Professional Documents

Culture Documents

ACCTG1 Chapter 6

Uploaded by

Mark Kevin JavierOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCTG1 Chapter 6

Uploaded by

Mark Kevin JavierCopyright:

Available Formats

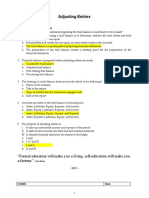

PART IV

ADJUSTING AND CLOSING THE ACCOUNTS

Chapter 6: Adjusting the Accounts

Objectives

discuss the types of adjusting entries

define worksheet

prepare adjusting entries

Worksheet Definition

It is a working paper used in accounting to facilitate the preparation of adjusting entries, financial statements, closing

entries and post- closing trial balance.

Definition of Adjusting Entries

These are journal entries made usually at the end of the accounting period to correct the balances of some accounts.

2 GROUPS OF ADJUSTING ENTRIES

1. ACCRUALS 2. DEFERRALS

TYPES OF ADJUSTING ENTRIES:

1. Adjusting entry to take up unrecorded or accrued income

2. Adjusting entry to take up unrecorded or accrued expense

3. Adjusting entry to take up bad debts

4. Adjusting entry to take up depreciation

5. Adjusting entry to take up earned revenue as income and unearned revenue as liability

6. Adjusting entry to take up unexpired cost as asset and expired cost as expense

7. Adjusting entry to take up inventory at the end

Methods of Recording or Accounting (in general):

1. Accrual basis

It is a method of recording wherein income is recorded when earned regardless of when cash is collected or

received, while expenses are recorded when incurred regardless of when cash is paid.

2. Cash basis

It is a method of recording wherein income is recorded when cash is received, while expenses are recorded

when cash is paid.

Methods of Recording Income:

1. Income Method

2. Liability Method

Methods of Recording Expense:

1. Expense Method

2. Asset Method

Classification of Accounts that are Usually Adjusted:

1. Bad Debts/Doubtful Accounts

These refer to the amount of Accounts Receivable that may not be collected for the period.

This account is classified as expense and presented in the Income Statement.

2. Allowance for Bad Debts or Allowance for Doubtful Accounts

This account is classified as a contra-asset account and is deducted from Accounts Receivable.

This account is presented in the Statement of Financial Position.

3. Depreciation

This refers to the lowering of value (for a particular period) of property, plant and equipment (except land) due to

constant use or passage of time.

This account is classified as expense and is presented in the Income Statement.

4. Accumulated Depreciation

This is classified as a contra-asset account and is deducted from property, plant and equipment (building,

machineries, vehicle, equipment, etc.)

This account is presented in the Statement of Financial Position.

5. Prepaid Expense

This account is classified as asset and is presented in the Statement of Financial Position.

6. Accrued Income

This account if classified as asset and is presented in the Statement of Financial Position.

7. Unearned Income

This account is classified as liability and is presented in the Statement of Financial Position.

8. Accrued Expense

This account is classified as liability and is presented in the Statement of Financial Position.

PRO-FORMA ENTRIES FOR ADJUSTING ENTRIES:

1. Unrecorded or Accrued Income:

_________Receivable xxxx

__________ Income xxxx

2. Unrecorded or Accrued Expense:

_________ Expense xxxx

__________Payable xxxx

3. Bad Debts:

Bad Debts xxxx

Allowance for Bad Debts xxxx

4. Depreciation:

Depreciation Expense xxxx

Accumulated Depreciation xxxx

5. Merchandise Inventory at the end:

Merchandise Inventory, Dec. 31, ______ xxxx

Income Summary xxxx

6. Prepaid Expense Using Asset Method:

_________ Expense xxxx

Prepaid _____ Expense xxxx

7. Prepaid Expense Using Expense Method:

Prepaid_______ Expense xxxx

________Expense xxxx

8. Unearned Income Using Income Method:

__________ Income xxxx

Unearned ________ Income xxxx

9. Unearned Income Using Liability Method:

Unearned ________ Income xxxx

_________ Income xxxx

Illustrative Problem:

Prepare the necessary adjusting entries for Ben Trading, for the year ended December 31, 2015.

1. Interest Income on Notes Receivable amounting to P500 remained unrecorded and uncollected.

2. Commission Income amounting to P2,000 remained unrecorded and uncollected.

3. Interest Expense on Notes Payable amounting to P1,000 remained unrecorded and unpaid.

4. Rent Expense amounting to P6,000 remained unrecorded and unpaid.

5. Of the Accounts Receivable of P300,000, 1% may be uncollectible.

6. Furniture and Equipment costing P105,000, has residual value (scrap value) of P5,000 and estimated useful life of 10

years. Compute depreciation for the year.

