Professional Documents

Culture Documents

Property Tax Notification 21 Aug 2014 PCMA (Amendment) 2014 Punjab Act No. 19 of 2014

Property Tax Notification 21 Aug 2014 PCMA (Amendment) 2014 Punjab Act No. 19 of 2014

Uploaded by

Puran Singh Labana0 ratings0% found this document useful (0 votes)

6 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageProperty Tax Notification 21 Aug 2014 PCMA (Amendment) 2014 Punjab Act No. 19 of 2014

Property Tax Notification 21 Aug 2014 PCMA (Amendment) 2014 Punjab Act No. 19 of 2014

Uploaded by

Puran Singh LabanaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

PUNJAB GOVT. GAZ. (EXTRA), AUGUST 21,2014 107

(SRWN30, 1936 SAKA)

PARTI

GOVERNMENT OF PUNJAB

DEPARTMENT OF LEGAL AND LEGISLATIVE AFFAIRS, PUNJAB

NOTIFICATION

“The 21st August, 2014

No. 20+Leg /2014.-The following Act of the Legislature of the State

cof Punjab received the assent of the Govemor of Punjab on the 13th Day

cof August, 2014, is hereby published for general information:-

‘THE PUNJAB MUNICIPAL CORPORATION (AMENDMENT)

ACT. 2014

(Punjab: Act Now 19 of 2014)

aN

Act

further to amend the Panjab Municipal Corporation Act, 1976.

Be it enacted by the Legislature of the State of Punjab in the Sixty-

fifth Year of the Republic + Tntia as foltows:-

1, (1). This Act may be called the Punjab Municipal Comporation storie and

(Amendment) Act, 2014. som nenaemet.

(2) Tt shall be deemed to have come into force on and with effect a

from the first day of April, 2013. v

2. In the Punjab Municipal Corperation abet, 1976 (hereinafter Awendoetin

sefrted 0 88 the principal AsD, i section 2, in clause (2A), forthe sign SFO

+." appearing atthe end, the sign "" shall be substituted and thereafter the Jgrs,

following provisos shall be inserted, namely -

“Provided that ifthe minimum value of the land upon which

an industrial building fs constructed or is likely to be constructed

as not declared as industrial land by the Collector, in such a ase.

the market Value of the land shall be seventy five per cent of the

minimum value of the land fixed by the Collector for aoa-

residential bui

Provided fher that if the market value of the Iand upoa

which an indus is ceonstrusted oF ts likely t0 be

constructed is declared as industrial land by the Collector during

the year 2014 on or aller the first day of January of the said

ie

PUNIAB GOVT. GAZ. (EXTRA), AUGUST 21.2014 108

(SRWN30, 1936SAKA)

‘Year, im guch a case the minimum value of the land so fixed shall

bbe taken into consideration for calculation of tax for the financial

year 2014-15.

3. In the principal Act, in section 90, in sub-section (3-A), in the

third proviso, in the Table, after serial No. 4, the following serial No. and

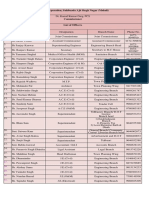

in any rank, whether as a combatant oF

4 non-combatant. in the Naval. Military

or Air Forces of the Union of India

Provided further that in case of buildings and lands of Units oF

Projects covered, under the Notification, the “Fiscal Incentives for

Industrial Promotion-2013'" as notified by the Government of Punjab,

Department of Industries and Commerse, viele No. CC/FIIP2013)

$5343 dated Sth December, 2013. the cxemption shall be available to

such Units or Projects subject tothe terms sind conditions set and 10

the extent indicated therein, on production of a certificate from the

nodal agency specified in the said Notification."

cement 4. In the principal Act, in section 97, for the Table excepting the

sestion97 of provisos thereto, the following Table and Explanation shall be substituted.

Pongbact stot

9% namely =

Serial Category of building Rate of tx

No.

TT Selfeccupied residential (i) Fifiy rupees incase land area isfifty

building square yards or below. having

covered area not more than 430

square Feet

Amendments

sexton 13Sof

Punjab Act 42 of

1976,

(ii)” One hundeed and fifty rupees in

case land area is one hundred

square yards or below, having

(area not more than 900

square feet

Half per cent of the rateable value

in case the land area is fifty square

yards or below OR one hundted

square yards oF below, but the

PUNIABGOVT.GAZ.(EXTRA), AUGUST 21,2014. 109

(SRVN 30, 1936 SAKA)

‘coveredarea exceeds the sipulat

indicated in (and (Zi) above:

(iv) Halt per cent of the rateable value,

incase the land area is five hundred

square yards or below: and

(») One per cent of the rateable value,

in case the fand area i€ more than

five humid square yards.

