Professional Documents

Culture Documents

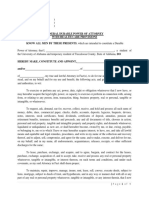

Estate POA - Gifting Powers Language (BCD)

Uploaded by

Audrey HuffOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate POA - Gifting Powers Language (BCD)

Uploaded by

Audrey HuffCopyright:

Available Formats

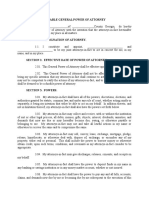

In addition, the Attorney-in-Fact shall have the powers to make gifts on behalf of

the Principal to those individuals and persons specifically named in the Principal's Last Will and

Testament or Revocable Living Trust, in existence at the date of making the gifts, in the same

manner, using the same assets and according to the same terms and conditions as contained in

the Principal's said Last Will and Testament or Revocable Living Trust, making said gifts as if

the Principal had died. In making any such gift, I grant to my Attorney-in-Fact the discretion to

determine the amount of the gift, the date of the gift, and the subject matter of the gift. In

making any such gifts my Attorney-in-Fact shall make the gifts in accordance with the above

directions as contained in the Principal's Last Will and Testament or Revocable Living Trust, in

existence on the date of making such gift, and is hereby specifically authorized on behalf of the

Principal to continue any gifts to be made, in trust or otherwise, as provided in said Last Will and

Testament. Notwithstanding any term or provision of this Durable Power of Attorney, the

Attorney-in-Fact shall not be authorized to exercise any powers granted in this instrument,

should said power be deemed to be a general power of appointment, directly or indirectly

benefitting the named Attorney-in-Fact. For purposes of clarity, the authority granted herein to

my Attorney-in-Fact to make gifts, includes, but is not limited to, the power to change ownership

and beneficiary designations on life insurance policies, annuities, pension, profit-sharing plans,

IRA accounts, and all similar accounts or agreements for purposes of transferring ownership or

beneficial interests or rights to receive benefits to the herein named individuals as donees, or

their estates. The Attorney-in-Fact shall be authorized to exercise all rights the Principal has,

with regard to any Section 529 plan funded or owned by the Principal, including but not limited

to, the power to withdraw, terminate, or change beneficiaries on said plan or plans.

Additionally, the Attorney-in-Fact shall have the authority to change the beneficiary designation

on any of the aforementioned accounts, rights or beneficial interests owned or given to the

Principal or to the Principal's estate.

Further, my Attorney-in-Fact shall have the power to execute and file disclaimers

on behalf of the Principal; provided, the execution and filing of the disclaimer is not a general

power of appointment in favor of the Attorney-in-Fact.

In making gifts to beneficiaries who may be minors at the time that the gift is

made to them, my Attorney-in-Fact is authorized to make said gifts in a trust for the benefit of

said minor beneficiary, or to make gifts to a custodian selected by my Attorney-in-Fact under

the Uniform Transfer to Minors Act for the benefit of the beneficiary.

The Attorney-in-Fact is specifically authorized to delegate their duties to another

co-Attorney-in-Fact or to any successor named Attorney-in-Fact. Said delegation may be made

orally or in writing, and if made orally, be memorialized in writing upon the request of any party

wishing verification of said delegation of duties.

You might also like

- Durable Power of AttorneyDocument5 pagesDurable Power of AttorneyDouglas NelsonNo ratings yet

- General POA PDFDocument4 pagesGeneral POA PDFAnthonyHansen100% (2)

- Washington Durable Financial Power of Attorney FormDocument5 pagesWashington Durable Financial Power of Attorney FormKwasi RayenNo ratings yet

- General POA PDFDocument4 pagesGeneral POA PDFlibriea runnellsNo ratings yet

- Durable Power of Attorney Postable VersionDocument9 pagesDurable Power of Attorney Postable Versionlegalparaeagle100% (1)

- Nominee Agreement SummaryDocument2 pagesNominee Agreement SummaryAlma SantiagoNo ratings yet

