Professional Documents

Culture Documents

12 Economics sp02

12 Economics sp02

Uploaded by

Prachi Tripathi 42Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Economics sp02

12 Economics sp02

Uploaded by

Prachi Tripathi 42Copyright:

Available Formats

myCBSEguide

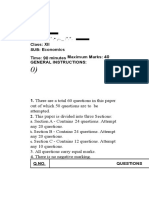

Class 12 - Economics

Sample Paper 02

Maximum Marks: 40

Time Allowed: 90 minutes

General Instructions:

1. There are a total 60 questions in this paper out of which 50 questions are to be attempted.

2. This paper is divided into three Sections:

a. Section A – Contains 24 questions. Attempt any 20 questions.

b. Section B – Contains 24 questions. Attempt any 20 questions.

c. Section C – Contains 12 questions. Attempt any 10 questions.

3. All questions carry equal marks.

4. There is no negative marking.

Section A

1. The FRBM Act aims at reducing gross fiscal deficit by:

a. 0.5%

b. 3%

c. 2%

d. 1%

2. Raising bank rate by the central bank in India during excess demand is

a. Inflationary

b. Stabilisation

c. Deflationary

d. Destabilisation

3. Primary deficit can be zero if ________.

a. Fiscal deficit > Interest payments

b. Fiscal deficit = Interest payments

c. Fiscal deficit < Interest payments

d. Revenue deficit < Fiscal deficit

4. Which of the following is a budget type?

a. Balanced budget

b. Surplus budget

c. Deficit budget

d. All of them

5. Which one is the invisible item of Balance of Payment?

a. Banking

b. Shipping

c. All of these

d. Communication

6. Green NNP

a. Green NNP = NNP N+ Net fall in the stock of natural capital

b. Green NNP = GDP – Net fall in the stock of natural capital

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 1 / 14

myCBSEguide

c. Green NNP = NNP – Net fall in the stock of natural capital

d. Green NNP = NDP – Net fall in the stock of natural capital

7. When was Twelfth five year plan started

a. 2007-2012

b. 1997-2002

c. 2012-2017

d. 2002-2007

8. How many countries are members of WTO at present?

a. 190

b. 180

c. 164

d. 156

9. Valmiki Ambedkar Awas Yojna was launched in:

a. 2000

b. 2001

c. 2004

d. 2005

To practice more questions & prepare well for exams, download myCBSEguide App. It provides

complete study material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams.

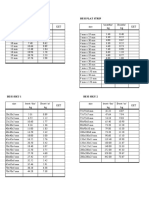

10. Match the following. Options are

a. NCERT I. It takes measures for promotion and coordination of university education

b. IGNOU II. Implementing policies in the field of school education

c. UGC III. Responsible for the introduction and promotion of open university

a. a - (iii), b - (ii), c - (i)

b. a - (ii), b - (iii), c - (i)

c. a - (iii), b - (i), c - (ii)

d. a - (ii), b - (i), c - (iii)

11. Which of the following is not an institutional source of rural credit?

a. Commission Agents

b. Self-Help Groups

c. Commercial Banks

d. Cooperative Societies

12. An example of a direct tax is

a. Toll Tax

b. Interest

c. Service tax

d. Excise duty

13. One of the various quantitative instruments used by the central bank in during inflation is ________.

a. Reduce bank rate

b. Fall in CRR

c. Fall in repo rate

d. Rise in Bank rate

14. A surplus budget is one where?

a. Estimated revenues > Estimated expenditure

b. All of these

c. Estimated revenues < Estimated Receipts of the govt.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 2 / 14

myCBSEguide

d. Estimated revenues = Estimated expenditure

15. What percentage of India was literate at the time of independence?

a. 16 percent

b. 7 per cent

c. 12 percent

d. 40 percent

16. Which of the following will not be included in balance of trade?

a. Travelling by citizens of one country to another

b. All of these

c. Export of handicraft

d. Import of machinery

17. Cotton textile mills were mainly located in:

a. Western India

b. Southern India

c. Eastern India

d. Northern India

18. Green Revolution introduced during the planning process was restricted mainly to crops like

a. wheat and rice

b. jowar and bajra

c. cereals and pulses

d. cotton and jute

19. LQP raj refers to:

a. license, quota, privatisation raj

b. license, quarter, privatisation raj

c. liberalisation, quota, permit raj

d. license, quota, permit raj

20. Who advocated that India would be truly independent only when the poorest of its people become free

of human suffering?