7. Merchandise Inventory on hand on December 31, 2015 amounts to P8,000.

Adjusting Entries

2015 Account Titles and Explanation Debit Credit

Dec. 31 Interest Receivable 500

Interest Income 500

-to take up unrecorded Interest Income

31 Commission Receivable 2,000

Commission Income 2,000

-to take up unrecorded Commission Income

31 Interest Expense 1,000

Interest Payable 1,000

-to take up unrecorded Interest Expense

31 Rent Expense 6,000

Rent Payable 6,000

-to take up unrecorded Rent Expense

31 Bad Debts Expense (300,000 x 0.01) 3,000

Allowance for Bad Debts 3,000

-to take up Bad Debts Expense

31 Depreciation Expense 10,000

Cost – Residual Value = 105,000 - 5,000

Estimated Useful Life = 10 years

Accumulated Depreciation 10,000

-to take up Depreciation Expense

31 Merchandise Inventory, December 31 8,000

Income Summary Account 8,000

-to take up ending inventory

You might also like

- Adjusting - Entries Lecture - 1014647190Document5 pagesAdjusting - Entries Lecture - 1014647190Ashera MonasterioNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting EntriesSeri CrisologoNo ratings yet

- Unit 3: Completion of The Accounting Cycle For A Merchandising BusinessDocument8 pagesUnit 3: Completion of The Accounting Cycle For A Merchandising BusinessChristine Joyce MagoteNo ratings yet

- Adjusting Entries IllustrationsDocument3 pagesAdjusting Entries IllustrationsHeeseung LeeNo ratings yet

- Accounting 1&2 ReviewerDocument6 pagesAccounting 1&2 Reviewerben tenNo ratings yet

- ACT103 - Topic 5Document4 pagesACT103 - Topic 5Juan FrivaldoNo ratings yet

- Receivables - AccountingDocument11 pagesReceivables - AccountingDairymple MendeNo ratings yet

- Module 2 - Merchandising Concern-Completing The Accounting CycleDocument26 pagesModule 2 - Merchandising Concern-Completing The Accounting Cycledimolangalam5No ratings yet

- The Accounting Process-A ReviewDocument11 pagesThe Accounting Process-A ReviewLeoreyn Faye MedinaNo ratings yet

- M7C Adjusting Process Prepaid ExpensesDocument8 pagesM7C Adjusting Process Prepaid ExpensesCharles Eli AlejandroNo ratings yet

- Chapter 7777Document10 pagesChapter 7777nimnimNo ratings yet

- Module 4Document67 pagesModule 4Chicos tacos100% (3)

- FOW 9 - PA - Notes Session 2Document15 pagesFOW 9 - PA - Notes Session 223006022No ratings yet

- Review On Basic Accounting: Universidad de Sta. IsabelDocument4 pagesReview On Basic Accounting: Universidad de Sta. IsabelRegina BengadoNo ratings yet

- Lecture Notes Adjusting EntriesDocument20 pagesLecture Notes Adjusting EntriesBRENT DECHERY LOPEZ BARCONo ratings yet

- Accrued Expense Depreciation: Asset Method: - Expense XXXDocument2 pagesAccrued Expense Depreciation: Asset Method: - Expense XXXJennilou AñascoNo ratings yet

- AE 101 Module 3 Lesson 3Document13 pagesAE 101 Module 3 Lesson 3Arly Kurt TorresNo ratings yet

- Accounts Notes Grade 11Document47 pagesAccounts Notes Grade 11Jordan Mulenga100% (1)

- Lesson 1 - Adjusting Entries 2 - Worksheet With Adjustments 3 - Financial Statements 4 - Closing Entries and Post-Closing Trial BalanceDocument40 pagesLesson 1 - Adjusting Entries 2 - Worksheet With Adjustments 3 - Financial Statements 4 - Closing Entries and Post-Closing Trial BalanceAngel LuzlesNo ratings yet

- ADJUSTING ENTRIES Part 3Document5 pagesADJUSTING ENTRIES Part 3MOCHI SSABELLENo ratings yet

- Principles of Accounts 11Document47 pagesPrinciples of Accounts 11Godfrey LwandoNo ratings yet

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- ADJUSTING ENTRIES With Answers by AlagangWencyDocument3 pagesADJUSTING ENTRIES With Answers by AlagangWencyHello KittyNo ratings yet

- B215 AC09 Buy First Sell Later - 6th Presentation - 25may2009Document35 pagesB215 AC09 Buy First Sell Later - 6th Presentation - 25may2009tohqinzhi100% (1)

- Adjusting THE AccountsDocument51 pagesAdjusting THE AccountsShai Anne Cortez100% (1)

- Prepaid Expense and Unearned RevenueDocument2 pagesPrepaid Expense and Unearned RevenueAccounting StuffNo ratings yet

- MAA AssignmentDocument8 pagesMAA AssignmentRaghavendra R BelurNo ratings yet

- Far 04 Accounting Cycle - Service BusinessDocument18 pagesFar 04 Accounting Cycle - Service Businessyna kyleneNo ratings yet

