Professional Documents

Culture Documents

Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010

Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010

Uploaded by

Sano Manjiro0 ratings0% found this document useful (0 votes)

7 views1 pageThis document defines key terms used in Philippine income tax law:

1) It defines terms related to taxpayers and income sources such as "shareholder", "taxpayer", "trade or business", and "securities".

2) It also defines accounting and business terms such as "taxable year", "fiscal year", "paid or incurred", and "including or includes".

3) Finally, it defines financial industry terms like "bank", "non-bank financial intermediary", and "quasi-banking activities". The purpose is to clarify the technical meaning of these terms as they are used in the country's tax code.

Original Description:

Original Title

Income_tax_reviewer-3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines key terms used in Philippine income tax law:

1) It defines terms related to taxpayers and income sources such as "shareholder", "taxpayer", "trade or business", and "securities".

2) It also defines accounting and business terms such as "taxable year", "fiscal year", "paid or incurred", and "including or includes".

3) Finally, it defines financial industry terms like "bank", "non-bank financial intermediary", and "quasi-banking activities". The purpose is to clarify the technical meaning of these terms as they are used in the country's tax code.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageIncome Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010

Income Tax Reviewer and Case Digests PAGE-3 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010

Uploaded by

Sano ManjiroThis document defines key terms used in Philippine income tax law:

1) It defines terms related to taxpayers and income sources such as "shareholder", "taxpayer", "trade or business", and "securities".

2) It also defines accounting and business terms such as "taxable year", "fiscal year", "paid or incurred", and "including or includes".

3) Finally, it defines financial industry terms like "bank", "non-bank financial intermediary", and "quasi-banking activities". The purpose is to clarify the technical meaning of these terms as they are used in the country's tax code.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

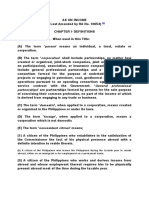

INCOME TAX REVIEWER AND CASE DIGESTS

PAGE- 3 –

ventures taxable as corporations, associations and recreation or The terms shall be construed according to the method of

amusement clubs (such as golf, polo or similar clubs), and accounting upon the basis of which the net income is computed

mutual fund certificates. under this Title.

SHAREHOLDER TRADE OR BUSINESS

The term shall include holders of a share/s of stock, warrant/s The term includes the performance of the functions of a public

and/or option/s to purchase shares of stock of a corporation, as office.

well as a holder of a unit of participation in a partnership

(except general professional partnerships) in a joint stock SECURITIES

company, a joint account, a taxable joint venture, a member of The term means shares of stock in a corporation and rights to

an association, recreation or amusement club (such as golf, polo subscribe for or to receive such shares. The term includes bonds,

or similar clubs) and a holder of a mutual fund certificate, a debentures, notes or certificates, or other evidence or

member in an association, joint-stock company, or insurance indebtedness, issued by any corporation, including those issued

company. by a government or political subdivision thereof, with interest

coupons or in registered form.

TAXPAYER

The term means any person subject to tax imposed by this Title. DEALER IN SECURITIES

The term means a merchant of stocks or securities, whether an

INCLUDING OR INCLUDES individual, partnership or corporation, with an established place

The terms when used in a definition contained in this Title, of business, regularly engaged in the purchase of securities and

shall not be deemed to exclude other things otherwise within the the resale thereof to customers; that is, one who, as a merchant,

meaning of the term defined. buys securities and re-sells them to customers with a view to the

gains and profits that may be derived therefrom.

TAXABLE YEAR

The term means the calendar year, or the fiscal year ending BANK

during such calendar year, upon the basis of which the net The term means every banking institution, as defined in Section

income is computed under this Title. 'Taxable year' includes, in 2 of Republic Act No. 337, as amended, otherwise known as the

the case of a return made for a fractional part of a year under General banking Act. A bank may either be a commercial bank,

the provisions of this Title or under rules and regulations a thrift bank, a development bank, a rural bank or specialized

prescribed by the Secretary of Finance, upon recommendation of government bank.

the commissioner, the period for which such return is made.