2 Residential building under __‘Thce percent of tie rateable value. +7

the occupatioa of tenant (5)

3” Self occupied non-residential Thwee percent of the rateable value. 3%

building

4 Self eccupied industrial ‘One ari! half per vent of the rateable “a

— eet, 4

5 Non-residential building under Ten per eent of the rateable value.”. oO

the occupation of tenants)

Explanation. is hereby clarified that if portion of a building ander land

is used for more purposes i

(i) the self occupied residential building for non-residential purpose

or on rent for residentisl purpose or on rent for non-residential

purpose: or

(ii) the self occupied non-residential building for residential porpose

cr on ent for residential purpose ron feat for noa-residestisl

purpose. o

(iti) the self occupied industrial building on rent, oc used for residential

purpose, or used for non-residential purpose:

the rate of tax for that portion of the building andor land shall be the

rate specified in the Table above according to its uses".

S. Ta the principal Act. in section H2-A.~ anes

(A). in sub-section (3), for the words "twenty five per cent" the pave ala

‘words ‘tem per cent” shail be substituted; ve

(B) tor sub-section (S), the following sub-section shall be

substituted, namely:~

“(5) If 90 return is files for

‘of that financial yea

Financial year by the 31st March

unuler sub-section (/), the owner oF

PUNJAB GOVT. GAZ. (EXTRA). AUGUST 21, 2014 10

(SRVN 30. 1936 SAKA)

The occupier, as the ease may be, shall, in addition to the

of the tax, be liable t0 pay twenty per cent of the

ihe rate of eighteen per cent per annum of the tax calculated

the first a upto the date of payment,’and.

the Whole of The amount shall become recoverable under

the provisions of section 138 immediately after the expiry

of the financial year for which no return has been filed.7=

6. Inthe principal Act. in section 138, for clause (¢), the following,

clause shall be substituted, namely:«

“(e) by the sealing oréand attachment and saleof defaulter’s immovable

Property:".

HPS. MAHAL,

Secretary 10 Government of Punjab.

Departmen of Leyal and Legislative AfFairs,

57008.2014/Pb. Govt Press. SAS. Nagar

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Workshop Practice Series - BooksDocument8 pagesWorkshop Practice Series - BooksPuran Singh LabanaNo ratings yet

- Sikh Religion and HinduismDocument277 pagesSikh Religion and HinduismPuran Singh LabanaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Mohali Municipal Corporation List of OfficerDocument2 pagesMohali Municipal Corporation List of OfficerPuran Singh LabanaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Baking Tools and Equipment and Their UsesDocument6 pagesBaking Tools and Equipment and Their UsesPuran Singh LabanaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Music CollectionDocument17 pagesMusic CollectionPuran Singh LabanaNo ratings yet

- Dharmi FoujiDocument108 pagesDharmi FoujiPuran Singh LabanaNo ratings yet

- Protective and Damaging Effects of Stress Mediators (Stress and The Immune System) Chapter FourDocument16 pagesProtective and Damaging Effects of Stress Mediators (Stress and The Immune System) Chapter FourPuran Singh LabanaNo ratings yet

- PROPERTY TAX - Notification - Municipal Corporation OTS-PTAX-date-extend-31.7.2020Document2 pagesPROPERTY TAX - Notification - Municipal Corporation OTS-PTAX-date-extend-31.7.2020Puran Singh LabanaNo ratings yet

- Electrical Engineering Practice ProblemsDocument4 pagesElectrical Engineering Practice ProblemsPuran Singh LabanaNo ratings yet

- PMA AND PMC (Second Amendments) Ordinances No. 5 & 6 of 2014 Respectively Dated 16122014 For PMA Act 1911Document17 pagesPMA AND PMC (Second Amendments) Ordinances No. 5 & 6 of 2014 Respectively Dated 16122014 For PMA Act 1911Puran Singh LabanaNo ratings yet

- Electrical Equipment Check ListDocument3 pagesElectrical Equipment Check ListPuran Singh LabanaNo ratings yet

- Electrical 4Document2 pagesElectrical 4Puran Singh LabanaNo ratings yet

- Carpentry Tools and EquipmentDocument5 pagesCarpentry Tools and EquipmentPuran Singh LabanaNo ratings yet

- Sikh Inqlab Punjabi by Jagjit SinghDocument327 pagesSikh Inqlab Punjabi by Jagjit SinghPuran Singh LabanaNo ratings yet

- Caste System in Sikhism by Jagjit SinghDocument193 pagesCaste System in Sikhism by Jagjit SinghPuran Singh LabanaNo ratings yet

- Percussions of History by Jagjit Singh EnglishDocument385 pagesPercussions of History by Jagjit Singh EnglishPuran Singh LabanaNo ratings yet