a. Mahatma Gandhi

b. Jawahar Lal Nehru

c. Subhash Chandra Bose

d. Indira Gandhi

21. Which of the following is not an example of physical capital?

a. Education and knowledge in people

b. Raw material

c. Building

d. Machinery

22. TANWA project relates to ________.

a. Both for men and women

b. Men

c. Women

d. None of these

23. The poverty line defined for urban areas as consumption worth rs ____ per person a month

a. 428

b. 454

c. 328

d. 228

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 3 / 14

myCBSEguide

24. Which one of the following organisations regulates the health sector in India?

a. UGC

b. AICTE

c. ICMR

d. RBI

Section B

25. Assertion (A): Loans from the rest of the world are a negative item.

Reason (R): It is recorded on the capital account of BoP.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

26. Which statement is false regarding economic planning

a. It is concerned with whole of economic life of a country

b. It is the purposive adoption of resources to social ends

c. It is a path of action in terms of policy measures which were followed in the past

d. It is an organised efforts to achieve objective within fixed framework

27. Assertion (A): Skill is valued because it contributes to the process of production by raising the level of

efficiency.

Reason (R): Overtime skill has emerged as a significant driver of growth which is known as human

capital.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

28. Which of the following countries initiated its process of Economic Reforms in the year 1991?

a. Pakistan

b. India

c. China

d. Russia

29. Assertion (A): Most landholdings were economic yielding low output at a high cost.

Reason (R): Landholdings were both small as well as fragmented.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

30. When was the Planning Commission set up?

a. 1949

b. 1947

c. 1950

d. 1952

31. Steps taken towards liberalisation

a. Dereservation of industries

b. Delicensing of imports

c. All of these

d. Delicensing of industries

32. One of the two components of Capital budget are:

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 4 / 14

myCBSEguide

a. Capital receipts

b. Investment receipts

c. Expenditure receipts

d. Revenue receipts

33. Assertion (A): We may not get a proper picture of the economic and social status of the people over

time in case the poverty line is changed.

Reason (R): If the poverty line is refixed at a lower level of expenditure we shall get a smaller number

of people below the poverty line.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

34. Human capital is similar to physical capital because

a. They are factors of production and raise nation’s ability to produce goods and services

b. They are factors of production

c. none of these

d. Raise nation’s ability to produce goods and services

35. Rural development implies:

a. Providing health facilities in rural areas

b. Development of an agriculture

c. Everything that raises the quality of life of rural people

d. Spread of agriculture among rural people

36. Which of the following was not the objective of economic plans?

a. Increase in national income

b. Increase in employment

c. Spread of education

d. Social justice

37. Assertion (A): Low CAD along with low borrowings has been a stable feature of India's BoP accounts.

Reason (R): The deficit on the current account has often been met through borrowings in the capital

account.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

38. One of the objectives of the government budget is ________.

a. Increasing regional disparities

b. Allocation of resources

c. Provision of private goods

d. Unbalanced growth

39. Assertion (A): Central Bank acts as an advisor to the government.

Reason (R): As an advisor to the government, it manages accounts of the government.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

40. Assertion (A): Budget is a reflection of government policies and a set of objectives that the government

seeks to fulfill through the budget.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 5 / 14

myCBSEguide

Reason (R): Budget of the government shows its comprehensive exercise on taxation and subsidies.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

41. Assertion (A): Full employment is an extremely important social objective of planning.

Reason (R): Equitable distribution of income implies social equality.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

42. Which of the following is not a Quantitative Method of credit control?

a. Open Market Operation

b. Bank Rate Policy

c. Variable Reserve Ratio

d. Margin Requirements

43. The midday meal, Public distribution system, integrated child development scheme etc.

a. Growth oriented approach

b. Minimum basic needs approach

c. None of these

d. Poverty alleviation approach

To practice more questions & prepare well for exams, download myCBSEguide App. It provides

complete study material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams.

44. A deficit budget is one where

a. Estimated revenues = estimated expenditure

b. Estimated revenues > estimated expenditure

c. Estimated revenues < estimated Receipts of the govt.

d. Estimated revenues < estimated expenditure

45. Per capita income is calculated?

a.

b.

c.

d.

46. Assertion (A): Agricultural diversification refers to the allocation of some of the farm's productive

resources into new activities or crops to reduce market risks.

Reason (R): Diversification helps stabilization of farm's income by lowering the market risk.

a. Both A and R are true and R is the correct explanation of A.

b. Both A and R are true but R is not the correct explanation of A.

c. A is true but R is false.

d. A is false but R is true.