NON-BANK FINANCIAL INTERMEDIARY

FISCAL YEAR The term means a financial intermediary, as defined in Section

The term means an accounting period of twelve (12) months 2(D)(C) of Republic Act No. 337, as amended, otherwise known

ending on the last day of any month other than December. as the General Banking Act, authorized by the Bangko Sentral

ng Pilipinas (BSP) to perform quasi-banking activities.

PAID OR INCURRED/PAID OR ACCRUED

QUASI-BANKING ACTIVITIES

MA. ANGELA LEONOR C. AGUINALDO

ATENEO LAW 2010

You might also like

- A Practical Introduction To Australian Taxation Pages 1 To 25Document25 pagesA Practical Introduction To Australian Taxation Pages 1 To 25PuffleNo ratings yet

- Convertible Note AgreementDocument12 pagesConvertible Note AgreementAbhinav Bharadwaj100% (1)

- Tax Opinion PDFDocument8 pagesTax Opinion PDFclaoctavianoNo ratings yet

- Module 4 - Fundamentals of Taxation-6601Document6 pagesModule 4 - Fundamentals of Taxation-6601YashNo ratings yet

- 31 CFR 363-Definitions For TDA Acct - Minor Acct, Delinking Acct., GAIN CONTROLDocument7 pages31 CFR 363-Definitions For TDA Acct - Minor Acct, Delinking Acct., GAIN CONTROLSteveManning100% (5)

- SCCP Multilateral Master Securities Lending Agreement - Original - Cash and Securities CollateralDocument35 pagesSCCP Multilateral Master Securities Lending Agreement - Original - Cash and Securities CollateralConsigliere122No ratings yet

- KKR Private Equity Investors, L.P. Limited Partnership Agreement 2-May-2007Document50 pagesKKR Private Equity Investors, L.P. Limited Partnership Agreement 2-May-2007AsiaBuyouts100% (11)

- Barangay Tax Code Sample PDFDocument14 pagesBarangay Tax Code Sample PDFSusan Carbajal100% (2)

- Lecture Notes VII Theories On Government SpendingDocument6 pagesLecture Notes VII Theories On Government SpendingrichelNo ratings yet

- Convertible NoteDocument11 pagesConvertible NoteMasood Khan100% (1)

- SEC. 22. Definitions. - When Used in This TitleDocument9 pagesSEC. 22. Definitions. - When Used in This TitleHazel Martinii PanganibanNo ratings yet

- Definition of Terms NIRC Tax CodeDocument5 pagesDefinition of Terms NIRC Tax CodeRaffyLaguesmaNo ratings yet

- Title Ii Chapter IDocument4 pagesTitle Ii Chapter IMae CarpilaNo ratings yet

- Kinds of TaxpayersDocument7 pagesKinds of TaxpayersRZ ZamoraNo ratings yet

- B (Face of Note)Document8 pagesB (Face of Note)J.D WorldclassNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument34 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleAj de CastroNo ratings yet

- Title Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in ThisDocument4 pagesTitle Ii Tax On Income (As Last Amended by RA No. 10653) Chapter I-Definitions SEC. 22. Definitions. - When Used in ThisJa Mi LahNo ratings yet

- Definition of Terms-TAXDocument5 pagesDefinition of Terms-TAXAnonymous iOYkz0wNo ratings yet

- Legal & Regularoty UndertakingDocument5 pagesLegal & Regularoty Undertakingmudassir.rehmanNo ratings yet

- Sec 22-NircDocument8 pagesSec 22-NircohyeahyeahNo ratings yet

- Devt Framework For GovDocument11 pagesDevt Framework For GovAriam Allewol YohogadNo ratings yet

- Chapter I - Definitions SEC. 22. Definitions - When Used in This TitleDocument10 pagesChapter I - Definitions SEC. 22. Definitions - When Used in This TitleKayzer SabaNo ratings yet

- Income TaxDocument6 pagesIncome TaxEARNo ratings yet

- Disposal AgreementDocument25 pagesDisposal Agreementgeorgeteo2003No ratings yet

