Professional Documents

Culture Documents

Noccc

Uploaded by

Saurav RanjitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Noccc

Uploaded by

Saurav RanjitCopyright:

Available Formats

ATLAS DOCUMANTARY

FACILITATORS COMPANY PVT. LTD.

Titanic Building, 3 rd Floor,

26 A, Narayan Properties

Off Saki Vihar Road, Sakinaka,

Andheri (E),Mumbai,400 072

Tel-2847 4900,fax-2856 9600

To ,

Mr. Saurav Kumar Ranjit Date. February 07, 2011

Location-Ansal Tower,

Rajouri Garden,

New Delhi,

Dear Mr. Saurav Kumar Ranjit,

With reference to the interview you had with us, We are pleased to make firm offer of appointment

To you in “Grade –T” as a “Trainee- Phone banking” as the following term and conditions.

1. you have total salary(CTC) per annum is attached in “Annexure-A”.

All remuneration, benefits and perquisites will be taxed in accordance with the provisions of

Income tax act and other enactment in force from time to time

2. a) You will be on a training for a period of six calendar months effective from 9 Feb 2011 to

9 Aug 2011 Which may be curtailed or extended at the sole discretion of the management?

The management reserves its rights to terminate your training period at any time with 15 days

Notice without assigning any reason thereof what so ever from either side.

b) if your conduct, attendance, progress of performance during the tenure of your employment

is found to be unsatisfactory, Management reserves its right to terminate your employment.

c) The company reserves the right to transfer you to any other branches, any of our principals office

or sister concerns which are existing or that may be formed in future at any place in india.

With Best Wishes,

Your Faithfully,

Acknowledge acceptance

S. Nagarajan sign of employee:

Chief operating officer

ATLAS DOCUMANTARY

FACILITATORS COMPANY PVT. LTD.

Titanic Building, 3 rd Floor,

26 A, Narayan Properties

Off Saki Vihar Road, Sakinaka,

Andheri (E),Mumbai,400 072

Tel-2847 4900,fax-2856 9600

Annexture “A”

Remuneration details

Name: Saurav Kumar Ranjit

Date of Joining: 09 feb 2011

Designation: Trainee- phone banking officer,

Grade: Grade-T

Branch: rajouri Garden-198

SALARY AND ALLOWANCES Amount in Rupees Per

Annum

Basic 87660

Allowance 31668

Conveyance 0

HRA 4380

Medical reimbursement 0

LTA 0

Total annual allowances 123708

INSURANCE BENEFITS

ESI(Employer’s contribution) 5880

TETIRALS

Provident fund(Employer’s contribution) 10524

TOTAL CTC 140112

Note:-

Medical reimbursement and I.T.A. Will be paid through monthly salary . However

Approximate documentary supporting should be provided by December to consider as non taxable components.

Employee and employer’s contribution towards ESI Will be 1.75% to 4.75% respectively to total salary and

allowance.

Employees drawing total salary and allowance of Rs.15001-and above per month will be eligible for group

med claim as per company policy.

You might also like

- Barrons 20230220 BarronsDocument56 pagesBarrons 20230220 BarronsLEE JEFFNo ratings yet

- Payslip 2023020 PDFDocument1 pagePayslip 2023020 PDFShaikh IrfanNo ratings yet

- Control Effectiveness Rating (Key 2)Document3 pagesControl Effectiveness Rating (Key 2)CORAL ALONSONo ratings yet

- Payslip 801647 CIN Nov 2021Document1 pagePayslip 801647 CIN Nov 2021mani kandanNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthNo ratings yet

- Payslip MatrimonyDocument2 pagesPayslip MatrimonyPuneeth KumarNo ratings yet

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Document1 pageTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNo ratings yet

- Cogoport Private Limited Offer Letter - Rishu KumarDocument4 pagesCogoport Private Limited Offer Letter - Rishu KumarRishu GuptaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Subject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionDocument4 pagesSubject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionAshish SinghNo ratings yet

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Document4 pagesJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajNo ratings yet

- Lancesoft Offer LetterDocument5 pagesLancesoft Offer LetterYogendraNo ratings yet

- 04 Soniya Guna Seelan Offer LetterDocument3 pages04 Soniya Guna Seelan Offer LetterawsrestartsNo ratings yet

- A-Star India CredentialDocument123 pagesA-Star India CredentialMecon LtdNo ratings yet

- BANKING ALLIED LAWS 10 November 2019Document19 pagesBANKING ALLIED LAWS 10 November 2019David YapNo ratings yet

- Payslip Matrimony PDFDocument2 pagesPayslip Matrimony PDFPuneeth KumarNo ratings yet

- InvestmentDocument9 pagesInvestmentJade Malaque0% (1)