47. Make in India programme was launched in ________.

a. 2015

b. 2014

c. 1991

d. 2016

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 6 / 14

myCBSEguide

48. Surplus in BoP occurs when:

a. receipts > payments

b. both receipts = payments and receipts > payments

c. receipts < payments

d. receipts = payments

Section C

Question No. 49 to 54 are based on the given text. Read the text carefully and answer the

questions:

The money supply is all the currency and other liquid instruments in a country's economy on the date

measured. The money supply roughly includes both cash and deposits that can be used almost as easily

as cash. Governments issue paper currency and coin through some combination of their central banks

and treasuries. Bank regulators influence the money supply available to the public through the

requirements placed on banks to hold reserves, how to extend credit and other regulation. An increase

in the supply of money typically lowers interest rates, which in turn, generates more investment and

puts more money in the hands of consumers, thereby stimulating spending.

The supply of money is a stock concept. It refers to the total stock of money(of all types) held by the

people of a country at a point of time. Supply of money includes that stock of money which is held by

people, other than the suppliers of money themselves.

49. Supply of money refers to the quantity of money ________.

a. as on 31st March

b. as on any point time

c. every month

d. every week

50. The stock of money with the money issuing authorities ________ part of the money supply.

a. form

b. does not form

c. limit

d. does not limit

51. ________ deposits constitutes money supply.

a. demand

b. credit

c. fixed

d. All of these

52. The claim of one bank against the other ________ part of the money supply.

a. form

b. is not load

c. is loan

d. does not form

53. Supply of money includes that stock of money which is held by the people which does not include the

________ of that money.

a. debitor

b. receiver

c. creditor

d. supplier

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 7 / 14

myCBSEguide

54. What happens when there is an increase in the supply of money?

i. Interest rates fall

ii. Money in hand increases

iii. Investment decreases

iv. Interest rates increases

a. i, ii, iii

b. iii, iv

c. i and ii

d. ii, iii, iv

Question No. 55 to 60 are based on the given text. Read the text carefully and answer the

questions:

Investors embraced the perceived safety of the American dollar as the financial crisis shook the world

in 2008. But since March 2009, as stock markets rebounded and investors again rolled the dice in

riskier markets, the dollar has suffered, raising questions about whether its status as a go-to currency

for trade and investment would fade in the coming years.

Washington officially supports a strong dollar, but a weaker dollar, while raising the prices of imported

goods like oil, also helps give American manufacturers an edge in foreign markets by decreasing the

relative price of their products. Officials in the Obama White House have done little to curb the dollar's

more recent slide.

As budget deficits reached an estimated $1.6 trillion for 2009 and the government printed money to

finance its financial rescue programs, other countries and investors started to get nervous. China,

which holds the most dollar reserves, raised concerns about rising American debt, and some of its top

officials floated proposals that would replace the dollar as the world's reserve currency. Global

investors began putting more of their money into Euros. And in October, rumors surfaced that the oil-

producing countries would stop pricing oil in dollars, though that speculation was quickly batted down

by governments in the Middle East and Russia.

The American economy is still the largest in the world, and with so many trillions of dollars being held

by foreign governments, the dollar's dominance in world markets is not likely to fade quickly. Still,

worries abound.

55. Demand for foreign currency depends upon:

a. direct foreign investment in the domestic economy

b. repayment of international loans

c. investment in rest of the world

d. Both repayment of international loans investment in rest of the world

56. Decrease in demand for foreign currency leads to ________ in exchange rate.

a. constant

b. rise

c. appreciation

d. fall

57. Direct purchases by the rest of the world are an important source of ________ for foreign transactions.

a. both supply and demand

b. None of these

c. supply

d. demand

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 8 / 14

myCBSEguide

58. The ________ market is of daily nature.

a. spot

b. foreign

c. regular

d. future

59. The price of one currency in terms of another currency is known as the ________ or simply the ________.

a. national exchange rate, price rate

b. currency exchange rate, value exchange

c. money exchange rate, exchange rate

d. foreign exchange rate, exchange rate

60. Who among the following does not participate in the foreign exchange market?

a. Brokers

b. Authorised dealers

c. Monetary authorities

d. Central Bank

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 9 / 14

myCBSEguide

Class 12 - Economics

Sample Paper 02

Solution

Section A

1. (a) 0.5%

Explanation: 0.5%

2. (c) Deflationary

Explanation: Doing so would discourage investment and lead to deficient aggregate demand via

multiplier process

3. (b) Fiscal deficit = Interest payments

Explanation: Fiscal deficit = Interest payments

Primary Deficit = Fiscal Deficit - Interest Payments

4. (d) All of them

Explanation: A budget can be a balanced budget, deficit budget or a surplus budget.

5. (c) All of these

Explanation: All the options are the invisible item of Balance of Payment.

6. (c) Green NNP = NNP – Net fall in the stock of natural capital

Explanation: ''Green NNP'' is a national accounting concept that subtracts off from GNP not just.

depreciation of capital, but also depletion of environmental assets.

