Professional Documents

Culture Documents

MCQs On Costing 20210622130833

Uploaded by

sarita0 ratings0% found this document useful (0 votes)

15 views5 pagesOriginal Title

MCQs-on-Costing-20210622130833

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views5 pagesMCQs On Costing 20210622130833

Uploaded by

saritaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

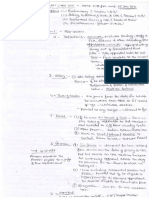

Multiple Choice Questions on Costing

1. Basic objective of cost accounting is

A. Tax Compliance

B. Financial Audit

C. Cost ascertainment

D. Profit Analysis

2. Process Costing is suitable for

A. Hospitals

B. Oil Refining Firms

C. Transport Firms

D. Brick Laying Firms

3. Cost Classification can be done in

A. Two ways

B. Three Ways

C. Four Ways

D. Several Ways

4. The cost to be incurred even when a business unit is closed is

A. Imputed cost

B. Historical cost

C. Sunk cost

D. Shutdown cost

5. Direct expenses are also called

A. Major expenses

B. Chargeable expenses

C. Overhead expenses

D. Sundry expenses

6. Indirect material used in production is called as

A. Office overhead

B. Selling overhead

C. Distribution overhead

D. Factory overhead

7. Warehouse rent is a part of

A. Prime Cost

B. Factory Cost

C. Distribution Cost

D. Production Cost

8. Indirect material scrap is adjusted along with

A. Prime cost

B. Factory cost

C. Labour cost

D. Cost of goods sold

9. Tender is an

A. Estimation of profit

B. Estimation of cost

C. Estimation of selling price

D. Estimation of units

10. Total of all direct costs is termed as

A. Prime cost

B. Works cost

C. Cost of sales

D. Cost of production

11. Bonus under Rowan scheme is paid

A. As a proportion of standard time to actual time

B. As a proportion of actual time to standard time

C. As a proportion of time saved to standard time

D. As a proportion of standard time to time saved

12. How many rate are used to calculate wages under Taylor’s differential piece rate

system

A. Two

B. Three

C. Four

D. Five

13. The loss which arise in manufacturing activity on account of inherent nature of

product is

A. Normal loss

B. Abnormal loss

C. Net loss

D. Gross loss

14. Fixed cost per unit increases when

A. Variable cost per unit increases

B. Variable cost per unit decreases

C. Production volume increases

D. Production volume decreases

15. Normal loss in manufacturing leads to

A. Reduction in unit price of other good units

B. Increase in unit price of other good units

C. Reduction in costing profit

D. Increase in costing profit

16. Process cost is ascertained and recorded in

A. Balance sheet

B. Profit and Loss account

C. Separate statement

D. Separate Ledger Account

17. Batch costing is useful to determine

A. Maximum quantity of output

B. Minimum quantity of ouput

C. Economic batch quantity

D. Profit of batches

18. Prime cost plus variable overheads is known as

A. Cost of sales

B. Production cost

C. Total cost

D. Marginal cost

19. The stock keeper should initiate a purchase requisition when stock reaches

A. Average stock level

B. Minimum

C. Maximum

D. Re-order level

20. Sale of defectives is reduced from

A. Prime cost

B. Works cost

C. Cost of production

D. Cost of sales

21. Depreciation of plant and machinery is a part of

A. Factory overhead

B. Selling overhead

C. Distribution overhead

D. Administration overhead

22. Appropriate basis for apportionment of material handling charges is

A. Material purchased

B. Material in stock

C. Material consumed

D. Material wasted

23. Recreation expenses in factory are apportioned on the basis of

A. Material cost

B. Wages

C. Prime cost

D. Number of employees

24. Comprehensive machine hour rate includes

A. Machine operator wages

B. Managing directors’ salary

C. Income tax

D. Office rent

25. Abnormal loss and its value are

A. Debited to process account

B. Credited to process account

C. Debited to costing profit and loss account

D. Debited to profit and loss account

You might also like

- Acctg 201 - Assignment 2Document11 pagesAcctg 201 - Assignment 2sarahbee75% (4)

- D. Depreciation of Machineries: Accounting 102 Quiz 3Document9 pagesD. Depreciation of Machineries: Accounting 102 Quiz 3Ho Ming Lam80% (5)