- SCM Case Study UNILEVERDocument10 pagesSCM Case Study UNILEVERVlad Liliac100% (2)

- Marketing Plan Pull&BearDocument50 pagesMarketing Plan Pull&Beartatiana_carr9081100% (17)

- Acces 01 02Document2 pagesAcces 01 02sasirajareddyNo ratings yet

- Sample Call LetterDocument5 pagesSample Call Letterpalashm876No ratings yet

- Cotiviti India Private Limited: Payslip For The Month of January 2023Document1 pageCotiviti India Private Limited: Payslip For The Month of January 2023Kshitij MadnalNo ratings yet

- Monika Kumari - Offer LetterDocument3 pagesMonika Kumari - Offer LetterMonika SinghNo ratings yet

- Sample Call Letter AfterDocument5 pagesSample Call Letter Afterpalashm876No ratings yet

- Novac PD Off 00617 2023Document9 pagesNovac PD Off 00617 2023choudharyankush731No ratings yet

- Concentrix Services India Private Limited Payslip For The Month of May - 2023Document1 pageConcentrix Services India Private Limited Payslip For The Month of May - 2023Bujji BabuNo ratings yet

- Sample Call Letter After PRE FINAL STAGEDocument5 pagesSample Call Letter After PRE FINAL STAGEpalashm876No ratings yet

- Aastha N. - Helppo OfferDocument3 pagesAastha N. - Helppo OfferAastha NathwaniNo ratings yet

- Mr. Bhanu Prakash Demand LetterDocument2 pagesMr. Bhanu Prakash Demand LetterBhanu PrakashNo ratings yet

- Annual Report2002Document50 pagesAnnual Report2002Pavan ChaudhariNo ratings yet

- Financial Results Standalone and Consolidated For The Quarter and Half Year Ended 30th September 2023Document14 pagesFinancial Results Standalone and Consolidated For The Quarter and Half Year Ended 30th September 2023abhinavkushwaha2122No ratings yet

- Durga Padma Sai SatishDocument1 pageDurga Padma Sai SatishBhaskar Siva KumarNo ratings yet

- Washim Akram-May '22 Month Salary Slip..Document1 pageWashim Akram-May '22 Month Salary Slip..Nits KohliNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuAshok GNo ratings yet

- Payslip NOV 23Document1 pagePayslip NOV 23finox.servicesNo ratings yet

- Appointment Letter T.KumundhvathiDocument2 pagesAppointment Letter T.KumundhvathiMadhu MadhanNo ratings yet

- QT 000259Document2 pagesQT 000259bravodextraNo ratings yet

- LOI of Letter IntentDocument2 pagesLOI of Letter IntentANUHYA CHINTHALANo ratings yet

- Payslip Aug 2023Document1 pagePayslip Aug 2023harshiniguttiNo ratings yet

- Kumar PrinceDocument3 pagesKumar PrincePrince kumarNo ratings yet

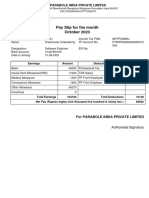

- Pay Slip For The Month October 2023: Parabole India Private LimitedDocument1 pagePay Slip For The Month October 2023: Parabole India Private LimitedKrishnendu ChakrabortyNo ratings yet

- Bhanu PrakeshDocument3 pagesBhanu PrakeshysrcnuNo ratings yet

- Appoinment LetterDocument3 pagesAppoinment LetterPrashant KumarNo ratings yet

- Payslip 1Document1 pagePayslip 1Tamoghna DeyNo ratings yet

- Engagement Letter ExecutiveDocument2 pagesEngagement Letter Executivesai kiranNo ratings yet

- Gtis Insur-1-1 PDFDocument1 pageGtis Insur-1-1 PDFShankar.R sharaNo ratings yet

- ArchanaDocument2 pagesArchanaARCHANA CHAUHANNo ratings yet

- Offer Letter - Pavan Kumar ReddyDocument2 pagesOffer Letter - Pavan Kumar Reddybalajivaddi2697No ratings yet

- Nishanth Appointment - LetterDocument10 pagesNishanth Appointment - LetterNishanth GowdaNo ratings yet

- Uppar Ext Solutions PVT LTD: Nevy KukrejaDocument4 pagesUppar Ext Solutions PVT LTD: Nevy KukrejaSanjana GuptaNo ratings yet

- 1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019Document10 pages1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019sossmsNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document8 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)Ranjit SamalNo ratings yet

- Feb 2018Document1 pageFeb 2018savan anvekarNo ratings yet

- Avinash June 2023Document1 pageAvinash June 2023The Avi SharmaNo ratings yet

- Sar - Invoice Jan 22-New HSNDocument4 pagesSar - Invoice Jan 22-New HSNAnjali rajNo ratings yet

