Professional Documents

Culture Documents

Taxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The State

Uploaded by

gilbert marimon chattoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Law Review Notes: I. Basic Principles of Taxation A. Taxation As An Inherent Power of The State

Uploaded by

gilbert marimon chattoCopyright:

Available Formats

Taxation Law Review

TAXATION LAW REVIEW NOTES

I. BASIC PRINCIPLES OF TAXATION

A. TAXATION AS AN INHERENT POWER OF THE STATE

Power to tax is inherent in sovereignty

the moment the State exists, the power to tax automatically exists

enforceable even without any delegation by the Constitution or legislation from Congress

LGUs have no inherent power to tax; but expressly granted by the Constitution or legislation

Lifeblood Theory (CIR v Algue)

Tax is necessary to meet the expenses of government without which the latter cannot

operate

Every person must contribute his share in the running of the government

B. PHASES AND SCOPE OF TAXATION

Levy – where Congress enacts a statute to impose taxes

Collection

Subject Matter – refers to persons, things, transaction, privilege, etc.

C. INHERENT LIMITATIONS

1. Taxation should be for public use

a. Public welfare should be the penultimate objective.

b. Taxation may be used to implement the State’s police power.

2. Taxation is inherently legislative.

3. The Government is self-explanatory.

a. LGUs are expressly prohibited from levying tax from the NG

b. Ng may tax GOCCs, agencies and instrumentalities

4. Territoriality

a. Taxing authority cannot impose taxes on subjects beyond its territorial jurisdiction.

b. It may determine the tax situs.

D. CONSTITUTIONAL LIMITATIONS

Constitution is not the source of the taxing power. It simply defines and delimits the power.

1. Due Process Clause (Section 1, Art. III)

Enforced contribution from the people cannot be made without a law authorizing the same

Substantive Due Process

Requires that the tax statute must be within the constitutional authority of Congress and that

it must be fair, just and reasonable.

Procedural Due Process

Requires notice and hearing, or at least an opportunity to be heard.

2. Equal Protection Clause (Section 1, Art. III)

Prepared by: Michael Gines Munsayac

Taxation Law Review

Means that taxpayers of the same footing should be treated alike, both as to privileges

conferred as well as on obligations imposed.

Violations (Villegas v Hsiu Chiong Tsai Poi)

When classification is made where there should be none

When no classification is called for

Valid Classification (Pp v Cayat)

There must be substantial distinctions that make real differences.

These must be germane and relevant to the purpose of law.

The distinction must not only be applicable to present but also to future conditions.

The distinction must apply to persons, things and transactions belonging to the same class.

3. Freedom of Religion (Section 5, Art. III)

Non Establishment Clause

Covers the prohibition to establish a national or official religion since in that case, there will

be an appropriation from taxes paid by the people.

Free Exercise Clause

This is the basis of tax-exemption granted to religious institutions.

4. Non-Impairment of Contracts (Section 10, Art. III)

Applications

People’s right and freedom to contract

Sanctity of contracts

Does not apply to franchises

Not applicable to police power and eminent domain

5. Non-imprisonment for Non-Payment of Tax (Section 20, Art. III)

Poll tax – tax imposed on persons without any qualification (e.g. CTC); payment is not

mandatory (merely permissive)

E. DOCTRINE OF EQUITABLE RECOUPMENT VS. DOCTRINE OF SET-OFF

Doctrine of Equitable Recoupment

Refers to a case where the taxpayer has a claim for refund but he was not able to file a

written claim due to the lapse of the prescription period within which to make a refund.

The taxpayer is allowed to credit such refund to his existing tax liability.

Allowed only in common law countries, not in the Philippines

Doctrine of Set-off or Compensation

Applies when the government and taxpayer are mutually debtors and creditors of each other.

Also not allowed in the Philippines since taxes are not in the nature of contracts between

parties.

Taxes grow out of duty to, and are the positive acts of the government to the making and

enforcing of which, the personal consent of the individual taxpayer is not required. (Republic

v. Mabulao)

F. DOUBLE TAXATION

Prepared by: Michael Gines Munsayac

Taxation Law Review

Double Taxation

The imposition of the same taxing body of two taxes on what is essentially the same thing

The imposition of two taxes on the same property during the same period and for the same

taxing purpose

Allowed in the Philippines because there is no prohibition in the Constitution or any statute

When not allowed? Elements:

The taxes are levied by the same taxing authority

Same subject matter

Same taxing period

Same purpose

International Juridical Double Taxation

The imposition of comparable taxes in 2 or more States on the same taxpayer in respect of

the same subject matter and for identical periods.

Can be eliminated by 2 contracting States.

Should be eliminated in order to encourage foreign investors to invest in the Philippines

Most Favored Nation Clause

Grants the contracting party terms and condition not less favorable than those granted to the

“most favored” among the other contracting parties.

Intended to establish the principle of equality of international treatment by providing the

citizens of the contracting parties privileges accorded by either party to those of the MFN

Methods to minimize burden

By granting tax exemptions

By giving tax credits

By reducing the rate of tax

G. EXEMPTION FROM REAL ESTATE TAX

Note: The properties must be ACTUALLY, DIRECTLY and EXCLUSIVELY used for religious,

educational and charitable purposes to be exempt from taxation. (Section 28[3], Art. VI).

II. INCOME TAXATION (RA 8242 Tax Reform Act of 1997)

A. INDIVIDUALS

Classification of taxpayers

1. Resident Citizen (RC)

a. Citizen of the Philippines residing therein

b. Citizen residing outside the Philippines without the intention of residing thereat

permanently

c. Citizen who did not manifest to the total satisfaction of the Commissioner the fact of

his physical presence abroad with a definite intention to reside therein perm.

2. Non-Resident Citizen (NRC)

a. Citizen who established to the satisfaction of the Commissioner the fact of his

physical presence abroad with a definite intention to reside therein.

Prepared by: Michael Gines Munsayac

Taxation Law Review

b. Citizen who leaves the Philippines during the taxable year to reside abroad as

immigrants.

3. Overseas Contract Worker (OCW)

a. Covers only those individuals with a working contract abroad

b. TNTs are not considered OCWs but are usually classified as RCs

4. Resident Alien (RA)

a. An individual residing in the Philippines who is not a citizen thereof

b. Intention to reside in the Philippines is not necessary

5. Non-resident Alien Engaged in Trade or Business in the Philippines (NRA ETB)

a. Engaged in retail trade or business

b. Engaged in the exercise of profession therein

c. Staying for an aggregate period of more than 180 days for the calendar year

6. Non-resident Alien Not Engaged in Trade of Business in the Phils. (NRA NETB)

a. NRAs not engaged in business but deriving income in the country

7. Aliens Employed in MNCs, OBUs, & Petroleum Service Contractors

B. CORPORATIONS

Definition: NIRC defines a corporation as including partnerships, no matter how created or

organized, joint stock companies, joint accounts, associations, insurance companies but does not

include general professional partnerships and JV formed for the purpose of undertaking construction

projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an

agreement under a service contract with the government.

Classification of Corporations

1. Domestic Corporations

2. Resident Foreign Corporations ETB

3. Non-Resident Foreign Corporations NETB

III. KINDS OF INCOME TAXES

Net Income Tax; Gross Income Tax; Final Income Tax; MCIT, IAET; Optional Corporate Income Tax

A. NET INCOME TAX

Taxable Income: Gross Income

Less: Deductions (Personal & Additional)

Net Income

Multiplied by: Tax Rate

Net Income Tax Payable

Less: Tax Credits

Net Income Tax Due

Note: This kind of income tax allows deduction, personal as well as additional exemptions

& tax credits.

The determination of actual gain or loss is material since the tax shall be based on NET

The rate of this tax is 32% for individual & 35% for corporate taxpayers.