7. (c) 2012-2017

Explanation: Twelfth five year plan started in 2012 with an objective to reduce poverty, to improve

equality among states and to eliminate gender gaps.

8. (c) 164

Explanation: The WTO has 164 members and 23 observer governments. Liberia became the 163rd

member on 14 July 2016, and Afghanistan became the 164th member on 29 July 2016.

9. (b) 2001

Explanation: Launched in 2001, the Valmiki Ambedkar Awaas Yojana is a centrally sponsored scheme

which aims to improve the living conditions of slum dwellers across India, hoping to transform the way

of life in these slums. Given the fact that the growth of our nation depends on the growth of

individuals, this scheme hopes to help slum dwellers utilise their potential, helping them achieve a

decent standard of living.

To practice more questions & prepare well for exams, download myCBSEguide App. It provides

complete study material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams.

10. (b) a - (ii), b - (iii), c - (i)

Explanation: NCERT pertains to school education.IGNOU is an open university and UGC pertains to

university education.

11. (a) Commission Agents

Explanation: Commission Agents are a non-institutional source of credit.

12. (a) Toll Tax

Explanation: Toll tax has to be paid by the person on whom it is levied. It cant be shifted.

13. (d) Rise in Bank rate

Explanation: Increase in bank rate is often followed by increase in the market rate of interest.

Accordingly, the cost of credit increases. This lowers the demand for credit and therefore the supply of

money tends to fall. Accordingly, inflation is corrected.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 10 / 14

myCBSEguide

14. (a) Estimated revenues > Estimated expenditure

Explanation: Surplus budget means a budget where the budgeted receipts are more than Budgeted

expenditure.

15. (a) 16 percent

Explanation: Being backward economy, the literacy rate of India was 16% on the eve of independence,

reflecting social backwardness as a reflection of economic backwardness.

16. (a) Travelling by citizens of one country to another

Explanation: Balance of trade only includes exports and imports of merchandise.

17. (a) Western India

Explanation: The cotton textile industry was concentrated in the cotton-growing belt of Maharashtra,

Rajasthan and Gujarat i.e. Western part of the country.

18. (a) wheat and rice

Explanation:

The period 1960 to 1980 is also called ‘golden era’ for the record foodgrain production like Wheat and

Rice. It is because of the green revolution that our country has become self-sufficient in food

production and even buffer stocks of food grains have been created for use in the times of natural

calamities like drought and floods.

19. (d) license, quota, permit raj

Explanation: The license, quota, permit raj was the elaborate system of licences, regulations and

accompanying red tape that were required to set up and run businesses in India between 1947 and

1990. The New Economic Policy (NEP) aimed at replacing LQP raj by liberalisation, privatisation and

globalisation (LPG) policies.

20. (a) Mahatma Gandhi

Explanation: Poverty, according to Mahatma Gandhi, is suffering which thousands of people are

undergoing. Only a few sections of people in Indian society are free from this suffering. They in turn

dominate the poorer section. So, unless and until the majority gets free from this cycle of poverty, India

cannot be considered an independent country in the true sense.

21. (a) Education and knowledge in people

Explanation: Education and knowledge in people is not an example of physical capital.

22. (c) Women

Explanation: Farm women's groups, focusing on income generation through the employment of

women in productive activities at the household level.

23. (b) 454

Explanation: Suresh Tendulkar Committee defined the poverty line on the basis of monthly spending

on food, education, health, electricity and transport. According to this estimate, a person who spends

Rs. 27.2 in rural areas and Rs. 33.3 in urban areas a day are defined as living below the poverty

line. The Rangarajan panel considered people living on less than Rs. 32 a day in rural areas and Rs. 47 a

day in urban areas as poor.

24. (c) ICMR

Explanation: ICMR (Indian Council for Medical Research) enforces rules and regulations relating to

education and research in the health sector.

Section B

25. (d) A is false but R is true.

Explanation: Loans from the rest of the world are a positive item. It is recorded on the capital account

of BoP.

26. (c) It is a path of action in terms of policy measures which were followed in the past

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 11 / 14

myCBSEguide

Explanation: Economic planning is a term used to describe the long term plans of an incumbent

government to manage the economy. Economic planning is a common feature of big government and

usually dictates increased spending and deficits to fund government programs and public works

projects.

27. (b) Both A and R are true but R is not the correct explanation of A.

Explanation: Skill is valued because it contributes to the process of production by raising the level of

efficiency. Higher the skill, the greater the contribution to the process of production, accordingly the

higher the value of the reward.

28. (b) India

Explanation: India initiated its process of Economic Reforms in the year 1991.

29. (d) A is false but R is true.

Explanation: Most landholdings were uneconomic yielding low output at a high cost. Landholdings

were both small as well as fragmented.

