Professional Documents

Culture Documents

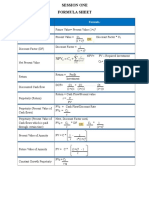

Formule Blad CME: C (N K) +W + +W +W + +W I 1 M M

Uploaded by

Lente ChristanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formule Blad CME: C (N K) +W + +W +W + +W I 1 M M

Uploaded by

Lente ChristanCopyright:

Available Formats

Formule Blad CME

Indexing

C n=C k

()

In

Ik

k =¿ reference year for which cost or price is known

n=¿ year for which cost or price is to be estimated (n> k )

C n=¿ estimated cost or price of item in year n

C k =¿ known cost or price of item in reference year k

I n=

W1 ( ) ( )

Cn 1

Ck 1

+W 2

Cn2

Ck 2

+ …+W M

CnM

C kM( ) ∗I k

W 1 +W 2 +…+W M

M =¿ total number of items in the index ( 1 ≤m ≤ M )

C n=¿ cost or price of the mth item in year n

C k =¿ cost or price of the mth item in reference year k

W m =¿ weight assigned to the m th item

I k =¿ composite index value in year k

Power-sizing technique

( )

X

SA

C A=C B

SB

C A=¿ cost of plant A

C B=¿ cost of plant B

S A =¿ size of plant A

S B=¿ size of plant B

X =cost−capacityfactor

Learning curve estimation

lnu

Zu =K ( u )=K s

n ln2

u=¿ output unit number

Zu =¿ number of input units needed to produce output unit u

K=¿ number of unput units needed to produce the first output unit

s=¿ the learning curve slop parameter as a decimal

ln s

n= =¿ learning curve exponent

ln 2

Factor technique

C=∑ C d + ∑ f m U m

d m

C=¿ cost being estimated

C d=¿ cost of the selected component d estimated directly

f m=¿ cost per unit of component m

U m =¿ number of units of component m

Lang Factor technique

n

C TM =F Lang ∑ C p ,i

i=1

C TM =¿ capital cost of the extension

C p .i=¿ purchased cost for the major equipment components

n=¿ total number of individual units

F Lang=¿ Lang Factor

Present and future value of a single cash flow

N F

F=P ( 1+i ) ↔ P=

( 1+i )N

Future value of annuity

F= A [ ( 1+ i) N −1

i ] (

=A

F

A

,i % , N )

Present value of annuity

P= A

[

( 1+i )N −1

i ( 1+i )

N

=A

P

A],i% ,N( )

i=¿ effective interest rate per interest period

N=¿ number of compounding (interest) periods

P=¿ present value of money; equivalent value of one or more cash flows today

F=¿ future amount of money; equivalent value of one or more cash flows at a point in the future

A=¿ end-of-period cash flows in a uniform series continuing for a certain number of periods

Risk premium

( R S−R F ) =β S ( R M −R F )

Required return on equity (no debt)

e a=R S=R F + β S ( R M −R F )

Effective interest rate

( ) −1

M

r

i= 1+

M

r =¿ be the nominal, annual interest rate per year

M =¿ the number of compounding periods per year (end of the period payment)

i=¿ the effective interest per year

Effective rate for the modelling period

i m= √(1+i)−1

X

i m=¿ effective rate for the modelling period

X =¿ modelling periods per compounding period

i=¿ effective rate

You might also like

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Calculating Present and Future Values of Cash FlowsDocument3 pagesCalculating Present and Future Values of Cash FlowsjainswapnilNo ratings yet

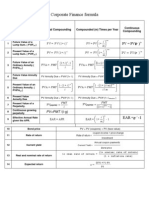

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Engineering formulas guide for financial analysisDocument4 pagesEngineering formulas guide for financial analysisJeff JabeNo ratings yet

- FINANCIAL FORMULA SHEETDocument4 pagesFINANCIAL FORMULA SHEETSameer SharmaNo ratings yet

- NotesDocument5 pagesNotesfiseco4756No ratings yet

- INDEX in ENG EconomicsDocument4 pagesINDEX in ENG EconomicsMark SmithNo ratings yet

- Inverse Trigonometric Functions (Trigonometry) Mathematics Question BankFrom EverandInverse Trigonometric Functions (Trigonometry) Mathematics Question BankNo ratings yet

- E ENGINEERING ECONOMICS ReviewDocument16 pagesE ENGINEERING ECONOMICS ReviewJM CopinoNo ratings yet

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- FM (Actuary Exam) FormulasDocument15 pagesFM (Actuary Exam) Formulasmuffinslayers100% (1)