Prepared by: Michael Gines Munsayac

Taxation Law Review

B. GROSS INCOME TAX

Unlike the net income tax, the gross income tax does not allow deductions, hence he formula is:

Gross Income X Tax Rate = Tax Due

Notes: The application of this tax BARS the application of the income tax.

The gross income tax is always subject to the Final WHT.

C. FINAL INCOME TAX

This is the only income tax applicable to all types of taxpayers without distinctions. The formula is:

Gross Income X Tax Rate = Tax Due

Notes: Under final income tax, the rate is multiplied to each income individually as each income may

have a different rate.

This tax does not allow deductions.

The determination of gain or loss is immaterial since the basis of taxation is the GROSS,

Hence actual gain or loss does not matter.

An income which is subject to final income tax is no longer subject to net income tax!

Withholding agent is responsible in filing the income tax returns.

Applicable only to passive income and income from sources within the Phils.

If the taxpayer fails to pay, the withholding agent shall be liable!!!

D. MINIMUM CORPORATE INCOME TAX – 2% on Gross Income

The 2% MCIT on gross income is imposed on corporations beginning the 4th year of the corporation.

The formula is:

Gross Income X 2% = MCIT

Pay the MCIT or the Net Income Tax, whichever is higher!

Rationale: To prevent corporations from claiming too many deductions.

E. IMPROPERLY ACCUMULATED EARNINGS TAX – 10% of Taxable Income

This tax is imposed on the improperly accumulated earnings by corporations.

Purpose: To discourage the practice of corporations of accumulating earnings

& profits in avoidance of the payment of taxes.

To avoid this: Distribute earnings among the shareholders.

F. OPTIONAL CORPORATE INCOME TAX – 15% on Gross Income

Corporations may opt to be taxed at 15% of their gross income in lieu of the Net Income Tax or the

MCIT. This may be imposed by the President upon the recommendation of the DOF.

Prepared by: Michael Gines Munsayac

Taxation Law Review

IV. SOURCES OF INCOME

What is the relevance in determining the sources?

Its relevance relates to the income tax liability of the taxpayers. RC and domestic corporations are

the only taxpayers liable for income derived from sources within and without the Philippines.

A. GROSS INCOME FROM SOURCES WITHIN THE PHILIPPINES. (Section 42[a])

1. Interest from sources within the Philippines

o Interests derived from sources within the Philippines

Interest earned from domestic bank deposits

o Interests on bonds, notes or other interest-bearing obligations of residents, corporate

or otherwise.

The determining factor is the residence of the obligor, whether individual or

corporation.

2. Dividends

o Any distribution made by a corporation to its shareholders out of its earnings or profits

and payable to its shareholders, whether in money or property.

o Dividends issued by foreign corporations are considered income from sources within

provided the 2 requisites are present:

At Least 50% of its gross income is from sources within the Phils.

Such gross income must be for the 3-year period ending with the close of the

taxable year.

3. Services

o This is the compensation for labor or personal services performed in the Phils.

o The determining factor is the place of performance. The place of payments is

IRRELEVANT!

4. Rentals and Royalties from property located in the Phils.

o Use of copyright, patent, design or model, plan, secret formula or process, goodwill,

trademark, trade brand or other like property or right in the Phils.

o Use of industrial, commercial or scientific equipment in the Phils.

o The supply of scientific, technical, industrial or commercial info.

o The supply of services by a non-resident person or his employee in connection with

the use of property or rights belonging to, or the installation or operation of any brand,

machinery or other apparatus purchased from such non-resident person.

o Technical advise, assistance or services rendered in connection with technical

management or administration of any scientific, industrial or commercial undertaking.

o The use or right to use motion picture films, films or video tapes for use or in

connection with TV, & tapes use in connection with radio broadcasting.

5. Sale of Real Property

o Gains, profits and income from sale of real property located in the Phils.

o Location of the property is the controlling factor to determine the source of the

income.

6. Sale of Personal Property

Prepared by: Michael Gines Munsayac

Taxation Law Review

B. GROSS INCOME FROM SOURCES WITHOUT THE PHILS.

Any income not falling under any of the 6 above is an income derived from sources outside the

Philippines.

C. INCOME FROM SOURCES PARTLY WITHIN & PARTLY WITHOUT THE PHILIPPINES

The taxable income is computed by first deducting the expenses, losses or other deductions

apportioned or allocated thereto and ratable part of any expense, loss or other deduction which

cannot definitely be allocated to some items or classes of gross income; and the portion of such

taxable income attributable to sources within the Phils.

Basic Formula: Gross Income Within

Gross Income World

= Rate X Expenses World

= Expenses to be allowed

To illustrate: Suppose the Gross Income Within is P10k; the Gross Income World is P100K; and the

Expenses-World is P50k, thus:

P10k_ = 10% X P50K = P5K.

P100k

In this illustration, only P5k should be allowed as deduction against the gross income derived in the

Phils.

D. SALE OF PERSONAL PROPERTY

Guidelines:

1. For those produced, in whole or in part, by the taxpayer within and sold without the

Philippines, or produced in whole or in part, by the taxpayer without and sold within the

Philippines – the income shall be treated as partly within and partly without from sources

within the Philippines and partly from sources without the Phils.

2. For those purchased within and sold without the Philippines, or for purchase of personal

property without and sold without – the gains, profits or income shall be treated as derived

entirely from sources within the country where the property is sold; EXCEPT – gains from the

sale of shares of stock in a domestic corporation shall be treated as derived entirely from

sources within the Phils., regardless of the place where the shares were sold.

V. CAPITAL GAINS AND LOSSES

What is a capital asset?

Capital assets are property held by the taxpayer, but does not include:

1. Stock in trade of the taxpayer / inventory on hand at the close of the taxable year

2. Property held primarily for sale to customers in the ordinary course of his business

3. Property used in the business, of a character which is subject to the allowance for

depreciation.

Prepared by: Michael Gines Munsayac

Taxation Law Review

4. Real property used in business of the taxpayer.

What is the relevance for the determination?

1. Holding period – percentage taken into account

2. Loss Limitation Rule – limitation on Capital Losses

3. Net Capital Loss Carry Over Rule

A. PERCENTAGE TAKEN INTO ACCOUNT

Holding period (percentage taken into account) is defined as the length of time or duration by which

an individual held the capital asset.

In sale of exchange of a capital asset, there are 2 percentages which should be taken into account

in recognizing the gain or loss from such sale or exchange:

1. 100% if the capital asset has been held for not more than 12 months (ST)

2. 50%, if held for more than 12 months (LT)

3. Capital Assets held by Corporation – not included

Sales not subject to the rule:

1. Sale or exchange of shares of stocks which is a capital asset.

2. Sale or exchange of real property held as a capital asset.

Notes: Capital gain is included in the gross income subject to net income tax.

A capital gain or loss is included in the gross income

B. LIMITATIONS ON CAPITAL LOSSES

Loss Limitation Rule provides that “losses from sales of exchanges of capital assets shall be allowed

only to the extent of the capital gains from such sale or exchange.”

A capital loss can only be deducted from capital gains but never from an ordinary gain, while an

ordinary loss may de deducted from both capital and ordinary gain. Applicable to individual and

corporations.

Rationale:

1. Ordinarily, a capital gain is included in the gross income. The items included in the gross

income are ordinary gains and losses – those related to the ordinary business.

2. With respect to capital losses, these are not related to the ordinary business of the taxpayer.

C. NET CAPITAL LOSS CARRY-OVER

A capital loss may only be deducted from a capital gain, if there is any. What then is the remedy of

the taxpayer where is capital loss but there is no capital gain?

Apply the NOLCO Rule.

NOLCO Rule:

Any capital loss sustained by the taxpayer during a taxable year shall be treated in the

succeeding taxable year as a loss from sale or exchange of capital asset held for not more

than 12 months.

Requisites

Prepared by: Michael Gines Munsayac

Taxation Law Review

o Amount of loss should not exceed net income for the taxable year when the loss was

incurred.

o There should be capital gain from which the carried over loss can be deducted

o Can only be availed by individuals!

