Professional Documents

Culture Documents

2021 Telecoms Preview Open RAN

2021 Telecoms Preview Open RAN

Uploaded by

Riad LoucifCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 Telecoms Preview Open RAN

2021 Telecoms Preview Open RAN

Uploaded by

Riad LoucifCopyright:

Available Formats

2021 telecoms preview: open RAN, towers and enterprise

digitisation

INSIGHT SPOTLIGHT

Before the pandemic, the telecoms sector was already As we look ahead to 2021, a number of storylines will

undergoing significant changes from a raft of trends, continue to run: the pandemic impact, commercialising

including new network models, 5G commercialisation 5G, new ways of designing/running mobile networks

and servicing enterprise verticals. While the pace of and the digitisation of the enterprise. This Insight

change has continued in some respects, in others it has Spotlight addresses the latter two, the others having

been masked, subdued or delayed as the been discussed in our previous piece.

reverberations from the pandemic occurred.

Analysis

Network infrastructure: open RAN and tower sharing IoT and enterprise digitisation

There has been a paradigm shift in network infrastructure over the IoT is now mainstream: our latest enterprise survey suggests 65%

last three years, as models of network ownership and operation of enterprise firms (of at least 20 employees) have an active IoT

have changed significantly. Open RAN vendors have made inroads deployment – and plans for further additions. The pandemic has

by offering (generally) very competitive pricing and flexibility with had a detrimental impact on enterprise IT spend and new projects.

reduced lock-in. In parallel, tower sell-offs and spin-outs continue The share of companies planning an IoT deployment in the next 12

at pace, the proceeds of which allow operators to pay down debt months has dropped from 60% to 39%. Consequently, we have

and/or invest in new projects or business lines. downgraded our overall IoT revenue forecast by nearly 20% to

$906 billion in 2025.

What to watch for in 2021

What to watch for in 2021

• Open RAN’s chicken-and-egg issue – On the face of it, open

RAN momentum should continue to build. Open RAN has • Spend recovery – Business investment moves cyclically with

become the native approach to 5G networks for a number of economic growth. Many of the delayed projects are just that,

high-profile groups, notably Rakuten (Japan) and Dish (US). meaning the budget is latent. Should a recovery ensue in the

However, there is a chicken-and-egg issue – that is, operators second half of 2021, spend should start to come back online in

want to adopt the technology once it has scaled but with this support of digital transformation plans.

scale only being possible after operators adopt the technology. It

• Private network deployments – Based on our enterprise

remains to be seen how much of a problem this will pose in the

survey, 20% of enterprises have a location-specific coverage

near term of 1–2 years. This will be a critical time for 5G rollouts,

requirement, but 55% rate private networks as “very important”

during which vendors will need to be capable of delivering

to their IoT plans. The actual demand is likely to sit somewhere

networks on a national-level scale.

in between the two figures, which is a large number when scaled

• Infrastructure consolidation – On the tower front, a number of across early-adopter sectors, notably manufacturing, healthcare

further consolidations have been announced. Telefónica will sell and utilities.

its infrastructure business (Telxius) to American Tower for €7.7

Overall view

billion, while Vodafone’s Vantage will expand its portfolio by

assimilating the mobile towers of the Vodafone/O2 UK network 2021 is likely to be an improvement on 2020, even if the first few

share. An open question is whether the divestment of towers by months are suppressed by the macroeconomic climate. SOHOs and

operators makes wholesale access to competitors a part of sale SMEs will be under pressure for longer than bigger companies.

and leaseback agreements. Large companies in essential production sectors that are less

exposed to lockdown restrictions (e.g. manufacturing) are likely to

Overall view

push ahead with capital investment in support of digital

Open RAN will continue to make inroads, particularly for operator transformation plans, given that many projects have multi-year

networks servicing B2B clients and enterprise connectivity deployment timelines. In addition, most companies with plans to

providers. Its share in national mobile networks is likely to be more invest in IoT, 5G and/or cloud services are now driven by new

limited for now since most operators have already made revenue generation (68% of surveyed enterprises), which can take

commitments to incumbent vendors for the bulk of national 5G time to materialise. A similar proportion (65%) are driven by cost

builds. We expect the trend of infrastructure consolidation to savings, but this has come down markedly from 2018 (85%), when

continue through 2021, and broaden from Europe to Africa and efficiencies were the de facto reason for upgrading IT equipment.

Asia.