- Deme U1 Act1 Glosario Piñatorresdiana KarinaDocument8 pagesDeme U1 Act1 Glosario Piñatorresdiana KarinaAdemia LolNo ratings yet

- VIMA 2.0 Model Founders' Agreement (Revised) (Clean)Document31 pagesVIMA 2.0 Model Founders' Agreement (Revised) (Clean)migapi2839No ratings yet

- 2020 - IMA Agreement (Directional) With Annex A PDFDocument5 pages2020 - IMA Agreement (Directional) With Annex A PDFKrisha Marie CarlosNo ratings yet

- Investment Advisers Act of 1940Document30 pagesInvestment Advisers Act of 1940Edward WinfreySNo ratings yet

- Financing Companies and Other Non Bank InstitutionsDocument24 pagesFinancing Companies and Other Non Bank InstitutionsbessmasanqueNo ratings yet

- CHAPTER I DefinitionsDocument6 pagesCHAPTER I DefinitionsJudy Ann NicodemusNo ratings yet

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Advanced Accounting NotesDocument8 pagesAdvanced Accounting Noteslove bangtanNo ratings yet

- L1LSFCY US Feeder Fund PPMDocument60 pagesL1LSFCY US Feeder Fund PPMlaquetengoNo ratings yet

- Convertible Promissory Note Purchase AgreementDocument14 pagesConvertible Promissory Note Purchase AgreementLegal Advisory & Commerce LawyerNo ratings yet

- Definition of Deposits For DPT-3Document2 pagesDefinition of Deposits For DPT-3Niyati KamaniNo ratings yet

- Amended Shareholders AgreementDocument44 pagesAmended Shareholders Agreementmigapi2839No ratings yet

- LPrep Draft 2020 40 Draft in On The Taxation of The Receipt of Deposits 23 July 2020Document14 pagesLPrep Draft 2020 40 Draft in On The Taxation of The Receipt of Deposits 23 July 2020GWENDOLINE HWEMENDENo ratings yet

- 5 Dex42.htm FORM OF DEBENTUREDocument7 pages5 Dex42.htm FORM OF DEBENTUREMOHAMMAD BHAI A SIDDIQUINo ratings yet

- Amended & Restated LLC Operating AgreementDocument36 pagesAmended & Restated LLC Operating Agreementmbortz-1No ratings yet

- Term Sheet - Convertible Note - SkillDzireDocument5 pagesTerm Sheet - Convertible Note - SkillDzireMAツVIcKYツNo ratings yet

- Investment in Associated CompaniesDocument10 pagesInvestment in Associated CompaniesMuhammad IbrahimNo ratings yet

- Income TaxDocument9 pagesIncome TaxYsa SumayaNo ratings yet

- Income Tax For Ind. and Corp. Wo ADocument11 pagesIncome Tax For Ind. and Corp. Wo Ashai santiagoNo ratings yet

- Draft Subscription Agreement - SIAA - Clean - 06.08.2020Document25 pagesDraft Subscription Agreement - SIAA - Clean - 06.08.2020Zahed IbrahimNo ratings yet

- Chapter 7 HomeworkDocument3 pagesChapter 7 HomeworkSarah MoonNo ratings yet

- Project Hope IA ExecutedDocument156 pagesProject Hope IA ExecutedFerdee FerdNo ratings yet

- NIRD Sec 21-33Document13 pagesNIRD Sec 21-33Jed MacaibayNo ratings yet

- Tax Code of The PhilippinesDocument10 pagesTax Code of The PhilippinesPooja MurjaniNo ratings yet

- Convertable Promissory Note - TemplateDocument10 pagesConvertable Promissory Note - TemplateM00SEKATEER100% (1)

- Barangay Tax Code SampleDocument14 pagesBarangay Tax Code SampleMark Andrei Gubac100% (1)

- Tax Prespective of Dividends in NepalDocument15 pagesTax Prespective of Dividends in NepalMahesh ChapaiNo ratings yet

- Income Tax For Ind - and Corp - 1Document11 pagesIncome Tax For Ind - and Corp - 1bobo kaNo ratings yet