D. GAINS AND LOSSES FROM SHORT SALES

Short Sale is defined as a sale where the seller is selling a property without distinction of what kind

of property he is selling, whether a share of stock or not. The seller is selling property which he is not

in his possession.

Any gains or losses are considered as capital gains or losses.

E. CAPITAL TO ORDINARY ASSET, VICE VERSA

Calasanz V CIR

A conversion from capital to ordinary asset is allowed provided that it is:

o In furtherance of the taxpayer’s business

o Substantially improved or very actively sold or both.

RR 7-2003

Properties classified as ordinary assets are automatically converted into capital assets upon

showing of proof that the same have not been used in business for more than 2 years prior to

the consummation of the taxable transactions involving said properties.

VI. TAX ON INDIVIDUALS

The RC is the only individual taxpayer who is liable for income derived from all sources, within and

without the Philippines.

A. RESIDENT CITIZEN, NON-RESIDENT CITIZEN, OCW AND SEAMEN AND RESIDENT ALIEN

1. Net Income Tax

a. Defined as the pertinent items of gross income less deductions and/or personal and

additional exemptions.

b. This is the only kind of income tax which admits of deductions, personal and

additional exemptions.

c. Married individuals shall compute separately their individual income tax. However,

this is applicable only for individuals earning purely compensation income.

d. Married individuals who do not derive income purely from compensation, shall file a

consolidated return to include income of both spouses, except where it is

impracticable.

e. RA 9504 exempts minimum wage earners from the payment of net income tax.

2. Final Income Tax ( for Passive income)

a. Interest, Royalties, Prizes and other Winning

i. Applicable tax is 20%

ii. Passive income should be derived from sources within the Philippines

Prepared by: Michael Gines Munsayac

Taxation Law Review

iii. FCDU deposits – apply 7.5%

iv. Long Term deposits or investments – exempt from final tax

4 to < 5 years – 5%

3 to < 4 years – 12%

< 3 years – 20%

For prizes, before tax is imposed:

Must be derived from sources within the Phils.

Must be >P10k

Must be pursuant to a promotion or contest

Prizes exempted from tax:

Received primarily in recognition of religious, charitable, scientific, educational,

artistic, literary, or civic achievement

The recipient was selected without any action on his part to enter the contest or

proceeding

The recipient is not required to render substantial future services as a condition to

receiving the prize or award.

Winnings are subject to FWHT of 20% including winnings pursuant to gambling (except

PCSO).

b. Cash and/or Property Dividends

i. Only cash and property dividends are subject to 10% final income tax

ii. Stock dividends are not taxable since such dividends are only a transfer of the

surplus profit from the retained earnings to the authorized capital stock.

iii. Share of an individual in the distributable net income after tax of a partnership

of which he is a partner is subject to final income tax

c. Capital Gains from Sale of Shares of Stock not Traded in the Stock Exchange

i. The net capital gains from sale, barter, exchange or other disposition of

shares of stock in a domestic corporation not listed and traded is subject to a

final tax rate of 5% for the first P100k of the net capital gain; and 10% of the

net capital gain of any amount in > P100k.

ii. Elements required

1. Shares must be shares in a domestic corporation.

2. Shares are capital assets.

3. The shares are not listed and traded in the local bourse.

iii. For listed shares, the gains are not subject to income tax but subject to a

business tax (percentage tax) at the rate of ½ of 1% of the gross selling price.

d. Capital Gains from Sale of Real Property

i. A final income tax of 6% based on the gross selling price or FMV, whichever is

higher shall be imposed on CG provided:

1. the property sold is real property

2. located in the Philippines

3. classified as a capital asset

ii. Sale of a natural person’s principal residence maybe exempted from payment

of the 6% CGT when the proceeds of the sale are fully utilized in acquiring or

constructing a new principal residence within 18 months from the date of

notarization of the Deed of Sale.

Prepared by: Michael Gines Munsayac

Taxation Law Review

iii. Sale of mortgaged property – taxable only if the buyer is other than a financial

institution.

B. NON RESIDENT ALIEN ENGAGED IN TRADE OF BUSINESS IN THE PHILIPPINES

1. Net Income Tax

An NRA ETB is subject to the net income tax.

Liable only for income derived from sources within the Phils.

2. Final Income Tax

a. Cash and/or property dividends or share in the distributable net income of a

partnership (not general partnership), Interests, Royalties and Other winnings.

20% final income tax levied on letter a.

For prizes less than P10k, the applicable tax is the net income tax.

Prizes from PCSO and Lotto are exempt from income tax.

Royalties for literary work – subject to tax rate of only 10%.

Interest income from LT deposits and investments are exempt fro

final income tax.

b. Capital Gains

Same as RA ETB in the Phils.

C. NON RESIDENT ALIENS NOT ENGAGED IN TRADE OR BUSINESS IN THE PHILS.

1. Net Income Tax

NRA NETB shall be liable for the entire income he received from all sources

within the Philippines by way of the gross income tax.

Tax rate is 25% on gross income

2. Final Income Tax

Sale of shares of stock or sale of real property which are capital assets, use tax

rate in the next section which is 15% final income tax.

D. ALIENS EMPLOYED BY MNCS, OBUS AND PETREOLEUM SERVICE CONTRACTORS

1. Income Tax Liability for Salaries and Compensation

These alien individuals are liable for final income tax at a rate of 15% on their

gross income

Same tax treatment is applicable to Filipinos employed and occupying the same

position as the aliens employed therein.

The 15% final income tax does not apply R&F employees – both aliens and

Filipinos.

2. Income Tax Liability for Other Income

Depends upon the taxpayer’s classification or status.

VII. TAX ON CORPORATIONS

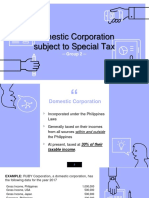

A. DOMESTIC CORPORATIONS

Prepared by: Michael Gines Munsayac

Taxation Law Review

1. In General

a. A domestic corporation is generally liable for net income tax because the

NIRC says:”taxable income.”

b. The net income tax is imposed at a rate of 35% on all income derived from

sources within and without the Phils.

2. Optional Corporate Income Tax

a. The tax rate is 15%

b. Immaterial since the President has not yet implemented this option.

3. Proprietary Educational Institutions and Hospitals

Liable for net income tax at a rate of only 10% provided:

a. It must a stock and non-profit institutions

b. It must be a private educations institution or hospital

c. Their gross income from unrelated activity does not exceed 50%.

d. Must have been issued a permit to operate from the government.

Note: Non-stock and non-profit educational institution is exempt from income tax

4. GOCCs, Agencies or Instrumentalities

The 35% net income tax rate is applicable to all GOCCs except the following:

a. SSS

b. Philhealth

c. PCSO

d. GSIS

5. Final Income Tax

Interest from deposits and yield from deposit substitutes and from trust funds and

similar arrangements, and royalties from sources within the Philippines are subject to

20% final income tax.

If these are derived from sources without , these shall be subject to the net income

tax and not the final income tax.

6. Capital Gains from the Sale of Shares of Stock Not Traded in the Stock Exchange

Apply rules on individuals

7. Tax on Income Derived under the Expanded Foreign Currency Deposit System

The depository bank is the income earner and is subject to the net income tax of 35%

However, when the depository bank under the system transacts with the following, its

income is exempt from net income tax:

a. Non-residents

b. OBUs

c. Local commercial banks

d. bBranches of foreign banks authorized by the BSP

e. Other depository banks under the system

With regard to FX loans, income derived therefrom shall be subject to a final tax

at the rate of 10%

8. Inter-corporate Dividends

The domestic corporation is the stockholder of another domestic corporation.

Being a stockholder, it is entitled to dividends. The dividends received by it shall

not be subject to tax, in other words, exempt.