- Template Nominee AgreementDocument3 pagesTemplate Nominee Agreementsheila yutuc0% (1)

- Revocable Living TrustDocument5 pagesRevocable Living TrustgrandebleuNo ratings yet

- Durable Power of AttorneyDocument7 pagesDurable Power of AttorneyRocketLawyer75% (8)

- Broad Power of AttorneyDocument6 pagesBroad Power of Attorneyanon_974142023No ratings yet

- Genaral Power of AttorneyDocument4 pagesGenaral Power of AttorneyharibabuNo ratings yet

- The Law Office of Clinton Consultancy: Durable Financial Power of AttorneyDocument5 pagesThe Law Office of Clinton Consultancy: Durable Financial Power of Attorneyvasol abrhaNo ratings yet

- California Power of AttorneyDocument5 pagesCalifornia Power of Attorneyjames breno100% (1)

- California Will TemplateDocument8 pagesCalifornia Will TemplateDaveNo ratings yet

- Florida General Power of Attorney FormDocument5 pagesFlorida General Power of Attorney FormClari Herrera0% (1)

- Basic Sample Will (South Africa) - With Legal Guardian ClauseDocument3 pagesBasic Sample Will (South Africa) - With Legal Guardian ClauseLauren Joanne Lister50% (2)

- Medical Power of Attorney PDFDocument10 pagesMedical Power of Attorney PDFPam Brewer100% (1)

- Child Support Agreement PDFDocument3 pagesChild Support Agreement PDFAnthonyHansen100% (2)

- BLANK Trust FOR BANKSDocument7 pagesBLANK Trust FOR BANKSGeraldNo ratings yet

- Florida Durable Power of Attorney: Effective DateDocument7 pagesFlorida Durable Power of Attorney: Effective DateDarci Peace-OfferNo ratings yet

- General Durable Power of AttorneyDocument4 pagesGeneral Durable Power of AttorneynrrtaftNo ratings yet

- Executed Docs (00907407xBADA8)Document15 pagesExecuted Docs (00907407xBADA8)kuhnr8677No ratings yet

- Will For Parents of Minor ChildrenDocument10 pagesWill For Parents of Minor ChildrenRocketLawyerNo ratings yet

- Power of Attorney - Blank GenericDocument9 pagesPower of Attorney - Blank GenericBELKALIBBANo ratings yet

- Power of AttorneyDocument13 pagesPower of AttorneyMd Shahad AliNo ratings yet

- Full Power of AttorneyDocument4 pagesFull Power of Attorneyempoweredwendy7588No ratings yet

- Arizona Durable Power of Attorney Form PDFDocument2 pagesArizona Durable Power of Attorney Form PDFmax midas100% (1)

- General Power of AttorneyDocument5 pagesGeneral Power of AttorneyRocketLawyer100% (9)

- Amending Trust Deeds in Terms of Common Law and Derived PowersDocument3 pagesAmending Trust Deeds in Terms of Common Law and Derived PowersMohit SoniNo ratings yet

- Trustees and Fiduciary RelationshipsDocument42 pagesTrustees and Fiduciary RelationshipsQuinnee VallejosNo ratings yet

- JOINT Durable General Power of Attorney WITH HIPPA WaiverDocument4 pagesJOINT Durable General Power of Attorney WITH HIPPA WaiverCarrington AdkinsNo ratings yet

- Revocable Living Trust TemplateDocument8 pagesRevocable Living Trust TemplateR Erin Lenth80% (15)

- North Carolina General Power of Attorney FormDocument5 pagesNorth Carolina General Power of Attorney FormDoug JonesNo ratings yet

- Redacted General Durable Poa, Executor & ArDocument5 pagesRedacted General Durable Poa, Executor & ArGreg GroeperNo ratings yet

- Last Will and Testament PDFDocument9 pagesLast Will and Testament PDFPam BrewerNo ratings yet

- Power of AttorneyDocument10 pagesPower of AttorneyRocketLawyer82% (17)