- Bir RR 12-2003Document10 pagesBir RR 12-2003HjktdmhmNo ratings yet

- Term Paper On DebentureDocument13 pagesTerm Paper On DebentureAakanchhya BhattaNo ratings yet

- Handout - Module 3 - Income Tax - Part 1Document65 pagesHandout - Module 3 - Income Tax - Part 1zahreenamolinaNo ratings yet

- 3 Deposit Insurance Guidelines On Determination of Beneficial Ownership of Deposits Including Transfers Break Up of DepositDocument3 pages3 Deposit Insurance Guidelines On Determination of Beneficial Ownership of Deposits Including Transfers Break Up of DepositjennidyNo ratings yet

- SHA TemplateDocument22 pagesSHA TemplatelechiezNo ratings yet

- Series LLC SPV PPMDocument62 pagesSeries LLC SPV PPMLV IbeNo ratings yet

- Eli Grace L. Bajado BSA - 212 Promissory NoteDocument2 pagesEli Grace L. Bajado BSA - 212 Promissory NoteMark christianNo ratings yet

- Yes G Form PDFDocument5 pagesYes G Form PDFjames agboNo ratings yet

- Glossary of Municipal Bond TermsDocument11 pagesGlossary of Municipal Bond TermsYenny SuNo ratings yet

- Irr PagibigDocument22 pagesIrr PagibigAustine Clarese VelascoNo ratings yet

- Production Departments Direct Labor Rate Manufacturing Overhead Application RatesDocument10 pagesProduction Departments Direct Labor Rate Manufacturing Overhead Application RatesSano ManjiroNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- 2.2.1 de Broglie Waves: 2.2 ProblemsDocument1 page2.2.1 de Broglie Waves: 2.2 ProblemsSano ManjiroNo ratings yet

- Quiz #1 PracticeDocument7 pagesQuiz #1 PracticeSano ManjiroNo ratings yet

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument15 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaSano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-119Document1 page1000 Solved Problem in Modern Physics-119Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-118Document1 page1000 Solved Problem in Modern Physics-118Sano ManjiroNo ratings yet

- Econs 101 - Quiz #2 Answer KeyDocument1 pageEcons 101 - Quiz #2 Answer KeySano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-120Document1 page1000 Solved Problem in Modern Physics-120Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-108Document1 page1000 Solved Problem in Modern Physics-108Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-116Document1 page1000 Solved Problem in Modern Physics-116Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-105Document1 page1000 Solved Problem in Modern Physics-105Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-101Document1 page1000 Solved Problem in Modern Physics-101Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-106Document1 page1000 Solved Problem in Modern Physics-106Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-107Document1 page1000 Solved Problem in Modern Physics-107Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-104Document1 page1000 Solved Problem in Modern Physics-104Sano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-103Document1 page1000 Solved Problem in Modern Physics-103Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case No.1 Land OLD BLDG NEW BLDG LI NotesSano ManjiroNo ratings yet

- Two Limiting Cases Ne: 1.3 Solutions 83Document1 pageTwo Limiting Cases Ne: 1.3 Solutions 83Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-4 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Capitalizable Cost of MachineryDocument1 pageNFCPAR-Auditing Problems: Capitalizable Cost of MachinerySano ManjiroNo ratings yet

- 1000 Solved Problem in Modern Physics-102Document1 page1000 Solved Problem in Modern Physics-102Sano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Old Building Will Not Be DemolishedDocument1 pageNFCPAR-Auditing Problems: Old Building Will Not Be DemolishedSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 2 Land BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-2 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-5 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- Solution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsDocument1 pageSolution Guide Property, Plant, and Equipment: NFCPAR-Auditing ProblemsSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Description Machinery Others NotesDocument1 pageNFCPAR-Auditing Problems: Description Machinery Others NotesSano ManjiroNo ratings yet

- NFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesDocument1 pageNFCPAR-Auditing Problems: Case 1 Land BLDG LI NotesSano ManjiroNo ratings yet