- Seminar 3 QsDocument7 pagesSeminar 3 Qsxxsummerblue.23No ratings yet

- Accounts ReceivableDocument8 pagesAccounts ReceivableFireworks PHNo ratings yet

- BFAR 11-04-2022 The Accounting Cycle 3 Adjusting EntriesDocument4 pagesBFAR 11-04-2022 The Accounting Cycle 3 Adjusting EntriesSheryl cornelNo ratings yet

- Auditing ProblemsDocument12 pagesAuditing ProblemsTricia Nicole DimaanoNo ratings yet

- Chapter 8 Adjusting Entries 2 SHSDocument81 pagesChapter 8 Adjusting Entries 2 SHSTep TepNo ratings yet

- Test Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, WarfieldDocument12 pagesTest Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, Warfielda384600180No ratings yet

- Lester Ontolan. - Unit-3-ActivitiesDocument12 pagesLester Ontolan. - Unit-3-Activitieslesterontolan756No ratings yet

- Las Q4 Fabm 1 GagalacDocument26 pagesLas Q4 Fabm 1 GagalacAira Venice GuyadaNo ratings yet

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Document17 pagesBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNo ratings yet

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONNo ratings yet

- Activity 5 1Document13 pagesActivity 5 1Trice DomingoNo ratings yet

- PDF DocumentDocument6 pagesPDF DocumentCiara Abdulhamid BasirNo ratings yet

- Final AccountsDocument13 pagesFinal AccountsRahul NegiNo ratings yet

- Weekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)Document3 pagesWeekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)That kid 246No ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesDyenNo ratings yet

- Mock 1 Mid-Term Exam (Answers and Explanations)Document8 pagesMock 1 Mid-Term Exam (Answers and Explanations)100519554No ratings yet

- True or False: 1. True 6. True 2. True 7. Fals E 3. Fals 8. TrueDocument10 pagesTrue or False: 1. True 6. True 2. True 7. Fals E 3. Fals 8. TrueXiena100% (2)

- 12 Accountancy I Revision em AkDocument13 pages12 Accountancy I Revision em AkBABA AssociatesNo ratings yet

- Adjusting Entries NotesDocument5 pagesAdjusting Entries NoteswingNo ratings yet

- Basic Accounting ReviewDocument9 pagesBasic Accounting ReviewAether SkywardNo ratings yet

- Toa 9 01 Accounting Process Answer KeyDocument11 pagesToa 9 01 Accounting Process Answer KeyChris LutzNo ratings yet

- FABM1 - Q2 - W2 - Adjusting Entries and Adjusted Trial BalanceDocument25 pagesFABM1 - Q2 - W2 - Adjusting Entries and Adjusted Trial BalanceLovely TaupoNo ratings yet

- 2 Adjusting Journal EntriesDocument6 pages2 Adjusting Journal EntriesJerric CristobalNo ratings yet

- Exam Revision - 9 & 10 SolDocument7 pagesExam Revision - 9 & 10 SolNguyễn Minh ĐứcNo ratings yet

- Cpar Far LecturesDocument73 pagesCpar Far LecturesXNo ratings yet

- Assignment-1 (Eco & Actg For Engineers) Exercise - 1Document4 pagesAssignment-1 (Eco & Actg For Engineers) Exercise - 1Nayeem HossainNo ratings yet

- Topic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainDocument8 pagesTopic: Adjusting Entries / Adjustments Compiled By: Sir Ghalib HussainGhalib HussainNo ratings yet

- Exam Revision - Chapter 9 10Document7 pagesExam Revision - Chapter 9 10Vũ Thị NgoanNo ratings yet

- AE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesDocument6 pagesAE21 Lesson 6: Review of The Accounting Cycle: Worksheet and Adjusting EntriesGlenda LinatocNo ratings yet

- Financial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicDocument7 pagesFinancial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicKyle Daniel PimentelNo ratings yet

- Module 3 in Gec 2: (Readings in Philippine History)Document19 pagesModule 3 in Gec 2: (Readings in Philippine History)Mark Kevin JavierNo ratings yet

- Module in GEC 2.chapter 2 Lesson 5 and 6Document6 pagesModule in GEC 2.chapter 2 Lesson 5 and 6Mark Kevin JavierNo ratings yet

- Module in GEC 2 Chapter 4Document62 pagesModule in GEC 2 Chapter 4Mark Kevin JavierNo ratings yet

- Module 2 in Gec 2: (Readings in Philippine History)Document4 pagesModule 2 in Gec 2: (Readings in Philippine History)Mark Kevin JavierNo ratings yet

- ACCTG1 Chapter 4Document11 pagesACCTG1 Chapter 4Mark Kevin JavierNo ratings yet