30. (c) 1950

Explanation: Planning Commission set up in 1950.

31. (c) All of these

Explanation: To liberalise the Indian economy, industrial licensing was abolished, many industries

reserved for the public sector were dereserved and import licensing was also abolished in most

industries.

32. (a) Capital receipts

Explanation: Capital receipts refer to those money receipts of the government which either create a

liability for the government or cause a reduction in the assets.

33. (a) Both A and R are true and R is the correct explanation of A.

Explanation: We may not get a proper picture of the economic and social status of the people over

time in case the poverty line is changed because of the poverty line is refixed at a lower level of

expenditure we shall get a smaller number of people below the poverty line.

34. (a) They are factors of production and raise nation’s ability to produce goods and services

Explanation: The human capital is the brain behind the technicalities and processes of the physical

capital. Both are needed for a society or nation to grow.

35. (c) Everything that raises the quality of life of rural people

Explanation: Rural development is the process of improving the quality of life and economic well-

being of people living in rural areas, often relatively isolated and sparsely populated areas.

36. (c) Spread of education

Explanation: The spread of education not the objective of economic plans.

37. (d) A is false but R is true.

Explanation: High CAD along with high borrowings has been a stable feature of India's BoP

accounts. The deficit on the current account has often been met through borrowings in the capital

account.

38. (b) Allocation of resources

Explanation: Its budgetary policy, the Government of a country directs the allocation of resources in a

manner such that there is a balance between the goals of profit maximisation and social welfare.

Production of goods which are injurious to health is discouraged through heavy taxation. On the other

hand, the production of socially useful goods is encouraged through subsidies.

39. (c) A is true but R is false.

Explanation: Central Bank acts as an advisor to the government. As an advisor to the government, it

frames policies to regulate the money market.

40. (b) Both A and R are true but R is not the correct explanation of A.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 12 / 14

myCBSEguide

Explanation: A budget is a reflection of government policies and a set of objectives that the

government seeks to fulfill through the budget. The budget of the government shows its comprehensive

exercise on taxation and subsidies.

41. (b) Both A and R are true but R is not the correct explanation of A.

Explanation: Both A and R are true but R is not the correct explanation of A.

Full employment is important social objective of planning because it implies that the process of

economic growth in the country is not Hijacked by the richer sections of the society. Although equitable

distribution of income implies social equality, because equitable distribution refers to a situation when

differences in income are allowed but only within certain limits.

42. (d) Margin Requirements

Explanation: Margin Requirements is the qualitative instrument of credit control. Quantitative

instruments are those instruments of credit control which focus on the overall supply of money in the

economy.

43. (b) Minimum basic needs approach

Explanation: The basic needs approach is one of the major approaches to the measurement of absolute

poverty in developing countries. Many modern lists emphasize the minimum level of consumption of

'basic needs' of not just food, water, clothing and shelter, but also sanitation, education, and healthcare.

44. (d) Estimated revenues < estimated expenditure

Explanation: Deficit budget is a budget in which the government revenues raised by the government

falls short of the government expenditure .

Deficit budget = estimated government revenue < estimated government expenditure

45. (b)

Explanation: Per capita income, also known as income per person. It is calculated by national income

and dividing it by the total population.

46. (b) Both A and R are true but R is not the correct explanation of A.

Explanation: Diversification helps stabilization of farm's income by lowering the market risk since if

one crop fetches low revenue the other may fetch high.

47. (b) 2014

Explanation: Make in India programme was launched in 2014.

48. (a) receipts > payments

Explanation: receipts > payments

Section C

49. (b) as on any point time

Explanation: as on any point time

50. (a) form

Explanation: form

51. (a) demand

Explanation: demand

52. (d) does not form

Explanation: does not form

53. (d) supplier

Explanation: supplier

54. (c) i and ii

Explanation: An increase in the supply of money typically lowers interest rates, which in

turn, generates more investment and puts more money in the hands of consumers, thereby

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 13 / 14

myCBSEguide

stimulating spending.

55. (d) Both repayment of international loans investment in rest of the world

Explanation: Both repayment of international loans investment in rest of the world

To practice more questions & prepare well for exams, download myCBSEguide App. It provides

complete study material for CBSE, NCERT, JEE (main), NEET-UG and NDA exams.

56. (d) fall

Explanation: fall

57. (c) supply

Explanation: supply

58. (a) spot

Explanation: spot

59. (d) foreign exchange rate, exchange rate

Explanation: The price of one currency in terms of another currency is known as the foreign

exchange rate or simply the exchange rate.

60. (d) Central Bank

Explanation: The major participants in the foreign exchange market are commercial banks, foreign

exchange brokers, and other authorised dealers and monetary authorities.