- Printable Flashcard On Accounting Final Exam Review - Free Flash CardsDocument16 pagesPrintable Flashcard On Accounting Final Exam Review - Free Flash CardsSureshArigelaNo ratings yet

- Managerial Accounting Sample Multiple Choice QuestionsDocument17 pagesManagerial Accounting Sample Multiple Choice Questionsjen1861280% (5)

- Accntncy MCQs For SAS CAGDocument12 pagesAccntncy MCQs For SAS CAGDeepak Kumar PandaNo ratings yet

- MCQ On PPP ModelDocument10 pagesMCQ On PPP Modelsarita100% (2)

- Modes of Entering International BusinessDocument6 pagesModes of Entering International BusinessWhat's app FunNo ratings yet

- Importance of Strategic Management.Document24 pagesImportance of Strategic Management.Grace Bwalya97% (29)

- BUS100 Test Bank Final + Answer KeyDocument66 pagesBUS100 Test Bank Final + Answer KeyShubh RawalNo ratings yet

- Chapter 9 Standard Costing - SynopsisDocument8 pagesChapter 9 Standard Costing - SynopsissajedulNo ratings yet

- Multiple Choices - Quiz - Chapter 1-To-3Document21 pagesMultiple Choices - Quiz - Chapter 1-To-3Ella SingcaNo ratings yet

- Sem VI - Cost Accounting - TY. BcomDocument7 pagesSem VI - Cost Accounting - TY. Bcommahesh patilNo ratings yet

- Auditing Problems Project - InventoriesDocument11 pagesAuditing Problems Project - InventoriesKAii Magno GuiaNo ratings yet

- MCQ Advance CostDocument11 pagesMCQ Advance CostAyesha ZaroobNo ratings yet

- Quiz Questions - MCQ For CostingDocument27 pagesQuiz Questions - MCQ For Costingprakashvasantham75% (4)

- Wa0000.Document4 pagesWa0000.Samira MohantyNo ratings yet

- COST&MANAGEMENTDocument6 pagesCOST&MANAGEMENTNiraj PatilNo ratings yet

- Comprehensive CostDocument8 pagesComprehensive CostTilahun GirmaNo ratings yet

- Comprehensive Exam in Cost Accounting and Control 2022Document8 pagesComprehensive Exam in Cost Accounting and Control 2022Maui EquizaNo ratings yet

- Job Order Costing Multiple ChoiceDocument3 pagesJob Order Costing Multiple ChoiceM CkNo ratings yet

- Unit I A. Cost AscertainmentDocument37 pagesUnit I A. Cost AscertainmentRajanNo ratings yet

- MIDTERMDocument23 pagesMIDTERMJanine LerumNo ratings yet

- Multiple Choices Quiz 1Document31 pagesMultiple Choices Quiz 1Justine AlcantaraNo ratings yet

- Manufacturing Operations - Theory ReviewerDocument4 pagesManufacturing Operations - Theory Reviewerquinn ezekielNo ratings yet

- Ica Question BankDocument22 pagesIca Question Bankicchapurtiutsavmandal1No ratings yet

- Cost AccountingDocument128 pagesCost AccountingCarl Adrian Valdez50% (2)

- BC 402Document8 pagesBC 402moiznoorNo ratings yet

- Reviewer in AccountingDocument9 pagesReviewer in Accountingdunabels25% (4)

- Managerial Accounting - Final ExamDocument7 pagesManagerial Accounting - Final Examchristian ReyesNo ratings yet

- Inventory ReviewerDocument7 pagesInventory ReviewerPau Santos100% (5)

- Prelim Quiz No 1Document4 pagesPrelim Quiz No 1regent galokrNo ratings yet

- MCQs On Costing - PracticeDocument7 pagesMCQs On Costing - PracticethegreatnamanpatelNo ratings yet

- Cost Accounting M.C.QDocument38 pagesCost Accounting M.C.QSaif HassanNo ratings yet

- Cost Accounting - MCQsDocument6 pagesCost Accounting - MCQsSandeep Chaudhary60% (5)

- Ch5 EconomicsDocument58 pagesCh5 Economicsravelstein100% (1)