Prepared by: Michael Gines Munsayac

Taxation Law Review

9. Capital Gains Realized from the Sale, Exchange or Disposition of Lands and/or Buildings

Apply final income tax rate of 6% is imposed on the gain presumed to have been

realized

B. RESIDENT FOREIGN CORPORATIONS

1. In General

Like a domestic corporation, a resident foreign corporation is subject to the net

income tax at a rate of 35%.

However, unlike a domestic corporation, a resident foreign corporation is only

liable for income derive by it from sources within the Philippines.

2. Optional Corporate Income Tax of 15%

Tax rate is 15% of Gross Income

3. MCIT

Compare the 2% of Gross Income versus net income, choose higher of the 2.

4. International Carrier Doing business in the Philippines

Liable to pay tax of 2½% on its Gross Philippine Billings (GPB)

For international air carriers, the following requisites must be present:

o The persons, excess baggage, cargo, and the mail must be originating in

the Philippines

o In a continuous and uninterrupted flight or shipment

o Irrespective of the place of sale or issue and the place of payment of the

ticket.

For international shipping carriers, the following are the pre-requisites:

o It must originate from the Philippines

o It must be up to the final destination

o Regardless of the place of sale or payments of the passage or freight

documents

5. Offshore Banking Units

A final income tax at the rate of 10% is imposed on income derived by OBUs

authorized by the BSP from its foreign currency transactions (e.g branches of

commercial banks).

Transactions of these OBUs are exempt from final income tax provided it is with

the following:

a. Nonresidents

b. Other OBUs

c. Local commercial banks

d. Branches of foreign banks

6. Tax on Branch Profit Remittance

A 15% final income tax based on the total profits applied or earmarked for

remittance is imposed on any profit remitted by a branch to its head office.

If the profit remitted us nor from activities connected with the conduct of its

business in the Phils., the net income tax rate of 35% shall apply.

Prepared by: Michael Gines Munsayac

Taxation Law Review

This tax does not apply to local subsidiaries of foreign corps. (for branch offices

only)

7. Regional Area Headquarters and Regional Operating Headquarters of MNCs

RAH – a branch established in the Phils by MNC and which headquarters do not

earn or derive income from the Philippines and which acts supervisory,

communications and coordinating center for their affiliates, subsidiaries, or

branches in the Asia-Pacific Regions and other foreign markets.

ROH – a branch established in the Philippines by MNCs which are engaged in

any of the following: general administration and planning; business planning and

coordination; sourcing and procurement of raw materials and components;

corporate finance advisory services; marketing and control and sales promotion;

training and personnel management; logistic services; R & D; product

development; technical support and maintenance; data processing and

communication; and business development.

RAH is exempt from income tax’ ROH is subject to a net income tax of 15%.

8. Final Income Tax

Interest income and Royalties – subject to 20% final income tax

Income derived from Expanded Foreign Currency Deposit Systems – The income

earner is a resident foreign corporation depository bank . The tax rate is 35%.

Intercorporate Dividends – The income received by the foreign corporation from

the domestic corporation shall be exempt from income tax.

C. NON-RESIDENT FOREIGN CORPORATIONS

1. In General

Liable for gross income tax at the rate of 35% on income derived from sources within the

Philippines.

2. Interest on foreign loans

A final WHT at the rate of 20% is imposed on the amount of interest on foreign loans.

Contemplated transaction here is one where the lender is a non-resident foreign

corporation and the borrower is a domestic corporation.

Exemption applies only when the lender is a foreign government or any of its GFI,

international and regional financial institutions (supra-nationals).

3. Intercorporate Dividends

Among the three corporate taxpayers, only the NR foreign corporation is liable for dividends

received by it from a domestic corporation at the rate of 35%.

Tax deemed paid credit rule (tax sparing rule) – The country of domicile of the non-resident

foreign corporation allows a tax credit of 20% for taxes deemed paid in he Philippines to be

entitled to the lower rate of 15%.

4. CGT from Sale of Shares not Traded in the Stock Exchange

Rules on individuals apply.

VII. MINIMUM CORPORATE INCOME TAX

Prepared by: Michael Gines Munsayac

Taxation Law Review

Nota Bene:

This tax is imposed on two types of corporations: the domestic corporation and the

resident foreign corporation.

To discourage these corporations from claiming too many deduction to avoid

payment of tax, the MCIT of 2% on the gross income is imposed in lieu of the net

income tax of 35%

A. IMPOSITION OF THE TAX

The 2% MCIT cannot be imposed simultaneously with the net income tax of 35%. Impose

whichever is higher!

The MCIT can be imposed only at the beginning of 4th taxable year immediately following the

year in which the corporation commenced its operations.

B. CARRY FORWARD IF EXCESS MINIMUM TAX

This is the 2nd carry over tax under the NIRC. The first is the NOLCO.

Any excess of the MCIT over the net income tax shall be carried forward and credited

against the net income tax over the net income tax shall be carried forwards and credited

against the net income tax for the 3 immediately succeeding taxable years.

Unlike the NOLCO, the MCIT can be carried over for the 3 immediately succeeding years.

C. RELIEF FROM THE MCIT

The Secretary of Finance is authorized to suspend the MCIT on any corporation who suffers

losses on account of:

o Prolonged labor dispute

o Force majeure

o Legitimate business reverses

IX. IMPROPERLY ACCUMULATED EARNINGS TAX

A. IN GENERAL

Generally, a tax of 10% is imposed on the improperly accumulated income for the purpose of

avoiding the income tax with respect to its shareholders.

The tax compels the corporations to declare dividends.

Inclusion: only domestic corporations and closely-held corporations.

Closely held corporations are those with at least 50% in value of the outstanding capital

stock or at least 50% of the total combined voting power of all classes of stock entitled to

vote is owned directly or indirectly by or for not more than 20 individuals.

B. EXEMPTED CORPORATIONS

Under the NIRC, the following are exempted from the application of this tax without

qualification:

o Publicly-held corporations

o Banks and NBFIs

o Insurance companies

Under the RR 2-2001, the following were added to the list with the proviso that the improperly

accumulated earnings must be for reasonable needs of the business:

Prepared by: Michael Gines Munsayac

Taxation Law Review

o Taxable partnerships

o General professional partnerships

o Non-taxable joint ventures

o Enterprises located within economic zones.

C. IMPROPERLY ACCUMULATED TAXABLE INCOME

IATI is “taxable income” adjusted by:

o Income exempt from tax

o Income excluded from tax

o Income subject to final income tax

o The amount of NOLCO deducted, and reduced by the sum of dividends actually

or constructively paid and income tax paid for the year.

D. EVIDENCE OF PRUPOSE TO AVOID INCOME TAX

There are 2 instanced which are to be considered:

o The fact that the company is a mere holding company or investment company

o The fact that the earnings or profits of a corporation are permitted to accumulate

beyond the reasonable needs of the business.

o The presence of either brings a prima facie evidence of the purpose to avoid payment

of this tax.

o The intention of the taxpayer at the time of accumulation is controlling to determine

whether the profits are accumulated beyond the reasonable needs of the business.

o Definiteness of plans coupled with actions taken towards its consummation are

essential.

X. EXEMPT CORPORATIONS

A. GENERAL PROFESSIONAL PARTNERSHIPS

A GPP is a partnership formed by persons for the sole purpose of exercising their common

profession, no part of income of which is derived from engaging in any trade or business. Any other

partnership is liable for corporate income tax.

A GPP may be exempted from corporate income tax if these 2 requisites are met:

1. It is formed by persons for the sole purpose of exercising their

common profession.

2. No part of the income of which is derived from engaging in any trade

or business.

Notes:

If the GPP is exempt from corporate income tax, the share of each partner is subject to

income tax. Each partner is liable in his separate and individual capacity.

Prepared by: Michael Gines Munsayac

Taxation Law Review

If the 2 requisites are absent, the partnership is deemed a corporation and is subject to

corporate income tax. The share of each partner, whether actually or constructively received,

is deemed as a dividend which is SUBJECT to final income tax.