- Income Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Document1 pageIncome Tax Reviewer and Case Digests PAGE-6 - : Ma. Angela Leonor C. Aguinaldo Ateneo Law 2010Sano ManjiroNo ratings yet

- 15 Ca CBDocument6 pages15 Ca CBMithileshNo ratings yet

- Founders' Agreement Template: The CompanyDocument7 pagesFounders' Agreement Template: The Companymishra1mayankNo ratings yet

- Adv CH - 1 PARTNERSHIPSDocument21 pagesAdv CH - 1 PARTNERSHIPSMohammed AwolNo ratings yet

- Integrated Financial Management System (IFMS) : VisionDocument4 pagesIntegrated Financial Management System (IFMS) : VisionPrince RajNo ratings yet

- Income Tax QuizDocument69 pagesIncome Tax QuizsubakarthiNo ratings yet

- Ledger and Balance SheetDocument4 pagesLedger and Balance SheetSyed ZamanNo ratings yet

- Vanguard Key FeaturesDocument12 pagesVanguard Key FeaturesPardeep SinghNo ratings yet

- RR No. 04-2007Document4 pagesRR No. 04-2007Kristel Anne LiwagNo ratings yet

- G.R. No. 192391Document9 pagesG.R. No. 192391Anonymous KgPX1oCfrNo ratings yet

- (Continuation Sheet For Form 1105) Section 1 - Taxpayer InformationDocument7 pages(Continuation Sheet For Form 1105) Section 1 - Taxpayer InformationWara GobeNo ratings yet

- 01 Introduction To Donation and Donor - S TaxDocument6 pages01 Introduction To Donation and Donor - S TaxJaneLayugCabacunganNo ratings yet

- Notre Dame Educational Association: Mock Board Examination TaxationDocument10 pagesNotre Dame Educational Association: Mock Board Examination TaxationirishjadeNo ratings yet

- Taxation Major Exam Final QuestionnaireDocument16 pagesTaxation Major Exam Final QuestionnaireSec PishNo ratings yet

- BUCKLEY - The American Illness - Essays On The Rule of Law-Yale University Press (2013)Document547 pagesBUCKLEY - The American Illness - Essays On The Rule of Law-Yale University Press (2013)Guilherme Carneiro Monteiro NitschkeNo ratings yet

- Chap-5 Network Design in The Supply ChainDocument44 pagesChap-5 Network Design in The Supply ChainMd. Sirajul IslamNo ratings yet

- Zurich Whole of Life Target Market StatementDocument1 pageZurich Whole of Life Target Market StatementLucia ChekaiNo ratings yet

- Mosaic RulebookDocument28 pagesMosaic RulebookDanNo ratings yet

- Wallstreetjournal 20171102 TheWallStreetJournalDocument36 pagesWallstreetjournal 20171102 TheWallStreetJournalsadaq84No ratings yet

- PSF36 Salary Sacrifice PDFDocument2 pagesPSF36 Salary Sacrifice PDFHarpreet KaurNo ratings yet

- Ebook PDF Transfer Pricing and The Arms Length Principle After Beps PDFDocument35 pagesEbook PDF Transfer Pricing and The Arms Length Principle After Beps PDFernest.kirschenbaum650100% (32)

- Supreme Court: Antonio Belmonte For Appellant. Attorney-General Avanceña For AppelleeDocument4 pagesSupreme Court: Antonio Belmonte For Appellant. Attorney-General Avanceña For AppelleeDarl YabutNo ratings yet

- Pakistan State Oil Limited: Horizontal AnalysisDocument17 pagesPakistan State Oil Limited: Horizontal AnalysissaadriazNo ratings yet

- Reviewer: Chapter 6 Disbursement: Modes of DisbursementsDocument4 pagesReviewer: Chapter 6 Disbursement: Modes of DisbursementsNicole AutrizNo ratings yet

- Madrigal V RaffertyDocument2 pagesMadrigal V RaffertyiptrinidadNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- IB1 CH 3.4 Final Accounts 2020 PDFDocument38 pagesIB1 CH 3.4 Final Accounts 2020 PDFamira zahari100% (1)