- 04 - Cost Accounting by Usry (Part1)Document4 pages04 - Cost Accounting by Usry (Part1)AkiNo ratings yet

- Cost ComboDocument188 pagesCost ComboShruti MohanrajNo ratings yet

- Costing McqsDocument3 pagesCosting Mcqsshivam kumarNo ratings yet

- Management Accounting Practice QuestionsDocument6 pagesManagement Accounting Practice QuestionsSayantan NandyNo ratings yet

- Finance 16UCF620-MANAGEMENT-ACCOUNTINGDocument27 pagesFinance 16UCF620-MANAGEMENT-ACCOUNTINGAkhil rayanaveniNo ratings yet

- Cost Accounting 16uco513 K1-Level Questions UNIT-1Document27 pagesCost Accounting 16uco513 K1-Level Questions UNIT-1Abirami santhanamNo ratings yet

- Unit 4 Module - 6 Absorption and Marginal Costing: M U L T I P L e C H o I C e Q U e S T I o N SDocument7 pagesUnit 4 Module - 6 Absorption and Marginal Costing: M U L T I P L e C H o I C e Q U e S T I o N SamitNo ratings yet

- Cost Accounting Objective Type QuestionsDocument2 pagesCost Accounting Objective Type QuestionsJoshua Stalin Selvaraj75% (16)

- Cost 1Document18 pagesCost 1Maryane AngelaNo ratings yet

- Ex Ch1 1 AnswersDocument10 pagesEx Ch1 1 Answersmahmoud08070058No ratings yet

- Final Exam - 2020Document10 pagesFinal Exam - 2020mshan lee100% (1)

- TheoryDocument9 pagesTheoryprettyNo ratings yet

- Theories: Manufacturing - Actual Costing ReviewerDocument12 pagesTheories: Manufacturing - Actual Costing ReviewerJuan Dela CruzNo ratings yet

- Model Exit Exam - Cost and Management Accounting IDocument12 pagesModel Exit Exam - Cost and Management Accounting Ijaabirm78No ratings yet

- I. Write If The Statement Is and Write IfitisDocument2 pagesI. Write If The Statement Is and Write IfitisYewulsewYitbarekNo ratings yet

- Managerial Accounting ConceptsDocument5 pagesManagerial Accounting ConceptsPia NietoNo ratings yet

- MCQ 101 MaDocument37 pagesMCQ 101 MaRishabh TiwariNo ratings yet

- Differential Cost AnalysisDocument19 pagesDifferential Cost Analysisbobo kaNo ratings yet

- Cost Accounting CycleDocument22 pagesCost Accounting CycleaprilNo ratings yet

- 10 Acct 1abDocument16 pages10 Acct 1abJerric Cristobal100% (1)

- Variable and Absorption Costing QuizzerDocument8 pagesVariable and Absorption Costing QuizzerCath AltabanoNo ratings yet

- (Accounting For Business Decision)Document69 pages(Accounting For Business Decision)Amit Jagtap50% (2)

- 101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Document3,032 pages101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Adwait BowlekarNo ratings yet

- Cost I Final ExtDocument6 pagesCost I Final ExtGetu WeyessaNo ratings yet

- (C) Present Value of Future Benefits: Multiple Choice Questions (MCQS)Document8 pages(C) Present Value of Future Benefits: Multiple Choice Questions (MCQS)Z the officerNo ratings yet

- Mid Term Assessment - Accounting For Managers (D) - Summer 2021Document5 pagesMid Term Assessment - Accounting For Managers (D) - Summer 2021Hole StudioNo ratings yet

- Cost Accounting Mcqs PDFDocument31 pagesCost Accounting Mcqs PDFநானும்நீயும்No ratings yet

- Managerial Accounting Mock ExamDocument4 pagesManagerial Accounting Mock Examldeguzman210000000953No ratings yet

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- (TR .Se, QC, Ag/tr-Fufuh: I Pau! A-,.i?rrg.l +?) GDocument5 pages(TR .Se, QC, Ag/tr-Fufuh: I Pau! A-,.i?rrg.l +?) GsaritaNo ratings yet

- CCS (Pension) Rules, 1972Document28 pagesCCS (Pension) Rules, 1972saritaNo ratings yet