If there is other income but the income derived is passive (e.g. interest income, which is

subject to final income tax of 20%), still the partnership can be exempt from the corporate

income tax. Passive income is not included in the partnership’s annual return.

B. JOINT VENTURE UNDER A SERVICE CONTRACT WITH THE GOVERNMENT

The JV which is exempt from corporate income tax, is a merger of two or more corporations for the

purpose of engaging in construction projects or energy operations pursuant to a consortium

agreement or a service contract with the government. The corporations must be engaged in the

same line of business.

Notes:

It is only the JV which is exempt from corporate income tax, not the income of each

corporation from the JV.

Thus, each corporation is liable for corporate income tax.

C. GOVERNMEN-OWNED OR CONTROLLED CORPORATIONS

The net income tax is applicable to all GOCCs except the following:

SSS

PHIC

PCSO

GSIS

D. OTHER EXEMPT CORPORATIONS

The following are exempt under Section 30 of the NIRC:

1. Labor and agricultural organizations not organized principally for profit.

2. Mutual savings bank not having a capital stock represented by shares, and cooperative

bank without capital stock organized and operated for mutual purposes and without

profit.

3. A beneficiary society operating for the exclusive benefit of the members, such as a

fraternal organization operating under a lodge system, or a mutual aid association or a non-

stock corporation organized by employees providing for the payment of life, sickness,

accident, or other benefits exclusively to the members of such society or their

dependents.

4. Cemetery companies owned and operated exclusively for the benefits of its members.

5. Non-stock corporations organized and operated exclusively for religious, charitable,

scientific, athletic, or cultural purposes, or for the rehabilitation of veterans, no part of its net

income or asset shall belong to or inure to the benefit of any member, organizer,

officer or any specific person.

6. Business league, chamber of commerce, or board of trade, not organized for profit and no

part of the income of which inures to the benefit of any private stockholder or

individual.

7. A non-stock and non-profit educational institution.

8. Government educational institution.

9. Farmers’ or other mutual typhoon or fire insurance company, mutual ditch or irrigation

company, mutual or cooperative telephone company , or like organization satisfying the

following requirements:

Prepared by: Michael Gines Munsayac

Taxation Law Review

a. The organization must be operating within a locality

b. The income of such organization must be used to meet the necessary expenses.

10. Farmers’ associations for organized and operated as a sales agent for the purpose of

marketing the products of its members and turning back to them the proceeds of sales

less necessary selling expenses on the basis of quantity of produce.

Notes:

An exempt corporation can be held liable for corporate income tax if it derives income from

any of their property or any of their activities conducted for profit regardless of the disposition

made of such income.

Above corporations are only exempt from income tax under Section 30 but this same section

doe not bar the applicability of other axes to these corporations.

CHAPTER XI. GROSS INCOME AND EXCLUSIONS

Section 32 of the NIRC speaks of gross income and exclusions. To arrive at the gross income, the

exclusions must be deducted from all the income, hence the formula is:

All income – Exclusions = Gross Income

A. GROSS INCOME INCLUSIONS

Gross income is defined by Section 32 quite broadly, as “all income derived from whatever source.”

This is an open ended definition, suggestive of an intention to include rather exclude. The following

items comprise the gross income subject to income tax:

1. Compensation for services in whatever form paid, including but not limited to fees, salaries,

wages, commissions, and similar items., EXCEPT for the following:

a. Those received by taxpayers who are subject to the Gross Income Tax

b. Those received by Aliens employed by MNCs, OBUs and Petroleum Service

Contractors because their compensation are subject to the 15% Final tax unless they

choose pay by way of final income tax.

2. Gross income derived from the conduct of trade or business or the exercise of a profession.

3. Gains derived from dealings in property.

a. If the real property is capital, the gain therefrom is subject to income tax and not

included as gross income.

b. If the real property is ordinary, it should be included.

4. Interest income

a. Interests from loans are always included in the gross income.

b. Interests from bank deposits are not included since they are subject to final income

tax.

5. Rental income

6. Royalties

a. The royalty is subject to final income tax if it is derived from sources within the

Philippines.

b. If the source is outside the Philippines, the net income tax is applicable.

7. Dividends

8. Annuities

9. Prizes and winnings, instances to be included in the gross income:

Prepared by: Michael Gines Munsayac

Taxation Law Review

a. It should be derived from sources within the Philippines and should be less than or

equal to P10k

b. The prize is derived from sources without the Philippines

c. The taxpayer is a corporation.

10. Pensions (unless excluded)

11. Partner’s distributive share from the net income of the GPP

B. EXCLUSIONS

Classes of income not included in the gross income:

Passive income, since this is already subject to final income tax.

Incomes which are exempt under the income tax law.

Income classified as exclusions under Section 32(b).

The following are the exclusions provided in section 32(b):

1. Life Insurance payable upon death of the insured.

2. Amount received by Insured a Return of Premium

3. Gifts, bequests and Devises

These are gratuitous in nature. Hence, exempt from gross income tax but is

subject to donor’s tax.

4. Compensation for Injuries and Sickness

5. Income exempt under treaty

6. Retirement Benefits, Pensions, Gratuities, etc.

a. Retirement Pay

i. Retirement benefits under RA 7641 (retirement benefits of private firms

without retirement plan)

1. The retiring employee is between 60 to 65 years old.

2. He must have served the company for at least 5 years.

ii. Retirement benefits pursuant to RA 4917 (retirement under private retirement

plan)

1. Retiring employee must not be less than 50 years old.

2. Must have been in the service for at least 10 years.

3. Exemption must be availed only once.

4. The private benefit plan must be approved by the BIR.

iii. Retirement pay given by GSIS, SSS and PVAO are exempted from income

tax without any qualification

iv. Retirement gratuities, pensions and other similar benefits given by foreign

government agencies and other institutions, private or public to residents,

nonresident citizens of the Philippines or aliens who come to reside in the

Phils., without any qualification.

b. Separation Pay

i. Exempted from income tax as long as the cause for separation from service is

death, sickness, physical disability or for any cause beyond the control of the

employee.

ii. If from foreign government agencies and other institutions, tax exempt also.

c. Terminal Leave Benefits

i. EO 291 provides that terminal leave benefits of government employees are

exempt from tax

ii. For private employees, if terminal leave benefits are paid upon retirement,

such benefits are exempt from income tax.

iii. However, if given annually, RR 2-98 provides:

Prepared by: Michael Gines Munsayac

Taxation Law Review

1. If sick leave – not exempt

2. If less than 10 days VL – exempt

3. If more than 10 days VL – subject to income tax.

7. Miscellaneous items

a. Income derived by foreign government.

i. Foreign government

ii. Financing institutions owned or controlled by foreign government

iii. International or regional financial institutions established by foreign

governments.

b. Income derived by the Government or its political subdivisions from:

i. Any public utility

ii. The exercise of any essential government function

c. Prizes and Awards

i. Primarily in recognition of religious, charitable, scientific, educational, artistic,

literary or civic achievement.

ii. The recipient was selected without any action on his part to join the contest.

iii. The recipient is not required to render future service as a condition to receive

the prize or award.

d. Prizes and Awards in Sports Competition

i. Held locally or internationally and

ii. Sanctioned by national sports association

e. 13th Month Pay and other Benefits

i. Applied both to the government and the private sector

ii. Exemption covers only the maximum amount of P30,000

f. GSIS, SSS, Philhealth, and Pag-ibig contributions

g. Gains from sale of bonds, debentures or other certificate of indebtedness

i. Maturity must be more than 5 years to be exempt

ii. If less than 5 years, subject to final income tax.

h. Gains from redemption of shares in Mutual fund

XII. FRINGE BENEFITS TAX

This tax was introduced in 1998. A final income tax of 32% is imposed on the grossed-up

monetary value of the fringe benefit furnished or granted to the employee by the employer.