- STSCN056Document1 pageSTSCN056Shilpa AmitNo ratings yet

- Pay Slip For The Month of Aug 2023-Goutam BinjwaDocument2 pagesPay Slip For The Month of Aug 2023-Goutam BinjwaSachin RajakNo ratings yet

- Wipro Sita Corp CotivitiDocument2 pagesWipro Sita Corp CotivitiBhanu PrakashNo ratings yet

- Quarterly Results Q2 FY 24.Document12 pagesQuarterly Results Q2 FY 24.sidishereagain688No ratings yet

- AppointmentLetter 872133 DocDocument6 pagesAppointmentLetter 872133 DocDatta SheteNo ratings yet

- Ganesh PayslipDocument1 pageGanesh PayslipBADI APPALARAJUNo ratings yet

- Vaibhav Chaudhari Offer LetterDocument3 pagesVaibhav Chaudhari Offer Letterwankhedesujeet432No ratings yet

- Archwell Operations India Private LimitedDocument4 pagesArchwell Operations India Private LimitedBalaji SNo ratings yet

- Normal Payslip AprDocument1 pageNormal Payslip AprBharath Kumar BharathNo ratings yet

- Epicor Software India Private Limited: Brief Details of Your Form-16 Are As UnderDocument9 pagesEpicor Software India Private Limited: Brief Details of Your Form-16 Are As UndersudhadkNo ratings yet

- Account Statement: Theme Engineering Services Private LimitedDocument1 pageAccount Statement: Theme Engineering Services Private LimitedashutoshstepcountNo ratings yet

- What Workers ThinkDocument8 pagesWhat Workers ThinkUnions TwentyOneNo ratings yet

- Strategic Analysis Case Study 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierDocument47 pagesStrategic Analysis Case Study 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierDiksha GuptaNo ratings yet

- Thesis AbstractDocument7 pagesThesis AbstractJianneDanaoNo ratings yet

- Summer Internship Report 8.10Document83 pagesSummer Internship Report 8.10Alok0% (1)

- 651593285MyGov 5th September, 2023 & Agenda KenyaDocument29 pages651593285MyGov 5th September, 2023 & Agenda KenyaJudy KarugaNo ratings yet

- Media Economics: Presented by Majid Heidari PHD Student Media MangementDocument43 pagesMedia Economics: Presented by Majid Heidari PHD Student Media MangementangenthNo ratings yet

- Cash Basis Accounting Vs Accrual SystemDocument3 pagesCash Basis Accounting Vs Accrual SystemAllen Jade PateñaNo ratings yet

- Global Marketing Plan For American Express: Bahrain: David CappsDocument14 pagesGlobal Marketing Plan For American Express: Bahrain: David Cappsdcapps_7No ratings yet

- Ms KQC 1 GYQnisr W6 WDocument2 pagesMs KQC 1 GYQnisr W6 WajitendraNo ratings yet

- Principle - DISCIPLINE - Management DiaryDocument8 pagesPrinciple - DISCIPLINE - Management Diaryharsh inaniNo ratings yet

- Taxation Law CIA 1 (B) Salary AnalysisDocument3 pagesTaxation Law CIA 1 (B) Salary Analysisawinash reddyNo ratings yet

- The Case For Flexible HousingDocument18 pagesThe Case For Flexible HousingMariaIliopoulouNo ratings yet

- Financial Markets AND Financial Services: Chapter-31Document7 pagesFinancial Markets AND Financial Services: Chapter-31Dipali DavdaNo ratings yet

- Country Profile The BahamasDocument4 pagesCountry Profile The Bahamasapi-307827450No ratings yet

- Lijjat PapadDocument14 pagesLijjat PapadKeyur Popat100% (1)

- R PLC Plans To Invest 1m in New Machinery ToDocument1 pageR PLC Plans To Invest 1m in New Machinery ToAmit PandeyNo ratings yet

- Economics For Today 5Th Asia Pacific Edition by Layton Full ChapterDocument41 pagesEconomics For Today 5Th Asia Pacific Edition by Layton Full Chapterphilip.prentice386100% (24)

- Priya PrajapatiDocument53 pagesPriya PrajapatiPriyanshu Prajapati (Pp)No ratings yet

- Walter2010 PDFDocument25 pagesWalter2010 PDFIpuk WidayantiNo ratings yet

- Fsac 230Document11 pagesFsac 230mahssounys.mNo ratings yet

- IPs and Local Economic DevelopmentDocument4 pagesIPs and Local Economic DevelopmentAnar AbbasoğluNo ratings yet

- Chapter 5Document35 pagesChapter 5ali.view6910No ratings yet

- Mis 2017Document133 pagesMis 2017Cruz J. AntonyNo ratings yet

- OM 1st SemesterDocument32 pagesOM 1st Semestermenna mokhtarNo ratings yet