- Objectives: Chapter 2: Accounting Principles and Reporting StandardsDocument2 pagesObjectives: Chapter 2: Accounting Principles and Reporting StandardsMark Kevin JavierNo ratings yet

- ACCTG 1 v2.2 C1Document2 pagesACCTG 1 v2.2 C1Mark Kevin JavierNo ratings yet

- ACCTG1 Chapter 5Document6 pagesACCTG1 Chapter 5Mark Kevin JavierNo ratings yet

- Objectives: Chapter 3: Accounting Equation and The Double Entry SystemDocument4 pagesObjectives: Chapter 3: Accounting Equation and The Double Entry SystemMark Kevin JavierNo ratings yet

- Objectives: Chapter 2: Accounting Principles and Reporting StandardsDocument2 pagesObjectives: Chapter 2: Accounting Principles and Reporting StandardsMark Kevin JavierNo ratings yet

- Chap 3 Warranty Liability Fin Acct 2 - Barter Summary TeamDocument2 pagesChap 3 Warranty Liability Fin Acct 2 - Barter Summary TeamAbigail Tumabao100% (1)

- B6005 Lecture 11 Trade Credit and Shortem Loan HandoutDocument32 pagesB6005 Lecture 11 Trade Credit and Shortem Loan HandoutTeddy HandayaNo ratings yet

- ACCG43 Help Material For Questions From ACCG41Document3 pagesACCG43 Help Material For Questions From ACCG41Nauman HashmiNo ratings yet

- FINM CA2TabDocument27 pagesFINM CA2TabTabrej AnsariNo ratings yet

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document7 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Corina Mamaradlo CaragayNo ratings yet

- O2C, P2P Accounting Entries With India LocalizationDocument2 pagesO2C, P2P Accounting Entries With India Localizationhsk12100% (1)

- 2018 Team Member HandbookDocument32 pages2018 Team Member HandbookAlex RayNo ratings yet

- 1001 Test 2Document22 pages1001 Test 2vabu4everandeverNo ratings yet

- 16 Fields in MM Pricing ProcedureDocument5 pages16 Fields in MM Pricing Proceduremusicshiva50% (2)

- Acc117-Chapter 2Document26 pagesAcc117-Chapter 2Fadilah JefriNo ratings yet

- Accounting For LaborDocument21 pagesAccounting For LaborCharlaign MalacasNo ratings yet

- Residential Status and Incidence of Tax On Income Under Income Tax ActDocument6 pagesResidential Status and Incidence of Tax On Income Under Income Tax ActhaseefaNo ratings yet

- Fundamentals of Payroll AccountingDocument25 pagesFundamentals of Payroll AccountingXNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Corporate Reporting: Statement of Cash FlowsDocument19 pagesCorporate Reporting: Statement of Cash FlowsageoshyNo ratings yet

- 76 FDJGJDocument9 pages76 FDJGJJohn Brian D. SorianoNo ratings yet

- Earnings Management and Creative AccountingDocument13 pagesEarnings Management and Creative Accountingjaclyn3kohNo ratings yet

- Financial Management On Square Toiletries LTDDocument73 pagesFinancial Management On Square Toiletries LTDShahriar AlamNo ratings yet

- O-Level-Accounts NotesDocument58 pagesO-Level-Accounts NotesKamranKhan100% (1)

- Business Planning For AgribusinessDocument26 pagesBusiness Planning For Agribusinesshussen seidNo ratings yet

- Finance Modeling LabDocument158 pagesFinance Modeling LabvwvwevwNo ratings yet

- Time ManagementDocument605 pagesTime ManagementtrishqNo ratings yet

- Topic: Human Resource and PayrollDocument11 pagesTopic: Human Resource and PayrollMelanie SamsonaNo ratings yet

- CH 03Document68 pagesCH 03Chang Chan Chong100% (1)

- Local Governments Financial and Accounting Manual 2007Document248 pagesLocal Governments Financial and Accounting Manual 2007markogenrwot100% (1)

- AssignmentDocument16 pagesAssignmentSABORDO, MA. KRISTINA COLEENNo ratings yet

- Candidate Brief: Alpina Ski LTD Case StudyDocument10 pagesCandidate Brief: Alpina Ski LTD Case StudyJonas SimoninNo ratings yet

- Classification of Deductible Expenses Section 212 Expenses:: Have AGI LimitationsDocument6 pagesClassification of Deductible Expenses Section 212 Expenses:: Have AGI Limitations张心怡No ratings yet

- Accounting 101: Brought To You byDocument24 pagesAccounting 101: Brought To You byJhonabie Suligan CadeliñaNo ratings yet

- The Purchasing Accounts Derived On The Requisitions and Purchase OrdersDocument11 pagesThe Purchasing Accounts Derived On The Requisitions and Purchase OrdersrahuldisyNo ratings yet