© 2021 GSM Association @GSMAi www.gsmaintelligence.com

2021 telecoms preview: open RAN, towers and enterprise digitisation

Implications

Mobile operators

• Seeding the open RAN ecosystem – It is widely recognised • Navigating competitive dynamics in the enterprise – While

that open RAN presents potential benefits in cost savings, operators are the main providers of 5G connectivity, enterprise

reduced vendor lock-in and flexibility in how network elements customers are now purchasing services as bundles more often

are more quickly deployed. And, despite a degree of rather than as a collection of standalone products from

competitive friction, the big picture is of a gradual convergence different suppliers. This means that operators need to act as IT

in network architecture towards a more flexible software-driven and OT consultants that help solve problems rather than being

model that all vendors will eventually follow to a greater or straight connectivity providers, which entails an operational

lesser extent with the figurative pull of gravity. This must, mindset change. The other challenge is that equipment

however, be weighed against practical realities. Operators face vendors (Ericsson, Huawei and Nokia) continue to enjoy higher

large capital outlays for 5G networks that are depreciated over preference ratings than operators among enterprise buyers for

a 5–7 year period. If contracts are awarded to traditional private networks. As a result, there could be more partnerships

vendors, open RAN’s participation is more likely to be on a or consortium-style approaches that involve operators and

targeted/tactical level (e.g. in rural areas) in the near term. vendors jointly bidding for enterprise 5G contracts with each

Vodafone’s UK commitment to 2,600 sites being run on open supplying separate services.

RAN (approximately 15–20% of its national footprint) is a

• Revenue proof points – If the enterprise sector is to become a

reasonable guide. In the near term, the more visible impacts

meaningful source of new 5G revenues for operators, proof

are likely to be in enterprise settings, such as manufacturing

points are needed. Although it remains early days, disclosure is

plants, where network deployments are more targeted and

still very limited, with only a handful of operators (mostly in

allow operators to modularise services such as edge and

South Korea) even releasing 5G subscriber counts. The

slicing.

combined share of B2B, IoT and other enterprise services, such

A scaled ecosystem with wider representation in mobile as security, averages 20–30% of revenue for the largest

networks is probably some years off. How quickly this happens operators (with variance). However, it is not so much the overall

will in large part depend on the buying behaviours of mobile share that matters as the influence on overall mobile revenue

operators. Our survey data indicates that a majority of growth. As new 5G enterprise wins are announced in early-

operators (57%) intend to add at least one new supplier to adopting sectors, such as manufacturing, financial services and

their roster for 5G kit. Open RAN vendors such as Mavenir, healthcare, indications of the impact on overall revenue will be

Altiostar and Parallel Wireless can make inroads, but they may closely followed over the next 2–3 years.

need to look at countrywide or regional partnerships to

increase their scale on a case-by-case basis.

Related reading Author

Network Transformation 2020 Tim Hatt, Head of Research

Sylwia Kechiche, Principal Analyst

Enterprises speak: IoT gets real

© 2021 GSM Association @GSMAi www.gsmaintelligence.com

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- DC30-009 QS-550 Service Manual Rev GDocument60 pagesDC30-009 QS-550 Service Manual Rev GYolanda Peña100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Activity 8 - CFAS AnswerDocument2 pagesActivity 8 - CFAS AnswerRocel Casilao DomingoNo ratings yet

- Model Predictive Control of A Crude Distillation Unit PDFDocument6 pagesModel Predictive Control of A Crude Distillation Unit PDFHussaini Hamisu100% (1)

- Credits and Debits ExplainedDocument2 pagesCredits and Debits ExplainedCristine Jean Dela CruzNo ratings yet

- Global 5G LandscapeDocument13 pagesGlobal 5G LandscapeRiad LoucifNo ratings yet

- Europe, Q4 2020: Commission Policy Will Guide Region's Digital DecadeDocument12 pagesEurope, Q4 2020: Commission Policy Will Guide Region's Digital DecadeRiad LoucifNo ratings yet

- Spectrum For Mobile, Q4 2020:: Auctions, Mmwave and Sharing Gain MomentumDocument25 pagesSpectrum For Mobile, Q4 2020:: Auctions, Mmwave and Sharing Gain MomentumRiad LoucifNo ratings yet

- 5G Digital World - Built On ChipsDocument38 pages5G Digital World - Built On ChipsRiad LoucifNo ratings yet