Copyright © myCBSEguide.com. Mass distribution in any mode is strictly prohibited. 14 / 14

You might also like

- Merchant Services - Credit Card Policy and Security StandardsDocument12 pagesMerchant Services - Credit Card Policy and Security StandardsHost Merchant ServiceNo ratings yet

- ECO-Self Examination Questions PDFDocument66 pagesECO-Self Examination Questions PDFadnan sheikNo ratings yet

- Hemophilia and Factor Assay PDFDocument17 pagesHemophilia and Factor Assay PDFSumaira JunaidNo ratings yet

- CH 1 Eco MCQsDocument6 pagesCH 1 Eco MCQsDarshan Shah100% (1)

- Assessment: Manage Risk BSBRSK501Document54 pagesAssessment: Manage Risk BSBRSK501Nidhi GuptaNo ratings yet

- Anatomy and Physiology 1st Semester BSN General MCQS, Educational Platform-1Document9 pagesAnatomy and Physiology 1st Semester BSN General MCQS, Educational Platform-1Prince Masroor Ali Abro0% (1)

- ISM Vs ISO 9001Document1 pageISM Vs ISO 9001sbdmanNo ratings yet

- BMS WiringDocument2 pagesBMS WiringJaved BhattiNo ratings yet

- TUTORIAL 1 Drilling EngineerDocument4 pagesTUTORIAL 1 Drilling EngineerAnonymous AkV8maWxGNNo ratings yet

- 12 Economics sp04Document14 pages12 Economics sp04naveen rajNo ratings yet

- ECONOMICS Sample Paper1Document11 pagesECONOMICS Sample Paper1Virain PartapNo ratings yet

- Final Economic Development Ch.1-2.2023Document9 pagesFinal Economic Development Ch.1-2.2023Amgad ElshamyNo ratings yet

- Sociology-Of-Development (Set 1)Document21 pagesSociology-Of-Development (Set 1)Izhar MakhdoomNo ratings yet

- BE MCQs SRMDocument7 pagesBE MCQs SRMSRMNo ratings yet

- McqsDocument22 pagesMcqsChandra Sai KumarNo ratings yet

- Mba201 MCQ Set 1Document39 pagesMba201 MCQ Set 1Sanju SahaNo ratings yet

- Economics Pre Term 1 QPDocument21 pagesEconomics Pre Term 1 QPGINNI BHULLARNo ratings yet

- QUIZ FinalLLLLLLLLDocument138 pagesQUIZ FinalLLLLLLLLVijay SaxenaNo ratings yet

- FEIA Unit 1Document3 pagesFEIA Unit 1prashanthuddar6No ratings yet

- IEPP MCQs by Swayam ClassesDocument63 pagesIEPP MCQs by Swayam Classesartisttarunsuthar1No ratings yet

- STD 12 Economics Pre Board QP (21-22) Set IDocument14 pagesSTD 12 Economics Pre Board QP (21-22) Set I12E23SakthiPalanichamyNo ratings yet

- Sample Ppaer 4 EconomicsDocument77 pagesSample Ppaer 4 EconomicsNeetu gargNo ratings yet

- TYBAF SemesterVI Indian EconomyDocument21 pagesTYBAF SemesterVI Indian EconomyAditya DeodharNo ratings yet

- 20uba2a02 22 05 2021Document2 pages20uba2a02 22 05 2021VISHAGAN MNo ratings yet

- Economics 1 - AnDocument13 pagesEconomics 1 - AnEziiiNo ratings yet

- Poverty MCQ CUET - 13147861 - 2023 - 05 - 06 - 13 - 44Document6 pagesPoverty MCQ CUET - 13147861 - 2023 - 05 - 06 - 13 - 44Riddhi GuptaNo ratings yet

- Development & EnvironmentalDocument25 pagesDevelopment & EnvironmentalHarikrishnan HNo ratings yet

- X SST Question Paper - Common ExaminationDocument9 pagesX SST Question Paper - Common Examinationcartoonexplorers7No ratings yet

- Comparative Development of Inida and Its Neighbour MCQ Class 12Document8 pagesComparative Development of Inida and Its Neighbour MCQ Class 12yazhinirekha4444No ratings yet

- Economics Mcqs For Lecturer Test 2017Document27 pagesEconomics Mcqs For Lecturer Test 2017Ameer HaiderNo ratings yet

- Subject-Indian Economics Sem-Vi MCQDocument29 pagesSubject-Indian Economics Sem-Vi MCQTembhurneNo ratings yet

- M.A - Economics - 2017Document17 pagesM.A - Economics - 2017Kanki RajeshNo ratings yet

