Accounts Receivable 5,100 5,904 6,567 7,117 7,539

Inventory 7,805 9,601 9,825 10,531 11,342

Accounts Payable 3,902 4,800 4,912 5,265 5,671

Net Working Capital (NWC) 9,003 10,705 11,480 12,382 13,210

Change in NWC 9,003 1,702 775 903 827

Depreciation Schedule

PPE Opening 50,000 45,500 42,350 40,145 38,602

Plus Capex 15,000 15,000 15,000 15,000 15,000

Less Depreciation 19,500 18,150 17,205 16,544 16,080

PPE Closing 45,500 42,350 40,145 38,602 37,521

Debt & Interest Schedule

Debt Opening 50,000 50,000 50,000 30,000 30,000

Issuance (repayment) - - (20,000) - -

Debt Closing 50,000 50,000 30,000 30,000 30,000

Interest Expense 2,500 2,500 1,500 1,500 1,500

Forecast

Period

2018 2019 2020

OK OK OK

You might also like

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Soldier Statesman Peacemaker Leadership Lessons From George C MarshallDocument257 pagesSoldier Statesman Peacemaker Leadership Lessons From George C Marshallhanc_florin100% (1)

- 2021 LG Chem Consolidated Financial Statements enDocument113 pages2021 LG Chem Consolidated Financial Statements enAyushika SinghNo ratings yet

- Loan Modification CalculatorDocument4 pagesLoan Modification CalculatorElizabeth ThomasNo ratings yet

- Hotel Development Cash FlowDocument23 pagesHotel Development Cash FlowMohammed Abubakar HusainNo ratings yet

- Ballerina Tech Assumptions & SummaryDocument48 pagesBallerina Tech Assumptions & Summaryapi-25978665No ratings yet

- Financial Statement AND Ratio Analysis TablesDocument46 pagesFinancial Statement AND Ratio Analysis TablesRanjani KSNo ratings yet

- 7 Consolidation Package - TemplateDocument369 pages7 Consolidation Package - TemplateOUSMAN SEIDNo ratings yet

- Existing Building AnalysisDocument15 pagesExisting Building AnalysisAmir H.TNo ratings yet

- New Model of NetflixDocument17 pagesNew Model of NetflixPencil ArtistNo ratings yet

- 1) Template Detailed ModelDocument20 pages1) Template Detailed Modelabdul5721No ratings yet

- Capital Budgeting Analysis For Medical Services USA: Purpose of SpreadsheetDocument71 pagesCapital Budgeting Analysis For Medical Services USA: Purpose of SpreadsheetSalman FarooqNo ratings yet

- Walmart Inc. - Operating Model and Valuation - Cover Page and NavigationDocument24 pagesWalmart Inc. - Operating Model and Valuation - Cover Page and Navigationmerag76668No ratings yet

- Ch02 P14 Build A Model AnswerDocument4 pagesCh02 P14 Build A Model Answersiefbadawy1No ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- Understanding Skeleton Arguments (Important)Document6 pagesUnderstanding Skeleton Arguments (Important)Mackaya V. Oweya100% (1)

- Annual ReportDocument193 pagesAnnual ReportShafali R ChandranNo ratings yet

- Revised - Econ and Financial Analysis 2nd HomeworkDocument3 pagesRevised - Econ and Financial Analysis 2nd HomeworkcaitlynnsetiabudiNo ratings yet

- vAJ1-DCF Spreadsheet FreeDocument6 pagesvAJ1-DCF Spreadsheet FreesumanNo ratings yet

- Eqvista DCF Excel TemplateDocument6 pagesEqvista DCF Excel TemplateAntonio Cesar de Sa LeitaoNo ratings yet

- Ultra Tech Cement CreatingDocument7 pagesUltra Tech Cement CreatingvikassinghnirwanNo ratings yet

- Balance Sheet: Annual ReportDocument2 pagesBalance Sheet: Annual ReportekanshjiNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Executive Reporting PackageDocument50 pagesExecutive Reporting PackageArthsNo ratings yet