Who is liable to pay the final income tax on fringe benefits?

The employee shall be liable because:

The law did not say that it is the liability of the employer but it says that is payable.

The law did not say that it is the of the employer period, but the law referred to Section 57(a)

– Withholding of Final Tax on Certain Incomes

The law admits that is the liability of the managerial employee

A. EXCLUSIONS

By way of exception, the following benefits are not subject to final income tax:

Those received by R&F employees

The fringe benefit is necessary for business

The fringe benefit is for the convenience or advantage of the employer.

If the fringe benefit is exempted from income tax under the code.

Employer contributions to employee retirement, insurance, and hospitalization benefit plans.

Prepared by: Michael Gines Munsayac

Taxation Law Review

De minimis benefits which limited to facilities or privileges furnished or offered by an

employer to his employees that are relatively small value and are given as a means of

promoting health, goodwill, contentment, or efficiency of his employees.

B. INCLUSIONS

Fringe benefit is any good, service, or other benefit furnished or granted in cash or in kind by an

employer to an individual employee such as but not limited to:

1. Housing, except:

RR 3-98 provides that a housing unit situated inside or adjacent to the premises of a

business within maximum of 50 meters shall not be considered as a taxable fringe

benefit.

Temporary housing for an employee who stays in the housing unit for 3 months or

less shall not be considered a taxable fringe benefit.

2. Expense Account – refers those incurred by the managerial worker which are to be

reimbursed by management.

3. Vehicle of any kind

4. Household personnel, such as maid, driver and others.

5. Interest on loans at less than prevailing market rate to the extent of the difference between

the market rate and actual rate granted.

6. Membership fees, dues and other expenses borne by the employer for the employee in

social and athletic clubs or other similar organizations.

7. Expenses fore foreign travel

8. Holiday and vacation expenses.

9. Educational assistance to the employee or his dependents.

10. Life or health insurance and other non-life insurance premiums in excess of GSIS and SSS.

XIII. ALLOWABLE DEDUCTIONS

This provision is applicable only to net income since it is only income tax which allows deductions.

Deductions are allowed because they are necessary to generate income

Pure compensation earners are not allowed under Section 34 for any deduction

Exception is for premium paid for health and/or hospitalization insurance.

The following deductions are allowed for a taxpayer under the net income tax:

A. EXPENSES

1. Ordinary and necessary trade, business or professional expenses.

In General, requirements are:

The expenses are incurred within the taxable year

These are ordinary and necessary

The expenses are incurred pursuant to the trade or business or the exercise of

profession

These should be supported by evidence.

a. A reasonable wages and salary, other forms of compensation for personal services

actually rendered, and the grossed-up monetary value of fringe benefits provided the

final income tax thereof has been paid.

Prepared by: Michael Gines Munsayac

Taxation Law Review

b. A reasonable allowance for travel expenses, here and abroad, while away from home

in the pursuit of trade, business or profession.

c. A reasonable allowance for rentals and/or other payments which are required as a

condition for the continued use or possession, for purposes of trade, business or

profession, of property to which the taxpayer has not taken or is not taking title or in

which he has no equity other than a lessee, user or possessor.

d. A reasonable allowance for entertainment, amusement and recreation expenses

during the taxable year that are directly connected to the development, management

and operation of the trade, business or profession of the taxpayer.

Conditions for an expense to be deductible:

The expense must be ordinary and necessary.

It must be paid or incurred within the taxable year.

It must be paid or incurred while carrying on a trade or business.

Note: Bribes, Kickbacks and other similar payments are not ordinary and necessary to the

trade, business or profession of the taxpayer, therefore not deductible!

2. Expenses allowable to Private Educational Institutions

a. To deduct expenditures otherwise considered as capital outlays of depreciable assets

incurred during a taxable year for the expansion of school facilities; or

b. To deduct allowance for depreciation thereof.

NIRC expressly prohibits the deduction of:

Any amount paid out for new buildings or for permanent improvements or betterments

made to increase the value of any property.

Any amount expended in restoring property or in making good the exhaustion thereof

for which an allowance is or has been made.

B. INTEREST

1. The amount of interest paid and incurred by the taxpayer within the taxable year shall be

allowed as a deduction from gross income.

Interest expense to be deducted is limited by the proviso which provides that the

allowable deduction shall be reduced by 42% of the interest income which was

previously subjected to final income tax.

2. By way of exception, the NIRC enumerated several instances where the interest expense

incurred by a taxpayer is allowed as a deduction but such is subject to qualifications:

a. If within the taxable year an individual taxpayer reporting income on the cash basis

incurs an indebtedness on an interest paid in advance through discount or otherwise,

provided:

i. That such interest shall be allowed as a deduction in the year the

indebtedness is paid.

ii. That if the indebtedness is payable in periodic amortizations, the amount of

interest which corresponds to the amount of the principal amortized or paid

during the taxable year shall be allowed as deduction in such taxable year.

b. If both the taxpayer and the person to whom payment has been made or is to be

made are persons specified under Section 36(b).

Prepared by: Michael Gines Munsayac

Taxation Law Review

3. The interest expense may be treated as part of the value of the property acquired which

property will be treated as a capital expenditure which is subject to the allowance for

depreciation.

C. TAXES

There are 2 ways to minimize a taxpayer’s liability:

Tax Deductions (deducted from gross income)

Tax Credits (deducted from the income tax due)

Formula: Gross Income

Less: Deductions

Net Income

X Tax Rate

Les: Tax Credits

Net Income Tax Payable

The taxes paid or incurred by a taxpayer during the taxable year in connection with his trade

or business, shall be allowed as deduction, except:

Income Tax

Income taxes imposed by authority of any foreign country, but this deduction shall be

allowed in the case of a taxpayer who does not signify in his return his desire o have

any extent of the benefits of Section 34(c)[3].

o The tax credit for taxes paid or incurred in any foreign country should not

exceed the taxes from which the tax credit is taken.

o Said tax should be compared with the tax to be paid in the Philippines by the

taxpayer and such credit should not exceed the amount of tax to be paid in the

Philippines

Estate and donor’s taxes

Taxes assesses against local benefits of a kind tending to increase the value of the

property assesses.

D. LOSSES

Losses may be deducted from the gross income provided the following requisites are present:

The losses are actually sustained during the taxable year.

Said losses are not compensated for by insurance or other forms of indemnity

Losses must be incurred from the exercise of business or from property connected

with the business or profession

Loss shall not be allowed as deduction if such loss has been claimed as a deduction

for estate tax purposes in the estate tax return.

NOLCO RULE

This rule provides that the net operating loss of the business for the taxable year

preceeding the current taxable year can be carried over as a deduction from the

gross income for the next 3 consecutive years immediately following the year the loss

was incurred.

For mining companies, net operating loss incurred during the first 10 years may be

carried over as a deduction from taxable income for the next 5 years.

Not allowed if there was substantial change in ownership of the business for

corporations.

Prepared by: Michael Gines Munsayac

Taxation Law Review

E. BAD DEBTS

Bad debts result from the unpaid receivables of the taxpayers from its customers in the

exercise of his trade, business or profession. These can be deducted and charged off within

the taxable year, EXCEPT in the following instances:

Those not connected with the profession, trade or business of the taxpayer

Those between related parties

Tax Benefit Rule

The rule provides that where the creditor was allowed a deduction of bad debts but

said debts are subsequently recovered, the previous deduction will not be cancelled

but the recovered amount will be added in the computation of the gross income.

F. DEPRECIATION

Depreciation is the expense which can be deducted by the taxpayer for several years as the

case may be. This deduction is an exception to the rule that expenses to be deducted

should have been incurred during the taxable year.

Incurred due to the ordinary exhaustion, wear and tear, including allowance for

obsolescence of property used in business.

Since the property is used for more than a year, it is only reasonable that the

expense be spread over the usual life of the property.