- Coremacroeconomics 3rd Edition Chiang Test BankDocument50 pagesCoremacroeconomics 3rd Edition Chiang Test Banktwintervoodooaq2t9100% (32)

- IE MCQ 75 CompletedDocument15 pagesIE MCQ 75 CompletedRaghuNo ratings yet

- Question Bank 11 AnnualDocument7 pagesQuestion Bank 11 Annualsayyedafreen091No ratings yet

- Economics MCQS: Answer-DDocument4 pagesEconomics MCQS: Answer-DAnshul WadhwaNo ratings yet

- AFCAT Logical Reasoning Test NoDocument15 pagesAFCAT Logical Reasoning Test NoSOHAM M PANDYANo ratings yet

- Economics: Sample PaperDocument20 pagesEconomics: Sample PaperKunwar PalNo ratings yet

- MCQs 3133 Indian and Global Economic DevelopmentDocument47 pagesMCQs 3133 Indian and Global Economic DevelopmentAtul BorbaneNo ratings yet

- Indian Economy Sample MCQDocument5 pagesIndian Economy Sample MCQswati barejaNo ratings yet

- Sample Question Paper, 12 EconomicsDocument7 pagesSample Question Paper, 12 EconomicsSubhamita DasNo ratings yet

- Home Economics Mcqs PaperDocument27 pagesHome Economics Mcqs Paperlog manNo ratings yet

- Economics Class 12th Sample Paper For Term 1Document39 pagesEconomics Class 12th Sample Paper For Term 1Rachit GilhotraNo ratings yet

- Applied Econ Pre-AssessmentDocument6 pagesApplied Econ Pre-Assessmentirene.lumambas001No ratings yet

- Question BankDocument25 pagesQuestion BankAnonymousNo ratings yet

- First Term Practice Paper NovemberDocument18 pagesFirst Term Practice Paper NovemberAkshat GulatiNo ratings yet

- Pre Board Class X Set BDocument11 pagesPre Board Class X Set BKashvi SinghNo ratings yet

- Class 12 Eco Unit Test 2 2021-22Document13 pagesClass 12 Eco Unit Test 2 2021-22Ayush MishraNo ratings yet

- Micro Finance Solved MCQs (Set-1) McqMatecom - 230619 - 130459Document6 pagesMicro Finance Solved MCQs (Set-1) McqMatecom - 230619 - 130459shyngle secryn100% (1)

- Competitive Exams - Economics MCQs (Practice - Test 34 of 122) - ExamraceDocument6 pagesCompetitive Exams - Economics MCQs (Practice - Test 34 of 122) - ExamracemahamnadirminhasNo ratings yet

- Model 1 XIIDocument18 pagesModel 1 XIISaja FarsanaNo ratings yet

- 10th SST1Document15 pages10th SST1DYNAMIC VERMANo ratings yet

- Cbse Sample Question Paper - 2021-22 Economics (Class 12) Term 1 Time: 90 Minutes Maximum Marks: 40 General Instructions: 1. 2Document15 pagesCbse Sample Question Paper - 2021-22 Economics (Class 12) Term 1 Time: 90 Minutes Maximum Marks: 40 General Instructions: 1. 2vivek periwalNo ratings yet

- Session - 2021-22 Set B Periodic Test - Ii Grade - Xii: Manav Rachna International SchoolDocument16 pagesSession - 2021-22 Set B Periodic Test - Ii Grade - Xii: Manav Rachna International SchoolAkshat GulatiNo ratings yet

- RuralDocument15 pagesRuralAshwani PathakNo ratings yet

- Economic MCQDocument7 pagesEconomic MCQKaran AroraNo ratings yet

- Stock Exchanges World WideDocument24 pagesStock Exchanges World WidebangarumayuriNo ratings yet

- Chapter - 6: Poverty: Ultiple Choice Questions (Choose The Correct Option:)Document16 pagesChapter - 6: Poverty: Ultiple Choice Questions (Choose The Correct Option:)arjunNo ratings yet

- MCQ Sem 5 Fill UpDocument14 pagesMCQ Sem 5 Fill UpAnkita Kumbhar B-205No ratings yet

- Periodic Test 2 Eco Class-12Document4 pagesPeriodic Test 2 Eco Class-12amandeep malikNo ratings yet

- Mycbseguide: Cbse Class 10 Social Science Sample Paper - 08 (MCQ Based)Document10 pagesMycbseguide: Cbse Class 10 Social Science Sample Paper - 08 (MCQ Based)Abdul MuqsitNo ratings yet

- ICO Olympiad Sample Paper 2 For Class 12 With SolutionsDocument29 pagesICO Olympiad Sample Paper 2 For Class 12 With Solutionsjeya moorthyNo ratings yet

