Professional Documents

Culture Documents

ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0

Uploaded by

Lorraine Joy Abanilla0 ratings0% found this document useful (0 votes)

11 views4 pagesThe document provides journal entries for inventory transactions under the periodic and perpetual inventory systems. For the periodic system, entries are made at the end of each period to record purchases, sales, returns, and adjustments to cost of goods sold. For the perpetual system, inventory balances are adjusted with each transaction through the year by decreasing inventory or increasing cost of goods sold accounts. The perpetual system allows for continuous update of inventory balances rather than a single annual adjustment.

Original Description:

Original Title

ABANILLA, LORRAINE JOY M._INTACC & 075_ Activity 2 (A02) - Inventory Accounting Systems 3.0

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides journal entries for inventory transactions under the periodic and perpetual inventory systems. For the periodic system, entries are made at the end of each period to record purchases, sales, returns, and adjustments to cost of goods sold. For the perpetual system, inventory balances are adjusted with each transaction through the year by decreasing inventory or increasing cost of goods sold accounts. The perpetual system allows for continuous update of inventory balances rather than a single annual adjustment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0

Uploaded by

Lorraine Joy AbanillaThe document provides journal entries for inventory transactions under the periodic and perpetual inventory systems. For the periodic system, entries are made at the end of each period to record purchases, sales, returns, and adjustments to cost of goods sold. For the perpetual system, inventory balances are adjusted with each transaction through the year by decreasing inventory or increasing cost of goods sold accounts. The perpetual system allows for continuous update of inventory balances rather than a single annual adjustment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

NAME: Lorraine Joy M.

Abanilla BSA-1 SECTION CODE: 075

PROFESSOR: Mr. Remi Gabon SUBJECT: INTACC-1

Activity 2 (A02) - Inventory Accounting Systems 3.0

Problem 1

SKEWED Company had the following transactions related to inventories during the current year

2020:

Requirements: (20 points)

Prepare the required journal entries to record the transactions using the:

1. Periodic inventory system.

2. Perpetual inventory system.

Periodic inventory system.

DATE TRANSACTION DEBIT CREDIT

January 1 Purchases ₱3,000,000

Cash ₱1,500,000

Accounts Payable ₱1,500,000

To record the purchase of inventories from the supplier

Freight-in ₱40,000

Cash ₱40,000

To record the payment of freight cost incurred

February 1 Accounts Payable ₱800,000

Purchase returns ₱800,000

To record the return of the inventories purchased

May 1 Cash ₱800,000

Sales ₱800,000

To record the sale of inventories to customers for cash

May 31 Sales returns ₱240,000

Cash ₱240,000

To record the return of inventories sold for cash

August 1 Accounts Receivable ₱550,000

Sales ₱550,000

To record the sale of inventories on credit basis

September 1 Sales returns ₱180,000

Accounts receivable ₱180,000

To record the return of inventories sold on credit basis

December 31 Inventories ₱1,550,000

Income and expense summary ₱1,550,000

To record the adjustments for ending inventories

Perpetual inventory system.

DATE TRANSACTION DEBIT CREDIT

January 1 Merchandise inventories ₱3,000,000

Cash ₱1,500,000

Accounts Payable ₱1,500,000

To record the purchase of inventories from the supplier

Merchandise inventories ₱40,000

Cash ₱40,000

To record the payment of freight cost incurred

February 1 Accounts Payable ₱800,000

Merchandise inventories ₱800,000

To record the return of the inventories purchased

May 1 Cash ₱800,000

Sales ₱800,000

To record the sale of inventories to customers for cash

Cost of goods sold ₱600,000

Merchandise inventories ₱600,000

To record the cost of inventories sold for cash

May 31 Sales returns ₱240,000

Cash ₱240,000

To record the return of inventories sold for cash

Merchandise inventories ₱160,000

Cost of goods sold ₱160,000

To record the reduction of the amount of cost of sales

August 1 Accounts Receivable ₱550,000

Sales ₱550,000

To record the sale of inventories on credit basis

Cost of goods sold ₱400,000

Merchandise inventories ₱400,000

To record the cost of inventories sold on credit basis

September 1 Sales returns ₱180,000

Accounts receivable ₱180,000

To record the return of inventories sold on credit basis

Merchandise inventories ₱150,000

Cost of goods sold ₱150,000

To record the reduction of the amount of cost of sales

December 31 No journal entry

You might also like

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- UntitledDocument2 pagesUntitledinto the unknownNo ratings yet

- EXERCISE Number 7 (E07) : InventoriesDocument9 pagesEXERCISE Number 7 (E07) : Inventorieszhyrus macasilNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane Miranda67% (3)

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane MirandaNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane MirandaNo ratings yet

- Chapter 10 - Problem 2Document5 pagesChapter 10 - Problem 2Christy HabelNo ratings yet

- TASK 5 - AMOYAN - BSA-1CfarDocument15 pagesTASK 5 - AMOYAN - BSA-1CfarNicolle AmoyanNo ratings yet