Every property can be subject to depreciation EXCEPT land.

Method of depreciation allowed under the NIRC:

Straight line method

Declining balance method

Sum-of-the-years digit method.

Any other method prescribed by the DOF and BIR

G. DEPLETION OF OIL & GAS WELLS AND MINES

A reasonable allowance for depletion or amortization is allowed as deduction from gross

income in accordance with the cost-depletion method. The provision is not self-executing.

This needs approval of the BIR and DOF.

H. CHARITABLE & OHER CONTRIBUTIONS

This deduction is deducted from the net income, not from the gross income since one of the

bases of the amount to be deducted is a percentage of the net income.

Who is entitled to claim the deduction for charitable contributions?

The donor is the one entitled to this deduction since, obviously, he was the one who

incurred this expense.

A pure compensation earner cannot claim this deduction

Prepared by: Michael Gines Munsayac

Taxation Law Review

There are 2 types of deduction:

Partial deduction may be claimed if the donee is ay of the following:

o GOP

o Accredited domestic corporations or associations organized and operated

exclusively for religious, charitable, scientific, youth and sports development,

cultural or educational purposes or for the rehab of veterans.

o Social welfare institutions

o NGOs

o Deduction should not exceed 10% of the taxable income for individuals and

should not exceed 5% of its taxable income for corporations.

Full deduction

o GOP, exclusively to finance undertakings in educations, health, youth and

sports development, human settlements, science and culture and in economic

development.

o Foreign institutions or international organizations in compliance with treaties,

agreements or special laws.

o NGOs accredited by the government certifying body

I. RESEARCH & DEVELOPMENT

Generally, expenses incurred for R&D are treated as ordinary and necessary expenses

which are not chargeable to the capital account. These expenses can only be allowed and

claimed during the taxable year when such expenses are incurred or paid.

R & D expenses can be treated as deferred expenses over a period of 6o months:

Those incurred in connection with the business or profession

Those not treated as expense under Section 34(I)1.

Those chargeable to the capital account but not chargeable to a property of a

character which is subject to depreciation or depletion.

This deduction is NOT ALLOWED for:

Any acquisition or improvement of land (except for private educational institutions in

case of school expansion)

Any expenditure related to ascertaining the existence, location, extent or quality of

mineral or oil deposits.

J. PENSION TRUSTS

The deduction refers to the reasonable amount transferred or paid by the employer into the

pension trusts of the employees. Prerequisites:

Not have been previously allowed as a deduction

Be apportioned in equal parts over a period of 10 consecutive years.

K. OPTIONAL STANDARD DEDUCTION as amended by RA 5904

Prepared by: Michael Gines Munsayac

Taxation Law Review

Individual and corporate taxpayers, instead of availing the itemized deductions, can claim a

deduction in an amount not exceeding 40% of their gross income. Once this option is

chosen, this will be irrevocable for the taxable year. Note that an NRA NETB is excluded

since his liability is by way of the gross income tax where deductions are not allowed.

L. PREMIUM PAYMENTS ON HEALTH & HOSPITALIZATION INSURANCE

This is the only deduction which can be claimed by a pure compensation earner. Life

insurance premium is not included as a deduction.

Limitations:

Amount to be deducted shall not exceed P2,400.00 per family

Allowed only if the said family has a gross income of not more than P250,000.00

For married couple, only the spouse claiming the additional exemption for

dependents shall be entitled to this deduction.

XIV. ALLOWANCE FOR PERSONAL EXEMPTIONS

The exemption provided in Section 35 is available to the following taxpayers: RC; NRC;

OCW & Seamen; RA ETB; and NRA ETB.

A. SECTION 35A AS AMENDED BY RA 9504

For purposes of determining the net income of the taxpayer, a personal exemption of

P50,000 shall be allowed for single individuals, legally separated, head of the family, and

married individuals.

Note that individual taxpayers are no longer classified as such. The P50,000 exemption is

regardless of status. For married individuals, only the earning spouse shall be allowed

personal exemption

B. ADDITIONAL EXEMPTIONS FOR DEPENDENTS

An additional exemption of P25,000 shall be allowed for each dependent not to exceed 4.

Applicable only for married individuals and shall be claimed by only one of the spouses.

They must be legally married. In case of legally separated spouses, the one who has

custody of the children can claim.

Dependent is a child chiefly dependent upon and living with the taxpayer, not more than 21

years of age, unmarried and not gainfully employed, or is incapable of self-support because

of mental or physical defect.

With the passage of RA 9504, a family of 6 can now claim a total of P200,000.

C. CHANGE OF STATUS

Prepared by: Michael Gines Munsayac

Taxation Law Review

The change of status of the taxpayers shall be effective only if such change will benefit the

taxpayer. Thus, the rule is the higher exemption will be the applicable exemption for the

taxpayer.

D. PERSONAL EXEMPTION ALLOWABLE TO NRA

NRA ETB shall be allowed personal exemptions in the amount equal to the exemptions

allowed in the income tax law in the country of which they are citizens.

XV. ITEMS NOT DEDUCTIBLE

These items are usually not related to the trade, business or profession of the taxpayer.

A. SECTION 26(A) IN GENERAL

The following items are not deductible:

1. Personal, living or family expenses

2. Any amount paid out for new buildings or for permanent improvements

3. Property restoration

4. Premiums paid on any life insurance policy covering the life of any officer or

employee and when the taxpayer is directly or indirectly a beneficiary of such

policy.

B. LOSSES FROM SALES OR EXCHANGE OF PROPERTY

Such losses are not allowed as deduction:

1. Between members of the family

2. Between an individual and a corporation more than 50% in value is owned by

or for such individual

3. Between 2 related corporations (more than 50% of each owned by the same

individual)

4. Between a grantor and a fiduciary of any trust

5. Between a fiduciary of a trust and a beneficiary of such trust

For number 4 to 6, the law presumes irregularity.

XVI. DETERMINATION OF AMOUNT & RECOGNITION OF GAIN OR LOSS

This shall be applicable to the income tax only since it is the only tax where the

determination of gain or loss is material.

A. COMPUTATION OF GAIN OR LOSS

For this purpose, the “amount realized from the sale or other disposition of the property” is

defined as the sum of money received plus the FMV of the property received.

Prepared by: Michael Gines Munsayac

Taxation Law Review

Notes:

With respect to personal property, the gain or loss should always be determined

since any gain or loss from the sale of such property is subject to the net income tax

(except gain from sale of shares not traded which is a capital asset which is subject

to final income tax.

As regards real property, determine first whether the property is a capital asset or

not. If it is a capital asset, the gain or loss is immaterial since the basis of the tax is

the FMV or assessed value of the property. The sale is subject to final income tax. If

the property is an ordinary asset, the gain or loss is material since it is subject to net

income tax.

B. BASIS OF DETERMINING GAIN OR LOSS

The following are the rules to be considered:

1. If the property was acquired by purchase, the acquisition cost shall be the basis of

determining the gain or loss. (Cost = purchase price + expenses)

2. If acquired through inheritance, the cost at the time of acquisition should be

determined.

3. If acquired by gift, the basis shall be the same as if the property was in the hands of

the donor who did not acquire the property by gift. Thus, the basis may either be the

acquisition cost or the FMV at the time of acquisition.

4. If property was acquired for less than adequate consideration, the basis is the

amount paid by the transferee for the property.

C. EXCHANGE OF PROPERTY

As a rule, the entire amount of the gain or loss shall be recognized subject to the following

exceptions under Section 40(C):

1. It is a contract if exchange

2. The parties are parties to the merger and consolidation

3. The subject matter is the one specifically provided by law.

Basic elements in order for the gain to be not taxable and loss not deductible:

1. The parties are not members of a merger or consolidation

2. Property is given in exchange of stocks, if cash is given, this is not applicable

3. After the exchange, said giver, alone or together with others not exceeding 4, gains

control over the corporation.