- Practice Questions - 2021-22 Term 1 - Class 12 EconomicsDocument12 pagesPractice Questions - 2021-22 Term 1 - Class 12 EconomicssarthakNo ratings yet

- Practice Questions - 2021-22 Term 1 - Class 12 EconomicsDocument12 pagesPractice Questions - 2021-22 Term 1 - Class 12 EconomicsTrilok ChandNo ratings yet

- M.A - Economics - 2016Document16 pagesM.A - Economics - 2016Prasant Kumar Mallick0% (1)

- Strengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceFrom EverandStrengthening India's Intergovernmental Fiscal Transfers: Learnings from the Asian ExperienceNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- 5 FortranDocument54 pages5 FortranKaleeswaran EinsteinNo ratings yet

- Aadhaar Update Form: (Name, Mobile,) Only Fields Mentioned Here Will Be Updated at ASK CenterDocument4 pagesAadhaar Update Form: (Name, Mobile,) Only Fields Mentioned Here Will Be Updated at ASK CenterIqbal FarukNo ratings yet

- DARTAR BERAT BESI BukuDocument12 pagesDARTAR BERAT BESI BukuJhuprie Supriyanto100% (1)

- Configuring The Netgear Ready NAS 2100 For The GDC SR-1000 IMBDocument5 pagesConfiguring The Netgear Ready NAS 2100 For The GDC SR-1000 IMBLA-ZOUBE GAELNo ratings yet

- Exploring Online Readiness in The Context of The COVID 19 PandemicDocument20 pagesExploring Online Readiness in The Context of The COVID 19 PandemicFaith WongNo ratings yet

- Rissner, Christoph - Seminar - Mind MapsDocument23 pagesRissner, Christoph - Seminar - Mind MapsvoodoogodsNo ratings yet

- How To Setup A Simple Scenario With SAP Records Management 2323Document22 pagesHow To Setup A Simple Scenario With SAP Records Management 2323JORGENo ratings yet

- BBVA Continental-Preliminary Offering Circular PDFDocument362 pagesBBVA Continental-Preliminary Offering Circular PDFfanatico1982No ratings yet

- De New Format - Final Exam 167 2023-2024Document8 pagesDe New Format - Final Exam 167 2023-2024phannguyenminh.thuat1412No ratings yet

- Submitted By:: Marketing Strategy Analysis of Bottlers Nepal LTDDocument84 pagesSubmitted By:: Marketing Strategy Analysis of Bottlers Nepal LTDquestion markNo ratings yet

- Chapter 9-Center of Gravity and Centroids-OdatDocument74 pagesChapter 9-Center of Gravity and Centroids-OdatMohammed Al-OdatNo ratings yet

- Partmaker Tech Note #081505: Using Config-By-Click'™ in PartmakerDocument9 pagesPartmaker Tech Note #081505: Using Config-By-Click'™ in Partmaker123anthonyNo ratings yet

- SLXD Guide en-USDocument43 pagesSLXD Guide en-USRicardo BalauNo ratings yet

- Bioremediation of Seafood Processing Plant Effluent: Collection and Biochemical Analysis of EffluentDocument10 pagesBioremediation of Seafood Processing Plant Effluent: Collection and Biochemical Analysis of EffluentAnonymous CwJeBCAXpNo ratings yet

- AT&T Alascom NetworkDocument1 pageAT&T Alascom NetworkrbskoveNo ratings yet

- 29112023T Relief Time Table ClhsDocument11 pages29112023T Relief Time Table Clhsduncan pengchew limNo ratings yet

- Rural Marketing - InsuranceDocument106 pagesRural Marketing - InsurancesinghinkingNo ratings yet

- Exemplar DLP MamchaDocument9 pagesExemplar DLP MamchaRosita C.CayananNo ratings yet

- Strong Rent A Car Offer For Vodafone EmployeeDocument1 pageStrong Rent A Car Offer For Vodafone EmployeeMuhammad Rizwan JavedNo ratings yet

- LUHBC NegoSale Batch 28050 090122Document8 pagesLUHBC NegoSale Batch 28050 090122Angelo James BruanNo ratings yet

- Plastic BagsDocument2 pagesPlastic Bagsapi-289380968No ratings yet

- Csec Poa: Page 8 of 24Document1 pageCsec Poa: Page 8 of 24Tori GeeNo ratings yet

- Production and Comparative Fuel Properties of Biodiesel From Non-Edible Oils Jatropha Curcas, Sterculia Foetida and Ceiba PentandraDocument11 pagesProduction and Comparative Fuel Properties of Biodiesel From Non-Edible Oils Jatropha Curcas, Sterculia Foetida and Ceiba PentandraNashiha SakinaNo ratings yet