- MeowDocument1 pageMeowyesha rodasNo ratings yet

- Fabm2 6a1 Books of AccountsDocument3 pagesFabm2 6a1 Books of AccountsRenz AbadNo ratings yet

- Pauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashDocument4 pagesPauline Anne R. Grana 11-ABM-A: To Record Purchase of Merchandise For CashPark EunbiNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisClint Abenoja100% (1)

- Kimkat Enterprise Journal Entry: Date Items Debit Credit Post RefDocument22 pagesKimkat Enterprise Journal Entry: Date Items Debit Credit Post RefGeorge Lubiano PastorNo ratings yet

- Book Exercises 2Document20 pagesBook Exercises 2Ace Hulsey TevesNo ratings yet

- Fundamentals of Accountancy Business and Management 1 11 FourthDocument4 pagesFundamentals of Accountancy Business and Management 1 11 FourthPaulo Amposta CarpioNo ratings yet

- Accounting Cycle: 2. Recording of The Transactions in The Journal. (Journalizing)Document9 pagesAccounting Cycle: 2. Recording of The Transactions in The Journal. (Journalizing)Ada Janelle ManzanoNo ratings yet

- Assignment#1 ADRIANOCAÑADADocument4 pagesAssignment#1 ADRIANOCAÑADAADRIANO, Glecy C.78% (9)

- Date Transactions Perpetual Inventory System Periodic Inventory SystemDocument4 pagesDate Transactions Perpetual Inventory System Periodic Inventory SystemBetina Maxine MendozaNo ratings yet

- Lec Merchandising Perpetual PeriodicDocument8 pagesLec Merchandising Perpetual PeriodicAiddan Clark De JesusNo ratings yet

- MERCHANDISING BUSINESS (Periodic Vs Perpetual)Document3 pagesMERCHANDISING BUSINESS (Periodic Vs Perpetual)Laurence Karl CurboNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Exercise-1 Merchandising Melanie-RodilDocument13 pagesExercise-1 Merchandising Melanie-RodilShiela RengelNo ratings yet

- Jornal MerchandiseDocument12 pagesJornal MerchandiseHannah Jane Toribio100% (1)

- Silid Act 6 - BALDERASDocument2 pagesSilid Act 6 - BALDERASJustine Marie BalderasNo ratings yet

- Merchandising Business PDFDocument5 pagesMerchandising Business PDFJenny Valerie SualNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Module 3 Chapter 7Document8 pagesModule 3 Chapter 7Angelie Bocala CatalanNo ratings yet

- Merchandising 1Document32 pagesMerchandising 1krisllyuyuyNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Myco Paque InventoriesDocument5 pagesMyco Paque InventoriesMYCO PONCE PAQUENo ratings yet

- Module VII Accounting Cycle of A Merchandising Business2Document3 pagesModule VII Accounting Cycle of A Merchandising Business2Marklein DumangengNo ratings yet

- Boat ThingsDocument12 pagesBoat ThingsVanya QuistoNo ratings yet

- Problem-10-4 FinalDocument2 pagesProblem-10-4 FinalAlyssa Faith NiangarNo ratings yet

- Steven's Trading Account For The Month: WorkingsDocument5 pagesSteven's Trading Account For The Month: WorkingsAndrei PrunilaNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument31 pagesAccounting Cycle of A Merchandising BusinessAresta, Novie Mae100% (1)

- Discussion Guide - Chapter 6 RevisedDocument6 pagesDiscussion Guide - Chapter 6 RevisedKhoi NguyenNo ratings yet

- Journalize Merchandise BusinessDocument2 pagesJournalize Merchandise BusinessEloise April G BalasabasNo ratings yet

- Topic 6.Document5 pagesTopic 6.Ernie AbeNo ratings yet

- Danielle Rachel Mina 1209 Male Q.4: Requirement ADocument4 pagesDanielle Rachel Mina 1209 Male Q.4: Requirement AWaz KaBoomNo ratings yet

- Merchandising Business - Sample Problem (Answers)Document4 pagesMerchandising Business - Sample Problem (Answers)Eana MabalotNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Task 5Document9 pagesTask 5Honey TolentinoNo ratings yet

- Acc Mod 5 Activity 4 PerezDocument13 pagesAcc Mod 5 Activity 4 PerezKenneth PerezNo ratings yet

- Journal EntryDocument6 pagesJournal Entrykaryma paloNo ratings yet

- Jan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisDocument8 pagesJan Mark Castillo - BSA 1 Chapter-6-Business-Transactions-And-Their-AnalysisJan Mark CastilloNo ratings yet

- Partnership Exercise 2Document5 pagesPartnership Exercise 2nikNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- At 5Document4 pagesAt 5Thùy NguyễnNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Mortel Bsa1202 Inventories PDF FreeDocument5 pagesMortel Bsa1202 Inventories PDF FreexicoyiNo ratings yet

- Accounting EquationDocument2 pagesAccounting Equationunknown PersonNo ratings yet

- Problems WPS OfficeDocument6 pagesProblems WPS Officelaica valderasNo ratings yet

- Audit of Inventory: Download NowDocument1 pageAudit of Inventory: Download NowMariz Julian Pang-aoNo ratings yet