- Questions On Financial AccountingDocument3 pagesQuestions On Financial AccountingsaritaNo ratings yet

- 13.01.2020 Comparative Studies of SampleDocument38 pages13.01.2020 Comparative Studies of SamplesaritaNo ratings yet

- Module in International Marketing Word ASC EditedDocument94 pagesModule in International Marketing Word ASC EditedJoy Emmanuel VallagarNo ratings yet

- Abul KhairDocument21 pagesAbul KhairYeasin Bappy33% (3)

- Report Chapter 12 & 13Document48 pagesReport Chapter 12 & 13Alieff IqmalNo ratings yet

- A Framework For The Implementation of E-Procurement M.V. Jooste and C. de W. Van SchoorDocument22 pagesA Framework For The Implementation of E-Procurement M.V. Jooste and C. de W. Van SchoorGowri J BabuNo ratings yet

- PAS 2 - Inventories - QuizDocument4 pagesPAS 2 - Inventories - QuizQueenie Mae San JuanNo ratings yet

- Market Segmentation in B2B MarketingDocument4 pagesMarket Segmentation in B2B MarketingSaisrita PradhanNo ratings yet

- Stanford PDFDocument1 pageStanford PDFNabil MNo ratings yet

- Case MethodDocument10 pagesCase MethodEka Moses MarpaungNo ratings yet

- Vinay Ch1ansDocument4 pagesVinay Ch1ansMukeshKumawatNo ratings yet

- XXXXX XXX LTD: Presenter: XXX, XXXX & XXX. Topic: Demo ClientDocument7 pagesXXXXX XXX LTD: Presenter: XXX, XXXX & XXX. Topic: Demo ClientSanjayNo ratings yet

- Spencer's Case StudyDocument1 pageSpencer's Case StudySANIDHYA IIMCNo ratings yet

- KSA Weekly ReportDocument8 pagesKSA Weekly ReportTayssir ElashioutyNo ratings yet

- Chapter 8 Entry Strategies in Global BusinessDocument3 pagesChapter 8 Entry Strategies in Global BusinessMariah Dion GalizaNo ratings yet

- Rolfe Dewolfe Animatronic For Sale - Google Shopping 2Document1 pageRolfe Dewolfe Animatronic For Sale - Google Shopping 2sageNo ratings yet

- Channels of Distribution and LogisticsDocument47 pagesChannels of Distribution and LogisticsGovindaGowda100% (1)

- Ingenico: More Than Just A Terminal Vendor, 1-OWDocument33 pagesIngenico: More Than Just A Terminal Vendor, 1-OWZexi WUNo ratings yet

- Indian Gems and Jewellery Industry ReportDocument20 pagesIndian Gems and Jewellery Industry ReportSamiksha AgarwalNo ratings yet

- Zappos Analysis Worksheet: Zappos Attributes Consumer Reactions To Zappos Requisites Diffrentiators Beliefs ExperiencesDocument3 pagesZappos Analysis Worksheet: Zappos Attributes Consumer Reactions To Zappos Requisites Diffrentiators Beliefs ExperiencesSwarna Rachna AjjampurNo ratings yet

- Unilever PresentaionDocument69 pagesUnilever PresentaionPédàzõ OwiNo ratings yet

- Week5 Ch6 in Class Examples-PrintDocument8 pagesWeek5 Ch6 in Class Examples-PrintnasduioahwaNo ratings yet

- Apple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureDocument3 pagesApple Blossom 1 Flowcharts, Organization Charts, Analytical ProcedureMaulana MuslimNo ratings yet

- Balaji Wafers (Marketing)Document41 pagesBalaji Wafers (Marketing)Alpesh63% (8)

- Accounting Ratios Excel TemplateDocument4 pagesAccounting Ratios Excel TemplateMAZIN SALAHELDEENNo ratings yet

- Why Selling and Salesmanship Is Important To Study For The Students of Business Administration?Document5 pagesWhy Selling and Salesmanship Is Important To Study For The Students of Business Administration?king jafrinNo ratings yet

- CH - 5.1 ProductDocument43 pagesCH - 5.1 ProductArayaselasie TechaluNo ratings yet

- Problem 3 Consignment SalesDocument7 pagesProblem 3 Consignment Salesskilled legilimence0% (1)