- Will - Single Woman Without ChildrenDocument4 pagesWill - Single Woman Without ChildrenLegal Forms100% (8)

- Spa ApuranDocument2 pagesSpa Apuranma.loidarollorataNo ratings yet

- Durable Power of Attorney For Financial ManagementDocument12 pagesDurable Power of Attorney For Financial ManagementEvan CaffreyNo ratings yet

- Oklahoma Durable Financial Power of Attorney FormDocument6 pagesOklahoma Durable Financial Power of Attorney FormCarlos VaqueroNo ratings yet

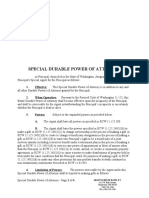

- Special Power of AttorneyDocument5 pagesSpecial Power of AttorneyRocketLawyer75% (12)

- Copy-Power-of-attorney FileDocument10 pagesCopy-Power-of-attorney Fileraheemtimo1No ratings yet

- Durable Power of AttorneyDocument9 pagesDurable Power of AttorneyJohn Wallace100% (3)

- Exported Durable Power of Attorney For Finances - Mario GaleanaDocument10 pagesExported Durable Power of Attorney For Finances - Mario GaleanaCOPIAS DELCENTRONo ratings yet

- Last Will and TestamentDocument10 pagesLast Will and Testamentapi-317218918No ratings yet

- Differences Between Trustees, Executors and AdministratorsDocument8 pagesDifferences Between Trustees, Executors and AdministratorsJuan VillanuevaNo ratings yet

- Weekly Assignment 5Document3 pagesWeekly Assignment 5Chaitanya ChoudharyNo ratings yet

- Florida Durable Power of Attorney Form For Finances Property and Health CareDocument6 pagesFlorida Durable Power of Attorney Form For Finances Property and Health CareDorian Taylor100% (1)

- Oregon General Power of AttorneyDocument5 pagesOregon General Power of AttorneyEmyrose IceNo ratings yet

- WISCONSIN BASIC POWER OF ATTORNEYDocument4 pagesWISCONSIN BASIC POWER OF ATTORNEYJim EngineeringNo ratings yet

- Persons and Family Relations - Support & Parental AuthorityDocument6 pagesPersons and Family Relations - Support & Parental AuthorityCed Jabez David EnocNo ratings yet

- General Power of Attorney967Document2 pagesGeneral Power of Attorney967annpurna pathakNo ratings yet

- Durable Power of AttorneyDocument5 pagesDurable Power of Attorneypretty new moon-elNo ratings yet

- Vermont Durable Financial Power of AttorneyDocument5 pagesVermont Durable Financial Power of AttorneyCarlos VaqueroNo ratings yet

- Trust AgreementDocument4 pagesTrust AgreementDeb VeilleNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- The Science of Happiness: ‘Discovering the Secrets of a Joyful and Fulfilling Life’From EverandThe Science of Happiness: ‘Discovering the Secrets of a Joyful and Fulfilling Life’No ratings yet

- JACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtFrom EverandJACK'S HANDY GUIDE TO TRUSTS: Staying Out of CourtRating: 5 out of 5 stars5/5 (1)

- Girls-Camp-Songbook1Document10 pagesGirls-Camp-Songbook1Audrey HuffNo ratings yet

- Special DPA (Eby Example) BCDDocument4 pagesSpecial DPA (Eby Example) BCDAudrey HuffNo ratings yet

- Delegation Agreement (Example)Document3 pagesDelegation Agreement (Example)Audrey HuffNo ratings yet

- Declination To Act As POADocument1 pageDeclination To Act As POAAudrey HuffNo ratings yet

- Declination To Act As TrusteeDocument1 pageDeclination To Act As TrusteeAudrey HuffNo ratings yet

- Nature and Form of Business OrganizationDocument2 pagesNature and Form of Business OrganizationJash Raven BoraboNo ratings yet

- Wills Trusts Estates OutlineDocument73 pagesWills Trusts Estates OutlineGScibNo ratings yet