- 2nd Quiz Aud ProbDocument4 pages2nd Quiz Aud ProbJohn Patrick Lazaro AndresNo ratings yet

- Accounting For Merchandising Operations ExercisesDocument4 pagesAccounting For Merchandising Operations ExercisesthachuuuNo ratings yet

- Entries For Perpetual and Periodic InventoryDocument2 pagesEntries For Perpetual and Periodic InventoryRACHEL RIANNE ANTONENo ratings yet

- Journal Entries and Adjusting EntriesDocument3 pagesJournal Entries and Adjusting EntriesGarp BarrocaNo ratings yet

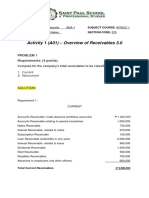

- Abanilla, Lorraine Joy M. - INTACC-1 - 075 - Activity 1 (A01) - Overview of Receivables 3.0Document2 pagesAbanilla, Lorraine Joy M. - INTACC-1 - 075 - Activity 1 (A01) - Overview of Receivables 3.0Lorraine Joy AbanillaNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Document7 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 4 (A04) - Inventory Estimation Methods 3.0Lorraine Joy AbanillaNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Document4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 1 (A01) - Overview of Inventories 3.0Lorraine Joy AbanillaNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 3 (A03) - Inventory Cost Flow Methods 3.0Document3 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 3 (A03) - Inventory Cost Flow Methods 3.0Lorraine Joy AbanillaNo ratings yet

- DSTechStartupReport2015 PDFDocument70 pagesDSTechStartupReport2015 PDFKhairudiNo ratings yet

- Preliminary PagesDocument17 pagesPreliminary PagesvanexoxoNo ratings yet

- Micro Finance in BrazilDocument7 pagesMicro Finance in BrazilguptarohanNo ratings yet

- Foreign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiDocument13 pagesForeign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiParth ShingalaNo ratings yet

- James Traficant SpeechDocument3 pagesJames Traficant Speechwideawak350% (2)

- Staff Imprest FormDocument2 pagesStaff Imprest FormSumeet MishraNo ratings yet

- Citibank CaseDocument6 pagesCitibank CaseLalatendu Das0% (1)

- Revenue Memo Ruling 02-2002Document20 pagesRevenue Memo Ruling 02-2002Annie SibayanNo ratings yet

- Southwind AflDocument42 pagesSouthwind Aflpraviny100% (1)

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- Combinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IDocument13 pagesCombinatorial Mathematics Business Mathematics Special Theory of Relativity-I Computational Mathematics Lab-IBurnwal RNo ratings yet

- Step by Step Sap GL User ManualDocument109 pagesStep by Step Sap GL User Manualkapil_73No ratings yet

- Rmi Personal Budget Worksheet v05 Xls - Monthly BudgetDocument6 pagesRmi Personal Budget Worksheet v05 Xls - Monthly Budgetapi-344074071No ratings yet

- Affidavit (Property Settlement)Document3 pagesAffidavit (Property Settlement)Jan Kenrick SagumNo ratings yet

- Quiz Conceptual Framework WITH ANSWERSDocument25 pagesQuiz Conceptual Framework WITH ANSWERSasachdeva17100% (1)

- Financial Management and Accounting ProceduresDocument23 pagesFinancial Management and Accounting Proceduressidra akramNo ratings yet

- Global Cities and Developmental StatesDocument29 pagesGlobal Cities and Developmental StatesmayaNo ratings yet

- Audit of LiabilitiesDocument4 pagesAudit of LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Hong Kong Housing Authority: For Chinese Medicine ClinicDocument14 pagesHong Kong Housing Authority: For Chinese Medicine Clinicapi-22629871No ratings yet

- Jayshree Periwal High School: AccountsDocument8 pagesJayshree Periwal High School: AccountsShreekumar MaheshwariNo ratings yet

- Resume Jurnal AdelDocument5 pagesResume Jurnal AdelMuhamad SyarifNo ratings yet

- Aglibot vs. SantiaDocument1 pageAglibot vs. SantiaAnonymous 5MiN6I78I0No ratings yet

- Annual Report - Federal Bank 2019-20Document278 pagesAnnual Report - Federal Bank 2019-20Rakesh MoparthiNo ratings yet

- Dayrit v. CA DigestDocument3 pagesDayrit v. CA DigestJosh BersaminaNo ratings yet

- Financial System and Financial MarketDocument10 pagesFinancial System and Financial MarketPulkit PareekNo ratings yet

- CHAP 2 Risk Magt ProDocument11 pagesCHAP 2 Risk Magt ProEbsa AdemeNo ratings yet

- Internship Report On Social Islami Bank Limited 1Document56 pagesInternship Report On Social Islami Bank Limited 1sakib100% (3)

- Saturn Retrograde Will Trigger Global RecessionDocument26 pagesSaturn Retrograde Will Trigger Global RecessionmichaNo ratings yet

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- Strategic Alliance v. Radstock DigestDocument9 pagesStrategic Alliance v. Radstock DigestLeighNo ratings yet