- Corporate Finance Formula SheetDocument5 pagesCorporate Finance Formula SheetChan Jun LiangNo ratings yet

- Engineering Economics Formula SheetDocument2 pagesEngineering Economics Formula Sheetmani123975% (4)

- R M R M R M R M: Time Value of MoneyDocument8 pagesR M R M R M R M: Time Value of MoneyHenry JiangNo ratings yet

- 17 Engineering EconomicsDocument7 pages17 Engineering EconomicsM Hadianto WaruwuNo ratings yet

- Engineering Economy - Lecture6Document40 pagesEngineering Economy - Lecture6Aly Bueser75% (4)

- Engineering Economy Lecture6Document40 pagesEngineering Economy Lecture6Jaed CaraigNo ratings yet

- Quiz 1 FormulasDocument2 pagesQuiz 1 FormulasCristina Beatrice MallariNo ratings yet

- Engineering Econ Factor TablesDocument7 pagesEngineering Econ Factor TablesZeJun ZhaoNo ratings yet

- Economics-3 1Document15 pagesEconomics-3 1hannah mae tabanaoNo ratings yet

- Time Value of Money Formulas SheetDocument1 pageTime Value of Money Formulas SheetBilal HussainNo ratings yet

- List of Corporate Finance FormulasDocument9 pagesList of Corporate Finance FormulasYoungRedNo ratings yet

- Mathematics of Investment FormulaDocument23 pagesMathematics of Investment FormulaFatima Ira ArcillaNo ratings yet

- Formula Sheets-GDBA505 – must be returned after exam < 40Document3 pagesFormula Sheets-GDBA505 – must be returned after exam < 40FLOREAROMEONo ratings yet

- Financial Statement Analysis RatiosDocument4 pagesFinancial Statement Analysis RatiosSumeet DekateNo ratings yet

- Depreciation, Capital Recovery and Break Even AnalysisDocument6 pagesDepreciation, Capital Recovery and Break Even AnalysisMa. Angeline GlifoneaNo ratings yet

- Session One FormulasDocument1 pageSession One FormulasSalarAliMemonNo ratings yet

- Fins1613 FormulasDocument7 pagesFins1613 FormulasEllia ChenNo ratings yet

- Important financial formulasDocument5 pagesImportant financial formulasKhalil AkramNo ratings yet

- CH 2Document6 pagesCH 2Hemant GoyalNo ratings yet

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Lec No 2Document23 pagesLec No 2engbabaNo ratings yet

- Marjorie ArevaloDocument22 pagesMarjorie ArevaloFrancis CayananNo ratings yet

- Guide To Engineering EconomicsDocument94 pagesGuide To Engineering Economicsagricultural and biosystems engineeringNo ratings yet

- P/ F, I%, NDocument3 pagesP/ F, I%, NCheerag DuggalNo ratings yet

- FNCE 623 Formulae For Mid Term ExamDocument3 pagesFNCE 623 Formulae For Mid Term Examleili fallahNo ratings yet

- ECON 211 Notes 10 19 23Document4 pagesECON 211 Notes 10 19 23Christine Joy RemegioNo ratings yet

- Economics-1 1Document11 pagesEconomics-1 1hannah mae tabanaoNo ratings yet

- D464 Formula SheetDocument13 pagesD464 Formula Sheetyomaira.bastidas.ysNo ratings yet

- ENGINEERING ECONOMICS FORMULASDocument7 pagesENGINEERING ECONOMICS FORMULASChris PecasalesNo ratings yet

- Engineering EconomicsDocument14 pagesEngineering EconomicsGeraldNo ratings yet

- FNCE Cheat Sheet Midterm 1Document1 pageFNCE Cheat Sheet Midterm 1carmenng1990No ratings yet

- Simple Interest and Depreciation FormulasDocument5 pagesSimple Interest and Depreciation FormulasBea Abesamis100% (1)

- Mathematical and Statistical Technique Sem IIDocument150 pagesMathematical and Statistical Technique Sem IIPriti BejadiNo ratings yet

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocument5 pagesAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNo ratings yet

- York University midterm finance formula sheetDocument2 pagesYork University midterm finance formula sheetleafsfan85No ratings yet

- Depreciation: Definition of TermsDocument6 pagesDepreciation: Definition of TermsGlyzel DizonNo ratings yet

- Lecture 2 - How Time and Interest Affect MoneyDocument50 pagesLecture 2 - How Time and Interest Affect MoneyDanar AdityaNo ratings yet