- CH 13Document14 pagesCH 13Trang VânNo ratings yet

- Serial NO. Case Name Facts DecisionDocument33 pagesSerial NO. Case Name Facts DecisionShweta TomarNo ratings yet

- Financial Feasibility of Product ADocument4 pagesFinancial Feasibility of Product AMuhammad AsadNo ratings yet

- 6banking - Eto TalagaDocument23 pages6banking - Eto TalagaRachel LeachonNo ratings yet

- Common Size Analysis TemplateDocument4 pagesCommon Size Analysis TemplateMuhammad FarooqNo ratings yet

- Simple Financial ModelDocument59 pagesSimple Financial Modelmincho4104No ratings yet

- 3 Statement Model: Strictly ConfidentialDocument13 pages3 Statement Model: Strictly ConfidentialLalit mohan PradhanNo ratings yet

- Concept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023From EverandConcept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023No ratings yet

- 6a02d65b A005 DCF Discounted Cash Flow ModelDocument8 pages6a02d65b A005 DCF Discounted Cash Flow ModelYeshwanth BabuNo ratings yet

- DCF Case Sample 1Document4 pagesDCF Case Sample 1Gaurav SethiNo ratings yet

- Use Excel Data Model To Manage Your Cashflow: Let's Get StartedDocument15 pagesUse Excel Data Model To Manage Your Cashflow: Let's Get StartedRandy FernandesNo ratings yet

- Business - Valuation - Modeling - Assessment FileDocument6 pagesBusiness - Valuation - Modeling - Assessment FileGowtham VananNo ratings yet

- Cumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowDocument173 pagesCumulative Cash Flow Discounted Cash Flow Cum Discounted Cash FlowAditi OholNo ratings yet

- Sensitivity Analysis in Excel TemplateDocument8 pagesSensitivity Analysis in Excel Templateuyenbp.a2.1720No ratings yet

- Discounted Cash FlowDocument43 pagesDiscounted Cash Flowsachin_ma09No ratings yet

- Boulder Utility 20-Year Cash Flow SummaryDocument2 pagesBoulder Utility 20-Year Cash Flow SummaryMatt SebastianNo ratings yet

- UST Labor Law CD - Re Application For Retirement of Judge Moslemen MacarambonDocument2 pagesUST Labor Law CD - Re Application For Retirement of Judge Moslemen MacarambonAnne MacaraigNo ratings yet

- Bus Plan InfinitySolutionsDocument9 pagesBus Plan InfinitySolutionsSamgse91No ratings yet

- Testate Estate of Ramirez v. Vda. de Ramirez, G.R. No. L-27952, (February 15, 1982), 197 PHIL 647-656)Document8 pagesTestate Estate of Ramirez v. Vda. de Ramirez, G.R. No. L-27952, (February 15, 1982), 197 PHIL 647-656)yasuren2No ratings yet

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- M&a Case Study SolutionDocument3 pagesM&a Case Study SolutionSoufiane EddianiNo ratings yet

- Policy Study For PNP MC 2017-048aDocument6 pagesPolicy Study For PNP MC 2017-048avrito_1100% (3)

- Use Excel Data Model To Manage Your Cashflow: Let's Get StartedDocument15 pagesUse Excel Data Model To Manage Your Cashflow: Let's Get StarteddeepakmeharNo ratings yet

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Model 2 Feb 05 V7.0 BlankDocument19 pagesModel 2 Feb 05 V7.0 BlanknicoweissNo ratings yet

- Debt Service Coverage Ratio TemplateDocument1 pageDebt Service Coverage Ratio TemplateGolamMostafaNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- Mighty Digits - Cash Out Dashboard KPeE5DGDocument6 pagesMighty Digits - Cash Out Dashboard KPeE5DGHilyah AuliaNo ratings yet

- WWW Wallstreetmojo Com Financial Modeling in Excel Popmake 95356Document20 pagesWWW Wallstreetmojo Com Financial Modeling in Excel Popmake 95356shashankNo ratings yet

- The Handbook of Financial Modeling: Printed BookDocument1 pageThe Handbook of Financial Modeling: Printed BookThanh NguyenNo ratings yet