- Data Extracts Definitions Android Extracts: Last Updated: 2021-10-18Document24 pagesData Extracts Definitions Android Extracts: Last Updated: 2021-10-18Riad LoucifNo ratings yet

- Bureau of Local Government Finance Opinion: Mr. Genestor E. CruzDocument3 pagesBureau of Local Government Finance Opinion: Mr. Genestor E. CruzNash Ortiz LuisNo ratings yet

- Anisa Yuniarti - 41033403200012 - Akuntansi A - TugasAkmenDocument4 pagesAnisa Yuniarti - 41033403200012 - Akuntansi A - TugasAkmenAnisa YuniartiNo ratings yet

- 2023 08 20 11.41.55Document5 pages2023 08 20 11.41.55jas.ibjiNo ratings yet

- 141001E - Gimbals For Antenna Radome MeasurementDocument6 pages141001E - Gimbals For Antenna Radome MeasurementasokanenNo ratings yet

- Uken Catalogue 2022Document214 pagesUken Catalogue 2022ALAMDAR COMPUTERNo ratings yet

- Sia v. CADocument4 pagesSia v. CAChelsy EliosNo ratings yet

- ACLS Skills ChecklistDocument2 pagesACLS Skills ChecklistabdullahNo ratings yet

- Negalegn AlemuDocument145 pagesNegalegn AlemuFanuel MarqosNo ratings yet

- ABOV Semiconductor MDS 20100926Document15 pagesABOV Semiconductor MDS 20100926antonmboxNo ratings yet

- Petrochemichal CatalogueDocument112 pagesPetrochemichal CatalogueHeri Setyanto100% (1)

- Capacitance Theory EDocument36 pagesCapacitance Theory Ethinkiit100% (5)

- Historiographies On The Nature of The Mughal State: Colonialsist HistoriographyDocument3 pagesHistoriographies On The Nature of The Mughal State: Colonialsist Historiographyshah malikNo ratings yet

- Assignment 1 Modelling - An200133Document7 pagesAssignment 1 Modelling - An200133Muhammad Haziq AfiqNo ratings yet

- Holy Child'S Academy: Self-Paced Learning Module in Empowerment Technologies 11Document4 pagesHoly Child'S Academy: Self-Paced Learning Module in Empowerment Technologies 11Jengol MadriñanNo ratings yet

- Lecture-5: Technological Properties of Metals Steel and Its ClassificationDocument51 pagesLecture-5: Technological Properties of Metals Steel and Its ClassificationSarojKumarSinghNo ratings yet

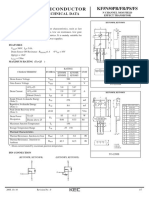

- Semiconductor KF5N50PR/FR/PS/FS: Technical DataDocument7 pagesSemiconductor KF5N50PR/FR/PS/FS: Technical DataHla Swe OoNo ratings yet

- JistadminDocument8 pagesJistadmintester x85No ratings yet

- Escape From MicroburstDocument4 pagesEscape From MicroburstRoger SacchelliNo ratings yet

- FBI Affidavit - Syed Ghulam Nabi Fai (2011.07.18)Document45 pagesFBI Affidavit - Syed Ghulam Nabi Fai (2011.07.18)Patrick PooleNo ratings yet

- UNHCR Travel Policy Changes 1 March 2022 FinalDocument15 pagesUNHCR Travel Policy Changes 1 March 2022 Finalnpbenedek99No ratings yet

- Sps. Buenaventura V CA PDFDocument9 pagesSps. Buenaventura V CA PDFRenceNo ratings yet

- Aadhaar Card ControversyDocument18 pagesAadhaar Card ControversySugandha Kaul100% (1)

- PCS-222B I Instruction Manual en Demostic General R1.00 (En ZNKZ0100.0086.0001)Document88 pagesPCS-222B I Instruction Manual en Demostic General R1.00 (En ZNKZ0100.0086.0001)Ricchie Gotama SihiteNo ratings yet

- Acct Statement - XX0012 - 25052023Document5 pagesAcct Statement - XX0012 - 25052023JunoonNo ratings yet

- Herbs As Raw Material: Prepared by Mrs. Pooja Khanpara R.D. Gardi Pharmacy College, RajkotDocument21 pagesHerbs As Raw Material: Prepared by Mrs. Pooja Khanpara R.D. Gardi Pharmacy College, Rajkotsahajdeep singhNo ratings yet

- Screw Propelled VehicleDocument4 pagesScrew Propelled Vehiclejpalex1986No ratings yet