- Notes by RK SirDocument80 pagesNotes by RK SirMriduNo ratings yet

- ECONOMICSDocument12 pagesECONOMICSJenielle SisonNo ratings yet

- ENGINEERING ECONOMICS FACTOR TABLEDocument7 pagesENGINEERING ECONOMICS FACTOR TABLEJonathan Garcia GomezNo ratings yet

- Midterm MathDocument4 pagesMidterm MathTuong TranNo ratings yet

- Credit Management - A Conceptual FrameworkDocument30 pagesCredit Management - A Conceptual Frameworkeknath20000% (1)

- Study On Vehicle Loan Disbursement ProceDocument11 pagesStudy On Vehicle Loan Disbursement ProceRuby PrajapatiNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Economics of Money Banking and Financial Markets 9th Edition Mishkin Test BankDocument27 pagesEconomics of Money Banking and Financial Markets 9th Edition Mishkin Test BankĐỗ Ngọc Huyền Trang100% (1)

- AFAR-02 (Partnership Dissolution & Liquidation)Document13 pagesAFAR-02 (Partnership Dissolution & Liquidation)Maricris AlilinNo ratings yet

- Audited Financial Statements Airlines 2021Document60 pagesAudited Financial Statements Airlines 2021VENICE OMOLONNo ratings yet

- Risk and Return AnalysisDocument64 pagesRisk and Return AnalysisHASIRNo ratings yet

- Monetary and Fiscal Policy in SpainDocument9 pagesMonetary and Fiscal Policy in SpaintunacobankingNo ratings yet

- Fundamentals of Investing: Fourteenth Edition, Global EditionDocument47 pagesFundamentals of Investing: Fourteenth Edition, Global EditionFreed DragsNo ratings yet

- Q & A IntaccDocument9 pagesQ & A IntaccAramina Cabigting BocNo ratings yet

- Role of Financial IntermediariesDocument8 pagesRole of Financial Intermediariesashwini.krs80No ratings yet

- "What Is " ا: َب ِّ رلا " (THE RIBA) ?Document11 pages"What Is " ا: َب ِّ رلا " (THE RIBA) ?Zaki AlattarNo ratings yet

- Sanctioned: Tractor Loan for Rs. 309400Document3 pagesSanctioned: Tractor Loan for Rs. 309400Shaik Chand BashaNo ratings yet

- Liabilitas PerusahaanDocument2 pagesLiabilitas Perusahaan21. Syafira Indi KhoirunisaNo ratings yet

- Corporate Financial Management IntroDocument17 pagesCorporate Financial Management IntroADEYANJU AKEEMNo ratings yet

- Camille - Deyong@okstate - Edu: IEM 3503 - Engineering Economic Analysis Course Syllabus - Spring 2019 IDocument5 pagesCamille - Deyong@okstate - Edu: IEM 3503 - Engineering Economic Analysis Course Syllabus - Spring 2019 IehecatlNo ratings yet

- Bec Su8 MCQDocument51 pagesBec Su8 MCQyejiNo ratings yet

- BSBFIM601 Full Learner ResourceDocument130 pagesBSBFIM601 Full Learner ResourceJazz100% (1)

- Franchise and LTCCDocument4 pagesFranchise and LTCCAngela Marie PenarandaNo ratings yet

- NBP KhurramDocument80 pagesNBP KhurramMRasul SalafiNo ratings yet

- BOP Category GuideDocument29 pagesBOP Category GuidePaul JohnNo ratings yet

- Emerging Market Carry Trade ChangedDocument7 pagesEmerging Market Carry Trade ChangedYinghong chen100% (2)

- 4 Sec 186 Laons InvestmentsDocument7 pages4 Sec 186 Laons InvestmentsKumar SwamyNo ratings yet

- Financial Environment PDFDocument11 pagesFinancial Environment PDFnira_110100% (3)

- TVM Chapter 04 Introduction to ValuationDocument6 pagesTVM Chapter 04 Introduction to ValuationLana LoaiNo ratings yet

- Asset and Liability Management in Indian BanksDocument27 pagesAsset and Liability Management in Indian BanksmeenakshisumanNo ratings yet

- Billingstatement - Primo R. JulianesDocument2 pagesBillingstatement - Primo R. JulianesMaria Judith Peña Julianes100% (1)

- Financial Ratio Analysis of Kotak Mahindra BankDocument106 pagesFinancial Ratio Analysis of Kotak Mahindra BankVarun JainNo ratings yet

- FIM Chapter 4Document16 pagesFIM Chapter 4Surafel BefekaduNo ratings yet

- Assignment-1 MATH 371 (Fall 2018)Document5 pagesAssignment-1 MATH 371 (Fall 2018)umar khanNo ratings yet