XVII. SITUS OF ESTATE AND DONOR’S TAX

The following are the taxpayers under the estate tax:

RC

NRC

RA

NRA

Prepared by: Michael Gines Munsayac

Taxation Law Review

Under the donor’s tax, the taxpayers are the following:

RC

NRC

RA

NRA

Domestic corporations

Foreign corporations

Note that a corporation is incapable of death, hence not a taxpayer under estate tax. It is

subject to donor’s tax since it is a juridical person who can enter into contract of donations,

thus may be subject to donor’s tax.

Only the NRAs and foreign corporations are liable for property within the Philippines. Others

are liable for properties located within and without the Philippines.

The following are intangibles deemed located in the Philippines:

Franchise exercised in the Phils.

Shares issued in the Phils.

Shares of foreign corporations, 85% of the business of which is located in the Phils.

Shares of any corporation which have acquired a business situs in the Phils.

Shares r rights in any partnership established in the Phils.

The enumeration is relevant to NRA and foreign corporations only.

Exceptions:

1. When the national law of the decedent does not impost a transfer tax in respect of

intangible personal property of citizens of the Philippines residing in that foreign

country

2. If the laws of the foreign country allow similar exemption from transfer taxes.

XVIII. ESTATE TAX

The formula for this tax is:

Gross Estate

Less: Deductions__

Net Estate

X Rate__________

Taxable Net Estate

Less: Tax Credit___

Estate Tax Payable

A. GROSS ESTATE

Prepared by: Michael Gines Munsayac

Taxation Law Review

This shall consist of the value of all the property, real or personal, tangible or intangible,

wherever situated with the exception of non-resident aliens since they are only liable for

property located in the Philippines.

In addition to the property owned by the decedent, there are certain properties which

although are not owned by the decedent, still form part of the gross estate:

1. Decedent’s interest at the time of his death

2. Transfer in contemplation of death (TICOD)

3. Revocable transfer (because of the tremendous power and control which the

transferor can exercise, he can revoke the transfer anytime)

4. Property passing under General Power of Appointment (executed by the decedent

similar to TICOD)

5. Proceeds of life insurance in which the beneficiary is the estate.

6. Prior interests

7. Transfers of insufficient consideration, EXCEPT in case of a bona fide sale.

8. Capital of surviving spouse – This is an exclusion in the gross estate.

Note: Transfer is a TICOD if:

The decedent still retained the possession

Notwithstanding the transfer, the decedent continued to receive the income of

the fruits

The decedent retained the right to designate the person who shall possess or

enjoy the property or the income there from.

B. COMPUTATION OF NET ESTATE

B(a) Deductions Allowed to the Estate of a Citizen or Resident

1. Expenses, Losses, Indebtedness, and Taxes

a. Funeral expenses not to exceed 5% of the gross estate not to exceed

P200,000

i. Mourning apparel of spouse and unmarried minor children

ii. Catering and food expenses during the wake

iii. Publication charges for death notices

iv. Telecommunication expenses incurred in informing relatives of the

deceased

v. Cost of burial plot, tombstones, mausoleum

vi. Interment and/or cremation fees.

vii. Expenses incurred for the performance of interment rites EXCLUDE

expenses incurred during 40 days, kalag luksa and death anniversary.

b. Judicial Expenses

i. Expenses incurred in the testamentary or intestate proceedings for he

settlement of estate

ii. Also include EJ expenses for the settlement of the estate of he

deceased

c. Claims Against the Estate; the following requisites must be present:

i. Amount of the indebtedness

ii. The debt instrument must be notarized at the time of indebtedness

Prepared by: Michael Gines Munsayac

Taxation Law Review

iii. Statement showing the disposition of the proceeds of loan

iv. Certification on the unpaid balance of loan

d. Claim Against Insolvent Persons

e. Mortgage Indebtedness, Taxes which accrued before the death of the

decedent (exclude Estate Tax) and Losses by virtue of natural calamities (no

insurance coverage)

2. Vanishing Deduction

a. This refers to a property which forms part of the gross estate of any person

who died within 5 years prior to his death.

b. The following percentages should be taken into account in the computation of

the net estate

i. 100% - Within 1 year

ii. 80% - 1 to 2 years

iii. 60% - 2 to 3 years

iv. 40% - 3 to 4 years

v. 20% - 4 to 5 years

3. Transfers for Public Use

a. Include the amount of all bequests, legacies, devises or transfers to the GOP

b. The property should be used for public purpose.

4. Family Home, conditions:

a. The amount to be deducted should not exceed P1.0M, excess is subject to

estate tax

b. Certification from the Barangay Captain that the family home is the actual

residence of the decedent.

c. Legally married or head of the family

d. The amount of the family home must be included in the gross estate.

5. Standard Deduction

a. The standard deduction is P1.0 Million

b. Automatic, no conditions attached.

6. Medical Expenses

a. Must be incurred within 1 year prior to death of decedent

b. Must be substantiated by official receipts

c. Maximum limit: P500,000.00

7. Retirement Pay

a. Received under RA 4917

b. Must satisfy the 50 and 10 Rule

B(b) Deductions allowed to NRAs are the following:

1. Expenses, losses, indebtedness and taxes

2. Vanishing deduction

3. Transfers for Public Use

The rules deductions on residents and citizens are applicable to NRAs except the following:

1. Family home

2. Standard deduction

3. Hospitalization expenses

4. Retirement pay

Prepared by: Michael Gines Munsayac

Taxation Law Review

B(c) Share in the conjugal property

The net share of the surviving spouse in the conjugal partnership is considered as a

deduction from the gross estate. The relevance lies in determining whether or not it is

necessary to comply with the requirements under Sections 89 and 90:

1. Written notice to the Commissioner

2. Filing of an estate return

3. A statement duly certified by a CPA

B(d) Miscelaneous Provisions

In cases of NRAs, for purposes of the estate tax return, all the properties of such NRA,

whether situated in the Philippines or outside, shall be included in the return. Failure to

comply will bar the estate to claim any deduction!

C. Exemption of Certain Acquisitions and Transmission

The following shall not be taxed:

1. The merger of the usufruct in the owner of the naked title

a. The decedent is the usufructuary (no fixed period)

b. Property is not included in his estate

2. The transmission or delivery of the inheritance or legacy by the fiduciary heir or

legatee to the fideicommissary

a. The decedent is the fiduciary heir

b. Upon his death, the property is transferred to the heir of the decedent.

3. The transmission from the first heir, legatee or donee in favour of another

beneficiary, in accordance with the desire of the predecessor

4. All bequests, devises, legacies or transfers to social welfare, cultural and charitable

institutions, provided:

a. No part of the income of such institution inures to the benefit of the individual

b. Not more than 30% of said bequest, devise, legacy or transfer shall be used

by such institutions for administration purposes.

D. Determination of the Value of the Estate

1. Usufruct for a fixed period

a. This forms part of the estate since the period has not yet lapsed

b. The value is determined by taking into account the probable life of the

beneficiary in accordance with the latest Basic Standard Mortality table, to be

approved by the DOF, upon recommendation of the IC.

2. Properties

a. Personal Property

i. Use FMV at the time of death

ii. Listed shares – highest value immediately before the death

iii. Unlisted Preferreds – Use par value

iv. Unlisted Commons – Book value

b. Real Property, us higher of the two:

i. FMV as determined by the BIR (Zonal Value)

Prepared by: Michael Gines Munsayac

Taxation Law Review

ii. FMV as determined by the Assessor’s Office (Assessed Value)

E. Notice of Death to be Filed

Guidelines:

1. File the notice if the gross estate exceeds P20,000

2. Executor, administrator or any legal heir may file

3. Filing period is within 60 days after decedent’s death

E. Estate Tax Returns

Guidelines:

1. Filing is required when the gross estate exceeds P200,000.00

2. File even if below P200k when the gross estate consists of real property, motor