- Coker Depreciation CalculatorDocument6 pagesCoker Depreciation CalculatorOmar ChaudhryNo ratings yet

- WhirlpoolDocument18 pagesWhirlpoolSaleemleem2qNo ratings yet

- ch02 PenmanDocument31 pagesch02 PenmansaminbdNo ratings yet

- Sensitivity Analysis TableDocument3 pagesSensitivity Analysis TableBurhanNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- Master BudgetDocument23 pagesMaster BudgetAryanNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- 1-Compare The Characteristic of Islamic Accounting Versus ConventionalDocument13 pages1-Compare The Characteristic of Islamic Accounting Versus ConventionalHafiz BajauNo ratings yet

- Ratio Analysis Using The DuPont ModelDocument10 pagesRatio Analysis Using The DuPont ModelDharini Raje SisodiaNo ratings yet

- A Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBAFrom EverandA Fast Track to Structured Finance Modeling, Monitoring, and Valuation: Jump Start VBARating: 3 out of 5 stars3/5 (1)

- Massachusetts Inmate Search Department of Corrections LookupDocument4 pagesMassachusetts Inmate Search Department of Corrections LookupinmatesearchinfoNo ratings yet

- TORTS MTG 5Document28 pagesTORTS MTG 5KarinNo ratings yet

- Prasnik Case Rule 99Document3 pagesPrasnik Case Rule 99Kring de VeraNo ratings yet

- UC4Document16 pagesUC4preethamsap82No ratings yet

- Essential RightDocument42 pagesEssential Righthamada3747No ratings yet

- BailmentDocument47 pagesBailmentGaurav SokhiNo ratings yet

- Universal Basic Income in India: A Policy AnalysisDocument3 pagesUniversal Basic Income in India: A Policy AnalysisARVIND MALLIKNo ratings yet

- 1st Que AnswerDocument4 pages1st Que AnswerTuraga PraneethaNo ratings yet

- Lowercase Alphabet On Two Lines PDFDocument27 pagesLowercase Alphabet On Two Lines PDFJason BrewerNo ratings yet

- Introduction To International Law: Prepared byDocument35 pagesIntroduction To International Law: Prepared bySunshine GarsonNo ratings yet

- Brief Description of Your Tuck ShopDocument12 pagesBrief Description of Your Tuck ShopKąlřőő Ãàmîŕ100% (2)

- Vol - CXXV-No .103Document80 pagesVol - CXXV-No .103Dummy AccountNo ratings yet

- Intel® Desktop Board DP45SG: Specification UpdateDocument8 pagesIntel® Desktop Board DP45SG: Specification UpdateRaphascovarNo ratings yet

- Madhuku, L. Law, Politics, and The Land Reform Process (Book Chapter)Document28 pagesMadhuku, L. Law, Politics, and The Land Reform Process (Book Chapter)lesley chirangoNo ratings yet

- URACDocument30 pagesURACPatrich Jerome LeccioNo ratings yet

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNo ratings yet

- Rhetorical Essay Prompt and Brainstorming SheetDocument4 pagesRhetorical Essay Prompt and Brainstorming SheetTYREE CARRNo ratings yet

- Wisconsin Law Journal - October 2015Document48 pagesWisconsin Law Journal - October 2015Michael DuntzNo ratings yet

- Cobalt Safety Data SheetDocument8 pagesCobalt Safety Data SheetAMIT GUPTANo ratings yet

- Pagdi Property & Taxation Issues On Transfer, Surrender & RedevelopmentDocument11 pagesPagdi Property & Taxation Issues On Transfer, Surrender & Redevelopmentrolaril797No ratings yet

- La Sicología Femenil en La Obra...Document18 pagesLa Sicología Femenil en La Obra...Leidy ZamaraNo ratings yet

- Manual Book Daihatsu Hijet 1000: 11.pdf 152 PDFDocument16 pagesManual Book Daihatsu Hijet 1000: 11.pdf 152 PDFAnton Seroja SaniNo ratings yet

- AL REEF 2 SEWA BILL APR 2024Document1 pageAL REEF 2 SEWA BILL APR 2024minedataNo ratings yet