- PCCr solidary liability extinguished by releasesDocument1 pagePCCr solidary liability extinguished by releasesMarcella Maria KaraanNo ratings yet

- Jones V Star Credit CaseDocument1 pageJones V Star Credit CaseOmar O'KhanadaNo ratings yet

- Aleman V CateraDocument2 pagesAleman V CateraDane NuesaNo ratings yet

- XM Client Agreement Terms and Conditions of BusinessDocument87 pagesXM Client Agreement Terms and Conditions of BusinessDian PratiwiNo ratings yet

- Law of Torts NotesDocument100 pagesLaw of Torts NotesVNo ratings yet

- Last Will and Testament v3Document4 pagesLast Will and Testament v3Abegail Protacio Guardian100% (1)

- Articles of Incorporation-Stock CorpDocument5 pagesArticles of Incorporation-Stock CorpjonjonNo ratings yet

- Affiliate Agreement SummaryDocument22 pagesAffiliate Agreement SummarySuruchi Singh100% (1)

- Zuellig Pharma Corp V Alice Sibal Et. AlDocument4 pagesZuellig Pharma Corp V Alice Sibal Et. AlFrank Gernale GolpoNo ratings yet

- DigestDocument4 pagesDigestailynvdsNo ratings yet

- Bank Loan Recovery CaseDocument9 pagesBank Loan Recovery CaseSanjukta MajumdarNo ratings yet

- Capacitor Conversion Chart Texas Tone Blog PDFDocument3 pagesCapacitor Conversion Chart Texas Tone Blog PDFELVISNo ratings yet

- Del Rosario v. Manila Electric DIGESTDocument3 pagesDel Rosario v. Manila Electric DIGESTkim_santos_20No ratings yet

- Complete Contracts 'A' Study NotesDocument77 pagesComplete Contracts 'A' Study NotesMohammad Fauzi Hassan50% (2)

- Case Digest G.R. No. 214866Document2 pagesCase Digest G.R. No. 214866Trisha Laine PinpinNo ratings yet

- Duties & Rights of PrincipalDocument5 pagesDuties & Rights of PrincipalAnnanya SinghNo ratings yet

- CPC Assignment 8 The SemDocument8 pagesCPC Assignment 8 The Semsinistro CFCNo ratings yet

- Union Bank v. Santibañez - G.R. No. 149926 PDFDocument6 pagesUnion Bank v. Santibañez - G.R. No. 149926 PDFAnn ChanNo ratings yet

- PNB Vs CA and PadillaDocument2 pagesPNB Vs CA and PadillaMuli MJNo ratings yet

- Heirs of Spouses Sandejas v. LinaDocument16 pagesHeirs of Spouses Sandejas v. LinaAaron CariñoNo ratings yet

- SCDL BusinessLaw Assignment Oct20Document9 pagesSCDL BusinessLaw Assignment Oct20priyajeejo100% (1)

- Switch Bills of Lading ExplainedDocument12 pagesSwitch Bills of Lading ExplainedMehul GujarNo ratings yet

- Cooperation Agt. PGG Recaneli Draft II 2020.08.25Document21 pagesCooperation Agt. PGG Recaneli Draft II 2020.08.25SelurongNo ratings yet

- 13 Sps Santos vs. Court of AppealsDocument2 pages13 Sps Santos vs. Court of AppealsMyla RodrigoNo ratings yet

- Marriage and Divorce - Annulment - Marriage in JestDocument4 pagesMarriage and Divorce - Annulment - Marriage in JestNadzlah BandilaNo ratings yet

- Smith Kline v. CA - 1997Document3 pagesSmith Kline v. CA - 1997RNicolo Ballesteros100% (1)

- Apply for an Auto Loan in 4 StepsDocument2 pagesApply for an Auto Loan in 4 StepsKarl LabagalaNo ratings yet

- Consipracy As Tort UPSC Law OPtional Mains ConceptsDocument4 pagesConsipracy As Tort UPSC Law OPtional Mains ConceptsaskshubhangivermaNo ratings yet